444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe Mobile Virtual Network Operator (MVNO) market represents a dynamic and rapidly evolving segment of the telecommunications industry, characterized by innovative service delivery models and competitive pricing strategies. MVNOs operate as wireless service providers without owning the underlying network infrastructure, instead leasing capacity from established mobile network operators to deliver services to end consumers. This market has experienced substantial growth across European countries, driven by increasing demand for flexible mobile services, competitive pricing, and specialized offerings targeting niche customer segments.

Market dynamics in Europe reflect a mature telecommunications landscape where MVNOs have successfully carved out significant market share by offering differentiated services and value propositions. The sector demonstrates robust expansion with growth rates exceeding 8.5% CAGR in several key markets, particularly in Western European countries where regulatory frameworks support competitive market structures. Digital transformation initiatives and the proliferation of IoT applications have further accelerated MVNO adoption, creating new opportunities for specialized service providers.

Regional variations across Europe showcase diverse market maturity levels, with countries like the United Kingdom, Germany, and France leading in MVNO penetration rates of approximately 15-20% of total mobile subscribers. The market encompasses various business models, from full MVNOs with comprehensive service capabilities to light MVNOs focusing on specific customer segments or applications. Technological advancements in 5G networks and edge computing are creating new opportunities for MVNOs to deliver innovative services and capture emerging market segments.

The Mobile Virtual Network Operator (MVNO) market refers to the ecosystem of wireless service providers that offer mobile communications services to consumers and businesses without owning or operating their own radio spectrum licenses or network infrastructure. MVNOs establish agreements with traditional mobile network operators (MNOs) to access network capacity and deliver branded services under their own identity and business model.

Core characteristics of MVNOs include their ability to provide competitive pricing, specialized services, and targeted customer experiences while leveraging existing network infrastructure. These operators typically focus on specific market segments, such as ethnic communities, budget-conscious consumers, or enterprise customers with specialized requirements. Business model flexibility allows MVNOs to adapt quickly to market changes and customer demands without the substantial capital investments required for network infrastructure.

Operational models vary significantly among MVNOs, ranging from full MVNOs that maintain their own core network infrastructure and customer management systems to light MVNOs that primarily focus on marketing and customer acquisition while relying heavily on host network operators for technical operations. This diversity enables different types of companies to enter the mobile services market and compete effectively against established network operators.

Strategic positioning of the Europe MVNO market demonstrates significant growth potential driven by regulatory support, technological advancement, and evolving consumer preferences for flexible mobile services. The market benefits from favorable regulatory environments that promote competition and consumer choice, particularly through initiatives supporting mobile number portability and wholesale access to network infrastructure.

Key growth drivers include increasing demand for specialized mobile services, with approximately 35% of consumers expressing interest in niche service offerings tailored to specific needs or demographics. The rise of IoT applications and machine-to-machine communications has created new opportunities for MVNOs to serve enterprise customers and vertical markets with specialized connectivity solutions. Digital-first business models enable MVNOs to operate with lower overhead costs and pass savings to consumers through competitive pricing.

Market challenges include intense competition from established network operators and the need for continuous innovation to maintain competitive differentiation. However, successful MVNOs have demonstrated the ability to achieve sustainable profitability through focused market strategies and efficient operations. Future prospects remain positive, with 5G network deployment creating new opportunities for innovative service delivery and enhanced customer experiences across diverse market segments.

Market penetration analysis reveals significant opportunities for MVNO expansion across European markets, with current penetration rates varying considerably between countries and customer segments. The following insights highlight critical market dynamics:

Competitive dynamics show established MVNOs maintaining market leadership through brand recognition and service quality, while new entrants focus on innovative business models and niche market segments. The market demonstrates healthy competition that benefits consumers through improved services and competitive pricing.

Regulatory support serves as a fundamental driver for MVNO market growth across Europe, with telecommunications authorities actively promoting competition through policies that ensure fair access to network infrastructure and wholesale services. European Union directives and national regulations create frameworks that enable MVNOs to compete effectively with established network operators while maintaining service quality standards.

Consumer demand for flexible mobile services continues to drive market expansion, particularly among younger demographics who prefer contract-free options and transparent pricing structures. The shift toward digital-first customer experiences aligns with MVNO business models that emphasize online customer acquisition and self-service capabilities. Price sensitivity among consumers creates opportunities for MVNOs to capture market share through competitive pricing strategies.

Technological advancement in network virtualization and cloud-based service platforms reduces barriers to entry for new MVNOs while enabling existing operators to enhance service capabilities. The deployment of 5G networks creates new opportunities for innovative service delivery, particularly in IoT applications and enterprise connectivity solutions. Digital transformation initiatives across industries drive demand for specialized mobile connectivity services that MVNOs are well-positioned to deliver.

Market fragmentation opportunities arise as traditional network operators focus on premium segments, leaving space for MVNOs to serve underserved customer groups and niche markets. The growing importance of brand differentiation and customer experience creates advantages for agile MVNOs that can adapt quickly to changing market conditions and customer preferences.

Infrastructure dependency represents a significant constraint for MVNOs, as their service quality and coverage capabilities depend entirely on agreements with host network operators. This dependency can limit service differentiation opportunities and create potential conflicts of interest when MVNOs compete directly with their network infrastructure providers. Wholesale pricing pressures from network operators can impact MVNO profitability and limit pricing flexibility in competitive markets.

Capital requirements for establishing MVNO operations, while lower than building network infrastructure, still present barriers to entry for smaller companies. Investment needs include customer acquisition costs, technology platforms, regulatory compliance, and working capital for operations. Scale challenges affect smaller MVNOs’ ability to negotiate favorable wholesale rates and achieve operational efficiencies necessary for sustainable profitability.

Regulatory complexity across different European countries creates compliance challenges for MVNOs seeking to operate in multiple markets. Varying national regulations, licensing requirements, and consumer protection standards increase operational complexity and costs. Market saturation in mature European markets limits growth opportunities and intensifies competition for customer acquisition and retention.

Technology evolution requires continuous investment in platforms and capabilities to remain competitive, particularly as 5G networks and advanced services become standard market expectations. MVNOs must balance investment needs with profitability requirements while maintaining competitive service offerings and customer satisfaction levels.

5G network deployment creates unprecedented opportunities for MVNOs to deliver innovative services and capture new market segments through enhanced connectivity capabilities. The low-latency, high-bandwidth characteristics of 5G networks enable MVNOs to serve enterprise customers with specialized applications such as industrial IoT, autonomous systems, and real-time communications. Network slicing capabilities allow MVNOs to offer customized network experiences tailored to specific customer requirements and use cases.

IoT market expansion presents significant growth opportunities for MVNOs specializing in machine-to-machine communications and connected device services. The proliferation of smart city initiatives, industrial automation, and consumer IoT devices creates demand for specialized connectivity solutions that MVNOs can deliver more efficiently than traditional network operators. Vertical market specialization enables MVNOs to develop deep expertise in specific industries and deliver tailored solutions.

Digital transformation initiatives across European businesses create opportunities for MVNOs to provide integrated communication and connectivity solutions. The shift toward remote work and digital collaboration tools increases demand for flexible mobile services that support diverse working arrangements. Enterprise mobility solutions represent high-value market segments where MVNOs can differentiate through specialized services and customer support.

Emerging market segments including seniors, ethnic communities, and environmentally conscious consumers offer opportunities for targeted service offerings and brand positioning. MVNOs can leverage their agility and customer focus to serve these segments more effectively than larger network operators with broader market approaches.

Competitive intensity in the Europe MVNO market continues to drive innovation and service improvement as operators seek to differentiate their offerings and maintain customer loyalty. The market demonstrates dynamic pricing strategies, with MVNOs adjusting their service packages and pricing models to respond to competitive pressures and changing customer preferences. Customer acquisition costs remain a critical factor influencing profitability, with successful MVNOs developing efficient digital marketing strategies to reduce acquisition expenses.

Technology integration plays an increasingly important role in market dynamics, as MVNOs invest in advanced customer management systems, artificial intelligence for customer service, and data analytics for personalized service delivery. The ability to leverage technology for operational efficiency and customer experience enhancement becomes a key competitive differentiator. Partnership ecosystems enable MVNOs to expand their service capabilities through collaborations with technology providers, content companies, and other service providers.

Market consolidation trends show larger MVNOs acquiring smaller operators to achieve scale advantages and expand market coverage. This consolidation creates opportunities for remaining independent MVNOs to serve niche markets while building sustainable competitive positions. Regulatory evolution continues to shape market dynamics, with authorities balancing competition promotion with consumer protection and market stability objectives.

Customer behavior shifts toward digital-first interactions and self-service capabilities align with MVNO business models, creating advantages over traditional network operators with legacy customer service approaches. The increasing importance of brand trust and customer experience quality influences market dynamics and competitive positioning strategies across the MVNO ecosystem.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Europe MVNO market landscape. Primary research activities include structured interviews with industry executives, regulatory officials, and key stakeholders across major European markets to gather firsthand insights into market trends, challenges, and opportunities. Survey methodologies capture consumer preferences, usage patterns, and satisfaction levels across different MVNO service categories and customer segments.

Secondary research encompasses extensive analysis of regulatory filings, financial reports, industry publications, and market data from telecommunications authorities across European countries. This approach ensures comprehensive coverage of market developments, competitive dynamics, and regulatory changes affecting MVNO operations. Data validation processes include cross-referencing multiple sources and conducting follow-up interviews to verify key findings and market insights.

Quantitative analysis utilizes statistical modeling and trend analysis to project market growth patterns and identify key performance indicators across different market segments and geographic regions. The methodology incorporates economic factors, demographic trends, and technology adoption patterns to develop robust market forecasts. Qualitative assessment provides context for quantitative findings through expert opinions, case studies, and detailed analysis of successful MVNO business models and strategies.

Market segmentation analysis employs clustering techniques and demographic analysis to identify distinct customer groups and service categories within the broader MVNO market. This approach enables detailed understanding of market dynamics and competitive positioning across different segments and geographic markets throughout Europe.

Western European markets demonstrate the highest MVNO penetration rates, with the United Kingdom leading at approximately 18% market share of total mobile subscribers. The UK market benefits from strong regulatory support and a competitive landscape that encourages innovation and customer choice. Germany represents the largest European market by subscriber volume, with MVNOs capturing approximately 12% market share through diverse service offerings and competitive pricing strategies.

France shows steady MVNO growth with market share reaching 14% of total mobile subscribers, driven by strong consumer acceptance of alternative service providers and regulatory frameworks supporting competition. The French market demonstrates particular strength in prepaid services and ethnic community-focused MVNOs. Netherlands achieves high MVNO penetration rates of approximately 16% through innovative service models and strong digital adoption among consumers.

Southern European markets including Spain and Italy show growing MVNO adoption, with market shares reaching 8-10% respectively. These markets benefit from increasing price sensitivity among consumers and regulatory initiatives promoting competition. Nordic countries demonstrate varying MVNO penetration levels, with Denmark and Norway showing higher adoption rates compared to Sweden and Finland, reflecting different regulatory approaches and market structures.

Eastern European markets present significant growth opportunities for MVNO expansion, with countries like Poland and Czech Republic showing increasing market acceptance and regulatory support for alternative service providers. These markets benefit from growing smartphone adoption and increasing demand for flexible mobile services among younger demographics.

Market leadership in the Europe MVNO sector is characterized by a diverse mix of established operators, telecommunications companies, and specialized service providers. The competitive landscape includes both pan-European operators and country-specific MVNOs that focus on local market opportunities and customer preferences.

Competitive strategies vary significantly among market participants, with some focusing on price competition while others emphasize service quality, customer experience, or specialized market segments. Successful MVNOs demonstrate the ability to balance competitive pricing with sustainable profitability through efficient operations and targeted customer acquisition strategies.

By Business Model: The Europe MVNO market encompasses various operational models that determine service capabilities and market positioning. Full MVNOs maintain comprehensive network infrastructure and customer management systems, enabling greater service control and differentiation opportunities. Light MVNOs focus primarily on customer acquisition and brand management while relying on host operators for technical services and network operations.

By Target Market: Customer segmentation reveals distinct market categories with different service requirements and value propositions. Consumer MVNOs target individual customers with competitive pricing and flexible service packages. Enterprise MVNOs focus on business customers requiring specialized connectivity solutions and enhanced service levels. Ethnic MVNOs serve specific cultural communities with tailored services including international calling and multilingual customer support.

By Technology: Network technology segmentation shows MVNOs operating across different generations of mobile networks. 4G/LTE MVNOs represent the majority of current operations, providing high-speed data services and comprehensive coverage. 5G-enabled MVNOs are emerging as network operators deploy next-generation infrastructure, creating opportunities for innovative service delivery and enhanced customer experiences.

By Service Type: Service categorization includes Postpaid MVNOs offering contract-based services with monthly billing and comprehensive service packages. Prepaid MVNOs focus on pay-as-you-go services that appeal to price-sensitive customers and those seeking service flexibility without long-term commitments. IoT MVNOs specialize in machine-to-machine communications and connected device services for enterprise and industrial applications.

Consumer MVNO Segment: This category represents the largest portion of the European MVNO market, characterized by intense price competition and focus on customer acquisition through digital channels. Consumer preferences increasingly favor transparent pricing, flexible contracts, and digital-first customer service experiences. Successful consumer MVNOs differentiate through brand positioning, customer experience quality, and value-added services that complement basic connectivity offerings.

Enterprise MVNO Segment: Business-focused MVNOs demonstrate higher average revenue per user and stronger customer loyalty through specialized service offerings and dedicated account management. Enterprise customers value reliability, security, and customized solutions that support their specific business requirements. This segment shows particular growth potential in IoT applications and industry-specific connectivity solutions.

Ethnic MVNO Segment: Specialized operators serving immigrant communities achieve strong customer loyalty through culturally relevant services and international connectivity options. Market dynamics in this segment emphasize community engagement, multilingual support, and competitive international calling rates. These MVNOs often achieve higher customer retention rates through strong community connections and specialized service offerings.

IoT MVNO Segment: Machine-to-machine communication specialists represent the fastest-growing category within the MVNO market, driven by increasing adoption of connected devices and industrial automation. Service requirements in this segment emphasize reliability, security, and scalable connectivity solutions that support diverse IoT applications across various industries and use cases.

For Consumers: MVNO market expansion provides significant benefits through increased choice, competitive pricing, and specialized service offerings tailored to specific needs and preferences. Cost savings represent a primary benefit, with MVNOs typically offering services at 20-30% lower prices compared to traditional network operators. Enhanced customer service quality and flexible contract terms provide additional value for consumers seeking alternatives to established network operators.

For Network Operators: Wholesale relationships with MVNOs create additional revenue streams and improve network utilization efficiency. Infrastructure monetization enables network operators to generate returns from excess capacity while maintaining focus on their core customer segments. Partnership opportunities with specialized MVNOs can help network operators access niche markets and customer segments that may be difficult to serve directly.

For Investors: The MVNO market presents attractive investment opportunities through scalable business models and growing market demand. Lower capital requirements compared to traditional network operators enable faster return on investment and reduced financial risk. Market growth potential and regulatory support create favorable conditions for long-term investment returns and portfolio diversification.

For Regulators: MVNO market development supports telecommunications policy objectives including increased competition, consumer choice, and market innovation. Competitive dynamics driven by MVNO participation help maintain reasonable pricing levels and service quality standards across the telecommunications market. Enhanced market competition reduces the need for direct regulatory intervention while promoting consumer welfare and market efficiency.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital-First Customer Experience: MVNOs increasingly adopt comprehensive digital platforms for customer acquisition, service delivery, and support functions. This trend reflects changing consumer preferences for self-service capabilities and online interactions. Artificial intelligence integration enhances customer service efficiency and personalization, enabling MVNOs to compete effectively with larger network operators through superior digital experiences.

Sustainability Focus: Environmental consciousness drives MVNO positioning around sustainable business practices and green technology adoption. Carbon footprint reduction initiatives and sustainable service delivery models appeal to environmentally conscious consumers and support corporate social responsibility objectives. This trend creates differentiation opportunities for MVNOs committed to environmental stewardship and sustainable operations.

Partnership Ecosystem Development: Strategic alliances with technology providers, content companies, and other service providers enable MVNOs to expand service capabilities and create comprehensive customer value propositions. Ecosystem partnerships facilitate service bundling opportunities and enhance competitive positioning against traditional network operators with broader service portfolios.

Regulatory Technology (RegTech) Adoption: Advanced compliance management systems help MVNOs navigate complex regulatory requirements across multiple European markets. Automated compliance solutions reduce operational costs and regulatory risks while enabling efficient market expansion and service delivery across different jurisdictions and regulatory frameworks.

5G Network Access: Major network operators across Europe are expanding wholesale access to 5G networks, enabling MVNOs to offer next-generation services and compete in emerging market segments. MarkWide Research analysis indicates that 5G-enabled MVNOs are achieving 25% higher customer acquisition rates compared to traditional 4G-only operators, demonstrating the competitive advantage of advanced network capabilities.

Merger and Acquisition Activity: Consolidation trends show larger MVNOs acquiring smaller operators to achieve scale advantages and expand geographic coverage. Recent transactions demonstrate investor confidence in the MVNO business model and market growth potential. Strategic acquisitions enable companies to enter new markets, acquire customer bases, and enhance service capabilities through combined operations.

Regulatory Framework Evolution: European telecommunications authorities continue refining wholesale access regulations to promote fair competition while ensuring network investment incentives. Policy developments focus on balancing MVNO market access with network operator investment requirements, creating stable regulatory environments that support long-term market growth and innovation.

Technology Platform Advancement: Cloud-based service platforms and network virtualization technologies reduce barriers to MVNO market entry while enabling enhanced service capabilities. Platform innovations support rapid service deployment, scalable operations, and improved customer experiences that drive competitive differentiation and market success.

Market Entry Strategy: New MVNO entrants should focus on clearly defined customer segments and develop differentiated value propositions that address specific market needs. Successful market entry requires comprehensive understanding of local regulatory requirements, competitive dynamics, and customer preferences. Companies should prioritize digital-first business models and efficient customer acquisition strategies to achieve sustainable profitability in competitive markets.

Partnership Development: Strategic relationships with host network operators, technology providers, and service partners are critical for MVNO success. Partnership selection should emphasize network quality, wholesale pricing competitiveness, and alignment with business objectives and customer service standards. Long-term partnership agreements provide operational stability and enable focused investment in customer acquisition and service development.

Technology Investment: MVNOs should prioritize investment in customer management platforms, digital service delivery capabilities, and data analytics systems that support efficient operations and enhanced customer experiences. Technology platforms should be scalable, flexible, and capable of supporting rapid service innovation and market expansion as business requirements evolve.

Regulatory Compliance: Comprehensive compliance management systems and legal expertise are essential for successful MVNO operations across multiple European markets. Regulatory strategy should include proactive engagement with telecommunications authorities and industry associations to stay informed about policy developments and market changes that may impact business operations and competitive positioning.

Market growth prospects for the Europe MVNO sector remain positive, with continued expansion expected across both mature and emerging markets. MWR projections indicate sustained growth rates of 6-8% annually over the next five years, driven by 5G network deployment, IoT market expansion, and continued consumer demand for competitive mobile services. The market will likely see increased specialization and service differentiation as operators focus on specific customer segments and use cases.

Technology evolution will continue shaping market dynamics, with 5G networks enabling new service categories and business models that create opportunities for innovative MVNOs. Network slicing capabilities will allow MVNOs to offer customized network experiences tailored to specific customer requirements and applications. Edge computing and IoT integration will drive demand for specialized connectivity solutions that MVNOs are well-positioned to deliver.

Regulatory developments are expected to maintain supportive frameworks for MVNO competition while addressing emerging challenges related to network security, data privacy, and consumer protection. Policy evolution will likely focus on balancing competitive market dynamics with investment incentives for network infrastructure development and technological advancement.

Market consolidation trends will continue as operators seek scale advantages and geographic expansion opportunities. However, niche market segments and specialized service categories will continue to support independent MVNO operations focused on specific customer needs and market opportunities. The overall market structure will likely evolve toward a mix of large-scale operators and specialized service providers serving distinct market segments.

The Europe Mobile Virtual Network Operator market represents a dynamic and growing segment of the telecommunications industry, characterized by innovation, competition, and diverse service offerings that benefit consumers and businesses across the region. Market fundamentals remain strong, supported by favorable regulatory frameworks, technological advancement, and continued consumer demand for competitive mobile services and specialized connectivity solutions.

Growth opportunities in 5G networks, IoT applications, and digital transformation initiatives create positive prospects for existing MVNOs and new market entrants. The market’s ability to adapt to changing technology landscapes and customer preferences demonstrates resilience and long-term viability. Successful operators will continue to differentiate through customer experience quality, service innovation, and efficient operations that deliver value to customers while maintaining sustainable profitability.

Strategic considerations for market participants include the importance of technology investment, partnership development, and regulatory compliance in achieving competitive success. The evolving market landscape requires continuous adaptation and innovation to maintain competitive positioning and capture emerging opportunities. Future success will depend on operators’ ability to balance growth ambitions with operational efficiency while delivering superior customer value and maintaining strong market positions in an increasingly competitive environment.

What is Mobile Virtual Network Operator (MVNO)?

A Mobile Virtual Network Operator (MVNO) is a telecommunications service provider that does not own the wireless infrastructure but instead leases network access from established mobile network operators. MVNOs offer various mobile services, including voice, text, and data, often targeting specific customer segments or niches.

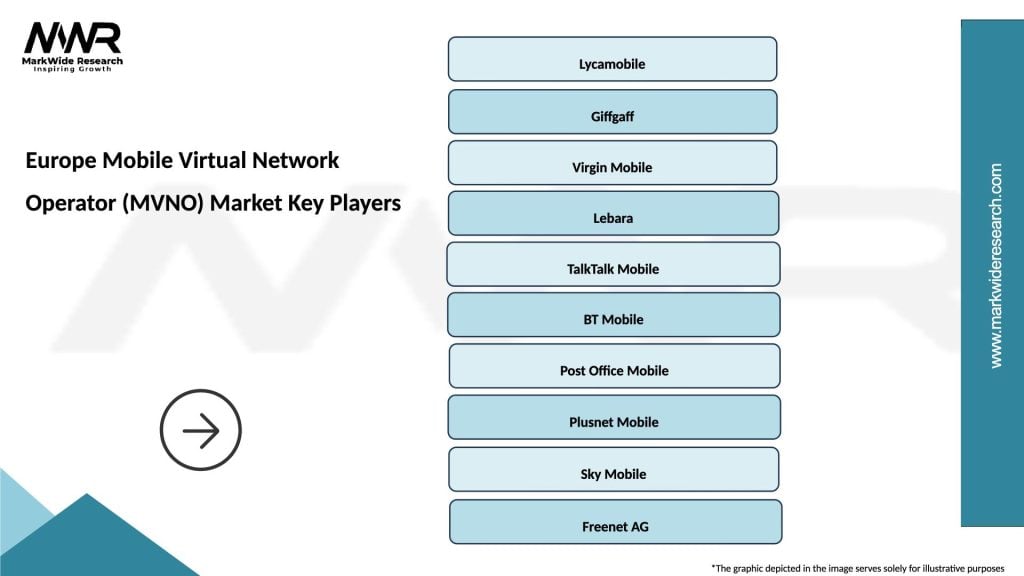

What are the key players in the Europe Mobile Virtual Network Operator (MVNO) Market?

Key players in the Europe Mobile Virtual Network Operator (MVNO) Market include companies like Virgin Mobile, Lebara, and Giffgaff. These companies compete by offering unique pricing plans and services tailored to specific consumer needs, among others.

What are the growth factors driving the Europe Mobile Virtual Network Operator (MVNO) Market?

The Europe Mobile Virtual Network Operator (MVNO) Market is driven by factors such as increasing demand for affordable mobile services, the rise of digital communication, and the growing trend of personalized mobile plans. Additionally, advancements in technology enable MVNOs to offer innovative services.

What challenges does the Europe Mobile Virtual Network Operator (MVNO) Market face?

The Europe Mobile Virtual Network Operator (MVNO) Market faces challenges such as intense competition from established mobile network operators, regulatory hurdles, and the need for continuous technological upgrades. These factors can impact profitability and market entry for new players.

What opportunities exist in the Europe Mobile Virtual Network Operator (MVNO) Market?

Opportunities in the Europe Mobile Virtual Network Operator (MVNO) Market include the potential for partnerships with IoT service providers, expansion into underserved markets, and the ability to offer niche services tailored to specific demographics. These avenues can enhance customer acquisition and retention.

What trends are shaping the Europe Mobile Virtual Network Operator (MVNO) Market?

Trends shaping the Europe Mobile Virtual Network Operator (MVNO) Market include the increasing adoption of eSIM technology, the rise of digital-only MVNOs, and a focus on sustainability in service offerings. These trends reflect changing consumer preferences and technological advancements.

Europe Mobile Virtual Network Operator (MVNO) Market

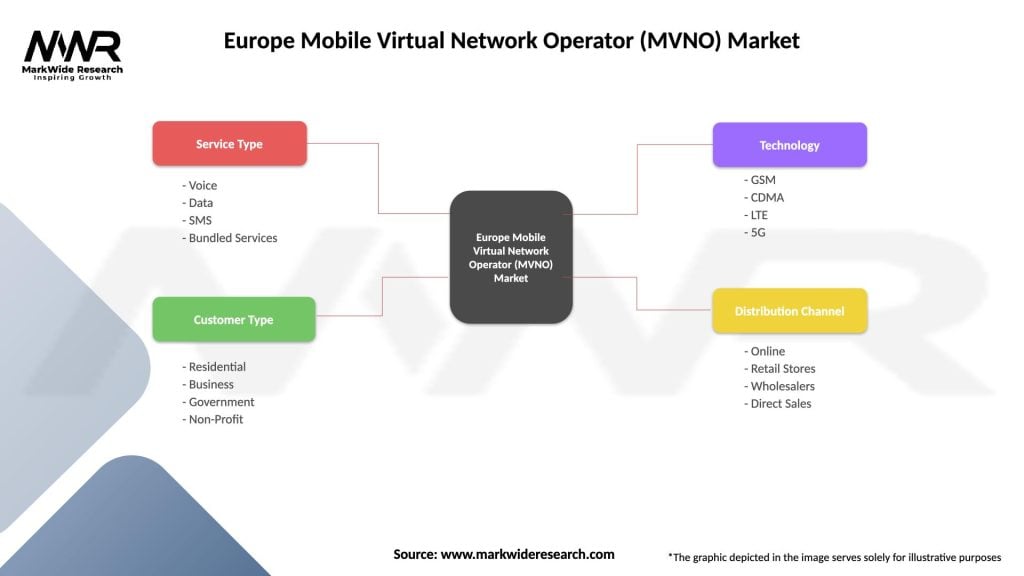

| Segmentation Details | Description |

|---|---|

| Service Type | Voice, Data, SMS, Bundled Services |

| Customer Type | Residential, Business, Government, Non-Profit |

| Technology | GSM, CDMA, LTE, 5G |

| Distribution Channel | Online, Retail Stores, Wholesalers, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Mobile Virtual Network Operator (MVNO) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at