444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe food cold chain logistics market represents a critical infrastructure backbone supporting the continent’s extensive food distribution network. This sophisticated system encompasses temperature-controlled storage, transportation, and handling of perishable food products from farm to fork. European cold chain logistics has evolved into a highly regulated and technologically advanced sector, driven by stringent food safety regulations, growing consumer demand for fresh products, and expanding international trade.

Market dynamics indicate robust growth across multiple segments, with the sector experiencing a 6.2% compound annual growth rate over recent years. The integration of advanced technologies such as IoT sensors, blockchain tracking, and automated storage systems has revolutionized traditional cold chain operations. Temperature-controlled logistics now extends beyond basic refrigeration to encompass sophisticated multi-temperature zones, real-time monitoring, and predictive maintenance systems.

Regional variations across Europe reflect diverse market maturity levels, with Western European countries leading in technological adoption while Eastern European markets show rapid expansion potential. The sector’s resilience was particularly evident during recent global disruptions, highlighting the essential nature of cold chain infrastructure in maintaining food security and supply chain continuity.

The Europe food cold chain logistics market refers to the comprehensive network of temperature-controlled storage facilities, refrigerated transportation systems, and specialized handling processes that maintain optimal conditions for perishable food products throughout the supply chain from production to consumption across European territories.

Cold chain logistics encompasses multiple temperature ranges, from frozen storage at sub-zero temperatures to controlled ambient conditions for specific products. This market includes various stakeholders such as third-party logistics providers, food manufacturers, retailers, and technology suppliers who collaborate to ensure product integrity, safety, and quality. Temperature-sensitive products covered include fresh produce, dairy products, meat and poultry, seafood, frozen foods, pharmaceuticals, and specialty items requiring specific environmental conditions.

Modern cold chain systems integrate advanced monitoring technologies, automated inventory management, and sophisticated tracking mechanisms to provide end-to-end visibility and control. The market also encompasses supporting services such as packaging solutions, quality assurance, regulatory compliance, and sustainability initiatives that collectively define the contemporary European cold chain landscape.

Europe’s food cold chain logistics market stands as a cornerstone of the continent’s food security infrastructure, characterized by technological innovation, regulatory compliance, and sustainability focus. The sector demonstrates remarkable resilience and adaptability, with digital transformation initiatives accounting for approximately 35% of operational improvements across leading logistics providers.

Key market characteristics include the dominance of third-party logistics providers, increasing automation adoption, and growing emphasis on sustainable practices. The market benefits from Europe’s strategic geographic position, well-developed transportation networks, and harmonized regulatory frameworks that facilitate cross-border trade. Consumer behavior shifts toward fresh, organic, and locally-sourced products continue to drive demand for sophisticated cold chain solutions.

Investment trends show significant capital allocation toward warehouse automation, fleet modernization, and technology integration. The sector’s evolution reflects broader supply chain digitization trends, with companies investing heavily in predictive analytics, artificial intelligence, and blockchain technologies to enhance operational efficiency and transparency.

Strategic insights reveal several critical trends shaping the European food cold chain logistics landscape:

Primary growth drivers propelling the Europe food cold chain logistics market encompass regulatory, technological, and consumer-driven factors that collectively create a robust demand environment.

Regulatory compliance requirements serve as fundamental market drivers, with European Union food safety directives mandating strict temperature control throughout the supply chain. These regulations ensure product quality, safety, and traceability, creating consistent demand for professional cold chain services. HACCP compliance and other quality assurance standards require sophisticated monitoring and documentation systems that drive technology adoption.

Consumer behavior evolution significantly influences market dynamics, with increasing demand for fresh, organic, and premium food products requiring specialized handling and storage. The growth of e-commerce food retail, particularly accelerated by recent market changes, creates new requirements for last-mile cold chain delivery solutions. Health consciousness trends drive demand for minimally processed foods that require careful temperature management.

Technological advancement enables new service capabilities and operational efficiencies that expand market opportunities. IoT integration, predictive analytics, and automation technologies reduce operational costs while improving service quality, making cold chain logistics more accessible to smaller food producers and retailers.

Operational challenges within the Europe food cold chain logistics market create significant constraints that impact growth potential and profitability across the sector.

High capital requirements represent a primary market restraint, as establishing and maintaining temperature-controlled facilities requires substantial initial investment and ongoing operational costs. Energy expenses for refrigeration systems, specialized equipment maintenance, and facility upgrades create financial barriers for market entry and expansion. Infrastructure development costs particularly challenge smaller logistics providers and regional operators.

Skilled labor shortages across Europe impact cold chain operations, with specialized technical knowledge required for equipment operation, maintenance, and quality control. The complexity of modern cold chain systems demands trained personnel capable of managing sophisticated monitoring and control systems. Training costs and retention challenges add operational complexity and expense.

Regulatory complexity across different European markets creates compliance challenges, particularly for cross-border operations. Varying national requirements, documentation standards, and inspection procedures increase administrative burden and operational costs. Environmental regulations regarding refrigerants and energy consumption add additional compliance requirements that impact operational flexibility.

Emerging opportunities within the European food cold chain logistics market present significant potential for growth, innovation, and market expansion across multiple dimensions.

Digital transformation initiatives offer substantial opportunities for operational improvement and service enhancement. Implementation of artificial intelligence, machine learning, and predictive analytics can optimize routing, reduce energy consumption, and improve demand forecasting. Blockchain technology presents opportunities for enhanced traceability, fraud prevention, and supply chain transparency that add value for food producers and consumers.

Sustainability initiatives create opportunities for competitive differentiation and regulatory compliance. Development of energy-efficient refrigeration systems, renewable energy integration, and carbon-neutral logistics solutions align with European environmental goals. Green logistics programs can reduce operational costs while meeting corporate sustainability objectives and consumer preferences.

Market expansion opportunities exist in Eastern European countries experiencing economic growth and infrastructure development. These emerging markets offer potential for establishing new facilities, expanding service networks, and capturing market share in developing food retail sectors. Cross-border consolidation opportunities enable logistics providers to achieve economies of scale and operational efficiency.

Complex market dynamics shape the European food cold chain logistics landscape through interconnected factors that influence supply, demand, and competitive positioning across the sector.

Supply chain integration trends drive consolidation among logistics providers, creating larger, more efficient operations capable of serving multinational food companies. This consolidation enables investment in advanced technologies and infrastructure while providing comprehensive service coverage across European markets. Vertical integration strategies allow food producers to gain greater control over their cold chain operations.

Competitive pressures intensify as traditional logistics companies compete with technology-focused startups and food retailers developing in-house capabilities. This competition drives innovation, service improvement, and cost optimization across the market. Service differentiation becomes increasingly important as providers seek to establish competitive advantages through specialized capabilities or technology integration.

Economic factors including energy costs, labor expenses, and transportation fuel prices significantly impact operational profitability and pricing strategies. Currency fluctuations affect cross-border operations and international trade flows, influencing demand patterns and operational planning. According to MarkWide Research analysis, economic stability correlates strongly with cold chain investment levels and capacity expansion decisions.

Comprehensive research methodology employed for analyzing the Europe food cold chain logistics market incorporates multiple data sources, analytical techniques, and validation processes to ensure accuracy and reliability of market insights.

Primary research activities include structured interviews with industry executives, logistics managers, technology providers, and regulatory officials across major European markets. Survey data collection from cold chain operators, food manufacturers, and retail organizations provides quantitative insights into market trends, operational challenges, and technology adoption patterns. Expert consultations with industry specialists validate findings and provide contextual understanding of market dynamics.

Secondary research sources encompass industry reports, regulatory publications, trade association data, and academic research relevant to cold chain logistics and food distribution. Financial analysis of publicly traded logistics companies provides insights into market performance, investment trends, and competitive positioning. Government statistics and trade data support market sizing and regional analysis components.

Analytical frameworks include market segmentation analysis, competitive landscape mapping, and trend identification methodologies. Statistical analysis techniques validate data consistency and identify significant market patterns. Forecasting models incorporate historical trends, current market conditions, and projected growth drivers to develop realistic market projections.

Regional market analysis reveals distinct characteristics and growth patterns across European cold chain logistics markets, reflecting varying levels of infrastructure development, regulatory environments, and economic conditions.

Western European markets including Germany, France, United Kingdom, and Netherlands demonstrate mature cold chain infrastructure with high technology adoption rates. These markets account for approximately 68% of regional cold storage capacity and feature sophisticated automation systems, advanced monitoring technologies, and comprehensive service networks. Market saturation in these regions drives focus toward efficiency improvements and service differentiation rather than capacity expansion.

Northern European countries such as Sweden, Denmark, and Norway exhibit strong sustainability focus with significant investment in energy-efficient systems and renewable energy integration. These markets demonstrate 15% higher energy efficiency compared to regional averages, reflecting environmental priorities and regulatory requirements. Cold climate advantages provide natural refrigeration benefits that reduce operational costs.

Eastern European markets including Poland, Czech Republic, and Hungary show rapid growth potential with expanding food retail sectors and increasing foreign investment. These markets experience 12% annual capacity growth as international logistics providers establish regional operations. Infrastructure development programs supported by European Union funding accelerate modernization efforts and technology adoption.

Competitive dynamics within the Europe food cold chain logistics market reflect a diverse ecosystem of international corporations, regional specialists, and technology-focused service providers competing across multiple service segments.

Market leaders include established logistics companies with comprehensive European networks:

Regional competitors maintain strong positions in specific geographic markets through local expertise, customer relationships, and specialized service offerings. These companies often focus on niche segments or specific product categories where they can provide superior service quality or cost advantages.

Technology integration increasingly differentiates competitive positioning, with companies investing in IoT platforms, predictive analytics, and automation systems to improve operational efficiency and service quality. Strategic partnerships between logistics providers and technology companies accelerate innovation adoption and capability development.

Market segmentation analysis reveals distinct categories within the Europe food cold chain logistics market, each characterized by specific requirements, growth patterns, and competitive dynamics.

By Temperature Range:

By Service Type:

By End-User Industry:

Detailed category analysis provides specific insights into major segments within the European food cold chain logistics market, highlighting unique characteristics and growth opportunities.

Frozen Food Logistics represents the largest market segment, driven by consumer convenience trends and expanding frozen food product ranges. This category requires the most stringent temperature control with -18°C to -25°C storage requirements and sophisticated monitoring systems. Automation adoption reaches highest levels in frozen storage facilities due to harsh working conditions and efficiency requirements.

Fresh Produce Logistics demonstrates rapid growth reflecting consumer health consciousness and demand for fresh, locally-sourced products. This segment requires flexible temperature management, rapid turnover capabilities, and specialized handling procedures. Seasonal variations create capacity planning challenges while offering opportunities for specialized service providers.

Dairy and Protein Logistics maintains steady demand with strict quality requirements and regulatory oversight. These products require consistent temperature maintenance and rapid distribution to preserve freshness and safety. Traceability requirements drive investment in tracking technologies and documentation systems.

E-commerce Cold Chain emerges as a high-growth segment driven by online grocery shopping and direct-to-consumer food delivery. This category requires last-mile delivery capabilities, small-batch handling, and flexible scheduling systems. Urban logistics challenges create opportunities for innovative delivery solutions and micro-fulfillment centers.

Comprehensive benefits derived from professional cold chain logistics services create value for multiple stakeholders across the European food supply chain ecosystem.

Food Manufacturers benefit from reduced operational complexity, improved product quality, and enhanced market reach through professional logistics partnerships. Cost optimization occurs through economies of scale, specialized expertise, and technology access that individual manufacturers cannot achieve independently. Risk mitigation includes regulatory compliance, quality assurance, and supply chain continuity that protect brand reputation and market position.

Retailers and Distributors gain access to sophisticated infrastructure, technology capabilities, and operational expertise without significant capital investment. Flexibility advantages include scalable capacity, seasonal adjustment capabilities, and geographic expansion support. Service quality improvements enhance customer satisfaction and reduce product waste through better temperature control and handling procedures.

Consumers ultimately benefit from improved food safety, extended product freshness, and greater product availability across diverse food categories. Quality assurance provided by professional cold chain management reduces foodborne illness risks and ensures consistent product standards. Price stability results from efficient logistics operations that minimize waste and optimize distribution costs.

Logistics Providers achieve operational efficiency through specialization, technology investment, and scale advantages. Revenue diversification across multiple customer segments and product categories provides business stability and growth opportunities. Technology leadership positions create competitive advantages and premium pricing capabilities in specialized market segments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends reshaping the Europe food cold chain logistics market reflect technological advancement, sustainability focus, and evolving consumer preferences that drive operational and strategic changes across the industry.

Automation and Robotics Integration accelerates across cold storage facilities, with automated storage and retrieval systems improving efficiency while reducing labor dependency. Robotic picking systems and autonomous vehicles enhance operational capabilities in challenging cold environments. These technologies achieve 25% efficiency improvements while reducing operational errors and workplace safety risks.

Sustainability and Green Logistics initiatives gain prominence as companies respond to environmental regulations and corporate responsibility requirements. Energy-efficient refrigeration systems, renewable energy integration, and carbon-neutral transportation options become competitive differentiators. Natural refrigerant adoption and waste reduction programs align with European environmental objectives.

Real-time Monitoring and IoT Integration provides unprecedented visibility into cold chain operations, enabling predictive maintenance, quality assurance, and operational optimization. Sensor networks monitor temperature, humidity, and other environmental factors throughout the supply chain. Data analytics platforms process monitoring information to identify trends, predict issues, and optimize performance.

Blockchain and Traceability Solutions enhance supply chain transparency, food safety, and fraud prevention capabilities. These technologies provide immutable records of product handling, temperature exposure, and quality parameters throughout the distribution process. Consumer access to product history information builds trust and supports premium positioning strategies.

Significant industry developments demonstrate the dynamic nature of the European food cold chain logistics market, with major investments, technological innovations, and strategic initiatives shaping future market direction.

Infrastructure Expansion Projects across Eastern Europe reflect growing market opportunities and international investment in cold chain capabilities. Major logistics providers establish new facilities, upgrade existing operations, and expand service networks to capture emerging market demand. Automated facility development incorporates latest technologies from project inception, creating competitive advantages in operational efficiency and service quality.

Technology Partnership Initiatives between logistics providers and technology companies accelerate innovation adoption and capability development. These collaborations focus on IoT platform integration, artificial intelligence applications, and blockchain implementation. Joint development programs create customized solutions that address specific cold chain challenges and operational requirements.

Sustainability Investment Programs demonstrate industry commitment to environmental responsibility and regulatory compliance. Companies invest in renewable energy systems, energy-efficient equipment, and carbon reduction initiatives. Green certification programs provide third-party validation of environmental performance and support customer sustainability objectives.

Merger and Acquisition Activity continues as companies seek scale advantages, geographic expansion, and technology capabilities. Strategic acquisitions enable rapid market entry, customer base expansion, and operational synergies. Cross-border consolidation creates pan-European service capabilities that serve multinational food companies more effectively.

Strategic recommendations for stakeholders in the Europe food cold chain logistics market focus on technology adoption, operational optimization, and market positioning strategies that enhance competitive advantage and long-term sustainability.

Technology Investment Priorities should emphasize IoT integration, automation systems, and data analytics platforms that provide measurable operational improvements. Companies should develop comprehensive technology roadmaps that align with business objectives and customer requirements. Phased implementation approaches allow for learning, adjustment, and risk mitigation while building technological capabilities progressively.

Sustainability Integration becomes essential for regulatory compliance, cost management, and competitive differentiation. Organizations should develop comprehensive environmental strategies that address energy efficiency, waste reduction, and carbon footprint minimization. MWR analysis indicates that sustainability initiatives correlate positively with customer retention and premium pricing capabilities.

Market Expansion Strategies should focus on high-growth segments such as e-commerce cold chain, organic food logistics, and emerging Eastern European markets. Companies should evaluate partnership opportunities, acquisition targets, and organic growth investments that align with strategic objectives. Risk assessment and market entry strategies require careful evaluation of regulatory requirements, competitive dynamics, and operational challenges.

Operational Excellence Programs should emphasize continuous improvement, quality management, and customer service enhancement. Companies should implement performance measurement systems, employee training programs, and process optimization initiatives that drive operational efficiency and service quality improvements.

Future market projections for the Europe food cold chain logistics market indicate continued growth driven by technological innovation, regulatory evolution, and changing consumer preferences that reshape industry dynamics and competitive landscape.

Technology Evolution will accelerate with artificial intelligence, machine learning, and advanced automation becoming standard operational components. Predictive analytics will enable proactive maintenance, demand forecasting, and route optimization that significantly improve operational efficiency. Integration of 5G networks and edge computing will enhance real-time monitoring and control capabilities across cold chain operations.

Market Growth Projections indicate sustained expansion with 8.5% annual growth rates expected across key segments over the next five years. Eastern European markets will likely experience above-average growth as infrastructure development and economic expansion drive demand for professional cold chain services. E-commerce cold chain segments may achieve double-digit growth rates as online grocery shopping becomes mainstream across European markets.

Sustainability Requirements will intensify with stricter environmental regulations, carbon pricing mechanisms, and corporate responsibility mandates driving operational changes. Companies will need to achieve carbon neutrality targets through renewable energy adoption, efficient equipment deployment, and sustainable transportation solutions. Circular economy principles will influence packaging, waste management, and resource utilization strategies.

Regulatory Development will continue harmonizing standards across European markets while introducing new requirements for food safety, environmental protection, and data privacy. Digital documentation and automated compliance reporting will become standard requirements, driving technology adoption and operational standardization across the industry.

The Europe food cold chain logistics market represents a dynamic and essential component of the continent’s food supply infrastructure, characterized by technological innovation, regulatory sophistication, and evolving consumer demands. Market fundamentals remain strong with consistent growth drivers including food safety requirements, fresh product demand, and cross-border trade expansion creating sustained demand for professional cold chain services.

Technology integration emerges as a critical success factor, with IoT monitoring, automation systems, and data analytics providing competitive advantages and operational improvements. Companies that successfully implement comprehensive technology strategies while maintaining focus on sustainability and customer service will likely achieve superior market positioning and financial performance.

Regional opportunities across European markets offer diverse growth potential, with mature Western markets providing stability and emerging Eastern markets offering expansion possibilities. The sector’s resilience and adaptability position it well for continued growth despite economic uncertainties and operational challenges.

Future success in the European food cold chain logistics market will depend on strategic technology adoption, sustainability integration, operational excellence, and customer-focused service development. Organizations that align their strategies with market trends while maintaining operational efficiency and regulatory compliance will be best positioned to capitalize on emerging opportunities and achieve sustainable competitive advantage in this essential industry sector.

What is Food Cold Chain Logistics?

Food Cold Chain Logistics refers to the temperature-controlled supply chain processes that ensure the safe storage and transportation of perishable food items. This includes various stages such as refrigeration, freezing, and monitoring to maintain product quality and safety.

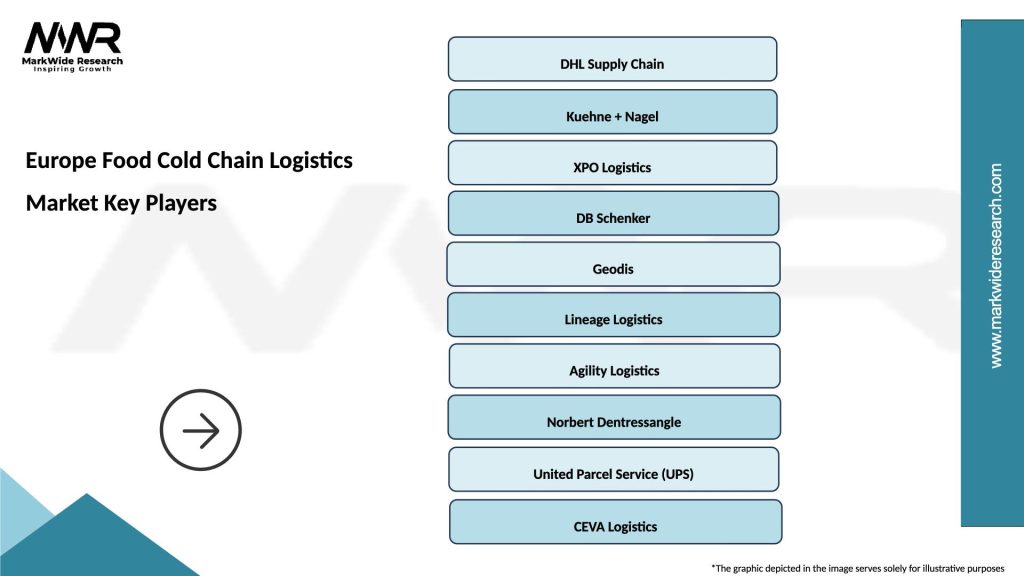

What are the key players in the Europe Food Cold Chain Logistics Market?

Key players in the Europe Food Cold Chain Logistics Market include companies like DHL Supply Chain, XPO Logistics, and Kuehne + Nagel, which provide specialized services for temperature-sensitive food products, among others.

What are the main drivers of the Europe Food Cold Chain Logistics Market?

The main drivers of the Europe Food Cold Chain Logistics Market include the increasing demand for fresh and frozen food products, the growth of e-commerce in food delivery, and stringent food safety regulations that necessitate proper temperature control.

What challenges does the Europe Food Cold Chain Logistics Market face?

Challenges in the Europe Food Cold Chain Logistics Market include high operational costs, the complexity of managing temperature-sensitive shipments, and the need for advanced technology to monitor and maintain cold chain integrity.

What opportunities exist in the Europe Food Cold Chain Logistics Market?

Opportunities in the Europe Food Cold Chain Logistics Market include the expansion of online grocery shopping, advancements in cold chain technology, and increasing consumer awareness regarding food safety and quality.

What trends are shaping the Europe Food Cold Chain Logistics Market?

Trends shaping the Europe Food Cold Chain Logistics Market include the adoption of IoT for real-time monitoring, the use of sustainable packaging solutions, and the integration of automation in logistics operations to enhance efficiency.

Europe Food Cold Chain Logistics Market

| Segmentation Details | Description |

|---|---|

| Product Type | Refrigerated Trucks, Insulated Containers, Cold Storage Warehouses, Temperature-Controlled Vans |

| Technology | IoT Solutions, GPS Tracking, Automated Temperature Control, RFID Systems |

| End User | Food Manufacturers, Distributors, Retail Chains, Restaurants |

| Service Type | Transportation, Warehousing, Packaging, Monitoring |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Food Cold Chain Logistics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at