444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe flash memory market represents a dynamic and rapidly evolving sector within the broader semiconductor industry, characterized by substantial growth momentum and technological innovation. Flash memory technology has become increasingly critical across multiple industries, from consumer electronics and automotive applications to enterprise storage solutions and industrial automation systems. The European market demonstrates particularly strong demand driven by the region’s robust manufacturing base, advanced automotive sector, and growing emphasis on digital transformation initiatives.

Market dynamics in Europe reflect a sophisticated ecosystem where established semiconductor companies collaborate with emerging technology providers to deliver cutting-edge flash memory solutions. The region’s commitment to technological sovereignty and reduced dependence on external suppliers has accelerated investments in domestic flash memory manufacturing capabilities. Growth projections indicate the market is expanding at a compound annual growth rate (CAGR) of 8.2%, driven by increasing demand for high-performance storage solutions across diverse applications.

Regional leadership in automotive innovation, particularly in electric vehicles and autonomous driving technologies, has positioned Europe as a critical market for specialized flash memory applications. The integration of advanced driver assistance systems (ADAS) and infotainment platforms requires high-reliability, high-capacity flash memory solutions that can withstand harsh automotive environments while delivering exceptional performance.

The Europe flash memory market refers to the comprehensive ecosystem encompassing the design, manufacturing, distribution, and application of non-volatile semiconductor memory devices across European countries. Flash memory technology utilizes floating-gate transistors to store data electronically without requiring continuous power supply, making it ideal for portable devices, embedded systems, and high-performance computing applications.

Market scope includes various flash memory types such as NAND flash, NOR flash, and emerging technologies like 3D NAND and QLC (Quad-Level Cell) memory. These technologies serve diverse applications ranging from smartphones and tablets to solid-state drives (SSDs), automotive electronics, and industrial control systems. The European market specifically encompasses both domestic consumption and manufacturing activities within EU member states, the United Kingdom, and associated European Economic Area countries.

Technology evolution within the European context reflects the region’s focus on high-value applications requiring superior reliability, security, and performance characteristics. European manufacturers and system integrators prioritize flash memory solutions that meet stringent automotive, industrial, and aerospace standards while supporting the region’s sustainability and circular economy objectives.

Strategic positioning of the Europe flash memory market reflects a mature yet rapidly evolving landscape where technological innovation meets diverse application requirements. The market demonstrates exceptional resilience and growth potential, supported by strong demand from key sectors including automotive, industrial automation, consumer electronics, and enterprise computing. Market penetration of advanced flash memory technologies has reached 72% adoption rate across critical applications, indicating robust market maturity and continued expansion opportunities.

Competitive dynamics showcase a balanced ecosystem featuring both global semiconductor leaders and specialized European companies focusing on niche applications and high-reliability solutions. The region’s emphasis on technological independence has stimulated increased investment in domestic manufacturing capabilities and research and development initiatives. Innovation drivers include the transition to electric vehicles, Industry 4.0 implementations, and growing demand for edge computing solutions.

Market segmentation reveals diverse growth patterns across different flash memory types and applications. NAND flash memory dominates volume shipments, while NOR flash maintains strong positioning in automotive and industrial applications requiring instant-on capabilities and high reliability. The emergence of 3D NAND technology has enabled significant capacity improvements while reducing per-gigabyte costs, accelerating adoption across consumer and enterprise segments.

Technology advancement represents the primary catalyst driving Europe flash memory market evolution, with several critical insights shaping industry direction:

Market maturation indicators suggest the European flash memory market has entered a phase of sophisticated application-specific optimization rather than simple capacity expansion. This evolution reflects the region’s advanced technological requirements and emphasis on high-value applications.

Automotive transformation stands as the most significant driver propelling Europe flash memory market growth. The region’s leadership in automotive innovation, particularly in electric vehicles and autonomous driving technologies, creates substantial demand for high-performance, automotive-grade flash memory solutions. Electric vehicle adoption requires sophisticated battery management systems, infotainment platforms, and over-the-air update capabilities, all dependent on reliable flash memory storage.

Digital transformation initiatives across European industries accelerate flash memory adoption as organizations modernize their IT infrastructure and implement advanced analytics capabilities. The transition from traditional storage systems to solid-state solutions delivers improved performance, reduced energy consumption, and enhanced reliability. Cloud computing expansion and edge computing deployments further amplify demand for high-capacity, high-performance flash memory solutions.

Industrial automation advancement driven by Industry 4.0 concepts requires sophisticated control systems and data acquisition capabilities supported by reliable flash memory storage. European manufacturers prioritize smart factory implementations that depend on real-time data processing and storage capabilities. IoT device proliferation creates additional demand for embedded flash memory solutions across diverse industrial applications.

Consumer electronics innovation continues driving volume growth as European brands compete in premium smartphone, tablet, and wearable device segments. The emphasis on superior user experiences requires high-performance flash memory solutions supporting advanced features like high-resolution cameras, augmented reality applications, and sophisticated multimedia capabilities.

Supply chain complexities present significant challenges for the Europe flash memory market, particularly regarding dependence on Asian manufacturing facilities for critical components and raw materials. Geopolitical tensions and trade restrictions can disrupt supply chains, leading to component shortages and price volatility that impact market stability and growth prospects.

High capital requirements for flash memory manufacturing facilities create barriers to entry and limit the number of European companies capable of establishing domestic production capabilities. The semiconductor industry requires substantial investments in advanced fabrication equipment, clean room facilities, and specialized expertise, making it challenging for new entrants to compete effectively.

Technology transition costs associated with migrating from older flash memory technologies to advanced solutions like 3D NAND can be substantial for system manufacturers and end users. Compatibility challenges and the need for redesigned systems can slow adoption rates and create temporary market disruptions during technology transitions.

Regulatory compliance requirements in Europe, while beneficial for security and environmental protection, can increase development costs and time-to-market for new flash memory products. Certification processes for automotive and industrial applications require extensive testing and validation, potentially delaying product launches and increasing development expenses.

Automotive electrification presents unprecedented opportunities for flash memory suppliers as European automakers accelerate electric vehicle development and production. The transition to electric powertrains requires sophisticated battery management systems, advanced infotainment platforms, and over-the-air update capabilities, all creating substantial demand for automotive-grade flash memory solutions. Autonomous driving development further amplifies these opportunities as vehicles require massive data storage and processing capabilities.

Edge computing expansion offers significant growth potential as European organizations implement distributed computing architectures to support real-time applications and reduce latency. 5G network deployment enables new applications requiring local data processing and storage, creating demand for high-performance flash memory solutions at network edges and in IoT devices.

Industrial digitalization initiatives across European manufacturing sectors create opportunities for specialized flash memory solutions supporting smart factory implementations, predictive maintenance systems, and advanced quality control processes. The emphasis on operational efficiency and sustainability drives demand for reliable, energy-efficient storage solutions.

Data center modernization projects present substantial opportunities as European organizations upgrade their IT infrastructure to support cloud computing, artificial intelligence, and big data analytics applications. The transition from traditional hard drives to solid-state storage solutions creates significant demand for enterprise-grade flash memory products.

Competitive intensity within the Europe flash memory market reflects a complex interplay between global semiconductor leaders and specialized regional companies. Market consolidation trends have resulted in fewer but more capable suppliers, while simultaneously creating opportunities for niche players focusing on specific applications or technologies. The dynamic nature of technology evolution requires continuous innovation and substantial research and development investments.

Price dynamics demonstrate cyclical patterns influenced by supply-demand imbalances, technology transitions, and global economic conditions. Cost reduction pressures from system manufacturers drive continuous improvements in flash memory density and performance while maintaining competitive pricing. The transition to advanced manufacturing processes enables higher capacities at lower per-gigabyte costs.

Technology convergence trends show increasing integration between flash memory and other semiconductor technologies, creating new product categories and application possibilities. System-level optimization approaches require closer collaboration between flash memory suppliers and system manufacturers to achieve optimal performance and cost targets.

Regional dynamics within Europe reveal varying growth patterns and application preferences across different countries and market segments. Northern European countries demonstrate strong demand for industrial and automotive applications, while Southern European markets show robust consumer electronics adoption. MarkWide Research analysis indicates these regional variations create opportunities for targeted product development and marketing strategies.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Europe flash memory market. Primary research includes extensive interviews with industry executives, technology experts, and key stakeholders across the flash memory value chain, from semiconductor manufacturers to system integrators and end users.

Secondary research encompasses detailed analysis of industry reports, company financial statements, patent filings, and regulatory documents to understand market trends, competitive positioning, and technology developments. Market sizing methodologies utilize bottom-up and top-down approaches to validate market estimates and growth projections.

Data triangulation processes ensure research findings accuracy by cross-referencing information from multiple sources and validating key insights through industry expert consultations. Quantitative analysis includes statistical modeling and trend analysis to identify growth patterns and market dynamics.

Industry validation involves presenting preliminary findings to industry experts and key market participants to ensure research conclusions accurately reflect market realities and future prospects. This collaborative approach enhances the reliability and practical applicability of research insights.

Germany dominates the European flash memory market, accounting for approximately 32% of regional demand, driven by its strong automotive industry and advanced manufacturing sector. German automotive manufacturers lead global electric vehicle development, creating substantial demand for automotive-grade flash memory solutions. The country’s emphasis on Industry 4.0 implementations further accelerates industrial flash memory adoption.

United Kingdom represents a significant market segment with 18% market share, characterized by strong demand from financial services, telecommunications, and consumer electronics sectors. Brexit implications have created both challenges and opportunities, with some companies establishing additional European operations while others consolidate UK-focused activities.

France contributes 16% of regional market demand, with particular strength in aerospace, defense, and telecommunications applications requiring high-reliability flash memory solutions. French technology companies emphasize security and performance characteristics, driving demand for specialized flash memory products.

Italy and Spain collectively account for 15% of market share, with growing demand from automotive suppliers, industrial automation companies, and consumer electronics manufacturers. These markets demonstrate increasing adoption of advanced flash memory technologies as local industries modernize and digitalize their operations.

Nordic countries including Sweden, Denmark, and Finland represent 12% of regional demand, characterized by high technology adoption rates and emphasis on sustainability. These markets prioritize energy-efficient flash memory solutions supporting their environmental objectives and advanced telecommunications infrastructure.

Market leadership in the Europe flash memory sector reflects a diverse ecosystem combining global semiconductor giants with specialized regional companies. The competitive landscape demonstrates dynamic interactions between established players and emerging technology providers.

Competitive strategies emphasize technology differentiation, application-specific optimization, and regional manufacturing capabilities. Companies increasingly focus on developing solutions tailored to European market requirements, including automotive reliability standards and industrial automation needs.

Technology-based segmentation reveals distinct market dynamics across different flash memory types:

By Technology:

By Application:

By Capacity:

Automotive flash memory represents the fastest-growing category within the European market, driven by electric vehicle adoption and advanced driver assistance system implementations. Automotive-grade requirements include extended temperature ranges, high reliability, and long-term availability, creating opportunities for specialized suppliers. The category demonstrates annual growth rates exceeding 15% as European automakers accelerate electrification and autonomous driving development.

Industrial flash memory applications show robust growth supported by Industry 4.0 initiatives and smart manufacturing implementations. Industrial requirements emphasize reliability, security, and real-time performance capabilities. European manufacturers prioritize solutions supporting predictive maintenance, quality control, and operational efficiency improvements.

Consumer electronics remains the largest volume category, with European brands competing in premium smartphone, tablet, and wearable device segments. Performance requirements continue escalating as devices support advanced features like high-resolution cameras, augmented reality applications, and sophisticated multimedia capabilities.

Enterprise storage applications demonstrate strong growth as European organizations modernize their IT infrastructure and implement cloud computing solutions. Data center requirements emphasize high performance, reliability, and energy efficiency, driving adoption of advanced SSD technologies and storage-class memory solutions.

Manufacturers benefit from the Europe flash memory market through diverse revenue opportunities across multiple application segments. Technology differentiation enables premium pricing for specialized solutions meeting automotive, industrial, and enterprise requirements. The market’s emphasis on quality and reliability creates opportunities for companies capable of delivering superior products and services.

System integrators gain competitive advantages by incorporating advanced flash memory solutions that enhance their products’ performance, reliability, and feature sets. Partnership opportunities with flash memory suppliers enable access to cutting-edge technologies and technical support for complex applications.

End users benefit from improved system performance, reduced energy consumption, and enhanced reliability through advanced flash memory implementations. Cost benefits include reduced total cost of ownership through improved efficiency and reduced maintenance requirements.

Investors find attractive opportunities in the growing European flash memory market, with potential for substantial returns through companies positioned to capitalize on automotive electrification, industrial digitalization, and enterprise modernization trends. Market growth projections indicate continued expansion opportunities across multiple sectors.

Strengths:

Weaknesses:

Opportunities:

Threats:

3D NAND adoption represents a fundamental trend transforming the European flash memory landscape. Vertical scaling enables significant capacity improvements while reducing per-gigabyte costs, making high-capacity storage solutions more accessible across diverse applications. European system manufacturers increasingly specify 3D NAND solutions for their performance and cost advantages.

Automotive integration trends show flash memory becoming increasingly critical for vehicle functionality and user experience. Over-the-air updates require substantial storage capacity for software and firmware updates, while advanced infotainment systems demand high-performance storage for multimedia content and applications.

Edge computing proliferation drives demand for flash memory solutions optimized for distributed computing environments. Real-time processing requirements necessitate low-latency storage solutions capable of supporting time-critical applications and data analytics at network edges.

Security enhancement trends reflect growing emphasis on data protection and cybersecurity across European markets. Hardware-based security features integrated into flash memory devices provide enhanced protection against data breaches and unauthorized access, particularly important for automotive and industrial applications.

Sustainability initiatives influence flash memory design and manufacturing processes as European companies prioritize environmental responsibility. Energy efficiency improvements and recyclable materials become increasingly important selection criteria for system manufacturers and end users.

Manufacturing investments across Europe have accelerated as companies seek to establish domestic flash memory production capabilities. Strategic partnerships between European governments and semiconductor companies aim to reduce dependence on external suppliers while building regional expertise and manufacturing capacity.

Technology collaborations between European automotive manufacturers and flash memory suppliers have intensified, focusing on developing specialized solutions for electric vehicles and autonomous driving applications. Joint development programs ensure flash memory solutions meet stringent automotive requirements while supporting innovation in vehicle electronics.

Acquisition activities within the European flash memory ecosystem reflect industry consolidation trends and companies’ efforts to expand their technology portfolios and market reach. Strategic acquisitions enable access to specialized technologies and customer relationships while creating synergies across product lines.

Research initiatives supported by European Union funding programs focus on next-generation flash memory technologies and manufacturing processes. Innovation programs emphasize sustainability, security, and performance improvements while building European technological capabilities and competitiveness.

Strategic positioning recommendations for European flash memory market participants emphasize the importance of application-specific specialization and technology differentiation. MarkWide Research analysis suggests companies should focus on developing solutions tailored to specific European market requirements, particularly in automotive and industrial applications where reliability and performance are paramount.

Investment priorities should emphasize research and development capabilities, manufacturing partnerships, and customer relationship development. Technology roadmap alignment with key customer requirements ensures product development efforts address real market needs and create sustainable competitive advantages.

Partnership strategies should focus on building strong relationships with European system manufacturers and technology integrators. Collaborative development approaches enable better understanding of customer requirements while creating opportunities for long-term business relationships and technology co-development.

Market expansion opportunities exist in emerging applications such as edge computing, IoT devices, and advanced automotive systems. Early market entry in these growing segments can establish competitive positioning before markets mature and competition intensifies.

Growth trajectory for the Europe flash memory market remains positive, supported by continued technology advancement and expanding application opportunities. Market evolution will be characterized by increasing specialization and application-specific optimization rather than simple capacity expansion. The emphasis on quality, reliability, and performance aligns well with European market preferences and requirements.

Technology development will focus on next-generation solutions including storage-class memory, advanced 3D NAND architectures, and integrated security features. Innovation cycles are expected to accelerate as competition intensifies and customer requirements become more sophisticated. MWR projections indicate the market will maintain robust growth rates above 8% annually through the forecast period.

Application expansion into new sectors and use cases will drive continued market growth. Emerging applications in artificial intelligence, machine learning, and advanced analytics create new requirements for high-performance flash memory solutions. The integration of flash memory into increasingly diverse systems and applications broadens market opportunities.

Regional dynamics will continue evolving as European countries implement digital transformation initiatives and modernize their industrial infrastructure. Investment trends in domestic manufacturing capabilities and technology development will strengthen European competitiveness while reducing supply chain dependencies.

The Europe flash memory market represents a dynamic and rapidly evolving sector with substantial growth potential across diverse application segments. Market fundamentals remain strong, supported by robust demand from automotive, industrial, consumer electronics, and enterprise sectors. The region’s emphasis on quality, reliability, and technological innovation creates opportunities for companies capable of delivering superior solutions meeting stringent European requirements.

Technology trends including 3D NAND adoption, automotive integration, and edge computing proliferation will continue driving market expansion and creating new application opportunities. Competitive dynamics favor companies with strong technology capabilities, application expertise, and customer relationships. The market’s diversity across multiple sectors provides resilience against economic volatility while creating cross-selling opportunities.

Future prospects for the European flash memory market remain highly positive, with continued growth expected across all major application segments. Strategic success will depend on companies’ ability to innovate, adapt to changing customer requirements, and build sustainable competitive advantages through technology differentiation and market specialization. The market’s evolution toward application-specific optimization creates opportunities for focused companies while rewarding innovation and customer-centric approaches.

What is Flash Memory?

Flash memory is a type of non-volatile storage that retains data even when the power is turned off. It is widely used in various applications, including USB drives, solid-state drives, and memory cards.

What are the key players in the Europe Flash Memory Market?

Key players in the Europe Flash Memory Market include Samsung Electronics, Micron Technology, and Western Digital, among others. These companies are known for their innovative products and significant market presence.

What are the main drivers of the Europe Flash Memory Market?

The main drivers of the Europe Flash Memory Market include the increasing demand for high-speed data storage solutions, the growth of mobile devices, and the expansion of cloud computing services. These factors contribute to the rising adoption of flash memory in various sectors.

What challenges does the Europe Flash Memory Market face?

The Europe Flash Memory Market faces challenges such as the high cost of advanced flash memory technologies and the rapid pace of technological change. Additionally, competition from alternative storage solutions can impact market growth.

What opportunities exist in the Europe Flash Memory Market?

Opportunities in the Europe Flash Memory Market include the growing demand for flash memory in automotive applications, the rise of Internet of Things (IoT) devices, and advancements in memory technology. These trends are expected to drive innovation and investment in the sector.

What trends are shaping the Europe Flash Memory Market?

Trends shaping the Europe Flash Memory Market include the shift towards higher capacity storage solutions, the integration of artificial intelligence in data management, and the increasing focus on energy-efficient memory technologies. These trends are influencing product development and consumer preferences.

Europe Flash Memory Market

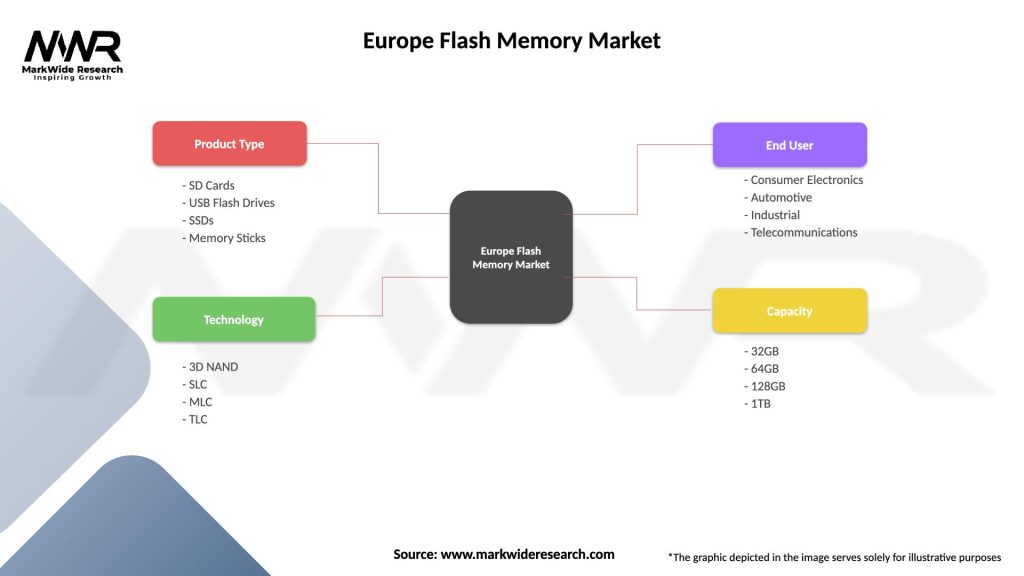

| Segmentation Details | Description |

|---|---|

| Product Type | SD Cards, USB Flash Drives, SSDs, Memory Sticks |

| Technology | 3D NAND, SLC, MLC, TLC |

| End User | Consumer Electronics, Automotive, Industrial, Telecommunications |

| Capacity | 32GB, 64GB, 128GB, 1TB |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Flash Memory Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at