444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe membrane water and wastewater treatment market represents a critical component of the continent’s environmental infrastructure, addressing growing concerns about water scarcity, pollution control, and sustainable resource management. This dynamic sector encompasses advanced filtration technologies including reverse osmosis, ultrafiltration, microfiltration, and nanofiltration systems that are revolutionizing how European industries and municipalities approach water treatment challenges.

Market dynamics indicate robust expansion driven by stringent environmental regulations, aging water infrastructure, and increasing industrial demand for high-quality water. The European Union’s commitment to achieving carbon neutrality by 2050 has accelerated investments in sustainable water treatment technologies, with membrane-based solutions emerging as preferred alternatives to conventional treatment methods.

Regional leadership in membrane technology adoption varies significantly across European countries, with Germany, France, and the Netherlands leading in both technological innovation and market penetration. The market demonstrates strong growth potential, with industry analysts projecting a compound annual growth rate of 8.2% through the forecast period, reflecting the urgent need for advanced water treatment infrastructure across diverse industrial sectors.

Technological advancement continues to drive market evolution, with manufacturers focusing on developing more efficient, cost-effective membrane solutions that address specific regional challenges including industrial wastewater treatment, municipal water purification, and agricultural water management. The integration of smart monitoring systems and IoT technologies is enhancing operational efficiency and reducing maintenance costs across European installations.

The Europe membrane water and wastewater treatment market refers to the comprehensive ecosystem of membrane-based filtration technologies, equipment, services, and solutions deployed across European countries to purify water and treat wastewater for various applications. This market encompasses physical separation processes that utilize semi-permeable membranes to remove contaminants, particles, and dissolved substances from water sources.

Membrane technology operates on the principle of selective permeability, allowing water molecules to pass through while blocking larger contaminants, dissolved salts, bacteria, viruses, and other pollutants. The European market specifically addresses regional water quality challenges, regulatory compliance requirements, and sustainability objectives established by the European Union and individual member states.

Market scope includes four primary membrane technologies: reverse osmosis for desalination and high-purity applications, ultrafiltration for removing suspended solids and macromolecules, microfiltration for particle removal and clarification, and nanofiltration for selective ion removal and water softening. These technologies serve diverse end-user segments including municipal water utilities, industrial manufacturing, food and beverage processing, pharmaceutical production, and power generation facilities.

Geographic coverage spans all European Union member states plus the United Kingdom, Norway, and Switzerland, with market dynamics influenced by varying water quality standards, environmental regulations, industrial development patterns, and infrastructure investment priorities across different regions and countries.

Strategic positioning of the Europe membrane water and wastewater treatment market reflects the continent’s leadership in environmental technology and sustainable development initiatives. The market has experienced accelerated growth following increased regulatory pressure, climate change impacts, and industrial transformation toward circular economy principles.

Key market drivers include the European Green Deal implementation, which mandates significant improvements in water quality and wastewater treatment efficiency. Industrial sectors are increasingly adopting membrane technologies to meet zero liquid discharge requirements and reduce environmental footprints, with adoption rates increasing by 15% annually across manufacturing industries.

Competitive landscape features a mix of global technology leaders and specialized European manufacturers, with companies focusing on innovation, service excellence, and localized solutions. Market consolidation continues as larger players acquire specialized membrane manufacturers to expand technological capabilities and geographic reach.

Regional variations in market development reflect different water challenges and regulatory environments. Northern European countries lead in municipal applications, while Southern Europe shows stronger growth in desalination and industrial wastewater treatment. Eastern European markets demonstrate rapid expansion as infrastructure modernization accelerates.

Future outlook indicates sustained growth driven by digital transformation, membrane material innovations, and increasing focus on water reuse and resource recovery. The market is transitioning toward integrated solutions that combine multiple membrane technologies with advanced monitoring and control systems.

Technology adoption patterns reveal significant shifts in European membrane water treatment preferences, with reverse osmosis maintaining the largest market share while ultrafiltration experiences the fastest growth rates. The following insights highlight critical market developments:

Market maturity varies significantly across European regions, with Western European countries showing mature markets focused on replacement and efficiency improvements, while Eastern European markets demonstrate higher growth rates driven by infrastructure development and EU compliance requirements.

Regulatory framework serves as the primary catalyst for European membrane water treatment market expansion. The EU Water Framework Directive, Urban Wastewater Treatment Directive, and emerging regulations on pharmaceutical residues and microplastics create mandatory compliance requirements that drive membrane technology adoption across municipal and industrial sectors.

Environmental sustainability initiatives throughout Europe are accelerating membrane system deployments as organizations seek to reduce water consumption, minimize wastewater discharge, and achieve circular economy objectives. The European Green Deal’s emphasis on resource efficiency and pollution prevention directly supports membrane technology investments.

Industrial water quality requirements continue to intensify across key European industries including pharmaceuticals, semiconductors, food processing, and chemicals. These sectors require ultra-pure water for production processes, driving demand for advanced membrane filtration systems capable of removing trace contaminants and ensuring consistent water quality.

Water scarcity concerns in Southern European regions are promoting membrane-based desalination and water reuse projects. Climate change impacts, including prolonged droughts and altered precipitation patterns, are forcing European countries to diversify water sources and implement advanced treatment technologies for alternative water supplies.

Infrastructure modernization programs across Europe are replacing aging water treatment facilities with energy-efficient membrane systems. Government funding initiatives and EU structural funds support these upgrades, particularly in Eastern European countries working to meet EU water quality standards.

Technological advancement in membrane materials, system design, and process optimization continues to improve performance while reducing operational costs. These improvements make membrane technologies more attractive compared to conventional treatment methods, driving broader market adoption.

High capital investment requirements for membrane water treatment systems present significant barriers to market entry, particularly for smaller municipalities and industrial facilities. Initial system costs, including membrane modules, pressure vessels, pumps, and control systems, can be substantial compared to conventional treatment alternatives.

Operational complexity associated with membrane systems requires specialized technical expertise for proper operation, maintenance, and troubleshooting. The shortage of qualified technicians and operators in some European regions limits market expansion and increases operational risks for end users.

Membrane fouling and replacement costs create ongoing operational challenges that can impact system economics. Frequent cleaning requirements, chemical consumption, and periodic membrane replacement add to total cost of ownership, potentially deterring adoption in cost-sensitive applications.

Energy consumption concerns, particularly for high-pressure membrane processes like reverse osmosis, can conflict with European energy efficiency objectives. While newer systems are more efficient, energy costs remain a significant operational expense that affects long-term project viability.

Concentrate disposal challenges arise from membrane processes that generate concentrated waste streams requiring proper treatment or disposal. Environmental regulations governing concentrate discharge can complicate system design and increase operational costs, particularly in water-scarce regions.

Market fragmentation across different European countries creates complexity for membrane suppliers and system integrators. Varying technical standards, certification requirements, and procurement processes increase market entry costs and limit economies of scale.

Digital transformation presents significant opportunities for membrane technology providers to develop smart water treatment solutions incorporating artificial intelligence, machine learning, and predictive analytics. These technologies can optimize membrane performance, reduce maintenance costs, and improve overall system reliability.

Circular economy initiatives across Europe create new market segments for membrane technologies focused on resource recovery, water reuse, and waste minimization. Opportunities exist in developing integrated systems that extract valuable materials from wastewater while producing high-quality recycled water.

Industrial water reuse applications offer substantial growth potential as European industries seek to reduce freshwater consumption and wastewater discharge. Membrane technologies can enable closed-loop water systems in manufacturing processes, creating competitive advantages and regulatory compliance benefits.

Decentralized treatment solutions represent emerging opportunities in rural areas and small communities where centralized infrastructure is not economically viable. Compact membrane systems can provide reliable water treatment for distributed applications while meeting EU water quality standards.

Pharmaceutical and biotechnology sectors in Europe continue expanding, creating demand for specialized membrane systems capable of producing ultra-pure water and processing complex biological materials. These high-value applications offer attractive margins for technology providers.

Climate adaptation strategies across European countries will require flexible water treatment solutions capable of handling variable water quality and extreme weather events. Membrane technologies can provide resilient treatment capabilities that adapt to changing conditions and ensure water security.

Supply chain evolution in the European membrane market reflects increasing localization of manufacturing and service capabilities. Major international suppliers are establishing European production facilities and service centers to reduce costs, improve delivery times, and enhance customer support.

Technology convergence is creating new market dynamics as membrane processes integrate with other treatment technologies including biological treatment, advanced oxidation, and electrochemical processes. These hybrid systems offer enhanced performance and expanded application possibilities.

Customer behavior is shifting toward long-term service partnerships rather than simple equipment purchases. European end users increasingly prefer comprehensive solutions including system design, installation, operation, and maintenance services from single providers.

Competitive intensity continues to increase as new players enter the European market and existing suppliers expand their offerings. Price competition is balanced by innovation and service differentiation, with successful companies focusing on value-added solutions.

Regulatory evolution creates both challenges and opportunities as European authorities develop new water quality standards and treatment requirements. Companies that anticipate regulatory changes and develop compliant solutions gain competitive advantages in the marketplace.

Investment patterns show increasing private sector participation in European water infrastructure projects, creating opportunities for membrane technology providers to participate in public-private partnerships and long-term service contracts.

Primary research methodology employed comprehensive interviews with key stakeholders across the European membrane water treatment value chain, including membrane manufacturers, system integrators, end users, and regulatory authorities. These interviews provided insights into market trends, technology developments, and future growth prospects.

Secondary research involved extensive analysis of industry reports, government publications, academic studies, and company financial statements to establish market baselines and validate primary research findings. European Union databases and national statistics offices provided regulatory and infrastructure data.

Market sizing utilized bottom-up and top-down approaches, analyzing membrane installation data, replacement cycles, and new project pipelines across different European countries and application segments. Regional variations in market development were carefully considered in the analysis.

Technology assessment included detailed evaluation of membrane types, system configurations, and performance characteristics to understand competitive positioning and market preferences. Patent analysis and R&D investment tracking provided insights into innovation trends.

Competitive analysis examined market share distribution, company strategies, and competitive dynamics through public information, industry databases, and stakeholder interviews. Financial performance analysis helped identify market leaders and growth companies.

Forecast modeling incorporated multiple scenarios considering regulatory changes, economic conditions, and technology developments to project market growth trajectories and identify potential risks and opportunities for market participants.

Western Europe maintains market leadership in membrane water treatment adoption, with Germany, France, and the Netherlands demonstrating mature markets characterized by replacement demand and efficiency upgrades. These countries show steady growth rates of 5-7% annually, driven primarily by industrial applications and municipal infrastructure modernization.

Germany represents the largest single market in Europe, with strong demand across industrial sectors including automotive, chemicals, and pharmaceuticals. The country’s commitment to environmental protection and industrial competitiveness drives continued investment in advanced membrane technologies.

France demonstrates significant growth in municipal water treatment applications, with major cities upgrading aging infrastructure to meet evolving water quality standards. The country’s nuclear power sector also creates specialized demand for ultra-pure water systems.

United Kingdom maintains strong market presence despite Brexit, with particular strength in industrial applications and water reuse projects. Regulatory continuity and ongoing infrastructure investments support continued market development.

Southern Europe shows the highest growth rates, with Spain, Italy, and Greece leading desalination and water reuse applications. Water scarcity challenges and tourism industry demands drive membrane technology adoption in these regions.

Eastern Europe demonstrates rapid market expansion as countries modernize water infrastructure to meet EU standards. Poland, Czech Republic, and Hungary show particularly strong growth in municipal treatment applications, with market expansion rates exceeding 12% annually.

Nordic countries focus on energy-efficient solutions and advanced process control, reflecting regional priorities for sustainability and operational excellence. These markets show steady growth with emphasis on technology innovation and system optimization.

Market leadership in the European membrane water treatment sector is distributed among several global technology providers and specialized regional companies. The competitive environment emphasizes innovation, service excellence, and local market knowledge.

Competitive strategies focus on technology differentiation, service expansion, and strategic partnerships. Leading companies are investing in digitalization, automation, and sustainable technologies to maintain competitive advantages in the evolving European market.

Market consolidation continues as larger players acquire specialized companies to expand technology portfolios and geographic coverage. This trend is creating more comprehensive solution providers capable of addressing complex customer requirements.

Technology segmentation reveals distinct market dynamics across different membrane types, with each technology addressing specific application requirements and market segments throughout Europe.

By Technology:

By Application:

By End User:

Municipal water treatment represents the most stable market category, with European cities and utilities investing in membrane technologies to meet increasingly stringent water quality standards. This segment shows consistent growth driven by infrastructure replacement cycles and regulatory compliance requirements.

Industrial applications demonstrate the highest growth potential, with manufacturing sectors adopting membrane technologies to reduce water consumption, improve product quality, and meet environmental discharge requirements. The pharmaceutical and food processing industries lead adoption rates in this category.

Desalination projects in Southern Europe create specialized market opportunities for high-capacity membrane systems. These projects require advanced technology and significant capital investment but offer long-term revenue potential for system suppliers and service providers.

Water reuse applications represent an emerging category with significant growth prospects as European countries implement circular economy policies. These applications require integrated membrane systems capable of producing high-quality recycled water for various uses.

Decentralized treatment systems serve rural communities and industrial facilities where centralized infrastructure is not economically viable. This category shows strong growth in Eastern European countries developing water infrastructure.

Emergency and temporary treatment applications provide niche opportunities for mobile membrane systems addressing water quality emergencies, construction projects, and temporary capacity needs across European markets.

Technology providers benefit from growing European demand for advanced membrane solutions, creating opportunities for revenue growth, market expansion, and technology development. The stable regulatory environment and long-term infrastructure investment cycles provide predictable business opportunities.

System integrators gain advantages from increasing complexity of membrane installations, which require specialized engineering and integration capabilities. The trend toward comprehensive solutions creates opportunities for value-added services and long-term customer relationships.

End users achieve significant benefits including improved water quality, reduced operational costs, enhanced regulatory compliance, and environmental sustainability. Membrane technologies enable industries to meet production requirements while minimizing environmental impact.

Municipal utilities benefit from membrane technologies through improved treatment efficiency, reduced chemical consumption, smaller footprint requirements, and enhanced ability to meet evolving water quality standards while serving growing populations.

Environmental consultants find expanding opportunities in membrane system design, permitting, and compliance services as European regulations become more stringent and complex. Specialized expertise in membrane applications creates competitive advantages.

Financial institutions benefit from stable, long-term investment opportunities in European water infrastructure projects utilizing membrane technologies. These investments typically offer predictable returns and support ESG investment objectives.

Research institutions gain funding opportunities and industry partnerships for membrane technology development, materials research, and process optimization studies. European research programs support innovation in sustainable water treatment technologies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization transformation is revolutionizing European membrane water treatment operations through integration of IoT sensors, artificial intelligence, and predictive analytics. These technologies enable real-time monitoring, predictive maintenance, and optimized performance, reducing operational costs and improving system reliability.

Sustainability focus drives development of energy-efficient membrane systems and renewable energy integration. European companies are prioritizing low-energy membrane processes and developing systems powered by solar and wind energy to align with carbon neutrality objectives.

Modular system design is gaining popularity as end users seek flexible, scalable solutions that can adapt to changing requirements. Containerized membrane systems enable rapid deployment and easy capacity expansion while reducing installation costs and complexity.

Advanced materials development continues to improve membrane performance, durability, and cost-effectiveness. New membrane materials offer enhanced fouling resistance, higher flux rates, and improved selectivity for specific contaminants.

Integrated solutions combining multiple treatment technologies are becoming standard practice for complex water treatment challenges. These hybrid systems optimize performance while minimizing footprint and operational complexity.

Service-oriented business models are replacing traditional equipment sales as customers prefer comprehensive solutions including design, installation, operation, and maintenance services. This trend creates recurring revenue opportunities and stronger customer relationships.

Regulatory anticipation drives technology development as companies prepare for emerging regulations on pharmaceutical residues, microplastics, and other contaminants of emerging concern in European water supplies.

Technology partnerships between European membrane manufacturers and research institutions are accelerating innovation in membrane materials and system design. These collaborations focus on developing next-generation membranes with improved performance and reduced environmental impact.

Acquisition activity continues to reshape the competitive landscape as larger companies acquire specialized membrane technology providers to expand their capabilities and market reach. Recent acquisitions have strengthened portfolios in industrial applications and service offerings.

Pilot project initiatives across Europe are demonstrating advanced membrane technologies for emerging applications including pharmaceutical removal, microplastic filtration, and resource recovery from wastewater. These projects provide valuable data for commercial deployment.

Manufacturing expansion by major membrane suppliers includes new European production facilities to serve growing regional demand and reduce supply chain risks. Local manufacturing capabilities improve delivery times and customer support.

Regulatory developments include new European standards for membrane system performance, testing protocols, and certification requirements. These standards harmonize technical requirements across EU member states and improve market transparency.

Funding announcements from the European Union and national governments support membrane technology research, demonstration projects, and infrastructure upgrades. These investments accelerate market development and technology adoption.

Digital platform launches by membrane companies provide customers with remote monitoring, predictive maintenance, and performance optimization services. These platforms enhance customer value and create new revenue opportunities.

Market entry strategies for new participants should focus on specialized applications or underserved geographic regions where established competitors have limited presence. Success requires deep understanding of local regulations, customer requirements, and competitive dynamics.

Technology investment priorities should emphasize energy efficiency, digitalization, and sustainability features that align with European environmental objectives. Companies investing in these areas will gain competitive advantages and access to government funding opportunities.

Service expansion represents the most promising growth opportunity for existing market participants. Developing comprehensive service capabilities including remote monitoring, predictive maintenance, and performance optimization can create recurring revenue streams and strengthen customer relationships.

Partnership development with local system integrators, engineering companies, and service providers can accelerate market penetration and reduce entry costs. Strategic partnerships provide market knowledge, customer relationships, and technical capabilities.

Regulatory monitoring is essential for anticipating market changes and identifying new opportunities. Companies should actively participate in industry associations and regulatory discussions to influence standards development and prepare for compliance requirements.

Customer education initiatives can accelerate adoption of advanced membrane technologies by demonstrating value propositions and addressing technical concerns. Educational programs should focus on total cost of ownership, environmental benefits, and operational advantages.

Geographic diversification across European markets can reduce risks and capture growth opportunities in different regions. Eastern European markets offer higher growth potential while Western European markets provide stability and premium applications.

Market evolution indicates continued strong growth for the European membrane water treatment sector, driven by regulatory requirements, environmental sustainability objectives, and technological advancement. MarkWide Research analysis suggests the market will maintain robust expansion through the forecast period, with particular strength in industrial applications and water reuse segments.

Technology development will focus on next-generation membrane materials offering improved performance, reduced energy consumption, and enhanced durability. Innovations in membrane chemistry and manufacturing processes will create new application possibilities and improve economic viability.

Digital transformation will accelerate as membrane systems integrate advanced monitoring, control, and optimization technologies. Artificial intelligence and machine learning applications will enable predictive maintenance, automated optimization, and remote operation capabilities.

Regulatory evolution will continue driving market demand as European authorities develop new standards for emerging contaminants and strengthen existing water quality requirements. Companies that anticipate regulatory changes will gain competitive advantages.

Market consolidation is expected to continue as larger companies acquire specialized technology providers and service companies to create comprehensive solution portfolios. This trend will create stronger, more capable market participants.

Sustainability integration will become increasingly important as European countries pursue carbon neutrality objectives. Membrane systems will need to demonstrate environmental benefits and integrate with renewable energy sources to remain competitive.

Application expansion into new market segments including resource recovery, pharmaceutical removal, and decentralized treatment will create additional growth opportunities for innovative membrane technology providers.

The Europe membrane water and wastewater treatment market represents a dynamic and rapidly evolving sector positioned at the intersection of environmental protection, technological innovation, and sustainable development. Market fundamentals remain strong, supported by stringent regulatory requirements, aging infrastructure replacement needs, and growing industrial demand for high-quality water treatment solutions.

Growth prospects appear robust across multiple market segments, with particular strength in industrial applications, water reuse projects, and advanced treatment technologies. The market’s evolution toward integrated, digitalized solutions creates opportunities for technology providers, system integrators, and service companies to develop comprehensive value propositions.

Competitive dynamics continue to favor companies that combine technological innovation with strong service capabilities and local market knowledge. The trend toward long-term partnerships and service-oriented business models is reshaping industry relationships and creating more stable revenue streams.

Regional variations in market development reflect different water challenges, regulatory environments, and economic conditions across European countries. Companies that understand these differences and adapt their strategies accordingly will achieve greater success in this diverse market.

Future success in the European membrane water treatment market will require continued investment in technology development, digitalization, sustainability, and customer service excellence. Organizations that anticipate market trends and regulatory changes while maintaining operational excellence will capture the greatest opportunities in this expanding market.

What is Membrane Water & Wastewater Treatment?

Membrane Water & Wastewater Treatment refers to the use of membrane technology to separate contaminants from water and wastewater, ensuring cleaner water for various applications. This technology is widely used in industries such as municipal water treatment, industrial processes, and desalination.

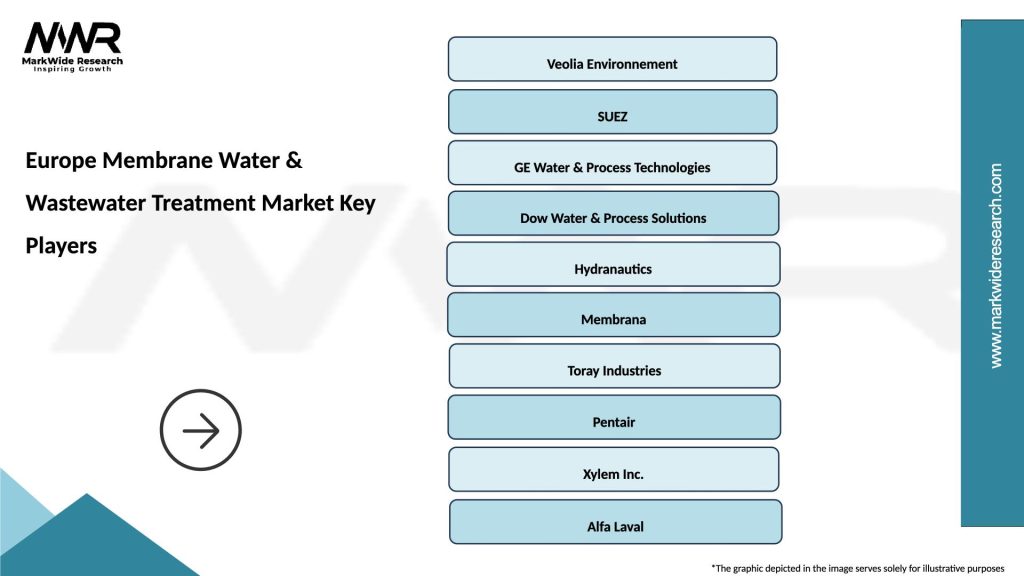

What are the key players in the Europe Membrane Water & Wastewater Treatment Market?

Key players in the Europe Membrane Water & Wastewater Treatment Market include companies like Veolia, SUEZ, and Xylem, which provide innovative solutions for water purification and wastewater management. These companies focus on developing advanced membrane technologies and sustainable practices, among others.

What are the main drivers of the Europe Membrane Water & Wastewater Treatment Market?

The main drivers of the Europe Membrane Water & Wastewater Treatment Market include increasing water scarcity, stringent environmental regulations, and the growing demand for clean water in various sectors. Additionally, advancements in membrane technology are enhancing efficiency and reducing operational costs.

What challenges does the Europe Membrane Water & Wastewater Treatment Market face?

The Europe Membrane Water & Wastewater Treatment Market faces challenges such as high initial investment costs and the need for regular maintenance of membrane systems. Furthermore, the disposal of used membranes and the potential for fouling can complicate operations.

What opportunities exist in the Europe Membrane Water & Wastewater Treatment Market?

Opportunities in the Europe Membrane Water & Wastewater Treatment Market include the increasing adoption of smart water management systems and the integration of renewable energy sources in treatment processes. There is also potential for growth in emerging markets and innovative membrane materials.

What trends are shaping the Europe Membrane Water & Wastewater Treatment Market?

Trends shaping the Europe Membrane Water & Wastewater Treatment Market include the rise of decentralized treatment systems and the use of advanced filtration technologies. Additionally, there is a growing emphasis on sustainability and circular economy practices within the industry.

Europe Membrane Water & Wastewater Treatment Market

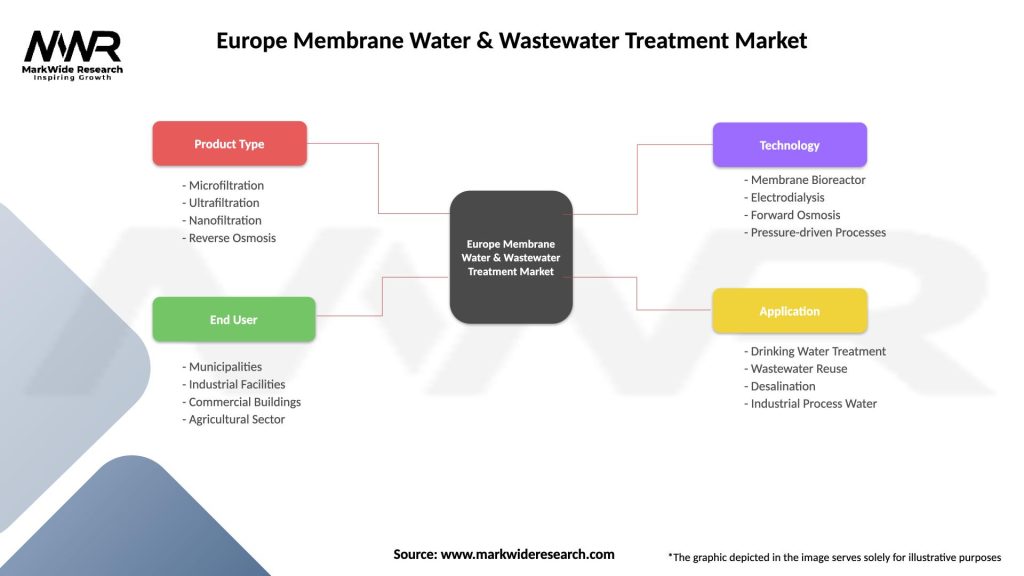

| Segmentation Details | Description |

|---|---|

| Product Type | Microfiltration, Ultrafiltration, Nanofiltration, Reverse Osmosis |

| End User | Municipalities, Industrial Facilities, Commercial Buildings, Agricultural Sector |

| Technology | Membrane Bioreactor, Electrodialysis, Forward Osmosis, Pressure-driven Processes |

| Application | Drinking Water Treatment, Wastewater Reuse, Desalination, Industrial Process Water |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Membrane Water & Wastewater Treatment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at