444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe HVAC field device market represents a dynamic and rapidly evolving sector within the broader building automation and climate control industry. HVAC field devices encompass a comprehensive range of sensors, actuators, controllers, and monitoring equipment that enable precise climate control, energy optimization, and system automation across residential, commercial, and industrial applications throughout European markets.

Market dynamics indicate robust growth driven by stringent energy efficiency regulations, increasing adoption of smart building technologies, and growing emphasis on sustainable construction practices. The European market demonstrates particularly strong momentum in countries such as Germany, France, the United Kingdom, and Nordic regions, where environmental consciousness and technological innovation converge to create substantial demand for advanced HVAC field devices.

Technological advancement continues to reshape the landscape, with Internet of Things (IoT) integration, wireless connectivity, and artificial intelligence-driven optimization becoming standard features in modern HVAC field devices. The market experiences significant growth at a CAGR of 8.2%, reflecting the increasing penetration of smart building solutions and the ongoing digital transformation of building management systems across Europe.

Regional distribution shows Western Europe maintaining approximately 68% market share, while Eastern European markets demonstrate accelerating adoption rates as infrastructure modernization initiatives gain momentum. The integration of renewable energy systems and heat pump technologies further amplifies demand for sophisticated field devices capable of managing complex, multi-source heating and cooling systems.

The Europe HVAC field device market refers to the comprehensive ecosystem of sensors, actuators, controllers, and monitoring equipment specifically designed for heating, ventilation, and air conditioning applications across European territories. These devices serve as the critical interface between HVAC systems and building automation networks, enabling precise environmental control, energy optimization, and system performance monitoring.

Field devices encompass temperature sensors, humidity detectors, pressure transducers, flow meters, damper actuators, valve controllers, and smart thermostats that collectively enable automated climate management. These components integrate seamlessly with building management systems to provide real-time data collection, system optimization, and predictive maintenance capabilities essential for modern building operations.

Market scope includes both wired and wireless field devices, spanning traditional pneumatic systems to cutting-edge IoT-enabled smart devices. The European market particularly emphasizes energy efficiency compliance, environmental sustainability, and integration with renewable energy sources, reflecting the region’s commitment to carbon neutrality and green building standards.

Market leadership in the Europe HVAC field device sector demonstrates strong growth momentum driven by regulatory mandates, technological innovation, and increasing awareness of energy efficiency benefits. The market encompasses diverse applications ranging from residential smart thermostats to complex industrial climate control systems, with significant opportunities emerging in retrofit applications and new construction projects.

Key growth drivers include the European Union’s energy efficiency directives, which mandate 40% energy consumption reduction by 2030, creating substantial demand for advanced field devices capable of optimizing HVAC system performance. The integration of artificial intelligence and machine learning capabilities enables predictive maintenance and autonomous system optimization, delivering measurable operational benefits to end users.

Competitive landscape features established global manufacturers alongside innovative European technology companies, fostering continuous product development and market expansion. The shift toward wireless connectivity and cloud-based management platforms represents a fundamental transformation in how HVAC field devices operate and integrate within broader building automation ecosystems.

Future prospects indicate sustained growth as digitalization initiatives accelerate across European markets, with particular strength in smart city developments, sustainable building certifications, and industrial automation applications. The market benefits from strong regulatory support, technological advancement, and increasing recognition of HVAC optimization as a critical component of environmental sustainability strategies.

Strategic insights reveal several critical factors shaping the Europe HVAC field device market landscape:

Market penetration varies significantly across European regions, with Scandinavian countries achieving 85% smart thermostat adoption in residential applications, while Southern European markets demonstrate accelerating growth as awareness and regulatory requirements increase.

Regulatory mandates serve as the primary catalyst for HVAC field device adoption across Europe, with the Energy Performance of Buildings Directive requiring significant improvements in building energy efficiency. These regulations create mandatory demand for smart controls, automated optimization systems, and comprehensive monitoring capabilities that traditional HVAC systems cannot provide.

Energy cost pressures motivate building owners and facility managers to invest in advanced field devices that deliver measurable operational savings. Rising utility costs, combined with carbon pricing mechanisms, make HVAC optimization a financially compelling investment with typical payback periods of 18-24 months for comprehensive field device implementations.

Technological advancement enables new capabilities that were previously impossible or prohibitively expensive, including wireless sensor networks, battery-powered devices with multi-year operation, and artificial intelligence-driven optimization algorithms. These innovations reduce installation costs while expanding application possibilities across diverse building types and use cases.

Sustainability initiatives drive corporate and institutional adoption as organizations seek to achieve carbon neutrality goals and obtain green building certifications. HVAC field devices enable the precise monitoring and optimization required for LEED, BREEAM, and other sustainability standards, making them essential components of environmental compliance strategies.

Digital transformation trends accelerate adoption as building owners recognize the value of data-driven facility management. Modern field devices provide the granular data necessary for predictive maintenance, space utilization optimization, and comprehensive building performance analytics that support strategic decision-making.

High implementation costs present significant barriers, particularly for small and medium-sized building owners who may struggle to justify the initial capital investment required for comprehensive field device deployments. While long-term savings are substantial, the upfront costs can be prohibitive without appropriate financing mechanisms or incentive programs.

Technical complexity challenges many potential adopters, as modern HVAC field devices require integration with existing building systems, network configuration, and ongoing maintenance by qualified technicians. The shortage of skilled installation and service personnel across Europe creates bottlenecks that can delay project implementation and increase costs.

Cybersecurity concerns increasingly influence purchasing decisions as connected field devices create potential vulnerabilities in building networks. Organizations must balance the benefits of remote monitoring and control against the risks of cyber attacks, requiring additional security measures that add complexity and cost to implementations.

Interoperability issues persist despite industry standardization efforts, as different manufacturers may use proprietary protocols that limit system integration flexibility. Building owners may face vendor lock-in situations that restrict future upgrade options and increase long-term operational costs.

Regulatory complexity varies across European markets, creating challenges for manufacturers and installers operating in multiple countries. Differing standards, certification requirements, and compliance procedures can increase costs and delay market entry for innovative field device technologies.

Retrofit applications represent enormous untapped potential as Europe’s existing building stock requires modernization to meet evolving energy efficiency standards. The European Commission estimates that 75% of buildings are energy inefficient, creating substantial opportunities for field device manufacturers to address this massive upgrade market.

Smart city initiatives across major European metropolitan areas create demand for integrated building automation systems that rely heavily on advanced field devices. These large-scale deployments offer opportunities for standardization, volume pricing, and comprehensive service contracts that benefit both suppliers and customers.

Industrial applications present significant growth potential as manufacturing facilities seek to optimize energy consumption and comply with environmental regulations. Industrial HVAC systems require specialized field devices capable of operating in challenging environments while providing precise control over complex climate management requirements.

Renewable energy integration creates new market segments as heat pumps, solar thermal systems, and geothermal installations require sophisticated control systems. Field devices that can manage multi-source heating and cooling systems while optimizing renewable energy utilization represent high-value market opportunities.

Artificial intelligence integration enables predictive analytics, autonomous optimization, and advanced fault detection capabilities that deliver substantial value to building operators. Companies that successfully integrate AI capabilities into field devices can command premium pricing while providing measurable performance improvements.

Supply chain evolution reflects the transition from traditional pneumatic and basic electronic controls to sophisticated IoT-enabled devices that require advanced semiconductor components, wireless communication modules, and embedded software capabilities. This transformation creates both opportunities and challenges as manufacturers adapt their production processes and supplier relationships.

Competitive intensity increases as traditional HVAC manufacturers compete with technology companies entering the market with innovative solutions. This competition drives rapid product development, price optimization, and enhanced customer service capabilities that benefit end users while challenging established market participants.

Customer expectations evolve rapidly as users become accustomed to consumer-grade smart home technologies and expect similar functionality in commercial and industrial applications. This trend drives demand for intuitive interfaces, mobile connectivity, and seamless integration capabilities that match consumer technology experiences.

Technology convergence accelerates as HVAC field devices integrate with broader building systems including lighting, security, and fire safety. This convergence creates opportunities for comprehensive building automation solutions while requiring manufacturers to develop expertise across multiple technical domains.

Service model transformation shifts from traditional product sales to ongoing service relationships that include remote monitoring, predictive maintenance, and performance optimization. This evolution enables recurring revenue streams while providing enhanced value to customers through improved system reliability and efficiency.

Comprehensive analysis of the Europe HVAC field device market employs multiple research methodologies to ensure accuracy and completeness. Primary research includes extensive interviews with industry executives, technology developers, system integrators, and end users across diverse European markets to capture current trends, challenges, and opportunities.

Secondary research encompasses analysis of industry publications, regulatory documents, company financial reports, and patent filings to understand technological developments and competitive positioning. This approach provides historical context and identifies emerging trends that may impact future market development.

Market modeling utilizes statistical analysis of historical data, regulatory impact assessments, and technology adoption curves to project future growth patterns and identify key market drivers. The methodology accounts for regional variations, application-specific requirements, and technology lifecycle considerations.

Expert validation ensures research findings align with industry expertise through consultation with technical specialists, regulatory experts, and market analysts. This validation process helps identify potential blind spots and confirms the accuracy of market projections and trend analysis.

Data triangulation combines multiple information sources to verify key findings and eliminate potential biases. This rigorous approach ensures that market insights reflect actual conditions rather than promotional claims or isolated incidents that may not represent broader market trends.

Western Europe dominates the HVAC field device market, with Germany leading adoption through stringent building energy standards and substantial industrial applications. The German market benefits from strong manufacturing expertise, environmental consciousness, and comprehensive regulatory frameworks that mandate energy efficiency improvements in both new construction and renovation projects.

Nordic countries demonstrate the highest penetration rates for advanced field devices, with Sweden and Denmark achieving 92% smart control adoption in commercial buildings. These markets benefit from extreme climate conditions that justify sophisticated HVAC optimization, strong environmental policies, and high technology acceptance rates among building owners and operators.

France and the United Kingdom represent substantial markets with growing adoption driven by energy efficiency regulations and sustainability initiatives. The French market particularly emphasizes integration with renewable energy systems, while the UK focuses on retrofit applications in existing building stock that requires modernization to meet evolving standards.

Southern Europe shows accelerating growth as countries like Spain, Italy, and Portugal implement stricter energy efficiency requirements. These markets benefit from increasing awareness of HVAC optimization benefits and growing availability of financing programs that support building modernization initiatives.

Eastern Europe demonstrates rapid adoption as infrastructure modernization accelerates and EU membership drives regulatory alignment. Countries like Poland, Czech Republic, and Hungary show particularly strong growth in commercial and industrial applications as economic development creates demand for modern building systems.

Market leadership reflects a diverse ecosystem of established HVAC manufacturers, technology companies, and specialized field device suppliers. The competitive landscape continues evolving as traditional boundaries blur between HVAC equipment manufacturers and technology providers.

Innovation focus centers on IoT integration, artificial intelligence capabilities, and enhanced energy efficiency features that deliver measurable value to end users. Companies invest heavily in research and development to maintain competitive advantages in this rapidly evolving market.

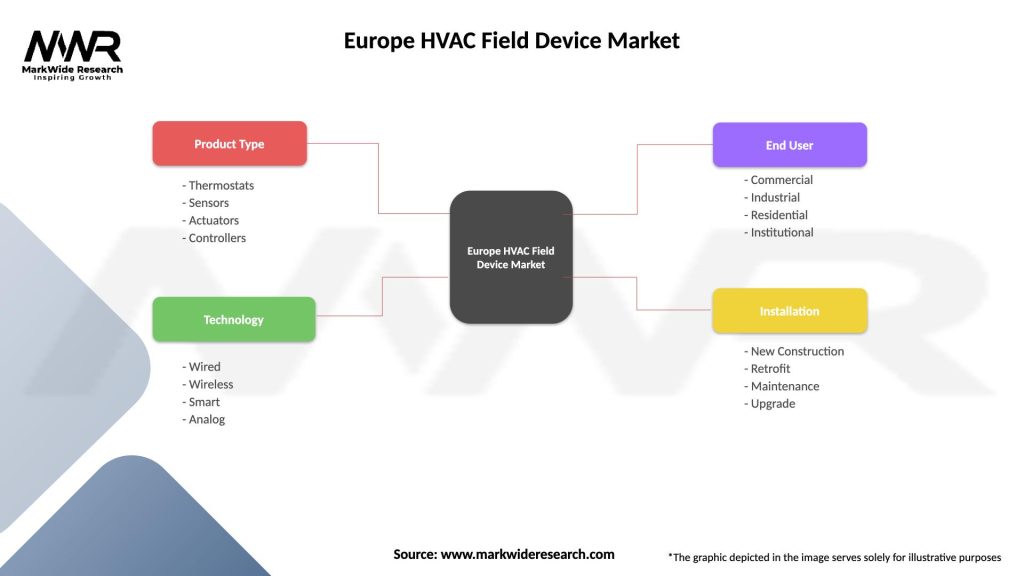

By Product Type:

By Technology:

By Application:

Smart Sensors represent the fastest-growing category, with wireless temperature and humidity sensors achieving 45% annual growth as building operators recognize the value of granular environmental monitoring. These devices enable zone-level optimization that can reduce energy consumption while improving occupant comfort through precise climate control.

Intelligent Actuators demonstrate strong adoption in retrofit applications where existing HVAC systems require modernization without complete replacement. Advanced actuators with integrated sensors and communication capabilities enable existing systems to achieve smart building functionality at a fraction of the cost of complete system replacement.

Wireless Controllers gain market share as installation costs decrease and battery life extends to multi-year operation. These devices eliminate the need for control wiring while providing advanced programming capabilities that enable sophisticated control strategies previously available only in high-end building automation systems.

IoT Gateways become essential components as building operators seek to integrate HVAC field devices with cloud-based analytics platforms. These devices enable remote monitoring, predictive maintenance, and energy optimization services that deliver ongoing value beyond the initial equipment investment.

Air Quality Sensors experience accelerated adoption following increased awareness of indoor environmental quality impacts on health and productivity. MarkWide Research indicates that demand for CO2, particulate matter, and volatile organic compound sensors grows at 38% annually as building operators prioritize occupant wellness alongside energy efficiency.

Building Owners benefit from substantial energy cost reductions, typically achieving 15-30% savings on HVAC operating expenses through optimized system operation and predictive maintenance capabilities. Advanced field devices also enhance property values and marketability by providing green building certifications and demonstrating environmental responsibility.

Facility Managers gain comprehensive visibility into system performance, enabling proactive maintenance that reduces emergency repairs and extends equipment life. Remote monitoring capabilities allow efficient management of multiple facilities while automated optimization reduces the need for constant manual adjustments.

System Integrators access new revenue opportunities through ongoing service contracts, remote monitoring services, and system optimization consulting. The transition to smart field devices creates demand for specialized expertise that commands premium pricing while building long-term customer relationships.

Occupants experience improved comfort through precise temperature and humidity control, better air quality monitoring, and responsive system operation that adapts to changing conditions. Smart interfaces enable individual control preferences while maintaining overall system efficiency.

Manufacturers develop recurring revenue streams through software subscriptions, cloud services, and predictive maintenance contracts that supplement traditional equipment sales. The shift toward connected devices creates opportunities for data monetization and value-added services that enhance customer relationships.

Strengths:

Weaknesses:

Opportunities:

Threats:

Wireless Connectivity dominates new installations as battery-powered sensors and controllers eliminate installation complexity while providing flexible deployment options. Advanced wireless protocols enable mesh networking that ensures reliable communication even in challenging building environments.

Artificial Intelligence Integration transforms HVAC field devices from simple sensors and actuators into intelligent systems capable of learning occupancy patterns, predicting equipment failures, and optimizing energy consumption automatically. Machine learning algorithms continuously improve performance without human intervention.

Cloud-Based Analytics enable building operators to leverage big data insights for portfolio-wide optimization, benchmarking, and predictive maintenance. Cloud platforms aggregate data from thousands of field devices to identify patterns and optimization opportunities that individual buildings cannot achieve independently.

Sustainability Focus drives demand for field devices that support renewable energy integration, carbon footprint reduction, and green building certification requirements. Environmental monitoring capabilities become standard features as building operators seek to demonstrate environmental responsibility.

User Experience Enhancement prioritizes intuitive interfaces, mobile connectivity, and automated operation that minimizes the need for technical expertise. Modern field devices emphasize plug-and-play installation and self-configuration capabilities that reduce deployment complexity and costs.

Standardization Initiatives accelerate as industry organizations work to establish common communication protocols and interoperability standards. The BACnet and Modbus protocols gain broader adoption while newer standards like Matter promise to simplify device integration across different manufacturers.

Partnership Strategies emerge as HVAC manufacturers collaborate with technology companies to integrate advanced capabilities into field devices. These partnerships combine domain expertise with cutting-edge technology to create solutions that neither party could develop independently.

Acquisition Activity increases as established companies acquire innovative startups to access new technologies and market segments. These transactions accelerate technology development while providing startups with the resources needed for large-scale market deployment.

Regulatory Evolution continues as European authorities refine energy efficiency standards and introduce new requirements for building automation and monitoring. These regulatory changes create both opportunities and challenges as companies adapt their products to meet evolving compliance requirements.

Investment Growth reflects increasing recognition of HVAC field devices as critical infrastructure components. Venture capital and private equity investment in building technology companies reaches record levels, funding innovation and market expansion initiatives.

Market Entry Strategy should focus on specific vertical markets or geographic regions where companies can establish competitive advantages through specialized expertise or local partnerships. Attempting to address the entire European market simultaneously may dilute resources and reduce effectiveness.

Technology Investment priorities should emphasize wireless connectivity, artificial intelligence capabilities, and cybersecurity features that address current market demands. Companies that fail to invest in these core technologies risk becoming obsolete as customer expectations evolve rapidly.

Service Development represents critical success factors as customers increasingly value ongoing support over initial product features. MWR analysis suggests that companies offering comprehensive service packages achieve 25% higher customer retention rates compared to product-only suppliers.

Partnership Opportunities should target system integrators, energy service companies, and facility management firms that can provide market access and installation expertise. These partnerships enable faster market penetration while reducing the need for direct sales and service infrastructure investment.

Regulatory Compliance requires proactive monitoring of evolving standards and early adoption of new requirements. Companies that anticipate regulatory changes and prepare compliant products in advance gain significant competitive advantages over reactive competitors.

Market evolution indicates sustained growth driven by regulatory requirements, technological advancement, and increasing recognition of energy efficiency benefits. The European market is expected to maintain its leadership position in advanced HVAC field device adoption while serving as a model for other global markets.

Technology trends point toward increased intelligence, autonomous operation, and seamless integration with broader building systems. Future field devices will likely incorporate advanced sensors, edge computing capabilities, and machine learning algorithms that enable sophisticated optimization without human intervention.

Application expansion will extend beyond traditional HVAC control to encompass indoor air quality management, occupancy analytics, and space utilization optimization. This broader scope creates new value propositions and market opportunities for innovative field device manufacturers.

Service transformation will shift the industry toward outcome-based business models where suppliers guarantee performance results rather than simply providing equipment. This evolution requires new capabilities in data analytics, remote monitoring, and customer relationship management.

Sustainability integration will become increasingly important as European markets pursue carbon neutrality goals. Field devices that support renewable energy integration, demand response programs, and comprehensive environmental monitoring will command premium pricing and market preference.

The Europe HVAC field device market represents a dynamic and rapidly expanding sector driven by regulatory mandates, technological innovation, and growing awareness of energy efficiency benefits. Strong growth momentum reflects the fundamental transformation of building systems from basic mechanical controls to intelligent, connected ecosystems that optimize performance automatically.

Market opportunities remain substantial as the vast majority of European buildings require modernization to meet evolving energy efficiency standards. The combination of retrofit applications, new construction requirements, and expanding industrial adoption creates a multi-faceted growth environment that benefits diverse market participants.

Technological advancement continues reshaping the competitive landscape as artificial intelligence, wireless connectivity, and cloud-based analytics become standard features rather than premium options. Companies that successfully integrate these capabilities while maintaining cost competitiveness will capture disproportionate market share in this evolving environment.

Success factors emphasize the importance of comprehensive solutions that combine advanced technology with ongoing service support. The shift toward outcome-based business models creates opportunities for recurring revenue while building stronger customer relationships that resist competitive pressure.

Future prospects indicate sustained growth as digitalization initiatives accelerate across European markets, with particular strength in smart city developments, sustainability certifications, and industrial automation applications. The Europe HVAC field device market is well-positioned to maintain its leadership role in global building automation while continuing to drive innovation that benefits building owners, operators, and occupants throughout the region.

What is HVAC Field Device?

HVAC Field Devices are essential components used in heating, ventilation, and air conditioning systems. They include sensors, actuators, and controllers that help regulate and monitor environmental conditions in residential, commercial, and industrial settings.

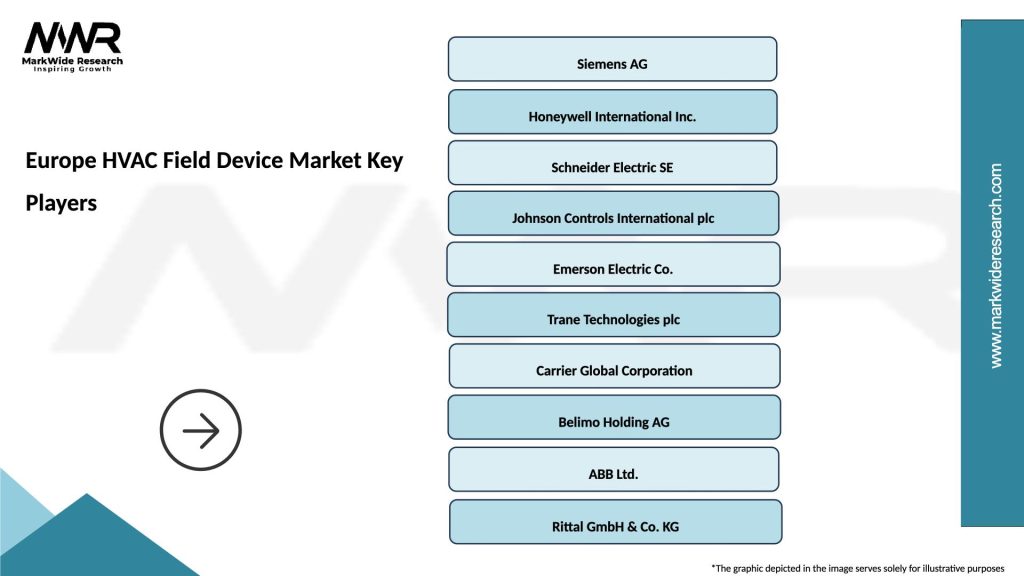

What are the key players in the Europe HVAC Field Device Market?

Key players in the Europe HVAC Field Device Market include Siemens, Honeywell, and Schneider Electric. These companies are known for their innovative solutions and extensive product offerings in the HVAC sector, among others.

What are the main drivers of the Europe HVAC Field Device Market?

The main drivers of the Europe HVAC Field Device Market include the increasing demand for energy-efficient systems, the growth of smart buildings, and the rising focus on indoor air quality. These factors are pushing the adoption of advanced HVAC technologies across various sectors.

What challenges does the Europe HVAC Field Device Market face?

The Europe HVAC Field Device Market faces challenges such as high installation costs and the complexity of integrating new technologies with existing systems. Additionally, regulatory compliance and the need for skilled labor can hinder market growth.

What opportunities exist in the Europe HVAC Field Device Market?

Opportunities in the Europe HVAC Field Device Market include the growing trend of automation and IoT integration in HVAC systems. Furthermore, the increasing emphasis on sustainability and energy efficiency presents avenues for innovation and product development.

What trends are shaping the Europe HVAC Field Device Market?

Trends shaping the Europe HVAC Field Device Market include the rise of smart HVAC solutions, the integration of AI and machine learning for predictive maintenance, and the increasing use of wireless technologies. These trends are enhancing system performance and user experience.

Europe HVAC Field Device Market

| Segmentation Details | Description |

|---|---|

| Product Type | Thermostats, Sensors, Actuators, Controllers |

| Technology | Wired, Wireless, Smart, Analog |

| End User | Commercial, Industrial, Residential, Institutional |

| Installation | New Construction, Retrofit, Maintenance, Upgrade |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe HVAC Field Device Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at