444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe novel drug delivery systems market represents a dynamic and rapidly evolving sector within the pharmaceutical industry, characterized by innovative technologies that enhance therapeutic efficacy and patient compliance. This market encompasses advanced delivery mechanisms including nanotechnology-based systems, targeted drug delivery platforms, and controlled-release formulations that revolutionize how medications are administered and absorbed in the human body. European pharmaceutical companies and research institutions are at the forefront of developing sophisticated delivery systems that address complex medical conditions while minimizing side effects and improving patient outcomes.

Market dynamics in Europe are driven by increasing prevalence of chronic diseases, aging population demographics, and growing demand for personalized medicine approaches. The region’s robust regulatory framework, led by the European Medicines Agency, provides a structured pathway for novel drug delivery system approvals while ensuring safety and efficacy standards. Innovation hubs across countries like Germany, Switzerland, United Kingdom, and France are contributing significantly to technological advancements in drug delivery mechanisms, with growth rates reaching 8.5% CAGR in key segments.

Technological advancement continues to shape market evolution, with emerging platforms such as lipid nanoparticles, polymeric microspheres, and implantable drug delivery devices gaining substantial traction among healthcare providers and patients. The market demonstrates strong potential for expansion, supported by increasing healthcare expenditure, favorable reimbursement policies, and growing adoption of advanced therapeutic modalities across European healthcare systems.

The Europe novel drug delivery systems market refers to the comprehensive ecosystem of advanced pharmaceutical technologies designed to transport therapeutic agents to specific target sites within the human body through innovative delivery mechanisms. These systems encompass a wide range of sophisticated platforms including nanoparticle-based carriers, liposomal formulations, transdermal patches, inhalation devices, and implantable systems that optimize drug bioavailability, reduce systemic toxicity, and enhance patient compliance through improved dosing regimens.

Novel drug delivery systems fundamentally transform traditional pharmaceutical approaches by incorporating cutting-edge materials science, nanotechnology, and bioengineering principles to create targeted, controlled, and sustained release mechanisms. These systems address critical challenges in conventional drug administration, including poor solubility, limited bioavailability, frequent dosing requirements, and adverse side effects that compromise treatment effectiveness and patient adherence to therapeutic protocols.

European market context emphasizes regulatory compliance, clinical validation, and commercial viability of innovative delivery platforms that meet stringent quality standards while addressing diverse therapeutic areas including oncology, cardiovascular diseases, neurological disorders, and autoimmune conditions across the region’s healthcare landscape.

Strategic market positioning reveals that Europe’s novel drug delivery systems market demonstrates exceptional growth potential driven by technological innovation, regulatory support, and increasing healthcare demands across the region. The market encompasses diverse delivery platforms serving multiple therapeutic applications, with nanotechnology-based systems representing the fastest-growing segment, achieving adoption rates of 42% among pharmaceutical companies developing next-generation therapeutics.

Key market drivers include rising prevalence of chronic diseases requiring long-term treatment, aging population demographics demanding improved medication compliance, and growing emphasis on personalized medicine approaches that necessitate precise drug targeting capabilities. European pharmaceutical companies are investing heavily in research and development activities, with innovation spending increasing by 12% annually in drug delivery technology development.

Competitive landscape features established pharmaceutical giants alongside emerging biotechnology companies specializing in novel delivery mechanisms. Market participants are focusing on strategic partnerships, licensing agreements, and collaborative research initiatives to accelerate product development timelines and expand market reach across European countries.

Future outlook indicates sustained market expansion supported by favorable regulatory environment, increasing healthcare expenditure, and growing acceptance of advanced therapeutic modalities among healthcare providers and patients throughout Europe.

Market segmentation analysis reveals distinct growth patterns across various delivery system categories, with several key insights emerging from comprehensive market evaluation:

Demographic transformation across Europe significantly influences novel drug delivery systems market growth, with aging population requiring sophisticated medication management solutions that address complex comorbidities and improve quality of life. The region’s demographic shift toward older age groups creates substantial demand for controlled-release formulations, transdermal delivery systems, and implantable devices that reduce dosing frequency while maintaining therapeutic effectiveness.

Chronic disease prevalence continues rising throughout European countries, necessitating advanced delivery mechanisms that optimize treatment outcomes for conditions such as diabetes, cardiovascular diseases, and neurological disorders. Healthcare systems increasingly recognize the value of targeted drug delivery platforms that minimize systemic exposure while maximizing therapeutic benefits, leading to improved patient outcomes and reduced healthcare costs.

Technological advancement in materials science, nanotechnology, and bioengineering enables development of sophisticated delivery systems previously considered impossible. European research institutions and pharmaceutical companies collaborate extensively to translate scientific breakthroughs into commercially viable products that address unmet medical needs across diverse therapeutic areas.

Regulatory support from European authorities facilitates market growth through streamlined approval processes, clear guidance documents, and incentive programs encouraging innovation in drug delivery technologies. The European Medicines Agency’s adaptive pathways approach enables earlier patient access to breakthrough delivery systems while maintaining rigorous safety standards.

High development costs associated with novel drug delivery systems present significant barriers to market entry, particularly for smaller biotechnology companies lacking substantial financial resources. The complex nature of these systems requires extensive research and development investments, lengthy clinical trial periods, and sophisticated manufacturing capabilities that strain organizational budgets and timelines.

Regulatory complexity surrounding novel delivery mechanisms creates challenges for companies navigating approval processes across multiple European jurisdictions. Despite harmonization efforts, varying national requirements and interpretation of guidelines can delay product launches and increase compliance costs, particularly for innovative platforms lacking established regulatory precedents.

Manufacturing challenges related to scaling production of sophisticated delivery systems often require specialized equipment, controlled environments, and highly trained personnel. These requirements create bottlenecks in commercial manufacturing and increase production costs, potentially limiting market accessibility and adoption rates among healthcare providers.

Market acceptance barriers include healthcare provider reluctance to adopt new delivery technologies, patient concerns about novel treatment approaches, and reimbursement uncertainties that affect commercial viability. Conservative prescribing practices and established treatment protocols can slow market penetration despite demonstrated clinical benefits of innovative delivery systems.

Personalized medicine integration presents substantial opportunities for novel drug delivery systems that can be tailored to individual patient characteristics, genetic profiles, and disease states. European healthcare systems increasingly embrace precision medicine approaches, creating demand for customizable delivery platforms that optimize therapeutic outcomes while minimizing adverse effects through patient-specific dosing and targeting strategies.

Digital health convergence offers innovative opportunities to combine drug delivery systems with smart monitoring technologies, connected devices, and data analytics platforms that enhance treatment adherence and enable real-time therapy optimization. Integration with digital health ecosystems creates value-added propositions for healthcare providers and patients seeking comprehensive treatment management solutions.

Emerging therapeutic areas including gene therapy, cell therapy, and regenerative medicine require specialized delivery mechanisms that protect sensitive biological materials while ensuring precise targeting and controlled release. These rapidly expanding fields present significant growth opportunities for companies developing advanced delivery platforms capable of handling complex therapeutic modalities.

Partnership opportunities with pharmaceutical companies, biotechnology firms, and academic institutions enable collaborative development of innovative delivery systems that combine complementary expertise and resources. Strategic alliances facilitate risk sharing, accelerate development timelines, and expand market reach across European countries and therapeutic applications.

Competitive intensity within the Europe novel drug delivery systems market continues escalating as established pharmaceutical companies and emerging biotechnology firms compete for market share across diverse therapeutic applications. Market participants employ various strategies including product differentiation, strategic partnerships, licensing agreements, and acquisition activities to strengthen competitive positioning and expand technological capabilities.

Innovation cycles accelerate as companies invest heavily in research and development activities, with breakthrough technologies emerging regularly that disrupt existing market dynamics. The rapid pace of technological advancement creates both opportunities for market leaders to maintain competitive advantages and threats from new entrants introducing disruptive delivery platforms.

Supply chain evolution reflects increasing complexity of novel delivery systems, requiring specialized manufacturing capabilities, quality control systems, and distribution networks that ensure product integrity throughout the value chain. Companies must navigate sophisticated supply chain requirements while maintaining cost competitiveness and regulatory compliance across European markets.

Market consolidation trends indicate ongoing merger and acquisition activity as companies seek to acquire complementary technologies, expand therapeutic portfolios, and achieve economies of scale in development and manufacturing operations. This consolidation creates larger, more diversified market participants capable of supporting comprehensive drug delivery system development programs.

Comprehensive market analysis employs multi-faceted research approaches combining primary and secondary data sources to provide accurate, reliable insights into Europe’s novel drug delivery systems market dynamics. The methodology incorporates quantitative analysis, qualitative assessment, and trend evaluation techniques that capture market complexities and emerging opportunities across the region.

Primary research activities include structured interviews with industry executives, pharmaceutical company representatives, regulatory officials, and healthcare providers to gather firsthand insights into market trends, challenges, and growth opportunities. Expert consultations provide valuable perspectives on technological developments, competitive dynamics, and future market evolution patterns.

Secondary research components encompass analysis of published reports, regulatory filings, patent databases, clinical trial registries, and industry publications that provide comprehensive market intelligence. Data triangulation techniques ensure accuracy and reliability of market insights while identifying potential discrepancies or gaps in available information.

Analytical frameworks utilize advanced statistical methods, trend analysis, and forecasting models that project market growth patterns, segment performance, and competitive positioning across different time horizons. MarkWide Research analytical capabilities enable comprehensive market evaluation that supports strategic decision-making for industry participants and stakeholders.

Western European markets demonstrate leadership in novel drug delivery systems development and adoption, with countries like Germany, Switzerland, France, and the United Kingdom contributing significantly to regional market growth. These markets benefit from robust pharmaceutical industries, advanced research infrastructure, and supportive regulatory environments that facilitate innovation and commercialization of breakthrough delivery technologies.

Germany represents the largest European market for novel drug delivery systems, accounting for approximately 22% of regional market share due to its strong pharmaceutical manufacturing base, extensive research capabilities, and favorable healthcare reimbursement policies. German companies lead development of nanotechnology-based platforms and targeted delivery systems serving diverse therapeutic applications.

Switzerland maintains a prominent position in high-value delivery system development, leveraging its concentration of pharmaceutical headquarters and research facilities to drive innovation in complex delivery mechanisms. The country’s expertise in precision manufacturing and quality control supports development of sophisticated delivery platforms requiring stringent production standards.

Nordic countries including Sweden, Denmark, and Norway demonstrate strong growth potential in digital health integration and personalized medicine applications of novel delivery systems. These markets emphasize patient-centric approaches and technology integration that enhance treatment outcomes while reducing healthcare costs through improved medication management.

Eastern European markets show increasing adoption of novel delivery systems, supported by expanding healthcare infrastructure, growing pharmaceutical industries, and improving regulatory frameworks. Countries like Poland, Czech Republic, and Hungary present emerging opportunities for market expansion as healthcare systems modernize and embrace advanced therapeutic technologies.

Market leadership in Europe’s novel drug delivery systems sector features a diverse ecosystem of established pharmaceutical companies, specialized biotechnology firms, and emerging technology developers competing across multiple therapeutic areas and delivery platforms. The competitive environment emphasizes innovation capability, regulatory expertise, and commercial execution as key differentiating factors.

Major market participants include:

Competitive strategies focus on research and development investments, strategic partnerships with academic institutions, licensing agreements for complementary technologies, and acquisition of innovative delivery system companies to expand technological capabilities and market reach across European countries.

Technology-based segmentation reveals distinct market categories based on delivery mechanism sophistication and therapeutic applications:

By Technology:

By Application:

By Route of Administration:

Nanotechnology-based delivery systems represent the most dynamic market category, demonstrating exceptional growth potential due to superior targeting capabilities and versatility across therapeutic applications. These systems achieve enhanced cellular uptake, improved pharmacokinetics, and reduced side effects compared to conventional formulations, making them particularly attractive for complex therapeutic challenges.

Oncology applications dominate market demand for novel delivery systems, driven by increasing cancer incidence across European populations and growing emphasis on targeted therapy approaches. Cancer treatment requires precise drug targeting to tumor sites while minimizing systemic toxicity, creating substantial opportunities for advanced delivery platforms that can navigate biological barriers and achieve selective tumor accumulation.

Chronic disease management represents a significant growth category as European healthcare systems seek cost-effective solutions for long-term patient care. Novel delivery systems that reduce dosing frequency, improve medication adherence, and minimize adverse effects provide substantial value propositions for healthcare providers managing patients with diabetes, cardiovascular diseases, and neurological conditions.

Personalized medicine integration emerges as a transformative category enabling customized delivery approaches based on individual patient characteristics, genetic profiles, and disease states. This category demonstrates rapid adoption rates among pharmaceutical companies developing precision medicine solutions that optimize therapeutic outcomes through patient-specific delivery strategies.

Pharmaceutical companies benefit significantly from novel drug delivery systems through enhanced product differentiation, extended patent protection, improved therapeutic efficacy, and expanded market opportunities. These systems enable companies to reformulate existing drugs, develop new therapeutic applications, and create competitive advantages in crowded therapeutic markets while addressing unmet medical needs.

Healthcare providers gain substantial advantages including improved patient outcomes, reduced treatment complications, enhanced medication adherence, and optimized resource utilization. Novel delivery systems often simplify treatment protocols, reduce administration frequency, and minimize monitoring requirements, leading to operational efficiencies and improved patient satisfaction.

Patients experience significant benefits through reduced side effects, improved treatment convenience, enhanced quality of life, and better therapeutic outcomes. Advanced delivery systems often eliminate painful injections, reduce dosing frequency, and provide more predictable therapeutic effects, leading to improved treatment compliance and better long-term health outcomes.

Healthcare systems realize economic benefits through reduced hospitalization rates, decreased treatment complications, improved resource allocation, and enhanced cost-effectiveness of therapeutic interventions. Novel delivery systems often reduce overall treatment costs by improving efficacy, reducing adverse events, and enabling outpatient management of complex conditions.

Research institutions benefit from collaborative opportunities, technology transfer agreements, licensing revenue, and enhanced research capabilities through partnerships with industry participants developing innovative delivery platforms.

Strengths:

Weaknesses:

Opportunities:

Threats:

Nanotechnology advancement continues driving market evolution through development of increasingly sophisticated delivery platforms capable of precise targeting, controlled release, and enhanced bioavailability. European companies lead innovation in lipid nanoparticles, polymeric carriers, and hybrid delivery systems that combine multiple mechanisms for optimal therapeutic outcomes.

Personalized medicine integration represents a transformative trend enabling customized delivery approaches based on individual patient characteristics, genetic profiles, and disease states. This trend demonstrates accelerating adoption among pharmaceutical companies developing precision medicine solutions that optimize therapeutic outcomes through patient-specific delivery strategies.

Digital health convergence creates innovative opportunities combining drug delivery systems with smart monitoring technologies, connected devices, and data analytics platforms that enhance treatment adherence and enable real-time therapy optimization. Integration with digital ecosystems provides comprehensive treatment management solutions valued by healthcare providers and patients.

Sustainability focus influences delivery system development through emphasis on biodegradable materials, environmentally friendly manufacturing, and reduced packaging waste. European companies increasingly prioritize sustainable approaches that align with environmental regulations and corporate responsibility initiatives.

Combination therapy platforms gain traction as companies develop delivery systems capable of administering multiple therapeutic agents simultaneously or sequentially. These platforms address complex diseases requiring multi-modal treatment approaches while simplifying patient management protocols.

Recent breakthrough approvals by the European Medicines Agency demonstrate growing acceptance of innovative delivery platforms, with several nanotechnology-based systems and targeted delivery platforms receiving marketing authorization for various therapeutic applications. These approvals validate the clinical utility and commercial viability of advanced delivery technologies.

Strategic partnership formations between pharmaceutical companies, biotechnology firms, and academic institutions accelerate development of novel delivery systems through collaborative research initiatives, technology sharing agreements, and joint development programs. These partnerships leverage complementary expertise while sharing development risks and costs.

Manufacturing capacity expansion across Europe reflects growing market demand and company confidence in long-term growth prospects. Several major pharmaceutical companies have announced significant investments in specialized manufacturing facilities capable of producing sophisticated delivery systems at commercial scale.

Regulatory guidance updates from European authorities provide clearer pathways for novel delivery system approval while maintaining rigorous safety and efficacy standards. Recent guidance documents address specific technical requirements for nanotechnology-based platforms and combination delivery systems.

Investment activity acceleration includes venture capital funding, private equity investments, and acquisition transactions involving companies developing innovative delivery technologies. This financial activity indicates strong investor confidence in market growth potential and commercial opportunities.

Strategic focus recommendations emphasize the importance of developing comprehensive delivery system portfolios that address multiple therapeutic areas while leveraging core technological competencies. Companies should prioritize platform approaches that enable rapid adaptation to different therapeutic applications rather than single-product development strategies.

Partnership strategy optimization suggests that companies should actively pursue collaborative relationships with academic institutions, research organizations, and complementary technology providers to accelerate innovation cycles and reduce development risks. MarkWide Research analysis indicates that companies with strong partnership networks achieve faster time-to-market and higher success rates in product development.

Regulatory preparation enhancement requires companies to invest in regulatory expertise and early engagement with European authorities to ensure smooth approval processes. Proactive regulatory strategies that address potential concerns early in development can significantly reduce approval timelines and commercial risks.

Market access planning should begin during early development phases, incorporating health economics considerations, reimbursement strategies, and value proposition development that demonstrate clear benefits over existing treatment options. Companies must articulate compelling value propositions that justify premium pricing for innovative delivery systems.

Manufacturing scalability planning requires early consideration of commercial production requirements, quality control systems, and supply chain management to ensure successful product launches. Companies should develop scalable manufacturing strategies that can accommodate market growth while maintaining product quality and cost competitiveness.

Market expansion trajectory indicates sustained growth across Europe’s novel drug delivery systems market, driven by technological advancement, demographic trends, and increasing healthcare demands. The market demonstrates strong fundamentals supporting continued expansion, with growth rates expected to maintain robust momentum through the forecast period.

Technology evolution will continue advancing delivery system capabilities through integration of artificial intelligence, machine learning, and advanced materials science that enable more sophisticated targeting, controlled release, and patient monitoring capabilities. These technological convergences create opportunities for breakthrough delivery platforms that address previously intractable therapeutic challenges.

Therapeutic area expansion will broaden market opportunities as novel delivery systems find applications in emerging fields such as gene therapy, cell therapy, and regenerative medicine. These rapidly growing therapeutic areas require specialized delivery mechanisms that protect sensitive biological materials while ensuring precise targeting and controlled release.

Regulatory evolution will continue adapting to accommodate innovative delivery technologies while maintaining safety standards. European authorities are developing more flexible regulatory frameworks that enable faster approval of breakthrough technologies while ensuring patient safety and therapeutic efficacy.

Market consolidation trends suggest continued merger and acquisition activity as companies seek to acquire complementary technologies, expand therapeutic portfolios, and achieve economies of scale. This consolidation will create larger, more diversified market participants capable of supporting comprehensive delivery system development programs across multiple therapeutic areas.

Europe’s novel drug delivery systems market represents a dynamic and rapidly evolving sector with exceptional growth potential driven by technological innovation, demographic trends, and increasing healthcare demands across the region. The market demonstrates strong fundamentals including robust regulatory frameworks, advanced research infrastructure, and growing acceptance of innovative therapeutic technologies among healthcare providers and patients.

Key success factors for market participants include technological innovation capabilities, regulatory expertise, strategic partnership development, and comprehensive market access strategies that demonstrate clear value propositions over existing treatment options. Companies that effectively combine these elements while maintaining focus on patient outcomes and healthcare system benefits are positioned for sustained success in this competitive market environment.

Future market evolution will be shaped by continued technological advancement, expanding therapeutic applications, regulatory framework evolution, and increasing integration with digital health technologies. The convergence of these trends creates substantial opportunities for companies developing innovative delivery platforms that address complex therapeutic challenges while improving patient outcomes and healthcare system efficiency across European markets.

What is Novel Drug Delivery Systems?

Novel Drug Delivery Systems refer to advanced methods and technologies designed to deliver therapeutic agents in a controlled and targeted manner, enhancing the efficacy and safety of treatments. These systems include various formulations and devices that improve drug absorption and bioavailability.

What are the key companies in the Europe Novel Drug Delivery Systems Market?

Key companies in the Europe Novel Drug Delivery Systems Market include Novartis, Roche, and Merck, which are known for their innovative approaches in drug delivery technologies. Other notable players include Pfizer and Sanofi, among others.

What are the drivers of growth in the Europe Novel Drug Delivery Systems Market?

The growth of the Europe Novel Drug Delivery Systems Market is driven by the increasing prevalence of chronic diseases, advancements in biotechnology, and the demand for personalized medicine. Additionally, the rise in research and development activities in drug formulation contributes to market expansion.

What challenges does the Europe Novel Drug Delivery Systems Market face?

The Europe Novel Drug Delivery Systems Market faces challenges such as regulatory hurdles, high development costs, and the complexity of manufacturing processes. These factors can hinder the timely introduction of new products into the market.

What opportunities exist in the Europe Novel Drug Delivery Systems Market?

Opportunities in the Europe Novel Drug Delivery Systems Market include the growing demand for biologics and biosimilars, advancements in nanotechnology, and the potential for developing targeted therapies. These factors are expected to drive innovation and investment in the sector.

What trends are shaping the Europe Novel Drug Delivery Systems Market?

Trends shaping the Europe Novel Drug Delivery Systems Market include the increasing use of smart drug delivery systems, the integration of digital health technologies, and a focus on patient-centric approaches. These trends are enhancing the effectiveness and convenience of drug therapies.

Europe Novel Drug Delivery Systems Market

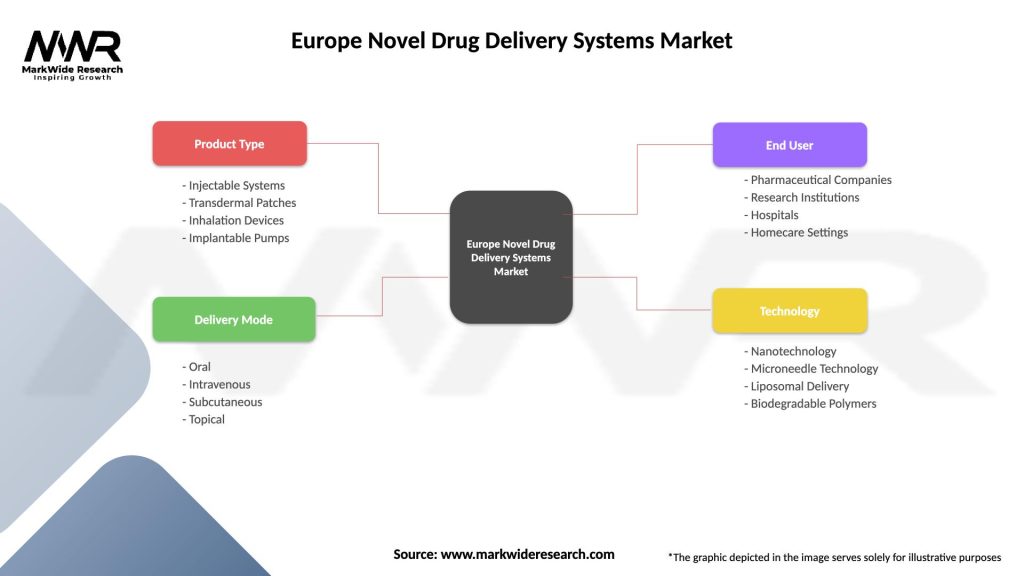

| Segmentation Details | Description |

|---|---|

| Product Type | Injectable Systems, Transdermal Patches, Inhalation Devices, Implantable Pumps |

| Delivery Mode | Oral, Intravenous, Subcutaneous, Topical |

| End User | Pharmaceutical Companies, Research Institutions, Hospitals, Homecare Settings |

| Technology | Nanotechnology, Microneedle Technology, Liposomal Delivery, Biodegradable Polymers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Novel Drug Delivery Systems Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at