444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe light commercial vehicle rental market represents a dynamic and rapidly evolving sector within the broader transportation and logistics industry. This market encompasses the rental of vehicles typically weighing between 3.5 and 7.5 tons, serving diverse commercial applications across multiple industries. Market dynamics indicate robust growth driven by increasing urbanization, e-commerce expansion, and evolving business models that prioritize flexibility over ownership.

Regional characteristics of the European market showcase significant variations across different countries, with Western European nations leading in market maturity while Eastern European markets demonstrate accelerated growth potential. The market experiences substantial demand from sectors including logistics, construction, retail, and last-mile delivery services. Growth projections suggest the market will expand at a compound annual growth rate of 6.2% through the forecast period, reflecting strong underlying demand fundamentals.

Technological integration plays an increasingly important role in market development, with digital platforms, telematics, and fleet management solutions transforming traditional rental operations. The market benefits from regulatory support for sustainable transportation solutions and government initiatives promoting shared mobility concepts. Market penetration varies significantly across European regions, with urban centers showing adoption rates exceeding 45% compared to rural areas.

The Europe light commercial vehicle rental market refers to the comprehensive ecosystem of businesses, services, and infrastructure dedicated to providing temporary access to commercial vehicles for business and commercial purposes across European territories. This market encompasses various rental models, from short-term daily rentals to long-term lease arrangements, serving businesses that require flexible transportation solutions without the capital investment of vehicle ownership.

Market definition includes vehicles specifically designed for commercial use, typically featuring cargo capacity, specialized equipment mounting capabilities, and enhanced durability for business applications. The rental services extend beyond simple vehicle provision to include comprehensive fleet management, maintenance, insurance, and support services that enable businesses to focus on their core operations while accessing reliable transportation solutions.

Strategic analysis of the Europe light commercial vehicle rental market reveals a sector experiencing significant transformation driven by changing business preferences, technological advancement, and evolving regulatory frameworks. The market demonstrates resilient growth patterns despite economic uncertainties, supported by fundamental shifts toward service-based business models and increased focus on operational flexibility.

Key market drivers include the rapid expansion of e-commerce activities, which has increased demand for last-mile delivery solutions by approximately 38% over recent years. Urbanization trends continue to influence market dynamics, with city-based businesses increasingly preferring rental solutions over ownership to navigate complex urban regulations and parking limitations. The market benefits from technological integration that enhances operational efficiency and customer experience.

Competitive landscape features a mix of established international players and regional specialists, creating a dynamic environment that fosters innovation and service improvement. Market consolidation trends indicate strategic partnerships and acquisitions as companies seek to expand geographic coverage and service capabilities. The sector demonstrates strong fundamentals with sustainable growth prospects supported by evolving business needs and regulatory support for shared mobility solutions.

Market intelligence reveals several critical insights that shape the Europe light commercial vehicle rental landscape. Primary insights include:

Primary market drivers propelling the Europe light commercial vehicle rental market encompass diverse economic, technological, and social factors that create sustained demand for flexible transportation solutions. E-commerce expansion stands as the most significant driver, with online retail growth necessitating sophisticated last-mile delivery networks that rely heavily on rental vehicles for operational flexibility.

Urbanization trends continue to influence market dynamics as businesses operating in densely populated areas face increasing challenges related to vehicle ownership, including limited parking, congestion charges, and environmental regulations. Cost optimization initiatives drive businesses toward rental solutions that eliminate capital expenditure, reduce maintenance responsibilities, and provide predictable operational expenses.

Regulatory support for shared mobility and sustainable transportation creates favorable conditions for market growth. Government initiatives promoting reduced vehicle ownership and improved air quality align with rental market objectives. Technological advancement in vehicle design, connectivity, and fleet management systems enhances the value proposition of rental services, making them more attractive compared to ownership alternatives.

Business model evolution toward service-based approaches encourages companies to focus on core competencies while outsourcing transportation needs to specialized rental providers. Seasonal demand fluctuations in various industries make rental solutions particularly attractive for businesses requiring flexible capacity management without long-term commitments.

Market constraints affecting the Europe light commercial vehicle rental sector include several structural and operational challenges that may limit growth potential. High capital requirements for fleet acquisition and maintenance create barriers for new market entrants and limit expansion capabilities for existing operators. The substantial investment needed for modern, compliant vehicles represents a significant operational challenge.

Regulatory complexity across different European markets creates operational difficulties for companies seeking to provide cross-border services. Varying licensing requirements, insurance regulations, and vehicle standards necessitate significant compliance investments and operational adaptations. Insurance costs continue to rise, particularly for commercial vehicle operations, impacting overall service pricing and profitability.

Vehicle availability constraints during peak demand periods can limit market growth and customer satisfaction. Supply chain disruptions affecting vehicle manufacturing have created inventory challenges that impact rental fleet expansion. Maintenance complexity for modern commercial vehicles requires specialized expertise and equipment, increasing operational costs and complexity.

Economic uncertainty and potential recession concerns may reduce business investment in transportation services, affecting demand patterns. Competition from alternative solutions including ride-sharing, crowdsourced delivery, and improved public transportation options may limit market expansion in certain segments.

Significant opportunities exist within the Europe light commercial vehicle rental market, driven by emerging trends and evolving customer needs. Electric vehicle adoption presents substantial growth potential as businesses seek sustainable transportation solutions to meet environmental commitments and regulatory requirements. The transition to electric fleets offers rental companies opportunities to differentiate services and capture environmentally conscious customers.

Technology integration opportunities include advanced telematics, autonomous driving features, and integrated logistics platforms that can enhance operational efficiency and customer value. Digital platform development enables improved customer experience, streamlined operations, and data-driven service optimization. Subscription-based models offer alternatives to traditional rental arrangements, providing predictable revenue streams and enhanced customer relationships.

Geographic expansion opportunities exist in Eastern European markets where rental penetration remains relatively low compared to Western European standards. Sector diversification into specialized applications such as refrigerated transport, mobile workshops, and emergency services can create new revenue streams and reduce dependence on traditional logistics customers.

Partnership opportunities with e-commerce platforms, logistics providers, and technology companies can create integrated service offerings that address comprehensive customer needs. Sustainability initiatives including carbon-neutral operations and circular economy principles can attract environmentally conscious businesses and align with regulatory trends.

Market dynamics within the Europe light commercial vehicle rental sector reflect complex interactions between supply and demand factors, technological evolution, and regulatory influences. Demand patterns show increasing preference for flexible, short-term rental arrangements over traditional long-term leases, driven by business needs for operational agility and cost management.

Supply chain considerations significantly impact market dynamics, with vehicle availability and pricing influenced by manufacturing capacity, raw material costs, and global supply disruptions. Competitive dynamics feature intense competition among established players while creating opportunities for innovative service models and technology-driven differentiation.

Pricing dynamics reflect balancing between operational costs, competitive pressures, and customer value expectations. Seasonal fluctuations create dynamic pricing opportunities while requiring sophisticated demand forecasting and fleet management capabilities. Technology adoption continues to reshape market dynamics, with digital platforms and data analytics enabling more efficient operations and improved customer experiences.

Regulatory dynamics influence market development through environmental standards, safety requirements, and urban access regulations. Customer behavior evolution toward sustainability and convenience drives service innovation and market differentiation strategies. Economic cycles impact business investment patterns and rental demand, requiring adaptive business models and flexible operational approaches.

Comprehensive research methodology employed for analyzing the Europe light commercial vehicle rental market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research includes extensive interviews with industry executives, rental company operators, fleet managers, and end-user customers across major European markets to gather firsthand insights into market trends and challenges.

Secondary research encompasses analysis of industry reports, government statistics, regulatory documents, and company financial statements to establish market baselines and validate primary findings. Quantitative analysis utilizes statistical modeling and trend analysis to project market growth patterns and identify key performance indicators.

Market segmentation analysis examines different vehicle types, rental duration categories, customer segments, and geographic regions to provide detailed market understanding. Competitive analysis evaluates market share, service offerings, pricing strategies, and strategic initiatives of major market participants.

Regulatory analysis reviews current and proposed legislation affecting the commercial vehicle rental sector across European markets. Technology assessment examines emerging technologies and their potential impact on market development. Economic analysis considers macroeconomic factors, industry cycles, and business investment patterns that influence market dynamics.

Regional market analysis reveals significant variations in market development and growth patterns across European territories. Western European markets including Germany, France, and the United Kingdom demonstrate mature market characteristics with market penetration rates exceeding 55% in urban areas. These markets feature sophisticated service offerings, advanced technology integration, and strong regulatory frameworks supporting sustainable transportation.

Nordic countries show exceptional adoption of electric and sustainable vehicle rental solutions, with environmental vehicle adoption rates reaching 40% in some markets. Southern European markets including Italy and Spain demonstrate growing demand driven by tourism, agriculture, and expanding e-commerce activities. These regions show annual growth rates of approximately 8.5% as market infrastructure develops.

Eastern European markets present the highest growth potential with expansion rates exceeding 12% annually as economic development drives increased commercial activity and business modernization. Countries including Poland, Czech Republic, and Hungary show rapid adoption of rental solutions as businesses embrace flexible operational models.

Central European markets benefit from strategic geographic positioning and strong manufacturing bases that drive consistent demand for commercial vehicle rental services. Cross-border trade activities create additional demand for flexible transportation solutions that can adapt to varying regulatory requirements across different countries.

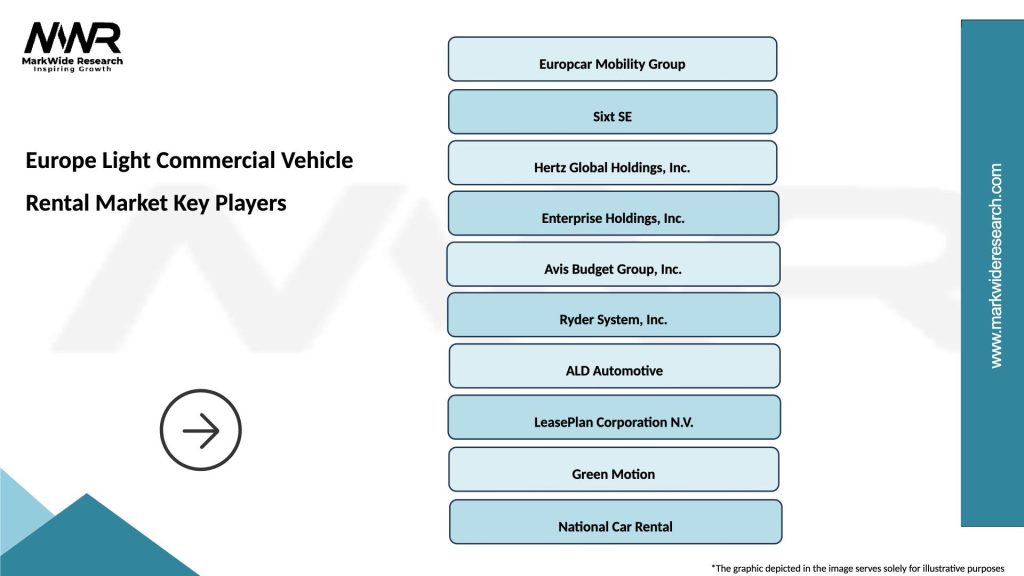

Competitive landscape analysis reveals a diverse market structure featuring international corporations, regional specialists, and emerging technology-driven companies. Market leaders include:

Competitive strategies focus on technology integration, service diversification, and geographic expansion to capture market share and improve operational efficiency. Market consolidation trends indicate strategic partnerships and acquisitions as companies seek to enhance service capabilities and market coverage.

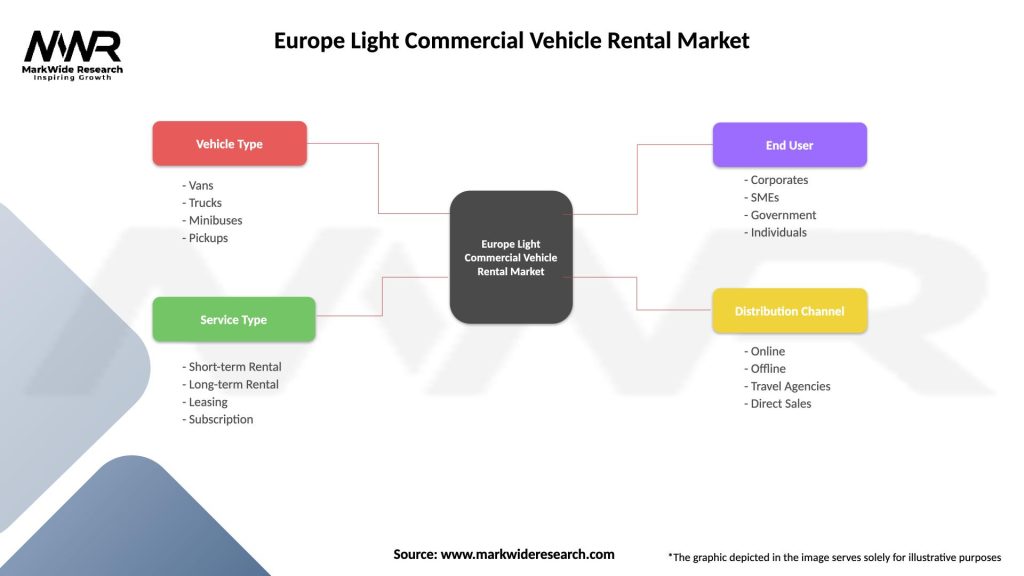

Market segmentation analysis provides detailed insights into different market categories and their respective growth patterns. By Vehicle Type:

By Rental Duration:

By End-User Industry:

Category analysis reveals distinct characteristics and growth patterns across different market segments. Light commercial vans represent the dominant category, accounting for the majority of rental transactions due to their versatility and broad application range. This category benefits from standardized configurations, widespread availability, and cost-effective operations that appeal to diverse business customers.

Electric vehicle categories show exceptional growth potential with adoption increasing by 45% annually as businesses prioritize sustainability and regulatory compliance. Specialized vehicle categories including refrigerated units and mobile workshops command premium pricing while serving niche market segments with specific operational requirements.

Technology-enhanced categories featuring advanced telematics, connectivity, and safety systems demonstrate superior customer retention and pricing power. Flexible rental categories offering hourly and on-demand access show strong growth as businesses seek maximum operational flexibility.

Cross-border rental categories serve businesses operating across multiple European markets, requiring vehicles that meet varying regulatory standards and operational requirements. Seasonal categories including agricultural and tourism-related vehicles show distinct demand patterns that require specialized fleet management approaches.

Industry participants and stakeholders realize numerous benefits from the evolving Europe light commercial vehicle rental market. For rental companies:

For business customers:

For vehicle manufacturers:

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends shaping the Europe light commercial vehicle rental market reflect broader changes in business practices, technology adoption, and environmental consciousness. Digitalization trends continue to transform customer interactions, with mobile applications and online platforms becoming standard for booking, fleet management, and customer service.

Sustainability trends drive increasing demand for electric and hybrid vehicles, with businesses seeking to reduce carbon footprints and meet environmental commitments. Flexibility trends favor short-term and on-demand rental options over traditional long-term arrangements, reflecting business needs for operational agility.

Technology integration trends include advanced telematics, predictive maintenance, and autonomous driving features that enhance safety and efficiency. Subscription model trends offer alternatives to traditional rental arrangements, providing predictable costs and enhanced service relationships.

Urban mobility trends influence vehicle design and service offerings as cities implement congestion charges, low-emission zones, and parking restrictions. Cross-border integration trends create demand for seamless rental services across European markets. Data analytics trends enable improved demand forecasting, pricing optimization, and customer service personalization.

Recent industry developments demonstrate the dynamic nature of the Europe light commercial vehicle rental market. Strategic partnerships between rental companies and technology providers have created integrated platforms that enhance customer experience and operational efficiency. Fleet electrification initiatives by major rental companies signal commitment to sustainable transportation solutions.

Digital platform launches have revolutionized customer interactions, enabling seamless booking, real-time vehicle tracking, and integrated payment systems. Market consolidation activities include strategic acquisitions and mergers that expand geographic coverage and service capabilities.

Regulatory developments across European markets have introduced new environmental standards and safety requirements that influence fleet composition and operational practices. Technology partnerships with automotive manufacturers have accelerated adoption of connected vehicle features and advanced safety systems.

Service innovation developments include integrated logistics solutions, mobile maintenance services, and specialized vehicle configurations that address specific customer needs. According to MarkWide Research analysis, these developments collectively contribute to market evolution and enhanced competitive positioning.

Strategic recommendations for market participants focus on leveraging emerging opportunities while addressing operational challenges. Technology investment should prioritize digital platforms, data analytics, and customer experience enhancement to maintain competitive advantage and operational efficiency.

Fleet modernization initiatives should emphasize electric and hybrid vehicles to meet growing sustainability demands and regulatory requirements. Service diversification into specialized applications and integrated logistics solutions can create new revenue streams and reduce dependence on traditional rental models.

Geographic expansion strategies should target Eastern European markets where rental penetration remains low and growth potential is significant. Partnership development with technology companies, logistics providers, and e-commerce platforms can create comprehensive service offerings that address evolving customer needs.

Operational optimization through advanced fleet management, predictive maintenance, and demand forecasting can improve asset utilization and profitability. Customer relationship management should focus on long-term partnerships and subscription-based models that provide predictable revenue and enhanced customer loyalty.

Future market prospects for the Europe light commercial vehicle rental sector appear highly favorable, supported by fundamental trends toward flexible business models, technological advancement, and sustainable transportation. Growth projections indicate continued market expansion with compound annual growth rates exceeding 6% driven by e-commerce growth, urbanization, and business model evolution.

Technology evolution will continue to reshape market dynamics, with autonomous driving features, advanced connectivity, and integrated logistics platforms becoming standard offerings. Sustainability initiatives will accelerate electric vehicle adoption, with electric vehicle penetration expected to reach 30% of rental fleets within the next five years.

Market consolidation trends will likely continue as companies seek scale advantages and expanded service capabilities. Service innovation will focus on integrated mobility solutions that combine vehicle rental with logistics, maintenance, and technology services. MWR projections suggest that digital platforms will handle over 80% of rental transactions as customer preferences shift toward online convenience.

Regulatory evolution will continue to influence market development through environmental standards, safety requirements, and urban access regulations. Geographic expansion opportunities in Eastern European markets will drive continued investment and market development initiatives.

The Europe light commercial vehicle rental market represents a dynamic and rapidly evolving sector with substantial growth potential driven by fundamental changes in business practices, technology adoption, and regulatory frameworks. Market analysis reveals strong underlying demand supported by e-commerce expansion, urbanization trends, and increasing preference for flexible operational models over traditional vehicle ownership.

Key success factors for market participants include technology integration, service innovation, and strategic positioning to capture emerging opportunities in electric vehicles, digital platforms, and specialized applications. Competitive advantages will increasingly depend on operational efficiency, customer experience, and ability to adapt to evolving market requirements.

Future market development will be shaped by continued digitalization, sustainability initiatives, and geographic expansion into high-growth Eastern European markets. Strategic recommendations emphasize the importance of technology investment, fleet modernization, and service diversification to maintain competitive positioning and capitalize on market opportunities. The sector’s robust fundamentals and favorable growth outlook position it as an attractive market for continued investment and development across the European region.

What is Light Commercial Vehicle Rental?

Light Commercial Vehicle Rental refers to the service of renting vehicles that are primarily used for commercial purposes, such as vans and small trucks, which are designed to transport goods or passengers. This service is essential for businesses that require flexible transportation solutions without the commitment of purchasing vehicles.

What are the key players in the Europe Light Commercial Vehicle Rental Market?

Key players in the Europe Light Commercial Vehicle Rental Market include companies like Europcar, Hertz, and Sixt, which offer a range of light commercial vehicles for various business needs. These companies provide services that cater to logistics, construction, and other sectors requiring commercial transportation, among others.

What are the growth factors driving the Europe Light Commercial Vehicle Rental Market?

The growth of the Europe Light Commercial Vehicle Rental Market is driven by increasing demand for flexible transportation solutions, the rise of e-commerce requiring efficient logistics, and the need for businesses to reduce capital expenditure on vehicle ownership. Additionally, urbanization and the expansion of delivery services contribute to this growth.

What challenges does the Europe Light Commercial Vehicle Rental Market face?

The Europe Light Commercial Vehicle Rental Market faces challenges such as fluctuating fuel prices, regulatory compliance regarding emissions, and competition from ride-sharing services. These factors can impact operational costs and the overall profitability of rental companies.

What opportunities exist in the Europe Light Commercial Vehicle Rental Market?

Opportunities in the Europe Light Commercial Vehicle Rental Market include the growing trend of electric light commercial vehicles, advancements in telematics for fleet management, and the increasing demand for last-mile delivery solutions. These trends can enhance service offerings and attract new customers.

What trends are shaping the Europe Light Commercial Vehicle Rental Market?

Trends shaping the Europe Light Commercial Vehicle Rental Market include the adoption of digital platforms for booking and managing rentals, a shift towards sustainable vehicle options, and the integration of technology for improved fleet efficiency. These trends are transforming how rental services operate and meet customer needs.

Europe Light Commercial Vehicle Rental Market

| Segmentation Details | Description |

|---|---|

| Vehicle Type | Vans, Trucks, Minibuses, Pickups |

| Service Type | Short-term Rental, Long-term Rental, Leasing, Subscription |

| End User | Corporates, SMEs, Government, Individuals |

| Distribution Channel | Online, Offline, Travel Agencies, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Light Commercial Vehicle Rental Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at