444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe IT recruitment market represents a dynamic and rapidly evolving sector that serves as the backbone of the continent’s digital transformation initiatives. This specialized recruitment domain focuses on connecting skilled technology professionals with organizations seeking to enhance their digital capabilities across diverse industries. The market encompasses various recruitment methodologies, including traditional staffing agencies, specialized IT recruitment firms, freelance platforms, and emerging AI-driven talent acquisition solutions.

Market dynamics indicate robust growth driven by the accelerating digitalization across European enterprises, with the sector experiencing a compound annual growth rate of 8.2% over recent years. The increasing demand for specialized skills in areas such as cloud computing, artificial intelligence, cybersecurity, and software development has created unprecedented opportunities for recruitment service providers. Technology adoption rates across European businesses have surged by 67% since 2020, directly correlating with heightened demand for IT talent acquisition services.

Regional variations within Europe showcase distinct patterns, with Western European markets demonstrating mature recruitment ecosystems while Eastern European countries exhibit rapid growth potential. The market’s complexity is further amplified by varying regulatory frameworks, language requirements, and cultural considerations that influence recruitment strategies across different European nations.

The Europe IT recruitment market refers to the comprehensive ecosystem of services, platforms, and organizations dedicated to sourcing, evaluating, and placing information technology professionals within European companies and institutions. This market encompasses both permanent and temporary staffing solutions, spanning from entry-level positions to executive leadership roles in technology-driven organizations.

Core components of this market include specialized recruitment agencies, internal corporate talent acquisition teams, freelance and contract staffing platforms, executive search firms focusing on technology leadership, and innovative recruitment technology solutions. The market serves diverse stakeholders including multinational corporations, small and medium enterprises, government agencies, and emerging technology startups seeking to build or expand their technical capabilities.

Service delivery models within this market range from traditional headhunting approaches to modern AI-powered matching algorithms, reflecting the industry’s evolution toward more efficient and precise talent acquisition methodologies.

Strategic positioning of the Europe IT recruitment market reveals a sector experiencing unprecedented transformation driven by digital acceleration, skills shortages, and evolving workplace dynamics. The market demonstrates remarkable resilience and adaptability, with recruitment firms increasingly leveraging advanced technologies to enhance their service delivery capabilities and improve candidate-client matching accuracy.

Key performance indicators highlight significant growth momentum, with 74% of European organizations reporting increased IT recruitment activities compared to previous years. The market’s evolution is characterized by the emergence of specialized niche recruitment services, increased focus on remote and hybrid work arrangements, and growing emphasis on diversity and inclusion initiatives within technology hiring practices.

Competitive landscape features a mix of established international recruitment giants, regional specialists, and innovative technology-driven platforms. The sector’s fragmentation creates opportunities for specialized service providers while maintaining healthy competition that drives innovation and service quality improvements. Market consolidation trends indicate strategic acquisitions and partnerships as firms seek to expand their geographical reach and service capabilities.

Fundamental insights into the Europe IT recruitment market reveal several critical trends shaping its trajectory:

Primary growth drivers propelling the Europe IT recruitment market forward encompass both technological and socioeconomic factors that create sustained demand for specialized recruitment services. The accelerating pace of digital transformation across European industries serves as the fundamental catalyst, with organizations requiring continuous access to skilled technology professionals to maintain competitive advantages.

Digital transformation initiatives across European enterprises have intensified significantly, with 82% of organizations reporting active digitalization projects requiring specialized IT talent. This transformation encompasses cloud migration projects, artificial intelligence implementations, cybersecurity enhancements, and digital customer experience improvements, all demanding specific technical expertise that traditional recruitment approaches struggle to identify and secure.

Skills shortage dynamics create persistent demand for recruitment services, as the supply of qualified IT professionals consistently lags behind market requirements. The emergence of new technologies and evolving technical requirements necessitate continuous talent acquisition efforts, with organizations relying on specialized recruitment partners to navigate complex skill assessment and candidate evaluation processes.

Regulatory compliance requirements across European markets drive demand for recruitment services that understand local employment laws, data protection regulations, and industry-specific compliance standards. Organizations increasingly value recruitment partners who can ensure compliant hiring processes while maintaining efficiency and effectiveness in talent acquisition activities.

Significant challenges facing the Europe IT recruitment market include structural limitations and external factors that constrain growth potential and operational efficiency. The fundamental skills shortage that drives market demand simultaneously creates service delivery challenges, as recruitment firms struggle to maintain adequate candidate pipelines for client requirements.

Economic uncertainties across European markets periodically impact recruitment spending, with organizations reducing external recruitment investments during economic downturns or uncertainty periods. These cyclical challenges require recruitment firms to maintain flexible business models and diversified service offerings to sustain operations during challenging periods.

Regulatory complexity across different European jurisdictions creates operational challenges for recruitment firms seeking to provide cross-border services. Varying employment laws, tax regulations, and compliance requirements increase operational costs and complexity, particularly for smaller recruitment organizations lacking extensive legal and regulatory expertise.

Technology disruption presents both opportunities and threats, as emerging recruitment technologies potentially reduce demand for traditional recruitment services while requiring significant investments in new capabilities and platforms. Organizations must balance innovation investments with maintaining core service quality and profitability.

Emerging opportunities within the Europe IT recruitment market reflect evolving technology landscapes, changing work patterns, and expanding digital adoption across industries. The growing emphasis on specialized technical skills creates premium recruitment opportunities, with organizations willing to invest significantly in accessing rare and highly valuable technical expertise.

Artificial intelligence integration presents substantial opportunities for recruitment firms to enhance their service delivery capabilities, improve candidate matching accuracy, and reduce time-to-hire metrics. Organizations implementing AI-powered recruitment solutions report 45% improvement in candidate quality and 38% reduction in recruitment cycle times, indicating significant value creation potential.

Cross-border talent mobility within Europe creates opportunities for recruitment firms to facilitate international placements and support organizations in accessing broader talent pools. The increasing acceptance of remote work arrangements expands geographical recruitment boundaries and enables access to previously unavailable talent markets.

Niche specialization opportunities emerge as technology domains become increasingly complex and specialized. Recruitment firms focusing on specific technical areas such as blockchain development, quantum computing, or advanced cybersecurity can command premium pricing and develop sustainable competitive advantages through deep domain expertise.

Complex market dynamics shape the Europe IT recruitment landscape through interconnected factors including supply-demand imbalances, technological evolution, and changing employment preferences. The fundamental tension between limited IT talent supply and growing demand creates a seller’s market for skilled professionals while driving innovation in recruitment methodologies and service delivery approaches.

Competitive pressures within the market drive continuous service innovation and specialization, with recruitment firms differentiating through technology adoption, industry expertise, and service quality improvements. The market’s fragmented nature enables both large-scale operations and specialized boutique firms to coexist and serve different market segments effectively.

Technology adoption cycles significantly influence market dynamics, as emerging technologies create new skill requirements while potentially obsoleting others. Recruitment firms must continuously adapt their expertise and candidate networks to align with evolving technology trends and client requirements. MarkWide Research analysis indicates that recruitment firms investing in continuous technology education report 52% higher client retention rates.

Economic cycles impact market dynamics through varying levels of recruitment activity, with economic growth periods driving increased hiring while downturns may reduce recruitment spending. However, the essential nature of IT skills in modern business operations provides some insulation from economic volatility compared to other recruitment sectors.

Comprehensive research approaches employed in analyzing the Europe IT recruitment market combine quantitative data analysis with qualitative insights gathered from industry stakeholders, recruitment professionals, and technology organizations. The methodology encompasses primary research through surveys and interviews with key market participants, secondary research utilizing industry reports and publications, and analytical modeling to project market trends and developments.

Data collection processes involve systematic gathering of information from multiple sources including recruitment firms, technology companies, industry associations, and regulatory bodies across European markets. This multi-source approach ensures comprehensive coverage of market dynamics and reduces potential bias from single-source dependencies.

Analytical frameworks applied to market data include trend analysis, competitive positioning assessment, regulatory impact evaluation, and technology adoption modeling. These frameworks enable identification of key market drivers, growth opportunities, and potential challenges facing market participants.

Validation procedures ensure research accuracy through cross-referencing data sources, expert review processes, and market participant feedback incorporation. The methodology emphasizes transparency and reproducibility while maintaining confidentiality of sensitive commercial information provided by market participants.

Western European markets demonstrate mature IT recruitment ecosystems characterized by established service providers, sophisticated client requirements, and high levels of technology adoption. Countries including Germany, France, and the United Kingdom maintain the largest recruitment markets, with Germany accounting for 28% of regional recruitment activity and France representing 22% of the market share.

Nordic countries exhibit distinctive characteristics including high technology adoption rates, progressive employment practices, and strong emphasis on work-life balance considerations in recruitment processes. These markets demonstrate premium pricing for recruitment services while maintaining high service quality expectations and regulatory compliance standards.

Eastern European markets show rapid growth potential driven by expanding technology sectors, increasing foreign investment, and growing domestic demand for IT services. Countries such as Poland, Czech Republic, and Romania experience growth rates exceeding 12% annually in IT recruitment activities, reflecting their emergence as significant technology hubs.

Southern European markets including Spain, Italy, and Portugal demonstrate recovering growth following economic challenges, with increasing technology adoption and digital transformation initiatives driving recruitment demand. These markets benefit from competitive cost structures while developing sophisticated technology capabilities and talent pools.

Market leadership within the Europe IT recruitment sector features a diverse ecosystem of service providers ranging from global recruitment giants to specialized boutique firms. The competitive landscape reflects market fragmentation that enables various business models and service approaches to coexist successfully.

Major international players maintain significant market presence through:

Regional specialists and boutique firms compete effectively through deep local market knowledge, specialized technical expertise, and personalized service delivery approaches. These organizations often focus on specific technology domains or geographical markets to develop competitive advantages.

Technology-driven platforms represent emerging competitive forces, utilizing artificial intelligence, machine learning, and advanced matching algorithms to enhance recruitment efficiency and effectiveness. These platforms challenge traditional recruitment models while creating new service delivery possibilities.

Service type segmentation within the Europe IT recruitment market encompasses diverse delivery models addressing varying client requirements and candidate preferences:

By Service Type:

By Technology Domain:

By Organization Size:

Permanent placement services continue to dominate the market, representing approximately 58% of total recruitment activity across European markets. This segment benefits from stable revenue streams and long-term client relationships, though faces increasing competition from alternative employment models and direct hiring initiatives by technology companies.

Contract staffing segments demonstrate the highest growth rates, driven by organizational preferences for flexible workforce management and project-based technology initiatives. The contract market enables organizations to access specialized skills for specific durations while providing professionals with diverse experience opportunities and flexible work arrangements.

Executive search services command premium pricing due to the specialized nature of senior technology leadership roles and the complex evaluation processes required. This segment requires deep industry knowledge, extensive professional networks, and sophisticated assessment capabilities to successfully place senior technology executives.

Emerging technology specializations including artificial intelligence, blockchain, and quantum computing create high-value recruitment opportunities with limited candidate supply. Recruitment firms developing expertise in these domains can command significant premiums while building sustainable competitive advantages through specialized knowledge and candidate networks.

Recruitment firms operating in the Europe IT recruitment market benefit from sustained demand driven by digital transformation initiatives and persistent skills shortages. The market’s growth trajectory provides opportunities for revenue expansion, service diversification, and geographical market expansion while enabling specialization in high-value technology domains.

Technology organizations gain access to specialized recruitment expertise, expanded candidate networks, and efficient hiring processes that reduce time-to-hire and improve candidate quality. Professional recruitment services enable organizations to focus on core business activities while ensuring access to required technical talent for growth and innovation initiatives.

IT professionals benefit from enhanced career opportunities, competitive compensation packages, and access to diverse employment options including permanent, contract, and freelance arrangements. Professional recruitment services provide career guidance, skill development insights, and market intelligence that support career advancement and professional growth.

Economic stakeholders including governments and industry associations benefit from efficient labor market functioning, reduced unemployment in technical sectors, and enhanced competitiveness of European technology industries. Effective IT recruitment markets support innovation, economic growth, and technological advancement across European economies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence adoption represents the most significant trend reshaping the Europe IT recruitment market, with recruitment firms increasingly implementing AI-powered candidate matching, resume screening, and predictive analytics capabilities. These technologies enable more efficient candidate identification, improved matching accuracy, and reduced recruitment cycle times while enhancing overall service quality.

Remote work normalization has fundamentally altered recruitment practices, expanding geographical boundaries for both candidates and clients while creating new service delivery models. Recruitment firms now regularly facilitate cross-border placements and support fully remote employment arrangements, requiring adaptation of assessment and onboarding processes.

Diversity and inclusion emphasis drives recruitment firms to implement inclusive hiring practices, diverse candidate sourcing strategies, and bias reduction technologies. Organizations increasingly evaluate recruitment partners based on their ability to deliver diverse candidate pools and support inclusive hiring objectives, with 71% of European companies prioritizing diversity in their recruitment partner selection criteria.

Skills-based hiring approaches gain prominence as organizations focus on specific technical capabilities rather than traditional qualification requirements. This trend requires recruitment firms to develop sophisticated skill assessment capabilities and maintain detailed candidate competency profiles to support precise matching processes.

Technology platform investments by major recruitment firms continue accelerating, with significant resources allocated to developing proprietary recruitment technologies, candidate relationship management systems, and client service platforms. These investments aim to enhance service delivery efficiency, improve candidate and client experiences, and create competitive differentiation through technology capabilities.

Strategic acquisitions and partnerships reshape the competitive landscape as recruitment firms seek to expand their geographical reach, technology capabilities, and specialized expertise. Recent consolidation activities focus on acquiring niche specialists, technology platforms, and regional market leaders to create comprehensive service offerings.

Regulatory compliance initiatives across European markets drive recruitment firms to invest in compliance management systems, data protection capabilities, and legal expertise. The implementation of GDPR and evolving employment regulations require continuous adaptation of recruitment processes and technology systems to ensure compliance.

Sustainability integration emerges as recruitment firms incorporate environmental, social, and governance considerations into their operations and service delivery. This includes supporting clients’ sustainability objectives through talent acquisition strategies and implementing sustainable business practices within recruitment operations.

Technology investment priorities should focus on artificial intelligence capabilities, candidate relationship management systems, and predictive analytics platforms that enhance recruitment efficiency and service quality. MWR analysis suggests that recruitment firms investing in comprehensive technology platforms achieve 35% higher client satisfaction rates and improved operational margins.

Specialization strategies offer significant opportunities for recruitment firms to differentiate their services and command premium pricing through deep expertise in specific technology domains. Organizations should consider focusing on emerging technologies, industry-specific requirements, or geographical markets where they can develop sustainable competitive advantages.

Partnership development with technology companies, educational institutions, and professional associations can enhance candidate sourcing capabilities, improve market intelligence, and create additional revenue opportunities. Strategic partnerships enable recruitment firms to access broader talent pools and develop specialized expertise more efficiently.

Service diversification beyond traditional recruitment services should include talent consulting, workforce planning, and technology skills assessment services that provide additional value to clients while creating new revenue streams. These expanded services can improve client relationships and reduce dependence on transactional recruitment activities.

Market trajectory for the Europe IT recruitment sector indicates continued growth driven by sustained digital transformation initiatives, emerging technology adoption, and persistent skills shortages across European markets. The sector’s evolution toward more sophisticated, technology-enabled service delivery models positions it for enhanced efficiency and service quality improvements.

Technology integration will accelerate significantly, with artificial intelligence, machine learning, and predictive analytics becoming standard components of recruitment service delivery. These technologies will enable more precise candidate matching, improved efficiency, and enhanced client and candidate experiences while creating new service possibilities and competitive advantages.

Market consolidation trends are expected to continue as recruitment firms seek scale advantages, expanded geographical reach, and enhanced technology capabilities through strategic acquisitions and partnerships. This consolidation will create larger, more capable service providers while maintaining opportunities for specialized niche players.

Regulatory evolution across European markets will continue shaping recruitment practices, with increasing emphasis on data protection, employment rights, and ethical recruitment practices. Recruitment firms must maintain adaptability and compliance capabilities to navigate evolving regulatory requirements while maintaining service quality and efficiency.

The Europe IT recruitment market represents a dynamic and essential component of the continent’s technology ecosystem, serving as the critical bridge between skilled IT professionals and organizations requiring technical expertise. The market’s robust growth trajectory, driven by digital transformation initiatives and persistent skills shortages, creates sustained opportunities for recruitment service providers while presenting operational challenges that require innovative solutions and strategic adaptation.

Strategic positioning within this market requires careful consideration of technology investments, specialization opportunities, and service delivery innovations that differentiate providers in an increasingly competitive landscape. The successful recruitment firms of the future will be those that effectively integrate advanced technologies, develop deep specialized expertise, and maintain adaptability to evolving market conditions and client requirements.

Market evolution toward more sophisticated, technology-enabled service delivery models promises enhanced efficiency, improved service quality, and new value creation opportunities for all market participants. The continued growth of European technology sectors, combined with ongoing digital transformation initiatives, ensures sustained demand for professional IT recruitment services while creating opportunities for innovation and market expansion across the diverse European landscape.

What is IT Recruitment?

IT Recruitment refers to the process of identifying, attracting, and hiring candidates for information technology positions. This includes roles such as software developers, system analysts, and IT project managers, among others.

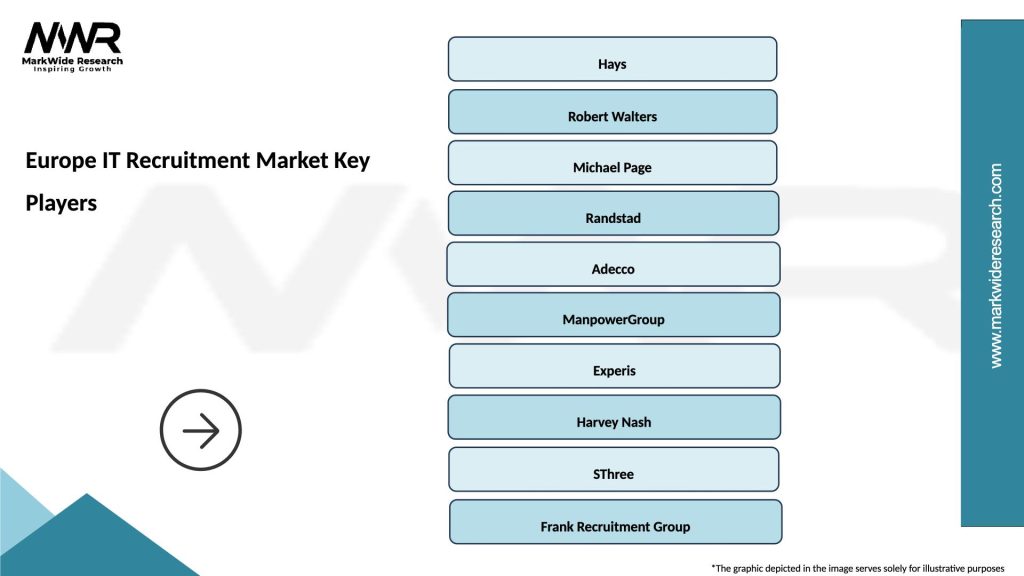

What are the key players in the Europe IT Recruitment Market?

Key players in the Europe IT Recruitment Market include companies like Hays, Robert Half, and Michael Page, which specialize in connecting IT professionals with employers. These firms often focus on various sectors such as cybersecurity, software development, and data analytics, among others.

What are the main drivers of growth in the Europe IT Recruitment Market?

The growth of the Europe IT Recruitment Market is driven by the increasing demand for digital transformation, the rise of remote work, and the need for specialized IT skills. Companies are seeking talent in areas like cloud computing, artificial intelligence, and cybersecurity to stay competitive.

What challenges does the Europe IT Recruitment Market face?

The Europe IT Recruitment Market faces challenges such as a talent shortage in key IT areas, high competition among employers, and the rapid pace of technological change. These factors can make it difficult for companies to find qualified candidates quickly.

What opportunities exist in the Europe IT Recruitment Market?

Opportunities in the Europe IT Recruitment Market include the growing emphasis on diversity and inclusion in hiring practices, the expansion of remote work options, and the increasing use of AI in recruitment processes. These trends can help companies attract a broader range of candidates.

What trends are shaping the Europe IT Recruitment Market?

Trends shaping the Europe IT Recruitment Market include the rise of freelance and contract work, the integration of technology in recruitment processes, and a focus on employer branding. Companies are leveraging social media and online platforms to enhance their recruitment strategies.

Europe IT Recruitment Market

| Segmentation Details | Description |

|---|---|

| End User | Corporations, Startups, Government Agencies, Non-Profits |

| Service Type | Permanent Placement, Contract Staffing, Executive Search, Freelance Services |

| Industry Vertical | Finance, Healthcare, Retail, Telecommunications |

| Technology | Cloud Computing, Cybersecurity, Data Analytics, Artificial Intelligence |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe IT Recruitment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at