444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe juices market represents one of the most dynamic and evolving segments within the continent’s food and beverage industry. Market dynamics indicate substantial growth potential driven by increasing health consciousness, premium product demand, and innovative flavor profiles. The European juice sector encompasses a diverse range of products including fresh juices, concentrated juices, organic variants, and functional beverages that cater to sophisticated consumer preferences across multiple demographic segments.

Consumer behavior patterns across Europe demonstrate a significant shift toward natural and organic juice products, with organic juice consumption growing at approximately 8.2% annually. This transformation reflects broader lifestyle changes where European consumers prioritize nutritional value, ingredient transparency, and sustainable production methods. The market spans various distribution channels from traditional retail outlets to modern e-commerce platforms, creating comprehensive accessibility for diverse consumer segments.

Regional variations within Europe showcase distinct consumption patterns, with Western European countries leading in premium juice categories while Eastern European markets demonstrate rapid growth in traditional fruit juice segments. The integration of advanced processing technologies, cold-pressed extraction methods, and innovative packaging solutions continues to reshape the competitive landscape, positioning Europe as a global leader in juice innovation and quality standards.

The Europe juices market refers to the comprehensive commercial ecosystem encompassing the production, distribution, and consumption of fruit and vegetable-based beverages across European Union countries and associated territories. This market includes various product categories such as pure fruit juices, juice blends, vegetable juices, organic variants, and functional juice beverages that meet specific nutritional or health-focused consumer demands.

Market classification extends beyond traditional fruit juices to include innovative product segments like cold-pressed juices, superfood blends, probiotic-enhanced beverages, and plant-based protein juices. The European juice market operates within stringent regulatory frameworks that ensure product quality, safety standards, and accurate labeling requirements, contributing to consumer confidence and market stability across the region.

Industry scope encompasses multiple stakeholder categories including agricultural producers, processing facilities, packaging companies, distribution networks, retail channels, and end consumers. This interconnected ecosystem supports both large-scale commercial operations and artisanal juice producers, creating a diverse marketplace that accommodates various consumer preferences, price points, and quality expectations throughout Europe’s diverse cultural and economic landscape.

Strategic analysis of the Europe juices market reveals a mature yet continuously evolving industry characterized by innovation, premiumization, and sustainability focus. The market demonstrates resilient growth patterns despite economic fluctuations, supported by consistent consumer demand for healthy beverage alternatives and the industry’s adaptive capacity to emerging trends and preferences.

Key performance indicators highlight the market’s strength across multiple dimensions, with premium juice segments experiencing growth rates of approximately 6.5% annually. The integration of sustainable packaging solutions, organic ingredient sourcing, and innovative flavor combinations positions European juice manufacturers as global industry leaders in quality and environmental responsibility.

Market consolidation trends indicate strategic partnerships between established brands and emerging organic producers, creating synergistic opportunities for market expansion and product diversification. The competitive landscape features both multinational corporations and specialized regional producers, fostering innovation through diverse approaches to product development, marketing strategies, and distribution channel optimization.

Consumer preference analysis reveals several critical insights that shape the European juice market landscape:

Primary growth catalysts propelling the Europe juices market include evolving consumer lifestyles, increased health awareness, and technological advancement in juice processing and preservation. The growing emphasis on preventive healthcare drives consumer preference toward nutrient-rich beverages that offer functional benefits beyond basic hydration and taste satisfaction.

Demographic shifts across Europe contribute significantly to market expansion, with aging populations seeking antioxidant-rich products and younger generations embracing sustainable consumption practices. The rise of fitness culture and wellness trends creates sustained demand for natural energy sources and post-workout recovery beverages, positioning juices as essential components of active lifestyles.

Innovation drivers include advanced extraction technologies that preserve nutritional content, extended shelf-life solutions that reduce food waste, and packaging innovations that enhance product convenience and environmental sustainability. The integration of smart packaging technologies and traceability systems addresses consumer demands for transparency and quality assurance throughout the supply chain.

Economic factors supporting market growth include rising disposable incomes in Eastern European markets, urbanization trends that favor convenient beverage options, and the expansion of modern retail infrastructure that improves product accessibility. Government initiatives promoting healthy dietary habits and reduced sugar consumption indirectly benefit natural juice products that offer healthier alternatives to artificial beverages.

Significant challenges facing the Europe juices market include intense price competition, seasonal raw material availability, and evolving regulatory requirements that impact production costs and market entry strategies. The high sugar content in traditional fruit juices faces increasing scrutiny from health authorities and consumer advocacy groups, potentially limiting growth in conventional juice segments.

Supply chain complexities present ongoing challenges, particularly regarding organic ingredient sourcing and maintaining consistent quality standards across diverse European markets. Climate change impacts on agricultural production create uncertainty in raw material costs and availability, affecting long-term planning and pricing strategies for juice manufacturers.

Consumer behavior shifts toward whole fruit consumption and reduced sugar intake challenge traditional juice formulations, requiring significant investment in product reformulation and marketing repositioning. The growing popularity of alternative beverages such as plant-based milk, kombucha, and functional waters creates competitive pressure on traditional juice categories.

Regulatory constraints including labeling requirements, health claims restrictions, and environmental compliance standards increase operational complexity and costs for juice producers. The fragmented nature of European markets with varying consumer preferences, distribution channels, and regulatory frameworks complicates standardized marketing and product development strategies across the region.

Emerging opportunities within the Europe juices market center on product innovation, market expansion, and strategic partnerships that leverage evolving consumer preferences and technological capabilities. The growing demand for personalized nutrition creates opportunities for customized juice blends and subscription-based delivery services that cater to individual health goals and dietary requirements.

Untapped market segments include senior consumers seeking functional health benefits, busy professionals requiring convenient nutrition solutions, and environmentally conscious consumers prioritizing sustainable packaging and ethical sourcing practices. The expansion of plant-based diets creates opportunities for vegetable-forward juice products and protein-enhanced formulations.

Technology integration presents significant opportunities through smart packaging solutions, blockchain-based traceability systems, and AI-driven flavor development that can accelerate product innovation and enhance consumer engagement. The development of shelf-stable organic products using advanced preservation techniques opens new distribution channels and geographic markets.

Strategic partnerships with health and wellness brands, fitness centers, and healthcare providers create opportunities for co-branded products and targeted marketing initiatives. The integration of e-commerce platforms and direct-to-consumer sales channels enables premium pricing strategies and enhanced customer relationship management capabilities.

Competitive dynamics within the Europe juices market reflect a complex interplay between established multinational brands, regional specialists, and emerging organic producers. Market consolidation trends indicate strategic acquisitions and partnerships that combine distribution capabilities with innovative product portfolios, creating enhanced market coverage and operational efficiency.

Innovation cycles demonstrate accelerating pace of product development, with new product launches increasing by approximately 12% annually across major European markets. This innovation focus encompasses flavor development, packaging solutions, nutritional enhancement, and sustainable production methods that address evolving consumer expectations and regulatory requirements.

Pricing strategies vary significantly across market segments, with premium products commanding price premiums of 40-60% compared to conventional alternatives. The premiumization trend reflects consumer willingness to pay higher prices for perceived quality, health benefits, and environmental sustainability, creating opportunities for margin expansion and brand differentiation.

Distribution evolution shows increasing importance of online channels, which now represent approximately 15% of total juice sales in major European markets. This shift requires investment in digital marketing capabilities, logistics infrastructure, and customer service systems that support direct-to-consumer engagement and subscription-based business models.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Europe juices market landscape. Primary research includes extensive surveys of industry stakeholders, consumer focus groups, and in-depth interviews with key market participants including manufacturers, distributors, retailers, and end consumers across major European markets.

Secondary research incorporates analysis of industry reports, government statistics, trade association data, and company financial statements to validate primary findings and provide comprehensive market context. Quantitative analysis utilizes statistical modeling techniques to identify market trends, growth patterns, and correlation factors that influence market dynamics and future projections.

Data validation processes include cross-referencing multiple sources, expert panel reviews, and statistical significance testing to ensure research accuracy and reliability. Market segmentation analysis employs demographic, psychographic, and behavioral criteria to identify distinct consumer groups and their specific preferences, purchasing patterns, and growth potential.

Forecasting methodology combines historical trend analysis, regression modeling, and scenario planning to develop realistic market projections that account for various economic, regulatory, and competitive factors. The research framework incorporates both top-down and bottom-up approaches to ensure comprehensive coverage of market dynamics and accurate representation of industry conditions across diverse European markets.

Western European markets dominate the continental juice landscape, with Germany, France, and the United Kingdom representing approximately 55% of total market consumption. These mature markets demonstrate strong preference for premium organic products and innovative flavor combinations, supported by high disposable incomes and sophisticated consumer preferences that drive product innovation and market premiumization.

Northern European countries including Scandinavia and the Netherlands show exceptional growth in functional juice categories, with health-conscious consumers driving demand for superfood-enhanced products and sustainable packaging solutions. These markets demonstrate willingness to pay premium prices for products that align with environmental values and health optimization goals.

Southern European markets maintain strong traditional juice consumption patterns while embracing local fruit varieties and artisanal production methods. Spain and Italy lead in citrus-based products, leveraging regional agricultural advantages and cultural preferences for fresh, natural flavors that reflect Mediterranean dietary traditions.

Eastern European markets represent the fastest-growing segment with annual growth rates exceeding 10% in several categories. Poland, Czech Republic, and Hungary demonstrate increasing consumer sophistication and rising disposable incomes that support market expansion from basic fruit juices toward premium and organic alternatives. According to MarkWide Research analysis, these markets show particular strength in value-oriented premium products that balance quality improvements with accessible pricing strategies.

Market leadership within the Europe juices sector features a diverse mix of multinational corporations, regional specialists, and emerging organic brands that compete across various product categories and price segments. The competitive environment demonstrates increasing consolidation through strategic acquisitions and partnerships that combine distribution capabilities with innovative product portfolios.

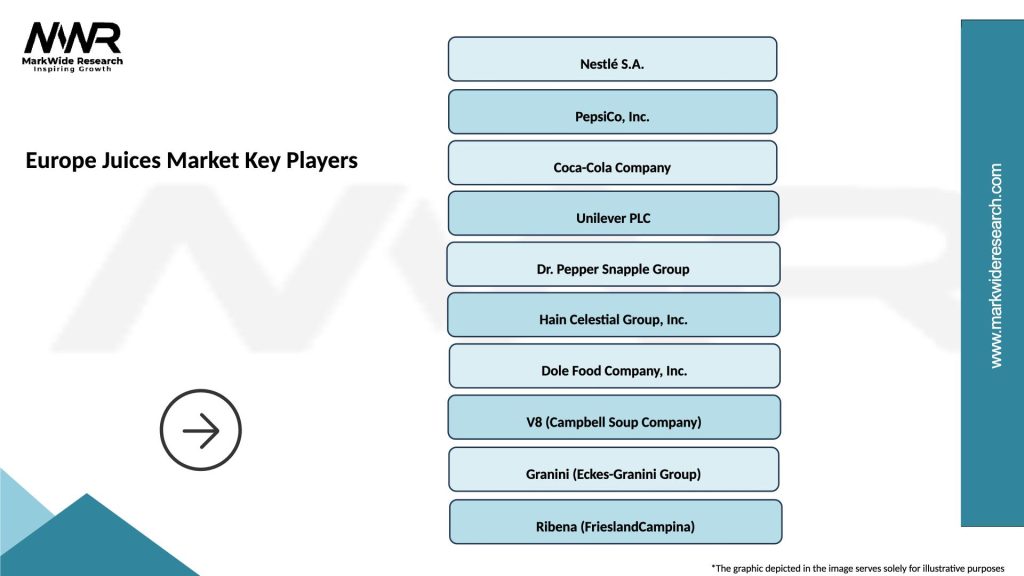

Key market participants include:

Competitive strategies emphasize product differentiation through organic certification, innovative packaging solutions, and targeted marketing campaigns that address specific consumer segments. The integration of sustainable practices and transparency initiatives becomes increasingly important for maintaining competitive advantage and consumer loyalty in premium market segments.

Product-based segmentation reveals distinct market categories with varying growth trajectories and consumer appeal:

By Product Type:

By Packaging Format:

By Distribution Channel:

Orange juice category maintains market leadership despite declining consumption trends, with premium variants and not-from-concentrate products showing resilience against overall category pressure. Innovation focuses on pulp variations, vitamin fortification, and sustainable sourcing that address evolving consumer preferences while maintaining traditional appeal.

Apple juice segment demonstrates steady performance with particular strength in organic variants and children’s products. The category benefits from local production capabilities across European apple-growing regions, enabling fresh processing and reduced transportation costs that support competitive pricing and environmental sustainability claims.

Mixed fruit juices represent the fastest-growing traditional category, with exotic fruit combinations and superfood additions driving consumer interest and premium positioning. This segment demonstrates particular strength among younger demographics seeking variety and nutritional enhancement in their beverage choices.

Vegetable juice category shows exceptional growth potential with annual increases of approximately 18% in several European markets. Tomato-based products lead this segment, while green vegetable blends and beet juice variants gain traction among health-focused consumers seeking functional nutrition benefits.

Functional juice products emerge as a distinct category combining traditional fruit bases with added vitamins, probiotics, protein supplements, and herbal extracts. This innovation-driven segment commands premium pricing and attracts consumers seeking specific health benefits and wellness optimization through their beverage choices.

Manufacturers benefit from diverse revenue streams, brand differentiation opportunities, and scalable production systems that accommodate both mass market and premium product segments. The industry’s innovation focus enables intellectual property development, process optimization, and sustainable competitive advantages through proprietary technologies and unique product formulations.

Retailers gain from high-margin premium products, consistent consumer demand, and category management opportunities that drive store traffic and basket size increases. The juice category’s impulse purchase potential and cross-merchandising opportunities with complementary products enhance overall retail profitability and customer engagement.

Distributors leverage established supply chains, temperature-controlled logistics expertise, and relationships with both producers and retailers to capture value throughout the distribution process. The category’s shelf-stable variants and predictable demand patterns support efficient inventory management and route optimization strategies.

Consumers receive convenient nutrition solutions, diverse flavor options, and functional health benefits that support active lifestyles and wellness goals. The industry’s focus on quality improvement, transparency initiatives, and sustainable practices aligns with evolving consumer values and purchasing criteria.

Agricultural stakeholders benefit from stable demand for fruit and vegetable raw materials, premium pricing for organic and specialty crops, and long-term supply agreements that support agricultural planning and investment decisions. The industry’s local sourcing initiatives strengthen regional agricultural economies and reduce environmental impact through shortened supply chains.

Strengths:

Weaknesses:

Opportunities:

Threats:

Premiumization trends dominate the European juice market landscape, with consumers increasingly seeking artisanal products, organic certification, and unique flavor profiles that justify higher price points. This trend reflects broader lifestyle changes where beverage choices become expressions of personal values, health priorities, and social consciousness.

Sustainability integration emerges as a critical market driver, with eco-friendly packaging, carbon-neutral production, and ethical sourcing becoming standard expectations rather than competitive differentiators. MWR data indicates that 72% of European consumers consider environmental impact when selecting juice products, driving industry-wide adoption of sustainable practices.

Functional nutrition represents a transformative trend where traditional juice products evolve into wellness solutions targeting specific health outcomes. Immunity-boosting formulations, digestive health products, and energy-enhancing blends create new product categories that command premium pricing and attract health-conscious consumer segments.

Personalization technologies enable customized juice products based on individual nutritional needs, taste preferences, and health goals. Subscription services and AI-driven recommendations create direct consumer relationships that bypass traditional retail channels and enable premium pricing strategies.

Transparency initiatives including blockchain traceability, ingredient sourcing disclosure, and nutritional impact reporting address consumer demands for product authenticity and corporate accountability. These trends require significant investment in supply chain management and digital infrastructure but create competitive advantages through enhanced consumer trust and brand loyalty.

Recent industry developments demonstrate accelerating innovation and strategic repositioning across the European juice market. Major acquisitions and strategic partnerships reshape competitive dynamics while enabling companies to access new technologies, distribution channels, and consumer segments that support long-term growth strategies.

Technology integration advances include cold-pressed extraction systems, high-pressure processing, and natural preservation methods that extend shelf life while maintaining nutritional integrity. These innovations enable premium positioning and expanded distribution reach without compromising product quality or consumer health benefits.

Packaging innovations focus on sustainable materials, portion control solutions, and convenience enhancements that address evolving consumer lifestyle needs. Smart packaging technologies incorporating freshness indicators and interactive features create enhanced consumer experiences and brand differentiation opportunities.

Market expansion initiatives include geographic diversification, channel development, and demographic targeting that broaden market reach and reduce dependency on traditional consumer segments. E-commerce platform development and direct-to-consumer strategies enable companies to capture higher margins while building stronger customer relationships.

Regulatory compliance developments include enhanced labeling requirements, health claim restrictions, and environmental standards that influence product development and marketing strategies. Industry adaptation to these requirements creates opportunities for companies that proactively embrace transparency and sustainability as competitive advantages.

Strategic recommendations for European juice market participants emphasize innovation investment, sustainability integration, and consumer-centric approaches that address evolving market dynamics and competitive pressures. Companies should prioritize product differentiation through functional benefits, premium positioning, and unique value propositions that justify higher price points and build consumer loyalty.

Market expansion strategies should focus on underserved segments including senior consumers, busy professionals, and environmentally conscious demographics that demonstrate willingness to pay premium prices for products that meet specific needs and values. Geographic expansion into Eastern European markets offers significant growth potential for companies with appropriate market entry strategies and local partnership capabilities.

Technology adoption recommendations include investment in digital marketing platforms, e-commerce capabilities, and supply chain optimization systems that enhance operational efficiency and customer engagement. Data analytics integration enables better understanding of consumer preferences and market trends that inform product development and marketing strategies.

Partnership opportunities with health and wellness brands, fitness organizations, and sustainable agriculture initiatives create synergistic marketing opportunities and enhanced credibility among target consumer segments. Vertical integration strategies may provide better control over quality, costs, and sustainability claims that become increasingly important for competitive positioning.

Risk management strategies should address supply chain vulnerabilities, regulatory changes, and competitive pressures through diversified sourcing, flexible production systems, and continuous innovation investment that maintains market relevance and competitive advantage in dynamic market conditions.

Long-term projections for the Europe juices market indicate continued evolution toward premium products, functional nutrition, and sustainable practices that align with broader consumer lifestyle trends and environmental consciousness. The market is expected to maintain steady growth momentum with annual increases of approximately 4.8% driven by innovation, premiumization, and geographic expansion into emerging European markets.

Innovation trajectories point toward personalized nutrition solutions, plant-based alternatives, and functional ingredient integration that transform traditional juice products into comprehensive wellness solutions. Technology integration including AI-driven flavor development and precision nutrition will enable customized products that meet individual health goals and taste preferences.

Market structure evolution suggests increasing consolidation among traditional players while creating opportunities for specialized organic producers and innovative startups that address niche consumer segments. Direct-to-consumer models and subscription services will gain importance as companies seek to capture higher margins and build stronger customer relationships.

Sustainability requirements will become standard market expectations rather than competitive differentiators, driving industry-wide adoption of circular economy principles, carbon-neutral production, and regenerative agriculture practices. Companies that proactively embrace these trends will maintain competitive advantages in increasingly environmentally conscious markets.

MarkWide Research projections indicate that functional juice categories will represent approximately 25% of total market volume within the next five years, reflecting the transformation of juice products from simple beverages to comprehensive nutrition solutions that support active lifestyles and health optimization goals across diverse European consumer segments.

The Europe juices market stands at a transformative juncture where traditional beverage categories evolve into sophisticated wellness solutions that address contemporary consumer needs and values. Market dynamics demonstrate resilient growth potential supported by innovation, premiumization, and sustainability integration that positions European juice producers as global industry leaders in quality and environmental responsibility.

Strategic opportunities abound for companies that embrace consumer-centric innovation, sustainable practices, and technology integration while maintaining the quality standards and authentic flavors that define European juice excellence. The market’s evolution toward functional nutrition and personalized solutions creates new revenue streams and competitive advantages for forward-thinking industry participants.

Future success in the European juice market will depend on companies’ ability to balance traditional appeal with innovative functionality, premium positioning with accessible pricing, and global scale with local relevance. The industry’s commitment to sustainability, transparency, and health optimization aligns with broader societal trends that support long-term market stability and growth potential across diverse European consumer segments and geographic markets.

What is Juice?

Juice refers to the liquid extracted from fruits and vegetables, often consumed as a beverage. It can be fresh, pasteurized, or concentrated, and is popular for its nutritional benefits and refreshing taste.

What are the key players in the Europe Juices Market?

Key players in the Europe Juices Market include companies like Tropicana Products, Inc., Innocent Drinks, and Hain Celestial Group, among others. These companies are known for their diverse product offerings and strong market presence.

What are the main drivers of growth in the Europe Juices Market?

The Europe Juices Market is driven by increasing health consciousness among consumers, a growing demand for natural and organic products, and the rising popularity of functional beverages. Additionally, innovations in packaging and flavors are attracting more consumers.

What challenges does the Europe Juices Market face?

The Europe Juices Market faces challenges such as stringent regulations on food safety and labeling, competition from alternative beverages, and fluctuating raw material prices. These factors can impact production costs and market dynamics.

What opportunities exist in the Europe Juices Market?

Opportunities in the Europe Juices Market include the expansion of cold-pressed juices, the introduction of new flavors and blends, and the growing trend of health and wellness products. Additionally, increasing online sales channels present new avenues for growth.

What trends are shaping the Europe Juices Market?

Trends in the Europe Juices Market include a shift towards sustainable packaging, the rise of plant-based juices, and the incorporation of superfoods into juice products. These trends reflect changing consumer preferences and a focus on health and sustainability.

Europe Juices Market

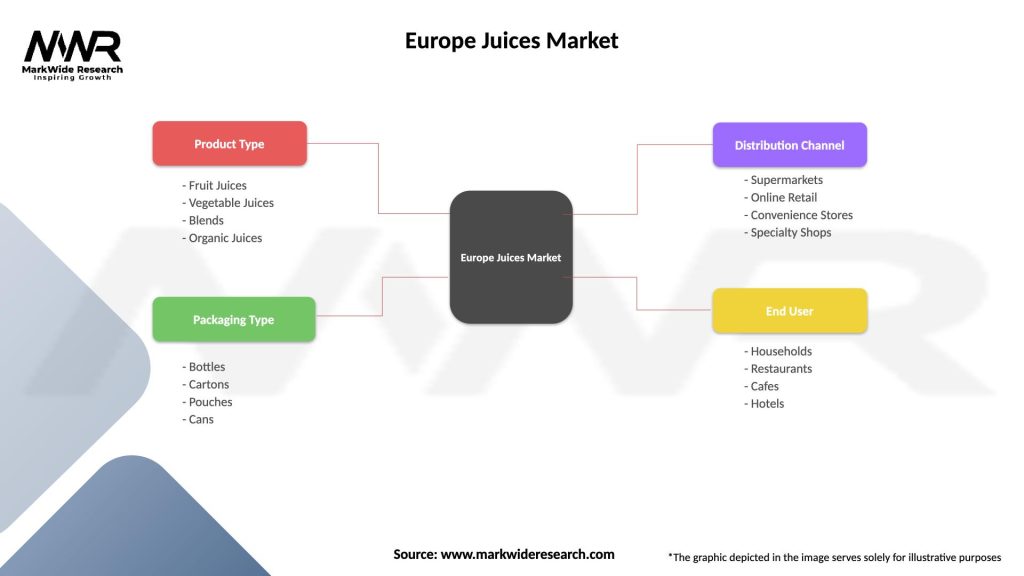

| Segmentation Details | Description |

|---|---|

| Product Type | Fruit Juices, Vegetable Juices, Blends, Organic Juices |

| Packaging Type | Bottles, Cartons, Pouches, Cans |

| Distribution Channel | Supermarkets, Online Retail, Convenience Stores, Specialty Shops |

| End User | Households, Restaurants, Cafes, Hotels |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Juices Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at