444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe health drinks market represents a dynamic and rapidly evolving sector within the broader beverage industry, characterized by increasing consumer awareness of wellness and nutritional benefits. Health-conscious consumers across European nations are driving unprecedented demand for functional beverages that offer more than basic hydration. The market encompasses a diverse range of products including protein drinks, vitamin-enhanced beverages, probiotic drinks, and energy-boosting formulations designed to support various health objectives.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 8.2% driven by shifting consumer preferences toward preventive healthcare and active lifestyle choices. Western European countries including Germany, France, and the United Kingdom lead consumption patterns, while Eastern European markets demonstrate accelerating adoption rates of functional beverages.

Innovation trends within the European health drinks landscape focus on natural ingredients, organic formulations, and personalized nutrition solutions. Major beverage manufacturers are investing heavily in research and development to create products that address specific health concerns such as immune system support, digestive health, and mental wellness. The market benefits from strong regulatory frameworks that ensure product quality and consumer safety across all European Union member states.

The Europe health drinks market refers to the comprehensive ecosystem of functional beverages specifically formulated to provide health benefits beyond basic nutrition and hydration. These products are designed to support various aspects of human wellness through the incorporation of bioactive compounds, essential nutrients, and functional ingredients that target specific physiological functions.

Health drinks in the European context encompass multiple product categories including sports nutrition beverages, meal replacement shakes, immunity-boosting drinks, and cognitive enhancement formulations. The market definition extends to both ready-to-drink products and powder-based supplements that consumers mix with water or other liquids to create functional beverages.

Regulatory compliance plays a crucial role in defining the market scope, with products required to meet stringent European Food Safety Authority guidelines for health claims and ingredient safety. The market operates within established frameworks that govern nutritional labeling, marketing communications, and product formulation standards across all participating European nations.

Strategic analysis of the Europe health drinks market reveals a sector positioned for sustained expansion, driven by fundamental shifts in consumer behavior and increasing investment in preventive healthcare solutions. Market penetration varies significantly across European regions, with Scandinavian countries demonstrating the highest per-capita consumption rates at 67% market penetration, while Southern European markets show accelerating growth trajectories.

Product innovation remains the primary competitive differentiator, with manufacturers focusing on clean label formulations, sustainable packaging solutions, and targeted health benefits. The market benefits from strong distribution networks spanning traditional retail channels, specialty health stores, and rapidly expanding e-commerce platforms that facilitate direct-to-consumer sales.

Consumer demographics indicate that millennials and Generation Z represent the largest market segments, accounting for approximately 58% of total consumption volume. These demographic groups demonstrate strong preferences for transparent ingredient lists, ethical sourcing practices, and environmentally responsible packaging. Premium product segments continue to outperform mass-market alternatives, reflecting consumers’ willingness to invest in perceived quality and efficacy.

Competitive landscape features both established multinational corporations and innovative startup companies, creating a dynamic environment that fosters continuous product development and market expansion. Strategic partnerships between beverage manufacturers and nutraceutical companies are becoming increasingly common as brands seek to leverage specialized expertise in functional ingredient development.

Consumer behavior analysis reveals several critical insights that shape the European health drinks market landscape. Primary purchase motivations include immune system support, energy enhancement, and digestive health improvement, with consumers increasingly seeking products that address multiple health concerns simultaneously.

Market segmentation reveals distinct preferences across different European regions, with Northern European countries favoring protein-rich formulations while Mediterranean markets show stronger demand for antioxidant-enhanced beverages. Seasonal consumption patterns also influence market dynamics, with immune-supporting products experiencing peak demand during autumn and winter months.

Primary growth drivers propelling the Europe health drinks market forward stem from fundamental changes in consumer lifestyle patterns and increasing awareness of the connection between nutrition and long-term health outcomes. Preventive healthcare approaches are gaining widespread acceptance as consumers seek to avoid chronic diseases through proactive dietary choices.

Demographic shifts contribute significantly to market expansion, with an aging population increasingly focused on maintaining vitality and independence through functional nutrition. Working professionals represent another key driver segment, seeking convenient solutions to maintain energy levels and cognitive performance throughout demanding schedules.

Fitness culture proliferation across European societies has created substantial demand for sports nutrition products and recovery beverages. The integration of health drinks into daily fitness routines has become commonplace, with consumers viewing these products as essential components of active lifestyles rather than optional supplements.

Scientific research advancement continues to validate the efficacy of functional ingredients, providing manufacturers with credible health claims that resonate with evidence-based consumer decision-making. Clinical studies demonstrating measurable health benefits create consumer confidence and drive market adoption rates.

Retail accessibility improvements have made health drinks more available to mainstream consumers through expanded distribution in supermarket chains, convenience stores, and online platforms. This increased availability removes barriers to trial and repeat purchase, facilitating market growth across diverse consumer segments.

Significant challenges facing the Europe health drinks market include regulatory complexity across different European Union member states, creating compliance burdens for manufacturers seeking to operate in multiple markets simultaneously. Health claim substantiation requirements demand extensive scientific evidence, increasing product development costs and time-to-market cycles.

Price sensitivity among certain consumer segments limits market penetration, particularly in price-conscious markets where consumers may view health drinks as luxury items rather than essential nutrition products. Economic uncertainty can impact discretionary spending on premium beverage products, affecting overall market growth rates.

Consumer skepticism regarding health claims and ingredient efficacy presents ongoing challenges for market education and brand building. Misinformation and conflicting nutritional advice in media and online sources can create confusion that inhibits purchase decisions and market adoption.

Competition from alternative products including traditional supplements, whole foods, and conventional beverages creates market share pressure. Consumers may choose to obtain health benefits through other means, limiting the addressable market for functional beverages.

Supply chain complexities associated with sourcing specialized ingredients and maintaining cold chain distribution can increase operational costs and limit market expansion opportunities. Ingredient availability and quality consistency challenges may impact product development and manufacturing scalability.

Emerging opportunities within the Europe health drinks market present substantial potential for growth and innovation. Personalized nutrition represents a transformative opportunity, with advances in genetic testing and biomarker analysis enabling customized formulations tailored to individual health profiles and metabolic requirements.

Digital health integration offers significant expansion possibilities through mobile applications and wearable technology that track health metrics and recommend appropriate functional beverages. Data-driven recommendations can enhance consumer engagement and drive repeat purchases through personalized product suggestions.

Untapped demographic segments including senior consumers and children’s health drinks represent substantial market expansion opportunities. Age-specific formulations addressing unique nutritional needs of different life stages could unlock new revenue streams and broaden market appeal.

Sustainable packaging innovations present opportunities to differentiate products and appeal to environmentally conscious consumers. Biodegradable materials and circular economy principles can create competitive advantages while addressing growing sustainability concerns.

Functional ingredient advancement continues to create opportunities for product innovation, with novel compounds and delivery systems enabling enhanced bioavailability and targeted health benefits. Microencapsulation technologies and time-release formulations can improve product efficacy and consumer satisfaction.

Emerging market penetration in Eastern European countries offers growth potential as economic development increases disposable income and health awareness. Market education initiatives and localized product development can accelerate adoption in these developing markets.

Complex market dynamics shape the competitive landscape of the Europe health drinks sector, with supply and demand factors creating both challenges and opportunities for market participants. Consumer education levels directly impact market growth, with higher awareness of functional ingredients correlating to increased adoption rates across European markets.

Seasonal fluctuations significantly influence market dynamics, with immune-supporting beverages experiencing 45% higher demand during winter months while hydration-focused products peak during summer periods. Marketing strategies must account for these cyclical patterns to optimize inventory management and promotional activities.

Technological advancement in ingredient processing and formulation science continues to reshape market possibilities, enabling manufacturers to create products with enhanced stability, taste profiles, and nutritional density. Cold-pressed extraction methods and fermentation technologies are particularly influential in product development cycles.

Regulatory evolution across European markets creates dynamic compliance requirements that influence product development strategies and market entry approaches. Harmonization efforts within the European Union facilitate cross-border trade while maintaining consumer protection standards.

Distribution channel evolution reflects changing consumer shopping behaviors, with e-commerce platforms capturing increasing market share at 23% annual growth rates. Direct-to-consumer models enable brands to build stronger customer relationships while improving profit margins through reduced intermediary costs.

Comprehensive research approaches employed in analyzing the Europe health drinks market combine quantitative analysis with qualitative insights to provide accurate market intelligence and strategic recommendations. Primary research methodologies include extensive consumer surveys, industry expert interviews, and focus group discussions across major European markets.

Data collection processes encompass multiple sources including industry databases, government statistics, trade association reports, and company financial statements to ensure comprehensive market coverage. Cross-validation techniques verify data accuracy and eliminate potential biases in market assessments.

Market sizing methodologies utilize bottom-up approaches that aggregate regional market data while applying top-down validation through industry-wide consumption patterns and economic indicators. Statistical modeling incorporates historical trends and forward-looking projections to establish reliable growth forecasts.

Competitive analysis frameworks evaluate market participants across multiple dimensions including product portfolios, distribution strategies, pricing approaches, and innovation capabilities. SWOT analysis and Porter’s Five Forces models provide strategic context for market positioning assessments.

Consumer behavior studies employ demographic segmentation, psychographic profiling, and purchase journey mapping to understand decision-making processes and identify market opportunities. Trend analysis incorporates social media monitoring and digital analytics to capture emerging consumer preferences and market shifts.

Regional market dynamics across Europe reveal distinct consumption patterns and growth trajectories that reflect cultural preferences, economic conditions, and regulatory environments. Western European markets including Germany, France, and the United Kingdom represent the largest consumption volumes, collectively accounting for 62% of total market share.

Germany leads the European health drinks market with strong consumer acceptance of functional beverages and premium product segments. German consumers demonstrate particular interest in organic formulations and scientifically-backed health claims, driving demand for high-quality products with transparent ingredient lists.

France exhibits sophisticated consumer preferences for artisanal health drinks and locally-sourced ingredients, reflecting broader cultural values around food quality and authenticity. French market growth is driven by increasing adoption among urban professionals and health-conscious millennials.

United Kingdom shows strong demand for convenience-oriented products and sports nutrition beverages, supported by active lifestyle trends and busy consumer schedules. Brexit implications have created some market uncertainty but have not significantly impacted overall growth trajectories.

Nordic countries including Sweden, Norway, and Denmark demonstrate the highest per-capita consumption rates, with 75% market penetration among target demographics. Scandinavian consumers prioritize sustainability and environmental responsibility in product selection, driving demand for eco-friendly packaging and ethical sourcing.

Eastern European markets including Poland, Czech Republic, and Hungary represent high-growth opportunities with expanding middle-class populations and increasing health awareness. Market development in these regions requires localized approaches that account for price sensitivity and cultural preferences.

Market competition within the Europe health drinks sector features a diverse mix of multinational corporations, regional specialists, and innovative startups that collectively drive product innovation and market expansion. Competitive strategies focus on brand differentiation, distribution excellence, and consumer engagement to capture market share in this dynamic environment.

Competitive differentiation strategies emphasize ingredient innovation, packaging sustainability, and targeted marketing approaches that resonate with specific consumer segments. Strategic partnerships between beverage companies and nutraceutical suppliers enable access to specialized ingredients and scientific expertise.

Market consolidation trends include acquisitions of smaller brands by larger corporations seeking to expand product portfolios and access innovative formulations. Startup companies continue to disrupt traditional market approaches through direct-to-consumer models and personalized nutrition solutions.

Market segmentation within the Europe health drinks sector reveals distinct product categories and consumer preferences that guide strategic positioning and product development initiatives. Segmentation analysis provides insights into market opportunities and competitive dynamics across different product types and consumer demographics.

By Product Type:

By Distribution Channel:

By Consumer Demographics:

Detailed category analysis reveals specific market dynamics and growth opportunities within distinct health drinks segments. MarkWide Research analysis indicates that functional water represents the fastest-growing category, experiencing 12.5% annual growth driven by mainstream consumer adoption and expanded distribution.

Energy drinks category maintains strong market position despite increasing scrutiny of high caffeine content and sugar levels. Natural energy alternatives using green tea extracts and adaptogenic herbs are gaining consumer acceptance as healthier options for energy enhancement.

Probiotic beverages demonstrate consistent growth supported by increasing awareness of gut health importance and microbiome research. Kefir-based products and kombucha varieties lead category expansion, particularly among health-conscious millennials seeking digestive wellness solutions.

Protein drinks segment benefits from expanding fitness culture and active lifestyle trends across European markets. Plant-based protein formulations are experiencing particularly strong growth, appealing to vegan consumers and those seeking sustainable nutrition options.

Sports drinks category faces increasing competition from natural hydration alternatives and coconut water products. Innovation focus centers on reduced sugar formulations and natural flavor systems that maintain performance benefits while addressing health concerns.

Immunity-focused beverages gained significant momentum following global health concerns, with consumers seeking preventive nutrition solutions. Vitamin C-enhanced products and elderberry formulations lead category growth, supported by scientific research validating immune system benefits.

Industry participants in the Europe health drinks market benefit from multiple value creation opportunities that extend across the entire value chain. Manufacturers gain access to expanding consumer bases willing to pay premium prices for functional benefits and quality ingredients, enabling improved profit margins compared to traditional beverage categories.

Retailers benefit from higher-margin products that drive customer traffic and basket size increases. Health drinks often serve as destination categories that attract health-conscious consumers who typically purchase additional wellness-related products during shopping visits.

Ingredient suppliers experience growing demand for specialized compounds and functional ingredients that command premium pricing. Innovation partnerships with beverage manufacturers create opportunities for co-development projects and exclusive supply agreements.

Distribution partners benefit from category growth that outpaces traditional beverage segments, providing opportunities for expanded shelf space and improved inventory turnover. Cold chain logistics specialists gain access to growing market segments requiring specialized handling and storage capabilities.

Healthcare professionals can leverage evidence-based products to support patient wellness recommendations, creating additional touchpoints for preventive healthcare approaches. Nutritionists and dietitians benefit from expanded product options that align with dietary recommendations and health goals.

Consumers gain access to convenient nutrition solutions that support busy lifestyles while providing measurable health benefits. Product variety and innovation enable personalized approaches to wellness that align with individual preferences and health objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends shaping the Europe health drinks market reflect evolving consumer preferences and technological advancement. Plant-based formulations represent a dominant trend, with botanical ingredients and herbal extracts gaining widespread acceptance among consumers seeking natural wellness solutions.

Functional ingredient sophistication continues advancing through microencapsulation technologies and targeted delivery systems that enhance bioavailability and efficacy. Adaptogenic compounds including ashwagandha, rhodiola, and ginseng are increasingly incorporated into formulations targeting stress management and mental wellness.

Sustainability integration has become essential for market success, with consumers demanding environmentally responsible packaging and ethical ingredient sourcing. Circular economy principles influence product development decisions and brand positioning strategies across major market participants.

Personalization technologies are emerging as significant differentiators, with companies developing AI-powered recommendation systems and genetic testing integration to create customized nutrition solutions. Subscription-based models enable ongoing consumer engagement and data collection for continuous product optimization.

Clean label movement drives formulation simplification and ingredient transparency, with consumers increasingly scrutinizing product labels for artificial additives and processing aids. Minimal processing and whole food ingredients become competitive advantages in premium market segments.

Digital health integration creates opportunities for connected product experiences that link beverage consumption to health tracking applications and wellness platforms. Data analytics enable personalized recommendations and behavior modification support that enhance consumer engagement and loyalty.

Recent industry developments demonstrate the dynamic nature of the Europe health drinks market and highlight strategic initiatives that shape competitive positioning. Major acquisitions and strategic partnerships reflect industry consolidation trends and the pursuit of innovation capabilities and market access.

Product launch activities have accelerated significantly, with companies introducing specialized formulations targeting specific health concerns such as cognitive enhancement, sleep quality improvement, and digestive health optimization. Limited edition products and seasonal formulations create consumer excitement and drive trial behavior.

Manufacturing capacity expansion across European markets reflects growing demand and the need for localized production to reduce transportation costs and environmental impact. State-of-the-art facilities incorporate sustainable technologies and quality assurance systems that meet stringent European standards.

Regulatory approvals for new functional ingredients and health claims enable product innovation and marketing differentiation. Novel food approvals from the European Food Safety Authority create opportunities for breakthrough formulations and competitive advantages.

Digital transformation initiatives include e-commerce platform development, mobile application launches, and social media engagement strategies that enhance direct-to-consumer relationships. Influencer partnerships and content marketing programs build brand awareness and consumer education.

Sustainability commitments from major industry players include carbon neutrality goals, packaging reduction initiatives, and renewable energy adoption in manufacturing operations. Circular economy projects focus on waste reduction and resource efficiency throughout the value chain.

Market participants should prioritize investment in functional ingredient research and development, focusing on clinically validated health benefits that resonate with increasingly sophisticated European consumers. Companies must establish transparent supply chains and pursue organic certifications to meet growing demand for clean-label products, while developing comprehensive sustainability strategies that address environmental concerns across the entire product lifecycle.

Product portfolio optimization requires strategic focus on emerging categories including adaptogenic beverages, plant-based protein drinks, and personalized nutrition solutions that address specific demographic needs. Manufacturers should leverage advanced formulation technologies to improve taste profiles while maintaining nutritional integrity, as palatability remains a critical factor in consumer adoption and long-term brand loyalty.

Digital marketing strategies must emphasize educational content that builds consumer awareness of health benefits while establishing brand credibility through scientific validation and expert endorsements. Companies should develop omnichannel distribution approaches that combine traditional retail presence with direct-to-consumer platforms, subscription services, and strategic partnerships with fitness centers, wellness clinics, and healthcare providers.

Regulatory compliance preparation is essential as European authorities implement stricter health claim substantiation requirements and labeling standards. Organizations should invest in clinical research capabilities and establish relationships with regulatory experts to navigate complex approval processes while building evidence-based product positioning that differentiates offerings in competitive markets.

Strategic partnerships with research institutions, ingredient suppliers, and technology providers will accelerate innovation while reducing development risks and costs. Companies should consider vertical integration opportunities in key ingredient sourcing to ensure supply security and quality control, particularly for specialized functional ingredients with limited supplier bases.

Market expansion strategies should focus on underserved segments including senior nutrition, children’s health drinks, and specialized dietary requirements such as diabetic-friendly and ketogenic-compatible formulations. Manufacturers must develop culturally appropriate products for diverse European markets while maintaining scalable production processes that enable cost-effective regional customization.

The Europe health drinks market is positioned for sustained expansion over the next decade, driven by demographic aging, increasing health consciousness, and growing acceptance of functional beverages as essential components of daily wellness routines. Market projections indicate robust growth as European consumers increasingly prioritize preventive healthcare and seek convenient nutrition solutions that support active lifestyles and longevity objectives.

Personalization trends will revolutionize product development through advanced technologies including genetic testing, microbiome analysis, and AI-powered nutrition recommendations that enable customized health drink formulations. The integration of digital health platforms with beverage consumption will create new opportunities for real-time nutrition tracking, health outcome monitoring, and dynamic product recommendations based on individual health data and goals.

Functional ingredient advancement will expand market possibilities through novel compounds including marine-derived nutrients, fermented ingredients, and bioactive peptides that offer enhanced bioavailability and targeted health benefits. According to MarkWide Research analysis, next-generation functional ingredients are expected to achieve 45-55% higher efficacy rates compared to traditional formulations, with 60% growth anticipated in cognitive health and immune support applications.

Sustainability integration will become a fundamental requirement rather than a competitive advantage, with circular economy principles influencing packaging design, ingredient sourcing, and production processes. The development of carbon-neutral beverages and regenerative agriculture partnerships will create new market segments appealing to environmentally conscious consumers willing to pay premiums for sustainable products.

Technology convergence including blockchain traceability, smart packaging with health monitoring capabilities, and IoT-enabled consumption tracking will transform how consumers interact with health drinks. The emergence of connected wellness ecosystems will integrate beverage consumption with fitness tracking, medical monitoring, and lifestyle coaching services.

Regulatory evolution is expected to create clearer frameworks for health claims while potentially restricting certain ingredients or marketing practices, requiring companies to maintain flexibility and compliance readiness. The harmonization of European health drink standards will facilitate cross-border trade while ensuring consistent consumer protection and product quality assurance.

Market segmentation expansion will create opportunities in specialized categories including sports recovery drinks, beauty-from-within beverages, and therapeutic nutrition products that bridge the gap between food and pharmaceutical applications. The growing acceptance of nutraceutical beverages among healthcare professionals will drive adoption in clinical and institutional settings.

The Europe health drinks market represents a dynamic and rapidly evolving sector that has successfully transitioned from niche wellness products to mainstream consumer staples, reflecting fundamental changes in European attitudes toward nutrition, health management, and lifestyle optimization. This comprehensive analysis has revealed a market characterized by innovation excellence, consumer sophistication, and strategic positioning at the intersection of nutrition science and beverage technology.

Market maturation demonstrates the successful establishment of health drinks as essential components of modern European lifestyles, with consumers increasingly viewing functional beverages as convenient and effective tools for achieving specific health outcomes. The evolution from basic vitamin-enriched drinks to scientifically formulated wellness solutions illustrates the industry’s commitment to delivering measurable health benefits while meeting demanding taste and quality expectations.

Innovation leadership has emerged as the primary differentiator in competitive positioning, with successful companies investing heavily in research and development, clinical validation, and advanced manufacturing technologies. The integration of cutting-edge nutritional science with consumer-centric product development has created a robust foundation for sustained growth and market expansion across diverse demographic segments.

Consumer behavior transformation reflects increasing health consciousness, preventive healthcare adoption, and willingness to invest in premium products that deliver proven health benefits. MarkWide Research findings indicate that European consumers demonstrate superior product knowledge and higher expectations for transparency, quality, and efficacy compared to global averages, driving continuous industry improvement and innovation.

Sustainability integration has become a defining characteristic of market leadership, with environmental responsibility now considered essential for long-term success rather than optional competitive advantage. The industry’s proactive approach to sustainable packaging, ethical sourcing, and carbon footprint reduction demonstrates commitment to responsible growth that aligns with European values and regulatory expectations.

Technological advancement has revolutionized product development, manufacturing efficiency, and consumer engagement through digital platforms, personalization technologies, and advanced analytical capabilities. The successful integration of traditional nutritional wisdom with modern scientific validation has created authentic and credible product propositions that resonate with educated European consumers.

Regulatory framework evolution has provided essential market structure while ensuring consumer protection and product quality standards that enhance overall market credibility and growth sustainability. The balance between innovation encouragement and safety assurance has created a stable environment for long-term investment and strategic planning across the value chain.

As the Europe health drinks market continues to evolve and expand, success will increasingly depend on companies’ ability to anticipate consumer needs, leverage emerging technologies, and maintain authentic commitment to health outcomes and environmental responsibility. The market’s future growth trajectory will be determined by stakeholders’ capacity to balance innovation ambition with practical consumer benefits while building trusted brands that deliver consistent value in Europe’s sophisticated and demanding health and wellness marketplace.

What is Health Drinks?

Health drinks are beverages that are formulated to provide nutritional benefits, often containing vitamins, minerals, and other health-promoting ingredients. They cater to various consumer needs, including hydration, energy, and wellness support.

What are the key players in the Europe Health Drinks Market?

Key players in the Europe Health Drinks Market include companies like Nestlé, Coca-Cola, and PepsiCo, which offer a range of health-focused beverages. Other notable companies include Danone and Red Bull, among others.

What are the main drivers of the Europe Health Drinks Market?

The Europe Health Drinks Market is driven by increasing health consciousness among consumers, a growing demand for functional beverages, and the rise of lifestyle-related health issues. Additionally, the trend towards natural and organic ingredients is influencing market growth.

What challenges does the Europe Health Drinks Market face?

The Europe Health Drinks Market faces challenges such as regulatory hurdles regarding health claims, intense competition among brands, and changing consumer preferences. Additionally, the high cost of raw materials can impact pricing strategies.

What opportunities exist in the Europe Health Drinks Market?

Opportunities in the Europe Health Drinks Market include the expansion of plant-based and functional beverages, innovations in packaging, and the potential for online sales growth. There is also an increasing interest in personalized nutrition, which can drive new product development.

What trends are shaping the Europe Health Drinks Market?

Trends in the Europe Health Drinks Market include the rise of low-sugar and no-sugar beverages, the incorporation of superfoods, and the growing popularity of ready-to-drink options. Sustainability and eco-friendly packaging are also becoming significant factors for consumers.

Europe Health Drinks Market

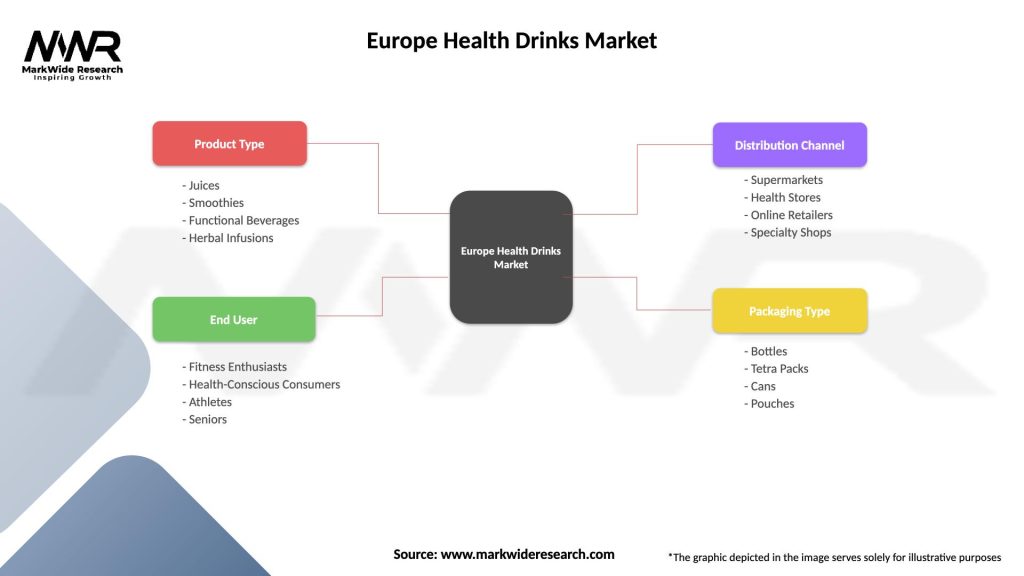

| Segmentation Details | Description |

|---|---|

| Product Type | Juices, Smoothies, Functional Beverages, Herbal Infusions |

| End User | Fitness Enthusiasts, Health-Conscious Consumers, Athletes, Seniors |

| Distribution Channel | Supermarkets, Health Stores, Online Retailers, Specialty Shops |

| Packaging Type | Bottles, Tetra Packs, Cans, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Health Drinks Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at