444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The Europe gas generator market refers to the industry involved in the production, distribution, and utilization of gas-powered generators in European countries. Gas generators are devices that convert natural gas or liquefied petroleum gas (LPG) into electrical energy, providing a reliable and efficient power source for various applications.

Meaning

Gas generators are a type of power generation equipment that utilize the combustion of natural gas or LPG to produce electricity. These generators are widely used in residential, commercial, and industrial sectors to provide backup power during grid outages or as a primary power source in off-grid locations.

Executive Summary

The Europe gas generator market has experienced significant growth in recent years, driven by the increasing demand for reliable and uninterrupted power supply across various sectors. The market is characterized by the presence of both global and regional players offering a wide range of gas generator products and services.

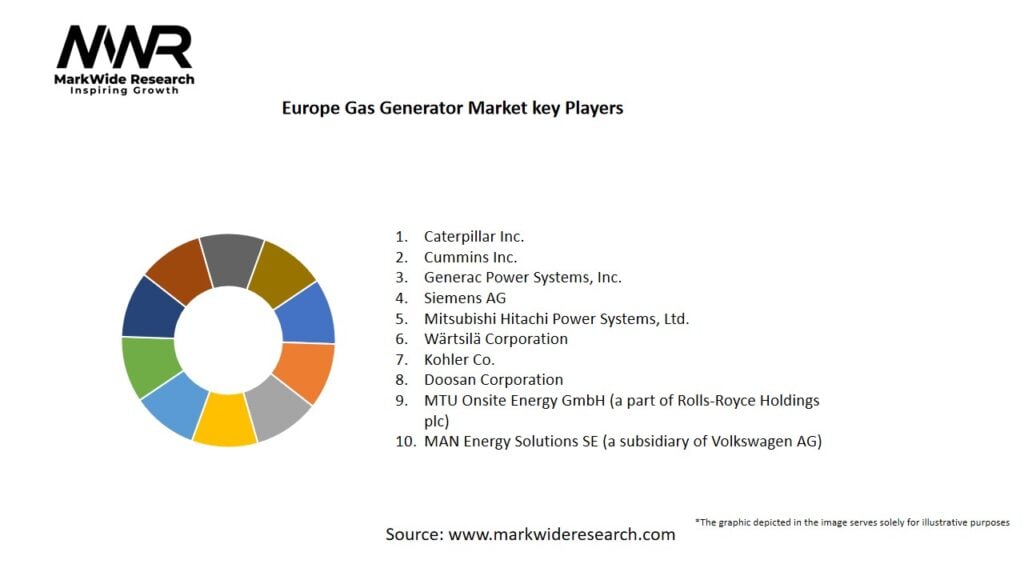

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Europe gas generator market is characterized by intense competition among key players striving to offer innovative and technologically advanced products. Market dynamics are influenced by factors such as changing customer preferences, evolving regulations, advancements in generator technologies, and the emergence of new market entrants.

Regional Analysis

Europe’s gas generator market is segmented into several key regions, including Western Europe, Eastern Europe, Northern Europe, Southern Europe, and Central Europe. Each region has unique market characteristics, demand patterns, and regulatory frameworks that impact the growth of the gas generator market.

In Western Europe, countries such as Germany, France, and the United Kingdom are the major contributors to the gas generator market due to their robust industrial sectors, increasing investments in infrastructure, and stringent environmental regulations.

In Eastern Europe, countries like Russia, Poland, and Ukraine have significant natural gas reserves and are witnessing a growing demand for gas generators in various applications.

Northern Europe, including countries such as Sweden, Finland, and Norway, has a strong focus on renewable energy, but gas generators play a role in providing backup power in remote areas or during peak demand periods.

Southern Europe, comprising countries like Italy, Spain, and Greece, has a mix of industrial and residential demand for gas generators, driven by factors such as tourism, construction activities, and regional power supply challenges.

Central Europe, including countries such as Czech Republic, Hungary, and Slovakia, is experiencing steady growth in the gas generator market due to increasing investments in manufacturing and infrastructure development.

Competitive Landscape

Leading Companies in the Europe Gas Generator Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Europe gas generator market can be segmented based on generator type, power capacity, end-user, and region.

Based on generator type, the market can be divided into natural gas generators, LPG generators, and biogas generators.

Based on power capacity, the market can be categorized into low power (below 100 kW), medium power (100 kW to 1 MW), and high power (above 1 MW) generators.

Based on end-user, the market can be segmented into residential, commercial, and industrial sectors.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a mixed impact on the Europe gas generator market. While the initial phase of the pandemic led to disruptions in supply chains and project delays, the subsequent focus on business continuity and emergency preparedness drove the demand for gas generators, especially in critical sectors such as healthcare and data centers.

The pandemic also highlighted the importance of reliable backup power solutions, leading to increased investments in gas generators for residential and commercial applications. Furthermore, the growing adoption of remote work arrangements and the need for remote power solutions contributed to the demand for portable gas generators.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Europe gas generator market is expected to continue its growth trajectory in the coming years. Factors such as the increasing demand for reliable power supply, the focus on reducing carbon emissions, and the integration of advanced technologies are likely to drive the market.

The transition towards cleaner energy sources and the expansion of renewable natural gas and biogas projects present opportunities for the gas generator market. The development of smart grid infrastructure, advancements in energy storage technologies, and the integration of IoT and predictive analytics will further enhance the performance and efficiency of gas generators.

Conclusion

The Europe gas generator market is witnessing steady growth, driven by the increasing demand for reliable power supply, the focus on reducing carbon emissions, and the abundant availability of natural gas resources. Gas generators offer a reliable and cost-effective solution for backup power, ensuring uninterrupted operations in various sectors.

While challenges such as high initial investment costs and volatility in natural gas prices exist, opportunities such as hybrid power solutions and advanced technology integration present avenues for market growth. By continuously innovating and adapting to evolving customer needs and regulatory requirements, industry participants can capitalize on the market’s potential and contribute to a sustainable and resilient energy landscape in Europe.

What is Gas Generator?

A gas generator is a device that converts gas fuel into electrical energy, commonly used for backup power, remote power supply, and in various industrial applications. These generators are essential in sectors such as construction, telecommunications, and emergency services.

What are the key players in the Europe Gas Generator Market?

Key players in the Europe Gas Generator Market include Caterpillar Inc., Cummins Inc., and Generac Holdings Inc., among others. These companies are known for their innovative technologies and extensive product offerings in the gas generator segment.

What are the growth factors driving the Europe Gas Generator Market?

The Europe Gas Generator Market is driven by increasing demand for reliable power supply, the growth of the construction industry, and the rising need for backup power solutions in residential and commercial sectors. Additionally, the shift towards cleaner energy sources is also contributing to market growth.

What challenges does the Europe Gas Generator Market face?

The Europe Gas Generator Market faces challenges such as stringent environmental regulations, high initial investment costs, and competition from alternative energy sources like solar and wind. These factors can hinder market expansion and adoption rates.

What opportunities exist in the Europe Gas Generator Market?

Opportunities in the Europe Gas Generator Market include advancements in generator technology, the integration of smart features for better efficiency, and the growing trend of hybrid power systems. These developments can enhance performance and attract new customers.

What trends are shaping the Europe Gas Generator Market?

Trends in the Europe Gas Generator Market include the increasing adoption of portable generators, the rise of dual-fuel generators, and a focus on sustainability through the use of cleaner fuels. These trends reflect the evolving needs of consumers and industries for more efficient and environmentally friendly power solutions.

Europe Gas Generator Market

| Segmentation Details | Description |

|---|---|

| Type | Portable, Standby, Prime, Continuous |

| Fuel Type | Natural Gas, Diesel, Propane, Biogas |

| End User | Industrial, Commercial, Residential, Agricultural |

| Power Rating | 1-5 kW, 6-10 kW, 11-20 kW, 21-50 kW |

Leading Companies in the Europe Gas Generator Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at