444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe, Middle-East and Africa hot-melt adhesives market represents a dynamic and rapidly evolving sector within the global adhesives industry. This comprehensive market encompasses a diverse range of thermoplastic adhesive solutions that are applied in molten state and form strong bonds upon cooling. Hot-melt adhesives have gained significant traction across multiple industries due to their exceptional bonding properties, environmental friendliness, and versatility in application.

Market dynamics in the EMEA region are characterized by robust industrial growth, increasing demand for sustainable packaging solutions, and technological advancements in adhesive formulations. The region’s diverse industrial landscape, spanning from advanced European manufacturing hubs to emerging Middle Eastern and African markets, creates unique opportunities for hot-melt adhesive applications. Current market trends indicate a 6.2% CAGR growth trajectory, driven primarily by expanding packaging, automotive, and construction sectors.

Regional variations within the EMEA market reflect different stages of industrial development and regulatory frameworks. European markets demonstrate mature adoption patterns with focus on high-performance and eco-friendly formulations, while Middle Eastern and African regions show accelerating growth driven by infrastructure development and manufacturing expansion. The market’s resilience is evidenced by consistent demand across economic cycles, with packaging applications accounting for approximately 45% market share across the region.

The Europe, Middle-East and Africa hot-melt adhesives market refers to the comprehensive ecosystem of thermoplastic adhesive products, technologies, and applications across these interconnected regions. Hot-melt adhesives are solid polymeric materials that become fluid when heated and form strong, durable bonds upon cooling, offering rapid setting times and excellent adhesion properties across diverse substrates.

These adhesive systems are characterized by their 100% solid content, meaning they contain no solvents or water, making them environmentally preferred alternatives to traditional liquid adhesives. The market encompasses various polymer chemistries including ethylene vinyl acetate (EVA), polyolefins, polyamides, and reactive hot-melts, each designed for specific application requirements and performance criteria.

Application versatility defines the market’s scope, spanning packaging and labeling, bookbinding, woodworking, automotive assembly, electronics manufacturing, and construction applications. The technology’s ability to provide instant bonding, excellent temperature resistance, and superior durability makes it indispensable across multiple industrial sectors throughout the EMEA region.

The EMEA hot-melt adhesives market demonstrates exceptional growth potential driven by increasing industrialization, sustainable packaging trends, and technological innovations in adhesive chemistry. Market expansion is particularly pronounced in packaging applications, where demand for efficient, environmentally friendly bonding solutions continues to accelerate across all three regions.

Key growth drivers include the rapid expansion of e-commerce packaging requirements, automotive lightweighting initiatives, and construction industry modernization. European markets lead in terms of technological sophistication and regulatory compliance, while Middle Eastern and African regions contribute significantly to volume growth through infrastructure development and manufacturing capacity expansion.

Competitive dynamics reveal a market characterized by both global players and regional specialists, with innovation focused on developing bio-based formulations, enhanced performance characteristics, and application-specific solutions. The market’s resilience is demonstrated by consistent growth even during economic uncertainties, with sustainable adhesive solutions representing approximately 28% adoption rate across the region.

Future prospects indicate continued expansion driven by emerging applications in renewable energy, advanced packaging technologies, and smart manufacturing processes. The integration of Industry 4.0 principles and circular economy concepts positions the market for sustained long-term growth across all EMEA territories.

Strategic market positioning reveals several critical insights that define the EMEA hot-melt adhesives landscape. The market demonstrates remarkable adaptability to regional requirements while maintaining consistent quality and performance standards across diverse applications and industries.

These insights collectively indicate a market poised for sustained growth, driven by technological advancement, regulatory evolution, and expanding application opportunities across the diverse EMEA economic landscape.

Primary market drivers propelling the EMEA hot-melt adhesives market stem from fundamental shifts in industrial practices, environmental consciousness, and technological capabilities. These drivers create sustained demand across multiple sectors and geographic regions.

E-commerce expansion represents the most significant driver, with online retail growth necessitating efficient, reliable packaging solutions. The surge in package volumes requires adhesives that provide instant bonding, temperature resistance, and cost-effectiveness. Packaging automation trends further amplify this demand, as hot-melt systems integrate seamlessly with high-speed production lines.

Sustainability imperatives drive adoption of solvent-free adhesive technologies. Environmental regulations across Europe, combined with corporate sustainability commitments, favor hot-melt solutions over traditional solvent-based alternatives. The circular economy concept promotes recyclable packaging designs where hot-melt adhesives play crucial roles in enabling material recovery and reuse.

Automotive lightweighting initiatives create opportunities for advanced adhesive bonding in vehicle assembly. Hot-melt technologies enable multi-material joining, reducing vehicle weight while maintaining structural integrity. The transition toward electric vehicles further expands adhesive applications in battery assembly and thermal management systems.

Construction modernization across emerging EMEA markets drives demand for efficient building assembly methods. Hot-melt adhesives facilitate rapid construction processes, improve energy efficiency, and enable innovative architectural designs. Infrastructure development projects throughout the Middle East and Africa create substantial market opportunities.

Market restraints affecting the EMEA hot-melt adhesives sector primarily relate to technical limitations, economic factors, and competitive pressures from alternative bonding technologies. Understanding these constraints is essential for strategic market navigation.

Temperature sensitivity represents a fundamental limitation for certain applications. While hot-melt adhesives offer excellent performance within specified temperature ranges, extreme heat or cold conditions can compromise bond integrity. This limitation restricts applications in harsh environmental conditions or high-temperature industrial processes.

Initial investment requirements for hot-melt application equipment can be substantial, particularly for small and medium enterprises. The need for specialized heating systems, application guns, and temperature control equipment creates barriers to adoption, especially in price-sensitive markets across developing regions.

Raw material price volatility impacts market stability, as petroleum-based polymer feedstocks experience price fluctuations linked to global oil markets. These variations affect production costs and pricing strategies, creating challenges for long-term contract negotiations and budget planning.

Technical expertise requirements for optimal application can limit market penetration in regions with limited technical infrastructure. Proper hot-melt adhesive application requires understanding of temperature profiles, substrate preparation, and equipment maintenance, creating training and support needs.

Competition from alternative technologies including structural acrylics, polyurethanes, and mechanical fastening systems challenges market share in specific applications. Each alternative offers unique advantages that may be preferred in certain use cases, requiring continuous innovation and value demonstration.

Emerging opportunities within the EMEA hot-melt adhesives market reflect evolving industrial needs, technological capabilities, and market dynamics. These opportunities span across traditional applications and entirely new market segments.

Bio-based adhesive development presents significant growth potential as sustainability becomes increasingly important. Opportunities exist for developing hot-melt formulations from renewable feedstocks, addressing environmental concerns while maintaining performance characteristics. The green chemistry trend creates demand for innovative, eco-friendly adhesive solutions.

Smart packaging applications offer expanding opportunities as consumer goods companies seek enhanced functionality. Hot-melt adhesives enable integration of sensors, indicators, and interactive elements in packaging designs. The growth of intelligent packaging systems creates new market segments with higher value propositions.

Renewable energy sector expansion creates opportunities for specialized adhesive applications in solar panel assembly, wind turbine manufacturing, and energy storage systems. These applications require high-performance adhesives capable of withstanding environmental stresses while maintaining long-term reliability.

Medical device manufacturing represents an emerging opportunity as healthcare industries across EMEA regions modernize. Hot-melt adhesives offer biocompatible bonding solutions for medical device assembly, pharmaceutical packaging, and healthcare product manufacturing.

Digital printing integration creates opportunities for developing adhesives compatible with digital printing processes. As printing technologies evolve, adhesive systems must adapt to new substrate materials, printing conditions, and finishing requirements.

Market dynamics within the EMEA hot-melt adhesives sector reflect complex interactions between supply chain factors, technological evolution, and regional economic conditions. These dynamics shape competitive strategies and investment decisions across the market.

Supply chain resilience has become increasingly important following global disruptions. Companies are developing regional supply networks to ensure consistent raw material availability and reduce dependency on single-source suppliers. This trend promotes local manufacturing capabilities and strengthens regional market positions.

Technology convergence drives market evolution as adhesive chemistry advances intersect with application technologies. The integration of smart manufacturing principles enables real-time monitoring and optimization of adhesive application processes, improving efficiency and reducing waste.

Regulatory harmonization across EMEA regions influences market dynamics by creating consistent standards and requirements. European regulations often serve as benchmarks for Middle Eastern and African markets, promoting technology transfer and best practice adoption.

Customer consolidation in key end-use industries affects market dynamics by concentrating purchasing power and increasing performance requirements. Large packaging companies and automotive manufacturers drive demand for customized solutions and long-term supply partnerships.

Innovation cycles accelerate as competitive pressures intensify. Companies invest heavily in research and development to maintain technological leadership and address evolving customer needs. The innovation pace has increased significantly, with new product introductions occurring more frequently.

Comprehensive research methodology employed for analyzing the EMEA hot-melt adhesives market incorporates multiple data sources, analytical techniques, and validation processes to ensure accuracy and reliability of market insights and projections.

Primary research forms the foundation of market analysis through extensive interviews with industry participants including manufacturers, suppliers, distributors, and end-users across all EMEA regions. These interactions provide firsthand insights into market trends, challenges, and opportunities while validating secondary research findings.

Secondary research encompasses analysis of industry publications, company reports, regulatory documents, and trade association data. This comprehensive review provides historical context, market sizing information, and competitive landscape understanding essential for accurate market assessment.

Regional analysis methodology addresses the diverse economic, regulatory, and industrial conditions across Europe, Middle East, and Africa. Country-specific factors are evaluated to understand local market dynamics while identifying regional trends and patterns.

Technology assessment involves detailed evaluation of adhesive chemistry developments, application technologies, and emerging innovations. This analysis identifies technological trends that will shape future market evolution and competitive positioning.

Market modeling utilizes advanced analytical techniques to project market growth, segment performance, and regional trends. Multiple scenarios are evaluated to account for various economic and industry conditions that may influence market development.

Regional market analysis reveals distinct characteristics and growth patterns across the diverse EMEA landscape. Each region contributes uniquely to overall market dynamics while presenting specific opportunities and challenges for hot-melt adhesive applications.

European markets demonstrate mature adoption patterns with emphasis on high-performance and sustainable adhesive solutions. Germany, France, and the United Kingdom lead in terms of technological innovation and market sophistication. The region’s regulatory framework drives adoption of environmentally friendly formulations, with bio-based adhesives gaining 32% market acceptance in packaging applications.

Middle Eastern markets show accelerating growth driven by infrastructure development and manufacturing expansion. The UAE, Saudi Arabia, and Turkey represent key growth markets with increasing industrial capacity and modernization initiatives. Construction applications account for approximately 38% regional demand, reflecting ongoing infrastructure investments.

African markets present emerging opportunities with significant growth potential as industrialization accelerates. South Africa, Egypt, and Nigeria lead regional development with expanding manufacturing sectors and improving industrial infrastructure. The region shows rapid adoption rates of approximately 15% annually in packaging and automotive applications.

Cross-regional trade patterns indicate strong integration between European technology providers and Middle Eastern/African end-users. This integration facilitates technology transfer and supports market development across all regions.

The competitive landscape of the EMEA hot-melt adhesives market features a diverse mix of global leaders, regional specialists, and emerging players, each contributing to market innovation and growth through distinct strategic approaches.

Competitive strategies emphasize innovation, sustainability, and regional market development. Companies invest heavily in research and development to create differentiated products while building strong customer relationships through technical support and customized solutions.

Market consolidation trends indicate ongoing merger and acquisition activity as companies seek to expand geographic reach, enhance technology portfolios, and achieve operational synergies. Strategic partnerships between global and regional players facilitate market penetration and technology transfer.

Market segmentation analysis reveals the diverse applications and technology categories that comprise the EMEA hot-melt adhesives market. Understanding these segments is crucial for identifying growth opportunities and competitive positioning strategies.

By Technology:

By Application:

By End-Use Industry:

Category-specific analysis provides detailed understanding of performance characteristics, market dynamics, and growth prospects within each major segment of the EMEA hot-melt adhesives market.

EVA-based adhesives maintain market leadership due to their excellent balance of performance and cost-effectiveness. These formulations offer good adhesion to various substrates, reasonable temperature resistance, and easy processing characteristics. Market penetration reaches approximately 52% share across packaging applications, driven by reliable performance and established supply chains.

Polyolefin adhesives demonstrate strong growth potential, particularly in demanding applications requiring chemical resistance and temperature stability. These formulations excel in automotive and industrial applications where traditional EVA systems may not provide adequate performance. Growth rates exceed market averages by approximately 2.3 percentage points.

Reactive hot-melt systems represent the premium segment, offering structural bonding capabilities that compete with traditional thermoset adhesives. These systems provide excellent durability and environmental resistance while maintaining the processing advantages of hot-melt technologies.

Packaging applications continue to drive market growth through increasing demand for efficient, sustainable bonding solutions. The segment benefits from e-commerce expansion, sustainability initiatives, and automation trends that favor hot-melt technologies.

Automotive applications show accelerating adoption as vehicle manufacturers seek lightweight, efficient assembly methods. Hot-melt adhesives enable multi-material bonding essential for modern vehicle design while supporting sustainability objectives through reduced weight and improved recyclability.

Industry participants across the EMEA hot-melt adhesives value chain realize significant benefits from market participation, ranging from operational advantages to strategic positioning opportunities that enhance competitive performance.

Manufacturers benefit from expanding market opportunities driven by industrial growth and technological advancement. The market’s diversity across regions and applications provides multiple revenue streams and risk mitigation through portfolio diversification. Innovation leadership creates competitive advantages and premium pricing opportunities.

End-users gain access to advanced bonding technologies that improve operational efficiency, product quality, and environmental performance. Hot-melt adhesives enable faster production cycles, reduced inventory requirements, and simplified handling procedures compared to traditional adhesive systems.

Suppliers and distributors benefit from stable demand patterns and growing market opportunities across multiple sectors. The technology’s essential role in modern manufacturing creates recurring revenue streams and long-term customer relationships.

Technology providers find opportunities for innovation and differentiation through specialized formulations and application systems. The market rewards technical excellence and customer-focused solutions with premium positioning and market share growth.

Regional economies benefit from industrial development, job creation, and technology transfer associated with hot-melt adhesive manufacturing and application. The industry supports broader manufacturing competitiveness and export capabilities.

Environmental stakeholders benefit from the technology’s inherent sustainability advantages including solvent-free formulations, energy efficiency, and recyclability support. These characteristics align with circular economy principles and environmental protection objectives.

Comprehensive SWOT analysis reveals the strategic position of the EMEA hot-melt adhesives market, identifying internal capabilities and external factors that influence market development and competitive dynamics.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the EMEA hot-melt adhesives landscape reflect broader industrial, environmental, and technological developments that influence demand patterns and competitive strategies across the region.

Sustainability integration represents the most significant trend, with increasing focus on bio-based raw materials, recyclable formulations, and circular economy principles. Companies are developing green chemistry solutions that maintain performance while reducing environmental impact. This trend drives innovation in renewable feedstock utilization and end-of-life product management.

Digital transformation influences market development through smart manufacturing integration, real-time monitoring systems, and predictive maintenance capabilities. Industry 4.0 principles enable optimized adhesive application processes, reduced waste, and improved quality control across manufacturing operations.

Customization demand increases as end-users seek specialized solutions for specific applications and performance requirements. This trend drives development of tailored formulations, application-specific products, and collaborative innovation partnerships between suppliers and customers.

Regional localization becomes increasingly important as companies seek supply chain resilience and reduced logistics costs. This trend promotes local manufacturing capabilities, regional supply networks, and reduced dependency on long-distance transportation.

Performance enhancement continues through advanced polymer chemistry, nanotechnology integration, and hybrid formulation development. These innovations expand application possibilities and enable hot-melt adhesives to compete in traditionally challenging market segments.

Recent industry developments demonstrate the dynamic nature of the EMEA hot-melt adhesives market, with significant investments in capacity expansion, technology advancement, and strategic partnerships shaping competitive landscapes.

Capacity expansion initiatives across the region reflect growing demand and market confidence. Major manufacturers are investing in new production facilities and upgrading existing operations to meet increasing market requirements. These investments particularly focus on sustainable production technologies and advanced formulation capabilities.

Technology partnerships between adhesive manufacturers and end-user industries accelerate innovation and market development. Collaborative research programs focus on developing specialized solutions for emerging applications while addressing specific performance challenges.

Sustainability initiatives gain momentum as companies commit to environmental responsibility and circular economy principles. MarkWide Research indicates that sustainability-focused product development represents a key competitive differentiator in the current market environment.

Regulatory compliance developments influence product formulations and market strategies as environmental and safety standards evolve. Companies invest in compliance capabilities and sustainable chemistry to meet changing regulatory requirements across EMEA regions.

Market consolidation activities include strategic acquisitions and partnerships that enhance geographic reach, technology portfolios, and market positioning. These developments reshape competitive dynamics and create new market leaders.

Strategic recommendations for market participants focus on leveraging growth opportunities while addressing competitive challenges and market constraints that influence long-term success in the EMEA hot-melt adhesives market.

Innovation investment should prioritize sustainable chemistry development, advanced performance characteristics, and application-specific solutions. Companies must balance research and development spending between incremental improvements and breakthrough technologies that create competitive advantages.

Regional market development requires tailored strategies that address local market conditions, regulatory requirements, and customer preferences. Successful companies develop regional expertise while maintaining global technology standards and quality consistency.

Partnership strategies should focus on building strong relationships with key end-users, technology providers, and distribution partners. Collaborative approaches enable market penetration, technology development, and customer loyalty building essential for sustained growth.

Sustainability positioning becomes increasingly important as environmental consciousness influences purchasing decisions. Companies should develop comprehensive sustainability strategies that address product formulations, manufacturing processes, and end-of-life considerations.

Digital transformation investments should focus on manufacturing optimization, customer engagement, and supply chain efficiency. Technology adoption enables competitive advantages through improved operational performance and enhanced customer service capabilities.

Market diversification across applications and regions reduces risk while capturing growth opportunities. Balanced portfolio approaches provide stability during economic uncertainties while enabling participation in high-growth market segments.

Future market prospects for the EMEA hot-melt adhesives sector indicate sustained growth driven by industrial development, technological advancement, and evolving application requirements across diverse end-use industries and geographic regions.

Growth projections suggest continued market expansion with particular strength in sustainable formulations, emerging applications, and developing regions. MWR analysis indicates that bio-based adhesive adoption could reach 40% market penetration within the next decade, driven by environmental regulations and corporate sustainability commitments.

Technology evolution will focus on enhanced performance characteristics, sustainable chemistry, and smart manufacturing integration. Advanced formulations incorporating nanotechnology, bio-based materials, and reactive chemistry will expand application possibilities and competitive positioning.

Market expansion opportunities exist in emerging applications including renewable energy systems, advanced packaging technologies, and healthcare products. These sectors offer higher value propositions and growth potential beyond traditional market segments.

Regional development patterns suggest continued European leadership in innovation and sustainability, while Middle Eastern and African markets contribute significantly to volume growth through industrialization and infrastructure development.

Competitive landscape evolution will favor companies that successfully integrate sustainability, innovation, and regional market development strategies. Market leadership will depend on technological capabilities, customer relationships, and operational excellence across diverse market conditions.

The EMEA hot-melt adhesives market represents a dynamic and growing sector with significant opportunities for industry participants across the value chain. Market fundamentals remain strong, supported by industrial growth, technological advancement, and increasing adoption of sustainable bonding solutions.

Regional diversity provides both opportunities and challenges, requiring tailored strategies that address local market conditions while maintaining global technology standards. The integration of European innovation leadership with Middle Eastern and African growth potential creates a compelling market proposition for strategic investors and industry participants.

Technology trends toward sustainability, performance enhancement, and digital integration will shape future market development. Companies that successfully navigate these trends while building strong customer relationships and operational capabilities will achieve sustainable competitive advantages.

Market outlook remains positive with continued growth expected across multiple segments and regions. The hot-melt adhesives market’s essential role in modern manufacturing, combined with evolving application requirements and technological capabilities, positions the sector for sustained long-term expansion throughout the EMEA region.

What is Hot-melt Adhesives?

Hot-melt adhesives are thermoplastic adhesives that are applied in a molten state and solidify upon cooling. They are widely used in various applications such as packaging, woodworking, and automotive assembly due to their quick bonding capabilities and versatility.

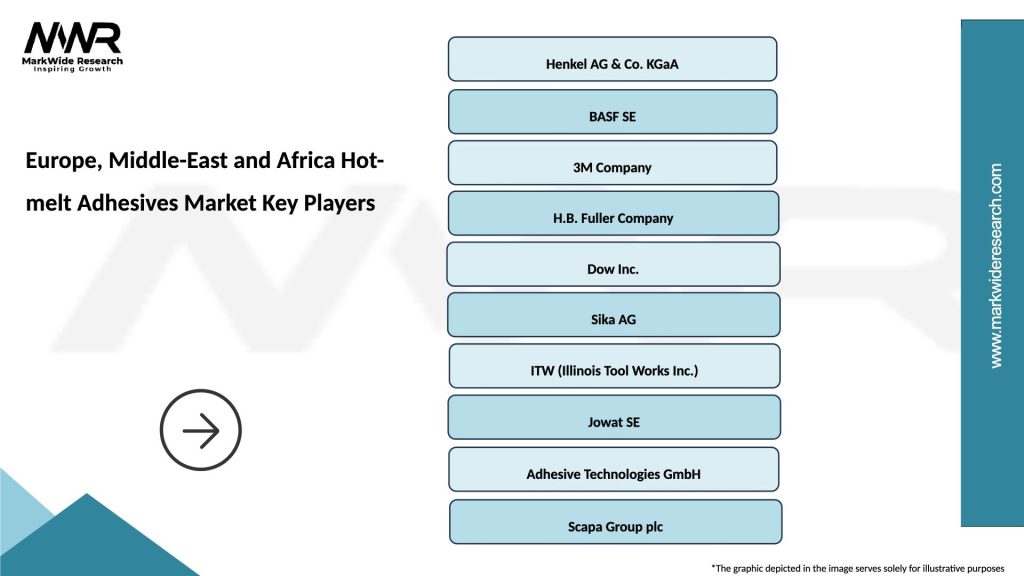

What are the key players in the Europe, Middle-East and Africa Hot-melt Adhesives Market?

Key players in the Europe, Middle-East and Africa Hot-melt Adhesives Market include Henkel AG, 3M Company, Bostik, and Sika AG, among others. These companies are known for their innovative adhesive solutions and extensive product portfolios.

What are the growth factors driving the Europe, Middle-East and Africa Hot-melt Adhesives Market?

The growth of the Europe, Middle-East and Africa Hot-melt Adhesives Market is driven by increasing demand from the packaging industry, advancements in adhesive technologies, and the rising trend of automation in manufacturing processes.

What challenges does the Europe, Middle-East and Africa Hot-melt Adhesives Market face?

Challenges in the Europe, Middle-East and Africa Hot-melt Adhesives Market include fluctuating raw material prices, environmental regulations regarding VOC emissions, and competition from alternative bonding solutions.

What opportunities exist in the Europe, Middle-East and Africa Hot-melt Adhesives Market?

Opportunities in the Europe, Middle-East and Africa Hot-melt Adhesives Market include the growing demand for eco-friendly adhesives, expansion in emerging markets, and innovations in product formulations that enhance performance and sustainability.

What trends are shaping the Europe, Middle-East and Africa Hot-melt Adhesives Market?

Trends in the Europe, Middle-East and Africa Hot-melt Adhesives Market include the increasing adoption of bio-based adhesives, the integration of smart technologies in adhesive applications, and a focus on sustainable packaging solutions.

Europe, Middle-East and Africa Hot-melt Adhesives Market

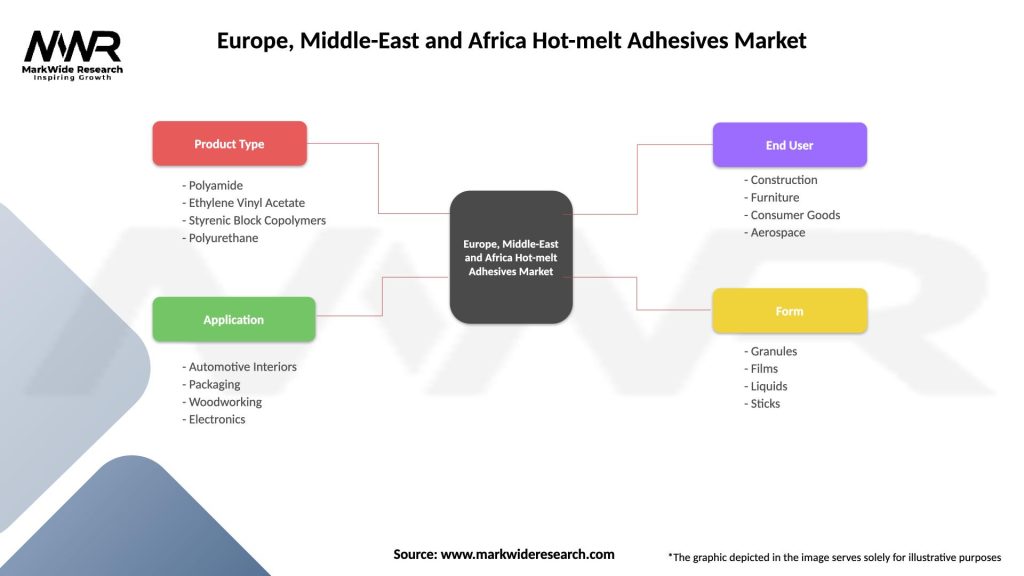

| Segmentation Details | Description |

|---|---|

| Product Type | Polyamide, Ethylene Vinyl Acetate, Styrenic Block Copolymers, Polyurethane |

| Application | Automotive Interiors, Packaging, Woodworking, Electronics |

| End User | Construction, Furniture, Consumer Goods, Aerospace |

| Form | Granules, Films, Liquids, Sticks |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe, Middle-East and Africa Hot-melt Adhesives Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at