444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe, Middle East and Africa (EMEA) flexible packaging market represents a dynamic and rapidly evolving sector that has become integral to modern supply chains across diverse industries. This comprehensive market encompasses innovative packaging solutions that offer superior protection, convenience, and sustainability benefits compared to traditional rigid packaging alternatives. The EMEA region demonstrates exceptional growth potential, driven by increasing consumer demand for convenient packaging formats, rising e-commerce activities, and growing emphasis on sustainable packaging solutions.

Market dynamics in the EMEA flexible packaging sector indicate robust expansion, with the industry experiencing a compound annual growth rate (CAGR) of 4.8% across the forecast period. This growth trajectory reflects the region’s diverse economic landscape, spanning developed European markets, emerging Middle Eastern economies, and rapidly developing African nations. The market’s resilience stems from its ability to serve multiple end-use industries, including food and beverages, pharmaceuticals, personal care, and industrial applications.

Regional variations within EMEA showcase distinct market characteristics, with Europe maintaining 62% market share due to advanced manufacturing capabilities and stringent packaging regulations. The Middle East contributes approximately 23% of regional demand, driven by expanding retail sectors and increasing urbanization. Africa represents the fastest-growing segment with 15% market share but demonstrates exceptional growth potential as infrastructure development accelerates across the continent.

The EMEA flexible packaging market refers to the comprehensive industry encompassing the production, distribution, and application of flexible packaging materials and solutions across Europe, Middle East, and Africa regions. This market includes various packaging formats such as pouches, bags, films, wraps, and specialized barrier materials designed to protect, preserve, and present products while offering enhanced functionality and consumer convenience.

Flexible packaging distinguishes itself from rigid packaging through its adaptable nature, lightweight characteristics, and ability to conform to product shapes. These packaging solutions utilize advanced materials including polyethylene, polypropylene, polyester, and specialized barrier films that provide excellent protection against moisture, oxygen, light, and other environmental factors that could compromise product quality and shelf life.

Strategic market analysis reveals that the EMEA flexible packaging market operates within a complex ecosystem characterized by technological innovation, regulatory compliance, and evolving consumer preferences. The market demonstrates remarkable adaptability to changing economic conditions, with flexible packaging solutions increasingly replacing traditional packaging formats across multiple industries.

Key growth drivers include the expanding food and beverage sector, which accounts for 68% of flexible packaging demand in the region. The pharmaceutical industry represents another significant growth area, contributing 18% of market demand as healthcare sectors across EMEA countries modernize their packaging requirements to meet international standards and improve patient safety.

Sustainability initiatives have emerged as critical market differentiators, with manufacturers investing heavily in recyclable materials, biodegradable options, and circular economy principles. These developments align with European Union regulations and growing environmental consciousness across the region, positioning sustainable flexible packaging as a key competitive advantage.

Market intelligence indicates several transformative trends reshaping the EMEA flexible packaging landscape. The following insights provide comprehensive understanding of current market dynamics:

Primary growth catalysts propelling the EMEA flexible packaging market forward encompass diverse economic, technological, and social factors that create sustained demand across multiple industry sectors. These drivers demonstrate the market’s fundamental strength and long-term viability.

Consumer lifestyle changes represent a fundamental driver, with urbanization and busy lifestyles increasing demand for convenient, portable packaging solutions. The rise of single-person households and on-the-go consumption patterns particularly benefits flexible packaging formats that offer portion control and easy handling characteristics.

Food safety requirements continue driving adoption of advanced flexible packaging solutions that provide superior barrier properties and extended shelf life. Regulatory frameworks across European markets mandate specific packaging standards that favor flexible materials capable of meeting stringent safety and quality requirements.

E-commerce expansion creates substantial opportunities for flexible packaging manufacturers, as online retailers require lightweight, protective packaging that reduces shipping costs while ensuring product integrity. The sector’s growth trajectory supports continued investment in specialized flexible packaging solutions designed for direct-to-consumer distribution.

Sustainability mandates increasingly influence packaging decisions, with flexible packaging offering inherent environmental advantages through reduced material usage, lower transportation emissions, and improved recyclability compared to rigid alternatives. These benefits align with corporate sustainability goals and regulatory requirements across the EMEA region.

Market challenges facing the EMEA flexible packaging industry include several structural and operational constraints that require strategic management and innovative solutions. Understanding these restraints enables stakeholders to develop effective mitigation strategies.

Raw material volatility presents ongoing challenges, with petroleum-based polymer prices subject to global commodity fluctuations that impact manufacturing costs and profit margins. This volatility requires sophisticated supply chain management and pricing strategies to maintain market competitiveness.

Regulatory complexity across different EMEA markets creates compliance challenges, particularly for manufacturers serving multiple countries with varying packaging standards, recycling requirements, and food contact regulations. These regulatory differences increase operational complexity and compliance costs.

Infrastructure limitations in certain African and Middle Eastern markets constrain market development, with inadequate recycling facilities and supply chain networks limiting the adoption of advanced flexible packaging solutions. These infrastructure gaps require significant investment and long-term development strategies.

Competition from alternatives includes both traditional rigid packaging and emerging sustainable packaging solutions that may offer specific advantages in certain applications. This competitive pressure requires continuous innovation and value proposition enhancement.

Emerging opportunities within the EMEA flexible packaging market present significant potential for growth and expansion across diverse industry segments and geographic regions. These opportunities reflect evolving market dynamics and technological capabilities.

Pharmaceutical packaging expansion offers substantial growth potential, particularly in generic drug markets and emerging healthcare sectors across Africa and Middle East. The increasing focus on patient safety and medication compliance creates demand for specialized flexible packaging solutions with enhanced barrier properties and tamper-evident features.

Smart packaging integration represents a transformative opportunity, with Internet of Things (IoT) technologies enabling intelligent packaging solutions that provide real-time product information, freshness indicators, and supply chain tracking capabilities. These innovations create new value propositions for premium market segments.

Sustainable material development presents opportunities for market differentiation through bio-based polymers, compostable films, and circular economy solutions. Companies investing in sustainable packaging technologies position themselves advantageously for future regulatory requirements and consumer preferences.

African market development offers exceptional growth potential as economic development, urbanization, and retail modernization create demand for advanced packaging solutions. Strategic partnerships and local manufacturing capabilities can capture this emerging market opportunity.

Dynamic market forces shaping the EMEA flexible packaging industry reflect complex interactions between technological innovation, regulatory evolution, and changing consumer behaviors. These dynamics create both challenges and opportunities that require strategic navigation.

Technology convergence drives market evolution through integration of advanced materials science, digital printing technologies, and smart packaging capabilities. This convergence enables manufacturers to offer differentiated solutions that provide enhanced functionality and consumer engagement opportunities.

Supply chain transformation influences market dynamics through changing distribution patterns, e-commerce growth, and sustainability requirements. Flexible packaging manufacturers must adapt to shorter lead times, customization demands, and environmental compliance while maintaining cost competitiveness.

Competitive landscape shifts result from industry consolidation, technological advancement, and market expansion strategies. According to MarkWide Research analysis, market concentration has increased by 12% over the past three years as leading companies acquire specialized capabilities and expand geographic reach.

Regulatory evolution continues shaping market dynamics through new sustainability mandates, food safety requirements, and recycling standards. These regulatory changes create both compliance challenges and opportunities for innovation in sustainable packaging solutions.

Comprehensive research approach employed for analyzing the EMEA flexible packaging market incorporates multiple data sources, analytical frameworks, and validation methodologies to ensure accuracy and reliability of market insights and projections.

Primary research activities include extensive interviews with industry executives, technology providers, regulatory officials, and end-user representatives across the EMEA region. These interviews provide qualitative insights into market trends, competitive dynamics, and future development strategies.

Secondary research analysis encompasses review of industry publications, regulatory documents, company financial reports, and trade association data to establish comprehensive market understanding. This analysis includes historical trend evaluation and competitive landscape assessment.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to develop accurate market projections and identify key growth opportunities. These models incorporate economic indicators, demographic trends, and industry-specific factors affecting market development.

Data validation processes ensure research accuracy through triangulation of multiple sources, expert review panels, and statistical verification methods. This validation approach provides confidence in market insights and strategic recommendations.

European markets dominate the EMEA flexible packaging landscape, representing the most mature and technologically advanced segment with sophisticated regulatory frameworks and high-value applications. Western European countries lead in premium packaging solutions, while Eastern European markets demonstrate rapid growth in basic flexible packaging applications.

Germany and France constitute the largest European markets, collectively accounting for 35% of regional demand. These markets emphasize high-quality packaging solutions for food, pharmaceutical, and industrial applications, with strong focus on sustainability and regulatory compliance.

Middle Eastern markets show robust growth driven by economic diversification, retail sector expansion, and increasing consumer goods demand. The UAE and Saudi Arabia lead regional development, with significant investments in food processing and pharmaceutical manufacturing creating demand for advanced flexible packaging solutions.

African markets represent the highest growth potential within EMEA, with urbanization, economic development, and retail modernization driving packaging demand. South Africa maintains market leadership, while Nigeria, Kenya, and Ghana emerge as key growth markets with expanding manufacturing sectors.

Regional trade dynamics influence market development through cross-border supply chains, technology transfer, and investment flows. European manufacturers increasingly establish operations in Middle Eastern and African markets to capture local growth opportunities while reducing transportation costs.

Market leadership in the EMEA flexible packaging sector reflects a combination of technological capabilities, geographic reach, and customer relationships. The competitive environment features both global multinational corporations and specialized regional players serving specific market segments.

Competitive strategies focus on technological innovation, sustainability leadership, and geographic expansion to capture emerging market opportunities. Leading companies invest heavily in research and development to maintain technological advantages and meet evolving customer requirements.

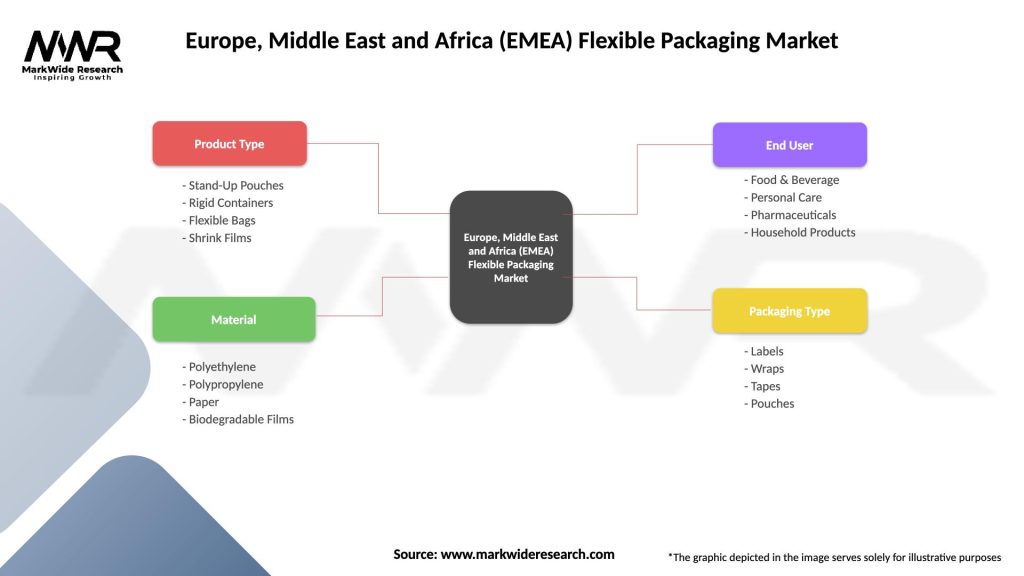

Market segmentation analysis reveals diverse application areas and product categories that comprise the EMEA flexible packaging market. This segmentation provides insights into growth opportunities and competitive dynamics across different market segments.

By Material Type:

By Application:

Food packaging applications dominate market demand, with flexible packaging solutions offering superior product protection, extended shelf life, and consumer convenience. This category benefits from growing demand for processed foods, ready-to-eat meals, and portion-controlled packaging formats across the EMEA region.

Pharmaceutical packaging represents the highest-value market segment, requiring specialized materials and manufacturing processes to ensure product safety and regulatory compliance. The aging population across Europe and expanding healthcare access in developing markets drive continued growth in this premium segment.

Personal care packaging demonstrates strong growth potential, particularly in premium and sustainable packaging solutions. Consumer preferences for convenient, attractive packaging drive innovation in this segment, with emphasis on resealable formats and premium presentation.

Industrial packaging applications provide stable demand for flexible packaging solutions in chemical, agricultural, and construction industries. These applications typically require specialized barrier properties and durability to protect products during storage and transportation.

Sustainable packaging categories show exceptional growth across all application segments, with bio-based materials growing at 8.2% annually as companies respond to environmental regulations and consumer preferences for sustainable packaging solutions.

Manufacturers benefit from flexible packaging through improved production efficiency, reduced material costs, and enhanced product differentiation capabilities. Flexible packaging solutions enable manufacturers to optimize supply chain operations while meeting diverse customer requirements across multiple market segments.

Retailers gain advantages through improved shelf appeal, reduced storage requirements, and enhanced inventory management capabilities. Flexible packaging solutions support retail strategies focused on convenience, sustainability, and customer satisfaction while reducing operational costs.

Consumers experience benefits including improved product freshness, convenient handling, and sustainable packaging options. Flexible packaging solutions address consumer demands for portion control, resealability, and easy-open features while supporting environmental consciousness.

Supply chain stakeholders benefit from reduced transportation costs, improved product protection, and optimized storage efficiency. Flexible packaging solutions enable supply chain optimization through weight reduction and space efficiency improvements.

Environmental benefits include reduced material usage, lower transportation emissions, and improved recyclability compared to rigid packaging alternatives. These environmental advantages support corporate sustainability goals and regulatory compliance requirements across the EMEA region.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation represents the most significant trend reshaping the EMEA flexible packaging market, with manufacturers investing heavily in recyclable materials, biodegradable options, and circular economy principles. This trend responds to regulatory requirements and consumer environmental consciousness across the region.

Smart packaging integration emerges as a key differentiator, with IoT technologies enabling intelligent packaging solutions that provide real-time product information, freshness indicators, and supply chain tracking capabilities. These innovations create new value propositions for premium market segments.

Customization and personalization trends drive demand for flexible packaging solutions that can accommodate small batch sizes, variable data printing, and customized formats. Digital printing technologies enable cost-effective customization that supports brand differentiation strategies.

E-commerce optimization influences packaging design and functionality, with flexible packaging solutions specifically developed for direct-to-consumer distribution. These solutions balance product protection, shipping efficiency, and unboxing experience requirements.

Barrier technology advancement continues driving innovation in high-performance materials that provide superior protection while reducing material usage. These developments enable flexible packaging to compete effectively with rigid alternatives in demanding applications.

Strategic acquisitions reshape the competitive landscape as major players acquire specialized capabilities and expand geographic reach. Recent consolidation activities focus on sustainable packaging technologies and emerging market access.

Technology partnerships between packaging manufacturers and material suppliers accelerate innovation in sustainable materials and advanced barrier technologies. These collaborations enable rapid development and commercialization of next-generation packaging solutions.

Manufacturing expansion in emerging markets reflects industry commitment to capturing growth opportunities in Africa and Middle East. New production facilities enable local supply chain optimization and cost competitiveness.

Regulatory compliance initiatives drive industry-wide investments in sustainable packaging solutions and recycling infrastructure. These initiatives align with European Union circular economy objectives and emerging environmental regulations across the region.

Digital transformation initiatives enhance operational efficiency through automation, data analytics, and supply chain optimization. These investments improve manufacturing flexibility and customer service capabilities while reducing operational costs.

Strategic recommendations for EMEA flexible packaging market participants emphasize the importance of sustainability leadership, technological innovation, and geographic diversification to capture emerging opportunities while managing market challenges.

Sustainability investment should be prioritized, with companies developing comprehensive strategies for recyclable materials, biodegradable options, and circular economy principles. MWR analysis indicates that sustainability leaders achieve 15% higher profit margins compared to traditional packaging providers.

Technology advancement requires continued investment in barrier technologies, smart packaging capabilities, and digital manufacturing processes. Companies should focus on developing differentiated solutions that provide superior performance and customer value.

Market expansion strategies should target high-growth African and Middle Eastern markets through strategic partnerships, local manufacturing capabilities, and customized product offerings. These markets offer exceptional growth potential but require patient capital and local expertise.

Supply chain optimization becomes increasingly important as raw material costs fluctuate and customer demands evolve. Companies should invest in supply chain flexibility and risk management capabilities to maintain competitive positioning.

Long-term market prospects for the EMEA flexible packaging industry remain highly positive, with sustained growth expected across all major market segments and geographic regions. The market’s fundamental drivers continue strengthening, supporting continued expansion and innovation.

Technological evolution will accelerate, with smart packaging, sustainable materials, and advanced barrier technologies becoming standard market offerings. These technological advances will enable flexible packaging to capture additional market share from rigid alternatives while creating new application opportunities.

Regional growth patterns indicate continued European market maturation with focus on premium and sustainable solutions, while Middle Eastern and African markets demonstrate exceptional expansion potential. According to MarkWide Research projections, African markets will achieve growth rates exceeding 7% annually over the next decade.

Sustainability requirements will intensify, with circular economy principles becoming mandatory rather than optional. Companies investing early in sustainable packaging solutions will achieve competitive advantages and regulatory compliance benefits.

Market consolidation will continue as companies seek scale advantages, technological capabilities, and geographic reach. This consolidation will create opportunities for specialized players while challenging smaller competitors to find niche market positions.

The EMEA flexible packaging market represents a dynamic and rapidly evolving industry with exceptional growth potential across diverse application segments and geographic regions. Market fundamentals remain strong, supported by technological innovation, sustainability trends, and expanding end-use applications.

Strategic success factors include sustainability leadership, technological advancement, and geographic diversification strategies that capture emerging opportunities while managing market challenges. Companies that invest in these areas will achieve competitive advantages and superior market positioning.

Future market development will be characterized by continued innovation in sustainable materials, smart packaging technologies, and customized solutions that meet evolving customer requirements. The industry’s ability to adapt to changing market conditions and regulatory requirements positions it for sustained long-term growth across the EMEA region.

What is Flexible Packaging?

Flexible packaging refers to packaging made from flexible materials that can be easily shaped and molded. It includes products such as pouches, bags, and wraps, which are widely used in food, pharmaceuticals, and consumer goods industries.

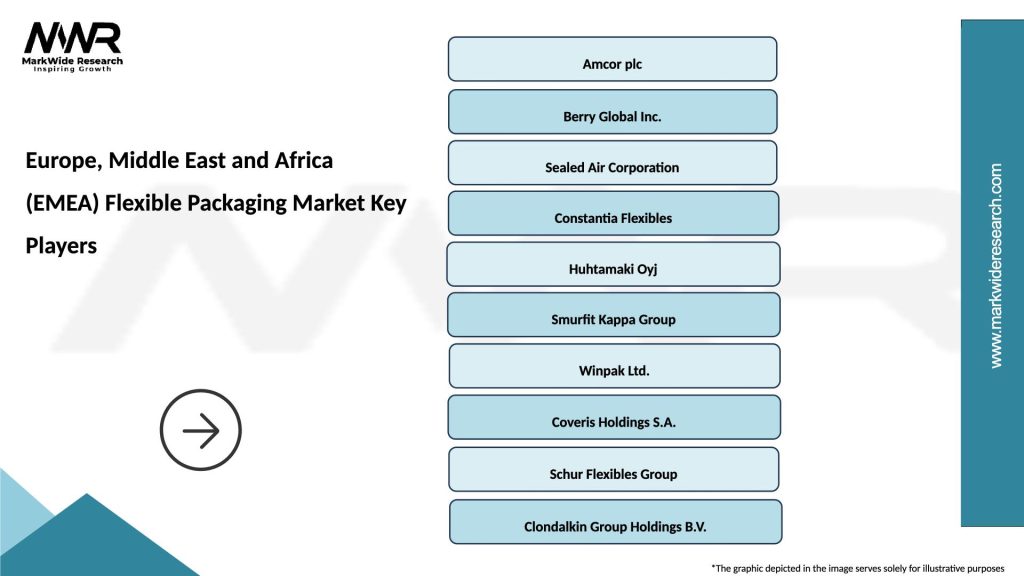

What are the key players in the Europe, Middle East and Africa (EMEA) Flexible Packaging Market?

Key players in the Europe, Middle East and Africa (EMEA) Flexible Packaging Market include Amcor, Sealed Air Corporation, and Berry Global, among others. These companies are known for their innovative packaging solutions and extensive product portfolios.

What are the growth factors driving the Europe, Middle East and Africa (EMEA) Flexible Packaging Market?

The growth of the Europe, Middle East and Africa (EMEA) Flexible Packaging Market is driven by increasing demand for convenient packaging solutions, the rise of e-commerce, and a growing focus on sustainability in packaging materials.

What challenges does the Europe, Middle East and Africa (EMEA) Flexible Packaging Market face?

Challenges in the Europe, Middle East and Africa (EMEA) Flexible Packaging Market include regulatory pressures regarding plastic use, competition from alternative packaging materials, and the need for continuous innovation to meet consumer preferences.

What opportunities exist in the Europe, Middle East and Africa (EMEA) Flexible Packaging Market?

Opportunities in the Europe, Middle East and Africa (EMEA) Flexible Packaging Market include the development of biodegradable materials, advancements in smart packaging technologies, and the expansion of online retail channels that require efficient packaging solutions.

What trends are shaping the Europe, Middle East and Africa (EMEA) Flexible Packaging Market?

Trends in the Europe, Middle East and Africa (EMEA) Flexible Packaging Market include the increasing adoption of sustainable packaging practices, the integration of digital printing technologies, and the growing demand for customized packaging solutions tailored to specific consumer needs.

Europe, Middle East and Africa (EMEA) Flexible Packaging Market

| Segmentation Details | Description |

|---|---|

| Product Type | Stand-Up Pouches, Rigid Containers, Flexible Bags, Shrink Films |

| Material | Polyethylene, Polypropylene, Paper, Biodegradable Films |

| End User | Food & Beverage, Personal Care, Pharmaceuticals, Household Products |

| Packaging Type | Labels, Wraps, Tapes, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe, Middle East and Africa (EMEA) Flexible Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at