444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe Logic Integrated Circuit (IC) Market represents a cornerstone of the continent’s semiconductor industry, driving innovation across multiple sectors including automotive, telecommunications, consumer electronics, and industrial automation. This sophisticated market encompasses a comprehensive range of logic IC products, from basic digital logic gates to complex programmable logic devices that form the backbone of modern electronic systems.

Market dynamics indicate robust growth potential, with the European logic IC sector experiencing a compound annual growth rate (CAGR) of 6.2% over the forecast period. The region’s strong manufacturing base, coupled with increasing demand for advanced electronic devices, positions Europe as a significant player in the global logic IC landscape.

Key market drivers include the accelerating digital transformation across industries, the proliferation of Internet of Things (IoT) devices, and the growing adoption of artificial intelligence and machine learning applications. European manufacturers are particularly focused on developing energy-efficient logic ICs that meet stringent environmental regulations while delivering superior performance.

The market’s geographical distribution shows Germany commanding approximately 28% market share, followed by France, the United Kingdom, and Italy as major contributors. This distribution reflects the concentration of automotive and industrial manufacturing hubs across these nations, creating substantial demand for sophisticated logic IC solutions.

The Europe Logic Integrated Circuit (IC) Market refers to the comprehensive ecosystem encompassing the design, manufacturing, distribution, and application of digital logic circuits within European territories. These integrated circuits serve as fundamental building blocks for digital systems, performing essential logical operations such as AND, OR, NOT, and more complex combinational and sequential logic functions.

Logic ICs represent semiconductor devices that process digital signals, enabling decision-making capabilities within electronic systems. The European market specifically focuses on products designed, manufactured, or consumed within the European Union and associated territories, catering to regional specifications, standards, and regulatory requirements.

This market encompasses various product categories including standard logic ICs, programmable logic devices, application-specific integrated circuits (ASICs), and field-programmable gate arrays (FPGAs). Each category serves distinct applications ranging from simple switching functions to complex data processing tasks in advanced computing systems.

Strategic analysis reveals that the Europe Logic IC Market is experiencing unprecedented growth driven by digital transformation initiatives across multiple industries. The market demonstrates remarkable resilience and adaptability, with European companies increasingly investing in next-generation logic IC technologies to maintain competitive advantages in global markets.

Key growth catalysts include the automotive industry’s transition toward electric and autonomous vehicles, which requires sophisticated logic ICs for advanced driver assistance systems (ADAS), battery management, and vehicle-to-everything (V2X) communication. The automotive sector alone accounts for approximately 35% of logic IC consumption in Europe.

The telecommunications infrastructure modernization, particularly the deployment of 5G networks, creates substantial demand for high-performance logic ICs capable of handling increased data throughput and reduced latency requirements. European telecom operators are investing heavily in network upgrades, driving telecommunications segment growth of 8.4% annually.

Industrial automation trends further amplify market opportunities, as European manufacturers embrace Industry 4.0 principles. Smart factories require sophisticated logic ICs for real-time data processing, predictive maintenance, and autonomous operation capabilities, contributing to sustained market expansion.

Market intelligence reveals several critical insights shaping the European logic IC landscape:

Primary growth drivers propelling the Europe Logic IC Market include technological advancement, regulatory support, and evolving consumer demands. The European Union’s digital strategy initiatives provide substantial funding for semiconductor research and development, fostering innovation in logic IC technologies.

Automotive electrification represents the most significant market driver, with European automakers committing to electric vehicle production targets. Modern electric vehicles require hundreds of logic ICs for various functions including battery management, motor control, charging systems, and advanced safety features. This transition creates sustained demand growth with automotive logic IC adoption increasing by 12% annually.

The Industrial IoT revolution drives substantial logic IC demand as European manufacturers implement smart manufacturing solutions. Connected sensors, actuators, and control systems require sophisticated logic ICs for data processing, communication, and decision-making capabilities. Industry 4.0 adoption rates show 65% of European manufacturers planning IoT integration within two years.

5G network deployment across Europe necessitates advanced logic ICs for base stations, network equipment, and user devices. The enhanced performance requirements of 5G technology, including ultra-low latency and massive device connectivity, drive demand for high-speed, low-power logic IC solutions.

Consumer electronics innovation continues driving market growth as European consumers demand increasingly sophisticated devices. Smartphones, tablets, wearables, and smart home devices require advanced logic ICs for processing, connectivity, and user interface functions.

Market challenges facing the Europe Logic IC Market include supply chain vulnerabilities, high development costs, and intense global competition. The semiconductor industry’s capital-intensive nature creates barriers for new entrants and limits expansion opportunities for existing players.

Supply chain disruptions pose significant challenges, particularly given Europe’s dependence on Asian semiconductor manufacturing. Geopolitical tensions and trade restrictions create uncertainty, prompting European companies to invest in regional manufacturing capabilities despite higher costs.

The complexity of advanced logic IC design requires substantial research and development investments, creating financial pressures for smaller companies. Development costs for cutting-edge logic ICs can reach hundreds of millions of euros, limiting innovation to well-funded organizations.

Skilled workforce shortages constrain market growth as the semiconductor industry requires highly specialized engineers and technicians. European universities and technical institutions struggle to produce sufficient graduates with relevant skills, creating talent acquisition challenges.

Regulatory compliance costs associated with European environmental and safety standards add complexity and expense to logic IC development and manufacturing processes. While these regulations drive innovation in sustainable technologies, they also increase time-to-market and development costs.

Emerging opportunities in the Europe Logic IC Market span multiple high-growth sectors and technological trends. The transition toward sustainable energy systems creates substantial demand for logic ICs in renewable energy generation, storage, and distribution applications.

Quantum computing development presents long-term opportunities for specialized logic ICs designed to interface with quantum systems. European research institutions and companies are investing heavily in quantum technologies, creating potential markets for supporting semiconductor solutions.

The healthcare digitization trend accelerated by recent global events creates opportunities for medical device logic ICs. Wearable health monitors, telemedicine equipment, and diagnostic devices require sophisticated logic ICs for data processing and communication capabilities.

Smart city initiatives across European urban centers drive demand for logic ICs in infrastructure applications. Traffic management systems, environmental monitoring, energy distribution, and public safety applications require reliable, efficient logic IC solutions.

Space technology advancement offers niche but high-value opportunities for radiation-hardened logic ICs. European space agencies and commercial satellite companies require specialized semiconductors capable of operating in harsh space environments.

Market dynamics in the Europe Logic IC sector reflect the interplay between technological innovation, regulatory frameworks, and competitive pressures. The market demonstrates cyclical patterns influenced by consumer electronics refresh cycles, automotive production schedules, and infrastructure investment cycles.

Competitive intensity remains high as global semiconductor companies compete for European market share. Local European companies leverage regional advantages including proximity to customers, regulatory compliance expertise, and government support programs to compete against larger international rivals.

Technology convergence trends blur traditional boundaries between logic ICs and other semiconductor categories. System-on-chip (SoC) solutions integrate multiple functions, creating both opportunities and challenges for specialized logic IC providers.

Customer consolidation in key sectors like automotive and telecommunications creates both opportunities and risks. Large customers offer substantial volume potential but also possess significant negotiating power, pressuring margins and demanding customized solutions.

According to MarkWide Research analysis, market dynamics indicate increasing emphasis on energy efficiency, with power consumption optimization becoming a primary differentiator among logic IC suppliers. This trend aligns with European sustainability goals and regulatory requirements.

Comprehensive research methodology employed for analyzing the Europe Logic IC Market combines primary and secondary research approaches to ensure accuracy and reliability of market insights. The methodology encompasses quantitative data analysis, qualitative expert interviews, and trend analysis across multiple market segments.

Primary research activities include structured interviews with industry executives, technology leaders, and market participants across the European logic IC value chain. These interviews provide firsthand insights into market trends, competitive dynamics, and future outlook perspectives.

Secondary research sources encompass industry publications, company financial reports, patent databases, and regulatory filings to gather comprehensive market data. Government statistics, trade association reports, and academic research contribute to the analytical foundation.

Data validation processes ensure information accuracy through cross-referencing multiple sources and expert verification. Market sizing methodologies employ bottom-up and top-down approaches to validate findings and eliminate inconsistencies.

Trend analysis techniques identify emerging patterns and forecast future market developments based on historical data, current indicators, and expert projections. Statistical modeling and scenario analysis support robust market projections.

Regional market distribution across Europe reveals distinct patterns reflecting industrial concentrations, economic development levels, and technological capabilities. Germany maintains market leadership with 28% market share, driven by its robust automotive and industrial sectors.

Germany’s dominance stems from its position as Europe’s largest automotive manufacturer and industrial automation leader. Major automotive companies including BMW, Mercedes-Benz, and Volkswagen drive substantial logic IC demand for electric vehicle development and advanced manufacturing systems.

France represents the second-largest market with 18% market share, supported by strong aerospace, defense, and telecommunications industries. French companies like Airbus and Thales create demand for specialized logic ICs in mission-critical applications.

United Kingdom maintains significant market presence with 15% market share despite Brexit-related uncertainties. The country’s strength in financial technology, telecommunications, and research institutions sustains logic IC demand.

Italy and Netherlands each account for approximately 8% market share, with Italy focusing on automotive and industrial applications while Netherlands emphasizes high-tech manufacturing and logistics automation.

Nordic countries collectively represent 12% market share, driven by telecommunications infrastructure, renewable energy systems, and advanced manufacturing applications. Sweden, Finland, and Denmark lead in sustainable technology adoption.

Eastern European markets show rapid growth potential with combined market share of 11%, as countries like Poland, Czech Republic, and Hungary attract manufacturing investments and develop technology sectors.

Competitive dynamics in the Europe Logic IC Market feature a mix of global semiconductor giants, regional specialists, and emerging technology companies. The landscape reflects both established market leaders and innovative startups pursuing niche opportunities.

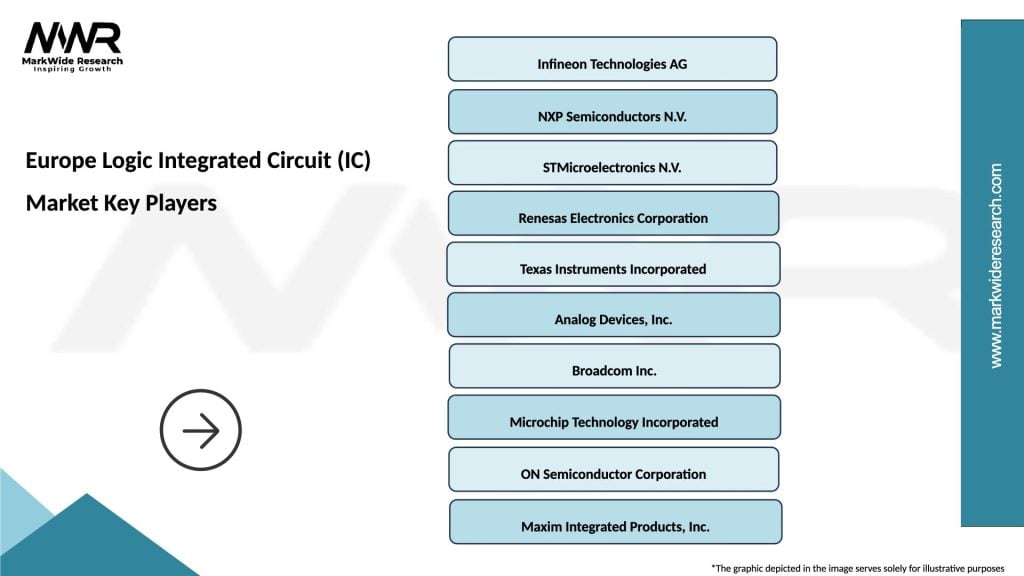

Major market participants include:

Competitive strategies focus on technological differentiation, customer relationships, and regional manufacturing capabilities. Companies invest heavily in research and development to maintain technology leadership while building strong partnerships with European automotive and industrial customers.

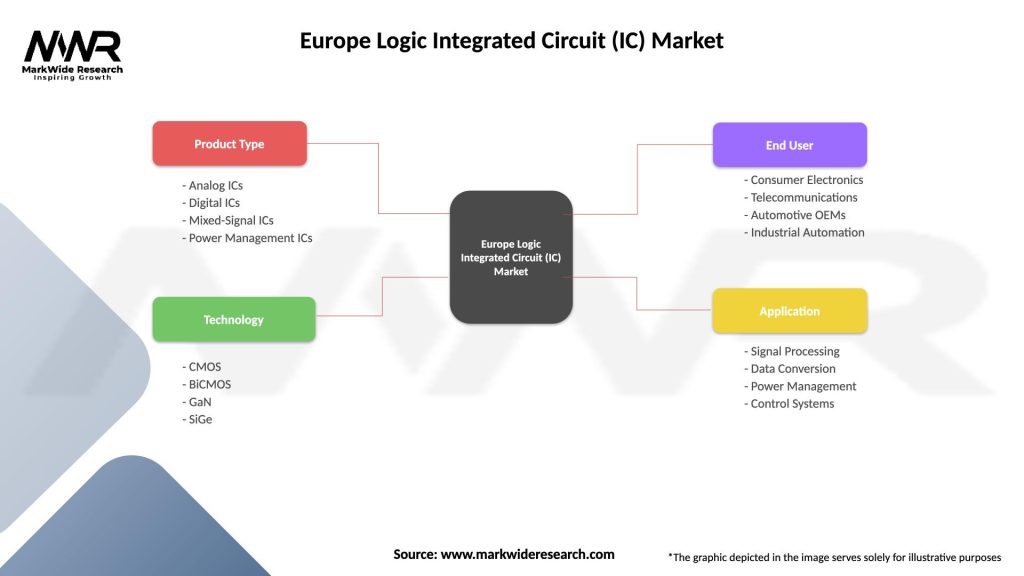

Market segmentation analysis reveals diverse categories based on product type, application, technology node, and end-user industry. This segmentation provides insights into growth opportunities and market dynamics across different logic IC categories.

By Product Type:

By Application:

By Technology Node:

Standard Logic ICs maintain market leadership due to their widespread applicability and cost-effectiveness. These devices serve as fundamental building blocks for digital systems, offering reliable performance for basic logic operations. European manufacturers particularly value standard logic ICs for industrial automation and automotive applications where proven reliability is essential.

Programmable Logic Devices represent the fastest-growing category with annual growth rates exceeding 9%. FPGAs and CPLDs offer flexibility for rapid prototyping and customization, making them ideal for European companies developing innovative products with shorter time-to-market requirements.

Automotive-specific Logic ICs demonstrate exceptional growth potential as European automakers transition toward electric and autonomous vehicles. These specialized devices must meet stringent automotive qualification standards while delivering high performance and reliability in harsh operating environments.

Industrial Logic ICs benefit from Industry 4.0 adoption across European manufacturing sectors. Smart factory implementations require sophisticated logic ICs for real-time data processing, machine learning inference, and predictive maintenance applications.

Communications Logic ICs experience strong demand driven by 5G network deployment and fiber optic infrastructure expansion. These devices must handle high-speed data processing while maintaining low power consumption for network equipment applications.

Industry participants in the Europe Logic IC Market enjoy numerous strategic advantages and growth opportunities. The market’s maturity and technological sophistication create value for various stakeholder groups throughout the supply chain.

For Logic IC Manufacturers:

For End-User Industries:

For Technology Partners:

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends shaping the Europe Logic IC Market reflect broader technological and societal shifts toward digitalization, sustainability, and automation. These trends create both opportunities and challenges for market participants.

Edge Computing Proliferation drives demand for intelligent logic ICs capable of local data processing and decision-making. European companies are developing edge-optimized logic ICs that reduce latency and bandwidth requirements while enabling real-time applications.

Artificial Intelligence Integration becomes increasingly important as logic ICs incorporate AI acceleration capabilities. Machine learning inference at the edge requires specialized logic architectures optimized for neural network operations and parallel processing.

Sustainability Focus influences logic IC design priorities, with energy efficiency improvements of 30% becoming standard requirements. European environmental regulations drive innovation in low-power logic IC technologies and sustainable manufacturing processes.

Automotive Transformation continues accelerating with electric and autonomous vehicle development requiring sophisticated logic ICs for safety-critical applications. Advanced driver assistance systems and vehicle connectivity create new market segments.

Security Enhancement becomes paramount as logic ICs incorporate hardware-based security features to protect against cyber threats. European data protection regulations drive demand for secure logic IC solutions with built-in encryption and authentication capabilities.

Recent industry developments highlight the dynamic nature of the Europe Logic IC Market and the continuous innovation driving market evolution. These developments reflect strategic investments, technological breakthroughs, and market expansion initiatives.

Manufacturing Capacity Expansion represents a significant trend as European companies invest in regional production capabilities. New fabrication facilities and capacity upgrades aim to reduce supply chain dependencies and improve customer service.

Strategic Partnerships between logic IC suppliers and automotive manufacturers accelerate electric vehicle development. Collaborative programs focus on developing specialized logic ICs for battery management, motor control, and autonomous driving applications.

Research and Development Investments in next-generation logic IC technologies intensify as companies prepare for future market requirements. Advanced process nodes, new materials, and novel architectures receive substantial funding from both private and public sources.

Acquisition Activities consolidate market positions as larger companies acquire specialized logic IC developers to expand their technology portfolios and market reach. These transactions reflect the strategic importance of logic IC capabilities.

Sustainability Initiatives gain momentum as logic IC companies implement environmental programs and develop eco-friendly products. Carbon neutrality commitments and circular economy principles influence business strategies and product development priorities.

Strategic recommendations for Europe Logic IC Market participants focus on leveraging regional advantages while addressing competitive challenges. MWR analysis suggests several key strategies for market success.

Invest in Advanced Technologies: Companies should prioritize research and development in next-generation logic IC technologies including AI acceleration, edge computing, and ultra-low power designs. These investments will differentiate products and capture high-value market segments.

Strengthen Customer Partnerships: Building deeper relationships with key customers, particularly in automotive and industrial sectors, creates competitive advantages and ensures long-term revenue streams. Collaborative development programs and technical support services enhance customer loyalty.

Develop Regional Manufacturing: Establishing or expanding European manufacturing capabilities reduces supply chain risks and improves customer service. Government incentives and customer preferences for regional suppliers support this strategy.

Focus on Sustainability: Incorporating environmental considerations into product design and manufacturing processes aligns with European regulations and customer preferences. Energy-efficient logic ICs and sustainable practices create competitive advantages.

Expand Application Expertise: Developing deep knowledge in key application areas like automotive electronics, industrial automation, and telecommunications enables better customer service and product optimization.

Future prospects for the Europe Logic IC Market remain highly positive, driven by continued digital transformation, automotive electrification, and industrial automation trends. The market is positioned for sustained growth with projected CAGR of 6.8% through the forecast period.

Technological evolution will continue driving market expansion as logic ICs become more sophisticated and capable. Advanced process nodes, new materials, and innovative architectures will enable higher performance while reducing power consumption and costs.

Application diversification creates new growth opportunities as logic ICs find applications in emerging sectors like renewable energy, healthcare devices, and smart infrastructure. These new markets complement traditional automotive and industrial applications.

Regional manufacturing expansion will strengthen Europe’s position in the global logic IC market. Government support for semiconductor manufacturing and customer preferences for regional suppliers drive investment in European production capabilities.

Sustainability requirements will increasingly influence logic IC design and manufacturing processes. Environmental regulations and customer demands for eco-friendly products create opportunities for companies leading in sustainable technologies.

According to MarkWide Research projections, the European logic IC market will benefit from continued investment in digital infrastructure, with telecommunications and automotive sectors driving 70% of growth over the next five years.

The Europe Logic Integrated Circuit (IC) Market stands at the forefront of technological innovation, driven by digital transformation initiatives across multiple industries. The market demonstrates remarkable resilience and growth potential, supported by strong automotive and industrial sectors, advanced telecommunications infrastructure, and robust research and development capabilities.

Key success factors for market participants include technological excellence, customer partnership development, and strategic positioning in high-growth application segments. The transition toward electric vehicles, 5G networks, and Industry 4.0 manufacturing creates substantial opportunities for logic IC suppliers who can deliver innovative, efficient, and reliable solutions.

Regional advantages including proximity to customers, regulatory compliance expertise, and government support programs position European companies favorably in the global competitive landscape. However, challenges including supply chain dependencies, high manufacturing costs, and intense competition require strategic responses and continuous innovation.

The future outlook remains highly positive as digital transformation accelerates across European industries. Logic ICs will continue playing critical roles in enabling advanced automotive systems, industrial automation, telecommunications infrastructure, and emerging applications in healthcare and renewable energy sectors, ensuring sustained market growth and innovation opportunities.

What is Logic Integrated Circuit (IC)?

Logic Integrated Circuit (IC) refers to a set of electronic components that perform logical operations, typically used in various electronic devices such as computers, smartphones, and automotive systems.

What are the key players in the Europe Logic Integrated Circuit (IC) Market?

Key players in the Europe Logic Integrated Circuit (IC) Market include companies like STMicroelectronics, Infineon Technologies, and NXP Semiconductors, among others.

What are the growth factors driving the Europe Logic Integrated Circuit (IC) Market?

The growth of the Europe Logic Integrated Circuit (IC) Market is driven by the increasing demand for consumer electronics, advancements in automotive technology, and the rise of IoT applications.

What challenges does the Europe Logic Integrated Circuit (IC) Market face?

Challenges in the Europe Logic Integrated Circuit (IC) Market include supply chain disruptions, rapid technological changes, and intense competition among manufacturers.

What opportunities exist in the Europe Logic Integrated Circuit (IC) Market?

Opportunities in the Europe Logic Integrated Circuit (IC) Market include the growing adoption of AI and machine learning technologies, expansion in the automotive sector, and increasing investments in smart home devices.

What trends are shaping the Europe Logic Integrated Circuit (IC) Market?

Trends in the Europe Logic Integrated Circuit (IC) Market include the miniaturization of components, the shift towards energy-efficient designs, and the integration of advanced functionalities in ICs.

Europe Logic Integrated Circuit (IC) Market

| Segmentation Details | Description |

|---|---|

| Product Type | Analog ICs, Digital ICs, Mixed-Signal ICs, Power Management ICs |

| Technology | CMOS, BiCMOS, GaN, SiGe |

| End User | Consumer Electronics, Telecommunications, Automotive OEMs, Industrial Automation |

| Application | Signal Processing, Data Conversion, Power Management, Control Systems |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Logic Integrated Circuit (IC) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at