-

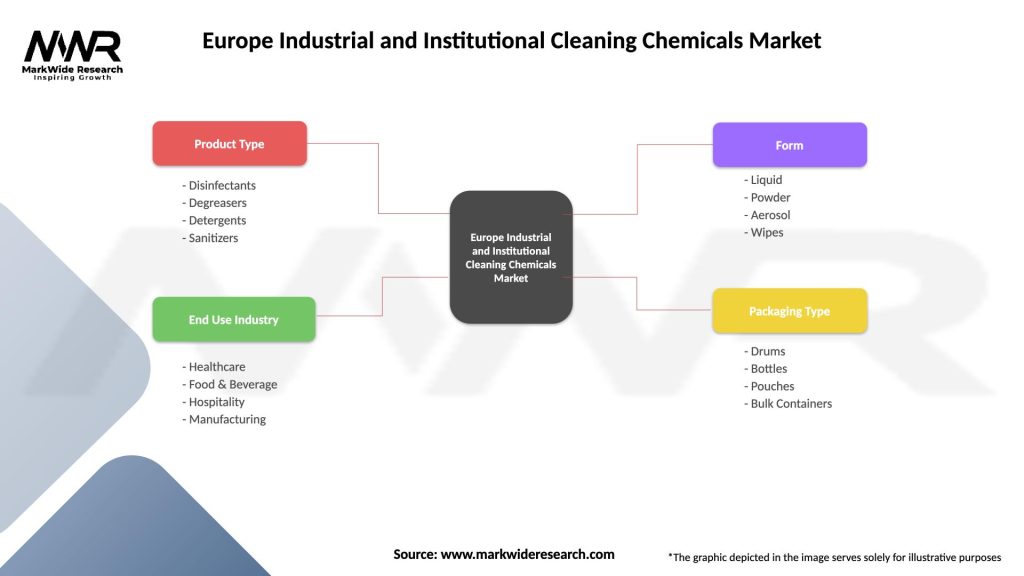

By Product Type:

-

Detergents & Degreasers

-

Disinfectants & Sanitizers

-

Floor Care & Hard Surface Cleaners

-

Specialty Cleaners (acidic, caustic, enzyme‑based)

-

Hand Hygiene & Soaps

-

-

By End‑User:

-

Food & Beverage Processing

-

Healthcare & Laboratories

-

Hospitality & Leisure

-

Manufacturing & Heavy Industry

-

Education & Public Institutions

-

-

By Formulation:

-

Liquids

-

Powders & Tablets

-

Ready‑to‑Use Sprays

-

-

By Distribution Channel:

-

Direct Sales (to large industrial accounts)

-

Distribution Partners & Wholesale

-

E‑Commerce & Online Platforms

-

-

By Region: Western Europe; Northern Europe; Southern Europe; Eastern Europe; United Kingdom

Category‑wise Insights

-

Detergents & Degreasers: High demand in food processing, requiring NSF‑certified, low‑residue solutions compatible with CIP systems.

-

Disinfectants: Hospital grade (EN 14885) and broad‑spectrum virucidal agents surged during the pandemic and remain elevated due to ongoing infection control protocols.

-

Floor Care: Automated scrubber machines paired with concentrated, low‑foam formulations for warehouses and public facilities improve throughput and reduce slip risks.

-

Specialty Cleaners: Acidic formulations for scale removal in dairy and brewing plants and caustic blends for heavy equipment cleaning in automotive operations.

Key Benefits for Industry Participants and Stakeholders

-

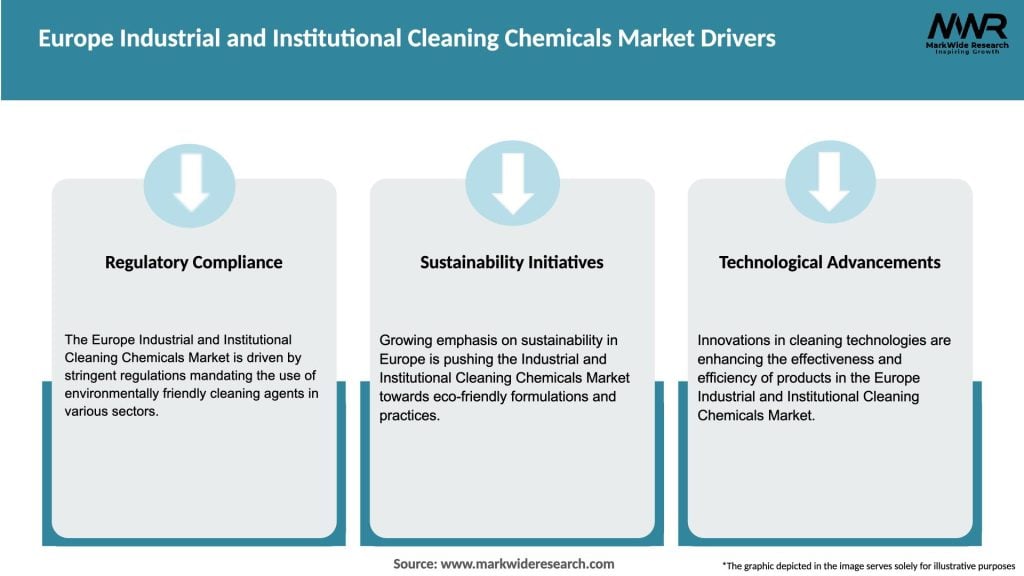

Regulatory Assurance: Compliance with EU biocide and food contact regulations reduces audit risks and downtime.

-

Operational Efficiency: Concentrated chemistries and precise dosing minimize waste and labor requirements.

-

Brand Reputation: Use of certified green products enhances corporate sustainability credentials and market positioning.

-

Total Cost of Ownership: Integrated service models reduce hidden costs related to spills, overuse, and improper handling.

-

Health & Safety: Proven disinfectant efficacy and ergonomic dispensing systems protect workers and end users.

SWOT Analysis

Strengths:

-

Established multinational players with comprehensive service offerings and deep application expertise.

-

Strong regulatory framework in Europe driving consistent demand for high‑performance chemistries.

Weaknesses:

-

High entry barriers for small formulators due to certification and compliance costs.

-

Price sensitivity among cost‑focused institutional buyers can limit margin expansion.

Opportunities:

-

Growth of automated cleaning equipment integrating with digital dosing and monitoring systems.

-

Expansion of enzyme‑ and biological‑based cleaners addressing both performance and sustainability demands.

Threats:

-

Raw material supply disruptions—especially specialty surfactants—impact formulation continuity.

-

Emergence of private labels and distributor‑branded chemicals intensifies price competition.

Market Key Trends

-

Enzyme‑Enhanced Formulations: Broadening application to cold‑water cleaning in energy‑conscious facilities.

-

IoT‑Enabled Dispensing: Remote monitoring of chemical usage and inventory levels through cloud platforms.

-

Refillable Packaging: Adoption of returnable and reusable containers to meet EU plastics reduction targets.

-

Green Certifications: Rising preference for EU Ecolabel, Nordic Swan, and Ecocert‑accredited products.

-

Robotic Cleaning Integration: Tailored chemistries optimized for automated scrubbers and disinfection robots.

Covid-19 Impact

-

Disinfectant Surge: Unprecedented demand spikes in virucidal cleaning agents across all end‑users, some of which normalize to elevated baseline volumes.

-

Supply‑Chain Strain: Import restrictions and logistic delays prompted manufacturers to localize production and secure domestic ingredient sources.

-

Digital Adoption: Pandemic accelerated deployment of remote monitoring and touchless dispensing systems to reduce contact points.

-

Training & Compliance: Heightened focus on staff training and documented cleaning protocols in healthcare and hospitality.

Key Industry Developments

-

Ecolab’s Digital Cleaning Platform: Launch of SABER™ Dashboard for real‑time usage tracking and compliance reporting.

-

Diversey’s Next‑Gen Enzymatic Cleaner: Introduction of biodegradable enzyme formulation effective at 10 °C, reducing energy use.

-

3M’s Antimicrobial Coatings: Rollout of long‑lasting surface treatments for high‑touch areas in hospitals and schools.

-

AkzoNobel’s Surfactant Plant Expansion: New European facility producing renewable, bio‑based surfactants to support green formulations.

-

Procter & Gamble Professional’s Refillable Pods: Deployment of modular dosing pods compatible with major dispensing platforms to cut plastic waste.

Analyst Suggestions

-

Invest in Digital Integration: Combine chemical expertise with IoT dispensing to deliver measurable ROI and differentiation.

-

Focus on Biodegradability: Drive transparency with third‑party lifecycle assessments and cradle‑to‑grave sustainability data.

-

Strengthen Supply Security: Develop strategic sourcing agreements for critical specialty ingredients and explore regional production partnerships.

-

Expand Service Models: Offer bundled training, audit support, and preventive maintenance to enhance customer loyalty and reduce risks.

-

Tailor Market Entry: Leverage local distribution partners with strong institutional relationships to navigate diverse regulatory landscapes efficiently.

Future Outlook

The Europe Industrial and Institutional Cleaning Chemicals Market is poised for steady growth as regulatory requirements tighten and sustainability mandates deepen. Digitally enabled, eco‑certified chemistries integrated with automated dispensing and cleaning machinery will become table stakes. Manufacturers that align formulation innovation with service excellence—backed by robust training and data analytics—will capture increasing share in both mature and emerging European markets.

Conclusion

Maintaining hygiene, safety, and operational efficiency in industrial and institutional environments remains a top priority. The evolving Europe market demands high‑performance, compliant, and sustainable cleaning chemicals delivered through intelligent service platforms. Stakeholders who invest in green technologies, digital connectivity, and comprehensive support services will lead the charge in this dynamic, high‑value segment.