444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe IP camera market represents a dynamic and rapidly evolving segment within the broader surveillance and security technology landscape. Internet Protocol cameras have fundamentally transformed how organizations and individuals approach security monitoring, offering advanced digital capabilities that far exceed traditional analog systems. The European market demonstrates particularly strong adoption rates, driven by stringent security regulations, increasing urbanization, and growing awareness of security threats across both commercial and residential sectors.

Market dynamics in Europe reflect a sophisticated understanding of surveillance technology, with countries like Germany, the United Kingdom, France, and the Netherlands leading adoption initiatives. The region’s emphasis on data privacy and security standards has created a unique environment where IP camera solutions must balance advanced functionality with compliance requirements. Current growth trajectories indicate the market is expanding at a robust CAGR of 12.3%, reflecting strong demand across multiple application segments.

Technological advancement serves as a primary catalyst for market expansion, with innovations in artificial intelligence, edge computing, and cloud integration driving new deployment scenarios. European enterprises increasingly recognize IP cameras as essential components of comprehensive security ecosystems, integrating seamlessly with access control systems, alarm networks, and business intelligence platforms.

The Europe IP camera market refers to the comprehensive ecosystem of Internet Protocol-based surveillance cameras, supporting infrastructure, software platforms, and related services operating across European territories. IP cameras utilize digital technology to capture, process, and transmit video data over network connections, enabling remote monitoring, advanced analytics, and seamless integration with modern security management systems.

Core functionality encompasses high-definition video capture, real-time streaming, motion detection, facial recognition, and automated alert generation. Unlike traditional analog systems, IP camera solutions offer scalable architectures that can accommodate everything from single-camera residential installations to enterprise-grade deployments spanning multiple locations. The European market specifically emphasizes solutions that comply with GDPR regulations and other regional privacy standards.

Market scope includes hardware components such as cameras, network video recorders, and storage systems, alongside software platforms for video management, analytics, and system administration. Professional services encompassing installation, maintenance, and system integration represent additional market segments experiencing significant growth across European territories.

Strategic positioning within the European security technology landscape positions IP cameras as fundamental infrastructure for modern surveillance requirements. The market demonstrates exceptional resilience and growth potential, supported by increasing security concerns, regulatory compliance needs, and technological advancement across multiple industry verticals. MarkWide Research analysis indicates that European organizations are prioritizing intelligent surveillance solutions that offer both security enhancement and operational efficiency benefits.

Key growth drivers include rising crime rates in urban areas, increased terrorist threats, growing adoption of smart city initiatives, and expanding retail security requirements. The market benefits from Europe’s advanced telecommunications infrastructure, which supports high-bandwidth video streaming and cloud-based analytics platforms. Commercial adoption rates currently exceed 78% among large enterprises, while residential market penetration continues expanding rapidly.

Competitive dynamics feature a mix of established global manufacturers and innovative European technology companies, creating a diverse ecosystem of solutions tailored to regional preferences and requirements. The market’s evolution toward AI-powered analytics, edge computing capabilities, and integrated security platforms represents significant opportunities for continued expansion and technological differentiation.

Market intelligence reveals several critical insights that define the European IP camera landscape and its future trajectory:

Market maturation indicators suggest European customers now prioritize total cost of ownership, system reliability, and vendor support capabilities over initial purchase price considerations. This evolution creates opportunities for premium solution providers offering comprehensive service packages and advanced technical capabilities.

Security concerns represent the primary catalyst driving IP camera adoption across European markets. Rising urban crime rates, increased terrorist activities, and growing awareness of security vulnerabilities motivate both commercial and residential customers to invest in advanced surveillance solutions. Government initiatives promoting smart city development and public safety enhancement create additional demand for large-scale IP camera deployments.

Regulatory compliance requirements across various industries necessitate comprehensive video surveillance capabilities. Financial institutions, healthcare facilities, educational establishments, and retail operations must maintain detailed security records to satisfy regulatory obligations. Insurance companies increasingly offer premium discounts for properties equipped with professional-grade IP camera systems, creating additional economic incentives for adoption.

Technological advancement continues expanding the value proposition of IP camera solutions. Integration with artificial intelligence platforms enables automated threat detection, behavioral analysis, and predictive security capabilities. Cloud computing adoption eliminates traditional infrastructure limitations, allowing organizations to scale surveillance systems without significant capital investments in on-premises hardware.

Cost reduction in camera hardware and supporting infrastructure makes advanced surveillance solutions accessible to smaller organizations and residential customers. Improved manufacturing efficiency and increased competition among suppliers drive down equipment costs while simultaneously improving feature sets and reliability standards.

Privacy concerns represent significant challenges for IP camera market expansion across European territories. GDPR compliance requirements create complex implementation scenarios, particularly for systems that capture images in public spaces or multi-tenant environments. Organizations must balance security objectives with privacy protection obligations, often requiring specialized legal and technical expertise.

Cybersecurity vulnerabilities associated with network-connected cameras create hesitation among potential adopters. High-profile security breaches involving compromised surveillance systems highlight the importance of robust cybersecurity measures. Network security concerns require ongoing investment in encryption, authentication, and system monitoring capabilities that increase total cost of ownership.

Technical complexity associated with advanced IP camera systems can overwhelm organizations lacking specialized IT expertise. Integration with existing security infrastructure, network configuration requirements, and ongoing system maintenance demand technical skills that may not be available internally. This complexity often necessitates professional installation and support services, increasing implementation costs.

Bandwidth limitations in some European regions constrain the deployment of high-resolution IP camera systems. Rural areas and older urban infrastructure may lack sufficient network capacity to support multiple high-definition video streams. Internet connectivity reliability issues can compromise system effectiveness and user confidence in IP camera solutions.

Artificial intelligence integration presents substantial opportunities for market expansion and differentiation. Machine learning algorithms enable advanced analytics capabilities including facial recognition, behavior analysis, and automated threat detection. European organizations increasingly seek intelligent surveillance solutions that reduce false alarms while improving security effectiveness through automated monitoring and alert generation.

Smart city initiatives across European municipalities create significant opportunities for large-scale IP camera deployments. Traffic monitoring, public safety enhancement, and urban planning applications require comprehensive surveillance infrastructure. Government funding for smart city projects provides financial support for advanced surveillance technology adoption, creating favorable market conditions for solution providers.

Retail analytics applications extend IP camera functionality beyond traditional security monitoring. Customer behavior analysis, inventory management, and operational efficiency optimization represent growing application areas. Retail sector adoption of analytics-enabled cameras currently shows growth rates exceeding 15% annually, indicating substantial market potential.

Cloud-based solutions eliminate traditional infrastructure barriers while enabling scalable deployment models. Software-as-a-Service platforms reduce upfront investment requirements and provide automatic updates and feature enhancements. Subscription-based models make advanced surveillance capabilities accessible to smaller organizations while creating recurring revenue opportunities for solution providers.

Competitive intensity within the European IP camera market drives continuous innovation and price optimization. Established manufacturers compete with emerging technology companies, creating a dynamic environment that benefits end customers through improved features and competitive pricing. Market consolidation trends indicate larger companies acquiring specialized technology providers to expand their solution portfolios and market reach.

Technology evolution cycles accelerate as manufacturers integrate cutting-edge capabilities including artificial intelligence, edge computing, and advanced analytics. Product lifecycles continue shortening as new features and capabilities become available, requiring vendors to maintain aggressive development schedules while ensuring backward compatibility with existing installations.

Customer expectations evolve toward comprehensive security ecosystems rather than standalone camera solutions. Integration capabilities with access control systems, alarm networks, and business intelligence platforms become essential requirements. System interoperability standards gain importance as organizations seek to avoid vendor lock-in while maximizing their technology investments.

Supply chain dynamics influence product availability and pricing across European markets. Global semiconductor shortages and manufacturing constraints impact delivery schedules and cost structures. Regional manufacturing initiatives aim to reduce dependency on Asian suppliers while ensuring compliance with European quality and environmental standards.

Comprehensive analysis of the European IP camera market employs multiple research methodologies to ensure accuracy and completeness of findings. Primary research activities include structured interviews with industry executives, technology vendors, system integrators, and end-user organizations across major European markets. Survey data collection encompasses quantitative metrics regarding adoption rates, spending patterns, and technology preferences.

Secondary research incorporates analysis of industry reports, regulatory filings, patent databases, and technical publications to understand market trends and competitive dynamics. Market sizing methodologies utilize bottom-up and top-down approaches, validating findings through multiple data sources and analytical frameworks.

Geographic coverage spans major European markets including Germany, United Kingdom, France, Italy, Spain, Netherlands, and Nordic countries. Regional analysis considers local regulatory requirements, economic conditions, and cultural factors that influence IP camera adoption patterns. Segmentation analysis examines market dynamics across application areas, technology types, and customer segments.

Data validation processes ensure research findings accurately reflect current market conditions and future trends. Expert interviews and industry workshops provide qualitative insights that complement quantitative analysis. Forecasting models incorporate multiple scenarios to account for potential market disruptions and technology evolution patterns.

Germany leads European IP camera adoption with the highest market share at approximately 28% of regional demand. The country’s strong manufacturing sector, advanced telecommunications infrastructure, and emphasis on security technology create favorable conditions for market growth. German enterprises particularly favor high-quality, feature-rich solutions that offer long-term reliability and comprehensive technical support.

United Kingdom represents the second-largest market, accounting for roughly 22% of European IP camera installations. Brexit-related security concerns and increased focus on urban surveillance drive demand for advanced monitoring solutions. London’s extensive CCTV network serves as a model for other European cities considering large-scale IP camera deployments.

France demonstrates strong growth in both commercial and residential segments, with particular emphasis on privacy-compliant solutions. French regulations regarding surveillance technology create unique requirements that influence product development and market positioning strategies. The country’s focus on domestic technology suppliers creates opportunities for European manufacturers.

Nordic countries including Sweden, Norway, and Denmark show high adoption rates for premium IP camera solutions. Environmental considerations drive demand for energy-efficient cameras and sustainable manufacturing practices. These markets demonstrate willingness to invest in advanced features and long-term service agreements.

Southern European markets including Italy and Spain experience rapid growth driven by tourism industry security requirements and urban development projects. Mediterranean regions particularly value outdoor-rated cameras with advanced weather protection and solar power capabilities.

Market leadership within the European IP camera sector features a diverse mix of global technology companies and specialized regional providers. The competitive environment encourages innovation while maintaining focus on quality, reliability, and customer service excellence.

Competitive strategies focus on technology differentiation, regional partnerships, and comprehensive service offerings. European manufacturers leverage local market knowledge and regulatory compliance expertise to compete effectively against global suppliers. Innovation in AI-powered analytics, cybersecurity features, and cloud integration capabilities drives competitive positioning.

Technology segmentation reveals distinct preferences across different application scenarios and customer requirements:

By Resolution:

By Application:

By Connectivity:

Indoor IP cameras dominate the European market with approximately 65% market share, driven by extensive commercial and residential applications. These systems emphasize image quality, low-light performance, and integration capabilities with existing security infrastructure. Dome cameras remain popular for retail and office environments due to their discrete appearance and vandal-resistant design.

Outdoor surveillance systems represent the fastest-growing segment, expanding at rates exceeding 14% annually. Weather-resistant cameras with advanced night vision capabilities address growing demand for perimeter security and public area monitoring. Solar-powered options gain traction for remote locations and temporary installations where traditional power sources are unavailable.

PTZ cameras (Pan-Tilt-Zoom) serve specialized applications requiring active monitoring and detailed investigation capabilities. These systems find particular favor in large-scale commercial deployments and public safety applications. Intelligent tracking features automatically follow subjects of interest while maintaining optimal image quality and coverage.

Thermal imaging cameras address specific security and safety requirements in industrial and critical infrastructure applications. European regulations regarding privacy protection make thermal cameras attractive for applications where traditional visible-light cameras might raise compliance concerns. Integration with AI analytics enables automated detection of temperature anomalies and security threats.

End users benefit from enhanced security capabilities, reduced operational costs, and improved situational awareness through advanced IP camera deployments. Remote monitoring capabilities enable centralized security management across multiple locations while reducing staffing requirements. Integration with business intelligence systems provides valuable insights into customer behavior, operational efficiency, and facility utilization patterns.

System integrators capitalize on growing demand for comprehensive security solutions that combine IP cameras with access control, alarm systems, and analytics platforms. Professional services opportunities include system design, installation, maintenance, and ongoing support contracts. Specialization in specific vertical markets or technology areas enables differentiation and premium pricing strategies.

Technology vendors benefit from expanding market opportunities driven by increasing security awareness and regulatory compliance requirements. Recurring revenue models through cloud services, software licensing, and maintenance contracts provide stable income streams. Innovation in AI capabilities, edge computing, and cybersecurity features creates competitive advantages and market differentiation opportunities.

Channel partners including distributors and resellers gain access to growing markets with strong demand fundamentals. Training programs and technical certification initiatives enable partners to develop expertise in advanced technologies while building customer confidence. Vendor support programs provide marketing resources, technical assistance, and competitive positioning tools.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend transforming European IP camera markets. Machine learning algorithms enable automated threat detection, facial recognition, and behavioral analysis capabilities that extend surveillance functionality far beyond traditional monitoring. Current adoption rates for AI-enabled cameras reach 38% in commercial applications, with rapid growth expected across all market segments.

Edge computing capabilities reduce bandwidth requirements while improving real-time response capabilities. Local processing enables immediate threat detection and response without dependence on cloud connectivity. This trend particularly benefits applications in remote locations or environments with limited network infrastructure.

Cloud-based video management systems gain popularity as organizations seek scalable, cost-effective alternatives to on-premises infrastructure. Software-as-a-Service models provide automatic updates, remote access capabilities, and reduced IT maintenance requirements. European data residency requirements drive demand for cloud services with local data storage and processing capabilities.

Cybersecurity enhancement becomes increasingly critical as IP cameras integrate with broader network infrastructure. Advanced encryption, multi-factor authentication, and secure communication protocols address growing concerns about surveillance system vulnerabilities. Manufacturers invest heavily in security features to maintain customer confidence and regulatory compliance.

Mobile integration enables remote monitoring and system management through smartphone and tablet applications. Real-time alerts, live video streaming, and system configuration capabilities provide unprecedented flexibility for security personnel and facility managers.

Strategic partnerships between camera manufacturers and software companies accelerate innovation in analytics and system integration capabilities. Collaborative development initiatives focus on creating comprehensive security ecosystems that address evolving customer requirements while maintaining interoperability standards.

Acquisition activity continues as larger companies seek to expand their technology portfolios and market reach. MarkWide Research analysis indicates consolidation trends particularly affect specialized analytics companies and regional system integrators. These transactions enable broader solution offerings while potentially reducing competitive intensity in certain market segments.

Regulatory developments across European jurisdictions influence product development and market positioning strategies. Updated privacy regulations require enhanced data protection features and user consent mechanisms. Manufacturers adapt their solutions to ensure compliance while maintaining functionality and user experience quality.

Technology standardization efforts promote interoperability and reduce integration complexity for end users. Industry associations work to establish common protocols and certification programs that benefit both manufacturers and customers through improved compatibility and reduced implementation risks.

Sustainability initiatives drive development of energy-efficient cameras and environmentally responsible manufacturing practices. Green technology features including solar power options and recyclable materials address growing environmental concerns among European customers and regulatory bodies.

Technology investment priorities should focus on artificial intelligence capabilities, cybersecurity features, and cloud integration functionality. Market leaders will distinguish themselves through comprehensive analytics platforms that provide actionable insights beyond basic surveillance capabilities. Investment in edge computing capabilities enables competitive differentiation while addressing bandwidth and latency concerns.

Geographic expansion strategies should prioritize markets with strong economic fundamentals and supportive regulatory environments. Eastern European countries represent significant growth opportunities as infrastructure development and security awareness increase. Partnership with local system integrators provides market access while ensuring cultural and regulatory compliance.

Vertical market specialization enables premium pricing and reduced competitive pressure through deep industry expertise. Healthcare, education, and retail sectors demonstrate particularly strong growth potential with specific compliance and operational requirements. Developing industry-specific solutions and certification programs creates sustainable competitive advantages.

Service portfolio expansion beyond hardware sales creates recurring revenue opportunities and stronger customer relationships. Managed services, cloud hosting, and analytics-as-a-service models provide stable income streams while reducing customer implementation complexity. Professional services including system design, installation, and ongoing support command premium pricing.

Partnership strategies with complementary technology providers enable comprehensive solution offerings without internal development costs. Integration partnerships with access control, alarm, and building management system vendors create complete security ecosystems that address broader customer requirements.

Market evolution toward intelligent surveillance ecosystems will accelerate over the next five years, driven by advancing AI capabilities and increasing customer sophistication. European adoption of analytics-enabled cameras is projected to reach 72% by 2028, representing substantial growth from current levels. Integration with IoT platforms and smart building systems will create new application scenarios and value propositions.

Technology convergence between surveillance, access control, and building automation systems will reshape market dynamics and competitive positioning. Unified platforms that manage multiple security functions through single interfaces will become standard requirements for large-scale deployments. This convergence creates opportunities for comprehensive solution providers while challenging traditional single-function vendors.

Regulatory evolution will continue influencing product development and market strategies across European territories. Enhanced privacy protection requirements may drive demand for privacy-by-design solutions that automatically anonymize or encrypt sensitive data. Compliance automation features will become essential for maintaining market access and customer confidence.

Cloud adoption will accelerate as organizations recognize the scalability and cost benefits of software-as-a-service models. MWR projections indicate cloud-based video management systems will capture over 55% market share within the next four years. This transition creates opportunities for service-oriented business models while potentially disrupting traditional hardware-centric approaches.

Emerging applications in retail analytics, traffic management, and environmental monitoring will expand the total addressable market beyond traditional security applications. Smart city initiatives across European municipalities will drive large-scale deployments that integrate surveillance with urban planning and public service optimization.

The Europe IP camera market demonstrates exceptional growth potential driven by advancing technology capabilities, increasing security awareness, and supportive regulatory frameworks. Market dynamics favor solutions that combine advanced surveillance functionality with privacy protection and cybersecurity features that address European regulatory requirements and customer preferences.

Competitive success will increasingly depend on comprehensive solution portfolios that extend beyond traditional camera hardware to include analytics software, cloud services, and professional support capabilities. Technology innovation in artificial intelligence, edge computing, and system integration will differentiate market leaders from commodity providers while creating sustainable competitive advantages.

Future growth opportunities span multiple application areas including smart cities, retail analytics, and industrial monitoring, indicating strong market fundamentals that support continued expansion. European market characteristics including sophisticated customers, advanced infrastructure, and supportive regulations create favorable conditions for premium solution providers focused on quality, reliability, and comprehensive service offerings.

Strategic positioning should emphasize technology leadership, regulatory compliance, and customer partnership approaches that address the unique requirements of European markets. Organizations that successfully navigate privacy regulations while delivering advanced surveillance capabilities will capture disproportionate market share in this dynamic and rapidly evolving sector.

What is IP Camera?

An IP camera, or Internet Protocol camera, is a type of digital video camera that transmits data over a network or the internet. These cameras are commonly used for surveillance and security purposes in various settings, including homes, businesses, and public spaces.

What are the key players in the Europe IP Camera Market?

Key players in the Europe IP Camera Market include Axis Communications, Hikvision, and Dahua Technology, which are known for their innovative surveillance solutions. Other notable companies include Bosch Security Systems and Panasonic, among others.

What are the main drivers of growth in the Europe IP Camera Market?

The growth of the Europe IP Camera Market is driven by increasing security concerns, advancements in technology, and the rising demand for smart home solutions. Additionally, the integration of AI and IoT in surveillance systems is enhancing their functionality and appeal.

What challenges does the Europe IP Camera Market face?

The Europe IP Camera Market faces challenges such as privacy concerns, regulatory compliance issues, and the high costs associated with advanced surveillance technologies. These factors can hinder market growth and adoption in certain regions.

What opportunities exist in the Europe IP Camera Market?

Opportunities in the Europe IP Camera Market include the growing demand for cloud-based surveillance solutions and the expansion of smart city initiatives. Additionally, the increasing adoption of IP cameras in retail and transportation sectors presents significant growth potential.

What trends are shaping the Europe IP Camera Market?

Trends shaping the Europe IP Camera Market include the shift towards wireless and high-definition cameras, the integration of advanced analytics, and the rise of mobile surveillance applications. These trends are enhancing the effectiveness and accessibility of security solutions.

Europe IP Camera Market

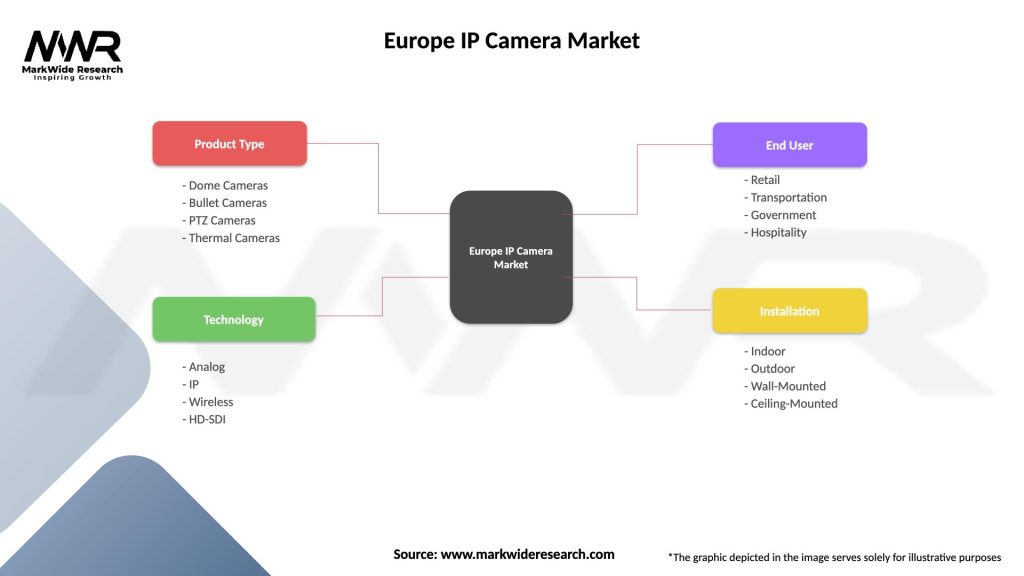

| Segmentation Details | Description |

|---|---|

| Product Type | Dome Cameras, Bullet Cameras, PTZ Cameras, Thermal Cameras |

| Technology | Analog, IP, Wireless, HD-SDI |

| End User | Retail, Transportation, Government, Hospitality |

| Installation | Indoor, Outdoor, Wall-Mounted, Ceiling-Mounted |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe IP Camera Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at