444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe gaming headset market represents a dynamic and rapidly evolving sector within the broader gaming peripherals industry. This market encompasses a comprehensive range of audio devices specifically designed for gaming applications, including wired and wireless headsets, professional esports equipment, and consumer-grade gaming audio solutions. European consumers demonstrate increasing sophistication in their gaming audio preferences, driving demand for high-quality, feature-rich headsets that deliver immersive gaming experiences.

Market dynamics in Europe are characterized by strong growth momentum, with the gaming headset segment experiencing robust expansion at a compound annual growth rate (CAGR) of 8.2% over the forecast period. This growth trajectory reflects the region’s thriving gaming ecosystem, which includes professional esports competitions, streaming culture, and the widespread adoption of gaming across diverse demographic segments. Western European countries lead market consumption, while Eastern European markets show accelerating adoption rates.

Technological innovation serves as a primary catalyst for market expansion, with manufacturers continuously introducing advanced features such as spatial audio, noise cancellation, and wireless connectivity solutions. The integration of artificial intelligence and machine learning capabilities into gaming headsets represents an emerging trend that enhances user experience through personalized audio profiles and adaptive sound optimization.

The Europe gaming headset market refers to the commercial ecosystem encompassing the design, manufacturing, distribution, and retail of specialized audio equipment tailored for gaming applications across European territories. This market includes various product categories ranging from entry-level consumer headsets to professional-grade equipment used in competitive gaming environments.

Gaming headsets differ from conventional audio devices through their specialized features designed to enhance gaming performance and experience. These products typically incorporate advanced audio processing technologies, ergonomic designs for extended gaming sessions, integrated microphones for communication, and compatibility with multiple gaming platforms including PC, console, and mobile devices.

The market encompasses both hardware manufacturers and software developers who create complementary technologies such as audio drivers, customization software, and virtual surround sound solutions. Additionally, the ecosystem includes distribution channels, retail partners, and service providers who facilitate product availability and customer support across European markets.

Market leadership in the European gaming headset sector is characterized by intense competition among established technology brands and emerging specialized manufacturers. The market demonstrates strong resilience and growth potential, driven by the expanding gaming population and increasing consumer spending on premium gaming accessories. Product innovation remains a critical differentiator, with companies investing heavily in research and development to introduce cutting-edge audio technologies.

Consumer preferences increasingly favor wireless connectivity, with wireless gaming headsets capturing approximately 62% market share in terms of unit sales across Europe. This shift reflects broader technological trends toward cable-free gaming setups and the improved reliability of wireless audio transmission technologies. Premium segment products show particularly strong growth, indicating consumer willingness to invest in high-quality gaming audio solutions.

The competitive landscape features a mix of multinational technology corporations and specialized gaming peripheral manufacturers. Market consolidation trends are evident as larger companies acquire innovative startups to expand their technological capabilities and market reach. Distribution strategies increasingly emphasize direct-to-consumer channels and partnerships with gaming-focused retailers to reach target audiences effectively.

Strategic market insights reveal several critical trends shaping the European gaming headset landscape. The following key observations provide essential understanding of market dynamics:

Primary growth drivers propelling the European gaming headset market include the exponential expansion of the gaming industry and evolving consumer entertainment preferences. The esports phenomenon significantly influences market demand, as competitive gaming requires high-performance audio equipment for optimal gameplay and communication. Professional gamers and streaming content creators serve as influential market drivers, demonstrating advanced gaming headset capabilities to large audiences.

Technological advancement represents another fundamental driver, with innovations in wireless connectivity, battery life, and audio processing creating compelling upgrade opportunities for consumers. The integration of virtual reality and augmented reality gaming experiences demands specialized audio solutions, driving development of next-generation gaming headsets with spatial audio capabilities and low-latency performance.

Remote work trends accelerated by global events have created crossover demand for gaming headsets in professional environments. Many consumers recognize the superior audio quality and comfort features of gaming headsets compared to traditional business communication devices, expanding the addressable market beyond pure gaming applications. Content creation and streaming activities further drive demand for high-quality audio equipment with professional-grade microphones and noise cancellation features.

Market constraints affecting the European gaming headset sector include economic pressures that influence consumer discretionary spending on gaming accessories. Price sensitivity among certain consumer segments limits market penetration, particularly for premium products with advanced features. Economic uncertainty and inflation concerns may cause consumers to delay gaming headset purchases or opt for lower-priced alternatives.

Technical limitations present ongoing challenges, including battery life constraints for wireless models, audio latency issues, and compatibility problems across different gaming platforms. Market saturation in mature European markets creates intensified competition and pressure on profit margins, requiring companies to invest heavily in differentiation and innovation to maintain market position.

Regulatory considerations including electromagnetic compatibility requirements and consumer safety standards add complexity and costs to product development and market entry processes. Supply chain disruptions and component shortages can impact product availability and pricing, affecting market growth momentum and consumer satisfaction levels.

Emerging opportunities in the European gaming headset market include the growing mobile gaming segment, which represents an underserved market for specialized mobile gaming audio solutions. Cloud gaming services create new demand patterns for headsets optimized for streaming gameplay, with emphasis on low-latency audio and reliable connectivity across various devices and network conditions.

Artificial intelligence integration presents significant opportunities for product differentiation through features such as adaptive noise cancellation, personalized audio profiles, and intelligent voice processing. Health and wellness considerations offer opportunities for headsets with ergonomic innovations, hearing protection features, and biometric monitoring capabilities that appeal to health-conscious gamers.

Subscription service models and gaming-as-a-service trends create opportunities for headset manufacturers to develop recurring revenue streams through software updates, premium features, and cloud-based audio processing services. Partnership opportunities with game developers, streaming platforms, and esports organizations can drive co-marketing initiatives and product integration that enhance market visibility and adoption.

Dynamic market forces shaping the European gaming headset landscape reflect the interplay between technological innovation, consumer behavior evolution, and competitive pressures. Supply and demand dynamics demonstrate strong consumer appetite for advanced gaming audio solutions, with demand consistently outpacing supply for innovative products featuring cutting-edge technologies.

Competitive dynamics intensify as traditional audio equipment manufacturers enter the gaming market, bringing established expertise in acoustic engineering and manufacturing scale. This increased competition drives innovation cycles and pricing pressures while expanding consumer choice and market accessibility. Brand positioning becomes increasingly important as companies seek to differentiate their products in a crowded marketplace.

Technology adoption cycles influence market dynamics, with early adopters driving initial demand for new features and mainstream consumers following as technologies mature and prices decrease. Seasonal patterns affect market dynamics, with holiday shopping periods and major gaming releases creating demand spikes that influence inventory management and marketing strategies. According to MarkWide Research analysis, these cyclical patterns show 35% higher sales volumes during peak gaming seasons.

Comprehensive research methodology employed in analyzing the European gaming headset market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability of market insights. Primary research includes extensive surveys of gaming headset users, interviews with industry executives, and focus groups with target demographic segments across major European markets.

Secondary research encompasses analysis of industry reports, company financial statements, patent filings, and regulatory documentation to understand market structure and competitive positioning. Market modeling techniques utilize statistical analysis and forecasting algorithms to project market trends and identify growth opportunities based on historical data and current market indicators.

Data validation processes include cross-referencing multiple sources, expert panel reviews, and statistical significance testing to ensure research findings meet rigorous quality standards. Regional analysis methodology accounts for cultural differences, economic variations, and regulatory environments across European countries to provide nuanced market understanding and localized insights for strategic decision-making.

Western European markets dominate the regional gaming headset landscape, with Germany, France, and the United Kingdom representing the largest consumer bases. Germany leads in market share with approximately 28% of total European consumption, driven by strong gaming culture, high disposable income levels, and preference for premium gaming equipment. The German market shows particular strength in professional gaming and esports applications.

France demonstrates robust growth in the gaming headset segment, with French consumers showing increasing preference for wireless models and aesthetically appealing designs. The market benefits from strong local gaming communities and government support for digital entertainment industries. United Kingdom maintains significant market presence despite economic uncertainties, with British consumers favoring established brands and proven performance characteristics.

Nordic countries including Sweden, Norway, and Denmark show disproportionately high per-capita consumption of gaming headsets, reflecting strong gaming cultures and high technology adoption rates. Eastern European markets including Poland, Czech Republic, and Hungary demonstrate accelerating growth rates as gaming becomes more mainstream and disposable incomes increase. These markets show 12% annual growth rates in gaming headset adoption, outpacing Western European averages.

Market leadership in the European gaming headset sector is distributed among several key players, each with distinct competitive advantages and market positioning strategies. The competitive environment features intense rivalry and continuous innovation as companies strive to capture market share and build brand loyalty among gaming enthusiasts.

Market segmentation analysis reveals distinct categories based on connectivity, price points, target applications, and consumer demographics. By Connectivity: The market divides between wired and wireless solutions, with wireless headsets gaining market share due to convenience and technological improvements. Wired headsets maintain relevance in professional gaming applications where latency concerns prioritize direct connections.

By Price Range: Market segmentation includes entry-level products under €50, mid-range options between €50-150, and premium models exceeding €150. Premium segments show strongest growth rates as consumers increasingly invest in high-quality gaming experiences and professional-grade equipment for content creation and competitive gaming applications.

By Application: Segmentation encompasses casual gaming, competitive esports, content creation, and professional communication applications. Esports applications drive demand for specialized features including tournament-approved designs, sponsor customization options, and professional-grade audio performance. Content creation segments require high-quality microphones and streaming-optimized features for online broadcasting and video production.

Wireless gaming headsets represent the fastest-growing category, benefiting from improved battery technology, reduced latency, and enhanced connectivity reliability. Consumer preference increasingly favors wireless solutions for their convenience and aesthetic appeal, driving manufacturers to invest heavily in wireless technology development and optimization.

Professional gaming headsets cater to esports athletes and serious competitive gamers requiring maximum performance and reliability. This category emphasizes audio precision, communication clarity, and durability under intensive use conditions. Professional categories command premium pricing and demonstrate strong brand loyalty among target users.

Multi-platform headsets address growing consumer demand for devices compatible across PC, console, and mobile gaming platforms. Versatility becomes a key selling point as gamers utilize multiple devices and seek unified audio solutions. This category drives innovation in universal connectivity solutions and adaptive audio processing technologies.

Manufacturers benefit from expanding market opportunities driven by growing gaming populations and increasing consumer willingness to invest in premium gaming accessories. Revenue diversification opportunities exist through product line extensions, software services, and partnership arrangements with gaming companies and content creators.

Retailers gain from high-margin gaming peripheral sales and opportunities to build relationships with engaged gaming communities. Specialty gaming retailers can differentiate through expert product knowledge, demonstration capabilities, and community engagement initiatives that build customer loyalty and drive repeat purchases.

Consumers benefit from continuous innovation resulting in improved product quality, expanded feature sets, and competitive pricing across market segments. Gaming experience enhancement through advanced audio technologies provides tangible value for entertainment, competitive gaming, and professional applications. Technology convergence enables gaming headsets to serve multiple purposes including professional communication and content creation.

Strengths:

Weaknesses:

Opportunities:

Threats:

Wireless technology advancement represents the most significant trend shaping the European gaming headset market, with manufacturers investing heavily in low-latency wireless solutions and extended battery life capabilities. Consumer adoption of wireless headsets accelerates as technology reliability improves and price points become more accessible across market segments.

Customization and personalization trends drive demand for headsets with modular components, RGB lighting systems, and software-based audio customization options. Gaming enthusiasts increasingly seek products that reflect personal style and provide tailored audio experiences through equalizer settings and sound profiles optimized for specific games or applications.

Cross-platform compatibility becomes increasingly important as gamers utilize multiple devices and gaming ecosystems. Universal connectivity solutions that seamlessly work across PC, console, and mobile platforms provide competitive advantages and appeal to consumers seeking versatile gaming accessories. MWR data indicates that 78% of European gamers use multiple gaming platforms regularly.

Strategic partnerships between gaming headset manufacturers and major game developers create opportunities for co-branded products and integrated gaming experiences. Collaboration initiatives include custom audio profiles for popular games, exclusive design partnerships, and early access programs that build brand awareness and consumer engagement.

Acquisition activity in the gaming peripheral sector reflects industry consolidation trends as larger technology companies acquire specialized gaming brands to expand their product portfolios and market reach. Investment flows into gaming audio technology startups indicate continued innovation potential and market growth expectations among industry participants.

Sustainability initiatives gain prominence as manufacturers respond to environmental concerns through recyclable materials, energy-efficient designs, and take-back programs for end-of-life products. Corporate responsibility programs increasingly influence purchasing decisions among environmentally conscious consumers, particularly in Northern European markets.

Market participants should prioritize wireless technology development and optimization to capitalize on strong consumer preference trends toward cable-free gaming setups. Investment priorities should focus on battery life improvement, latency reduction, and connectivity reliability to address remaining technical barriers to wireless adoption.

Product differentiation strategies should emphasize unique features such as AI-powered audio optimization, health monitoring capabilities, and advanced customization options that create compelling value propositions beyond basic audio performance. Brand building through community engagement and esports partnerships can establish market position and drive consumer loyalty.

Geographic expansion opportunities exist in Eastern European markets showing rapid gaming adoption and increasing disposable income levels. Localization strategies should account for regional preferences, pricing sensitivities, and distribution channel characteristics to maximize market penetration and growth potential in emerging European markets.

Long-term market prospects for the European gaming headset sector remain highly positive, supported by continued gaming industry expansion and technological innovation cycles. Growth projections indicate sustained market expansion at approximately 8.5% CAGR through the forecast period, driven by new gaming platforms, emerging technologies, and expanding consumer demographics.

Technology evolution will likely focus on artificial intelligence integration, spatial audio advancement, and seamless multi-device connectivity solutions. Next-generation features may include biometric monitoring, adaptive noise cancellation, and cloud-based audio processing that enhance gaming experiences and expand application possibilities beyond traditional gaming use cases.

Market maturation in Western European countries will drive companies to seek growth opportunities in Eastern European markets and adjacent product categories. MarkWide Research projects that emerging European markets will account for 40% of regional growth over the next five years, reflecting shifting demographic and economic patterns across the continent.

The European gaming headset market represents a dynamic and rapidly evolving sector with substantial growth potential driven by technological innovation, expanding gaming demographics, and increasing consumer sophistication. Market fundamentals remain strong, supported by robust gaming industry growth, professional esports development, and cross-platform gaming trends that create sustained demand for high-quality audio solutions.

Competitive dynamics will continue to intensify as traditional audio companies enter the gaming market and specialized manufacturers expand their technological capabilities. Success factors will increasingly depend on innovation leadership, brand differentiation, and ability to anticipate and respond to evolving consumer preferences across diverse European markets.

Strategic opportunities exist for companies that can effectively balance technological advancement with market accessibility, creating products that serve both enthusiast and mainstream consumer segments. The integration of emerging technologies such as artificial intelligence and spatial audio will likely define the next phase of market evolution, creating new possibilities for product differentiation and market expansion across the European gaming headset landscape.

What is Gaming Headset?

Gaming headsets are specialized audio devices designed for immersive gaming experiences, featuring high-quality sound, a built-in microphone, and often additional features like surround sound and noise cancellation.

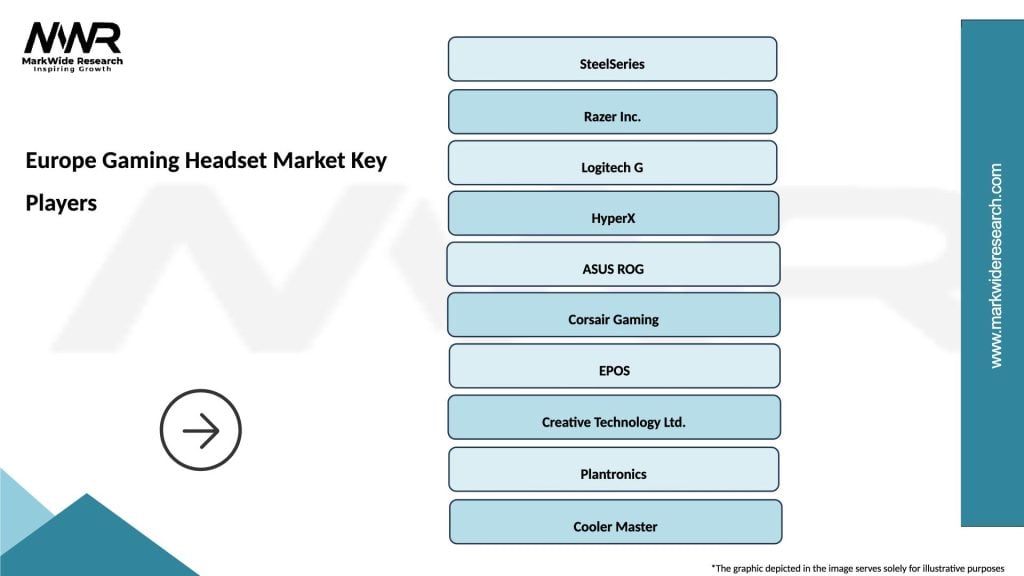

What are the key players in the Europe Gaming Headset Market?

Key players in the Europe Gaming Headset Market include Logitech, Razer, SteelSeries, and Corsair, among others.

What are the main drivers of growth in the Europe Gaming Headset Market?

The growth of the Europe Gaming Headset Market is driven by the increasing popularity of online gaming, advancements in audio technology, and the rising demand for high-quality gaming accessories.

What challenges does the Europe Gaming Headset Market face?

Challenges in the Europe Gaming Headset Market include intense competition among manufacturers, rapid technological changes, and the need for continuous innovation to meet consumer expectations.

What opportunities exist in the Europe Gaming Headset Market?

Opportunities in the Europe Gaming Headset Market include the expansion of esports, the growing trend of virtual reality gaming, and the increasing adoption of wireless headsets.

What trends are shaping the Europe Gaming Headset Market?

Trends in the Europe Gaming Headset Market include the rise of customizable headsets, the integration of advanced audio technologies, and a focus on ergonomic designs for prolonged use.

Europe Gaming Headset Market

| Segmentation Details | Description |

|---|---|

| Product Type | Wired, Wireless, Over-Ear, In-Ear |

| Technology | Bluetooth, USB, Analog, Surround Sound |

| End User | Casual Gamers, Professional Gamers, Streamers, Esports Teams |

| Distribution Channel | Online Retail, Specialty Stores, Supermarkets, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Gaming Headset Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at