444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe integrated circuits market represents one of the most dynamic and technologically advanced sectors within the global semiconductor industry. This comprehensive market encompasses a vast array of electronic components that form the backbone of modern digital infrastructure, from consumer electronics to industrial automation systems. European nations have established themselves as key players in the integrated circuits ecosystem, with countries like Germany, France, the Netherlands, and the United Kingdom leading innovation in semiconductor design and manufacturing.

Market dynamics in the European region reflect a strong emphasis on technological sovereignty and advanced manufacturing capabilities. The market has experienced robust growth driven by increasing demand for automotive electronics, industrial IoT applications, and next-generation telecommunications infrastructure. European manufacturers and design houses have positioned themselves strategically to capture opportunities in emerging technologies such as artificial intelligence, 5G communications, and electric vehicle systems.

Regional characteristics of the European integrated circuits market include a strong focus on research and development, substantial government support for semiconductor initiatives, and strategic partnerships between academic institutions and industry leaders. The market benefits from advanced manufacturing facilities and a skilled workforce that supports both established semiconductor companies and innovative startups developing cutting-edge integrated circuit solutions.

The Europe integrated circuits market refers to the comprehensive ecosystem of semiconductor devices, design services, manufacturing capabilities, and related technologies operating within European territories. This market encompasses the development, production, and distribution of integrated circuits that serve as fundamental building blocks for electronic systems across multiple industries and applications.

Integrated circuits themselves are sophisticated electronic components that combine multiple electronic elements such as transistors, resistors, and capacitors onto a single semiconductor substrate, typically silicon. These components enable complex electronic functions while maintaining compact form factors and high reliability standards essential for modern technological applications.

European market scope includes various categories of integrated circuits ranging from simple analog components to complex digital processors, memory devices, and specialized application-specific integrated circuits (ASICs). The market also encompasses supporting infrastructure including design software, testing equipment, and manufacturing technologies that enable the development and production of these critical electronic components.

Strategic positioning of the European integrated circuits market demonstrates significant strength in specialized applications and advanced technology segments. The region has developed particular expertise in automotive semiconductors, industrial automation components, and high-performance computing solutions that serve both domestic and global markets. European companies have established competitive advantages through focused innovation and strategic partnerships with leading technology firms worldwide.

Market growth drivers include accelerating digital transformation initiatives across European industries, increasing adoption of electric vehicles, and expanding deployment of IoT devices in smart city applications. The market benefits from substantial investment in research and development activities, with European governments and private sector organizations committing significant resources to semiconductor technology advancement and manufacturing capability enhancement.

Competitive landscape features a mix of established multinational corporations and innovative smaller companies that specialize in niche applications and emerging technologies. European market participants have demonstrated particular strength in developing integrated circuits for automotive safety systems, renewable energy applications, and advanced manufacturing automation solutions that align with regional sustainability and efficiency objectives.

Technology trends shaping the European integrated circuits market reveal several critical developments that influence market dynamics and growth opportunities:

Market segmentation reveals diverse applications spanning consumer electronics, automotive systems, industrial equipment, telecommunications infrastructure, and emerging technology sectors. Each segment demonstrates unique growth patterns and technology requirements that influence overall market development and investment priorities.

Digital transformation initiatives across European industries serve as a primary catalyst for integrated circuits market growth. Organizations throughout the region are implementing advanced digital technologies to improve operational efficiency, enhance customer experiences, and maintain competitive advantages in global markets. This transformation requires sophisticated semiconductor solutions that can support complex data processing, connectivity, and automation requirements.

Automotive industry evolution represents another significant driver, with European automakers leading global efforts to develop electric vehicles, autonomous driving systems, and connected car technologies. These applications demand specialized integrated circuits that can handle high-power management, advanced sensor processing, and real-time communication functions while meeting stringent automotive safety and reliability standards.

Government support programs throughout Europe provide substantial backing for semiconductor industry development through funding initiatives, research grants, and strategic partnerships. The European Chips Act and similar regional programs demonstrate commitment to strengthening semiconductor capabilities and reducing dependence on external suppliers while fostering innovation in critical technology areas.

Industrial automation advancement continues driving demand for integrated circuits that enable smart manufacturing, predictive maintenance, and efficient resource management. European manufacturers are investing heavily in Industry 4.0 technologies that require sophisticated semiconductor solutions for sensor networks, edge computing, and automated control systems.

Supply chain complexities present ongoing challenges for the European integrated circuits market, particularly regarding access to raw materials and manufacturing capacity during periods of high global demand. These constraints can impact production schedules, increase costs, and limit the ability of European companies to meet customer requirements in competitive timeframes.

High development costs associated with advanced semiconductor technologies create barriers for smaller companies and startups seeking to enter the market or develop innovative solutions. The substantial investment required for research and development, manufacturing equipment, and skilled personnel can limit participation in certain market segments and slow innovation cycles.

Regulatory compliance requirements across different European markets can create complexity and additional costs for integrated circuits manufacturers. Varying standards, certification processes, and environmental regulations require companies to adapt their products and processes to meet diverse regional requirements while maintaining cost competitiveness.

Talent shortage in specialized semiconductor engineering and design roles constrains market growth potential. The complex technical requirements of modern integrated circuits development require highly skilled professionals, and competition for qualified candidates can limit expansion capabilities and innovation speed for European companies.

Emerging technology applications present substantial growth opportunities for European integrated circuits companies, particularly in areas such as quantum computing, advanced AI processing, and next-generation telecommunications systems. These applications require specialized semiconductor solutions that leverage European expertise in high-performance computing and advanced materials science.

Sustainability-focused applications align well with European environmental priorities and create opportunities for integrated circuits that enable renewable energy systems, energy-efficient building management, and electric transportation infrastructure. The region’s commitment to carbon neutrality goals drives demand for semiconductor solutions that support clean technology implementations.

Strategic partnerships between European companies and global technology leaders offer opportunities to access new markets, share development costs, and accelerate innovation cycles. These collaborations can help European firms leverage their specialized expertise while gaining access to broader distribution networks and complementary technologies.

Government procurement programs and public sector digitization initiatives create stable demand for integrated circuits solutions in areas such as smart city infrastructure, healthcare technology, and educational systems. These opportunities provide European companies with predictable revenue streams while supporting regional development objectives.

Competitive intensity within the European integrated circuits market reflects both regional competition and global market pressures. European companies compete not only among themselves but also with major international semiconductor manufacturers, creating a dynamic environment that drives innovation and efficiency improvements. This competition has resulted in enhanced product quality and accelerated development cycles across the market.

Technology convergence trends are reshaping market dynamics as traditional boundaries between different types of integrated circuits become less distinct. The integration of analog and digital functions, the incorporation of AI capabilities into standard processors, and the development of system-on-chip solutions are creating new market categories and competitive dynamics.

Customer requirements evolution continues influencing market dynamics as end-users demand more sophisticated functionality, higher performance, and greater energy efficiency from integrated circuits solutions. These evolving requirements drive continuous innovation and create opportunities for companies that can anticipate and respond to changing market needs effectively.

Investment patterns in the European integrated circuits market show increasing focus on strategic technologies and applications that align with regional priorities. Venture capital, government funding, and corporate investment are concentrating on areas such as automotive semiconductors, industrial IoT, and sustainable technology applications that offer long-term growth potential.

Comprehensive market analysis for the European integrated circuits market employs multiple research methodologies to ensure accurate and reliable insights. Primary research activities include extensive interviews with industry executives, technology experts, and market participants across different European countries to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research components involve systematic analysis of industry reports, company financial statements, patent filings, and regulatory documents to understand market structure, competitive positioning, and technology development patterns. This research approach provides quantitative validation for qualitative insights gathered through primary research activities.

Data validation processes ensure research findings accuracy through cross-referencing multiple sources, statistical analysis of market data, and expert review of research conclusions. MarkWide Research employs rigorous quality control measures to verify data accuracy and eliminate potential biases that could affect research reliability.

Market modeling techniques utilize advanced analytical tools to project market trends, assess growth scenarios, and evaluate the impact of various factors on market development. These models incorporate historical data, current market conditions, and expert projections to provide comprehensive market forecasts and strategic insights for stakeholders.

Germany maintains its position as the largest European integrated circuits market, driven by strong automotive and industrial sectors that demand sophisticated semiconductor solutions. The country’s advanced manufacturing capabilities and substantial R&D investments support both domestic consumption and export activities. German companies have developed particular expertise in automotive semiconductors and industrial automation components, with market share reaching approximately 28% of the European total.

France demonstrates significant strength in specialized integrated circuits applications, particularly in aerospace, defense, and telecommunications sectors. French companies have established competitive advantages in high-reliability semiconductor solutions and advanced materials science applications. The country’s focus on digital sovereignty initiatives supports continued investment in domestic semiconductor capabilities, representing approximately 18% market share within the European region.

Netherlands has emerged as a critical hub for semiconductor equipment and advanced manufacturing technologies, with companies like ASML providing essential lithography equipment for global chip production. The country’s strategic position in the semiconductor supply chain extends beyond equipment to include design services and specialized component manufacturing, accounting for roughly 15% of European market activity.

United Kingdom maintains strong capabilities in semiconductor design and specialized applications, particularly in areas such as RF components, power management, and custom integrated circuits. Despite Brexit-related challenges, UK companies continue to play important roles in global semiconductor supply chains, representing approximately 12% of European market share.

Market leadership in the European integrated circuits sector features a diverse mix of multinational corporations, regional specialists, and innovative technology companies. The competitive environment reflects both established players with decades of experience and emerging companies developing next-generation semiconductor solutions.

Strategic positioning among these companies varies significantly, with some focusing on high-volume standard products while others specialize in custom solutions for specific applications. The competitive landscape continues evolving as companies adapt to changing market requirements and emerging technology opportunities.

By Product Type: The European integrated circuits market encompasses various product categories, each serving distinct applications and market requirements:

By Application: Market segmentation by end-use applications reveals diverse demand patterns:

By Technology Node: Manufacturing process segmentation reflects different performance and cost characteristics:

Automotive semiconductor segment represents the fastest-growing category within the European integrated circuits market, driven by accelerating adoption of electric vehicles and advanced driver assistance systems. This segment benefits from stringent safety requirements that favor European suppliers with proven reliability and quality management capabilities. Growth rates in this category consistently exceed 12% annually as automotive manufacturers integrate more sophisticated electronic systems.

Industrial IoT applications demonstrate strong growth potential as European manufacturers implement smart factory technologies and predictive maintenance systems. This category requires specialized integrated circuits that can operate reliably in harsh industrial environments while providing advanced connectivity and processing capabilities. Market adoption rates for industrial IoT semiconductors have reached approximately 35% penetration across European manufacturing facilities.

Consumer electronics segment shows steady demand patterns with particular strength in premium and specialized applications. European consumers demonstrate preferences for high-quality electronic devices that support advanced features and sustainable design principles. This segment benefits from growing demand for smart home technologies and wearable devices that require sophisticated semiconductor solutions.

Telecommunications infrastructure category experiences significant growth driven by 5G network deployment and fiber optic expansion across European markets. This segment requires high-performance integrated circuits capable of handling increased data throughput and reduced latency requirements. Investment in telecommunications infrastructure has increased by approximately 25% annually in recent years.

Manufacturers in the European integrated circuits market benefit from access to advanced research facilities, skilled engineering talent, and supportive government policies that encourage innovation and technology development. The region’s emphasis on quality and reliability enables manufacturers to command premium pricing for specialized applications while building long-term customer relationships.

Technology companies gain advantages through collaboration opportunities with leading European universities and research institutions, facilitating access to cutting-edge research and development capabilities. These partnerships enable accelerated innovation cycles and provide pathways for commercializing advanced semiconductor technologies.

End-user industries benefit from proximity to semiconductor suppliers, enabling closer collaboration in product development and faster response to changing requirements. European integrated circuits suppliers often provide customized solutions and application-specific support that enhance end-product performance and differentiation.

Investors find attractive opportunities in the European integrated circuits market due to strong fundamentals, government support, and growing demand from key application sectors. The market offers diverse investment options ranging from established companies with stable revenue streams to innovative startups developing breakthrough technologies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents a transformative trend affecting the European integrated circuits market, with increasing demand for specialized AI processors and machine learning accelerators. European companies are developing AI-optimized semiconductor solutions that can handle complex computational tasks while maintaining energy efficiency standards required for edge computing applications.

Sustainability focus continues gaining momentum as European companies and customers prioritize environmentally responsible semiconductor solutions. This trend drives development of energy-efficient integrated circuits and sustainable manufacturing processes that align with European environmental regulations and corporate sustainability commitments.

Edge computing expansion creates opportunities for integrated circuits that can process data locally rather than relying on cloud-based systems. This trend supports real-time processing requirements and data privacy concerns while reducing bandwidth requirements and improving system responsiveness across various applications.

Automotive electrification accelerates demand for power management integrated circuits, battery management systems, and electric motor control solutions. European automotive suppliers are investing heavily in electric vehicle semiconductor technologies to support the transition away from internal combustion engines.

5G and beyond telecommunications advancement requires sophisticated RF integrated circuits and high-speed signal processing components. European companies are developing next-generation communication semiconductors that can support increased data rates and reduced latency requirements for advanced telecommunications applications.

Strategic partnerships between European semiconductor companies and global technology leaders have accelerated in recent years, enabling access to new markets and complementary technologies. These collaborations often focus on emerging application areas such as autonomous vehicles, industrial IoT, and advanced telecommunications systems.

Manufacturing capacity expansion initiatives across Europe reflect growing confidence in regional market demand and strategic importance of semiconductor production capabilities. Several companies have announced significant investment programs to expand fabrication facilities and develop advanced manufacturing processes.

Research and development investments in next-generation semiconductor technologies have increased substantially, with both private companies and government organizations committing resources to areas such as quantum computing, advanced materials, and novel device architectures.

Acquisition activities within the European integrated circuits market have intensified as companies seek to expand capabilities, access new technologies, and strengthen market positions. These transactions often involve specialized technology companies with expertise in emerging application areas.

Regulatory developments including the European Chips Act and related initiatives demonstrate government commitment to strengthening regional semiconductor capabilities and reducing dependence on external suppliers. These programs provide substantial funding support for research, development, and manufacturing activities.

Market participants should focus on developing specialized capabilities in high-growth application areas such as automotive electronics, industrial IoT, and sustainable technology solutions. MarkWide Research analysis indicates that companies with strong positions in these segments are likely to achieve above-average growth rates and maintain competitive advantages.

Investment strategies should prioritize research and development activities that align with European technology priorities and sustainability objectives. Companies that can demonstrate environmental benefits and energy efficiency improvements are likely to receive favorable treatment from both customers and government support programs.

Partnership opportunities with academic institutions, research organizations, and complementary technology companies can accelerate innovation and reduce development costs. These collaborations often provide access to specialized expertise and funding opportunities that support advanced technology development.

Supply chain resilience should remain a priority for European integrated circuits companies, with emphasis on developing alternative sourcing options and reducing dependencies on single suppliers. Companies should invest in supply chain visibility and risk management capabilities to minimize potential disruptions.

Talent development initiatives are essential for maintaining competitive advantages in the highly technical integrated circuits market. Companies should invest in training programs, university partnerships, and workforce development activities to ensure access to qualified engineering and technical personnel.

Long-term growth prospects for the European integrated circuits market remain positive, driven by continued digital transformation, automotive electrification, and industrial automation trends. The market is expected to maintain steady growth momentum with particular strength in specialized applications that leverage European technological expertise and quality advantages.

Technology evolution will continue shaping market dynamics, with emerging areas such as quantum computing, advanced AI processing, and next-generation telecommunications creating new opportunities for European companies. The region’s strong research capabilities and government support position it well to participate in these high-value technology segments.

Sustainability requirements are expected to become increasingly important market drivers, with European regulations and customer preferences favoring environmentally responsible semiconductor solutions. Companies that can demonstrate clear sustainability benefits are likely to gain competitive advantages and access to premium market segments.

Market consolidation may accelerate as companies seek to achieve scale advantages and access complementary technologies. However, the specialized nature of many European integrated circuits companies suggests that niche market leaders will continue to thrive alongside larger multinational corporations.

Government support through programs such as the European Chips Act is expected to continue providing substantial backing for semiconductor industry development. This support should help European companies maintain technological leadership and expand manufacturing capabilities while reducing dependence on external suppliers. MWR projects that sustained government investment will contribute to enhanced market competitiveness and technological advancement across the region.

The Europe integrated circuits market demonstrates remarkable resilience and innovation capacity, positioning the region as a critical player in the global semiconductor ecosystem. With strong foundations in automotive electronics, industrial automation, and specialized applications, European companies have established competitive advantages that support continued growth and market leadership in key technology segments.

Strategic opportunities abound for market participants who can effectively leverage European strengths in quality, innovation, and customer collaboration while addressing challenges related to cost competitiveness and manufacturing scale. The combination of government support, technological expertise, and growing demand from key application sectors creates a favorable environment for continued market development and expansion.

Future success in the European integrated circuits market will depend on companies’ ability to adapt to evolving technology requirements, maintain innovation leadership, and develop sustainable business models that align with regional priorities and global market demands. Organizations that can effectively balance specialization with scalability while maintaining quality and reliability standards are likely to achieve the strongest performance in this dynamic and competitive market environment.

What is Integrated Circuits?

Integrated Circuits (ICs) are semiconductor devices that combine multiple electronic components into a single chip, enabling efficient processing and functionality in various applications such as consumer electronics, telecommunications, and automotive systems.

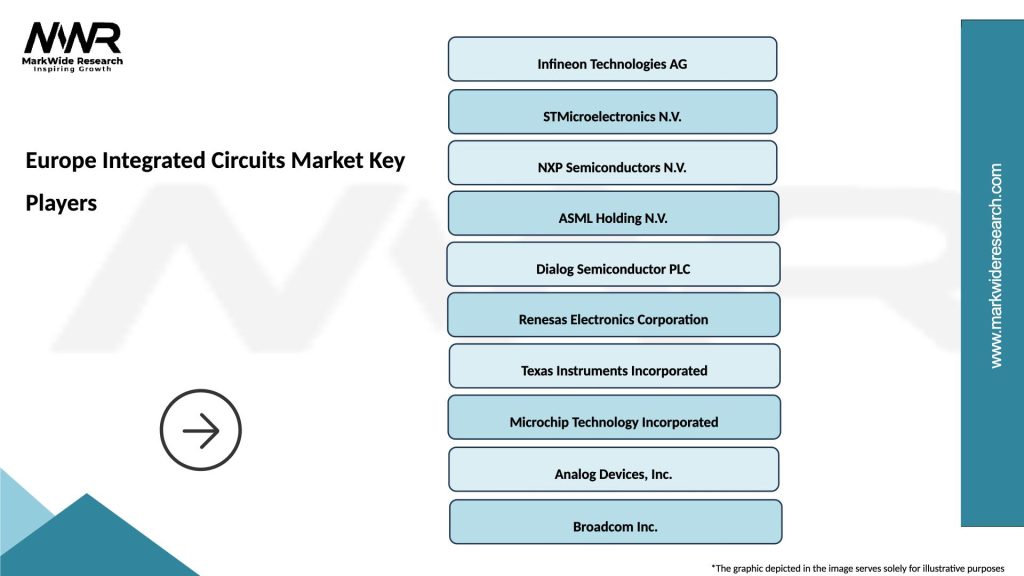

What are the key players in the Europe Integrated Circuits Market?

Key players in the Europe Integrated Circuits Market include companies like STMicroelectronics, Infineon Technologies, and NXP Semiconductors, which are known for their innovations in microcontrollers and power management solutions, among others.

What are the main drivers of the Europe Integrated Circuits Market?

The Europe Integrated Circuits Market is driven by the increasing demand for consumer electronics, advancements in automotive technology, and the growth of the Internet of Things (IoT), which require sophisticated ICs for enhanced functionality.

What challenges does the Europe Integrated Circuits Market face?

Challenges in the Europe Integrated Circuits Market include supply chain disruptions, the high cost of research and development, and intense competition among manufacturers, which can impact pricing and innovation.

What opportunities exist in the Europe Integrated Circuits Market?

Opportunities in the Europe Integrated Circuits Market include the rising adoption of artificial intelligence in electronics, the expansion of smart home devices, and the increasing focus on renewable energy technologies that require advanced ICs.

What trends are shaping the Europe Integrated Circuits Market?

Trends in the Europe Integrated Circuits Market include the miniaturization of components, the integration of AI capabilities into ICs, and the growing emphasis on energy-efficient designs to meet sustainability goals.

Europe Integrated Circuits Market

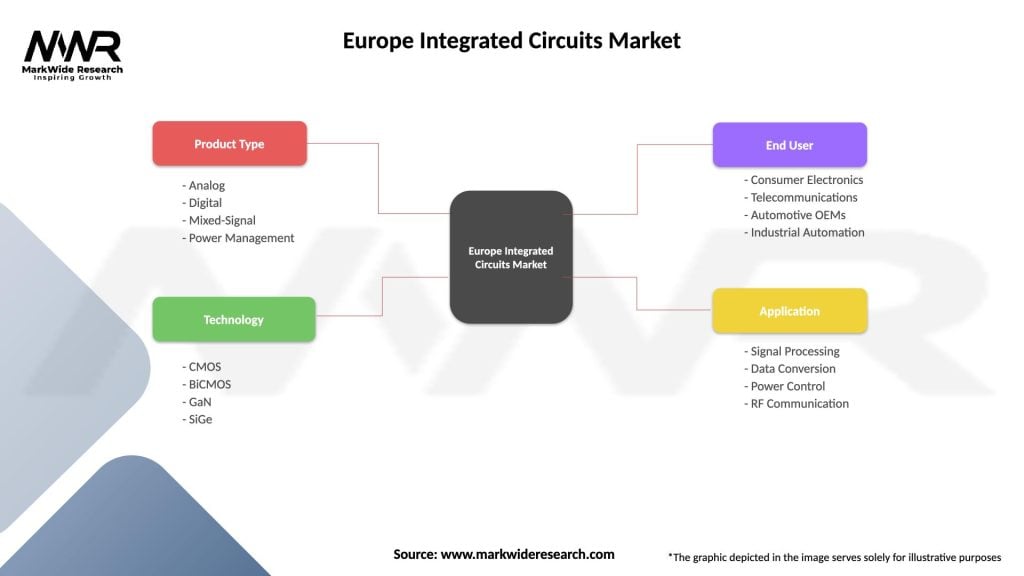

| Segmentation Details | Description |

|---|---|

| Product Type | Analog, Digital, Mixed-Signal, Power Management |

| Technology | CMOS, BiCMOS, GaN, SiGe |

| End User | Consumer Electronics, Telecommunications, Automotive OEMs, Industrial Automation |

| Application | Signal Processing, Data Conversion, Power Control, RF Communication |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Integrated Circuits Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at