444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The Europe Insurance Telematics Market has been witnessing remarkable growth in recent years, driven by the increasing adoption of telematics-based insurance solutions by insurance providers and consumers alike. Telematics technology, which involves the use of advanced communication systems to monitor and analyze driving behavior, has revolutionized the insurance industry. This technology enables insurers to offer personalized insurance plans based on individual driving patterns, leading to fairer premiums and incentivizing safer driving practices.

Meaning

Insurance telematics, also known as usage-based insurance (UBI) or pay-as-you-drive (PAYD) insurance, is a method of calculating insurance premiums based on the actual usage of a vehicle. It involves the installation of telematics devices in vehicles, which collect data on driving behavior, including factors like speed, distance, acceleration, braking, and time of driving. This data is then transmitted to insurance companies, allowing them to assess risk accurately and provide customized insurance policies.

Executive Summary

The Europe Insurance Telematics Market has experienced substantial growth over the past few years, with advancements in telematics technology and increased consumer awareness about its benefits. This report aims to provide comprehensive insights into the market dynamics, key trends, drivers, restraints, opportunities, and the impact of the Covid-19 pandemic. Furthermore, it highlights the competitive landscape, regional analysis, and key industry developments that will shape the future outlook of the market.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

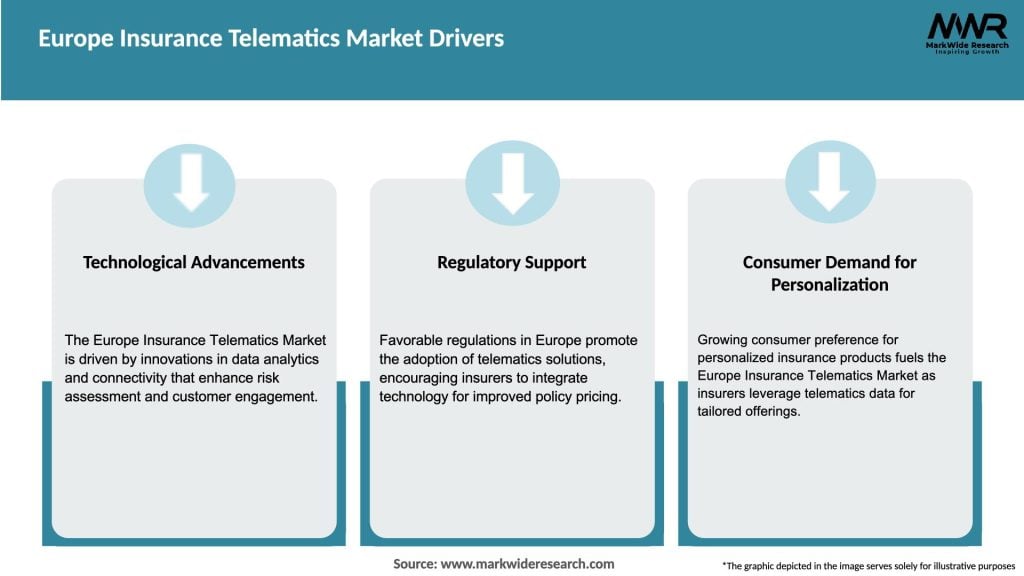

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Europe Insurance Telematics Market is experiencing dynamic growth, driven by the convergence of advanced technologies, changing consumer preferences, and a shift towards data-driven decision-making in the insurance industry. As insurers embrace telematics to stay competitive, the market is witnessing increased investments in research and development to improve the accuracy and efficiency of telematics systems.

Regional Analysis

The report provides a comprehensive regional analysis of the Europe Insurance Telematics Market, focusing on key countries like the United Kingdom, Germany, France, Italy, Spain, and others. Each country has its own regulatory environment, driving behavior, and insurance market dynamics, impacting the adoption of telematics solutions.

Competitive Landscape

Leading Companies in Europe Insurance Telematics Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

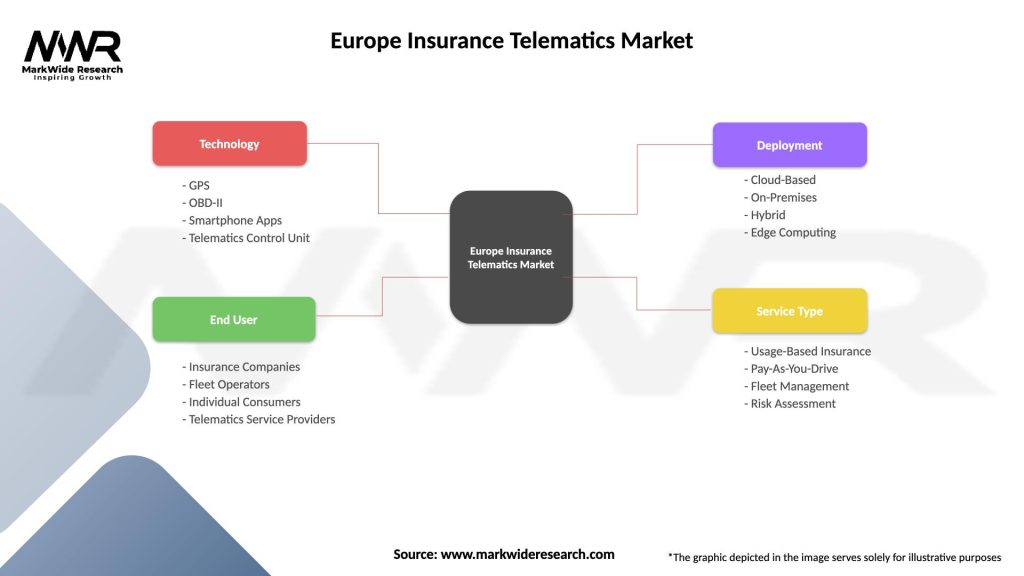

The Europe Insurance Telematics Market can be segmented based on:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths: Accurate risk assessment, cost savings for policyholders, and regulatory support.

Weaknesses: Privacy concerns, high initial costs, and limited consumer awareness.

Opportunities: Partnerships with automakers and expanding telematics usage to other insurance segments.

Threats: Intense competition among insurance companies and potential data breaches impacting consumer trust.

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a mixed impact on the insurance telematics market. While there was a decline in driving activity during lockdowns, the demand for usage-based insurance increased as consumers sought more affordable coverage options.

Key Industry Developments

The Europe Insurance Telematics Market has seen several key developments:

Analyst Suggestions

Future Outlook

The future of the Europe Insurance Telematics Market looks promising, with continued advancements in telematics technology, increasing consumer awareness, and regulatory support. As insurers embrace data-driven solutions, insurance telematics is poised to become mainstream across various insurance segments.

Conclusion

The Europe Insurance Telematics Market is witnessing significant growth, driven by the demand for personalized insurance plans, cost savings, and advancements in telematics technology. Despite some challenges, the market offers lucrative opportunities for insurance companies, technology providers, and consumers. As the market continues to evolve, collaboration between stakeholders and a focus on customer-centric solutions will be key to long-term success in the insurance telematics industry.

What is Insurance Telematics?

Insurance telematics refers to the use of telematics technology to collect data on driving behavior, which is then used by insurance companies to assess risk and determine premiums. This technology often involves GPS and onboard diagnostics to monitor speed, braking, and other driving patterns.

What are the key players in the Europe Insurance Telematics Market?

Key players in the Europe Insurance Telematics Market include companies like Octo Telematics, Vodafone Automotive, and Cambridge Mobile Telematics, among others. These companies are known for their innovative solutions in data collection and analysis for insurance purposes.

What are the growth factors driving the Europe Insurance Telematics Market?

The growth of the Europe Insurance Telematics Market is driven by increasing demand for personalized insurance products, advancements in telematics technology, and a growing focus on road safety. Additionally, the rise in connected vehicles is contributing to the market’s expansion.

What challenges does the Europe Insurance Telematics Market face?

Challenges in the Europe Insurance Telematics Market include concerns over data privacy and security, regulatory compliance issues, and the need for consumer education regarding telematics-based insurance. These factors can hinder widespread adoption among potential users.

What opportunities exist in the Europe Insurance Telematics Market?

Opportunities in the Europe Insurance Telematics Market include the potential for partnerships between insurers and automotive manufacturers, the development of new telematics applications, and the increasing integration of artificial intelligence in risk assessment. These trends can enhance service offerings and customer engagement.

What trends are shaping the Europe Insurance Telematics Market?

Trends shaping the Europe Insurance Telematics Market include the rise of usage-based insurance models, advancements in mobile app technology for real-time data access, and the growing importance of sustainability in insurance practices. These trends are influencing how insurers approach risk management and customer interaction.

Europe Insurance Telematics Market

| Segmentation Details | Description |

|---|---|

| Technology | GPS, OBD-II, Smartphone Apps, Telematics Control Unit |

| End User | Insurance Companies, Fleet Operators, Individual Consumers, Telematics Service Providers |

| Deployment | Cloud-Based, On-Premises, Hybrid, Edge Computing |

| Service Type | Usage-Based Insurance, Pay-As-You-Drive, Fleet Management, Risk Assessment |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Europe Insurance Telematics Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at