444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe Mandatory Motor Third-Party Liability Insurance Market represents a fundamental pillar of the continental automotive insurance landscape, providing essential financial protection for millions of vehicle owners across European Union member states and associated countries. This mandatory insurance coverage serves as a critical safety net, ensuring that victims of motor vehicle accidents receive adequate compensation for personal injuries and property damage caused by insured drivers.

Market dynamics in the European mandatory motor third-party liability insurance sector are characterized by stringent regulatory frameworks, harmonized minimum coverage requirements, and evolving consumer expectations. The market demonstrates steady growth patterns with an estimated compound annual growth rate of 4.2% CAGR driven by increasing vehicle registrations, enhanced coverage requirements, and technological innovations in risk assessment and claims processing.

Regulatory compliance remains the primary market driver, with the European Union’s Motor Insurance Directive establishing minimum coverage thresholds and cross-border recognition protocols. This regulatory foundation ensures that approximately 85% of European drivers maintain continuous third-party liability coverage, creating a stable and predictable market environment for insurance providers and consumers alike.

Digital transformation initiatives are reshaping traditional insurance distribution channels, with online policy purchases accounting for nearly 38% of new policy acquisitions across major European markets. This technological evolution enables insurers to streamline underwriting processes, enhance customer experiences, and optimize pricing strategies through advanced data analytics and artificial intelligence applications.

The Europe Mandatory Motor Third-Party Liability Insurance Market refers to the comprehensive ecosystem of insurance products, services, and regulatory frameworks that provide compulsory financial protection for motor vehicle operators across European territories. This market encompasses insurance policies that cover legal liabilities arising from bodily injuries and property damage caused to third parties in motor vehicle accidents.

Third-party liability insurance serves as the foundational layer of motor insurance protection, ensuring that accident victims receive prompt compensation regardless of the at-fault driver’s financial capacity. The mandatory nature of this coverage creates a universal safety net that protects both individual road users and the broader transportation infrastructure from the financial consequences of motor vehicle accidents.

Coverage scope typically includes medical expenses, rehabilitation costs, lost income compensation, and property damage repairs for affected third parties. The insurance framework operates under the principle of strict liability, meaning that coverage applies regardless of fault determination, ensuring rapid claim resolution and victim compensation.

Market leadership in the European mandatory motor third-party liability insurance sector is distributed among established multinational insurers, regional specialists, and emerging digital-first providers. The competitive landscape reflects a mature market with stable pricing dynamics, regulatory compliance requirements, and evolving customer service expectations.

Key market trends include the integration of telematics-based pricing models, expansion of usage-based insurance products, and implementation of artificial intelligence in claims processing workflows. These innovations are driving operational efficiency improvements of approximately 22% in claims processing times while enhancing customer satisfaction and retention rates.

Geographic distribution shows concentrated market activity in Western European countries, with Germany, France, and the United Kingdom representing collectively 48% of total premium volumes. Eastern European markets demonstrate accelerated growth potential, driven by increasing vehicle ownership rates and harmonization with EU insurance directives.

Future prospects indicate continued market expansion supported by autonomous vehicle integration, cross-border mobility initiatives, and enhanced digital service delivery capabilities. Industry analysts project sustained growth momentum with particular strength in emerging mobility solutions and integrated insurance-technology platforms.

Market segmentation reveals distinct patterns across vehicle categories, geographic regions, and customer demographics. The following key insights shape strategic decision-making for industry participants:

Regulatory mandates serve as the primary catalyst for market growth and stability in the European mandatory motor third-party liability insurance sector. The European Union’s comprehensive regulatory framework establishes minimum coverage requirements, cross-border recognition protocols, and consumer protection standards that create a stable foundation for market development.

Vehicle registration growth across European markets drives consistent demand expansion for mandatory insurance coverage. Increasing urbanization, economic development in Eastern European countries, and evolving mobility preferences contribute to steady vehicle fleet expansion, creating corresponding insurance coverage requirements.

Technological advancement in vehicle safety systems, telematics integration, and digital service delivery platforms enhances market attractiveness for both insurers and consumers. These innovations enable more accurate risk assessment, personalized pricing strategies, and improved customer experiences throughout the insurance lifecycle.

Cross-border mobility initiatives within the European Union framework increase demand for comprehensive coverage solutions that provide seamless protection across multiple jurisdictions. Business travel, tourism, and international commerce activities require insurance products that adapt to diverse regulatory environments and coverage requirements.

Economic stability in major European markets supports consistent premium collection, claims payment capabilities, and long-term market growth. Stable economic conditions enable consumers to maintain continuous insurance coverage while providing insurers with predictable revenue streams and manageable risk exposures.

Regulatory complexity across different European jurisdictions creates operational challenges for insurance providers seeking to offer standardized products and services. Varying national requirements, coverage thresholds, and administrative procedures increase compliance costs and limit operational efficiency gains.

Price sensitivity among consumers, particularly in economically constrained markets, limits premium growth potential and profitability margins for insurance providers. Competitive pricing pressures and regulatory restrictions on premium increases constrain revenue expansion opportunities in mature market segments.

Claims inflation driven by increasing vehicle repair costs, medical expense inflation, and enhanced compensation standards creates ongoing pressure on insurance profitability. Rising claim severities require corresponding premium adjustments that may impact market competitiveness and consumer affordability.

Fraud challenges in claims processing and policy applications create additional operational costs and risk management complexities. Sophisticated fraud schemes require enhanced detection capabilities, investigation resources, and prevention strategies that increase overall operational expenses.

Market saturation in established European markets limits organic growth opportunities and intensifies competitive pressures among existing market participants. High market penetration rates reduce the potential for significant market share expansion through traditional customer acquisition strategies.

Digital transformation initiatives present substantial opportunities for operational efficiency improvements, customer experience enhancement, and new product development. Advanced analytics, artificial intelligence, and automation technologies enable insurers to optimize underwriting processes, streamline claims handling, and develop innovative coverage solutions.

Emerging mobility solutions including electric vehicles, shared mobility platforms, and autonomous driving technologies create new market segments and coverage requirements. These evolving transportation modes require specialized insurance products that address unique risk profiles and operational characteristics.

Cross-border expansion opportunities in developing European markets offer growth potential for established insurers seeking to diversify geographic exposure and capture emerging market demand. Eastern European countries demonstrate particular growth potential driven by increasing vehicle ownership and economic development.

Partnership opportunities with automotive manufacturers, technology companies, and mobility service providers enable insurers to access new customer segments and distribution channels. Strategic alliances facilitate product innovation, market penetration, and competitive differentiation in evolving market conditions.

Sustainability integration initiatives align with environmental regulations and consumer preferences, creating opportunities for green insurance products and corporate responsibility programs. Environmental considerations increasingly influence consumer purchasing decisions and regulatory requirements across European markets.

Competitive intensity in the European mandatory motor third-party liability insurance market reflects a mature industry with established players, regulatory barriers to entry, and standardized product offerings. Market dynamics are characterized by price competition, service differentiation, and technological innovation as primary competitive strategies.

Supply chain integration encompasses relationships between insurance providers, distribution channels, claims service providers, and regulatory authorities. Effective supply chain management enables insurers to optimize operational efficiency, enhance customer service delivery, and maintain competitive positioning in dynamic market conditions.

Customer behavior evolution toward digital service expectations, personalized product offerings, and transparent pricing structures influences market development strategies. According to MarkWide Research analysis, consumer preferences increasingly favor insurers that provide comprehensive digital platforms and responsive customer service capabilities.

Risk management sophistication continues advancing through enhanced data analytics, predictive modeling, and real-time monitoring capabilities. These technological improvements enable more accurate risk assessment, personalized pricing strategies, and proactive loss prevention initiatives that benefit both insurers and policyholders.

Regulatory evolution toward enhanced consumer protection, cross-border harmonization, and sustainability requirements shapes market development priorities and strategic planning initiatives. Regulatory changes create both compliance challenges and competitive opportunities for market participants.

Primary research activities encompass comprehensive surveys of insurance industry executives, regulatory officials, and consumer representatives across major European markets. These direct engagement initiatives provide current insights into market trends, competitive dynamics, and emerging challenges facing industry participants.

Secondary research analysis incorporates extensive review of regulatory filings, industry publications, financial reports, and academic studies related to European motor insurance markets. This comprehensive literature review ensures thorough understanding of historical trends, current market conditions, and future development prospects.

Data validation processes employ multiple verification methods including cross-referencing of statistical information, expert interviews, and comparative analysis across different data sources. These validation procedures ensure accuracy and reliability of market insights and quantitative assessments.

Market modeling techniques utilize advanced statistical methods, trend analysis, and scenario planning to develop comprehensive market projections and strategic recommendations. These analytical approaches provide robust foundations for strategic decision-making and investment planning activities.

Geographic coverage includes detailed analysis of major European Union member states, associated countries, and emerging markets with significant motor insurance activity. This comprehensive geographic scope ensures complete market understanding and identification of regional growth opportunities.

Western European markets demonstrate mature characteristics with stable growth patterns, established regulatory frameworks, and sophisticated competitive dynamics. Germany represents the largest single market with approximately 23% of regional premium volumes, followed by France and the United Kingdom as significant market contributors.

Northern European countries including Sweden, Denmark, and Norway exhibit high market penetration rates, advanced digital adoption, and strong regulatory compliance standards. These markets demonstrate innovation leadership in telematics integration and sustainable insurance practices.

Eastern European markets show accelerated growth potential driven by increasing vehicle ownership, economic development, and European Union integration initiatives. Poland, Czech Republic, and Hungary represent key growth markets with expanding middle-class populations and evolving mobility preferences.

Southern European regions including Italy, Spain, and Portugal demonstrate recovery momentum following economic challenges, with renewed growth in vehicle registrations and insurance coverage adoption. These markets benefit from tourism-related mobility demands and cross-border travel requirements.

Market integration trends across European regions reflect harmonization efforts, cross-border mobility initiatives, and standardization of regulatory requirements. Regional integration facilitates market access, competitive dynamics, and operational efficiency improvements for multinational insurance providers.

Market leadership in the European mandatory motor third-party liability insurance sector is distributed among several categories of providers, each with distinct competitive advantages and market positioning strategies:

Competitive strategies emphasize digital transformation, customer experience enhancement, and operational efficiency optimization. Leading providers invest significantly in technology platforms, data analytics capabilities, and automated service delivery systems to maintain competitive advantages.

Market consolidation trends reflect ongoing merger and acquisition activities as insurers seek to achieve scale advantages, geographic diversification, and technological capabilities. Strategic partnerships and joint ventures also facilitate market access and competitive positioning improvements.

By Vehicle Type:

By Distribution Channel:

By Coverage Type:

Passenger vehicle insurance represents the largest market category, driven by widespread personal vehicle ownership and diverse customer needs across European markets. This segment demonstrates steady growth with increasing emphasis on digital service delivery and personalized pricing strategies.

Commercial vehicle coverage shows accelerated expansion driven by e-commerce growth, logistics optimization, and last-mile delivery service requirements. Business customers increasingly demand comprehensive coverage solutions that address operational risks and regulatory compliance requirements.

Motorcycle insurance exhibits seasonal variations and specialized risk characteristics requiring tailored underwriting approaches and coverage solutions. This segment benefits from growing recreational riding popularity and urban mobility trends in major European cities.

Heavy goods vehicle insurance serves professional transportation operators with complex coverage requirements, international operations, and specialized risk exposures. This segment requires sophisticated risk management capabilities and comprehensive claims handling expertise.

Digital distribution channels demonstrate rapid growth across all vehicle categories, with online policy purchases increasing by approximately 35% annually in major European markets. Digital platforms enable enhanced customer experiences, streamlined processes, and competitive pricing strategies.

Insurance Providers:

Consumers:

Regulatory Authorities:

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital-first customer experiences are transforming traditional insurance interactions through mobile applications, online policy management platforms, and automated claims processing systems. These technological advances enable 24/7 customer service access and streamlined transaction processing.

Telematics integration in motor insurance products provides usage-based pricing models, driver behavior monitoring, and risk assessment capabilities. These technologies enable personalized premium calculations and proactive safety interventions that benefit both insurers and policyholders.

Artificial intelligence applications in underwriting, claims processing, and fraud detection enhance operational efficiency and decision-making accuracy. MWR data indicates that AI-powered systems improve claims processing speed by approximately 28% while reducing operational costs.

Sustainability initiatives influence product development, corporate operations, and customer engagement strategies. Environmental considerations increasingly impact consumer preferences and regulatory requirements across European markets.

Cross-border harmonization efforts continue advancing through European Union initiatives that standardize coverage requirements, facilitate market access, and enhance consumer protection across member states.

Partnership ecosystems between insurers, automotive manufacturers, and technology providers create integrated solutions that address evolving mobility needs and customer expectations.

Regulatory modernization initiatives across European markets focus on digital service delivery, consumer protection enhancement, and cross-border integration improvements. These developments create opportunities for operational efficiency gains and competitive differentiation.

Technology partnerships between traditional insurers and fintech companies accelerate digital transformation initiatives and customer experience improvements. Strategic alliances enable rapid deployment of advanced capabilities and market innovation.

Market consolidation activities continue through mergers, acquisitions, and strategic partnerships that create scale advantages and geographic diversification benefits. These transactions reshape competitive dynamics and market structure.

Product innovation in coverage options, pricing models, and service delivery methods addresses evolving customer needs and competitive pressures. New product development focuses on personalization, flexibility, and value enhancement.

Sustainability integration in corporate strategies and product offerings reflects environmental consciousness and regulatory requirements. Green insurance initiatives align with broader sustainability goals and consumer preferences.

Data analytics advancement through machine learning, predictive modeling, and real-time monitoring capabilities enhance risk assessment accuracy and operational efficiency across insurance operations.

Digital transformation acceleration should remain a strategic priority for insurance providers seeking to maintain competitive advantages and meet evolving customer expectations. Investment in technology platforms, data analytics capabilities, and automated service delivery systems provides sustainable competitive benefits.

Customer experience optimization through personalized service delivery, streamlined processes, and responsive support systems enhances customer satisfaction and retention rates. Focus on digital touchpoints and omnichannel service integration creates competitive differentiation opportunities.

Geographic expansion strategies in emerging European markets offer growth potential and risk diversification benefits. Eastern European countries demonstrate particular attractiveness for market entry and expansion initiatives.

Partnership development with automotive manufacturers, technology companies, and mobility service providers enables access to new customer segments and distribution channels. Strategic alliances facilitate innovation and market penetration in evolving mobility ecosystems.

Risk management sophistication through advanced analytics, predictive modeling, and real-time monitoring capabilities improves underwriting accuracy and claims management efficiency. Investment in risk management technologies provides operational and competitive advantages.

Regulatory compliance excellence ensures operational continuity and competitive positioning in highly regulated markets. Proactive compliance management and regulatory relationship development support long-term market success.

Market evolution in the European mandatory motor third-party liability insurance sector will be shaped by technological advancement, regulatory development, and changing mobility patterns. The integration of autonomous vehicles, electric mobility, and shared transportation services will create new coverage requirements and risk profiles.

Growth projections indicate continued market expansion with an estimated 4.8% CAGR over the next five years, driven by vehicle fleet growth, coverage enhancement requirements, and digital service adoption. Eastern European markets are expected to demonstrate above-average growth rates as economic development and EU integration progress.

Technology integration will accelerate across all aspects of insurance operations, from customer acquisition and underwriting to claims processing and customer service. Artificial intelligence, machine learning, and automation technologies will become standard operational tools rather than competitive differentiators.

Regulatory harmonization efforts will continue advancing European market integration while maintaining national sovereignty over specific coverage requirements and consumer protection standards. These developments will facilitate cross-border operations and competitive dynamics.

Sustainability considerations will increasingly influence product development, operational practices, and customer engagement strategies. Environmental consciousness and regulatory requirements will drive green insurance initiatives and corporate responsibility programs.

Competitive dynamics will intensify as digital transformation enables new market entrants and business models. Traditional insurers must adapt to changing competitive landscapes while leveraging their operational expertise and customer relationships.

The Europe Mandatory Motor Third-Party Liability Insurance Market represents a mature and stable sector with significant growth potential driven by technological innovation, regulatory evolution, and changing mobility patterns. Market participants benefit from mandatory coverage requirements that ensure consistent demand while facing competitive pressures that drive operational efficiency and customer service improvements.

Strategic success factors in this market include digital transformation capabilities, customer experience excellence, regulatory compliance proficiency, and risk management sophistication. Insurance providers that effectively integrate these capabilities while maintaining competitive pricing and comprehensive coverage options will achieve sustainable market leadership positions.

Future market development will be characterized by continued technological advancement, regulatory harmonization, and evolving mobility solutions that create both opportunities and challenges for industry participants. The integration of autonomous vehicles, electric mobility, and shared transportation services will fundamentally reshape risk profiles and coverage requirements, requiring adaptive strategies and innovative product development.

Market outlook remains positive with projected growth rates reflecting stable demand fundamentals, technological enhancement opportunities, and geographic expansion potential. According to MarkWide Research projections, the market will continue demonstrating resilience and growth momentum despite evolving competitive dynamics and regulatory requirements, positioning it as an attractive sector for sustained investment and strategic development initiatives.

What is Mandatory Motor Third-Party Liability Insurance?

Mandatory Motor Third-Party Liability Insurance is a legal requirement for vehicle owners to cover damages caused to third parties in the event of an accident. This type of insurance protects against claims for bodily injury and property damage resulting from the insured’s vehicle.

What are the key players in the Europe Mandatory Motor Third-Party Liability Insurance Market?

Key players in the Europe Mandatory Motor Third-Party Liability Insurance Market include Allianz, AXA, and Zurich Insurance Group, among others. These companies offer a range of policies tailored to meet regulatory requirements and consumer needs.

What are the growth factors driving the Europe Mandatory Motor Third-Party Liability Insurance Market?

The growth of the Europe Mandatory Motor Third-Party Liability Insurance Market is driven by increasing vehicle ownership, stringent regulatory frameworks, and rising awareness of road safety. Additionally, the expansion of e-commerce and delivery services has led to a higher demand for comprehensive insurance coverage.

What challenges does the Europe Mandatory Motor Third-Party Liability Insurance Market face?

Challenges in the Europe Mandatory Motor Third-Party Liability Insurance Market include rising claims costs, fraud, and regulatory compliance complexities. Insurers must also navigate varying regulations across different countries, which can complicate policy offerings.

What opportunities exist in the Europe Mandatory Motor Third-Party Liability Insurance Market?

Opportunities in the Europe Mandatory Motor Third-Party Liability Insurance Market include the integration of technology for better risk assessment and customer engagement. Additionally, the growing trend of electric vehicles presents new avenues for tailored insurance products.

What trends are shaping the Europe Mandatory Motor Third-Party Liability Insurance Market?

Trends in the Europe Mandatory Motor Third-Party Liability Insurance Market include the adoption of telematics for personalized premiums and the increasing focus on sustainability in insurance practices. Moreover, the rise of digital platforms is transforming how consumers purchase and manage their insurance policies.

Europe Mandatory Motor Third-Party Liability Insurance Market

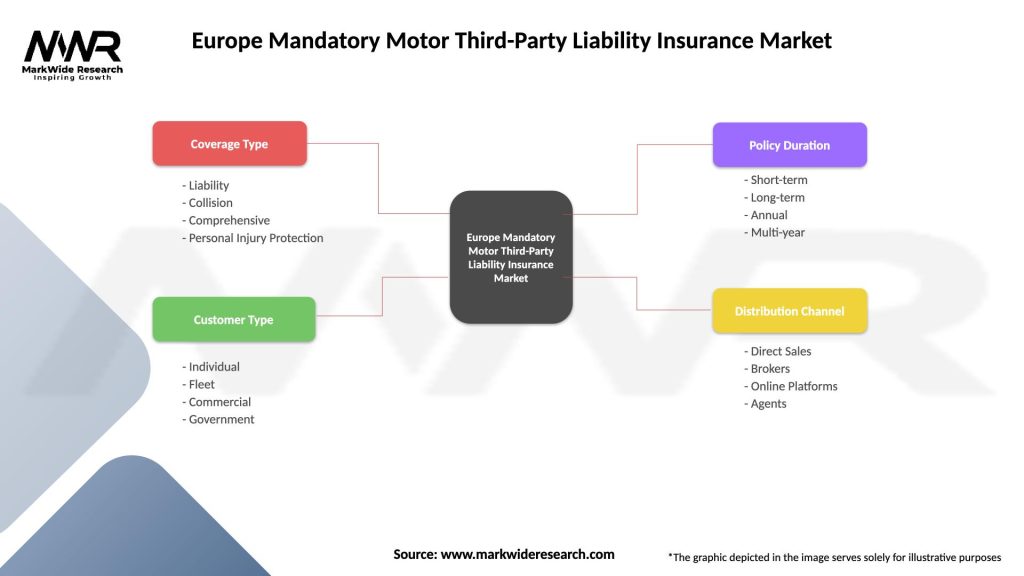

| Segmentation Details | Description |

|---|---|

| Coverage Type | Liability, Collision, Comprehensive, Personal Injury Protection |

| Customer Type | Individual, Fleet, Commercial, Government |

| Policy Duration | Short-term, Long-term, Annual, Multi-year |

| Distribution Channel | Direct Sales, Brokers, Online Platforms, Agents |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Mandatory Motor Third-Party Liability Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at