444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe Fixed Wireless Access (FWA) market represents a transformative telecommunications segment that is revolutionizing broadband connectivity across the continent. Fixed Wireless Access technology enables high-speed internet delivery to homes and businesses through wireless radio links instead of traditional wired infrastructure, offering unprecedented flexibility and rapid deployment capabilities. The European market has witnessed remarkable growth momentum, driven by increasing demand for reliable broadband services, especially in underserved rural areas and regions where fiber deployment remains economically challenging.

Market dynamics indicate that Europe’s FWA sector is experiencing robust expansion, with adoption rates accelerating at 12.5% CAGR across key markets. The technology has gained significant traction among telecommunications operators seeking cost-effective solutions to bridge the digital divide and extend broadband coverage to previously inaccessible locations. 5G FWA deployments have particularly captured market attention, offering gigabit-speed capabilities that rival traditional fiber connections while maintaining superior deployment flexibility.

Regional variations across Europe showcase diverse adoption patterns, with Nordic countries leading in rural FWA implementation while Western European markets focus on urban and suburban applications. The market encompasses various frequency bands, including sub-6 GHz and millimeter wave spectrum, each serving specific use cases and geographic requirements. Regulatory support from European telecommunications authorities has facilitated spectrum allocation and streamlined deployment processes, contributing to accelerated market growth.

The Europe Fixed Wireless Access market refers to the comprehensive ecosystem of wireless broadband technologies, infrastructure, and services that deliver high-speed internet connectivity to fixed locations across European territories without requiring physical cable connections. This market encompasses point-to-point and point-to-multipoint wireless systems that utilize licensed and unlicensed spectrum bands to provide broadband services comparable to traditional wired solutions.

FWA technology operates by establishing wireless links between base stations and customer premises equipment, creating reliable broadband connections that can support residential, business, and enterprise applications. The market includes various technological approaches, from traditional microwave systems to advanced 5G New Radio implementations, each designed to address specific coverage requirements and performance objectives. Service providers leverage FWA solutions to rapidly expand their broadband footprint while minimizing infrastructure investment and deployment timelines.

Market participants include telecommunications operators, equipment manufacturers, technology vendors, and service integrators who collectively drive innovation and deployment across diverse European markets. The ecosystem supports multiple deployment scenarios, from last-mile connectivity in rural areas to high-capacity backhaul solutions in urban environments, demonstrating the versatility and adaptability of FWA technologies in addressing varied connectivity challenges.

Europe’s Fixed Wireless Access market stands at the forefront of telecommunications innovation, delivering transformative broadband solutions that address critical connectivity gaps across the continent. The market has demonstrated exceptional resilience and growth potential, with 5G FWA adoption reaching 35% penetration in leading European markets. This remarkable expansion reflects the technology’s ability to provide fiber-like performance while maintaining deployment flexibility and cost advantages.

Key market drivers include accelerating digital transformation initiatives, government broadband expansion programs, and increasing demand for high-speed connectivity in both urban and rural environments. European telecommunications operators have embraced FWA as a strategic solution for rapid network expansion, with deployment timelines reduced by 60% compared to traditional fiber installations. The technology’s ability to serve diverse applications, from residential broadband to enterprise connectivity, has positioned it as a cornerstone of Europe’s digital infrastructure strategy.

Competitive dynamics reveal a mature ecosystem with established equipment vendors, innovative technology providers, and forward-thinking service operators driving market evolution. The integration of advanced technologies, including beamforming, massive MIMO, and network slicing, has enhanced FWA performance capabilities while expanding addressable market opportunities. Regulatory frameworks across European markets continue to evolve, supporting spectrum availability and encouraging investment in next-generation FWA infrastructure.

Strategic market insights reveal several critical trends shaping Europe’s FWA landscape. The convergence of 5G technology with FWA applications has created unprecedented opportunities for service differentiation and market expansion. Network operators are increasingly viewing FWA as a complementary technology to fiber deployments rather than a competing solution, enabling hybrid network architectures that optimize coverage and performance.

Primary market drivers propelling Europe’s FWA sector include the urgent need for ubiquitous broadband connectivity and the economic advantages of wireless deployment models. Digital inclusion initiatives across European governments have created substantial demand for rapid broadband expansion, particularly in underserved rural communities where traditional infrastructure deployment faces geographical and economic challenges.

5G network rollouts have fundamentally transformed FWA capabilities, enabling service providers to offer competitive broadband speeds while maintaining deployment flexibility. The technology’s ability to deliver multi-gigabit performance has attracted enterprise customers seeking reliable, high-capacity connectivity solutions without long-term infrastructure commitments. Cost optimization remains a significant driver, as FWA deployments typically require 40% lower capital investment compared to equivalent fiber installations.

Regulatory support from European telecommunications authorities has facilitated spectrum availability and streamlined deployment processes, encouraging operator investment in FWA infrastructure. The growing demand for backup and redundant connectivity solutions, particularly following increased remote work adoption, has created additional market opportunities. Environmental considerations also favor FWA deployments, which minimize ground disturbance and reduce construction-related environmental impact compared to traditional wired solutions.

Market restraints affecting Europe’s FWA sector include spectrum availability limitations and potential interference challenges in dense deployment environments. Line-of-sight requirements for optimal performance can restrict deployment flexibility in certain geographic areas, particularly urban environments with complex building structures and topographical obstacles.

Weather sensitivity remains a technical consideration for FWA systems, particularly at higher frequency bands where atmospheric conditions can impact signal quality and service reliability. Regulatory complexity across different European markets creates deployment challenges for operators seeking pan-European FWA strategies, requiring navigation of varied licensing requirements and technical standards.

Competition from fiber networks continues to influence market dynamics, particularly in urban areas where fiber infrastructure offers established performance benchmarks and customer familiarity. Customer perception challenges persist in some markets where wireless technologies are associated with mobile service limitations rather than fixed broadband capabilities. Equipment costs for advanced 5G FWA solutions can present initial investment barriers for smaller operators and rural service providers.

Significant market opportunities emerge from the convergence of 5G technology advancement and increasing demand for flexible broadband solutions across Europe. Rural connectivity programs supported by European Union funding initiatives create substantial deployment opportunities for FWA providers targeting underserved communities. The technology’s rapid deployment capabilities position it as an ideal solution for emergency connectivity restoration and temporary service provision.

Enterprise market expansion represents a particularly promising opportunity, as businesses increasingly seek agile connectivity solutions that support digital transformation initiatives without requiring extensive infrastructure modifications. Private network applications utilizing FWA technology offer opportunities for specialized industrial and commercial deployments, including smart city initiatives and IoT connectivity platforms.

Technology integration opportunities with edge computing, network slicing, and artificial intelligence create potential for differentiated service offerings and enhanced performance capabilities. Cross-border connectivity applications present opportunities for FWA solutions in border regions and international corridor applications. The growing demand for backup connectivity solutions creates additional market segments for FWA providers offering redundant and resilient broadband services.

Market dynamics within Europe’s FWA sector reflect the complex interplay between technological advancement, regulatory evolution, and competitive pressures. Operator strategies have shifted toward viewing FWA as a complementary technology that enhances overall network capabilities rather than competing directly with fiber deployments. This strategic evolution has led to more sophisticated deployment models that optimize both technologies for specific use cases and geographic requirements.

Competitive intensity varies significantly across European markets, with established telecommunications operators facing challenges from specialized FWA providers and technology-focused new entrants. Innovation cycles continue to accelerate, with equipment manufacturers introducing advanced solutions that improve performance, reduce costs, and expand deployment flexibility. The integration of artificial intelligence and machine learning technologies has enhanced network optimization capabilities, improving service quality and operational efficiency.

Customer expectations have evolved substantially, with FWA services now expected to deliver performance levels comparable to traditional broadband solutions while maintaining the flexibility advantages of wireless deployment. Pricing dynamics reflect increasing competition and technology maturation, with service providers offering competitive packages that challenge traditional broadband pricing models. Partnership strategies between operators, equipment vendors, and technology providers continue to shape market development and deployment acceleration.

Comprehensive research methodology employed for analyzing Europe’s FWA market incorporates multiple data collection approaches and analytical frameworks to ensure accurate market assessment and reliable insights. Primary research activities include extensive interviews with industry executives, technology vendors, regulatory officials, and end-user organizations across major European markets to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research components encompass detailed analysis of industry reports, regulatory filings, company financial statements, and technical documentation to establish quantitative baselines and validate market trends. Market modeling techniques utilize statistical analysis and forecasting methodologies to project market development scenarios and identify key growth drivers and restraints affecting sector evolution.

Data validation processes ensure research accuracy through cross-referencing multiple sources, expert review panels, and statistical verification procedures. Geographic coverage spans major European markets including Germany, United Kingdom, France, Italy, Spain, and Nordic countries, with additional analysis of emerging markets and regulatory developments. Temporal analysis examines historical market development patterns to establish baseline trends and inform future projections, ensuring comprehensive market understanding and reliable strategic insights.

Regional market analysis reveals distinct patterns of FWA adoption and deployment across European territories, reflecting varied regulatory environments, infrastructure requirements, and market maturity levels. Nordic countries lead European FWA adoption with 45% market penetration in rural broadband applications, driven by geographic challenges and progressive regulatory frameworks that encourage innovative connectivity solutions.

Western European markets including Germany, France, and the United Kingdom demonstrate strong FWA growth in suburban and enterprise segments, with operators leveraging 5G capabilities to deliver competitive broadband services. Germany’s FWA market has experienced particularly rapid expansion, with deployment rates increasing 25% annually as operators address coverage gaps in rural and semi-urban areas. United Kingdom deployments focus on alternative broadband provision in areas where fiber deployment faces economic or regulatory challenges.

Southern European markets including Italy and Spain show increasing FWA adoption driven by geographic diversity and infrastructure deployment challenges in mountainous and island regions. Eastern European countries present significant growth opportunities, with FWA technology offering cost-effective solutions for rapid broadband expansion in developing telecommunications markets. Regulatory harmonization efforts across European Union markets continue to facilitate cross-border deployment strategies and equipment standardization initiatives.

Competitive landscape analysis reveals a dynamic ecosystem comprising established telecommunications equipment vendors, innovative technology providers, and forward-thinking service operators driving FWA market evolution across Europe. Market leadership positions reflect companies’ ability to deliver comprehensive solutions that address diverse deployment requirements and performance objectives.

Strategic positioning among competitive players emphasizes technology differentiation, deployment flexibility, and total cost of ownership advantages. Innovation focus areas include advanced antenna technologies, network optimization algorithms, and integration capabilities that enhance overall system performance and operational efficiency.

Market segmentation analysis provides detailed insights into diverse FWA applications, deployment models, and customer segments driving European market growth. Technology segmentation encompasses various wireless standards and frequency bands, each serving specific performance requirements and deployment scenarios across different market segments.

By Technology:

By Application:

By Frequency Band:

Category-wise analysis reveals distinct market dynamics and growth patterns across different FWA segments, providing strategic insights for market participants and stakeholders. Residential FWA services represent the largest market category, driven by increasing demand for reliable home broadband connectivity and the technology’s ability to serve previously underserved areas effectively.

Enterprise FWA applications demonstrate the highest growth rates, with businesses increasingly adopting wireless broadband solutions for their flexibility, rapid deployment capabilities, and competitive performance characteristics. 5G FWA implementations show particular strength in enterprise segments, where advanced features like network slicing and ultra-low latency enable specialized applications and service differentiation.

Rural connectivity applications continue to drive significant deployment activity, with FWA technology offering cost-effective solutions for extending broadband coverage to geographically challenging areas. Urban FWA deployments focus on high-capacity applications and alternative broadband provision, particularly in areas where fiber deployment faces regulatory or economic constraints. Backup connectivity services represent an emerging category with growing demand from businesses and critical infrastructure operators seeking resilient communication solutions.

Industry participants across Europe’s FWA ecosystem realize substantial benefits from market participation, ranging from revenue generation opportunities to strategic positioning advantages. Telecommunications operators benefit from FWA technology’s ability to rapidly expand broadband coverage while minimizing infrastructure investment and deployment timelines, enabling competitive service offerings in previously challenging markets.

Equipment manufacturers gain access to expanding market opportunities driven by increasing FWA adoption and technology evolution toward 5G implementations. Technology vendors benefit from growing demand for specialized solutions including antenna systems, network optimization software, and integration services that enhance FWA deployment success and performance optimization.

End-user stakeholders including residential customers, businesses, and government organizations benefit from improved broadband access, competitive pricing, and service flexibility that FWA technology enables. Regulatory authorities achieve policy objectives related to digital inclusion and broadband expansion through FWA deployments that extend connectivity to underserved areas. Economic development benefits include job creation, infrastructure investment, and enhanced competitiveness in regions with improved broadband connectivity through FWA solutions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping Europe’s FWA landscape reflect the convergence of technological advancement, regulatory evolution, and changing customer requirements. 5G FWA adoption represents the most significant trend, with operators increasingly deploying advanced New Radio technology to deliver competitive broadband services with enhanced performance capabilities.

Network convergence strategies demonstrate growing sophistication as operators integrate FWA solutions with existing fiber and mobile networks to create comprehensive connectivity portfolios. Artificial intelligence integration is transforming network optimization and service management, enabling automated performance tuning and predictive maintenance capabilities that improve service quality and operational efficiency.

Sustainability initiatives are increasingly influencing FWA deployment decisions, with operators and customers recognizing the environmental advantages of wireless solutions over traditional infrastructure construction. Edge computing integration creates opportunities for enhanced service capabilities and reduced latency performance, particularly valuable for enterprise and industrial applications. Private network deployments utilizing FWA technology are expanding rapidly, serving specialized industrial, campus, and enterprise requirements with dedicated connectivity solutions.

Recent industry developments highlight the dynamic nature of Europe’s FWA market and the continuous innovation driving sector evolution. Major telecommunications operators have announced significant FWA expansion programs, with deployment targets reflecting confidence in technology capabilities and market opportunities.

Equipment manufacturer innovations include advanced antenna technologies, improved chipset capabilities, and enhanced network management solutions that address deployment challenges and performance optimization requirements. Regulatory developments across European markets have facilitated spectrum availability and streamlined deployment processes, encouraging operator investment in FWA infrastructure.

Strategic partnerships between operators, equipment vendors, and technology providers continue to shape market development, enabling comprehensive solution delivery and accelerated deployment timelines. Standards evolution including 5G Advanced and future 6G development activities promise continued performance improvements and expanded application possibilities for FWA technology. Investment activities from both private and public sources demonstrate sustained confidence in FWA market potential and long-term growth prospects across European territories.

Strategic recommendations for Europe’s FWA market participants emphasize the importance of technology differentiation, customer-focused service development, and operational excellence in competitive market environments. MarkWide Research analysis suggests that operators should prioritize 5G FWA deployments to maintain competitive positioning and capitalize on advanced technology capabilities.

Investment strategies should focus on spectrum acquisition, infrastructure optimization, and customer experience enhancement to build sustainable competitive advantages. Partnership development with equipment vendors, technology providers, and complementary service organizations can accelerate market entry and enhance solution capabilities while reducing deployment risks and costs.

Market positioning strategies should emphasize FWA technology’s unique advantages including deployment flexibility, cost efficiency, and performance capabilities rather than competing directly with established broadband solutions. Customer education initiatives can address perception challenges and highlight FWA service capabilities, particularly in markets where wireless technology associations may create performance expectation concerns. Regulatory engagement remains critical for ensuring favorable spectrum policies and deployment frameworks that support continued market growth and innovation.

Future market outlook for Europe’s FWA sector remains highly positive, with continued growth expected across multiple market segments and geographic regions. Technology evolution toward 6G and advanced 5G implementations will further enhance FWA capabilities, enabling new applications and service differentiation opportunities that expand addressable markets and competitive positioning.

Market expansion is projected to continue at robust growth rates, driven by increasing demand for flexible broadband solutions, rural connectivity initiatives, and enterprise digital transformation requirements. MWR projections indicate that European FWA adoption will reach 65% penetration in suitable deployment scenarios by 2028, reflecting technology maturation and market acceptance.

Innovation trajectories including artificial intelligence integration, edge computing capabilities, and advanced network optimization will create opportunities for enhanced service offerings and operational efficiency improvements. Regulatory evolution is expected to continue supporting FWA deployment through spectrum availability, streamlined licensing processes, and policy frameworks that encourage investment in wireless broadband infrastructure. Competitive dynamics will likely intensify as market opportunities expand, driving continued innovation and service improvement across the FWA ecosystem.

Europe’s Fixed Wireless Access market represents a transformative force in telecommunications, delivering innovative broadband solutions that address critical connectivity challenges while enabling rapid deployment and cost-effective service provision. The market has demonstrated remarkable growth momentum, driven by technological advancement, regulatory support, and increasing recognition of FWA’s strategic value in comprehensive connectivity strategies.

Strategic positioning of FWA technology as a complementary solution to traditional broadband infrastructure has created sustainable growth opportunities and competitive advantages for market participants. The convergence of 5G technology with FWA applications has fundamentally enhanced performance capabilities, enabling service offerings that rival traditional broadband solutions while maintaining deployment flexibility and cost advantages.

Future prospects remain highly favorable, with continued innovation, expanding market applications, and supportive regulatory frameworks creating conditions for sustained growth and market development. Industry participants who embrace technology evolution, focus on customer-centric service development, and maintain operational excellence will be well-positioned to capitalize on the significant opportunities presented by Europe’s dynamic FWA market landscape.

What is Fixed Wireless Access?

Fixed Wireless Access (FWA) refers to a technology that provides internet connectivity to homes and businesses using wireless signals instead of traditional wired connections. It is particularly useful in areas where laying cables is impractical or too costly.

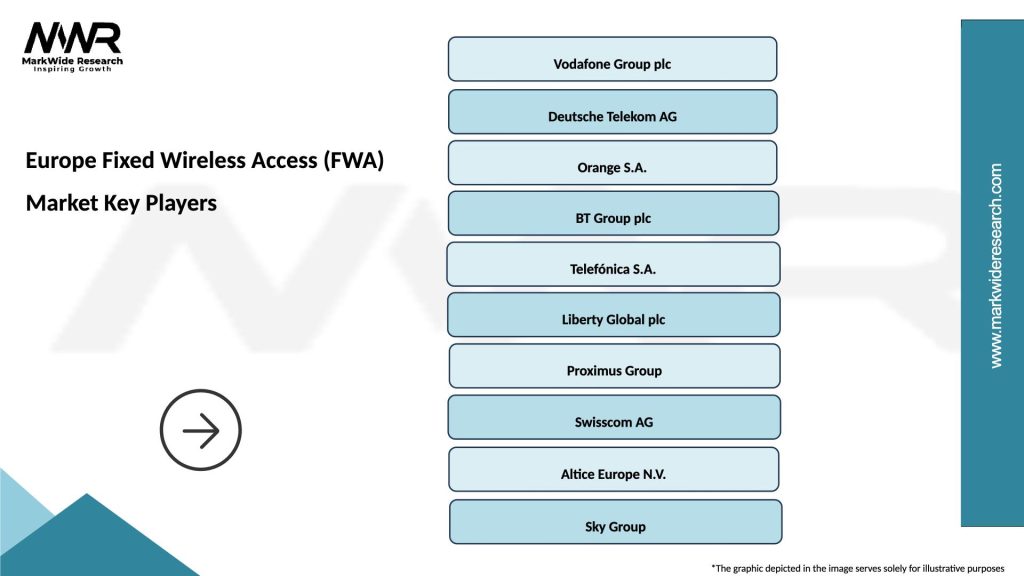

What are the key players in the Europe Fixed Wireless Access (FWA) Market?

Key players in the Europe Fixed Wireless Access (FWA) Market include companies like Nokia, Ericsson, and Huawei, which provide the necessary infrastructure and technology for FWA solutions, among others.

What are the growth factors driving the Europe Fixed Wireless Access (FWA) Market?

The growth of the Europe Fixed Wireless Access (FWA) Market is driven by increasing demand for high-speed internet in rural areas, the expansion of 5G networks, and the need for cost-effective broadband solutions.

What challenges does the Europe Fixed Wireless Access (FWA) Market face?

Challenges in the Europe Fixed Wireless Access (FWA) Market include competition from fiber-optic networks, regulatory hurdles, and the need for significant investment in infrastructure to ensure reliable service.

What opportunities exist in the Europe Fixed Wireless Access (FWA) Market?

Opportunities in the Europe Fixed Wireless Access (FWA) Market include the potential for partnerships with local governments to enhance connectivity, advancements in technology that improve service quality, and the growing trend of remote work increasing demand for reliable internet access.

What trends are shaping the Europe Fixed Wireless Access (FWA) Market?

Trends shaping the Europe Fixed Wireless Access (FWA) Market include the rise of smart cities, the integration of Internet of Things (IoT) devices, and the increasing adoption of cloud services that require robust internet connectivity.

Europe Fixed Wireless Access (FWA) Market

| Segmentation Details | Description |

|---|---|

| Technology | LTE, 5G, WiMAX, Satellite |

| End User | Residential, Small Business, Enterprises, Government |

| Deployment | Urban, Suburban, Rural, Remote |

| Service Type | Internet Access, VoIP, Video Streaming, Cloud Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Fixed Wireless Access (FWA) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at