444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe herbicide market represents a dynamic and evolving agricultural sector that plays a crucial role in modern farming practices across the continent. European farmers increasingly rely on advanced herbicide solutions to maintain crop productivity while addressing growing environmental concerns and regulatory requirements. The market encompasses a diverse range of chemical formulations designed to control unwanted vegetation, supporting agricultural efficiency and food security initiatives throughout the region.

Market dynamics indicate robust growth driven by technological innovations in herbicide formulations and increasing adoption of precision agriculture techniques. The European market demonstrates significant regional variations, with Western European countries leading in terms of advanced herbicide adoption, while Eastern European markets show substantial growth potential. Current trends suggest the market is experiencing a 6.2% annual growth rate, reflecting strong demand for sustainable agricultural solutions.

Regulatory frameworks across Europe continue to shape market development, with stringent environmental protection standards driving innovation toward more eco-friendly herbicide formulations. The market benefits from strong research and development investments, particularly in bio-based herbicides and selective herbicide technologies that minimize environmental impact while maintaining agricultural effectiveness.

The Europe herbicide market refers to the comprehensive ecosystem of chemical and biological products designed to control unwanted plant growth across agricultural, commercial, and residential applications throughout European territories. This market encompasses the development, manufacturing, distribution, and application of various herbicide formulations that help farmers and land managers maintain productive agricultural systems while managing weed populations effectively.

Herbicides function through different mechanisms of action, including systemic absorption, contact killing, and growth regulation, providing targeted solutions for specific weed species and crop protection requirements. The European market specifically addresses regional agricultural needs, climate conditions, and regulatory compliance requirements that distinguish it from global herbicide markets.

Market participants include multinational chemical companies, specialized agricultural technology firms, research institutions, and distribution networks that collectively support the development and deployment of herbicide solutions across diverse European agricultural landscapes.

Strategic analysis reveals the Europe herbicide market as a mature yet innovative sector experiencing transformation driven by sustainability requirements and technological advancement. The market demonstrates resilience despite regulatory challenges, with companies investing heavily in next-generation herbicide formulations that balance agricultural effectiveness with environmental responsibility.

Key market drivers include increasing food production demands, climate change adaptation requirements, and the need for labor-efficient farming practices. European farmers face mounting pressure to maintain productivity while reducing chemical inputs, creating opportunities for precision application technologies and integrated pest management solutions. Market research indicates that 72% of European farmers are actively seeking more sustainable herbicide alternatives.

Competitive dynamics show established chemical companies maintaining market leadership while facing challenges from innovative biotechnology firms developing biological herbicide alternatives. The market structure reflects consolidation trends, with major players expanding their product portfolios through strategic acquisitions and research partnerships.

Future prospects point toward continued market evolution, with digital agriculture integration and precision application technologies expected to drive the next phase of market development. Regulatory compliance remains a critical factor, with companies adapting their strategies to meet evolving European Union environmental standards.

Market intelligence reveals several critical insights that define the current state and future trajectory of the Europe herbicide market:

Primary market drivers propelling the Europe herbicide market forward include several interconnected factors that reflect both agricultural necessities and evolving industry dynamics. Food security concerns remain paramount, with European agricultural systems under pressure to maintain high productivity levels while adapting to changing climate conditions and reduced arable land availability.

Labor shortages across European agricultural sectors drive increased reliance on chemical weed control solutions, as traditional manual weeding becomes economically unfeasible for large-scale operations. This trend particularly affects specialty crop production and organic farming transitions, where effective weed management directly impacts crop yields and quality.

Climate change adaptation creates new challenges for European farmers, with shifting weather patterns affecting weed species distribution and growth cycles. Invasive weed species are expanding their range across Europe, requiring specialized herbicide solutions and integrated management approaches. Research indicates that 38% of European crop losses are attributed to inadequate weed control measures.

Technological advancement in herbicide formulations drives market expansion, with companies developing more effective and environmentally compatible products. Precision agriculture adoption enables farmers to optimize herbicide applications, reducing costs while improving effectiveness. The integration of GPS-guided application systems and variable rate technology supports more efficient herbicide deployment across diverse field conditions.

Regulatory constraints represent the most significant challenge facing the Europe herbicide market, with increasingly stringent European Union regulations limiting the availability of certain active ingredients and requiring extensive safety testing for new products. Registration costs for new herbicide formulations continue to rise, creating barriers for smaller companies and limiting innovation in certain market segments.

Environmental concerns among consumers and policymakers drive restrictions on herbicide usage, particularly in areas near water sources and sensitive ecosystems. Public perception issues surrounding chemical agriculture create market resistance, with some regions implementing additional usage restrictions beyond EU requirements. These concerns particularly impact glyphosate-based products and other widely used herbicide formulations.

Herbicide resistance development in weed populations poses ongoing challenges for farmers and herbicide manufacturers, requiring continuous investment in new active ingredients and application strategies. Cross-resistance patterns complicate weed management decisions, forcing farmers to adopt more complex and expensive herbicide rotation programs.

Economic pressures on European farmers, including volatile commodity prices and reduced agricultural subsidies, limit spending on premium herbicide products. Generic competition from off-patent herbicide formulations creates pricing pressure throughout the market, affecting profitability for both manufacturers and distributors.

Emerging opportunities within the Europe herbicide market reflect evolving agricultural practices and technological capabilities that create new avenues for growth and innovation. Biological herbicide development represents a significant opportunity, with European farmers increasingly interested in sustainable alternatives that meet regulatory requirements while maintaining agricultural effectiveness.

Precision agriculture integration offers substantial market expansion potential, with smart application technologies enabling more efficient herbicide usage and reduced environmental impact. Drone-based application systems and robotic weeding technologies create opportunities for specialized herbicide formulations designed for automated application systems.

Organic farming expansion across Europe drives demand for approved herbicide alternatives and integrated weed management solutions. Specialty crop markets, including high-value horticultural products and emerging agricultural sectors, require customized herbicide solutions that address specific weed challenges while meeting quality standards.

Digital agriculture platforms create opportunities for herbicide companies to develop integrated solutions that combine chemical products with decision support systems and application guidance. Data-driven farming approaches enable more targeted herbicide recommendations based on field-specific conditions and weed pressure assessments. Market analysis suggests that 45% of European farmers are interested in digital herbicide management tools.

Market dynamics in the Europe herbicide sector reflect complex interactions between regulatory pressures, technological innovation, and evolving agricultural practices. Supply chain optimization continues to drive efficiency improvements, with companies investing in regional distribution networks and specialized storage facilities to ensure product availability during critical application periods.

Competitive pressures intensify as patent expirations create opportunities for generic manufacturers while established companies focus on developing next-generation formulations with enhanced performance characteristics. Market consolidation trends affect pricing strategies and product availability, with larger companies acquiring specialized herbicide technologies and regional market access.

Innovation cycles in herbicide development typically span 8-12 years from discovery to market introduction, requiring substantial investment in research and development activities. Regulatory approval processes add additional complexity and timeline extensions, particularly for novel active ingredients and biological herbicide formulations.

Seasonal demand patterns create inventory management challenges for herbicide suppliers, with peak application periods varying across European regions based on climate conditions and cropping systems. Weather variability affects application timing and herbicide effectiveness, influencing annual market performance and farmer purchasing decisions.

Comprehensive research methodology employed in analyzing the Europe herbicide market incorporates multiple data collection approaches and analytical frameworks to ensure accuracy and reliability of market insights. Primary research activities include extensive interviews with industry stakeholders, including herbicide manufacturers, agricultural distributors, farming cooperatives, and regulatory officials across major European markets.

Secondary research encompasses analysis of industry publications, regulatory databases, agricultural statistics, and company financial reports to establish market baselines and identify emerging trends. MarkWide Research utilizes proprietary analytical models to process market data and generate actionable insights for industry participants and stakeholders.

Data validation processes involve cross-referencing information from multiple sources and conducting follow-up interviews to verify key findings and market projections. Regional analysis methodology accounts for significant variations in agricultural practices, regulatory environments, and market conditions across different European countries and regions.

Quantitative analysis incorporates statistical modeling techniques to identify market trends, growth patterns, and correlation factors affecting herbicide demand and usage patterns. Qualitative assessment provides context for numerical data through expert opinions and industry experience, ensuring comprehensive understanding of market dynamics and future prospects.

Regional market analysis reveals significant variations in herbicide adoption, regulatory environments, and agricultural practices across European territories. Western European markets, including Germany, France, and the United Kingdom, demonstrate mature herbicide usage patterns with emphasis on premium formulations and precision application technologies. These markets account for approximately 58% of European herbicide consumption.

Germany represents the largest single market within Europe, driven by intensive agricultural production systems and advanced farming technologies. French agricultural sectors show strong demand for specialized herbicide solutions supporting diverse crop rotations and quality-focused production systems. United Kingdom markets emphasize environmental compatibility and integrated pest management approaches.

Southern European regions, including Spain, Italy, and Greece, demonstrate growing herbicide adoption rates driven by modernizing agricultural practices and increasing crop intensification. Mediterranean agricultural systems require specialized formulations adapted to hot, dry climate conditions and specific weed species prevalent in the region.

Eastern European markets show the highest growth potential, with countries like Poland, Czech Republic, and Hungary experiencing rapid agricultural modernization and increasing herbicide adoption rates. These markets benefit from EU agricultural development programs and foreign investment in farming infrastructure. Market penetration rates in Eastern Europe currently reach 34% of potential usage, indicating substantial expansion opportunities.

Competitive dynamics within the Europe herbicide market reflect a mix of established multinational corporations and emerging specialized companies focused on innovative herbicide solutions. Market leadership remains concentrated among several key players who maintain strong positions through comprehensive product portfolios and extensive distribution networks.

Strategic partnerships and technology licensing agreements enable smaller companies to access European markets while providing established players with innovative herbicide technologies. Research collaborations between companies and academic institutions drive development of next-generation herbicide formulations and application technologies.

Market segmentation analysis reveals diverse herbicide categories serving different agricultural applications and crop protection requirements across European markets. Product segmentation encompasses various herbicide types, application methods, and crop-specific formulations that address specific weed management challenges.

By Product Type:

By Application Method:

By Crop Type:

Selective herbicides dominate European market demand, accounting for the largest share of herbicide applications due to their ability to provide targeted weed control while preserving valuable crop plants. Cereal herbicides represent the most significant category within selective formulations, supporting Europe’s extensive grain production systems across diverse climate zones and soil conditions.

Glyphosate-based formulations maintain substantial market presence despite regulatory scrutiny, with farmers relying on these products for effective broad-spectrum weed control in various agricultural applications. Alternative active ingredients are gaining market share as companies develop formulations to address potential glyphosate restrictions and resistance issues.

Biological herbicides emerge as a growing category, with European farmers increasingly interested in sustainable alternatives that meet organic certification requirements and environmental regulations. Microbial herbicides and plant-derived formulations show promising development, though market penetration remains limited compared to synthetic alternatives.

Specialty herbicides for high-value crops demonstrate strong growth potential, with formulations designed for specific weed challenges in vegetable production, viticulture, and specialty grain crops. These products typically command premium pricing due to their specialized nature and limited application volumes. Market data indicates that specialty herbicide segments are experiencing 8.4% annual growth across European markets.

Industry participants across the Europe herbicide market value chain realize significant benefits from continued market development and technological advancement. Herbicide manufacturers benefit from stable demand patterns and opportunities for product differentiation through innovative formulations and application technologies.

Agricultural distributors gain from expanding product portfolios and opportunities to provide value-added services including application guidance and integrated pest management consulting. Precision agriculture integration enables distributors to offer comprehensive solutions combining herbicide products with digital farming tools and decision support systems.

Farmers and agricultural producers realize substantial benefits through improved weed control effectiveness, reduced labor requirements, and enhanced crop productivity. Economic benefits include reduced production costs, improved crop quality, and increased operational efficiency through optimized herbicide application strategies.

Research institutions benefit from collaboration opportunities with industry partners, accessing funding for herbicide development projects and contributing to sustainable agriculture advancement. Regulatory agencies gain from improved environmental monitoring data and industry cooperation in developing safer herbicide formulations.

Environmental stakeholders benefit from industry investments in sustainable herbicide technologies and reduced-risk formulations that minimize ecological impact while maintaining agricultural productivity. Consumer benefits include stable food prices and consistent agricultural product availability supported by effective weed management systems.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration represents the most significant trend shaping the Europe herbicide market, with companies investing heavily in environmentally compatible formulations and application technologies. Bio-based herbicides gain market acceptance as farmers seek alternatives that meet organic certification requirements and address environmental concerns while maintaining weed control effectiveness.

Precision application technologies transform herbicide usage patterns, with GPS-guided systems and variable rate application enabling more efficient product deployment and reduced environmental impact. Drone technology integration creates opportunities for targeted herbicide applications in difficult-to-access areas and precision spot treatments.

Resistance management strategies become increasingly important as herbicide resistance spreads across European weed populations. Multi-mode action products and herbicide rotation programs gain adoption as farmers implement integrated weed management approaches to preserve herbicide effectiveness.

Digital agriculture platforms integrate herbicide recommendations with field monitoring data, weather information, and crop growth models to optimize application timing and product selection. Artificial intelligence applications enable predictive weed management and automated herbicide application decisions based on real-time field conditions.

Regulatory compliance automation becomes essential as companies develop systems to track product usage, environmental impact, and safety data across European markets. Traceability systems enable better monitoring of herbicide applications and support regulatory reporting requirements. Current trends indicate that 67% of European herbicide applications now utilize some form of digital record-keeping system.

Recent industry developments highlight the dynamic nature of the Europe herbicide market and ongoing efforts to address evolving agricultural and regulatory challenges. Product innovation continues at a rapid pace, with companies launching new formulations that combine multiple active ingredients to address resistance issues and improve weed control spectrum.

Acquisition activities reshape the competitive landscape as major herbicide companies acquire specialized biotechnology firms and regional market leaders to expand their product portfolios and geographic reach. Strategic partnerships between herbicide manufacturers and precision agriculture technology companies create integrated solutions for modern farming operations.

Regulatory developments significantly impact market dynamics, with European Union decisions on herbicide registrations affecting product availability and market strategies. Glyphosate renewal discussions create uncertainty while driving investment in alternative active ingredients and formulation technologies.

Research breakthroughs in herbicide mode of action and application technologies promise next-generation products with improved environmental profiles and enhanced effectiveness. Biotechnology applications enable development of novel herbicide formulations based on natural compounds and biological mechanisms.

Sustainability initiatives drive industry-wide efforts to reduce environmental impact through improved formulations, application technologies, and integrated pest management approaches. Carbon footprint reduction programs influence herbicide manufacturing processes and supply chain optimization strategies.

Strategic recommendations for Europe herbicide market participants emphasize the importance of adapting to evolving regulatory environments while maintaining agricultural effectiveness and market competitiveness. MarkWide Research analysis suggests that companies should prioritize investment in sustainable herbicide technologies and precision application systems to address future market demands.

Product development strategies should focus on biological alternatives and reduced-risk formulations that meet stringent European environmental standards while providing effective weed control. Innovation partnerships with biotechnology companies and research institutions can accelerate development of next-generation herbicide solutions.

Market expansion opportunities in Eastern European countries require tailored approaches that consider local agricultural practices, economic conditions, and regulatory requirements. Distribution network development and technical support capabilities are essential for successful market penetration in emerging European markets.

Digital transformation initiatives should integrate herbicide products with precision agriculture platforms and decision support systems to provide comprehensive weed management solutions. Data analytics capabilities enable better understanding of herbicide performance and optimization of application strategies.

Regulatory compliance strategies must anticipate future restrictions and develop contingency plans for potential active ingredient limitations. Proactive engagement with regulatory agencies and environmental stakeholders can help shape policy development and maintain market access for essential herbicide products.

Future market prospects for the Europe herbicide market indicate continued evolution driven by sustainability requirements, technological advancement, and changing agricultural practices. Market growth is expected to continue at a steady pace, with biological herbicides and precision application technologies driving the next phase of market development.

Regulatory landscape evolution will continue to shape market dynamics, with increasing emphasis on environmental protection and sustainable agriculture practices. Product registration requirements are likely to become more stringent, favoring companies with strong regulatory expertise and sustainable product portfolios.

Technology integration will accelerate, with herbicide applications becoming increasingly automated and data-driven. Artificial intelligence and machine learning applications will enable more precise herbicide recommendations and application strategies based on real-time field conditions and predictive modeling.

Market consolidation trends may continue as companies seek to achieve economies of scale and expand their technological capabilities through strategic acquisitions. Specialty market segments are expected to show the strongest growth, with opportunities in high-value crops and sustainable agriculture applications.

Climate change adaptation will drive demand for herbicide solutions that perform effectively under changing environmental conditions and address shifting weed species distributions. Integrated pest management approaches will become more prevalent, combining herbicide applications with biological and mechanical control methods. Market projections suggest that sustainable herbicide solutions could account for 28% of total market applications by the end of the decade.

The Europe herbicide market stands at a critical juncture, balancing agricultural productivity requirements with increasing environmental and regulatory pressures. Market dynamics reflect the complex interplay between technological innovation, sustainability demands, and evolving agricultural practices across diverse European regions.

Growth opportunities remain substantial, particularly in biological herbicide development, precision application technologies, and Eastern European market expansion. Industry participants who successfully navigate regulatory challenges while investing in sustainable innovation are positioned to capture significant market value in the evolving agricultural landscape.

Strategic success in the Europe herbicide market requires comprehensive understanding of regional variations, regulatory requirements, and farmer needs across diverse agricultural systems. MWR analysis indicates that companies emphasizing sustainability, technological integration, and precision agriculture solutions will achieve the strongest market positions in the coming decade.

Future market development will be characterized by continued innovation in herbicide formulations, application technologies, and integrated weed management approaches that support sustainable agricultural intensification across European farming systems. The Europe herbicide market remains essential to agricultural productivity and food security, with ongoing evolution ensuring its continued relevance in modern farming operations.

What is Herbicide?

Herbicide refers to a type of pesticide specifically designed to control or eliminate unwanted plants, commonly known as weeds. These chemicals are widely used in agriculture, landscaping, and gardening to enhance crop yields and maintain aesthetic landscapes.

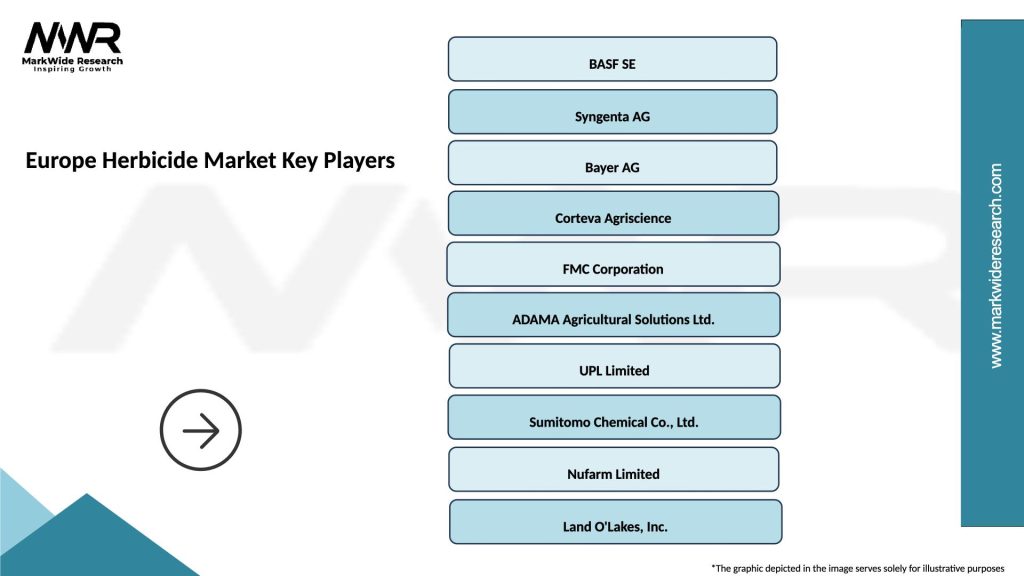

What are the key players in the Europe Herbicide Market?

Key players in the Europe Herbicide Market include Bayer Crop Science, BASF SE, Syngenta AG, and Corteva Agriscience, among others. These companies are involved in the development and distribution of various herbicide products tailored for different agricultural needs.

What are the growth factors driving the Europe Herbicide Market?

The Europe Herbicide Market is driven by factors such as the increasing demand for food production, the rise in organic farming practices, and advancements in herbicide formulations. Additionally, the need for effective weed management solutions in agriculture contributes to market growth.

What challenges does the Europe Herbicide Market face?

The Europe Herbicide Market faces challenges such as regulatory restrictions on chemical usage, the development of herbicide-resistant weed species, and environmental concerns regarding pesticide application. These factors can hinder market expansion and product adoption.

What opportunities exist in the Europe Herbicide Market?

Opportunities in the Europe Herbicide Market include the development of bio-based herbicides and integrated pest management solutions. Additionally, increasing investments in agricultural technology and precision farming present avenues for growth.

What trends are shaping the Europe Herbicide Market?

Trends in the Europe Herbicide Market include the shift towards sustainable agricultural practices, the use of digital farming technologies, and the growing popularity of herbicide-tolerant crop varieties. These trends are influencing product development and consumer preferences.

Europe Herbicide Market

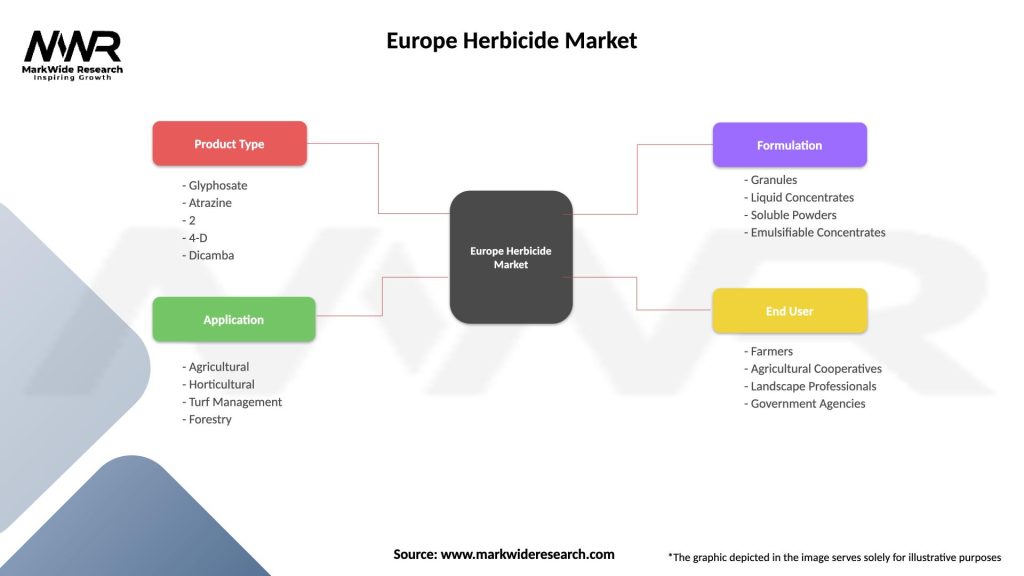

| Segmentation Details | Description |

|---|---|

| Product Type | Glyphosate, Atrazine, 2,4-D, Dicamba |

| Application | Agricultural, Horticultural, Turf Management, Forestry |

| Formulation | Granules, Liquid Concentrates, Soluble Powders, Emulsifiable Concentrates |

| End User | Farmers, Agricultural Cooperatives, Landscape Professionals, Government Agencies |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Herbicide Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at