444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview:

The family floater health insurance market in Europe is a vital segment of the insurance landscape, offering comprehensive coverage for families. In a region known for its robust healthcare systems, family floater plans provide an added layer of financial protection, covering medical expenses for all family members under a single policy.

Meaning:

Family floater health insurance in Europe refers to a policy that extends coverage to an entire family under a single plan. This inclusive approach ensures that all family members, from children to elders, are protected against medical expenses, fostering a sense of security and well-being.

Executive Summary:

The European family floater health insurance market has witnessed steady growth, driven by the increasing awareness of the importance of comprehensive health coverage for families. As healthcare costs rise and family dynamics evolve, the demand for efficient and cost-effective family health insurance plans has surged.

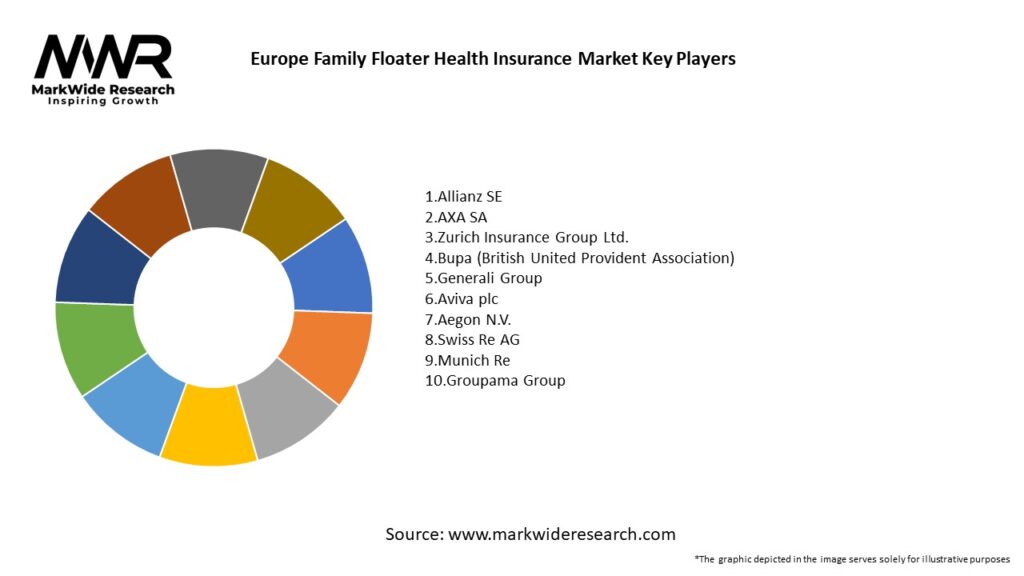

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics:

The family floater health insurance market in Europe operates in a dynamic environment influenced by factors such as evolving healthcare regulations, technological advancements, and shifting consumer preferences. Staying attuned to these dynamics is crucial for insurers to adapt strategies and capitalize on emerging opportunities.

Regional Analysis:

Competitive Landscape:

Leading Companies in Europe Family Floater Health Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

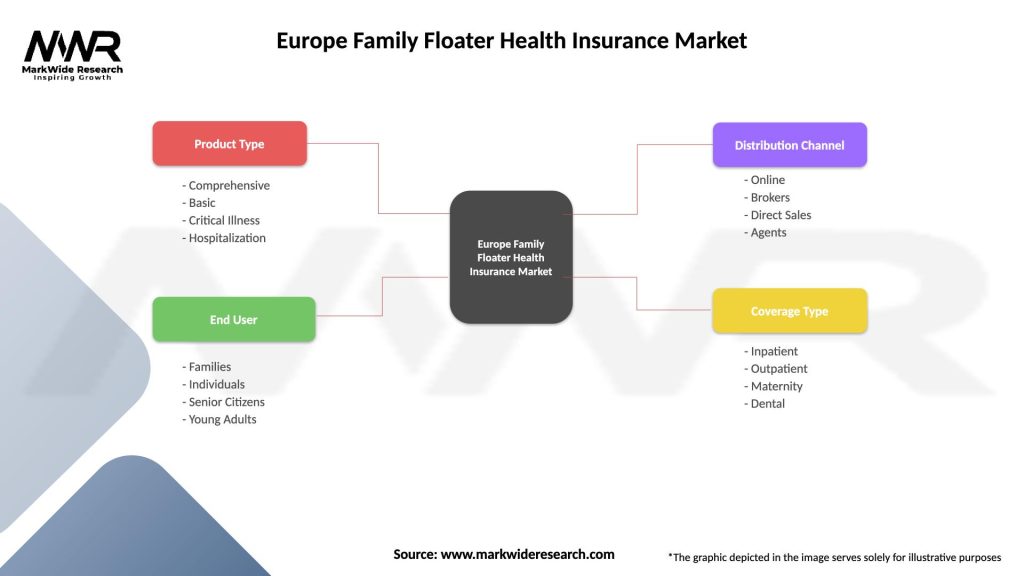

Segmentation:

The family floater health insurance market in Europe can be segmented based on:

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends:

Covid-19 Impact:

The COVID-19 pandemic has underscored the importance of health insurance, leading to an increased awareness of family floater plans in Europe. Insurers adapted by offering specific COVID-19 coverage and telehealth services, addressing the evolving healthcare landscape.

Key Industry Developments:

Analyst Suggestions:

Future Outlook:

The family floater health insurance market in Europe is poised for sustained growth. As healthcare needs diversify and digitalization continues to shape the industry, insurers adapting to these changes will thrive. Family floater plans tailored to specific demographics, coupled with innovative offerings, will be instrumental in capturing market share.

Conclusion:

The European family floater health insurance market represents a pivotal sector within the broader insurance landscape. With a focus on comprehensive coverage for families, insurers navigating this dynamic market must prioritize innovation, customer-centricity, and strategic collaborations to secure a robust position in the evolving healthcare landscape.

What is Family Floater Health Insurance?

Family Floater Health Insurance is a type of health insurance policy that covers the entire family under a single sum insured. It provides financial protection against medical expenses for all family members, making it a cost-effective solution for healthcare needs.

What are the key players in the Europe Family Floater Health Insurance Market?

Key players in the Europe Family Floater Health Insurance Market include Allianz, AXA, and Bupa, among others. These companies offer a variety of plans tailored to meet the diverse healthcare needs of families across Europe.

What are the main drivers of the Europe Family Floater Health Insurance Market?

The main drivers of the Europe Family Floater Health Insurance Market include the rising healthcare costs, increasing awareness of health insurance benefits, and a growing aging population. These factors contribute to a higher demand for comprehensive health coverage among families.

What challenges does the Europe Family Floater Health Insurance Market face?

The Europe Family Floater Health Insurance Market faces challenges such as regulatory complexities, varying healthcare standards across countries, and competition from alternative health coverage options. These factors can impact the growth and accessibility of family floater plans.

What opportunities exist in the Europe Family Floater Health Insurance Market?

Opportunities in the Europe Family Floater Health Insurance Market include the potential for digital transformation in policy management and claims processing, as well as the introduction of personalized health plans. Additionally, increasing partnerships with healthcare providers can enhance service offerings.

What trends are shaping the Europe Family Floater Health Insurance Market?

Trends shaping the Europe Family Floater Health Insurance Market include the rise of telemedicine services, the integration of wellness programs into insurance plans, and a focus on preventive healthcare. These trends reflect a shift towards more holistic health management for families.

Europe Family Floater Health Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Comprehensive, Basic, Critical Illness, Hospitalization |

| End User | Families, Individuals, Senior Citizens, Young Adults |

| Distribution Channel | Online, Brokers, Direct Sales, Agents |

| Coverage Type | Inpatient, Outpatient, Maternity, Dental |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Europe Family Floater Health Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at