444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe metal precision turned product manufacturing market represents a cornerstone of the continent’s industrial manufacturing ecosystem, serving diverse sectors from automotive to aerospace. This specialized manufacturing segment focuses on creating high-precision components through advanced turning processes, utilizing state-of-the-art CNC machinery and traditional lathe operations. European manufacturers have established themselves as global leaders in precision engineering, delivering components that meet stringent quality standards and dimensional tolerances.

Market dynamics indicate robust growth driven by increasing demand for precision components across multiple industries. The automotive sector remains the largest consumer, accounting for approximately 35% of total demand, while aerospace and defense applications contribute significantly to market expansion. Germany, Italy, and Switzerland lead the regional market, leveraging their strong manufacturing heritage and technological expertise.

Technological advancement continues to reshape the industry landscape, with manufacturers investing heavily in Industry 4.0 technologies, automated production systems, and advanced quality control mechanisms. The integration of digital manufacturing solutions has enabled European companies to maintain competitive advantages while addressing growing demand for customized precision components with shorter lead times.

The Europe metal precision turned product manufacturing market refers to the specialized industrial sector focused on producing high-accuracy metal components through precision turning processes, utilizing advanced machining technologies to create parts that meet exact dimensional specifications for various industrial applications across the European region.

Precision turning encompasses various manufacturing techniques including CNC turning, Swiss-type machining, and multi-axis turning operations. These processes enable manufacturers to create complex geometries, tight tolerances, and superior surface finishes essential for critical applications in automotive, aerospace, medical devices, and industrial machinery sectors.

Manufacturing capabilities within this market segment include working with diverse materials such as stainless steel, aluminum alloys, brass, titanium, and specialized engineering plastics. European manufacturers distinguish themselves through their ability to handle complex projects requiring exceptional precision, often achieving tolerances within ±0.005mm for critical components.

Market performance in the European metal precision turned product manufacturing sector demonstrates consistent growth momentum, driven by technological innovation and expanding application areas. The industry benefits from Europe’s strong manufacturing base, skilled workforce, and commitment to quality excellence that has established the region as a preferred supplier for precision components globally.

Key growth drivers include increasing automation in manufacturing processes, rising demand for lightweight components in automotive applications, and expanding aerospace sector requirements. The medical device industry has emerged as a significant growth catalyst, with precision turned components essential for surgical instruments, implants, and diagnostic equipment manufacturing.

Regional distribution shows concentrated activity in traditional manufacturing hubs, with Germany commanding approximately 28% market share, followed by Italy and Switzerland. The market exhibits strong export orientation, with European manufacturers supplying precision components to global markets while maintaining technological leadership in specialized applications.

Future prospects remain positive, supported by ongoing digitalization initiatives, sustainable manufacturing practices, and increasing demand for high-precision components in emerging technologies such as electric vehicles, renewable energy systems, and advanced medical devices.

Industry analysis reveals several critical insights shaping the European metal precision turned product manufacturing landscape:

Automotive sector expansion serves as the primary market driver, with European automotive manufacturers increasingly demanding precision components for advanced engine systems, transmission assemblies, and electric vehicle applications. The transition toward electric mobility creates new opportunities for precision turned components in battery systems, electric motors, and charging infrastructure.

Aerospace industry growth significantly impacts market demand, particularly for components used in commercial aircraft, defense systems, and space applications. European aerospace manufacturers require precision turned parts that meet stringent safety standards and performance specifications, driving continuous innovation in manufacturing processes and material capabilities.

Medical device advancement represents a rapidly expanding driver, with precision turned components essential for surgical instruments, implantable devices, and diagnostic equipment. The aging European population and increasing healthcare expenditure support sustained demand growth in this high-value segment.

Industrial automation trends fuel demand for precision components used in robotics, manufacturing equipment, and process control systems. European manufacturers benefit from the region’s leadership in industrial automation technology and the ongoing Industry 4.0 transformation across manufacturing sectors.

High capital investment requirements present significant barriers for smaller manufacturers seeking to upgrade equipment and implement advanced technologies. The cost of modern CNC machinery, quality control systems, and automation equipment can strain financial resources, particularly for companies serving niche markets with limited volume potential.

Skilled labor shortage challenges the industry’s growth potential, as precision turning requires specialized technical expertise that takes years to develop. European manufacturers face increasing competition for qualified machinists, engineers, and quality control specialists, driving up labor costs and potentially limiting expansion capabilities.

Raw material price volatility impacts profitability and project planning, particularly for manufacturers working with specialized alloys and high-performance materials. Fluctuating commodity prices and supply chain disruptions can significantly affect manufacturing costs and delivery schedules.

Environmental regulations impose additional compliance costs and operational constraints, requiring investments in emission control systems, waste management infrastructure, and sustainable manufacturing practices. While supporting long-term sustainability goals, these requirements can burden smaller manufacturers with limited resources.

Electric vehicle transition creates substantial opportunities for precision turned component manufacturers, as EV systems require specialized parts for battery assemblies, electric motors, and charging systems. European automotive manufacturers’ commitment to electrification drives demand for innovative precision components with enhanced performance characteristics.

Renewable energy expansion opens new market segments for precision turned products used in wind turbines, solar panel systems, and energy storage applications. The European Union’s green energy initiatives support sustained demand growth in this emerging sector.

Medical technology advancement presents high-value opportunities in minimally invasive surgical instruments, implantable devices, and diagnostic equipment. The precision and biocompatibility requirements in medical applications align well with European manufacturers’ technical capabilities and quality standards.

Aerospace innovation in commercial space applications, unmanned aerial vehicles, and next-generation aircraft systems creates demand for specialized precision components. European aerospace companies’ technological leadership positions regional manufacturers advantageously for these emerging opportunities.

Supply chain evolution significantly influences market dynamics, with manufacturers increasingly adopting regional sourcing strategies to enhance resilience and reduce dependency on distant suppliers. This trend supports European precision turning companies by creating opportunities for closer customer relationships and shorter supply chains.

Technology convergence between traditional machining and digital manufacturing creates new competitive dynamics. Companies successfully integrating Industry 4.0 technologies achieve significant advantages in efficiency, quality control, and customer responsiveness, while those lagging behind face increasing competitive pressure.

Customer expectations continue evolving toward shorter lead times, higher quality standards, and greater customization capabilities. Manufacturers must balance efficiency improvements with flexibility to meet diverse customer requirements across multiple industry segments.

Regulatory landscape changes, particularly regarding environmental standards and product safety requirements, influence manufacturing processes and investment priorities. Companies proactively addressing regulatory compliance gain competitive advantages while those reactive to changes face operational disruptions.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the European metal precision turned product manufacturing market. Primary research includes extensive interviews with industry executives, manufacturing engineers, and procurement specialists across key European markets.

Secondary research incorporates analysis of industry publications, trade association reports, government statistics, and company financial disclosures. This approach provides comprehensive market understanding while validating primary research findings through multiple data sources.

Market sizing methodology utilizes bottom-up and top-down approaches, analyzing production capacity, demand patterns, and trade flows across European countries. Regional variations in manufacturing capabilities and market conditions receive detailed examination to ensure accurate market representation.

Trend analysis incorporates historical data review, current market assessment, and forward-looking projections based on identified growth drivers and market dynamics. MarkWide Research employs proprietary analytical models to project market evolution and identify emerging opportunities across different industry segments.

Germany dominates the European precision turned product manufacturing landscape, leveraging its strong automotive and industrial machinery sectors. German manufacturers excel in high-volume production capabilities and advanced automation technologies, serving both domestic and international markets with approximately 28% regional market share.

Italy maintains significant market presence through specialized manufacturers focused on luxury automotive, aerospace, and industrial applications. Italian companies distinguish themselves through craftsmanship excellence and ability to handle complex, low-volume projects requiring exceptional precision and quality.

Switzerland leads in high-value precision applications, particularly for medical devices, luxury watches, and aerospace components. Swiss manufacturers command premium pricing through superior quality, precision capabilities, and strong customer relationships in specialized market segments.

France contributes substantially through aerospace and automotive applications, with manufacturers benefiting from strong domestic demand and export opportunities. French companies increasingly focus on sustainable manufacturing practices and advanced material applications.

United Kingdom maintains specialized capabilities in aerospace and defense applications, despite Brexit-related challenges. UK manufacturers adapt to new trade relationships while maintaining technological excellence in precision turning applications.

Market structure features a mix of large multinational corporations and specialized medium-sized enterprises, each serving distinct market segments with different competitive strategies. Leading companies compete through technological innovation, quality excellence, and comprehensive service capabilities.

Key market participants include:

Competitive strategies focus on technological differentiation, customer service excellence, and specialized market positioning. Companies invest heavily in R&D, automation technologies, and workforce development to maintain competitive advantages in increasingly demanding market conditions.

By Material Type:

By Application:

By Manufacturing Process:

Automotive segment demonstrates consistent growth driven by increasing vehicle production and component complexity. European automotive manufacturers demand precision turned parts for advanced engine systems, transmission assemblies, and emerging electric vehicle applications, with quality requirements becoming increasingly stringent.

Aerospace category exhibits strong performance supported by commercial aircraft production and defense spending. This segment requires exceptional precision and material certifications, offering higher margins but demanding significant quality investments and regulatory compliance.

Medical device segment shows rapid expansion as healthcare technology advances and European populations age. Precision turned components for surgical instruments and implantable devices require biocompatible materials and exceptional quality standards, creating opportunities for specialized manufacturers.

Industrial machinery category benefits from ongoing automation trends and Industry 4.0 implementation across European manufacturing. Precision components for robotics, machine tools, and process equipment drive steady demand growth in this established market segment.

Manufacturers benefit from strong European demand across multiple industry sectors, providing diversification opportunities and reduced dependency on single markets. The region’s commitment to quality excellence and technological innovation supports premium pricing strategies for high-value precision components.

Suppliers gain from stable, long-term relationships with European manufacturers who prioritize quality and reliability over lowest-cost sourcing. This approach enables suppliers to invest in advanced capabilities and maintain sustainable business models.

Customers receive access to world-class precision manufacturing capabilities, advanced quality systems, and innovative solutions for complex engineering challenges. European manufacturers’ technical expertise and customer service excellence provide significant value beyond basic component supply.

Investors find attractive opportunities in a mature market with steady growth prospects, supported by strong fundamentals in automotive, aerospace, and medical device sectors. The industry’s capital-intensive nature creates barriers to entry while rewarding companies with advanced capabilities.

Regional economies benefit from high-value manufacturing activities, skilled employment opportunities, and export revenue generation. The precision turning industry supports broader manufacturing ecosystems and contributes to European competitiveness in global markets.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation accelerates across the industry, with manufacturers implementing IoT sensors, predictive maintenance systems, and real-time quality monitoring. These technologies enable 15% efficiency improvements while reducing defect rates and enhancing customer satisfaction through improved delivery performance.

Sustainability initiatives gain prominence as manufacturers adopt circular economy principles, waste reduction programs, and energy-efficient processes. European companies lead in developing environmentally responsible manufacturing practices that meet regulatory requirements while reducing operational costs.

Customization capabilities expand through flexible manufacturing systems and advanced programming technologies. Manufacturers increasingly offer tailored solutions for specific customer requirements, enabling premium pricing and stronger customer relationships in competitive markets.

Material innovation drives new application possibilities, with advanced alloys, composites, and specialized materials expanding the range of precision turned products. These developments support entry into high-value market segments with enhanced performance requirements.

Automation integration continues advancing, with robotic loading systems, automated quality inspection, and lights-out manufacturing capabilities becoming standard in leading facilities. This trend addresses labor shortage challenges while improving consistency and productivity.

Technology partnerships between precision manufacturers and software companies accelerate digital transformation initiatives. These collaborations focus on developing integrated manufacturing solutions that combine advanced machining capabilities with intelligent process control and quality management systems.

Acquisition activity increases as larger companies seek to expand capabilities and market reach through strategic acquisitions of specialized manufacturers. This consolidation trend enables companies to offer comprehensive solutions while achieving operational synergies.

Research investments in advanced materials and manufacturing processes support innovation in precision turning applications. European companies collaborate with universities and research institutions to develop next-generation manufacturing technologies and material solutions.

Certification achievements in aerospace and medical device standards enable manufacturers to access high-value market segments. Companies invest significantly in quality systems and regulatory compliance to meet stringent industry requirements.

Facility expansions in key European markets support growing demand and enable manufacturers to serve customers more effectively. These investments focus on advanced manufacturing capabilities and automation technologies that enhance competitive positioning.

Investment priorities should focus on automation technologies and digital manufacturing systems that enhance productivity while addressing skilled labor constraints. MWR analysis indicates that companies implementing comprehensive automation strategies achieve 20% productivity improvements within two years of implementation.

Market positioning strategies should emphasize technical expertise, quality excellence, and customer service capabilities that differentiate European manufacturers from low-cost competitors. Companies should focus on high-value applications where precision and reliability command premium pricing.

Partnership development with key customers in automotive, aerospace, and medical device sectors creates opportunities for collaborative innovation and long-term supply agreements. These relationships provide stability and support for capacity expansion investments.

Sustainability initiatives should be integrated into core business strategies, as environmental performance increasingly influences customer purchasing decisions and regulatory compliance requirements. Companies leading in sustainable manufacturing practices gain competitive advantages in European markets.

Workforce development programs require ongoing investment to address skilled labor shortages and support technology adoption. Companies should collaborate with educational institutions and government programs to develop technical training initiatives.

Market prospects remain positive through the forecast period, supported by strong fundamentals in key end-use sectors and ongoing technological advancement. The automotive sector’s transition to electric vehicles creates new opportunities while traditional applications continue providing stable demand.

Growth projections indicate sustained expansion at approximately 4.2% CAGR over the next five years, driven by increasing demand for precision components in emerging technologies and applications. Medical device and aerospace segments are expected to outperform overall market growth rates.

Technology evolution will continue reshaping the industry, with artificial intelligence, machine learning, and advanced automation becoming standard capabilities. Companies successfully integrating these technologies will achieve significant competitive advantages in efficiency and quality performance.

Regional dynamics may shift as manufacturers adapt to changing trade relationships and supply chain strategies. However, European manufacturers’ technical capabilities and quality reputation position them well for continued success in global markets.

MarkWide Research projects that companies investing in digital transformation and sustainable manufacturing practices will capture disproportionate market share growth, while those maintaining traditional approaches may face increasing competitive pressure.

The European metal precision turned product manufacturing market demonstrates remarkable resilience and growth potential, supported by strong industrial fundamentals and technological leadership. European manufacturers have successfully positioned themselves as premium suppliers in global markets, leveraging superior quality, technical expertise, and customer service excellence.

Future success will depend on continued investment in advanced technologies, workforce development, and sustainable manufacturing practices. Companies that embrace digital transformation while maintaining their commitment to quality excellence will thrive in increasingly competitive global markets.

Market opportunities in electric vehicles, medical devices, and aerospace applications provide substantial growth potential for manufacturers willing to invest in specialized capabilities and customer relationships. The industry’s evolution toward higher value-added applications supports optimistic long-term prospects for European precision turning manufacturers.

What is Metal Precision Turned Product Manufacturing?

Metal Precision Turned Product Manufacturing refers to the process of creating highly accurate and finely detailed metal components through turning operations on lathes. This manufacturing technique is essential for producing parts used in various industries, including automotive, aerospace, and electronics.

What are the key players in the Europe Metal Precision Turned Product Manufacturing Market?

Key players in the Europe Metal Precision Turned Product Manufacturing Market include companies like Heller Machine Tools, DMG Mori, and Haas Automation. These companies are known for their advanced machining technologies and precision engineering capabilities, among others.

What are the growth factors driving the Europe Metal Precision Turned Product Manufacturing Market?

The growth of the Europe Metal Precision Turned Product Manufacturing Market is driven by the increasing demand for lightweight and high-strength components in industries such as automotive and aerospace. Additionally, advancements in automation and precision machining technologies are enhancing production efficiency.

What challenges does the Europe Metal Precision Turned Product Manufacturing Market face?

The Europe Metal Precision Turned Product Manufacturing Market faces challenges such as high production costs and the need for skilled labor. Additionally, fluctuations in raw material prices can impact profitability and operational efficiency.

What opportunities exist in the Europe Metal Precision Turned Product Manufacturing Market?

Opportunities in the Europe Metal Precision Turned Product Manufacturing Market include the growing trend towards customization and the increasing adoption of Industry Four-point-oh technologies. These trends are expected to enhance production capabilities and meet specific customer requirements.

What trends are shaping the Europe Metal Precision Turned Product Manufacturing Market?

Trends shaping the Europe Metal Precision Turned Product Manufacturing Market include the integration of smart manufacturing technologies and the use of advanced materials. Additionally, sustainability initiatives are prompting manufacturers to adopt eco-friendly practices in their production processes.

Europe Metal Precision Turned Product Manufacturing Market

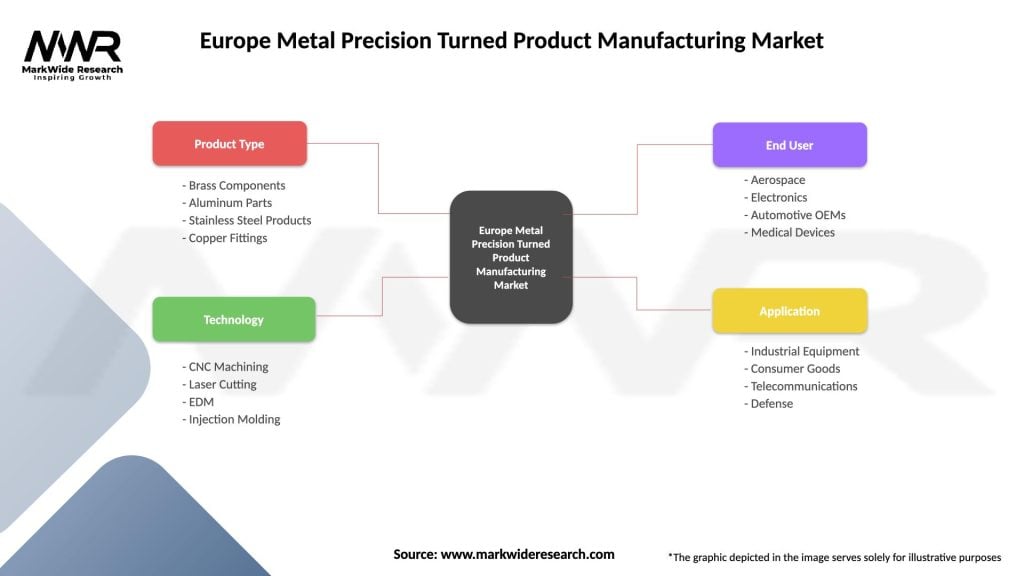

| Segmentation Details | Description |

|---|---|

| Product Type | Brass Components, Aluminum Parts, Stainless Steel Products, Copper Fittings |

| Technology | CNC Machining, Laser Cutting, EDM, Injection Molding |

| End User | Aerospace, Electronics, Automotive OEMs, Medical Devices |

| Application | Industrial Equipment, Consumer Goods, Telecommunications, Defense |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Metal Precision Turned Product Manufacturing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at