444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe, Middle-East and Africa diaphragm pump market represents a dynamic and rapidly evolving sector within the industrial pumping solutions landscape. This comprehensive market encompasses a diverse range of applications across multiple industries, from chemical processing and water treatment to pharmaceutical manufacturing and mining operations. Diaphragm pumps have established themselves as essential components in fluid handling systems, offering superior performance characteristics that make them indispensable for handling corrosive, abrasive, and viscous fluids.

Market dynamics in the EMEA region are driven by increasing industrialization, stringent environmental regulations, and growing demand for efficient fluid handling solutions. The region’s diverse industrial base, spanning from advanced European manufacturing facilities to emerging Middle Eastern petrochemical complexes and expanding African mining operations, creates a robust demand foundation for diaphragm pump technologies. Growth projections indicate the market is expanding at a compound annual growth rate of 6.2%, reflecting strong adoption across key industrial sectors.

Regional variations within the EMEA market present unique opportunities and challenges. European markets demonstrate high demand for technologically advanced, energy-efficient solutions, while Middle Eastern markets focus on robust pumps capable of handling harsh operating conditions in oil and gas applications. African markets show increasing adoption driven by infrastructure development and mining sector expansion, with adoption rates increasing by 8.5% annually in key industrial segments.

The Europe, Middle-East and Africa diaphragm pump market refers to the comprehensive ecosystem of manufacturers, suppliers, distributors, and end-users involved in the production, distribution, and application of diaphragm pump technologies across these three distinct geographical regions. Diaphragm pumps are positive displacement pumps that utilize a flexible membrane to create pumping action, making them ideal for handling challenging fluids that would damage conventional pumping systems.

Market definition encompasses various pump configurations, including air-operated double diaphragm pumps, electric diaphragm pumps, and hydraulically-operated variants. These pumps serve critical functions in industries requiring precise fluid handling, contamination-free transfer, and reliable operation in demanding environments. The market includes both original equipment manufacturing and aftermarket services, replacement parts, and maintenance solutions.

Technological scope covers traditional mechanical diaphragm pumps as well as advanced electronic and smart pump systems integrated with monitoring and control capabilities. The market serves diverse applications ranging from simple fluid transfer to complex chemical processing, pharmaceutical production, and environmental remediation projects across the EMEA region’s varied industrial landscape.

Strategic market analysis reveals the Europe, Middle-East and Africa diaphragm pump market as a robust and expanding sector characterized by technological innovation, diverse application requirements, and strong growth fundamentals. The market benefits from increasing industrial activity, environmental compliance requirements, and growing emphasis on operational efficiency across key end-user industries.

Key market drivers include expanding chemical processing industries, growing pharmaceutical manufacturing, increasing water treatment requirements, and rising demand for reliable pumping solutions in harsh operating environments. European markets contribute approximately 65% of regional demand, driven by advanced manufacturing sectors and stringent quality requirements, while Middle Eastern and African markets show rapid growth potential.

Competitive landscape features established global manufacturers alongside regional specialists, creating a dynamic market environment with continuous innovation and product development. Technology trends emphasize smart pump systems, improved materials, enhanced efficiency, and integrated monitoring capabilities. Market participants focus on developing solutions that address specific regional requirements while maintaining global quality standards.

Future outlook indicates sustained growth driven by infrastructure development, industrial expansion, and increasing adoption of advanced pumping technologies. The market is expected to benefit from growing environmental awareness, regulatory compliance requirements, and ongoing industrial modernization across the EMEA region.

Market intelligence reveals several critical insights that define the current state and future trajectory of the Europe, Middle-East and Africa diaphragm pump market:

Industrial expansion across the EMEA region serves as a primary driver for diaphragm pump market growth. The ongoing development of manufacturing facilities, chemical processing plants, and infrastructure projects creates sustained demand for reliable pumping solutions. Chemical industry growth particularly drives demand, as diaphragm pumps offer superior performance for handling corrosive and hazardous chemicals safely and efficiently.

Environmental regulations increasingly mandate the use of leak-free, contamination-resistant pumping systems, positioning diaphragm pumps as preferred solutions for compliance-critical applications. These regulations drive adoption in water treatment, pharmaceutical manufacturing, and chemical processing where environmental protection and product purity are paramount concerns.

Technological advancement in pump design, materials, and control systems enhances performance characteristics and expands application possibilities. Smart pump technologies with remote monitoring, predictive maintenance, and automated control capabilities attract industrial users seeking operational efficiency and reduced maintenance costs.

Infrastructure development in emerging markets, particularly in Africa and parts of the Middle East, creates new opportunities for diaphragm pump applications in water treatment, mining, and industrial processing. Growing urbanization and industrial development drive demand for reliable fluid handling solutions across diverse applications.

High initial costs associated with quality diaphragm pump systems can limit adoption, particularly in price-sensitive markets and applications. The premium pricing of advanced diaphragm pumps compared to conventional alternatives may deter cost-conscious buyers, especially in emerging markets where budget constraints are significant considerations.

Technical complexity of advanced diaphragm pump systems requires specialized knowledge for proper selection, installation, and maintenance. The lack of technical expertise in some regional markets can limit adoption and create barriers to optimal system performance, particularly for sophisticated smart pump technologies.

Competition from alternatives including centrifugal pumps, gear pumps, and other positive displacement technologies provides customers with multiple options, potentially limiting diaphragm pump market share in certain applications. Cost-effective alternatives may be preferred in non-critical applications where diaphragm pump advantages are less pronounced.

Economic volatility in certain EMEA regions can impact industrial investment and capital equipment purchases. Economic uncertainties, currency fluctuations, and political instability in some markets may delay or reduce industrial expansion projects that drive pump demand.

Emerging market expansion presents significant opportunities as African and Middle Eastern countries continue industrial development and infrastructure modernization. Growing mining operations, expanding chemical industries, and increasing water treatment requirements create substantial demand potential for diaphragm pump technologies.

Smart technology integration offers opportunities for market differentiation and value creation through IoT-enabled pump systems, predictive maintenance capabilities, and integrated monitoring solutions. Digital transformation in industrial operations drives demand for intelligent pumping systems that provide operational insights and optimization opportunities.

Sustainability initiatives across industries create opportunities for energy-efficient, environmentally-friendly pump solutions. Growing emphasis on reducing environmental impact and improving operational efficiency drives demand for advanced diaphragm pump technologies that deliver superior performance with lower environmental footprint.

Application diversification into new industries and specialized applications expands market potential. Emerging applications in renewable energy, biotechnology, food processing, and advanced manufacturing create new demand segments for specialized diaphragm pump solutions.

Supply chain dynamics in the Europe, Middle-East and Africa diaphragm pump market reflect complex interactions between global manufacturers, regional distributors, and local service providers. Manufacturing concentration in developed European markets provides technological leadership, while growing local assembly and service capabilities in emerging markets improve accessibility and reduce costs.

Demand patterns vary significantly across the region, with European markets showing steady, mature demand characteristics, while Middle Eastern and African markets demonstrate more volatile but higher growth potential. Seasonal variations affect certain applications, particularly in water treatment and agricultural sectors, creating cyclical demand patterns that influence market dynamics.

Technology transfer from developed to emerging markets accelerates adoption of advanced pump technologies while creating opportunities for local manufacturing and service capabilities. This dynamic promotes market development while potentially increasing competitive pressure on established manufacturers.

Regulatory harmonization efforts across regions influence product standards, quality requirements, and market access conditions. Evolving regulations create both opportunities for compliant manufacturers and challenges for those requiring product modifications or certifications.

Comprehensive market research methodology employed for analyzing the Europe, Middle-East and Africa diaphragm pump market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research includes extensive interviews with industry participants, including manufacturers, distributors, end-users, and technology providers across all three regional markets.

Secondary research encompasses analysis of industry publications, company reports, regulatory documents, and trade statistics from relevant government and industry organizations. Market sizing methodology utilizes bottom-up and top-down approaches, incorporating production data, trade statistics, and end-user consumption patterns to develop comprehensive market assessments.

Regional analysis methodology addresses the unique characteristics of European, Middle Eastern, and African markets through localized research approaches that account for cultural, economic, and regulatory differences. Trend analysis incorporates historical data patterns, current market indicators, and forward-looking assessments based on industry developments and economic projections.

Data validation processes include cross-referencing multiple sources, expert review, and statistical analysis to ensure research accuracy and reliability. MarkWide Research analytical frameworks provide structured approaches for market assessment and forecasting across diverse regional markets.

European markets dominate the regional diaphragm pump landscape, accounting for approximately 65% of total market demand. Key markets include Germany, United Kingdom, France, Italy, and Netherlands, where advanced manufacturing industries, stringent quality requirements, and environmental regulations drive demand for high-performance pump solutions. German market leadership reflects the country’s strong chemical and pharmaceutical industries, while UK markets emphasize water treatment and environmental applications.

Middle Eastern markets show robust growth driven by expanding petrochemical industries, water desalination projects, and infrastructure development. Saudi Arabia, UAE, and Qatar lead regional demand, with growth rates exceeding 7.5% annually in key industrial segments. Oil and gas applications dominate, but diversification into other industries creates new opportunities for diaphragm pump manufacturers.

African markets demonstrate significant growth potential despite current smaller market size. South Africa leads regional demand, followed by Nigeria, Egypt, and Morocco. Mining sector expansion drives substantial pump demand, while growing industrial development and water treatment requirements create additional market opportunities. Infrastructure development and industrial modernization support sustained market growth across the continent.

Cross-regional trade patterns show European manufacturers serving as primary suppliers to Middle Eastern and African markets, while local assembly and service capabilities continue expanding in emerging markets to improve accessibility and reduce costs.

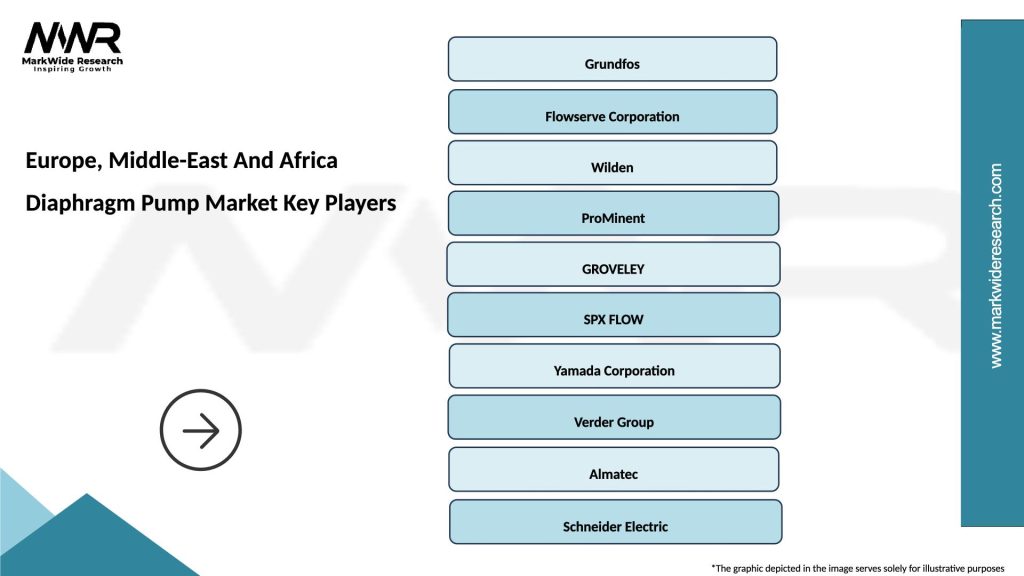

Market leadership in the Europe, Middle-East and Africa diaphragm pump market is characterized by a mix of global industrial pump manufacturers and specialized diaphragm pump companies. The competitive environment features both established multinational corporations and innovative regional players competing across different market segments and applications.

Key market participants include:

Competitive strategies focus on technological innovation, regional market expansion, service capability development, and application-specific solution development. Companies invest in research and development, strategic partnerships, and local market presence to maintain competitive advantages in diverse regional markets.

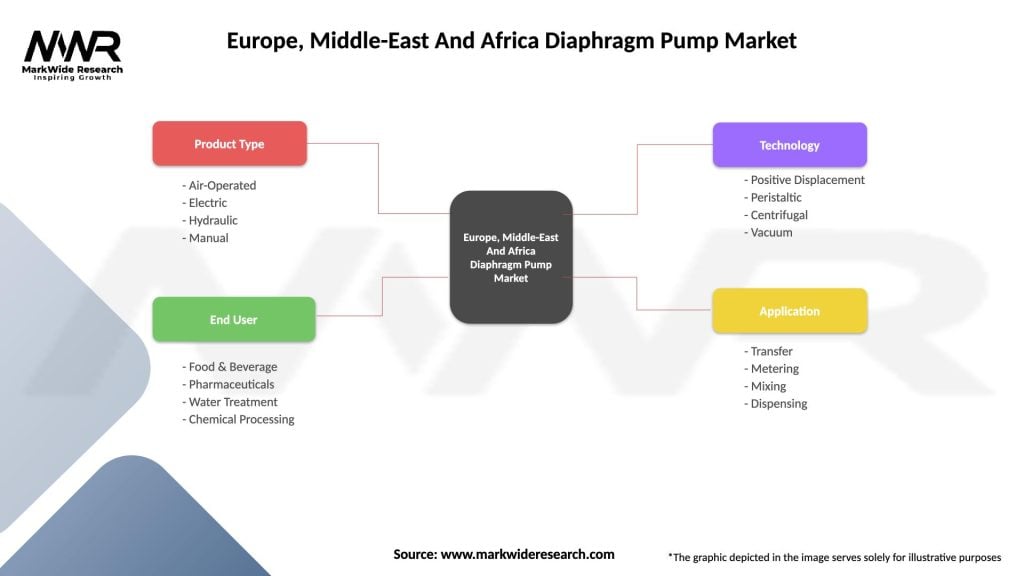

Technology-based segmentation divides the market into distinct categories based on pump operating principles and design characteristics:

Application-based segmentation reflects diverse end-use requirements:

Regional segmentation addresses distinct market characteristics across Europe, Middle East, and Africa, with varying demand patterns, regulatory requirements, and competitive dynamics influencing market development in each region.

By Technology: Air-operated double diaphragm pumps maintain market leadership due to their versatility, reliability, and ability to handle challenging fluids without electrical power requirements. These pumps excel in hazardous environments and applications requiring explosion-proof operation. Electric diaphragm pumps show increasing adoption where precise flow control and energy efficiency are priorities, particularly in European markets with high energy costs.

By Material: Pump material selection significantly impacts performance and application suitability. Stainless steel construction dominates in pharmaceutical and food applications, while specialized alloys serve chemical processing requirements. Advanced polymer and composite materials expand application possibilities while reducing costs in suitable applications.

By End-User Industry: Chemical processing industries represent the largest end-user segment, driven by the need for reliable handling of corrosive and hazardous chemicals. Water treatment applications show rapid growth, particularly in regions with expanding infrastructure and environmental compliance requirements. Pharmaceutical manufacturing demands the highest quality standards and represents a high-value market segment.

By Capacity Range: Medium-capacity pumps serve the broadest range of applications, while high-capacity systems address large-scale industrial requirements. Compact pump systems gain popularity in space-constrained applications and mobile equipment installations.

Manufacturers benefit from expanding market opportunities across diverse industries and regions, with growing demand for advanced pump technologies creating premium pricing opportunities. Technology leadership in smart pump systems and specialized materials provides competitive advantages and market differentiation possibilities.

End-users gain access to reliable, efficient pumping solutions that improve operational performance while reducing maintenance requirements and environmental impact. Advanced pump technologies offer enhanced monitoring capabilities, predictive maintenance features, and improved process control that optimize industrial operations.

Distributors and service providers benefit from growing aftermarket opportunities, including maintenance services, spare parts supply, and system optimization consulting. Regional market expansion creates new business opportunities while technological advancement drives demand for specialized services and support.

Investors find attractive opportunities in a growing market with strong fundamentals, technological innovation, and expanding global demand. Market consolidation trends create opportunities for strategic acquisitions and partnerships that enhance market position and capabilities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend shaping the diaphragm pump market, with smart pump systems incorporating IoT connectivity, remote monitoring, and predictive maintenance capabilities. Industry 4.0 adoption drives demand for intelligent pumping systems that integrate with broader industrial automation and control systems.

Sustainability focus influences product development and market preferences, with increasing emphasis on energy-efficient pump designs, recyclable materials, and reduced environmental impact. Circular economy principles drive development of repairable, upgradeable pump systems that minimize waste and resource consumption.

Material innovation continues advancing pump performance and application possibilities through development of advanced elastomers, composites, and specialized alloys. Nanotechnology applications in pump materials enhance durability, chemical resistance, and performance characteristics while potentially reducing costs.

Customization demand increases as industries seek application-specific solutions tailored to unique operational requirements. Modular pump designs enable flexible configuration and easy modification to meet changing application needs while reducing inventory requirements.

Technological advancement in diaphragm pump design includes development of advanced control systems, improved materials, and enhanced monitoring capabilities. Smart pump platforms integrate sensors, connectivity, and analytics to provide comprehensive operational insights and optimization opportunities.

Strategic partnerships between pump manufacturers and technology companies accelerate innovation and market development. Collaboration initiatives focus on developing integrated solutions that combine pumping equipment with process control, monitoring, and optimization technologies.

Manufacturing expansion in emerging markets improves product accessibility and reduces costs while creating local employment and economic development. Regional production facilities enable customization for local market requirements and improved service support.

Regulatory developments across the EMEA region influence product standards, safety requirements, and environmental compliance specifications. Harmonization efforts simplify market access while maintaining high quality and safety standards across different regional markets.

Market participants should focus on developing comprehensive digital solutions that combine traditional pump reliability with modern connectivity and analytics capabilities. Investment priorities should emphasize smart technology integration, predictive maintenance capabilities, and user-friendly interfaces that simplify system operation and optimization.

Regional expansion strategies should prioritize emerging markets in Africa and Middle East while maintaining strong positions in mature European markets. Local partnerships and service capabilities are essential for success in diverse regional markets with varying technical requirements and support needs.

Product development should emphasize sustainability, energy efficiency, and application-specific customization to meet evolving market demands. Material innovation and manufacturing process improvement can provide competitive advantages while reducing costs and environmental impact.

Service integration represents a critical success factor, with comprehensive support offerings including installation, maintenance, monitoring, and optimization services becoming essential for market differentiation. MWR analysis indicates that companies providing integrated solutions achieve higher customer retention rates of 85% compared to product-only suppliers.

Long-term market prospects for the Europe, Middle-East and Africa diaphragm pump market remain highly positive, supported by continued industrial expansion, infrastructure development, and increasing adoption of advanced pumping technologies. Growth trajectory is expected to accelerate in emerging markets while maintaining steady expansion in mature European markets.

Technology evolution will continue driving market development through smart pump systems, advanced materials, and integrated solutions that provide enhanced value to end-users. Digital transformation in industrial operations creates sustained demand for intelligent pumping systems with monitoring, control, and optimization capabilities.

Market consolidation trends may accelerate as companies seek to achieve scale advantages and comprehensive solution capabilities. Strategic acquisitions and partnerships will likely focus on technology integration, regional market access, and service capability enhancement.

Regulatory trends supporting environmental protection and operational safety will continue favoring diaphragm pump technologies over conventional alternatives. MarkWide Research projections indicate sustained market expansion with growth rates maintaining above 6% annually through the forecast period, driven by industrial development and technology advancement across the region.

The Europe, Middle-East and Africa diaphragm pump market represents a dynamic and expanding sector with strong growth fundamentals, technological innovation, and diverse application opportunities. Market evolution is characterized by increasing sophistication in pump technologies, expanding regional demand, and growing emphasis on sustainability and operational efficiency.

Strategic opportunities abound for market participants who can successfully combine traditional pump reliability with modern digital capabilities while addressing the unique requirements of diverse regional markets. Success factors include technological leadership, comprehensive service capabilities, regional market understanding, and commitment to sustainability and innovation.

Future market development will be shaped by continued industrial expansion, infrastructure development, and increasing adoption of smart technologies across the EMEA region. Companies that invest in technology advancement, regional capabilities, and customer-focused solutions are well-positioned to capitalize on the substantial growth opportunities in this evolving market landscape.

What is Diaphragm Pump?

A diaphragm pump is a positive displacement pump that uses a flexible diaphragm to separate the pumping chamber from the drive mechanism. This design allows for the handling of various fluids, including corrosive and viscous materials, making it suitable for applications in industries such as chemical processing and water treatment.

What are the key players in the Europe, Middle-East And Africa Diaphragm Pump Market?

Key players in the Europe, Middle-East And Africa Diaphragm Pump Market include companies like Grundfos, Xylem, and ARO Fluid Handling. These companies are known for their innovative diaphragm pump solutions and extensive product portfolios, catering to diverse industrial needs.

What are the growth factors driving the Europe, Middle-East And Africa Diaphragm Pump Market?

The growth of the Europe, Middle-East And Africa Diaphragm Pump Market is driven by increasing demand for efficient fluid handling solutions in industries such as pharmaceuticals, food and beverage, and wastewater management. Additionally, the rising focus on automation and process optimization in manufacturing is contributing to market expansion.

What challenges does the Europe, Middle-East And Africa Diaphragm Pump Market face?

Challenges in the Europe, Middle-East And Africa Diaphragm Pump Market include the high initial costs associated with advanced diaphragm pump technologies and the need for regular maintenance. Furthermore, competition from alternative pumping technologies can hinder market growth.

What opportunities exist in the Europe, Middle-East And Africa Diaphragm Pump Market?

Opportunities in the Europe, Middle-East And Africa Diaphragm Pump Market include the increasing adoption of diaphragm pumps in emerging markets and the development of energy-efficient models. Additionally, advancements in materials and technology are expected to enhance pump performance and reliability.

What trends are shaping the Europe, Middle-East And Africa Diaphragm Pump Market?

Trends in the Europe, Middle-East And Africa Diaphragm Pump Market include the growing emphasis on sustainability and eco-friendly solutions, as well as the integration of smart technologies for monitoring and control. These trends are influencing product development and customer preferences in various sectors.

Europe, Middle-East And Africa Diaphragm Pump Market

| Segmentation Details | Description |

|---|---|

| Product Type | Air-Operated, Electric, Hydraulic, Manual |

| End User | Food & Beverage, Pharmaceuticals, Water Treatment, Chemical Processing |

| Technology | Positive Displacement, Peristaltic, Centrifugal, Vacuum |

| Application | Transfer, Metering, Mixing, Dispensing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe, Middle-East And Africa Diaphragm Pump Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at