444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe Light Commercial Vehicle (LCV) market represents a dynamic and rapidly evolving segment within the broader automotive industry, characterized by significant technological advancement and changing consumer preferences. This market encompasses vehicles with gross vehicle weight ratings typically between 3.5 and 7.5 tonnes, serving diverse commercial applications across various industries. European manufacturers have established themselves as global leaders in LCV innovation, driving sustainable transportation solutions and advanced connectivity features.

Market dynamics indicate robust growth driven by e-commerce expansion, urbanization trends, and increasing demand for last-mile delivery solutions. The sector is experiencing a transformative shift toward electric and hybrid powertrains, with adoption rates reaching approximately 12% annually across major European markets. Commercial fleet operators are increasingly prioritizing fuel efficiency, total cost of ownership, and environmental compliance in their purchasing decisions.

Regional variations across Europe reflect diverse economic conditions, regulatory frameworks, and infrastructure development levels. Western European markets demonstrate higher penetration of advanced technologies and alternative fuel vehicles, while Eastern European regions show strong growth potential in traditional diesel-powered segments. The market’s resilience during economic fluctuations underscores its essential role in supporting commercial transportation networks and supply chain operations throughout the continent.

The Europe Light Commercial Vehicle market refers to the comprehensive ecosystem encompassing the design, manufacturing, distribution, and servicing of commercial vehicles specifically engineered for business applications across European territories. These vehicles typically feature payload capacities ranging from 1,000 to 3,500 kilograms, designed to bridge the gap between passenger cars and heavy-duty commercial trucks.

LCV categories include panel vans, pickup trucks, chassis cabs, and specialized commercial vehicles tailored for specific industry requirements. The market encompasses both original equipment manufacturers and aftermarket service providers, creating a complex value chain that supports diverse commercial transportation needs. Vehicle classifications vary by country but generally align with European Union regulatory standards for commercial vehicle operation and licensing requirements.

Market participants range from established automotive manufacturers to emerging electric vehicle startups, each contributing unique technologies and solutions to address evolving customer demands. The sector’s significance extends beyond vehicle sales to encompass financing, leasing, maintenance, and fleet management services that support commercial operations across industries.

Strategic analysis reveals the Europe LCV market as a cornerstone of commercial transportation infrastructure, experiencing steady growth driven by digital commerce expansion and evolving logistics requirements. Key market drivers include increasing urbanization, stringent emission regulations, and growing demand for efficient last-mile delivery solutions. The market demonstrates remarkable adaptability to technological disruption, with electrification trends gaining momentum at approximately 15% growth rate annually.

Competitive dynamics showcase intense rivalry among established European manufacturers and emerging technology-focused companies. Traditional market leaders are investing heavily in electric vehicle development and autonomous driving technologies to maintain competitive advantages. Market consolidation trends indicate strategic partnerships and acquisitions aimed at accelerating innovation and expanding market reach across diverse European regions.

Regulatory influences play a crucial role in shaping market development, with European Union emissions standards driving technological advancement and alternative fuel adoption. The market’s future trajectory appears strongly aligned with sustainability objectives and smart city initiatives, positioning LCV manufacturers to capitalize on emerging opportunities in connected and autonomous commercial vehicle segments.

Market intelligence reveals several critical insights shaping the Europe LCV landscape. MarkWide Research analysis indicates that commercial vehicle electrification is accelerating beyond initial projections, with urban delivery applications leading adoption trends. The following insights provide strategic perspective on market evolution:

Primary growth drivers propelling the Europe LCV market reflect fundamental changes in commercial transportation requirements and technological capabilities. E-commerce expansion continues to generate unprecedented demand for efficient delivery vehicles, with online retail growth driving approximately 18% increase in commercial vehicle utilization across major European cities.

Urbanization trends create both opportunities and challenges for LCV manufacturers. Growing urban populations require more sophisticated logistics networks, while city centers implement increasingly restrictive access policies favoring low-emission vehicles. Environmental regulations serve as powerful catalysts for innovation, pushing manufacturers to develop cleaner, more efficient powertrain technologies.

Technological advancement in battery systems, connectivity, and autonomous driving capabilities opens new market possibilities. Fleet operators recognize the potential for reduced operating costs through improved fuel efficiency, predictive maintenance, and optimized route planning. Additionally, government incentives for electric commercial vehicles and infrastructure development provide financial motivation for early adoption of advanced technologies.

Supply chain evolution demands more flexible and responsive transportation solutions. The rise of same-day delivery expectations and distributed fulfillment networks requires vehicles capable of handling diverse cargo types and delivery scenarios. Labor shortages in commercial driving sectors also drive interest in automated and semi-autonomous vehicle technologies.

Significant challenges constrain Europe LCV market growth despite favorable underlying trends. High acquisition costs for advanced technology vehicles, particularly electric and hybrid models, create barriers for small and medium-sized commercial operators. Initial purchase price premiums can exceed traditional diesel alternatives by substantial margins, requiring careful total cost of ownership analysis.

Infrastructure limitations pose ongoing challenges for alternative fuel vehicle adoption. Charging network coverage remains inconsistent across European regions, with rural and peripheral areas showing significant gaps. Grid capacity constraints and installation costs for commercial charging facilities create additional hurdles for fleet electrification initiatives.

Regulatory complexity across different European markets complicates vehicle development and market entry strategies. Varying emission standards, taxation policies, and access restrictions require manufacturers to develop multiple vehicle variants and compliance strategies. Brexit implications continue to create uncertainty for cross-border operations and supply chain management.

Economic volatility affects commercial vehicle purchasing decisions, as businesses defer capital investments during uncertain periods. Supply chain disruptions and component shortages have impacted production schedules and delivery timelines, creating customer satisfaction challenges and market share shifts among competitors.

Emerging opportunities within the Europe LCV market present significant potential for growth and innovation. Electric vehicle transition creates space for new market entrants and technology partnerships, with established manufacturers seeking to accelerate development through strategic collaborations. The shift toward sustainable transportation opens opportunities for companies offering comprehensive electrification solutions.

Digital transformation in logistics and fleet management creates demand for connected vehicle technologies and data analytics services. Autonomous driving development for commercial applications represents a substantial long-term opportunity, particularly for urban delivery and highway transport scenarios. Companies investing in these technologies position themselves for future market leadership.

Service-based business models offer alternatives to traditional vehicle ownership, including leasing, subscription services, and mobility-as-a-service offerings. Aftermarket opportunities in vehicle conversion, customization, and retrofit services address diverse customer requirements and extend vehicle lifecycle value.

Export potential beyond Europe leverages advanced European LCV technologies and manufacturing capabilities in emerging markets. Circular economy initiatives create opportunities for vehicle recycling, component remanufacturing, and sustainable material utilization throughout the value chain.

Complex interactions between technological, regulatory, and economic factors shape Europe LCV market dynamics. Competitive intensity continues to increase as traditional automotive manufacturers face challenges from technology-focused startups and companies from adjacent industries. Market dynamics reflect the tension between established business models and disruptive innovations.

Customer expectations are evolving rapidly, with commercial operators demanding vehicles that offer superior total cost of ownership, advanced connectivity features, and environmental compliance. Digitalization trends influence both vehicle design and business model innovation, creating new value propositions and competitive differentiators.

Supply chain relationships are becoming more strategic and collaborative, with manufacturers working closely with suppliers to develop integrated solutions. Vertical integration trends in battery production and software development reflect efforts to control critical technology components and reduce external dependencies.

Market consolidation through mergers, acquisitions, and strategic partnerships reshapes competitive landscapes and accelerates technology development. Regional specialization allows companies to focus on specific market segments or geographic areas where they can achieve competitive advantages and sustainable growth.

Comprehensive research approach combines quantitative data analysis with qualitative market insights to provide accurate and actionable intelligence on Europe LCV market trends. Primary research includes extensive interviews with industry executives, fleet operators, and technology providers across major European markets to understand current challenges and future requirements.

Secondary research encompasses analysis of industry reports, regulatory filings, financial statements, and market databases to establish baseline market conditions and identify emerging trends. Data triangulation methods ensure accuracy and reliability of market insights through cross-verification of information sources and analytical approaches.

Market modeling techniques incorporate economic indicators, regulatory changes, and technology adoption curves to project future market scenarios and growth trajectories. Regional analysis considers local market conditions, competitive dynamics, and regulatory environments to provide granular insights into market development patterns.

Expert validation processes involve review and feedback from industry specialists, academic researchers, and market participants to ensure research findings accurately reflect market realities and provide valuable strategic guidance for decision-making purposes.

Western Europe dominates the LCV market with mature automotive industries and advanced technology adoption rates. Germany leads in manufacturing excellence and innovation, hosting major LCV producers and maintaining approximately 28% market share across the region. France and the United Kingdom represent significant markets with strong commercial vehicle traditions and growing electric vehicle adoption.

Northern European countries including Netherlands, Denmark, and Sweden demonstrate leadership in sustainable transportation initiatives and electric vehicle infrastructure development. These markets show higher adoption rates for alternative fuel vehicles and advanced technology features, driven by supportive government policies and environmental awareness.

Southern Europe presents diverse market conditions, with Italy and Spain showing strong demand for commercial vehicles supporting tourism and manufacturing sectors. Economic recovery in these regions drives renewed investment in commercial vehicle fleets and infrastructure modernization projects.

Eastern Europe exhibits rapid growth potential with expanding economies and increasing commercial activity. Poland, Czech Republic, and Hungary benefit from manufacturing investments and logistics hub development, creating demand for modern commercial vehicle solutions. These markets show approximately 22% growth rates in LCV adoption as businesses modernize their transportation capabilities.

Market leadership in the Europe LCV segment reflects a combination of established automotive manufacturers and emerging technology companies. Competitive positioning depends on factors including product portfolio breadth, technology innovation, distribution network strength, and customer service capabilities.

Emerging competitors include electric vehicle startups and technology companies entering commercial vehicle markets with innovative solutions and business models. Strategic partnerships between traditional manufacturers and technology providers create new competitive dynamics and accelerate innovation development.

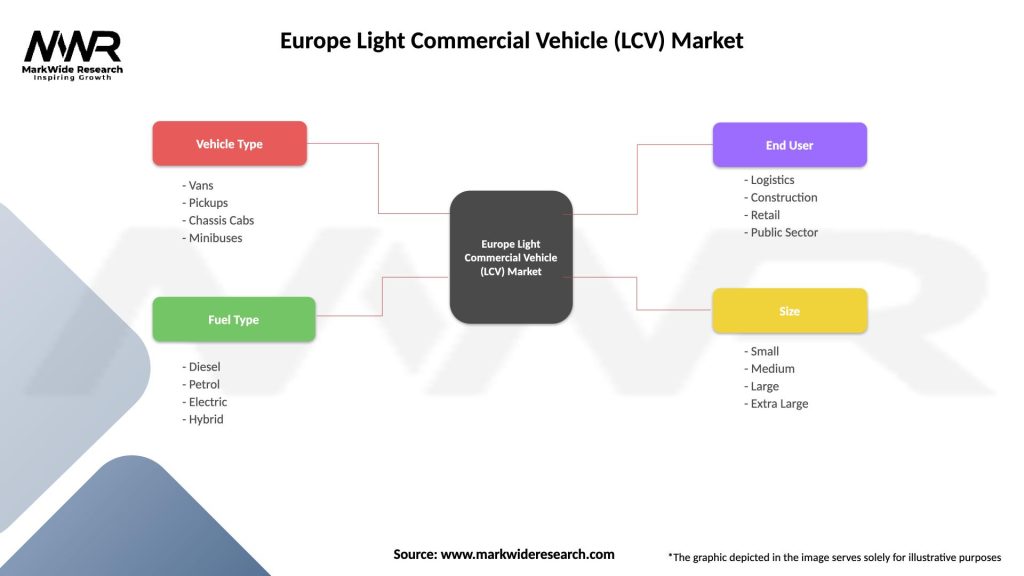

Market segmentation analysis reveals diverse customer requirements and application-specific vehicle configurations across the Europe LCV market. Segmentation approaches consider vehicle size, powertrain type, application focus, and customer characteristics to provide comprehensive market understanding.

By Vehicle Type:

By Powertrain:

By Application:

Panel van category represents the largest segment within Europe LCV market, accounting for approximately 65% market share due to versatile cargo carrying capabilities and widespread commercial applications. Design evolution focuses on maximizing cargo volume while maintaining maneuverability in urban environments. Advanced features include modular interior systems, improved aerodynamics, and enhanced driver comfort.

Pickup truck segment shows strong growth potential, particularly in markets where regulatory frameworks support commercial pickup usage. European pickup designs emphasize fuel efficiency and compact dimensions compared to global counterparts, addressing local market preferences and infrastructure constraints. Lifestyle applications complement traditional commercial usage patterns.

Electric vehicle categories demonstrate varying adoption rates across different applications. Urban delivery vehicles show highest electric adoption due to suitable duty cycles and environmental regulations. Long-distance applications remain challenging for electric powertrains due to range limitations and charging infrastructure requirements.

Specialized vehicle categories including refrigerated vans, mobile workshops, and emergency vehicles represent high-value market segments with specific technical requirements. Customization capabilities and aftermarket support services become critical competitive factors in these specialized applications.

Manufacturers benefit from growing market demand and opportunities for technology differentiation in the Europe LCV sector. Product innovation in electric powertrains, connectivity, and autonomous features creates competitive advantages and premium pricing opportunities. Service expansion beyond vehicle sales generates recurring revenue streams and strengthens customer relationships.

Fleet operators gain access to more efficient and capable commercial vehicles that reduce operating costs and improve service quality. Total cost of ownership improvements through better fuel efficiency, reduced maintenance requirements, and extended vehicle lifecycles provide significant economic benefits. Technology integration enables better fleet management and operational optimization.

Suppliers participate in growing market opportunities through component innovation and system integration. Technology partnerships with vehicle manufacturers create long-term business relationships and revenue growth potential. Aftermarket services provide additional revenue opportunities throughout vehicle lifecycles.

End customers benefit from improved vehicle capabilities, lower operating costs, and enhanced service quality from commercial vehicle operators. Environmental benefits from cleaner vehicle technologies contribute to improved air quality and reduced carbon emissions in urban areas. Service reliability improvements support business operations and customer satisfaction.

Strengths:

Weaknesses:

Opportunities:

Threats:

Electrification acceleration represents the most significant trend reshaping the Europe LCV market, with battery technology improvements and charging infrastructure expansion driving adoption beyond initial projections. Urban access restrictions and emission regulations create compelling business cases for electric commercial vehicles in city center operations.

Connectivity integration transforms commercial vehicles into mobile data platforms, enabling fleet optimization, predictive maintenance, and enhanced driver safety. Telematics adoption reaches approximately 45% penetration across European commercial fleets, with continued growth expected as technology costs decrease and benefits become more apparent.

Autonomous driving development focuses on commercial applications where controlled environments and repetitive routes provide favorable conditions for technology deployment. Highway automation and depot-to-depot operations represent near-term opportunities for autonomous commercial vehicle implementation.

Service model evolution shifts from traditional vehicle ownership toward mobility-as-a-service and subscription-based offerings. Flexible financing options and comprehensive service packages address diverse customer requirements and reduce barriers to advanced technology adoption. Circular economy principles influence vehicle design and end-of-life management strategies.

Recent developments in the Europe LCV market reflect accelerating pace of innovation and strategic repositioning among market participants. Major manufacturers announce significant investments in electric vehicle production capacity and battery technology development to meet growing market demand.

Strategic partnerships between automotive manufacturers and technology companies accelerate development of connected and autonomous vehicle capabilities. Collaboration initiatives focus on charging infrastructure development, software integration, and service platform creation to support comprehensive mobility solutions.

Regulatory developments include updated emission standards, urban access policies, and incentive programs supporting clean vehicle adoption. Government initiatives provide financial support for electric vehicle purchases and charging infrastructure development across European markets.

Technology breakthroughs in battery chemistry, charging systems, and vehicle integration improve electric commercial vehicle capabilities and reduce total cost of ownership. Manufacturing investments in European production facilities demonstrate long-term commitment to regional market development and supply chain localization.

Strategic recommendations for Europe LCV market participants emphasize the importance of balancing immediate market requirements with long-term technology transitions. MWR analysis suggests that companies should prioritize electric vehicle development while maintaining competitive positions in traditional powertrain segments during the transition period.

Investment priorities should focus on core technology capabilities including battery systems, software integration, and manufacturing flexibility. Partnership strategies can accelerate development timelines and reduce investment risks through shared resources and expertise. Market entry approaches should consider regional variations in customer requirements and regulatory environments.

Customer engagement strategies must address total cost of ownership concerns and provide comprehensive support for technology adoption. Service expansion beyond vehicle sales creates competitive differentiation and recurring revenue opportunities. Sustainability initiatives align with customer values and regulatory requirements while supporting brand positioning.

Risk management approaches should address supply chain vulnerabilities, technology obsolescence, and market volatility through diversification and flexibility. Monitoring systems for regulatory changes, competitive developments, and customer preference shifts enable proactive strategic adjustments and market positioning.

Long-term prospects for the Europe LCV market appear highly favorable, driven by fundamental shifts in commercial transportation requirements and technology capabilities. Electric vehicle adoption is projected to accelerate significantly, with penetration rates potentially reaching 35% by 2030 across major European markets. Infrastructure development and battery technology improvements will address current adoption barriers.

Autonomous driving integration will gradually transform commercial vehicle operations, beginning with controlled environments and expanding to broader applications. Connected vehicle technologies will become standard features, enabling new service models and operational efficiencies. Data analytics and artificial intelligence will optimize fleet operations and vehicle performance.

Market consolidation trends will continue as companies seek scale advantages and technology capabilities through strategic partnerships and acquisitions. New market entrants from technology and adjacent industries will challenge traditional competitive dynamics and accelerate innovation pace.

Sustainability focus will intensify, with circular economy principles influencing vehicle design, manufacturing processes, and end-of-life management. Regulatory evolution will continue driving clean technology adoption and shaping market development patterns across European regions. The market’s transformation toward sustainable, connected, and autonomous commercial transportation solutions positions Europe as a global leader in advanced commercial vehicle technologies.

The Europe Light Commercial Vehicle market stands at a pivotal transformation point, characterized by accelerating electrification, advancing connectivity, and evolving customer requirements. Market dynamics reflect the complex interplay between technological innovation, regulatory pressures, and commercial transportation needs across diverse European markets. The sector’s resilience and adaptability position it well for continued growth despite economic uncertainties and competitive challenges.

Strategic success in this evolving market requires balanced approaches that address immediate customer needs while investing in future technology capabilities. Electric vehicle transition represents both the greatest opportunity and challenge, demanding significant investments in technology development, manufacturing capacity, and market education. Companies that successfully navigate this transition will establish competitive advantages in the emerging sustainable transportation economy.

Future market leadership will depend on capabilities in technology integration, customer service excellence, and strategic partnership development. The Europe LCV market will continue serving as a global innovation center, developing advanced commercial vehicle solutions that address urbanization challenges, environmental requirements, and operational efficiency demands across diverse commercial applications and regional markets.

What is Light Commercial Vehicle (LCV)?

Light Commercial Vehicles (LCVs) are motor vehicles designed primarily for the transportation of goods and passengers, typically with a weight limit that allows for easier maneuverability and fuel efficiency. They are commonly used in various sectors, including logistics, construction, and delivery services.

What are the key players in the Europe Light Commercial Vehicle (LCV) Market?

Key players in the Europe Light Commercial Vehicle (LCV) Market include companies such as Ford, Volkswagen, and Renault, which are known for their diverse range of LCV models. These companies compete on factors like fuel efficiency, payload capacity, and technological advancements, among others.

What are the main drivers of the Europe Light Commercial Vehicle (LCV) Market?

The main drivers of the Europe Light Commercial Vehicle (LCV) Market include the growing demand for efficient transportation solutions, the rise of e-commerce requiring last-mile delivery vehicles, and advancements in vehicle technology that enhance fuel efficiency and reduce emissions.

What challenges does the Europe Light Commercial Vehicle (LCV) Market face?

The Europe Light Commercial Vehicle (LCV) Market faces challenges such as stringent emissions regulations, fluctuating fuel prices, and the need for significant investment in electric vehicle infrastructure. These factors can impact the operational costs and adoption rates of LCVs.

What opportunities exist in the Europe Light Commercial Vehicle (LCV) Market?

Opportunities in the Europe Light Commercial Vehicle (LCV) Market include the increasing shift towards electric and hybrid LCVs, the expansion of urban delivery services, and the potential for smart vehicle technologies that improve logistics efficiency and fleet management.

What trends are shaping the Europe Light Commercial Vehicle (LCV) Market?

Trends shaping the Europe Light Commercial Vehicle (LCV) Market include the growing adoption of electric LCVs, the integration of advanced telematics for fleet management, and a focus on sustainability practices among manufacturers and consumers alike.

Europe Light Commercial Vehicle (LCV) Market

| Segmentation Details | Description |

|---|---|

| Vehicle Type | Vans, Pickups, Chassis Cabs, Minibuses |

| Fuel Type | Diesel, Petrol, Electric, Hybrid |

| End User | Logistics, Construction, Retail, Public Sector |

| Size | Small, Medium, Large, Extra Large |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Light Commercial Vehicle (LCV) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at