444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe fitness ring market represents a dynamic and rapidly evolving segment within the broader fitness technology landscape. Fitness rings have emerged as innovative wearable devices that combine traditional fitness tracking with gamification elements, creating an engaging approach to health and wellness monitoring. The European market demonstrates substantial growth potential driven by increasing health consciousness, technological advancement, and the rising popularity of interactive fitness solutions.

Market dynamics in Europe reflect a strong consumer preference for versatile fitness accessories that seamlessly integrate with digital platforms and gaming systems. The region’s tech-savvy population, combined with robust healthcare infrastructure and growing awareness of preventive health measures, creates an ideal environment for fitness ring adoption. European consumers increasingly seek fitness solutions that offer both entertainment value and practical health benefits, positioning fitness rings as compelling alternatives to traditional fitness trackers.

Regional variations across Europe show distinct patterns, with Northern and Western European countries leading in adoption rates at approximately 42% market penetration, while Eastern and Southern regions demonstrate accelerating growth trajectories. The market benefits from strong retail networks, advanced e-commerce platforms, and supportive regulatory frameworks that encourage innovation in health technology sectors.

The Europe fitness ring market refers to the commercial ecosystem encompassing the development, manufacturing, distribution, and sales of ring-shaped wearable fitness devices specifically designed for the European consumer base. These innovative devices typically feature motion sensors, accelerometers, and wireless connectivity capabilities that enable users to engage in interactive fitness activities while monitoring various health metrics.

Fitness rings distinguish themselves from conventional fitness wearables through their unique form factor and integration with gaming platforms or dedicated fitness applications. Unlike traditional fitness trackers worn on the wrist, these devices are designed to be held, squeezed, or manipulated during exercise routines, providing tactile feedback and resistance training elements that enhance the overall fitness experience.

Market scope encompasses various product categories including resistance-based fitness rings, smart fitness rings with digital connectivity, and hybrid devices that combine multiple functionalities. The European market specifically addresses regional preferences for design aesthetics, regulatory compliance requirements, and localized software interfaces that cater to diverse linguistic and cultural preferences across different European countries.

Strategic positioning of the Europe fitness ring market reveals a sector experiencing robust expansion driven by convergence trends between gaming, fitness, and wearable technology. The market demonstrates exceptional resilience and adaptability, particularly following increased home fitness adoption patterns that emerged during recent global health challenges.

Key growth drivers include rising health consciousness among European consumers, increasing penetration of smart home fitness solutions, and growing integration between fitness devices and popular gaming platforms. The market benefits from strong consumer spending power in developed European economies and increasing acceptance of technology-enhanced fitness solutions across all age demographics.

Competitive landscape features a mix of established gaming companies, emerging fitness technology startups, and traditional fitness equipment manufacturers expanding their product portfolios. Innovation cycles remain rapid, with manufacturers focusing on enhanced sensor accuracy, improved battery life, and expanded compatibility with various fitness applications and gaming systems.

Market challenges include intense price competition, rapidly evolving consumer preferences, and the need for continuous software updates and platform compatibility maintenance. However, opportunities abound in untapped market segments, particularly among older adults seeking accessible fitness solutions and corporate wellness programs looking for engaging employee health initiatives.

Consumer behavior analysis reveals several critical insights shaping the European fitness ring market landscape. Primary users span diverse demographics, with particularly strong adoption among millennials and Generation Z consumers who value technology integration in their fitness routines.

Health consciousness surge represents the primary catalyst driving European fitness ring market expansion. Growing awareness of lifestyle-related health issues, combined with increasing healthcare costs, motivates consumers to invest in preventive health solutions that offer engaging and sustainable fitness experiences.

Technological advancement in sensor technology, wireless connectivity, and mobile application development creates new possibilities for fitness ring functionality and user experience enhancement. Improved accuracy in motion detection, extended battery life, and seamless device synchronization contribute to increased consumer adoption and satisfaction rates.

Gaming industry influence significantly impacts market growth as major gaming companies introduce fitness-focused products that blur the lines between entertainment and exercise. The success of interactive fitness gaming platforms demonstrates strong consumer appetite for gamified fitness solutions that make exercise more enjoyable and sustainable.

Home fitness trend acceleration continues to drive demand for compact, versatile fitness equipment that can be easily stored and used in residential settings. Fitness rings offer an ideal solution for space-constrained European homes while providing comprehensive workout capabilities that rival traditional gym equipment.

Corporate wellness programs increasingly incorporate innovative fitness technologies to engage employees and promote workplace health initiatives. European companies recognize the value of investing in employee wellness solutions that demonstrate measurable health outcomes and improved productivity metrics.

High competition intensity creates significant pressure on profit margins and requires continuous innovation investment to maintain market position. The proliferation of fitness ring alternatives and traditional fitness tracking devices intensifies competitive dynamics and challenges brand differentiation efforts.

Technology adoption barriers persist among certain consumer segments, particularly older adults who may find complex device setup and operation challenging. Limited digital literacy and resistance to new technology platforms can restrict market penetration in specific demographic groups.

Platform dependency risks emerge as fitness rings often require specific gaming consoles or mobile applications to function effectively. Changes in platform policies, compatibility issues, or discontinued support can negatively impact device utility and consumer satisfaction.

Regulatory compliance complexity across different European countries creates additional costs and operational challenges for manufacturers. Varying safety standards, data privacy requirements, and medical device regulations necessitate careful navigation of multiple regulatory frameworks.

Economic uncertainty factors can influence consumer spending patterns on discretionary fitness technology products. Economic downturns or reduced disposable income may lead consumers to prioritize essential purchases over fitness accessories, impacting market growth trajectories.

Aging population demographics in Europe present substantial opportunities for fitness ring manufacturers to develop products specifically designed for senior citizens. Age-appropriate fitness programs, simplified interfaces, and health monitoring capabilities tailored for older adults represent an underserved market segment with significant growth potential.

Healthcare integration possibilities offer promising avenues for market expansion through partnerships with healthcare providers, insurance companies, and medical professionals. Fitness rings equipped with advanced health monitoring capabilities could become valuable tools in preventive healthcare and chronic disease management programs.

Corporate market expansion represents a lucrative opportunity as European businesses increasingly invest in employee wellness initiatives. Bulk sales to corporations, customized fitness programs, and integration with existing workplace wellness platforms could drive substantial revenue growth.

Emerging technology integration including artificial intelligence, machine learning, and augmented reality creates opportunities for next-generation fitness ring development. Advanced features such as personalized workout recommendations, real-time form correction, and immersive fitness experiences could differentiate products in competitive markets.

Subscription service models provide opportunities for recurring revenue generation through premium fitness content, personalized coaching services, and exclusive workout programs. European consumers show increasing willingness to pay for high-quality digital fitness services that complement their hardware investments.

Supply chain considerations significantly influence market dynamics as manufacturers navigate component sourcing, production capacity, and distribution logistics across diverse European markets. Global supply chain disruptions have highlighted the importance of regional manufacturing capabilities and diversified supplier networks.

Innovation cycles in the fitness ring market demonstrate accelerating pace as companies compete to introduce new features and capabilities. Product lifecycle management becomes increasingly critical as consumer expectations for regular updates and new functionality continue to rise.

Seasonal demand patterns create predictable market fluctuations with peak sales typically occurring during New Year resolution periods and summer fitness preparation seasons. Understanding these patterns enables manufacturers to optimize inventory management and marketing campaign timing for maximum effectiveness.

Cross-platform compatibility requirements drive technical development priorities as consumers expect fitness rings to work seamlessly across multiple devices and operating systems. Interoperability standards and universal connectivity protocols become increasingly important for market success.

Data privacy concerns influence product development and marketing strategies as European consumers and regulators maintain strict requirements for personal health data protection. GDPR compliance and transparent data usage policies are essential for maintaining consumer trust and market access.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into the Europe fitness ring market landscape. Primary research activities included extensive consumer surveys, industry expert interviews, and direct engagement with key market participants across major European countries.

Secondary research components encompassed analysis of industry reports, company financial statements, patent filings, and regulatory documentation from relevant European authorities. Market data validation processes involved cross-referencing multiple sources and conducting follow-up verification interviews with industry stakeholders.

Quantitative analysis techniques included statistical modeling, trend analysis, and market sizing calculations based on available sales data, import/export statistics, and consumer spending patterns. Qualitative research methods provided deeper insights into consumer motivations, purchasing decisions, and brand preferences through focus groups and in-depth interviews.

Geographic coverage spanned major European markets including Germany, France, United Kingdom, Italy, Spain, Netherlands, and Nordic countries, with additional analysis of emerging markets in Eastern Europe. Temporal analysis examined market trends over multiple years to identify growth patterns and cyclical behaviors.

Data collection periods extended across multiple quarters to account for seasonal variations and ensure comprehensive market understanding. MarkWide Research methodologies incorporated both traditional market research approaches and innovative digital analytics techniques to capture evolving consumer behaviors in the digital fitness ecosystem.

Western Europe dominance characterizes the regional distribution of fitness ring market activity, with Germany, France, and the United Kingdom representing approximately 58% of total market share. These mature markets demonstrate strong consumer purchasing power, advanced retail infrastructure, and high technology adoption rates that support premium fitness ring products.

Nordic countries including Sweden, Norway, and Denmark show exceptional per-capita adoption rates driven by strong health consciousness, high disposable incomes, and cultural emphasis on active lifestyles. Scandinavian markets particularly favor environmentally sustainable products and innovative technology integration.

Southern European markets including Italy, Spain, and Portugal demonstrate growing interest in fitness ring products, with adoption rates increasing by approximately 23% annually. These markets show particular preference for aesthetically appealing designs and social connectivity features that align with cultural values emphasizing community and social interaction.

Eastern European expansion represents a significant growth opportunity as countries like Poland, Czech Republic, and Hungary experience rising disposable incomes and increasing health awareness. Market penetration rates in these regions remain relatively low but show accelerating growth trajectories as infrastructure development and consumer education initiatives expand.

Cross-border e-commerce facilitates market access across European regions, with online sales channels accounting for approximately 34% of total fitness ring sales. Digital distribution networks enable smaller manufacturers to reach diverse European markets without extensive physical retail presence requirements.

Market leadership in the European fitness ring sector features a diverse mix of established gaming companies, specialized fitness technology manufacturers, and emerging startups focused on innovative wearable solutions. Competitive positioning strategies vary significantly based on target demographics, price points, and technological capabilities.

Innovation strategies focus on enhanced user experience through improved sensor accuracy, extended battery life, and seamless connectivity with popular fitness applications. Competitive differentiation increasingly relies on software capabilities, content libraries, and ecosystem integration rather than hardware specifications alone.

Partnership strategies enable companies to leverage complementary strengths through collaborations with gaming platforms, fitness content providers, and healthcare organizations. Strategic alliances facilitate market entry, technology sharing, and expanded distribution capabilities across diverse European markets.

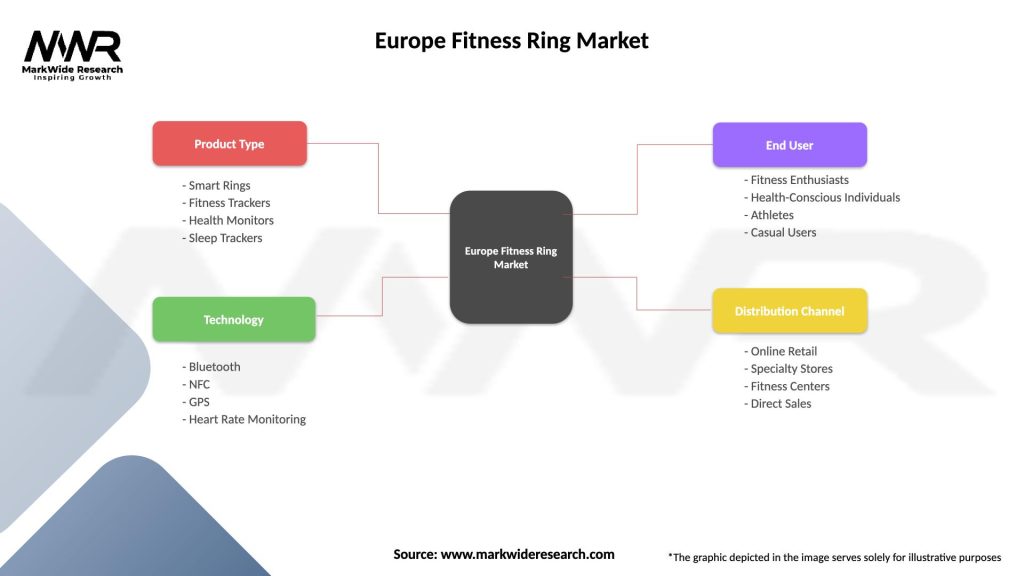

Product type segmentation reveals distinct categories within the European fitness ring market, each addressing specific consumer needs and preferences. Basic fitness rings focus on resistance training and simple motion tracking, while smart fitness rings incorporate advanced sensors and digital connectivity features.

By Technology:

By Application:

By Distribution Channel:

Gaming-integrated fitness rings represent the largest and fastest-growing category within the European market, driven by successful product launches that combine entertainment value with fitness benefits. Consumer engagement levels in this category significantly exceed traditional fitness equipment, with users reporting higher exercise frequency and longer session durations.

Smart connected fitness rings demonstrate strong growth potential as consumers increasingly value data tracking, progress monitoring, and social sharing capabilities. Advanced analytics features including personalized workout recommendations and health insights drive premium pricing acceptance among tech-savvy European consumers.

Traditional resistance rings maintain steady market presence, particularly among fitness enthusiasts seeking affordable, durable exercise equipment without digital complexity. Professional fitness applications continue to drive demand in this category as personal trainers and fitness studios incorporate rings into group exercise programs.

Rehabilitation-focused rings represent an emerging category with significant growth potential as healthcare providers recognize the value of engaging, technology-enhanced physical therapy tools. Medical device certification and clinical validation become increasingly important for products targeting healthcare applications.

Corporate wellness rings constitute a specialized category addressing the needs of employee health programs and workplace fitness initiatives. Bulk purchasing arrangements and customized software solutions drive growth in this segment as European companies invest in innovative employee wellness technologies.

Manufacturers benefit from expanding market opportunities as European consumers demonstrate increasing willingness to invest in innovative fitness technologies. Product differentiation possibilities enable companies to develop unique value propositions that command premium pricing and build strong brand loyalty among target demographics.

Retailers gain from high-margin product categories that attract tech-savvy consumers and drive cross-selling opportunities for complementary fitness and gaming products. Online retail advantages include reduced inventory requirements and ability to serve diverse European markets without extensive physical presence.

Consumers receive engaging fitness solutions that combine entertainment value with health benefits, making exercise more enjoyable and sustainable. Convenience factors including compact storage, versatile exercise options, and progress tracking capabilities enhance overall fitness experience and motivation levels.

Healthcare providers can leverage fitness ring technology to enhance patient engagement in rehabilitation programs and preventive health initiatives. Data collection capabilities provide valuable insights into patient progress and treatment effectiveness, supporting evidence-based healthcare decisions.

Corporate wellness programs benefit from innovative employee engagement tools that demonstrate measurable health outcomes and improved workplace productivity. Cost-effective implementation compared to traditional fitness facilities makes fitness rings attractive options for companies seeking scalable wellness solutions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Gamification integration continues to dominate market trends as consumers increasingly seek fitness solutions that combine entertainment value with health benefits. Interactive gaming elements including challenges, achievements, and social competitions drive higher user engagement and exercise adherence rates compared to traditional fitness equipment.

Artificial intelligence integration emerges as a significant trend with fitness rings incorporating AI-powered personal training features, adaptive workout recommendations, and intelligent progress tracking. Machine learning algorithms analyze user behavior patterns to optimize exercise routines and maximize fitness outcomes.

Sustainability focus reflects growing European consumer preference for environmentally responsible products, driving manufacturers to adopt eco-friendly materials, sustainable packaging, and circular economy principles. Carbon footprint reduction initiatives become important differentiating factors in competitive markets.

Health data integration with broader wellness ecosystems enables fitness rings to connect with healthcare providers, insurance companies, and wellness platforms. Comprehensive health monitoring capabilities expand beyond fitness tracking to include stress management, sleep quality, and overall wellness indicators.

Personalization advancement through sophisticated user profiling and customized workout programs addresses individual fitness levels, preferences, and goals. Adaptive technology automatically adjusts difficulty levels and exercise recommendations based on user progress and performance data.

Product innovation acceleration characterizes recent industry developments as manufacturers introduce advanced sensor technologies, improved battery life, and enhanced connectivity features. Next-generation fitness rings incorporate haptic feedback, voice control, and augmented reality capabilities that create more immersive exercise experiences.

Strategic partnerships between fitness ring manufacturers and major gaming platforms expand market reach and enhance product functionality. Collaborative development initiatives result in exclusive content, integrated gaming experiences, and cross-platform compatibility that benefit both hardware and software providers.

Healthcare sector engagement increases as medical professionals recognize the potential of fitness rings in rehabilitation therapy, chronic disease management, and preventive healthcare programs. Clinical validation studies provide evidence-based support for therapeutic applications and insurance coverage considerations.

Retail channel expansion includes new distribution partnerships with major European retailers, specialized fitness stores, and online marketplaces. Omnichannel strategies enable consumers to experience products in physical stores while purchasing through preferred online channels.

Regulatory compliance initiatives address evolving European data privacy requirements, medical device standards, and consumer safety regulations. Proactive compliance strategies help manufacturers maintain market access and build consumer trust through transparent data handling practices.

Market entry strategies should prioritize understanding diverse European consumer preferences and regulatory requirements across different countries. Localization efforts including language support, cultural adaptation, and region-specific marketing approaches significantly improve market acceptance and brand recognition.

Product development focus should emphasize user experience optimization, seamless technology integration, and accessibility features that appeal to broader demographic groups. Innovation investments in AI-powered personalization, advanced health monitoring, and sustainable design principles align with emerging market trends and consumer expectations.

Partnership development with healthcare providers, corporate wellness programs, and fitness content creators can accelerate market penetration and create sustainable competitive advantages. Ecosystem integration strategies that connect fitness rings with popular health apps, gaming platforms, and wellness services enhance product value and user engagement.

Distribution channel optimization should balance online and offline presence while leveraging e-commerce capabilities to reach diverse European markets efficiently. Retail partnerships with established fitness and gaming retailers provide credibility and access to target customer segments.

MarkWide Research analysis suggests that companies focusing on comprehensive user experience, strong ecosystem integration, and sustainable business models will achieve the strongest market positions in the evolving European fitness ring landscape.

Market expansion trajectory indicates continued robust growth driven by increasing health consciousness, technological advancement, and expanding application areas beyond traditional fitness. Growth projections suggest the European fitness ring market will experience sustained expansion at approximately 15.2% CAGR over the next five years.

Technology evolution will likely focus on enhanced sensor accuracy, extended battery life, and deeper integration with artificial intelligence and machine learning capabilities. Next-generation products may incorporate biometric monitoring, real-time health analysis, and predictive wellness insights that transform fitness rings into comprehensive health management tools.

Market maturation will bring increased competition, price pressure, and consolidation among smaller manufacturers, while creating opportunities for companies with strong brand recognition and innovative capabilities. Premium market segments focusing on advanced features and professional applications will likely maintain higher profit margins.

Healthcare integration expansion represents a significant future opportunity as medical professionals increasingly recognize the value of engaging, technology-enhanced therapeutic tools. Regulatory approval for medical applications could open substantial new market segments and revenue streams.

Sustainability requirements will become increasingly important as European consumers and regulators demand environmentally responsible products and manufacturing practices. Circular economy principles including product longevity, repairability, and recyclability will influence design decisions and competitive positioning strategies.

The Europe fitness ring market represents a dynamic and rapidly evolving sector that successfully combines fitness, technology, and entertainment to create engaging health solutions for diverse consumer segments. Market fundamentals remain strong, supported by increasing health consciousness, technological advancement, and growing acceptance of gamified fitness approaches across European demographics.

Strategic opportunities abound for companies that can effectively navigate the complex European market landscape while delivering innovative products that address evolving consumer needs. Success factors include strong technology integration, comprehensive user experience design, and adaptive strategies that respond to diverse regional preferences and regulatory requirements.

Future market development will likely be characterized by continued innovation in sensor technology, artificial intelligence integration, and expanded healthcare applications that position fitness rings as essential tools in preventive health and wellness management. MWR analysis indicates that companies investing in sustainable design, ecosystem integration, and user-centric innovation will achieve the strongest competitive positions in this evolving market landscape.

What is Fitness Ring?

Fitness Rings are wearable devices designed to monitor various health metrics, including heart rate, activity levels, and sleep patterns. They are increasingly popular among fitness enthusiasts and health-conscious individuals for tracking their wellness journey.

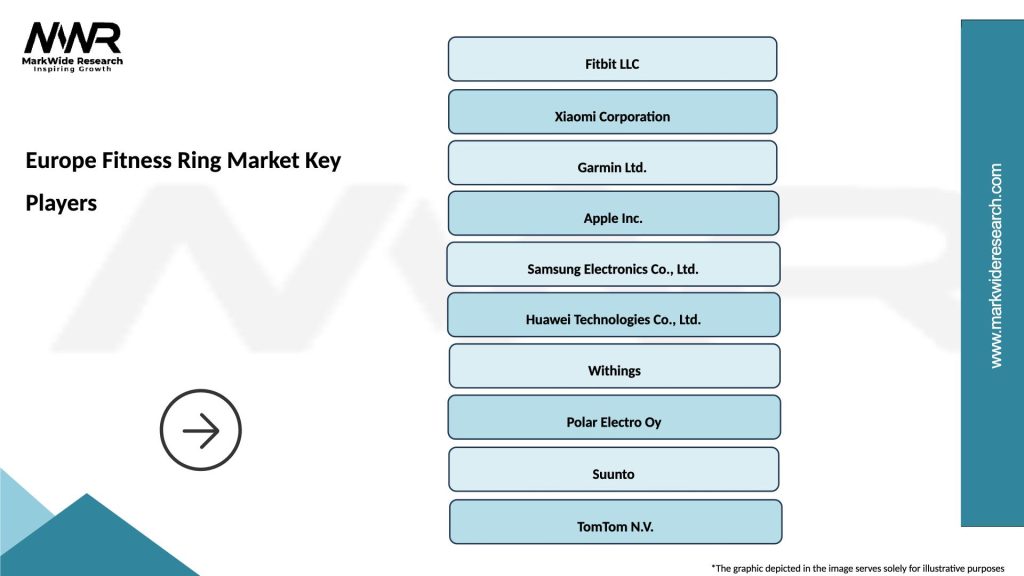

What are the key players in the Europe Fitness Ring Market?

Key players in the Europe Fitness Ring Market include Fitbit, Garmin, and Xiaomi, which offer a range of fitness tracking devices. These companies focus on innovation and user-friendly designs to cater to the growing demand for health monitoring solutions, among others.

What are the growth factors driving the Europe Fitness Ring Market?

The Europe Fitness Ring Market is driven by increasing health awareness, the rise of fitness trends, and the growing adoption of wearable technology. Additionally, the integration of advanced features like GPS and heart rate monitoring enhances user engagement and satisfaction.

What challenges does the Europe Fitness Ring Market face?

Challenges in the Europe Fitness Ring Market include data privacy concerns and the saturation of the wearable technology market. Additionally, competition from smartphones and other smart devices can limit the growth potential of dedicated fitness rings.

What opportunities exist in the Europe Fitness Ring Market?

Opportunities in the Europe Fitness Ring Market include the development of advanced health monitoring features and integration with fitness apps. There is also potential for partnerships with healthcare providers to promote preventive health measures through wearable technology.

What trends are shaping the Europe Fitness Ring Market?

Trends in the Europe Fitness Ring Market include the increasing focus on personalized health data and the rise of social fitness challenges. Additionally, advancements in sensor technology and battery life are enhancing the functionality and appeal of fitness rings.

Europe Fitness Ring Market

| Segmentation Details | Description |

|---|---|

| Product Type | Smart Rings, Fitness Trackers, Health Monitors, Sleep Trackers |

| Technology | Bluetooth, NFC, GPS, Heart Rate Monitoring |

| End User | Fitness Enthusiasts, Health-Conscious Individuals, Athletes, Casual Users |

| Distribution Channel | Online Retail, Specialty Stores, Fitness Centers, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Fitness Ring Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at