444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The Europe Offshore Oil & Gas Paints and Coatings market holds strategic importance within the energy sector, providing essential protective solutions for offshore structures exposed to demanding marine environments. These coatings play a critical role in preserving the integrity of offshore assets, ensuring durability and corrosion resistance in challenging conditions prevalent in European offshore operations.

Meaning

Offshore Oil & Gas Paints and Coatings in Europe refer to specialized formulations designed to safeguard offshore structures, pipelines, and equipment from corrosion, abrasion, and environmental factors. These coatings serve as a protective barrier, extending the operational life of assets and reducing maintenance costs associated with offshore activities.

Executive Summary

The Europe Offshore Oil & Gas Paints and Coatings market has witnessed consistent growth driven by the expansion of offshore exploration and production endeavors. The market’s significance lies in providing coatings that adhere to stringent environmental standards while offering robust protection against harsh marine conditions. While opportunities for growth are abundant, challenges such as fluctuating oil prices and the need for sustainable coating solutions shape the market landscape.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Europe Offshore Oil & Gas Paints and Coatings market operates in a dynamic landscape influenced by factors such as renewable energy transitions, environmental regulations, technological advancements, and the expansion of offshore activities. Understanding these dynamics is essential for stakeholders to navigate challenges and capitalize on emerging opportunities.

Regional Analysis

The performance of the Europe Offshore Oil & Gas Paints and Coatings market varies across regions, with key considerations including the concentration of offshore projects, regulatory frameworks, and the presence of major energy hubs.

Competitive Landscape

Leading Companies in Europe Offshore Oil & Gas Paints and Coatings Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

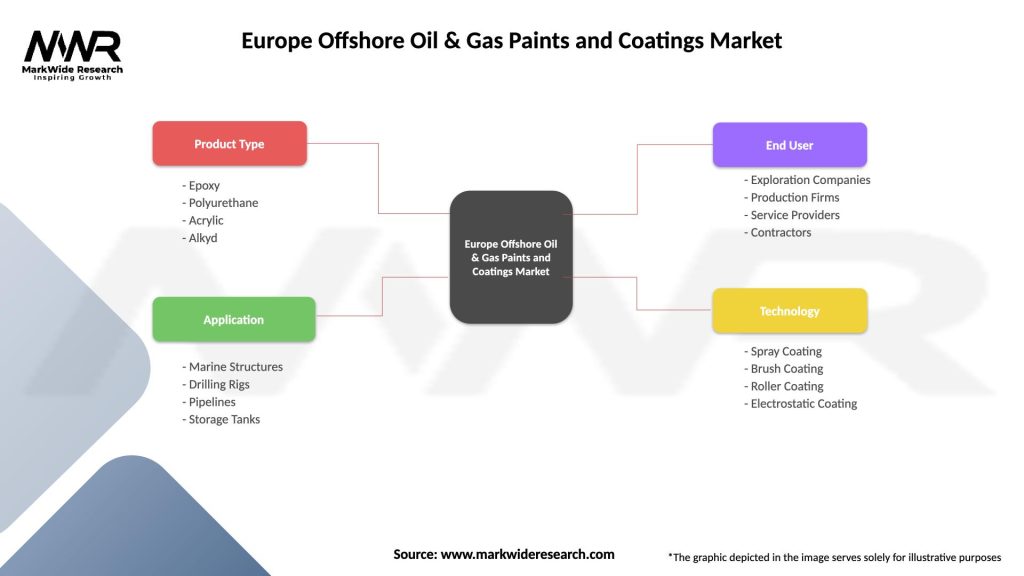

Segmentation

The Europe Offshore Oil & Gas Paints and Coatings market can be segmented based on various factors, including:

Segmentation provides a detailed understanding of market dynamics, allowing coating manufacturers to tailor their products to the specific needs of different applications and end-users.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The Europe Offshore Oil & Gas Paints and Coatings market offers several benefits for industry participants and stakeholders:

SWOT Analysis

A SWOT analysis provides an overview of the Europe Offshore Oil & Gas Paints and Coatings market’s strengths, weaknesses, opportunities, and threats:

Understanding these factors through a SWOT analysis helps businesses formulate strategies to leverage strengths, address weaknesses, capitalize on opportunities, and mitigate potential threats.

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had notable implications for the Europe Offshore Oil & Gas Paints and Coatings market:

Key Industry Developments

Analyst Suggestions

Future Outlook

The Europe Offshore Oil & Gas Paints and Coatings market’s future outlook is shaped by evolving industry dynamics, technological advancements, and the transition towards sustainable practices. With a focus on innovation, collaboration, and environmental responsibility, the market is expected to witness continued growth as offshore activities expand and the demand for high-performance coatings persists.

Conclusion

In conclusion, the Europe Offshore Oil & Gas Paints and Coatings market is a critical component of the energy sector, contributing to the protection and longevity of offshore infrastructure. While facing challenges related to environmental regulations, volatile oil prices, and application complexities, the market offers opportunities for manufacturers to innovate and provide coatings that align with industry standards and sustainability goals. Strategic collaborations, investment in sustainable formulations, and the adoption of digital technologies are key elements for success in this dynamic market.

What is Offshore Oil & Gas Paints and Coatings?

Offshore Oil & Gas Paints and Coatings are specialized protective coatings designed to withstand harsh marine environments, ensuring the longevity and safety of offshore structures and equipment.

What are the key players in the Europe Offshore Oil & Gas Paints and Coatings Market?

Key players in the Europe Offshore Oil & Gas Paints and Coatings Market include AkzoNobel, PPG Industries, and Hempel, among others.

What are the growth factors driving the Europe Offshore Oil & Gas Paints and Coatings Market?

The growth of the Europe Offshore Oil & Gas Paints and Coatings Market is driven by increasing offshore exploration activities, the need for corrosion protection, and advancements in coating technologies.

What challenges does the Europe Offshore Oil & Gas Paints and Coatings Market face?

Challenges in the Europe Offshore Oil & Gas Paints and Coatings Market include stringent environmental regulations, the high cost of specialized coatings, and competition from alternative materials.

What opportunities exist in the Europe Offshore Oil & Gas Paints and Coatings Market?

Opportunities in the Europe Offshore Oil & Gas Paints and Coatings Market include the development of eco-friendly coatings, increasing investments in renewable energy projects, and the expansion of offshore wind farms.

What trends are shaping the Europe Offshore Oil & Gas Paints and Coatings Market?

Trends in the Europe Offshore Oil & Gas Paints and Coatings Market include the growing demand for high-performance coatings, innovations in nanotechnology, and a shift towards sustainable and low-VOC products.

Europe Offshore Oil & Gas Paints and Coatings Market

| Segmentation Details | Description |

|---|---|

| Product Type | Epoxy, Polyurethane, Acrylic, Alkyd |

| Application | Marine Structures, Drilling Rigs, Pipelines, Storage Tanks |

| End User | Exploration Companies, Production Firms, Service Providers, Contractors |

| Technology | Spray Coating, Brush Coating, Roller Coating, Electrostatic Coating |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Europe Offshore Oil & Gas Paints and Coatings Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at