444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe insulin pumps market represents a rapidly evolving segment of the diabetes management industry, characterized by significant technological advancement and growing patient adoption. Insulin pump therapy has emerged as a preferred treatment option for individuals with Type 1 diabetes and select Type 2 diabetes patients across European nations. The market demonstrates robust growth driven by increasing diabetes prevalence, technological innovations, and enhanced healthcare infrastructure supporting continuous glucose monitoring integration.

Market dynamics indicate substantial expansion opportunities, with the region experiencing a 6.8% CAGR in insulin pump adoption rates. European healthcare systems increasingly recognize the long-term benefits of pump therapy, including improved glycemic control, reduced hypoglycemic episodes, and enhanced quality of life for diabetes patients. Germany, France, and the United Kingdom lead market penetration, while emerging markets in Eastern Europe present significant growth potential.

Technological convergence between insulin pumps and continuous glucose monitoring systems has revolutionized diabetes management, creating integrated solutions that offer real-time glucose monitoring and automated insulin delivery. This advancement positions Europe as a key market for next-generation diabetes management technologies, with 65% of new pump users opting for integrated systems that combine pump therapy with continuous glucose monitoring capabilities.

The Europe insulin pumps market refers to the comprehensive ecosystem encompassing the development, manufacturing, distribution, and utilization of insulin delivery devices across European countries. These sophisticated medical devices provide continuous subcutaneous insulin infusion, replacing traditional multiple daily injection regimens for diabetes management.

Insulin pumps are battery-operated devices that deliver rapid-acting insulin through a catheter placed under the skin, programmed to provide both basal insulin throughout the day and bolus doses during meals. The European market encompasses various pump technologies, including traditional pumps, patch pumps, and advanced hybrid closed-loop systems that integrate with continuous glucose monitors for automated insulin delivery.

Market scope includes device manufacturing, software development, consumable supplies, patient training services, and ongoing technical support. European regulatory frameworks, particularly CE marking requirements, ensure device safety and efficacy while facilitating market access across member states. The market serves diverse patient populations, from pediatric users to elderly patients, each requiring specialized pump features and support services.

Europe’s insulin pumps market demonstrates exceptional growth momentum, driven by rising diabetes prevalence, technological innovation, and supportive healthcare policies. The market benefits from strong reimbursement frameworks in major European countries, facilitating patient access to advanced pump technologies. Market penetration rates vary significantly across regions, with Nordic countries achieving 45% adoption rates among Type 1 diabetes patients, while Southern and Eastern European markets present substantial growth opportunities.

Key market drivers include increasing awareness of pump therapy benefits, healthcare provider education initiatives, and continuous technological improvements. The integration of artificial intelligence and machine learning algorithms into pump systems has enhanced insulin delivery precision, reducing patient burden while improving clinical outcomes. Hybrid closed-loop systems represent the fastest-growing segment, with adoption rates increasing by 78% annually across major European markets.

Competitive landscape features established medical device manufacturers alongside innovative technology companies developing next-generation solutions. Market consolidation through strategic partnerships and acquisitions has accelerated product development cycles while expanding geographic reach. Patient-centric innovations focus on device miniaturization, smartphone integration, and simplified user interfaces to enhance therapy adherence and patient satisfaction.

Market insights reveal several critical trends shaping the European insulin pumps landscape. MarkWide Research analysis indicates that patient preferences increasingly favor integrated systems combining insulin delivery with continuous glucose monitoring capabilities.

Market maturation varies significantly across European regions, with Western European countries demonstrating higher adoption rates while Eastern European markets show rapid growth potential. Healthcare infrastructure development and physician training initiatives continue expanding market accessibility, particularly in emerging European economies where diabetes prevalence is rising rapidly.

Primary market drivers propelling European insulin pumps market growth encompass clinical, technological, and economic factors. Rising diabetes prevalence across Europe creates expanding patient populations requiring advanced insulin delivery solutions. The International Diabetes Federation reports increasing Type 1 diabetes incidence rates, particularly among pediatric populations, driving demand for sophisticated pump technologies.

Technological advancement serves as a crucial growth catalyst, with manufacturers developing increasingly sophisticated systems offering enhanced user experience and clinical outcomes. Artificial intelligence integration enables predictive insulin dosing algorithms, reducing hypoglycemic episodes while improving overall glycemic control. These innovations attract both patients and healthcare providers seeking optimal diabetes management solutions.

Healthcare policy support across European countries facilitates market expansion through improved reimbursement coverage and clinical guidelines recommending pump therapy for appropriate patient populations. Government initiatives promoting diabetes prevention and management create favorable environments for advanced medical device adoption. Clinical evidence demonstrating pump therapy benefits, including reduced long-term complications and improved quality of life, supports healthcare system investment in these technologies.

Patient empowerment trends drive demand for devices offering greater flexibility and control over diabetes management. Modern pump systems provide detailed data analytics, smartphone connectivity, and customizable insulin delivery profiles, appealing to tech-savvy patients seeking comprehensive diabetes management solutions.

Market restraints present challenges to widespread insulin pump adoption across European markets. High initial costs associated with pump systems and ongoing consumable expenses create barriers for patients and healthcare systems, particularly in countries with limited reimbursement coverage. Economic disparities between European regions result in unequal access to advanced pump technologies, limiting market penetration in price-sensitive markets.

Technical complexity associated with pump operation and maintenance can deter some patients, particularly elderly individuals or those with limited technological proficiency. Healthcare provider training requirements create implementation challenges, as successful pump therapy initiation requires specialized knowledge and ongoing support capabilities. Limited availability of trained diabetes educators and endocrinologists in certain regions restricts market growth potential.

Regulatory compliance requirements, while ensuring patient safety, can delay product launches and increase development costs for manufacturers. Data privacy concerns related to connected pump systems and cloud-based data storage may limit adoption among privacy-conscious patients and healthcare providers. Insurance coverage variations across European countries create market fragmentation, complicating manufacturer strategies and limiting patient access in certain regions.

Competition from alternative therapies, including long-acting insulin formulations and emerging diabetes medications, may limit pump therapy adoption among certain patient populations. Device reliability concerns and potential technical failures can impact patient confidence and healthcare provider recommendations for pump therapy initiation.

Significant opportunities exist for market expansion across European insulin pumps segments. Emerging markets in Eastern Europe present substantial growth potential as healthcare infrastructure develops and diabetes awareness increases. Market penetration rates in these regions remain below 15%, indicating considerable room for expansion through targeted market development strategies.

Technological innovation opportunities include development of fully automated closed-loop systems, advanced predictive algorithms, and integration with broader digital health ecosystems. Artificial intelligence applications offer potential for personalized insulin delivery optimization based on individual patient patterns and lifestyle factors. Miniaturization advances could produce discrete, patch-style pumps appealing to patients concerned about device visibility.

Pediatric market expansion represents a key growth opportunity, with specialized pump designs and features addressing unique needs of young diabetes patients. Type 2 diabetes applications offer significant market expansion potential as clinical evidence supports pump therapy benefits for select patient populations. Healthcare system partnerships could facilitate broader adoption through integrated care models and outcome-based reimbursement arrangements.

Digital health integration creates opportunities for comprehensive diabetes management platforms combining pump therapy with telemedicine, remote monitoring, and AI-powered coaching services. Personalized medicine approaches utilizing genetic and metabolic profiling could optimize pump therapy selection and configuration for individual patients.

Market dynamics within the European insulin pumps sector reflect complex interactions between technological innovation, regulatory frameworks, and healthcare system evolution. Competitive intensity continues increasing as established medical device manufacturers face challenges from innovative technology companies developing disruptive solutions. Market consolidation through strategic acquisitions and partnerships accelerates product development while expanding geographic reach and market access capabilities.

Regulatory landscape evolution impacts market dynamics through updated safety requirements, clinical evidence standards, and post-market surveillance obligations. European Medical Device Regulation implementation has strengthened safety requirements while potentially extending approval timelines for new products. Reimbursement policy changes across European healthcare systems significantly influence market access and adoption patterns.

Technology convergence between insulin pumps, continuous glucose monitors, and digital health platforms creates new market dynamics requiring manufacturers to develop integrated solutions rather than standalone devices. Patient expectations for seamless technology integration and user-friendly interfaces drive continuous product innovation and feature enhancement. Healthcare provider preferences for evidence-based solutions with comprehensive support services influence product development priorities and market positioning strategies.

Supply chain dynamics have evolved to ensure reliable access to pump consumables and technical support across diverse European markets. Distribution partnerships with local healthcare providers and diabetes centers facilitate market penetration while ensuring appropriate patient training and ongoing support services.

Comprehensive research methodology employed for European insulin pumps market analysis incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research includes extensive interviews with key stakeholders including healthcare providers, patients, industry executives, and regulatory experts across major European markets. Survey methodologies capture quantitative insights regarding market trends, adoption patterns, and future growth projections.

Secondary research encompasses analysis of published clinical studies, regulatory filings, company financial reports, and industry publications to validate primary findings and identify emerging trends. Market sizing methodologies utilize bottom-up and top-down approaches, incorporating patient population data, adoption rates, and average selling prices to develop comprehensive market assessments. Competitive analysis examines product portfolios, market positioning strategies, and financial performance of key market participants.

Regional analysis methodology incorporates country-specific factors including healthcare system structures, reimbursement policies, regulatory requirements, and cultural preferences affecting pump therapy adoption. Trend analysis utilizes historical data patterns to project future market developments while considering technological advancement trajectories and healthcare policy evolution. Expert validation processes ensure research findings accuracy through review by industry specialists and clinical experts.

Data triangulation techniques cross-validate findings from multiple sources to enhance reliability and minimize potential biases. Scenario modeling approaches evaluate potential market outcomes under various assumptions regarding technology adoption, regulatory changes, and economic conditions affecting European healthcare systems.

Regional market analysis reveals significant variations in insulin pump adoption and growth patterns across European countries. Western European markets including Germany, France, and the United Kingdom demonstrate mature adoption patterns with 35-45% penetration rates among Type 1 diabetes patients. These markets benefit from established reimbursement frameworks, comprehensive healthcare infrastructure, and high levels of diabetes education and awareness.

Nordic countries lead European adoption rates, with Sweden and Denmark achieving 50% penetration rates among eligible patient populations. Government support for diabetes management technologies and comprehensive healthcare coverage facilitate broad patient access to advanced pump systems. Clinical excellence in diabetes care and strong patient advocacy contribute to high adoption rates in these markets.

Southern European markets including Italy, Spain, and Portugal show moderate adoption rates with significant growth potential. Healthcare system modernization initiatives and improving reimbursement coverage support market expansion. Cultural factors and varying levels of diabetes education influence adoption patterns, creating opportunities for targeted market development strategies.

Eastern European markets present the highest growth potential, with countries like Poland, Czech Republic, and Hungary experiencing rapid market development. Healthcare infrastructure improvements and increasing diabetes awareness drive market expansion, though adoption rates remain below 20% in most markets. Economic development and EU healthcare harmonization initiatives support long-term growth prospects in these emerging markets.

Competitive landscape within the European insulin pumps market features established medical device manufacturers alongside innovative technology companies developing next-generation solutions. Market leadership positions are held by companies with comprehensive product portfolios, strong clinical evidence, and extensive distribution networks across European markets.

Competitive strategies focus on technological differentiation, clinical evidence development, and comprehensive patient support services. Strategic partnerships with continuous glucose monitor manufacturers create integrated solutions appealing to patients and healthcare providers. Market access initiatives include reimbursement advocacy, healthcare provider education, and patient assistance programs supporting broader adoption.

Innovation competition drives continuous product enhancement, with manufacturers investing heavily in artificial intelligence, predictive algorithms, and user interface improvements. Geographic expansion strategies target emerging European markets through local partnerships and distribution agreements.

Market segmentation analysis reveals distinct categories based on technology type, patient demographics, and application areas. Technology segmentation includes traditional insulin pumps, patch pumps, and hybrid closed-loop systems, each serving specific patient needs and preferences. Patient segmentation encompasses pediatric, adult, and elderly populations, with specialized features and support requirements for each demographic group.

By Technology Type:

By Patient Demographics:

By Application:

Category analysis provides detailed insights into specific market segments and their unique characteristics. Traditional insulin pumps maintain significant market share due to established clinical evidence, comprehensive reimbursement coverage, and healthcare provider familiarity. These systems offer reliable insulin delivery with proven track records, appealing to conservative patients and healthcare providers prioritizing established technology.

Patch pump category demonstrates rapid growth driven by patient preferences for discrete, tubeless designs. Adoption rates for patch pumps have increased by 42% annually as patients appreciate the freedom from tubing and reduced visibility. Smartphone integration capabilities enhance user experience while providing comprehensive data management and sharing capabilities with healthcare providers.

Hybrid closed-loop systems represent the fastest-growing category, combining insulin pumps with continuous glucose monitors to create automated insulin delivery systems. Clinical outcomes demonstrate superior glycemic control compared to traditional pump therapy, driving healthcare provider recommendations and patient demand. Technology advancement continues improving algorithm sophistication and reducing user intervention requirements.

Pediatric pump category requires specialized features including parental controls, safety mechanisms, and age-appropriate interfaces. Growth rates in pediatric applications exceed 25% annually as parents and healthcare providers recognize pump therapy benefits for young diabetes patients. Educational support programs facilitate successful pump therapy initiation and management in pediatric populations.

Industry participants across the European insulin pumps market ecosystem realize substantial benefits from market growth and technological advancement. Medical device manufacturers benefit from expanding market opportunities, premium pricing for advanced technologies, and recurring revenue from consumable supplies and service contracts. Innovation investments in pump technology create competitive advantages while addressing unmet patient needs.

Healthcare providers gain access to advanced tools improving patient outcomes while potentially reducing long-term diabetes complications and associated healthcare costs. Integrated systems provide comprehensive patient data enabling more informed treatment decisions and personalized therapy optimization. Remote monitoring capabilities enhance care efficiency while maintaining high-quality patient support.

Patients benefit from improved glycemic control, reduced injection burden, and enhanced quality of life through flexible insulin delivery options. Technology integration provides detailed insights into diabetes patterns while automating many management tasks. Clinical outcomes include reduced hypoglycemic episodes, improved HbA1c levels, and decreased risk of long-term complications.

Healthcare systems realize long-term cost benefits through reduced diabetes complications, fewer emergency interventions, and improved patient self-management capabilities. Economic analysis demonstrates positive return on investment for pump therapy programs through reduced hospitalization rates and improved patient productivity. MWR analysis indicates that comprehensive pump therapy programs generate substantial healthcare system savings over patient lifetimes.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the European insulin pumps landscape reflect technological advancement, patient preference evolution, and healthcare system modernization. Artificial intelligence integration represents a transformative trend, with advanced algorithms providing predictive insulin dosing recommendations and automated delivery adjustments. Machine learning capabilities enable personalized therapy optimization based on individual patient patterns and lifestyle factors.

Smartphone connectivity has become standard across new pump systems, providing patients with comprehensive device control and data management capabilities. Mobile applications offer intuitive interfaces for bolus calculations, carbohydrate counting, and therapy tracking while enabling seamless data sharing with healthcare providers. Cloud-based platforms facilitate remote monitoring and telemedicine consultations, particularly valuable during pandemic-related healthcare disruptions.

Miniaturization trends continue driving device design evolution, with manufacturers developing increasingly compact and discrete pump systems. Patch pump adoption accelerates as patients appreciate tubeless designs offering greater freedom and reduced visibility. Wearable technology integration creates opportunities for comprehensive health monitoring beyond diabetes management.

Personalized medicine approaches utilize genetic profiling, metabolic analysis, and lifestyle data to optimize pump therapy selection and configuration. Precision dosing algorithms account for individual insulin sensitivity patterns, exercise habits, and dietary preferences to enhance therapy effectiveness. Outcome-based care models link reimbursement to clinical results, encouraging comprehensive patient support and therapy optimization.

Recent industry developments highlight significant advancement in pump technology and market expansion strategies. Regulatory approvals for next-generation hybrid closed-loop systems have accelerated market adoption while providing patients with advanced automated insulin delivery options. Clinical trial results demonstrating superior outcomes for integrated pump and continuous glucose monitor systems support broader healthcare provider recommendations.

Strategic partnerships between pump manufacturers and technology companies have accelerated innovation in artificial intelligence applications and digital health integration. Acquisition activities consolidate market positions while expanding product portfolios and geographic reach. Investment in research and development focuses on fully automated systems requiring minimal user intervention.

Reimbursement expansions across European healthcare systems improve patient access to advanced pump technologies. Government initiatives supporting diabetes prevention and management create favorable environments for pump therapy adoption. Healthcare provider education programs enhance clinical expertise in pump therapy initiation and management.

Manufacturing capacity expansion addresses growing demand while ensuring reliable supply chain operations across European markets. Distribution network development improves patient access to pump supplies and technical support services. Patient advocacy efforts promote awareness of pump therapy benefits while supporting policy initiatives improving access and coverage.

Strategic recommendations for European insulin pumps market participants focus on technology innovation, market expansion, and patient-centric service development. Manufacturers should prioritize artificial intelligence integration and predictive algorithm development to differentiate products and improve clinical outcomes. Investment in user experience design will enhance patient satisfaction and therapy adherence while reducing training requirements.

Geographic expansion strategies should target emerging Eastern European markets through local partnerships and tailored market entry approaches. Reimbursement advocacy initiatives can improve patient access while demonstrating economic value to healthcare systems. Healthcare provider education programs should emphasize clinical benefits and practical implementation strategies to accelerate adoption.

Digital health integration represents a critical success factor, requiring comprehensive platforms combining pump therapy with telemedicine, remote monitoring, and AI-powered coaching services. Data analytics capabilities should provide actionable insights for both patients and healthcare providers while ensuring privacy and security compliance. Interoperability standards will facilitate integration with broader healthcare technology ecosystems.

Patient support services should encompass comprehensive training, ongoing technical support, and peer networking opportunities to enhance therapy success rates. Outcome measurement programs can demonstrate clinical and economic value while supporting reimbursement negotiations. Innovation partnerships with academic institutions and research organizations can accelerate technology development while building clinical evidence.

Future market outlook for European insulin pumps indicates continued robust growth driven by technological advancement, expanding patient populations, and supportive healthcare policies. Market projections suggest sustained growth rates exceeding 8% CAGR over the next decade, with hybrid closed-loop systems representing the fastest-growing segment. Technology convergence will create comprehensive diabetes management ecosystems integrating pump therapy with continuous monitoring, digital health platforms, and artificial intelligence optimization.

Emerging technologies including fully automated closed-loop systems and implantable pump devices will transform diabetes management paradigms while expanding addressable patient populations. Artificial intelligence advancement will enable increasingly sophisticated insulin delivery algorithms requiring minimal user intervention. Personalized medicine approaches utilizing genetic and metabolic profiling will optimize therapy selection and configuration for individual patients.

Market expansion into Eastern European countries will accelerate as healthcare infrastructure develops and diabetes awareness increases. Patient population growth includes expanding applications for Type 2 diabetes and elderly patients requiring intensive insulin therapy. Pediatric market development will benefit from specialized pump designs and comprehensive family support programs.

Healthcare system evolution toward value-based care models will emphasize clinical outcomes and cost-effectiveness, favoring advanced pump technologies demonstrating superior results. Regulatory harmonization across European markets will facilitate product development and market access while maintaining high safety standards. MarkWide Research projects that technological advancement and market expansion will position Europe as a global leader in insulin pump innovation and adoption.

The European insulin pumps market represents a dynamic and rapidly evolving sector characterized by significant technological advancement, expanding patient adoption, and supportive healthcare policies. Market growth is driven by rising diabetes prevalence, clinical evidence demonstrating superior outcomes, and continuous innovation in pump technology and integrated diabetes management solutions.

Key success factors include artificial intelligence integration, user experience optimization, comprehensive patient support services, and strategic geographic expansion into emerging markets. Technology convergence between insulin pumps, continuous glucose monitors, and digital health platforms creates comprehensive solutions addressing diverse patient needs while improving clinical outcomes and quality of life.

Future opportunities encompass market expansion into underserved regions, development of fully automated systems, and personalized medicine approaches utilizing advanced analytics and patient profiling. Industry participants positioned to capitalize on these trends through innovation investment, strategic partnerships, and patient-centric service development will achieve sustainable competitive advantages in this growing market.

The European insulin pumps market outlook remains highly positive, with sustained growth expected across all major segments and geographic regions. Technological advancement will continue driving market evolution while expanding treatment options and improving outcomes for diabetes patients across Europe.

What is Insulin Pumps?

Insulin pumps are medical devices used to deliver insulin to individuals with diabetes. They provide a continuous supply of insulin through a small tube inserted under the skin, helping to manage blood glucose levels effectively.

What are the key players in the Europe Insulin Pumps Market?

Key players in the Europe Insulin Pumps Market include Medtronic, Roche, and Insulet Corporation, among others. These companies are known for their innovative products and technologies in diabetes management.

What are the growth factors driving the Europe Insulin Pumps Market?

The Europe Insulin Pumps Market is driven by factors such as the increasing prevalence of diabetes, advancements in insulin delivery technology, and a growing awareness of diabetes management solutions. Additionally, the rise in healthcare expenditure supports market growth.

What challenges does the Europe Insulin Pumps Market face?

Challenges in the Europe Insulin Pumps Market include high costs associated with insulin pumps, the need for regular maintenance and training, and potential complications from device use. These factors can limit accessibility for some patients.

What opportunities exist in the Europe Insulin Pumps Market?

Opportunities in the Europe Insulin Pumps Market include the development of advanced insulin delivery systems, integration of digital health technologies, and increasing partnerships between technology companies and healthcare providers. These trends can enhance patient outcomes.

What trends are shaping the Europe Insulin Pumps Market?

Trends in the Europe Insulin Pumps Market include the rise of smart insulin pumps with connectivity features, personalized diabetes management solutions, and the growing emphasis on patient-centric care. These innovations are transforming how diabetes is managed.

Europe Insulin Pumps Market

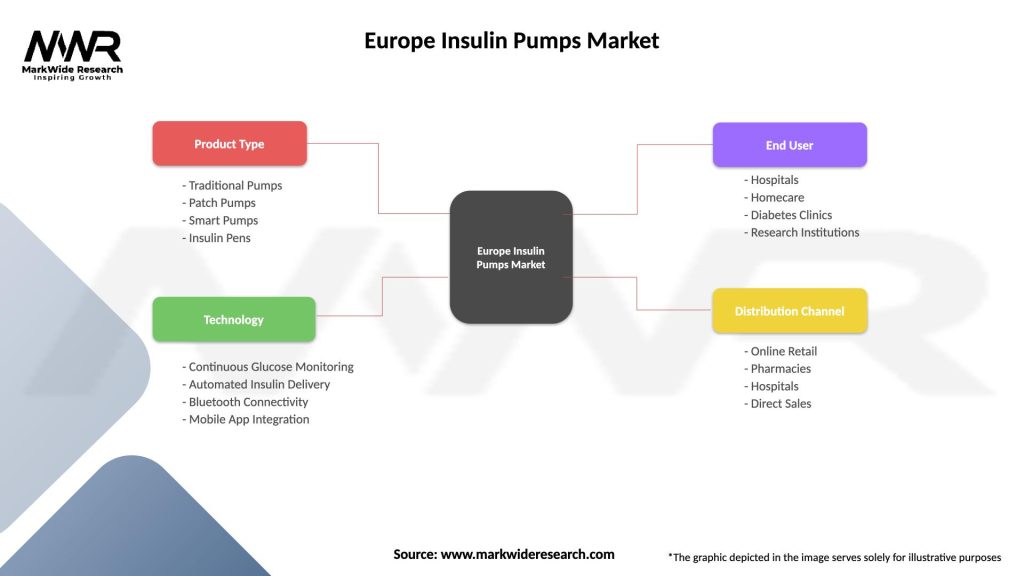

| Segmentation Details | Description |

|---|---|

| Product Type | Traditional Pumps, Patch Pumps, Smart Pumps, Insulin Pens |

| Technology | Continuous Glucose Monitoring, Automated Insulin Delivery, Bluetooth Connectivity, Mobile App Integration |

| End User | Hospitals, Homecare, Diabetes Clinics, Research Institutions |

| Distribution Channel | Online Retail, Pharmacies, Hospitals, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Insulin Pumps Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at