444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The Europe offshore energy market is a thriving sector that plays a significant role in the region’s energy landscape. Offshore energy refers to the production of electricity or the extraction of oil and gas from offshore sources such as wind farms, oil rigs, and subsea installations. In recent years, Europe has witnessed substantial growth in offshore energy projects, driven by the need for renewable energy sources, energy security, and reducing greenhouse gas emissions.

Meaning

Offshore energy involves harnessing natural resources from marine environments to generate electricity or extract oil and gas. It utilizes various technologies such as offshore wind turbines, floating solar panels, and offshore oil and gas platforms. This industry is vital for meeting Europe’s energy demands, promoting sustainability, and reducing reliance on fossil fuels.

Executive Summary

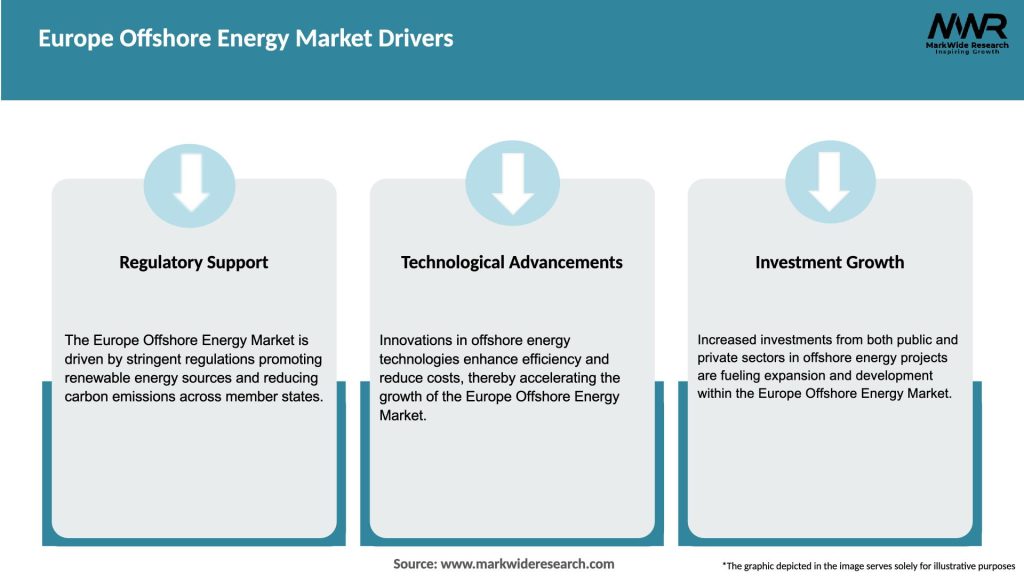

The Europe offshore energy market has experienced rapid growth in recent years, driven by favorable government policies, technological advancements, and increasing environmental concerns. The market comprises several segments, including offshore wind energy, offshore oil and gas exploration, and subsea installations. This executive summary provides an overview of the market’s key insights, drivers, restraints, opportunities, and dynamics.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Europe offshore energy market is characterized by dynamic factors that shape its growth and trajectory. These dynamics include market drivers, restraints, opportunities, and ongoing trends. The market’s performance is influenced by evolving government policies, technological advancements, environmental considerations, and economic factors. Understanding the market dynamics is crucial for industry participants to make informed decisions and capitalize on emerging trends.

Regional Analysis

The Europe offshore energy market exhibits significant regional variations in terms of resource availability, government support, and market maturity. Coastal countries such as the United Kingdom, Germany, Denmark, and the Netherlands have established themselves as leaders in offshore wind energy. Southern European countries like Spain and Portugal are emerging as potential growth markets. Each region has unique characteristics and opportunities for offshore energy development.

Competitive Landscape

Leading Companies in the Europe Offshore Energy Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

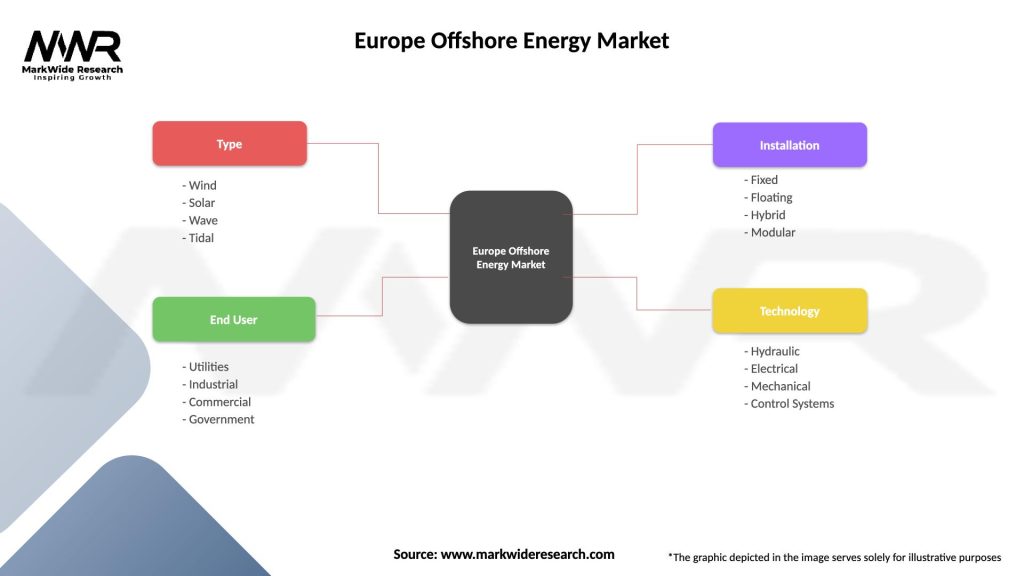

Segmentation

The Europe offshore energy market can be segmented based on the following criteria:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had both positive and negative impacts on the Europe offshore energy market. While the pandemic caused temporary disruptions in project timelines, supply chains, and financing, it also highlighted the importance of a resilient and sustainable energy sector. The recovery phase presents an opportunity for governments and industry stakeholders to prioritize renewable energy investments and accelerate the transition to a low-carbon economy.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Europe offshore energy market is poised for significant growth in the coming years. The expansion of offshore wind energy, advancements in floating solar technologies, and the integration of energy storage systems will be key drivers. The industry will continue to evolve, driven by technological innovations, government policies, and environmental imperatives. Offshore energy will play a crucial role in Europe’s transition to a sustainable and decarbonized energy future.

Conclusion

The Europe offshore energy market offers vast potential for renewable energy generation, oil and gas exploration, and subsea installations. With a focus on reducing carbon emissions, enhancing energy security, and leveraging offshore resources, the region is witnessing rapid growth in offshore wind energy and other offshore energy projects. Overcoming challenges, capitalizing on opportunities, and fostering collaboration among stakeholders will be essential to harness the full potential of Europe’s offshore energy market and achieve a sustainable energy future.

What is Offshore Energy?

Offshore energy refers to the production of energy from sources located in ocean or sea environments, including wind, oil, and gas. This sector plays a crucial role in meeting energy demands while minimizing land use and environmental impact.

What are the key players in the Europe Offshore Energy Market?

Key players in the Europe Offshore Energy Market include Ørsted, Siemens Gamesa, and Equinor, which are involved in offshore wind and oil exploration. These companies are leading the way in developing innovative technologies and sustainable practices in the sector, among others.

What are the growth factors driving the Europe Offshore Energy Market?

The Europe Offshore Energy Market is driven by increasing energy demands, advancements in technology, and government policies promoting renewable energy. Additionally, the push for reducing carbon emissions and enhancing energy security contributes to market growth.

What challenges does the Europe Offshore Energy Market face?

Challenges in the Europe Offshore Energy Market include high initial investment costs, regulatory hurdles, and environmental concerns related to marine ecosystems. These factors can hinder project development and operational efficiency.

What opportunities exist in the Europe Offshore Energy Market?

The Europe Offshore Energy Market presents opportunities in expanding offshore wind farms, developing floating solar technologies, and enhancing energy storage solutions. These innovations can lead to increased efficiency and sustainability in energy production.

What trends are shaping the Europe Offshore Energy Market?

Trends in the Europe Offshore Energy Market include the rise of hybrid energy systems, increased investment in floating wind technology, and a focus on decarbonization strategies. These trends reflect a shift towards more sustainable and integrated energy solutions.

Europe Offshore Energy Market

| Segmentation Details | Description |

|---|---|

| Type | Wind, Solar, Wave, Tidal |

| End User | Utilities, Industrial, Commercial, Government |

| Installation | Fixed, Floating, Hybrid, Modular |

| Technology | Hydraulic, Electrical, Mechanical, Control Systems |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Europe Offshore Energy Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at