444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe household appliances market represents one of the most dynamic and technologically advanced sectors in the global consumer goods industry. This comprehensive market encompasses a diverse range of products including refrigerators, washing machines, dishwashers, ovens, air conditioners, and small kitchen appliances that have become integral to modern European households. Market dynamics indicate robust growth driven by technological innovation, energy efficiency mandates, and evolving consumer preferences toward smart home integration.

Regional leadership in this sector is characterized by strong manufacturing capabilities, particularly in Germany, Italy, and Turkey, which serve as major production hubs for both domestic consumption and global export. The market demonstrates significant growth potential with increasing adoption of energy-efficient appliances, driven by stringent EU regulations and consumer awareness of environmental sustainability. Smart appliance penetration has reached approximately 28% market share across major European markets, indicating substantial room for continued expansion.

Consumer behavior patterns show a marked shift toward premium appliances with advanced features, including IoT connectivity, artificial intelligence integration, and enhanced energy efficiency ratings. The market benefits from replacement demand cycles typically ranging from 8-15 years for major appliances, ensuring consistent market activity. Innovation leadership from European manufacturers continues to drive competitive advantage, with companies investing heavily in research and development to maintain market position.

The Europe household appliances market refers to the comprehensive ecosystem of consumer durables designed for domestic use across European households, encompassing both major appliances such as refrigerators, washing machines, and cooking equipment, as well as small appliances including coffee makers, vacuum cleaners, and food processors that enhance daily living convenience and efficiency.

Market scope includes all electrically powered devices intended for household use, spanning categories from essential large appliances that form the backbone of modern home functionality to specialized small appliances that cater to specific consumer needs and lifestyle preferences. Geographic coverage encompasses all European Union member states plus the United Kingdom, Norway, and Switzerland, representing diverse market conditions and consumer preferences across different cultural and economic contexts.

Industry classification typically segments the market into major appliances, which include refrigeration equipment, laundry appliances, cooking appliances, and dishwashers, alongside small appliances covering food preparation, floor care, personal care, and comfort appliances. Market participants range from global multinational corporations to specialized regional manufacturers, creating a competitive landscape characterized by both scale advantages and niche specialization opportunities.

Market performance across Europe demonstrates resilient growth patterns supported by technological advancement, regulatory compliance requirements, and evolving consumer lifestyle preferences. The sector benefits from stable replacement demand combined with new household formation and increasing penetration of smart home technologies. Energy efficiency regulations continue to drive product innovation and market transformation, with manufacturers investing significantly in developing compliant solutions.

Competitive dynamics reveal a market dominated by established European brands alongside strong Asian competitors, creating intense innovation pressure and driving continuous product improvement. Premium segment growth has accelerated, with consumers increasingly willing to invest in high-quality, feature-rich appliances that offer enhanced functionality and durability. Digital transformation initiatives have become critical success factors, with connected appliance adoption growing at approximately 15% annually across major European markets.

Regional variations show distinct preferences, with Northern European markets favoring energy efficiency and sustainability features, while Southern European consumers prioritize design aesthetics and cooking-related appliances. Market consolidation trends continue as manufacturers seek scale advantages and broader product portfolios to serve diverse consumer needs effectively. Supply chain resilience has emerged as a key strategic priority following recent global disruptions, driving localization initiatives and supplier diversification strategies.

Consumer preferences have shifted dramatically toward smart, connected appliances that integrate seamlessly with home automation systems and mobile applications. Energy efficiency remains the primary purchase driver, with EU energy labels significantly influencing consumer decision-making processes across all appliance categories.

Technological advancement serves as the primary catalyst for market growth, with manufacturers continuously introducing innovative features that enhance user experience and operational efficiency. Smart home integration capabilities have become essential product attributes, enabling remote monitoring, predictive maintenance, and energy optimization through advanced connectivity solutions.

Regulatory compliance requirements, particularly EU energy efficiency directives and environmental standards, drive continuous product development and market transformation. Consumer awareness of environmental impact has increased significantly, creating strong demand for appliances with superior energy ratings and sustainable manufacturing practices. Urbanization trends across Europe necessitate space-efficient appliances with compact designs and multi-functional capabilities.

Replacement cycles for major appliances create consistent market demand, with consumers upgrading to more efficient and feature-rich models as existing appliances reach end-of-life. Income growth in emerging European markets expands the addressable customer base for premium appliances with advanced features. Lifestyle changes including increased home cooking, remote work adoption, and health consciousness drive demand for specialized appliances that support these trends.

Innovation investment by manufacturers continues to introduce breakthrough technologies including artificial intelligence, machine learning, and advanced materials that enhance appliance performance and durability. Distribution channel evolution through e-commerce platforms and omnichannel retail strategies improves market accessibility and customer convenience.

Economic uncertainty across European markets can significantly impact consumer spending on discretionary household appliances, particularly premium products with higher price points. Supply chain disruptions have created challenges in component availability and manufacturing efficiency, leading to increased costs and extended delivery times for certain appliance categories.

Raw material price volatility affects manufacturing costs and profit margins, particularly for steel, copper, and rare earth elements essential for appliance production. Regulatory complexity across different European markets creates compliance challenges and increases development costs for manufacturers serving multiple jurisdictions. Market saturation in developed European countries limits growth opportunities for basic appliance categories.

Competition intensity from low-cost manufacturers, particularly from Asian markets, pressures pricing strategies and profit margins for European producers. Consumer price sensitivity during economic downturns can delay replacement purchases and shift demand toward lower-priced alternatives. Installation complexity for advanced appliances may deter some consumers, particularly older demographics less comfortable with technology integration.

Environmental regulations while driving innovation, also increase compliance costs and may restrict certain technologies or materials previously used in appliance manufacturing. Energy cost fluctuations can impact consumer purchasing decisions, with high energy prices potentially delaying appliance upgrades despite long-term efficiency benefits.

Smart home ecosystem development presents substantial growth opportunities as consumers increasingly seek integrated solutions that enhance convenience and energy management. Artificial intelligence integration enables predictive maintenance, personalized user experiences, and optimized operational efficiency, creating premium product positioning opportunities.

Sustainability initiatives open new market segments for eco-friendly appliances with enhanced recyclability, reduced environmental impact, and circular economy principles. Emerging market expansion within Eastern Europe offers significant growth potential as disposable income increases and consumer preferences evolve toward modern appliances. Service-based business models including appliance-as-a-service and subscription maintenance programs create recurring revenue opportunities.

Health and wellness trends drive demand for specialized appliances including air purifiers, water filtration systems, and advanced cooking equipment that support healthy lifestyle choices. Aging population demographics create opportunities for appliances with accessibility features, simplified interfaces, and enhanced safety mechanisms. Energy storage integration with renewable energy systems presents opportunities for appliances that optimize energy consumption patterns.

Customization capabilities through modular designs and personalization options allow manufacturers to command premium pricing while meeting diverse consumer preferences. Digital transformation enables new customer engagement models, predictive analytics, and enhanced after-sales service delivery that strengthen customer relationships and brand loyalty.

Competitive landscape evolution shows increasing consolidation among major manufacturers seeking scale advantages and broader product portfolios to serve diverse market segments effectively. Innovation cycles have accelerated with manufacturers introducing new product generations more frequently to maintain competitive differentiation and market share.

Consumer behavior shifts toward online research and purchasing have transformed traditional retail models, requiring manufacturers to develop comprehensive digital strategies and direct-to-consumer capabilities. Supply chain optimization initiatives focus on resilience and flexibility to manage disruptions while maintaining cost competitiveness and delivery reliability.

Technology convergence between appliances and digital platforms creates new value propositions through data analytics, remote diagnostics, and predictive maintenance services. Regulatory harmonization efforts across European markets simplify compliance requirements while maintaining high standards for energy efficiency and environmental protection. Partnership strategies between appliance manufacturers and technology companies accelerate innovation and market entry for smart home solutions.

Market segmentation has become more sophisticated with manufacturers targeting specific consumer demographics, lifestyle preferences, and price points through tailored product offerings and marketing strategies. Sustainability reporting requirements drive transparency in manufacturing processes and product lifecycle environmental impact, influencing consumer purchasing decisions and brand perception.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of market insights and projections. Primary research includes extensive surveys of consumers, retailers, and industry stakeholders across major European markets to understand purchasing behavior, preferences, and market trends.

Secondary research incorporates analysis of industry reports, regulatory filings, company financial statements, and trade association data to validate market size estimates and competitive positioning. Expert interviews with industry leaders, technology specialists, and market analysts provide qualitative insights into market dynamics and future trends.

Data triangulation methods ensure consistency across different information sources and research approaches, enhancing the reliability of market projections and strategic recommendations. Statistical modeling techniques analyze historical market data to identify patterns and develop forecasting models for various market segments and geographic regions.

Market segmentation analysis examines product categories, price points, distribution channels, and consumer demographics to provide detailed insights into market structure and growth opportunities. Competitive intelligence gathering includes analysis of product launches, pricing strategies, marketing campaigns, and strategic partnerships across major market participants.

Germany maintains its position as the largest European market for household appliances, driven by strong consumer purchasing power, preference for premium products, and leadership in energy efficiency standards. German market share represents approximately 22% of total European demand, with particular strength in major appliances and smart home integration technologies.

United Kingdom demonstrates resilient market performance despite economic uncertainties, with consumers prioritizing energy-efficient appliances and smart home solutions. French market dynamics show strong preference for design-oriented appliances and cooking equipment, reflecting cultural emphasis on culinary excellence and aesthetic appeal.

Italy serves as both a major consumer market and manufacturing hub, with Italian brands maintaining strong positions in premium appliance segments globally. Spanish market growth has accelerated with increasing adoption of modern appliances and replacement of aging equipment in residential properties.

Nordic countries including Sweden, Norway, and Denmark lead in sustainability-focused appliance adoption, with energy efficiency penetration reaching approximately 85% market coverage for A+++ rated appliances. Eastern European markets including Poland, Czech Republic, and Hungary show rapid growth as consumer preferences evolve and disposable income increases.

Turkey represents a significant manufacturing base for European appliance distribution while also demonstrating strong domestic market growth. Regional preferences vary significantly, with Northern European markets favoring functionality and efficiency, while Southern European consumers prioritize design and cooking-related features.

Market leadership is distributed among several major European and international manufacturers, each with distinct competitive advantages and market positioning strategies. Innovation capabilities and brand recognition serve as primary competitive differentiators in this mature market environment.

Strategic partnerships between appliance manufacturers and technology companies have become increasingly important for developing smart home solutions and IoT integration capabilities. Acquisition activity continues as companies seek to expand product portfolios, enter new markets, and acquire technological capabilities.

Product category segmentation reveals distinct market dynamics and growth patterns across different appliance types, with smart appliances representing the fastest-growing segment across all categories.

By Product Type:

By Technology Level:

By Distribution Channel:

Refrigeration appliances maintain the largest market share within major appliances, with consumers increasingly demanding energy-efficient models with advanced features including smart temperature control and food management systems. Innovation focus centers on reducing energy consumption while enhancing storage capacity and food preservation capabilities.

Laundry appliances show strong growth in premium segments with consumers valuing water and energy efficiency, gentle fabric care, and smart connectivity features. Washing machine technology has evolved to include steam cleaning, allergen removal, and smartphone integration for remote monitoring and control.

Cooking appliances demonstrate significant regional variations, with induction cooktops gaining popularity in Northern Europe while gas cooking remains preferred in Southern European markets. Smart oven technology incorporating artificial intelligence and automated cooking programs represents a high-growth segment.

Small appliances category shows the highest innovation velocity with frequent product launches and rapid technology adoption. Health and wellness appliances including air fryers, blenders, and water purifiers have experienced exceptional growth driven by lifestyle trends and health consciousness.

Dishwasher penetration varies significantly across European markets, with adoption rates reaching approximately 75% in Northern European households compared to lower penetration in Southern European regions, presenting growth opportunities for market expansion.

Manufacturers benefit from comprehensive market intelligence enabling strategic product development, competitive positioning, and resource allocation decisions. Market insights support innovation investment priorities and help identify emerging consumer trends before they become mainstream market demands.

Retailers gain valuable understanding of consumer preferences, seasonal demand patterns, and product category performance to optimize inventory management and merchandising strategies. Channel insights enable effective partnership strategies with manufacturers and improved customer service delivery.

Investors receive detailed market analysis supporting investment decisions, merger and acquisition evaluations, and portfolio optimization strategies within the household appliances sector. Financial projections and market growth forecasts inform capital allocation and risk assessment processes.

Technology providers understand market requirements for smart home integration, IoT connectivity, and artificial intelligence applications in household appliances. Partnership opportunities with appliance manufacturers become clearer through comprehensive competitive landscape analysis.

Regulatory bodies access market data supporting policy development, energy efficiency standards, and environmental protection initiatives. Compliance trends and industry response patterns inform regulatory strategy and implementation timelines.

Consumers benefit indirectly through improved product offerings, competitive pricing, and enhanced service quality resulting from market-driven innovation and competition among manufacturers and retailers.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart connectivity has emerged as the dominant trend across all appliance categories, with manufacturers integrating IoT capabilities, smartphone apps, and voice control interfaces to enhance user experience and operational efficiency. Artificial intelligence integration enables predictive maintenance, personalized settings, and automated optimization of appliance performance.

Sustainability initiatives drive product development toward circular economy principles, including improved recyclability, reduced environmental impact, and energy efficiency optimization. Consumer awareness of environmental issues influences purchasing decisions, with energy labels and sustainability certifications becoming critical product attributes.

Design aesthetics have gained importance as appliances become integral elements of home décor, with manufacturers offering customizable finishes, sleek profiles, and architectural integration options. Space optimization solutions address urbanization trends through compact designs and multi-functional appliances.

Health and wellness considerations influence appliance development, including air purification systems, water filtration technology, and cooking appliances that support healthy food preparation. Contactless operation features have gained popularity, driven by hygiene consciousness and convenience preferences.

Service digitization transforms customer relationships through remote diagnostics, predictive maintenance alerts, and digital customer support platforms. Subscription models for appliance services and consumables create recurring revenue opportunities while enhancing customer engagement.

Strategic acquisitions continue reshaping the competitive landscape as manufacturers seek to expand product portfolios, enter new markets, and acquire technological capabilities. Recent merger activity has focused on combining traditional appliance expertise with smart home technology capabilities.

Manufacturing localization initiatives have accelerated as companies seek supply chain resilience and reduced transportation costs. European production capacity expansion includes new facilities in Eastern European countries offering cost advantages while maintaining quality standards.

Technology partnerships between appliance manufacturers and software companies have intensified to develop advanced smart home solutions and artificial intelligence applications. Collaboration strategies enable faster innovation cycles and access to specialized technological expertise.

Regulatory compliance initiatives address evolving EU energy efficiency standards and environmental regulations, driving product redesign and manufacturing process improvements. Industry cooperation on sustainability standards and recycling programs demonstrates collective commitment to environmental responsibility.

Digital transformation investments focus on e-commerce capabilities, customer relationship management systems, and data analytics platforms to enhance market responsiveness and customer engagement. Direct-to-consumer strategies have gained importance as manufacturers seek closer customer relationships and improved margins.

MarkWide Research recommends that manufacturers prioritize smart home integration capabilities while maintaining focus on energy efficiency and sustainability credentials. Investment strategies should emphasize artificial intelligence development and predictive analytics capabilities to differentiate products in competitive markets.

Market expansion opportunities in Eastern European markets require tailored product offerings and localized marketing strategies to address diverse consumer preferences and price sensitivities. Partnership development with technology companies and service providers can accelerate innovation and market entry for smart appliance solutions.

Supply chain diversification initiatives should reduce dependency on single-source suppliers while maintaining quality standards and cost competitiveness. Manufacturing flexibility through modular production systems enables rapid response to market demand fluctuations and product customization requirements.

Customer engagement strategies should leverage digital platforms and data analytics to develop personalized experiences and strengthen brand loyalty. Service innovation through subscription models and predictive maintenance programs creates differentiation opportunities and recurring revenue streams.

Sustainability leadership positions companies advantageously as environmental regulations tighten and consumer consciousness increases. Circular economy initiatives including product lifecycle management and recycling programs demonstrate corporate responsibility while creating operational efficiencies.

Market evolution toward smart, connected appliances will accelerate with IoT adoption rates projected to reach approximately 45% market penetration within the next five years across major European markets. Artificial intelligence integration will become standard in premium appliance segments, enabling predictive maintenance and personalized user experiences.

Sustainability requirements will intensify with stricter energy efficiency standards and circular economy regulations driving continuous product innovation and manufacturing process improvements. Consumer preferences will increasingly favor appliances with demonstrated environmental benefits and lifecycle sustainability credentials.

Regional market dynamics will show continued growth in Eastern European markets as disposable income increases and consumer preferences evolve toward modern appliances. Western European markets will focus on replacement demand and premium product segments with advanced features and smart connectivity.

Technology convergence between appliances and home automation systems will create integrated solutions that optimize energy consumption, enhance convenience, and provide comprehensive home management capabilities. Service-based business models will gain traction as manufacturers seek recurring revenue streams and deeper customer relationships.

Competitive landscape evolution will continue through strategic partnerships, acquisitions, and technology collaborations as companies position for leadership in the smart home ecosystem. Innovation investment will remain critical for maintaining competitive advantage in rapidly evolving market conditions.

Europe household appliances market demonstrates remarkable resilience and innovation capacity, driven by technological advancement, regulatory requirements, and evolving consumer preferences toward smart, sustainable solutions. Market fundamentals remain strong with consistent replacement demand, growing smart home adoption, and expanding opportunities in emerging European markets.

Strategic success in this dynamic environment requires balanced investment in technology innovation, sustainability initiatives, and customer engagement capabilities. Manufacturers that effectively combine traditional appliance expertise with smart home technologies and environmental responsibility will capture the greatest market opportunities. Future growth will be characterized by increased connectivity, artificial intelligence integration, and service-based business models that transform traditional appliance relationships into comprehensive home management solutions.

Market outlook remains positive with continued innovation driving premium segment growth while emerging markets provide volume expansion opportunities. Industry participants that adapt to changing consumer expectations and regulatory requirements while maintaining operational excellence will achieve sustainable competitive advantage in this evolving marketplace.

What is Household Appliances?

Household appliances refer to electrical or mechanical devices used in domestic settings for various tasks, such as cooking, cleaning, and food preservation. Common examples include refrigerators, washing machines, and microwaves.

What are the key players in the Europe Household Appliances Market?

Key players in the Europe Household Appliances Market include Bosch, Electrolux, and Whirlpool, which are known for their innovative products and strong market presence. These companies focus on energy efficiency and smart technology integration, among others.

What are the main drivers of the Europe Household Appliances Market?

The main drivers of the Europe Household Appliances Market include increasing consumer demand for energy-efficient products, advancements in smart home technology, and a growing focus on sustainability. Additionally, urbanization and changing lifestyles contribute to market growth.

What challenges does the Europe Household Appliances Market face?

The Europe Household Appliances Market faces challenges such as intense competition, fluctuating raw material prices, and regulatory compliance related to energy efficiency standards. These factors can impact profitability and market dynamics.

What opportunities exist in the Europe Household Appliances Market?

Opportunities in the Europe Household Appliances Market include the rising trend of smart home devices, increasing demand for eco-friendly appliances, and the potential for growth in emerging markets. Companies can leverage these trends to innovate and expand their product offerings.

What trends are shaping the Europe Household Appliances Market?

Trends shaping the Europe Household Appliances Market include the integration of IoT technology in appliances, a shift towards sustainable materials, and the growing popularity of multifunctional devices. These trends reflect changing consumer preferences and technological advancements.

Europe Household Appliances Market

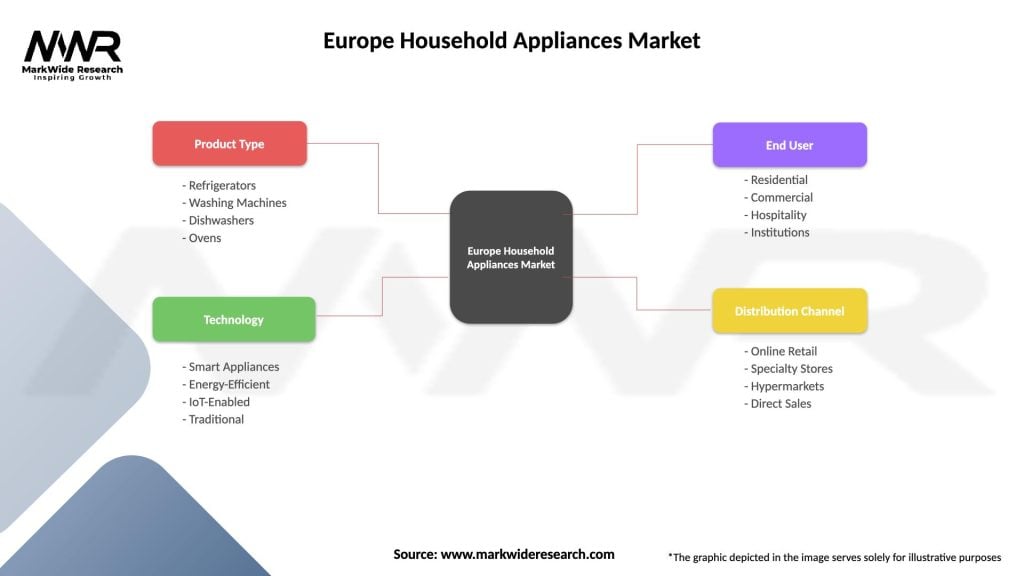

| Segmentation Details | Description |

|---|---|

| Product Type | Refrigerators, Washing Machines, Dishwashers, Ovens |

| Technology | Smart Appliances, Energy-Efficient, IoT-Enabled, Traditional |

| End User | Residential, Commercial, Hospitality, Institutions |

| Distribution Channel | Online Retail, Specialty Stores, Hypermarkets, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Household Appliances Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at