444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe HVAC market represents one of the most dynamic and rapidly evolving sectors within the region’s construction and building services industry. Heating, ventilation, and air conditioning systems have become essential components of modern infrastructure across European nations, driven by stringent energy efficiency regulations, environmental sustainability goals, and increasing consumer demand for comfortable indoor environments. The market encompasses a comprehensive range of products including heat pumps, boilers, air conditioning units, ventilation systems, and smart HVAC controls.

Market dynamics indicate robust growth potential, with the sector experiencing a 6.2% compound annual growth rate as energy-efficient solutions gain widespread adoption. European Union directives promoting carbon neutrality by 2050 have significantly accelerated the transition toward sustainable HVAC technologies, particularly heat pump systems and renewable energy integration. The market’s expansion is further supported by increasing construction activities, renovation projects, and the growing emphasis on indoor air quality following recent global health concerns.

Regional variations across Europe reflect diverse climate conditions, regulatory frameworks, and economic development levels. Northern European countries demonstrate strong demand for heating solutions, while Southern European markets show increasing adoption of cooling systems. The integration of Internet of Things (IoT) technology and artificial intelligence in HVAC systems has created new opportunities for energy optimization and predictive maintenance, positioning Europe as a global leader in smart building technologies.

The Europe HVAC market refers to the comprehensive ecosystem of heating, ventilation, and air conditioning products, services, and technologies deployed across European residential, commercial, and industrial sectors to maintain optimal indoor environmental conditions while maximizing energy efficiency and sustainability.

HVAC systems encompass various interconnected components designed to regulate temperature, humidity, air quality, and circulation within enclosed spaces. These systems include heating equipment such as boilers, heat pumps, and radiators; ventilation components including fans, ductwork, and air handling units; and cooling solutions comprising air conditioners, chillers, and evaporative cooling systems. Modern HVAC applications increasingly incorporate smart controls, energy recovery systems, and renewable energy integration to meet evolving regulatory requirements and consumer expectations.

Market scope extends beyond traditional equipment manufacturing to include installation services, maintenance contracts, energy management solutions, and digital monitoring platforms. The sector serves diverse end-user segments ranging from single-family homes and apartment complexes to office buildings, retail spaces, healthcare facilities, and industrial manufacturing plants, each requiring specialized HVAC solutions tailored to specific operational requirements and regulatory compliance standards.

Europe’s HVAC market stands at the forefront of global sustainability transformation, driven by ambitious climate targets and comprehensive regulatory frameworks promoting energy efficiency. The sector demonstrates remarkable resilience and innovation capacity, with heat pump adoption rates increasing by 34% annually across key European markets as consumers and businesses prioritize renewable heating solutions over traditional fossil fuel systems.

Key market drivers include the European Green Deal initiatives, building renovation wave programs, and increasing awareness of indoor air quality importance. The market benefits from substantial government incentives, tax rebates, and financing programs supporting HVAC system upgrades and replacements. Digital transformation has emerged as a critical success factor, with smart HVAC solutions capturing 28% market penetration in commercial applications and showing rapid growth in residential segments.

Competitive landscape features established European manufacturers alongside emerging technology companies specializing in IoT integration and energy management platforms. The market’s evolution toward service-oriented business models has created new revenue streams through maintenance contracts, performance guarantees, and energy-as-a-service offerings. Supply chain optimization and local manufacturing capabilities have become increasingly important following recent global disruptions, positioning European companies favorably for sustained growth.

Strategic market analysis reveals several transformative trends reshaping Europe’s HVAC landscape. The following insights highlight critical developments driving market evolution:

Regulatory compliance serves as the primary catalyst for Europe’s HVAC market expansion, with comprehensive legislation mandating energy efficiency improvements across all building categories. The European Green Deal establishes ambitious carbon neutrality targets, requiring substantial HVAC system upgrades and replacements throughout the region. National governments complement EU directives with specific incentive programs, tax credits, and financing mechanisms that reduce barriers to HVAC modernization.

Energy cost volatility has heightened consumer awareness of HVAC system efficiency, driving demand for advanced technologies that minimize operational expenses. Recent energy price fluctuations demonstrate the economic benefits of high-efficiency heat pumps, smart controls, and renewable energy integration. Building owners increasingly recognize HVAC investments as strategic assets that enhance property values while reducing long-term operating costs.

Climate change adaptation requirements have expanded HVAC applications beyond traditional comfort conditioning to include resilience against extreme weather events. Urban heat island effects in major European cities necessitate more sophisticated cooling solutions, while changing precipitation patterns require enhanced humidity control capabilities. The growing emphasis on indoor air quality following health concerns has created new market segments for advanced filtration, UV sterilization, and ventilation systems.

Technological advancement continues accelerating market growth through improved system performance, reduced installation complexity, and enhanced user experiences. Digital connectivity enables remote monitoring, predictive maintenance, and energy optimization that were previously impossible with conventional HVAC equipment. The integration of artificial intelligence and machine learning algorithms provides unprecedented insights into system performance and optimization opportunities.

High initial investment requirements represent the most significant barrier to HVAC market expansion, particularly for comprehensive system replacements in existing buildings. Premium heat pump systems and smart HVAC solutions often require substantial upfront capital that may deter cost-sensitive consumers despite long-term savings potential. Complex financing arrangements and extended payback periods can complicate decision-making processes for both residential and commercial customers.

Installation complexity poses ongoing challenges for market growth, as advanced HVAC systems require specialized technical expertise that may be limited in certain regions. Skilled technician shortages across Europe have created bottlenecks in system deployment and maintenance services, potentially delaying project timelines and increasing installation costs. The need for extensive retrofitting in older buildings can significantly complicate HVAC upgrades and increase overall project complexity.

Regulatory fragmentation across European countries creates compliance challenges for manufacturers and installers operating in multiple markets. Varying standards for energy efficiency, safety requirements, and environmental regulations necessitate customized approaches that increase costs and complexity. Brexit-related trade complications have introduced additional uncertainties for companies serving both EU and UK markets.

Supply chain vulnerabilities have become increasingly apparent following recent global disruptions, affecting component availability and pricing stability. Semiconductor shortages particularly impact smart HVAC systems that rely heavily on electronic controls and connectivity features. Raw material price volatility and transportation challenges continue influencing market dynamics and profitability across the value chain.

Building renovation initiatives across Europe present unprecedented opportunities for HVAC market expansion, with the European Commission’s Renovation Wave strategy targeting millions of building upgrades over the next decade. Deep energy retrofits typically require comprehensive HVAC system replacements, creating substantial demand for high-efficiency equipment and advanced control systems. Government funding programs and green financing mechanisms reduce financial barriers and accelerate project implementation.

Smart city development programs throughout Europe increasingly incorporate advanced HVAC technologies as essential infrastructure components. District heating and cooling systems utilizing renewable energy sources offer scalable solutions for urban areas while creating new business models for HVAC companies. The integration of HVAC systems with smart grid technologies enables demand response capabilities and energy storage applications.

Industrial decarbonization requirements create significant opportunities for specialized HVAC solutions in manufacturing, data centers, and process industries. Heat recovery systems and waste heat utilization technologies offer substantial energy savings while supporting corporate sustainability goals. The growing emphasis on worker health and safety drives demand for advanced air filtration and environmental control systems in industrial applications.

Emerging technologies such as hydrogen-powered heating systems, advanced heat pump refrigerants, and AI-driven optimization platforms represent future growth areas with substantial market potential. Energy-as-a-service business models enable HVAC companies to capture ongoing revenue streams while providing customers with predictable operating costs and guaranteed performance levels. The convergence of HVAC systems with renewable energy generation and storage creates integrated solutions that maximize efficiency and sustainability.

Competitive intensity within Europe’s HVAC market has intensified as traditional manufacturers face challenges from technology-focused startups and digital platform companies. Market consolidation trends reflect the need for comprehensive solution portfolios and global scale advantages, with larger companies acquiring specialized technology firms to enhance their capabilities. The shift toward service-oriented business models has altered competitive dynamics, emphasizing long-term customer relationships over transactional equipment sales.

Innovation cycles have accelerated significantly, driven by regulatory pressures and technological advancement opportunities. Product development timelines have shortened as companies race to introduce next-generation efficiency improvements and smart connectivity features. The integration of artificial intelligence, machine learning, and IoT technologies has created new competitive differentiators while raising barriers to entry for traditional manufacturers lacking digital capabilities.

Customer expectations continue evolving toward comprehensive solutions that combine equipment, installation, maintenance, and performance optimization services. Digital interfaces and mobile applications have become standard requirements, with customers expecting seamless integration with smart home and building management systems. The growing emphasis on sustainability and environmental responsibility influences purchasing decisions across all market segments.

Supply chain dynamics have shifted toward regional sourcing and manufacturing strategies to reduce transportation costs and improve delivery reliability. Vertical integration trends reflect companies’ efforts to control critical components and technologies while ensuring quality consistency. Strategic partnerships between HVAC manufacturers and technology companies have become essential for accessing advanced capabilities and accelerating innovation timelines.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Europe’s HVAC market dynamics. Primary research activities include extensive interviews with industry executives, technical experts, and key stakeholders across the HVAC value chain, providing firsthand perspectives on market trends, challenges, and opportunities. Survey data collection from end-users, installers, and distributors offers quantitative insights into purchasing behaviors, satisfaction levels, and future requirements.

Secondary research encompasses detailed analysis of industry reports, regulatory documents, company financial statements, and technical publications to establish comprehensive market context. Government databases and statistical agencies provide essential data on construction activities, energy consumption patterns, and regulatory compliance trends across European countries. Trade association publications and industry conference proceedings contribute valuable insights into emerging technologies and market developments.

Market modeling techniques utilize advanced statistical methods and forecasting algorithms to project future market trends and growth patterns. Scenario analysis evaluates potential market outcomes under different regulatory, economic, and technological conditions to provide robust strategic insights. Cross-validation methodologies ensure data accuracy and reliability across multiple information sources and research approaches.

Expert validation processes involve consultation with recognized industry authorities and technical specialists to verify research findings and market projections. Peer review mechanisms ensure analytical rigor and methodological consistency throughout the research process. Continuous monitoring and updating procedures maintain research currency and relevance as market conditions evolve.

Northern Europe leads the regional HVAC market transformation, with Scandinavian countries achieving 42% heat pump penetration rates in residential applications through comprehensive government incentive programs and environmental awareness campaigns. Germany represents the largest national market, driven by ambitious energy efficiency targets and substantial building renovation activities. The region’s cold climate conditions create strong demand for advanced heating solutions, while high energy costs motivate consumers to invest in efficient technologies.

Western Europe demonstrates balanced growth across heating and cooling segments, with France and the United Kingdom showing increasing adoption of heat pump systems and smart HVAC controls. Commercial sector demand remains robust in major business centers, while residential market growth reflects rising living standards and comfort expectations. Brexit implications continue influencing trade patterns and regulatory alignment between EU and UK markets.

Southern Europe experiences accelerating demand for cooling solutions as climate change intensifies summer temperatures and extends cooling seasons. Spain and Italy lead regional air conditioning adoption, with 23% annual growth rates in residential cooling system installations. The region’s abundant solar resources create opportunities for renewable-powered HVAC systems and energy storage integration.

Eastern Europe presents significant growth potential as economic development and EU integration drive infrastructure modernization and energy efficiency improvements. Poland and Czech Republic show strong market expansion supported by EU funding programs and increasing environmental awareness. The region’s transition away from coal-based heating systems creates substantial opportunities for modern HVAC technologies and renewable energy integration.

Market leadership in Europe’s HVAC sector reflects a combination of established manufacturers with strong regional presence and innovative companies specializing in advanced technologies. The competitive environment emphasizes comprehensive solution portfolios, service capabilities, and digital integration rather than purely product-based competition.

Competitive strategies increasingly emphasize service differentiation, digital capabilities, and sustainability leadership. Companies invest heavily in IoT platforms, artificial intelligence, and predictive analytics to provide value-added services beyond traditional equipment sales. Strategic partnerships with technology companies, utilities, and service providers enable comprehensive solution offerings that address evolving customer requirements.

Product segmentation within Europe’s HVAC market reflects diverse technological approaches and application requirements across different building types and climate zones. The market encompasses multiple product categories with distinct growth patterns and competitive dynamics.

By Product Type:

By Application Sector:

By Technology:

Heat pump systems represent the fastest-growing category within Europe’s HVAC market, driven by regulatory support and environmental consciousness. Air-source heat pumps dominate residential applications due to installation simplicity and cost-effectiveness, while ground-source systems gain traction in new construction projects where higher efficiency justifies additional investment. The category benefits from continuous technological improvements in cold-weather performance and refrigerant efficiency.

Smart HVAC controls demonstrate exceptional growth potential as building owners seek energy optimization and operational insights. Wireless thermostats and mobile applications provide user-friendly interfaces for residential customers, while building management systems offer comprehensive monitoring and control capabilities for commercial applications. Integration with voice assistants and smart home platforms enhances user adoption and system utilization.

Air conditioning systems experience accelerating demand across European markets traditionally focused on heating applications. Inverter technology and variable-speed compressors improve efficiency and reduce operating costs, making cooling systems more attractive to cost-conscious consumers. The category’s growth reflects changing climate conditions and rising comfort expectations throughout Europe.

Ventilation solutions have gained prominence following increased awareness of indoor air quality importance. Heat recovery ventilation systems provide energy-efficient fresh air supply while maintaining thermal comfort, particularly valuable in high-performance buildings. Advanced filtration technologies and UV sterilization capabilities address health concerns and regulatory requirements for improved indoor environments.

Industrial HVAC applications require specialized solutions tailored to specific process requirements and environmental conditions. Precision cooling systems for data centers and manufacturing facilities demand high reliability and efficiency, while process heating applications increasingly utilize waste heat recovery and renewable energy integration. The category’s growth reflects industrial modernization and sustainability initiatives across European manufacturing sectors.

Manufacturers benefit from expanding market opportunities driven by regulatory requirements and technological advancement. Product differentiation through smart connectivity, energy efficiency, and sustainability features enables premium pricing and improved profit margins. The shift toward service-oriented business models creates recurring revenue streams and stronger customer relationships, reducing dependence on cyclical equipment sales.

Installers and contractors experience increased demand for specialized services as HVAC systems become more sophisticated and integrated. Training and certification programs in advanced technologies create competitive advantages and higher service rates. The growing emphasis on maintenance and optimization services provides stable revenue opportunities and long-term customer relationships.

Building owners realize substantial benefits through reduced energy costs, improved occupant comfort, and enhanced property values. Smart HVAC systems provide operational insights and predictive maintenance capabilities that minimize downtime and extend equipment lifespan. Government incentives and financing programs reduce initial investment barriers while accelerating payback periods.

End users enjoy enhanced comfort, improved indoor air quality, and reduced environmental impact through advanced HVAC technologies. Smart controls and mobile applications provide convenient system management and energy monitoring capabilities. The integration of renewable energy sources reduces dependence on fossil fuels and provides protection against energy price volatility.

Utilities and energy companies benefit from reduced peak demand and improved grid stability through smart HVAC integration and demand response capabilities. Heat pump adoption supports electrification strategies and renewable energy utilization. Energy-as-a-service business models create new revenue opportunities while supporting customer sustainability goals.

Strengths:

Weaknesses:

Opportunities:

Threats:

Electrification acceleration represents the most significant trend transforming Europe’s HVAC landscape, with heat pump adoption rates reaching unprecedented levels across residential and commercial applications. Government policies actively promote electric heating solutions as alternatives to fossil fuel systems, supported by substantial subsidies and regulatory mandates. The trend aligns with broader decarbonization objectives and renewable energy integration strategies throughout European markets.

Digital transformation continues reshaping HVAC system capabilities and business models, with IoT connectivity becoming standard across product categories. Artificial intelligence algorithms enable predictive maintenance, energy optimization, and automated system adjustments that improve performance and reduce operational costs. Cloud-based platforms provide remote monitoring and control capabilities that enhance user convenience and system reliability.

Indoor air quality focus has intensified following health concerns and regulatory developments emphasizing ventilation system importance. Advanced filtration technologies and UV sterilization systems gain widespread adoption in commercial and institutional applications. The trend extends beyond traditional comfort conditioning to encompass comprehensive environmental control and health protection capabilities.

Circular economy principles increasingly influence HVAC industry practices, with manufacturers emphasizing product durability, repairability, and end-of-life recycling. Refrigerant management and low-global-warming-potential alternatives address environmental concerns while maintaining system performance. The trend creates opportunities for remanufacturing, component recovery, and sustainable business model development.

Energy-as-a-service models gain traction as customers seek predictable operating costs and guaranteed performance outcomes. Performance contracting and comprehensive maintenance agreements shift risk from building owners to HVAC service providers while ensuring optimal system operation. The trend enables access to advanced technologies without substantial capital investment requirements.

Regulatory milestone achievements have accelerated HVAC market transformation, with the European Union’s Fit for 55 package establishing comprehensive frameworks for building energy performance improvements. National implementation programs across member states provide specific timelines and incentive structures for HVAC system upgrades and replacements. Recent policy developments emphasize heat pump deployment and fossil fuel heating phase-out schedules.

Technology breakthrough announcements continue advancing HVAC system capabilities and efficiency levels. Next-generation refrigerants with minimal environmental impact enable improved performance while addressing regulatory requirements. Advanced heat pump designs achieve effective operation in extreme cold conditions, expanding application opportunities across Northern European markets.

Strategic partnership formations between HVAC manufacturers and technology companies accelerate digital capability development and market expansion. Utility collaborations enable demand response programs and grid integration services that benefit both energy providers and building owners. Cross-industry alliances with renewable energy companies create integrated solutions combining HVAC systems with solar panels and energy storage.

Investment activity increases reflect growing confidence in HVAC market potential and technology advancement opportunities. Venture capital funding supports startup companies developing innovative solutions for energy optimization, predictive maintenance, and system integration. Established manufacturers acquire specialized technology firms to enhance their digital capabilities and competitive positioning.

Market expansion initiatives by leading companies include new manufacturing facilities, distribution network enhancements, and service capability development. Localization strategies reduce supply chain risks while improving customer service and market responsiveness. Training and certification programs address skilled workforce shortages while ensuring proper installation and maintenance of advanced HVAC systems.

Strategic positioning recommendations for HVAC industry participants emphasize the critical importance of digital transformation and service capability development. MarkWide Research analysis indicates that companies investing in IoT platforms, artificial intelligence, and predictive analytics will achieve competitive advantages and improved customer retention rates. The transition toward service-oriented business models requires substantial organizational changes but offers superior long-term profitability and market stability.

Technology investment priorities should focus on heat pump efficiency improvements, smart control integration, and renewable energy compatibility. Research and development efforts targeting cold-climate heat pump performance and advanced refrigerant systems address key market requirements and regulatory trends. Companies should prioritize modular system designs that enable flexible installation and future upgrade capabilities.

Market entry strategies for new participants should emphasize specialized applications or underserved geographic regions rather than direct competition with established manufacturers. Partnership approaches with existing distributors, installers, or technology companies can accelerate market penetration while reducing investment requirements. Focusing on specific vertical markets such as data centers, healthcare facilities, or industrial applications may provide differentiation opportunities.

Customer engagement strategies must evolve beyond traditional sales approaches to encompass comprehensive solution development and long-term relationship management. Educational initiatives help customers understand advanced technology benefits and return on investment calculations. Digital platforms and mobile applications enhance customer experience while providing valuable usage data for system optimization and service delivery.

Supply chain optimization recommendations include regional sourcing strategies, strategic inventory management, and supplier diversification to reduce disruption risks. Vertical integration in critical components may provide cost advantages and quality control benefits. Companies should develop contingency plans for potential supply shortages and implement flexible manufacturing capabilities to respond to demand variations.

The European HVAC market is positioned for substantial transformation driven by stringent energy efficiency regulations, decarbonization initiatives, and advancing smart building technologies through 2030 and beyond. Market projections indicate accelerated adoption of heat pump systems, renewable energy integration, and IoT-enabled climate control solutions across major European markets including Germany, France, United Kingdom, Italy, and Nordic countries. Regulatory frameworks such as the European Green Deal and F-Gas regulations will continue reshaping industry standards and driving innovation toward sustainable HVAC technologies.

Technological evolution will center on smart HVAC systems with artificial intelligence integration, predictive maintenance capabilities, and seamless building automation connectivity. Heat pump technology advancement will accelerate with improved efficiency ratings, enhanced cold climate performance, and hybrid system configurations becoming mainstream across residential and commercial applications. Digital transformation including remote monitoring, cloud-based controls, and energy management platforms will become standard features in next-generation HVAC installations.

Market growth will be supported by increasing renovation activities, commercial construction projects, and replacement demand for aging HVAC infrastructure. Sustainable refrigerants and low-GWP alternatives will gain widespread adoption as environmental regulations become more stringent. Emerging applications in data centers, electric vehicle charging infrastructure, and industrial decarbonization will create new market segments requiring specialized HVAC solutions.

Regional expansion opportunities will emerge in Eastern European markets as economic development accelerates and energy efficiency standards align with Western European requirements. Innovation investment in hydrogen-based heating systems, geothermal integration, and waste heat recovery technologies will shape long-term market dynamics and competitive positioning across the European HVAC landscape.

The European HVAC market stands at the forefront of global sustainability transformation, driven by ambitious climate targets, advanced regulatory frameworks, and sophisticated consumer demands for energy-efficient solutions. Market leadership across key European countries demonstrates robust growth potential supported by ongoing digitalization, building renovation initiatives, and increasing focus on indoor air quality and comfort. Environmental regulations and energy efficiency mandates continue driving innovation and market evolution throughout the region.

Strategic success in this mature yet rapidly evolving market requires deep understanding of diverse climate conditions, regulatory requirements, and cultural preferences across European countries. Companies that prioritize sustainable technologies, smart system integration, and comprehensive service offerings will be best positioned to capture emerging opportunities. Digital connectivity and IoT integration have become essential capabilities for maintaining competitive advantage in modern HVAC applications.

Innovation leadership in heat pump technologies, renewable energy integration, and building automation systems positions Europe as a global benchmark for sustainable HVAC solutions. Technology advancement in artificial intelligence, predictive maintenance, and energy optimization continues creating new value propositions for end users. Emerging trends including hydrogen heating, thermal energy storage, and carbon-neutral HVAC systems present significant opportunities for forward-thinking market participants.

The competitive landscape will continue evolving as established manufacturers, emerging technology providers, and service-focused companies compete for market leadership in this transformation period. Long-term success will require ongoing investment in sustainable technologies, digital capabilities, and customer-centric solutions to meet increasingly sophisticated performance and environmental requirements. Market-focused strategies emphasizing energy efficiency, system reliability, and comprehensive lifecycle support will become increasingly critical differentiators in this dynamic and environmentally conscious European HVAC market.

What is HVAC?

HVAC stands for Heating, Ventilation, and Air Conditioning, which refers to the technology used for indoor environmental comfort. It encompasses systems that provide heating and cooling to residential, commercial, and industrial buildings.

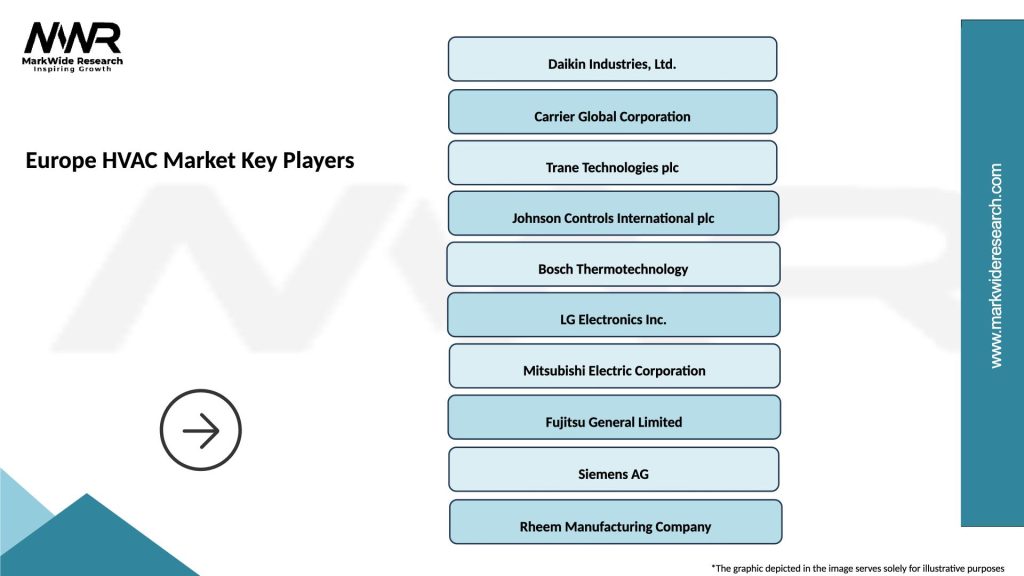

What are the key players in the Europe HVAC Market?

Key players in the Europe HVAC Market include companies like Daikin Industries, Trane Technologies, and Carrier Global Corporation, which are known for their innovative HVAC solutions and extensive product offerings, among others.

What are the main drivers of growth in the Europe HVAC Market?

The main drivers of growth in the Europe HVAC Market include increasing energy efficiency regulations, rising demand for smart HVAC systems, and the growing focus on sustainable building practices. These factors are pushing both residential and commercial sectors to adopt advanced HVAC technologies.

What challenges does the Europe HVAC Market face?

The Europe HVAC Market faces challenges such as high installation and maintenance costs, regulatory compliance complexities, and the need for skilled labor. These factors can hinder market growth and adoption of new technologies.

What opportunities exist in the Europe HVAC Market?

Opportunities in the Europe HVAC Market include the increasing adoption of renewable energy sources, advancements in IoT and smart technologies, and the growing trend of retrofitting existing buildings for improved energy efficiency. These trends are expected to create new avenues for growth.

What trends are shaping the Europe HVAC Market?

Trends shaping the Europe HVAC Market include the rise of energy-efficient systems, the integration of smart technology for better control and monitoring, and a shift towards environmentally friendly refrigerants. These trends are influencing consumer preferences and industry standards.

Europe HVAC Market

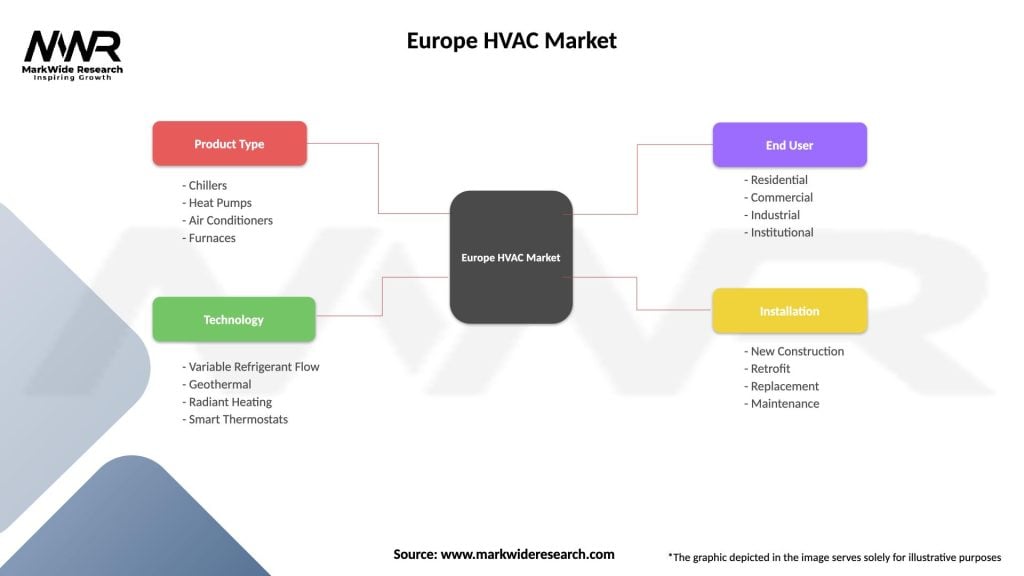

| Segmentation Details | Description |

|---|---|

| Product Type | Chillers, Heat Pumps, Air Conditioners, Furnaces |

| Technology | Variable Refrigerant Flow, Geothermal, Radiant Heating, Smart Thermostats |

| End User | Residential, Commercial, Industrial, Institutional |

| Installation | New Construction, Retrofit, Replacement, Maintenance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe HVAC Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at