444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The Europe On-Demand Insurance Market is a rapidly evolving segment within the insurance industry, leveraging digital platforms to provide flexible and customizable insurance solutions. This market caters to the changing preferences of consumers who seek on-demand coverage for specific needs and timeframes. As technology continues to reshape the insurance landscape, on-demand insurance in Europe stands at the forefront of innovation, offering convenience and adaptability to a diverse consumer base.

Meaning

On-Demand Insurance in Europe refers to insurance products that allow customers to activate coverage for specific assets or activities on a temporary basis. Unlike traditional insurance policies with fixed terms, on-demand insurance provides flexibility, enabling users to customize coverage based on their immediate requirements. This model aligns with the on-demand economy, offering quick and accessible insurance solutions when needed.

Executive Summary

The Europe On-Demand Insurance Market has gained traction due to the growing demand for personalized and instant coverage. This market addresses the need for flexibility, allowing consumers to secure insurance for short durations or specific events. The integration of digital platforms and innovative technologies enhances the accessibility and efficiency of on-demand insurance, making it a compelling choice for modern consumers.

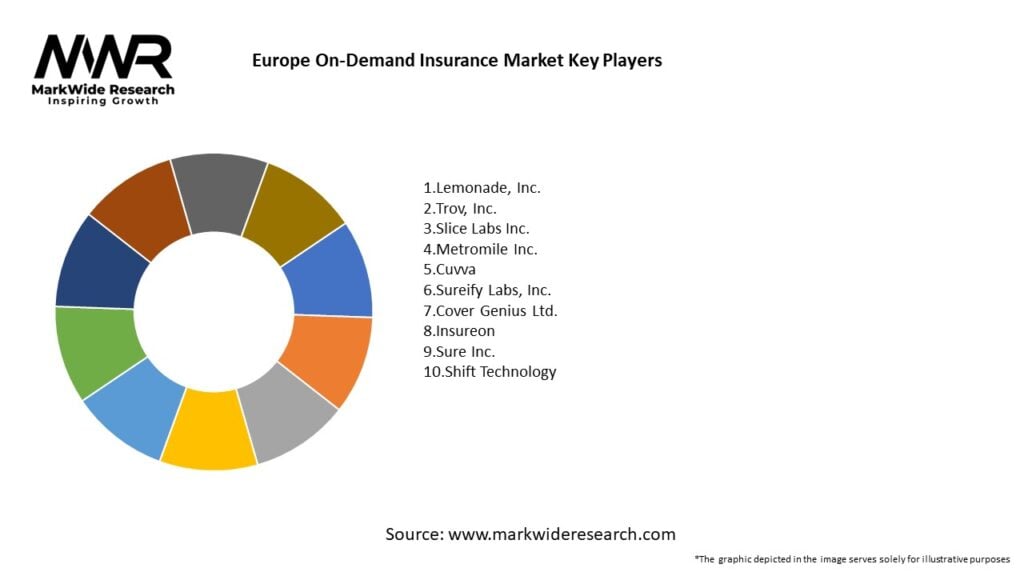

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Europe On-Demand Insurance Market operates within dynamic dynamics influenced by technological advancements, regulatory changes, and shifts in consumer behavior. The ability to adapt to these dynamics and innovate in response to emerging trends is essential for sustained growth.

Regional Analysis

The on-demand insurance landscape in Europe exhibits regional variations influenced by cultural factors, regulatory frameworks, and economic conditions. Understanding the specific needs and preferences of different European markets enables providers to tailor their offerings effectively.

Competitive Landscape

Leading Companies in Europe On-Demand Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

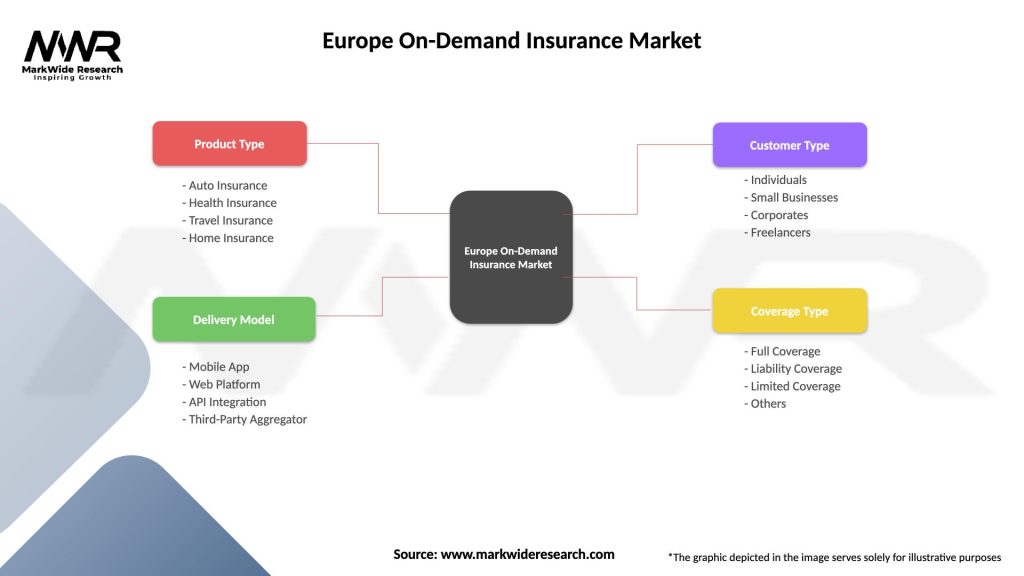

Segmentation

The segmentation of the Europe On-Demand Insurance Market considers factors such as coverage duration, type of assets or activities covered, and user demographics. Tailoring offerings based on these segments allows providers to address specific consumer needs effectively.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The Europe On-Demand Insurance Market offers several benefits for industry participants and stakeholders:

SWOT Analysis

A SWOT analysis provides insights into the strengths, weaknesses, opportunities, and threats within the Europe On-Demand Insurance Market:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has influenced the Europe On-Demand Insurance Market by highlighting the need for flexible coverage options in response to unforeseen circumstances. The pandemic accelerated the adoption of digital insurance platforms and underscored the importance of agility in product development and service delivery.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Europe On-Demand Insurance Market is poised for continued growth as consumer preferences evolve, and digital transformation accelerates across the insurance industry. The ability to navigate regulatory challenges, embrace technological innovations, and build consumer trust will shape the future trajectory of this dynamic market.

Conclusion

The Europe On-Demand Insurance Market represents a paradigm shift in the insurance industry, responding to the changing needs and expectations of modern consumers. The combination of flexibility, customization, and digital integration positions on-demand insurance as a significant player in the evolving insurance landscape. As the market matures, collaboration, innovation, and strategic partnerships will be essential for on-demand insurance providers to thrive and contribute to the reshaping of Europe’s insurance sector.

What is On-Demand Insurance?

On-Demand Insurance refers to a flexible insurance model that allows consumers to purchase coverage for specific events or periods, rather than committing to long-term policies. This model is particularly popular in sectors like travel, automotive, and personal property, where users can activate and deactivate coverage as needed.

What are the key players in the Europe On-Demand Insurance Market?

Key players in the Europe On-Demand Insurance Market include companies like Zego, Trov, and Cuvva, which offer innovative solutions tailored to consumer needs. These companies focus on providing flexible insurance options that cater to the gig economy and short-term usage, among others.

What are the growth factors driving the Europe On-Demand Insurance Market?

The growth of the Europe On-Demand Insurance Market is driven by increasing consumer demand for flexibility, the rise of the gig economy, and advancements in technology that enable real-time policy adjustments. Additionally, changing consumer behaviors towards ownership and sharing economy models are contributing to this trend.

What challenges does the Europe On-Demand Insurance Market face?

The Europe On-Demand Insurance Market faces challenges such as regulatory hurdles, consumer trust issues, and the need for robust technology infrastructure. Additionally, competition from traditional insurance models can hinder the adoption of on-demand solutions.

What opportunities exist in the Europe On-Demand Insurance Market?

Opportunities in the Europe On-Demand Insurance Market include the potential for partnerships with tech companies, the expansion of coverage options to new sectors, and the increasing acceptance of digital insurance solutions among consumers. As more people seek personalized insurance experiences, the market is poised for growth.

What trends are shaping the Europe On-Demand Insurance Market?

Trends shaping the Europe On-Demand Insurance Market include the integration of artificial intelligence for personalized pricing, the rise of usage-based insurance models, and the growing importance of customer experience in policy design. These trends reflect a shift towards more consumer-centric insurance solutions.

Europe On-Demand Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Auto Insurance, Health Insurance, Travel Insurance, Home Insurance |

| Delivery Model | Mobile App, Web Platform, API Integration, Third-Party Aggregator |

| Customer Type | Individuals, Small Businesses, Corporates, Freelancers |

| Coverage Type | Full Coverage, Liability Coverage, Limited Coverage, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Europe On-Demand Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at