444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe home automation system market represents one of the most dynamic and rapidly evolving sectors within the broader smart technology landscape. European consumers are increasingly embracing intelligent home solutions that offer enhanced convenience, energy efficiency, and security features. The market encompasses a comprehensive range of products including smart lighting systems, automated climate control, security and surveillance equipment, entertainment systems, and integrated home management platforms.

Market dynamics indicate robust growth driven by technological advancement, increasing consumer awareness, and supportive regulatory frameworks across European Union member states. The region’s commitment to energy efficiency standards and sustainability initiatives has particularly accelerated adoption of smart home technologies. Germany, United Kingdom, France, and Nordic countries lead market penetration, while emerging markets in Eastern Europe show significant growth potential.

Consumer preferences in Europe emphasize privacy, data security, and interoperability between different smart home devices. This has influenced product development strategies among manufacturers, who increasingly focus on GDPR compliance and open-standard protocols. The market is experiencing a shift from standalone smart devices toward comprehensive, integrated home automation ecosystems that provide seamless user experiences.

Growth projections suggest the European market will expand at a compound annual growth rate of 12.5% through the forecast period, driven by increasing urbanization, rising disposable incomes, and growing awareness of smart home benefits. Wireless connectivity improvements and the rollout of 5G networks across Europe are expected to further accelerate market expansion.

The Europe home automation system market refers to the comprehensive ecosystem of interconnected devices, software platforms, and services that enable homeowners to remotely monitor, control, and automate various household functions and appliances. Home automation systems integrate multiple technologies including Internet of Things sensors, wireless communication protocols, artificial intelligence, and cloud-based management platforms to create intelligent living environments.

Core components of these systems include smart thermostats, automated lighting controls, security cameras and sensors, smart locks, voice-activated assistants, and centralized control hubs. The technology enables users to manage their homes through smartphone applications, voice commands, or automated scheduling based on occupancy patterns and preferences.

European market characteristics distinguish this region through emphasis on energy efficiency compliance, strict data privacy regulations, and preference for locally manufactured or European-standard certified products. The market encompasses both DIY installation systems and professionally installed comprehensive automation solutions, catering to diverse consumer segments and budget ranges.

Integration capabilities allow these systems to communicate with utility grids, emergency services, and third-party service providers, creating a connected ecosystem that extends beyond individual homes to smart neighborhood and city-wide initiatives across European urban centers.

Market leadership in Europe’s home automation sector is characterized by strong competition between established technology giants and innovative European startups. The market demonstrates remarkable resilience and growth potential, with penetration rates reaching 28% in developed European markets while maintaining significant expansion opportunities in emerging regions.

Key growth drivers include increasing consumer awareness of energy savings potential, enhanced home security concerns, and the desire for convenient lifestyle solutions. European consumers show particular interest in energy management systems that help reduce utility costs and carbon footprints, aligning with regional sustainability goals and government incentives.

Technology trends shaping the market include artificial intelligence integration, voice control advancement, and improved interoperability standards. The emergence of Matter protocol adoption is expected to address fragmentation issues and accelerate consumer adoption by ensuring device compatibility across different brands and platforms.

Regional variations show Northern European countries leading in smart heating and energy management adoption, while Southern European markets demonstrate stronger growth in security and entertainment automation. Western European markets focus on premium, feature-rich solutions, while Eastern European regions show increasing demand for cost-effective, basic automation systems.

Investment activity remains robust, with venture capital and private equity firms actively supporting European home automation startups and established companies expanding their smart home portfolios through strategic acquisitions and partnerships.

Consumer adoption patterns reveal that European homeowners typically begin their smart home journey with security systems or smart thermostats before expanding to comprehensive automation solutions. Research findings indicate that once consumers install their first smart home device, they add an average of three additional connected devices within the following year.

Energy efficiency mandates across European Union member states serve as primary market catalysts, with government regulations requiring improved home energy performance driving smart thermostat and automated lighting adoption. Utility cost increases motivate consumers to invest in systems that provide measurable energy savings and consumption monitoring capabilities.

Demographic shifts significantly influence market growth, particularly the aging population’s need for assisted living technologies and millennials’ preference for connected, convenient lifestyle solutions. Urbanization trends in major European cities create demand for space-efficient, remotely manageable home systems that maximize living comfort in smaller residential spaces.

Security concerns drive substantial market demand, with increasing property crime rates in urban areas motivating homeowners to invest in comprehensive smart security systems. Insurance incentives offered by European insurance companies for homes equipped with monitored security systems further accelerate adoption rates.

Technological advancement in wireless communication, particularly 5G network deployment and improved Wi-Fi standards, enables more reliable and responsive home automation systems. Artificial intelligence integration enhances system capabilities through predictive automation and personalized user experiences, increasing consumer value perception.

Government support programs and subsidies for energy-efficient home improvements across various European countries provide financial incentives for smart home technology adoption. Building code updates increasingly require or encourage smart home readiness in new construction projects, expanding the addressable market.

High initial investment costs present significant barriers for many European consumers, particularly in price-sensitive markets where comprehensive home automation systems require substantial upfront expenditure. Economic uncertainty and varying income levels across European regions limit market penetration in certain demographic segments.

Technical complexity challenges many consumers who lack technical expertise to install, configure, and maintain sophisticated home automation systems. Compatibility issues between different manufacturers’ products create frustration and additional costs when consumers attempt to build integrated systems.

Privacy and security concerns remain paramount for European consumers, with high-profile data breaches and cybersecurity incidents creating skepticism about connected home devices. GDPR compliance requirements add complexity and costs for manufacturers while creating uncertainty among privacy-conscious consumers.

Infrastructure limitations in rural and older urban areas across Europe restrict reliable internet connectivity necessary for cloud-based home automation systems. Aging housing stock in many European cities presents installation challenges and additional costs for retrofitting smart home technologies.

Market fragmentation with numerous competing standards and protocols creates confusion among consumers and limits interoperability between different smart home ecosystems. Rapid technology evolution leads to concerns about product obsolescence and long-term investment protection.

Emerging market expansion in Eastern European countries presents substantial growth opportunities as economic development and urbanization increase disposable income and technology adoption rates. Government digitization initiatives across the European Union create supportive environments for smart home technology deployment.

Integration with renewable energy systems offers significant opportunities as European homeowners increasingly adopt solar panels and energy storage solutions. Smart grid connectivity enables home automation systems to optimize energy consumption based on real-time pricing and grid demand, creating value for both consumers and utilities.

Aging population services represent a growing opportunity segment, with home automation technologies providing safety monitoring, medication reminders, and emergency response capabilities for elderly residents. Healthcare integration possibilities expand market applications beyond traditional home management into wellness and medical monitoring.

Subscription service models create recurring revenue opportunities for companies offering cloud-based features, professional monitoring, and ongoing system optimization services. Data analytics services can provide valuable insights to consumers about their energy usage, security patterns, and lifestyle optimization opportunities.

Partnership opportunities with European utility companies, insurance providers, and telecommunications operators can accelerate market penetration through bundled service offerings and cross-promotional marketing initiatives. Smart city integration projects across European municipalities create opportunities for home automation systems to connect with broader urban infrastructure.

Competitive landscape evolution shows increasing consolidation as larger technology companies acquire specialized home automation startups to expand their product portfolios and market reach. Strategic partnerships between device manufacturers, software platforms, and service providers create comprehensive ecosystem offerings that enhance consumer value propositions.

Technology convergence drives market dynamics as artificial intelligence, Internet of Things, and cloud computing technologies integrate to create more sophisticated and user-friendly home automation solutions. Standards development through industry consortiums like the Matter alliance addresses interoperability challenges and accelerates market growth.

Consumer behavior shifts toward sustainability and energy consciousness influence product development priorities and marketing strategies across the European market. Regulatory environment changes regarding data privacy, energy efficiency, and building standards continuously reshape market requirements and opportunities.

Supply chain considerations affect market dynamics as European companies balance cost competitiveness with preferences for locally manufactured or European-sourced components. Distribution channel evolution includes growth in online sales platforms, specialized smart home retailers, and integration with traditional home improvement stores.

Investment flows from venture capital, private equity, and corporate development funds support innovation and market expansion, while public market valuations reflect investor confidence in long-term growth prospects for European home automation companies.

Primary research methodology employed comprehensive surveys and interviews with European consumers, industry professionals, and technology experts to gather firsthand insights about market trends, preferences, and challenges. Consumer surveys included representative samples from major European markets including Germany, France, United Kingdom, Italy, Spain, and Nordic countries.

Secondary research analysis incorporated extensive review of industry reports, government statistics, regulatory documents, and company financial filings to establish market context and validate primary research findings. Technology assessment included evaluation of patent filings, product launches, and innovation trends across the European home automation ecosystem.

Market sizing methodology utilized bottom-up analysis combining product category sales data, consumer adoption rates, and regional market penetration statistics. Forecasting models incorporated demographic trends, economic indicators, and technology adoption curves to project future market development.

Competitive analysis included detailed examination of major market participants’ strategies, product portfolios, distribution channels, and financial performance. Regulatory impact assessment evaluated current and proposed European Union directives affecting home automation technology deployment and market development.

Data validation processes included cross-referencing multiple sources, expert review panels, and statistical analysis to ensure research accuracy and reliability. MarkWide Research analytical frameworks provided structured approaches to market segmentation and trend identification across diverse European markets.

Western European markets demonstrate the highest penetration rates and consumer sophistication, with Germany leading in smart heating and energy management adoption while maintaining 32% household penetration for connected home devices. United Kingdom shows strong growth in security and entertainment automation despite Brexit-related economic uncertainties.

Nordic countries including Sweden, Norway, and Denmark exhibit exceptional adoption rates for energy management systems, driven by environmental consciousness and government incentives for sustainable technology. Finland demonstrates particular strength in smart home software development and system integration capabilities.

France and Netherlands show balanced growth across multiple home automation categories, with strong consumer preference for locally developed or European-manufactured solutions. Switzerland and Austria represent premium market segments with high willingness to pay for advanced features and professional installation services.

Southern European markets including Italy, Spain, and Portugal demonstrate rapid growth in security automation and climate control systems, with adoption rates increasing 18% annually as economic conditions improve and technology costs decrease.

Eastern European expansion shows significant potential, with Poland, Czech Republic, and Hungary leading regional adoption while maintaining 15% annual growth rates in smart home technology deployment. Baltic states demonstrate strong interest in energy efficiency solutions supported by EU development funding programs.

Market leadership includes both global technology giants and specialized European companies that focus on regional preferences and regulatory requirements. Competition intensity varies by product category, with security systems showing high fragmentation while voice control platforms demonstrate oligopolistic characteristics.

Competitive strategies include platform ecosystem development, strategic partnerships with European retailers and installers, and emphasis on GDPR compliance and data privacy protection. Innovation focus areas include artificial intelligence integration, energy optimization algorithms, and improved user interface design.

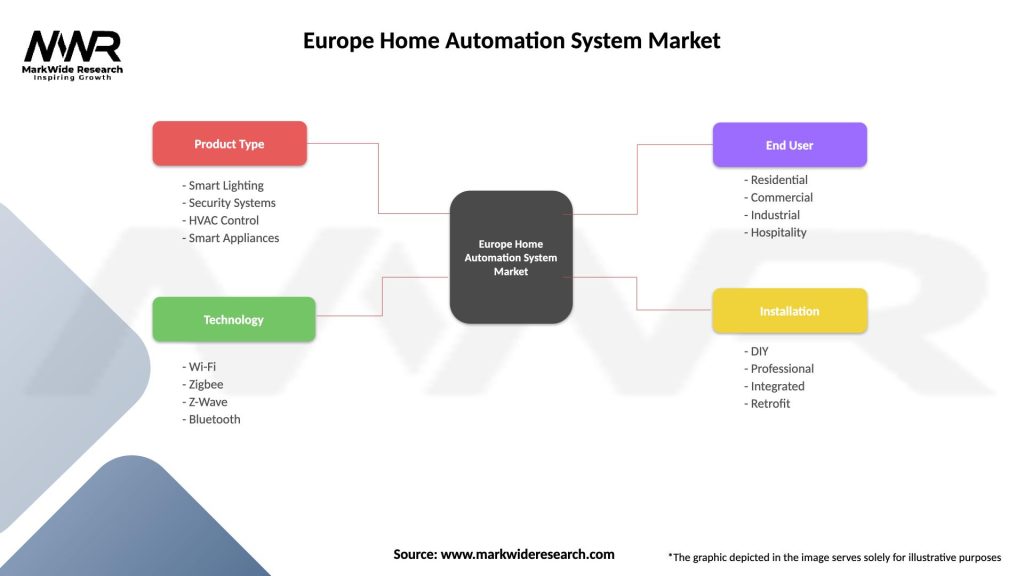

By Technology: The European market segments into wireless and wired systems, with wireless solutions dominating consumer preferences due to installation flexibility and lower costs. Wireless technologies include Wi-Fi, Zigbee, Z-Wave, and emerging Matter protocol implementations.

By Application: Security and access control systems represent the largest application segment, followed by lighting control, climate management, and entertainment automation. Energy management applications show the fastest growth rates driven by utility cost concerns and environmental awareness.

By End User: Residential applications dominate the market, with single-family homes showing higher adoption rates than multi-unit residential buildings. New construction projects increasingly incorporate smart home readiness, while retrofit applications focus on wireless, easy-installation solutions.

By Price Range: The market segments into premium, mid-range, and budget categories, with mid-range solutions showing the strongest growth as technology costs decrease and feature sets expand. Premium segments emphasize professional installation and comprehensive integration capabilities.

By Distribution Channel: Online sales channels show rapid growth, while traditional retail and specialized smart home stores maintain importance for complex systems requiring consultation and support. Professional installer channels remain crucial for high-end residential and commercial applications.

Security and Access Control: This category maintains market leadership with comprehensive solutions including smart locks, security cameras, motion sensors, and integrated alarm systems. European consumers prioritize systems with local data storage options and professional monitoring services that comply with regional privacy regulations.

Lighting Control Systems: Smart lighting represents a high-adoption category with solutions ranging from basic smart bulbs to comprehensive architectural lighting control. Energy efficiency benefits and integration with natural light sensors drive consumer interest, while color-changing and mood lighting features appeal to lifestyle-focused segments.

Climate Control and HVAC: Smart thermostats and automated climate control systems show strong growth driven by energy cost savings and comfort optimization. Integration capabilities with renewable energy systems and utility demand response programs enhance value propositions for environmentally conscious European consumers.

Entertainment and Media: Home theater automation and multi-room audio systems cater to premium market segments, while streaming device integration and voice control capabilities expand mainstream appeal. Content integration with European streaming services and local media sources influences product development strategies.

Kitchen and Appliance Automation: Smart appliances including refrigerators, ovens, and dishwashers show increasing integration capabilities, while coffee makers and small appliances offer entry-level automation experiences. European appliance manufacturers emphasize energy efficiency ratings and connectivity standards compliance.

Manufacturers and Technology Companies benefit from expanding market opportunities across diverse European regions, with potential for recurring revenue through subscription services and ongoing software updates. Product differentiation through privacy-focused features and European regulatory compliance creates competitive advantages in the regional market.

Retailers and Distribution Partners gain access to high-margin product categories with strong consumer demand growth and opportunities for value-added services including installation and support. Cross-selling opportunities allow traditional home improvement retailers to expand into technology categories and increase customer lifetime value.

Professional Installers and Integrators benefit from growing demand for complex system installation and ongoing maintenance services, particularly in premium market segments. Certification programs and manufacturer partnerships provide competitive differentiation and higher service margins.

Utility Companies and Energy Providers can leverage home automation systems for demand response programs, grid optimization, and customer engagement initiatives. Partnership opportunities with smart home companies enable new service offerings and improved customer relationships.

Insurance Companies benefit from reduced claim costs through smart security systems and risk monitoring capabilities, while offering premium discounts creates customer acquisition and retention advantages. Data insights from connected home devices support improved risk assessment and pricing models.

Real Estate Developers and Property Managers can differentiate properties through smart home features and attract technology-savvy tenants and buyers. Operational efficiency improvements through automated building management systems reduce maintenance costs and improve tenant satisfaction.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration represents a transformative trend as smart home systems incorporate machine learning algorithms for predictive automation and personalized user experiences. AI-powered features include adaptive climate control, predictive maintenance alerts, and behavioral pattern recognition for enhanced security and convenience.

Voice Control Advancement continues expanding with improved natural language processing and multi-language support tailored for European markets. Privacy-focused voice solutions that process commands locally rather than in the cloud address European consumer concerns while maintaining functionality.

Energy Management Sophistication evolves beyond basic thermostat control to comprehensive home energy optimization including solar panel integration, battery storage management, and utility grid interaction. Carbon footprint tracking features appeal to environmentally conscious European consumers.

Health and Wellness Integration emerges as smart home systems incorporate air quality monitoring, circadian rhythm lighting, and integration with wearable health devices. Wellness-focused automation includes sleep optimization and stress reduction through environmental control.

Professional Service Evolution shows growth in comprehensive home automation services including design consultation, installation, ongoing maintenance, and system optimization. Subscription service models provide continuous value through software updates, cloud services, and professional monitoring.

Interoperability Standardization advances through industry initiatives like the Matter protocol, addressing fragmentation issues and enabling seamless integration between different manufacturers’ products. Open standard adoption reduces consumer concerns about vendor lock-in and system compatibility.

Strategic Acquisitions continue reshaping the competitive landscape as major technology companies acquire specialized European home automation startups to expand their regional presence and product capabilities. Recent acquisition activity focuses on companies with strong privacy compliance and energy management expertise.

Partnership Announcements between smart home companies and European utility providers create integrated energy management solutions that benefit both consumers and grid operators. Utility partnerships enable demand response programs and time-of-use optimization features.

Product Launch Activity emphasizes GDPR-compliant solutions with local data processing capabilities and enhanced privacy controls. European-specific features include multi-language support, regional building standard compliance, and integration with local service providers.

Investment Rounds in European home automation companies demonstrate continued investor confidence, with funding focused on artificial intelligence development, energy management innovation, and market expansion initiatives. Venture capital activity supports both established companies and emerging startups.

Regulatory Compliance Initiatives address evolving European Union requirements for cybersecurity, data protection, and energy efficiency. Industry collaboration with regulatory bodies ensures product development aligns with current and anticipated regulatory requirements.

Technology Standard Development through European industry consortiums advances interoperability goals and addresses regional market requirements. Standards evolution includes enhanced security protocols and privacy protection mechanisms tailored for European regulatory environment.

Market Entry Strategies for new participants should emphasize privacy compliance and local partnership development to address European consumer preferences and regulatory requirements. MWR analysis indicates that companies demonstrating strong GDPR compliance and local data processing capabilities achieve higher market acceptance rates.

Product Development Priorities should focus on energy efficiency features, interoperability standards, and user-friendly installation processes to address primary consumer concerns. Investment allocation toward artificial intelligence capabilities and predictive automation features will differentiate products in competitive markets.

Distribution Channel Optimization requires balanced approach combining online sales platforms with traditional retail partnerships and professional installer networks. Channel strategy should account for regional preferences, with Northern European markets showing higher online adoption while Southern European consumers prefer in-store consultation.

Pricing Strategy Considerations must balance affordability with feature sophistication, particularly in emerging Eastern European markets where price sensitivity remains high. Tiered product offerings can address diverse market segments while maintaining premium positioning for advanced features.

Partnership Development with European utility companies, insurance providers, and telecommunications operators can accelerate market penetration and provide competitive advantages. Strategic alliances should focus on creating integrated value propositions that benefit all stakeholders.

Innovation Investment should prioritize areas with highest consumer demand including security enhancement, energy optimization, and health and wellness integration. Research and development focus on local market requirements will support long-term competitive positioning.

Market expansion across Europe is expected to accelerate as technology costs continue decreasing and consumer awareness increases through successful early adopter experiences. Penetration rates are projected to reach 45% of European households within the next five years, driven by improved product accessibility and enhanced value propositions.

Technology evolution will focus on artificial intelligence advancement, energy management sophistication, and health and wellness integration. Next-generation systems will provide more intuitive user experiences and deliver measurable benefits in energy savings, security enhancement, and lifestyle improvement.

Regional market development shows Eastern European countries positioned for rapid growth as economic conditions improve and infrastructure development supports smart home technology deployment. Government digitization initiatives across the European Union will continue supporting market expansion through favorable policies and incentive programs.

Industry consolidation is expected to continue as larger companies acquire specialized capabilities and smaller companies seek scale advantages through strategic partnerships. Market maturation will favor companies with comprehensive ecosystems and strong service capabilities over standalone product providers.

Consumer behavior evolution toward sustainability and energy consciousness will drive demand for smart home systems that provide environmental benefits and support renewable energy integration. MarkWide Research projects that energy management features will become standard expectations rather than premium options across all market segments.

Innovation opportunities in areas such as predictive maintenance, health monitoring integration, and smart city connectivity will create new market segments and revenue streams for forward-thinking companies that invest in advanced technology development.

The Europe home automation system market represents a dynamic and rapidly evolving sector with substantial growth potential across diverse regional markets. Strong consumer demand driven by energy efficiency concerns, security needs, and lifestyle convenience preferences creates a robust foundation for continued market expansion.

Key success factors for market participants include privacy compliance, interoperability focus, and regional market adaptation to address specific European consumer preferences and regulatory requirements. Technology advancement in artificial intelligence, energy management, and user interface design will differentiate successful products and services.

Market opportunities extend beyond traditional home automation into emerging areas including health and wellness integration, renewable energy management, and smart city connectivity. Strategic partnerships with utilities, insurance companies, and service providers will accelerate market penetration and create competitive advantages.

Future growth prospects remain positive despite challenges including high implementation costs, technical complexity, and privacy concerns. Industry evolution toward comprehensive ecosystems and service-based models will support sustainable revenue growth and enhanced customer relationships across European markets.

What is Home Automation System?

Home Automation System refers to the integration of technology and services that allow for the control and management of home systems such as lighting, heating, security, and appliances through a centralized interface.

What are the key players in the Europe Home Automation System Market?

Key players in the Europe Home Automation System Market include companies like Philips Hue, Nest Labs, and Schneider Electric, among others.

What are the main drivers of the Europe Home Automation System Market?

The main drivers of the Europe Home Automation System Market include the increasing demand for energy efficiency, the growing trend of smart homes, and advancements in IoT technology.

What challenges does the Europe Home Automation System Market face?

Challenges in the Europe Home Automation System Market include high installation costs, concerns over data privacy and security, and the complexity of integrating various devices and systems.

What opportunities exist in the Europe Home Automation System Market?

Opportunities in the Europe Home Automation System Market include the expansion of smart city initiatives, the rise of AI-driven automation solutions, and increasing consumer awareness of home security systems.

What trends are shaping the Europe Home Automation System Market?

Trends shaping the Europe Home Automation System Market include the growing popularity of voice-activated devices, the integration of renewable energy sources, and the development of more user-friendly interfaces for home automation systems.

Europe Home Automation System Market

| Segmentation Details | Description |

|---|---|

| Product Type | Smart Lighting, Security Systems, HVAC Control, Smart Appliances |

| Technology | Wi-Fi, Zigbee, Z-Wave, Bluetooth |

| End User | Residential, Commercial, Industrial, Hospitality |

| Installation | DIY, Professional, Integrated, Retrofit |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Home Automation System Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at