444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe Industrial Automation Services Market represents a dynamic and rapidly evolving sector that encompasses comprehensive solutions for manufacturing optimization, process enhancement, and operational efficiency across diverse industrial verticals. This market has experienced substantial growth driven by the region’s commitment to Industry 4.0 initiatives, digital transformation mandates, and the increasing adoption of smart manufacturing technologies. European manufacturers are increasingly leveraging automation services to maintain competitive advantages in global markets while addressing labor shortages and sustainability requirements.

Market dynamics indicate robust expansion across key European economies, with Germany, France, the United Kingdom, and Italy leading adoption rates. The integration of artificial intelligence, machine learning, and Internet of Things (IoT) technologies within automation services has created new opportunities for service providers and end-users alike. Current trends show a 12.3% annual growth rate in automation service implementations across European manufacturing facilities, reflecting the region’s strategic focus on technological advancement and operational excellence.

Industrial sectors including automotive, pharmaceuticals, food and beverage, chemicals, and energy are driving significant demand for comprehensive automation services. The market encompasses various service categories including system integration, maintenance and support, consulting services, and training programs, each contributing to the overall ecosystem of industrial modernization across Europe.

The Europe Industrial Automation Services Market refers to the comprehensive ecosystem of professional services, technical solutions, and support offerings that enable European manufacturers to implement, maintain, and optimize automated industrial processes and systems. This market encompasses a broad spectrum of services designed to enhance operational efficiency, reduce manual intervention, and improve overall manufacturing performance through advanced technological integration.

Automation services include system design and integration, installation and commissioning, preventive and corrective maintenance, software development and customization, training and skill development, and ongoing technical support. These services are delivered by specialized providers who possess deep expertise in industrial technologies, process optimization, and digital transformation strategies tailored to European market requirements and regulatory standards.

The market serves as a critical enabler for European industries seeking to modernize their operations, comply with stringent environmental regulations, and maintain competitiveness in increasingly complex global supply chains. Service providers work closely with manufacturers to develop customized automation solutions that address specific operational challenges while supporting long-term strategic objectives.

Market leadership in the Europe Industrial Automation Services sector is characterized by strong technological innovation, comprehensive service portfolios, and deep industry expertise. The market demonstrates consistent growth patterns driven by increasing digitalization requirements, regulatory compliance needs, and the ongoing transition toward smart manufacturing paradigms across European industrial sectors.

Key growth drivers include the European Union’s commitment to digital transformation initiatives, increasing focus on sustainability and energy efficiency, and the growing complexity of modern manufacturing processes requiring specialized expertise. Service providers are expanding their offerings to include cloud-based solutions, predictive maintenance capabilities, and advanced analytics services that deliver measurable value to industrial clients.

Competitive dynamics reveal a market structure comprising established multinational service providers, specialized regional players, and emerging technology-focused companies. The integration of emerging technologies such as artificial intelligence, machine learning, and advanced robotics is creating new service categories and revenue opportunities for market participants.

Regional variations across European markets reflect different industrial priorities, regulatory environments, and technological adoption rates. Northern European countries demonstrate higher adoption rates of advanced automation services, while Southern and Eastern European markets present significant growth opportunities as industrial modernization accelerates.

Strategic insights reveal several critical factors shaping the Europe Industrial Automation Services Market landscape:

Primary market drivers propelling the Europe Industrial Automation Services Market include the region’s strategic commitment to maintaining manufacturing competitiveness through technological advancement and operational optimization. European manufacturers face increasing pressure to reduce production costs while maintaining high quality standards and meeting stringent regulatory requirements.

Industry 4.0 initiatives across European Union member states are creating substantial demand for comprehensive automation services. Government incentives and funding programs supporting digital transformation are encouraging manufacturers to invest in advanced automation technologies and associated services. The European Digital Strategy emphasizes the importance of industrial digitalization in maintaining regional economic competitiveness.

Labor market dynamics represent another significant driver, as European manufacturers face persistent skills shortages and aging workforce challenges. Automation services provide solutions that reduce dependency on specialized manual labor while creating opportunities for workforce upskilling and reskilling initiatives.

Sustainability requirements are increasingly driving automation service adoption as manufacturers seek to optimize energy consumption, reduce waste generation, and comply with environmental regulations. Advanced automation systems enable precise resource utilization and comprehensive monitoring of environmental impact metrics.

Supply chain resilience concerns, particularly following recent global disruptions, are motivating manufacturers to implement automation services that enhance operational flexibility and reduce vulnerability to external shocks. Automated systems provide greater control over production processes and enable rapid adaptation to changing market conditions.

Implementation challenges represent significant restraints in the Europe Industrial Automation Services Market, particularly regarding the complexity and cost of comprehensive automation initiatives. Many European manufacturers, especially small and medium-sized enterprises, face budget constraints that limit their ability to invest in extensive automation services.

Technical complexity associated with integrating automation services into existing manufacturing infrastructure creates barriers for some organizations. Legacy system compatibility issues, integration challenges, and the need for specialized technical expertise can complicate automation service implementation and increase project timelines.

Cybersecurity concerns are increasingly restraining market growth as manufacturers become more aware of potential vulnerabilities associated with connected industrial systems. The risk of cyber attacks on automated systems creates hesitation among some organizations considering comprehensive automation service adoption.

Regulatory compliance requirements across different European markets can create complexity for service providers and manufacturers. Varying standards, certification requirements, and regulatory frameworks across EU member states can complicate service delivery and increase compliance costs.

Skills availability paradoxically serves as both a driver and restraint, as the shortage of qualified automation professionals can limit service provider capacity and increase service costs. The need for specialized training and certification programs creates additional barriers to market expansion.

Emerging opportunities in the Europe Industrial Automation Services Market are primarily driven by technological advancement and evolving industrial requirements. The integration of artificial intelligence and machine learning technologies into automation services creates new possibilities for predictive analytics, autonomous optimization, and intelligent decision-making capabilities.

Green manufacturing initiatives present substantial opportunities as European manufacturers increasingly prioritize sustainability and environmental responsibility. Automation services that optimize energy consumption, reduce waste generation, and enable circular economy practices are experiencing growing demand across industrial sectors.

Small and medium enterprise (SME) market penetration represents a significant growth opportunity, as these organizations begin recognizing the competitive advantages of automation services. Service providers are developing scalable, cost-effective solutions specifically designed for SME requirements and budget constraints.

Cross-border service delivery opportunities are expanding as European market integration continues. Service providers with multi-country capabilities can leverage economies of scale and standardized service delivery models across different European markets.

Vertical specialization opportunities exist in sectors such as pharmaceuticals, food processing, and renewable energy, where specific regulatory requirements and operational challenges create demand for specialized automation services. Service providers developing industry-specific expertise can command premium pricing and build sustainable competitive advantages.

Dynamic market forces shaping the Europe Industrial Automation Services landscape reflect the complex interplay between technological innovation, economic pressures, and regulatory requirements. The market demonstrates cyclical patterns influenced by broader economic conditions, industrial investment cycles, and technology adoption rates across different European regions.

Competitive intensity is increasing as traditional automation vendors expand their service portfolios while specialized service providers develop comprehensive solution offerings. This convergence is creating more integrated value propositions but also intensifying price competition and margin pressure across the market.

Customer expectations are evolving toward more comprehensive, outcome-based service models that deliver measurable business results rather than simply providing technical solutions. Manufacturers increasingly demand automation services that demonstrate clear return on investment and support strategic business objectives.

Technology convergence between operational technology (OT) and information technology (IT) is creating new service categories and requiring service providers to develop broader technical competencies. This convergence enables more sophisticated automation solutions but also increases complexity and implementation challenges.

Partnership ecosystems are becoming increasingly important as no single service provider can deliver all required capabilities independently. Strategic alliances between automation vendors, system integrators, and specialized service providers are creating more comprehensive solution offerings while enabling market expansion into new geographic regions and industry verticals.

Comprehensive research methodology employed in analyzing the Europe Industrial Automation Services Market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability of market insights. Primary research activities include extensive interviews with industry executives, service providers, and end-user organizations across key European markets.

Data collection encompasses both quantitative and qualitative research approaches, including structured surveys of market participants, in-depth interviews with industry experts, and detailed case studies of successful automation service implementations. Secondary research involves analysis of industry reports, regulatory documents, and financial disclosures from publicly traded companies.

Market segmentation analysis utilizes statistical modeling techniques to identify key market segments, growth patterns, and competitive dynamics. Geographic analysis covers major European markets including Germany, France, United Kingdom, Italy, Spain, Netherlands, and emerging Eastern European markets.

Validation processes include cross-referencing data from multiple sources, expert panel reviews, and statistical verification of key findings. Market projections are developed using econometric modeling techniques that account for macroeconomic factors, industry trends, and technology adoption patterns.

Continuous monitoring of market developments ensures research findings remain current and relevant. Regular updates incorporate new technology developments, regulatory changes, and evolving competitive dynamics that impact market conditions and growth prospects.

Germany dominates the Europe Industrial Automation Services Market, accounting for approximately 32% of regional market share due to its strong manufacturing base, advanced industrial infrastructure, and leadership in Industry 4.0 initiatives. German manufacturers demonstrate high adoption rates of sophisticated automation services, particularly in automotive, machinery, and chemical sectors.

France represents the second-largest market with significant growth in automation services across aerospace, automotive, and food processing industries. French manufacturers are increasingly investing in automation services to maintain competitiveness and comply with stringent environmental regulations. The country’s focus on digital transformation is driving demand for comprehensive automation solutions.

United Kingdom maintains strong market presence despite Brexit-related uncertainties, with particular strength in pharmaceutical and food processing automation services. UK manufacturers are leveraging automation to address labor shortages and maintain operational efficiency in challenging economic conditions.

Italy and Spain represent emerging growth markets with increasing adoption of automation services in traditional manufacturing sectors. These markets demonstrate 15.7% annual growth rates in automation service implementations as manufacturers modernize operations and improve competitiveness.

Eastern European markets including Poland, Czech Republic, and Hungary are experiencing rapid growth in automation services as foreign investment and EU funding support industrial modernization initiatives. These markets present significant opportunities for service providers seeking expansion into cost-competitive manufacturing regions.

Nordic countries demonstrate advanced adoption of sustainable automation services, with particular emphasis on energy efficiency and environmental compliance. These markets serve as testing grounds for innovative automation technologies and service delivery models.

Market leadership in the Europe Industrial Automation Services sector is characterized by a diverse ecosystem of established multinational corporations, specialized regional providers, and emerging technology-focused companies. The competitive landscape reflects varying approaches to service delivery, technology integration, and market positioning.

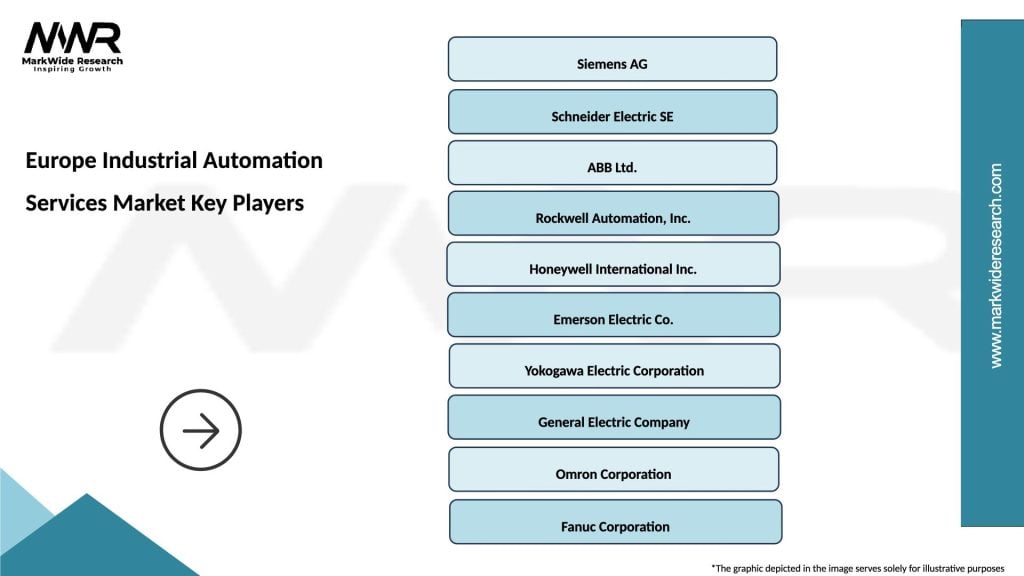

Leading market participants include:

Competitive strategies focus on developing comprehensive service portfolios, expanding geographic coverage, and building industry-specific expertise. Market leaders are investing heavily in digital technologies, remote service capabilities, and predictive maintenance solutions to differentiate their offerings.

Partnership strategies are becoming increasingly important as companies seek to expand their service capabilities and geographic reach through strategic alliances and acquisitions. Collaboration between automation vendors and specialized service providers is creating more comprehensive solution offerings.

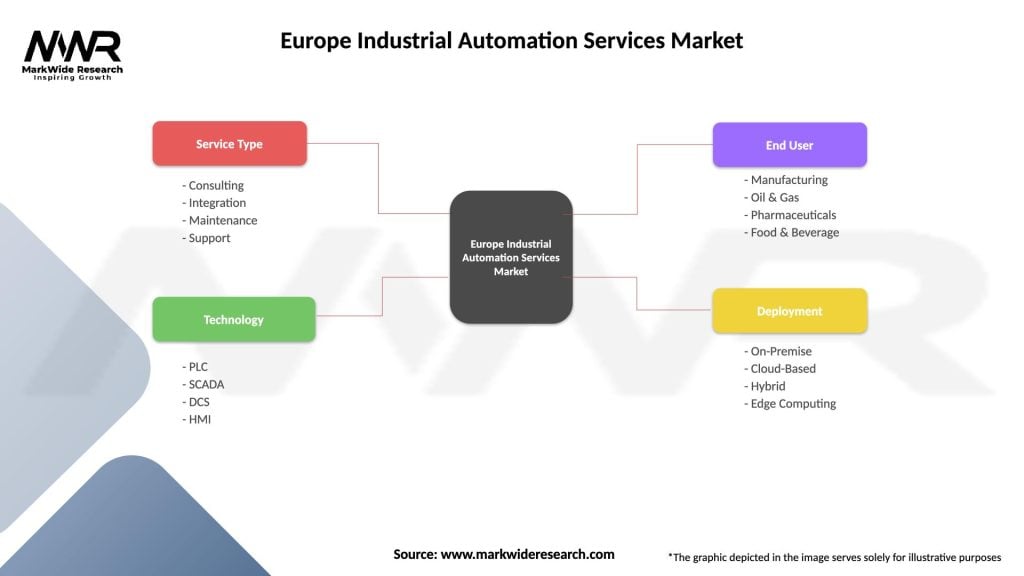

Service type segmentation reveals distinct categories within the Europe Industrial Automation Services Market:

By Service Type:

By Industry Vertical:

By Technology:

System Integration Services represent the largest segment within the Europe Industrial Automation Services Market, driven by increasing demand for comprehensive automation solutions that integrate multiple technologies and systems. This category demonstrates strong growth as manufacturers seek to modernize legacy systems and implement Industry 4.0 technologies.

Maintenance and Support Services show consistent growth patterns as the installed base of automated systems expands across European manufacturing facilities. Predictive maintenance capabilities enabled by IoT and analytics technologies are creating new revenue opportunities and improving service value propositions.

Consulting Services are experiencing rapid growth as manufacturers require specialized expertise to navigate complex automation decisions and technology selections. Strategic consulting services help organizations develop comprehensive automation roadmaps aligned with business objectives and regulatory requirements.

Automotive sector services maintain market leadership due to the industry’s advanced automation requirements and continuous innovation demands. European automotive manufacturers are driving adoption of next-generation automation services including AI-powered quality control and flexible manufacturing systems.

Pharmaceutical automation services demonstrate strong growth driven by regulatory compliance requirements and increasing demand for personalized medicine manufacturing capabilities. Specialized service providers are developing expertise in Good Manufacturing Practice (GMP) compliant automation solutions.

Industrial IoT services represent the fastest-growing technology category, with 23.4% annual growth in service implementations across European manufacturing facilities. These services enable comprehensive data collection, analysis, and optimization of industrial processes.

Manufacturers benefit from automation services through improved operational efficiency, reduced production costs, and enhanced product quality. Comprehensive automation solutions enable manufacturers to optimize resource utilization, minimize waste generation, and improve overall equipment effectiveness across production facilities.

Service providers gain access to expanding market opportunities, recurring revenue streams, and opportunities to develop specialized expertise in high-value market segments. The shift toward outcome-based service models creates potential for long-term customer relationships and predictable revenue generation.

Technology vendors benefit from increased demand for automation hardware, software, and integrated solutions. Partnership opportunities with service providers enable technology vendors to expand market reach and develop comprehensive solution offerings that address complete customer requirements.

End-user advantages include:

Economic stakeholders including governments and regional development agencies benefit from increased industrial competitiveness, job creation in high-skill sectors, and enhanced export capabilities. Automation services support broader economic development objectives and industrial modernization initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital twin technology is emerging as a transformative trend in European automation services, enabling virtual modeling and simulation of industrial processes. Service providers are developing expertise in digital twin implementation and management, creating new revenue opportunities and enhanced value propositions for manufacturing clients.

Edge computing integration is revolutionizing automation service delivery by enabling real-time data processing and decision-making at the production floor level. This trend reduces dependency on cloud connectivity while improving system responsiveness and data security for industrial applications.

Sustainability-focused automation services are gaining prominence as European manufacturers prioritize environmental compliance and carbon footprint reduction. Service providers are developing specialized offerings that optimize energy consumption, reduce waste generation, and support circular economy initiatives.

As-a-Service models are transforming traditional automation service delivery, with 41% of European manufacturers expressing interest in subscription-based automation solutions. These models reduce upfront capital requirements while providing predictable operational expenses and continuous technology updates.

Collaborative robotics services are expanding rapidly as manufacturers seek flexible automation solutions that work alongside human operators. Service providers are developing expertise in cobot integration, programming, and safety compliance to address growing market demand.

Predictive analytics integration is becoming standard in automation services, enabling proactive maintenance scheduling and operational optimization. Advanced analytics capabilities help manufacturers reduce unplanned downtime and improve overall equipment effectiveness.

Strategic partnerships between automation vendors and cloud service providers are creating new possibilities for scalable, cloud-based automation services. These collaborations enable service providers to offer more flexible and cost-effective solutions while leveraging advanced cloud computing capabilities.

Acquisition activity in the European automation services market reflects consolidation trends as larger companies seek to expand their service capabilities and geographic coverage. Recent acquisitions focus on specialized service providers with expertise in emerging technologies and vertical market segments.

Technology investments by leading service providers emphasize artificial intelligence, machine learning, and advanced analytics capabilities. These investments enable more sophisticated automation services and support the development of autonomous manufacturing systems.

Regulatory developments including updated machinery safety standards and cybersecurity requirements are driving demand for compliance-focused automation services. Service providers are investing in regulatory expertise and certification capabilities to address evolving compliance requirements.

Skills development initiatives across Europe are addressing automation workforce challenges through public-private partnerships, training programs, and educational collaborations. These initiatives support market growth by expanding the pool of qualified automation professionals.

Sustainability certifications and green automation standards are emerging as important differentiators in the European market. Service providers are developing expertise in sustainable automation practices and environmental compliance to meet growing customer demands.

MarkWide Research analysis suggests that service providers should prioritize development of comprehensive digital transformation capabilities that integrate multiple automation technologies into cohesive solutions. The convergence of operational and information technologies creates opportunities for providers who can deliver end-to-end digital manufacturing solutions.

Investment priorities should focus on emerging technologies including artificial intelligence, machine learning, and advanced analytics capabilities. Service providers who develop expertise in these areas will be positioned to capture premium pricing and build sustainable competitive advantages in the evolving market landscape.

Geographic expansion strategies should target Eastern European markets where industrial modernization is accelerating and competition remains limited. These markets offer opportunities for early market entry and establishment of strong competitive positions before market maturity.

Partnership development with technology vendors, system integrators, and specialized service providers can enable comprehensive solution offerings without requiring extensive internal capability development. Strategic alliances provide access to complementary expertise and expanded market reach.

Vertical specialization in high-value sectors such as pharmaceuticals, aerospace, and renewable energy can support premium pricing and reduced competitive pressure. Deep industry expertise enables service providers to address specific regulatory requirements and operational challenges.

Service model innovation toward outcome-based and subscription-based offerings can improve customer value propositions while creating more predictable revenue streams. These models align service provider incentives with customer success and support long-term relationship development.

Long-term growth prospects for the Europe Industrial Automation Services Market remain positive, driven by continued industrial digitalization, sustainability requirements, and technological advancement. The market is expected to maintain robust growth rates as European manufacturers increasingly recognize automation services as essential for maintaining competitiveness.

Technology evolution will continue driving market expansion, with artificial intelligence, machine learning, and autonomous systems creating new service categories and value propositions. Service providers who invest in these emerging technologies will be positioned to capture disproportionate market share and premium pricing.

Market maturation is expected to result in increased consolidation as larger service providers acquire specialized capabilities and expand geographic coverage. This consolidation will create more comprehensive solution offerings while potentially reducing competitive intensity in certain market segments.

Regulatory developments will continue shaping market dynamics, with increasing emphasis on cybersecurity, environmental compliance, and worker safety. Service providers who develop expertise in regulatory compliance will benefit from reduced competitive pressure and premium pricing opportunities.

Customer expectations will evolve toward more integrated, outcome-based service models that deliver measurable business results. Service providers must develop capabilities to demonstrate clear return on investment and support customer strategic objectives beyond technical implementation.

Geographic expansion opportunities will emerge in Eastern European markets as industrial modernization accelerates and EU funding supports automation initiatives. Early market entrants in these regions can establish strong competitive positions and benefit from rapid market growth.

The Europe Industrial Automation Services Market represents a dynamic and rapidly evolving sector with substantial growth potential driven by digital transformation initiatives, sustainability requirements, and technological advancement. Market participants who develop comprehensive service capabilities, invest in emerging technologies, and build strong customer relationships will be positioned to capture significant opportunities in this expanding market.

Strategic success in this market requires balancing technology innovation with practical implementation expertise, developing deep industry knowledge while maintaining operational flexibility, and building scalable service delivery models that can adapt to evolving customer requirements. The integration of advanced technologies including AI, machine learning, and IoT creates new possibilities for value creation and competitive differentiation.

Future market leaders will be those organizations that can effectively combine technical expertise with business acumen, delivering automation services that drive measurable operational improvements and support customer strategic objectives. The continued evolution toward outcome-based service models and digital transformation initiatives will create sustained growth opportunities for well-positioned market participants across the European industrial automation services landscape.

What is Industrial Automation Services?

Industrial Automation Services refer to the integration of technology and services that enhance the efficiency and productivity of industrial processes. This includes automation solutions for manufacturing, process control, and system integration.

What are the key players in the Europe Industrial Automation Services Market?

Key players in the Europe Industrial Automation Services Market include Siemens AG, Schneider Electric, ABB Ltd., and Rockwell Automation, among others.

What are the main drivers of the Europe Industrial Automation Services Market?

The main drivers of the Europe Industrial Automation Services Market include the increasing demand for operational efficiency, the rise of smart manufacturing, and the growing adoption of IoT technologies in industrial applications.

What challenges does the Europe Industrial Automation Services Market face?

Challenges in the Europe Industrial Automation Services Market include high initial investment costs, the complexity of integrating new technologies with existing systems, and a shortage of skilled workforce in automation technologies.

What opportunities exist in the Europe Industrial Automation Services Market?

Opportunities in the Europe Industrial Automation Services Market include the expansion of Industry Four Point Zero initiatives, advancements in AI and machine learning for predictive maintenance, and the increasing focus on sustainability and energy efficiency.

What trends are shaping the Europe Industrial Automation Services Market?

Trends shaping the Europe Industrial Automation Services Market include the growing use of robotics in manufacturing, the shift towards cloud-based automation solutions, and the integration of cybersecurity measures in industrial automation systems.

Europe Industrial Automation Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Consulting, Integration, Maintenance, Support |

| Technology | PLC, SCADA, DCS, HMI |

| End User | Manufacturing, Oil & Gas, Pharmaceuticals, Food & Beverage |

| Deployment | On-Premise, Cloud-Based, Hybrid, Edge Computing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Industrial Automation Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at