444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe facilities management market represents a dynamic and rapidly evolving sector that encompasses comprehensive property and infrastructure management services across commercial, industrial, and residential properties. This market has experienced substantial growth driven by increasing demand for integrated facility services, technological advancement, and the growing emphasis on operational efficiency and cost optimization.

Market dynamics indicate robust expansion across key European regions, with organizations increasingly recognizing the strategic value of outsourcing facility management operations to specialized service providers. The market demonstrates strong growth momentum, with projections indicating a compound annual growth rate (CAGR) of 6.2% over the forecast period, reflecting the sector’s resilience and adaptability to changing business requirements.

Digital transformation has emerged as a primary catalyst for market evolution, with smart building technologies, IoT integration, and data-driven facility management solutions gaining significant traction. European organizations are increasingly adopting integrated facility management approaches that combine traditional services with advanced technological capabilities, creating new opportunities for service providers and enhancing operational outcomes for end users.

Sustainability initiatives continue to drive market demand, with approximately 78% of European facilities implementing green building practices and energy-efficient management systems. This trend aligns with stringent European environmental regulations and corporate sustainability commitments, positioning facilities management as a critical component of organizational environmental strategies.

The Europe facilities management market refers to the comprehensive sector encompassing professional services designed to ensure optimal functionality, comfort, safety, and efficiency of built environments across European commercial, industrial, and institutional properties. This market includes integrated service delivery covering maintenance, security, cleaning, catering, space management, and strategic facility planning.

Facilities management encompasses both hard services, including mechanical and electrical maintenance, building repairs, and infrastructure management, and soft services such as cleaning, security, catering, and reception services. The European market is characterized by increasing integration of these services under single-source providers, enabling streamlined operations and enhanced cost efficiency for client organizations.

Service delivery models within the European facilities management market range from single-service contracts to comprehensive integrated facility management (IFM) solutions. The market demonstrates growing preference for outcome-based service agreements that emphasize performance metrics, sustainability targets, and strategic business alignment rather than traditional transactional service delivery approaches.

Market performance across Europe demonstrates consistent growth trajectory driven by increasing outsourcing trends, technological innovation, and evolving workplace requirements. The facilities management sector has proven resilient through economic fluctuations, with organizations recognizing the strategic value of professional facility management in optimizing operational efficiency and reducing total cost of ownership.

Key growth drivers include the expansion of commercial real estate portfolios, increasing focus on workplace experience and employee satisfaction, and growing demand for sustainable facility management practices. Approximately 65% of European organizations have increased their facilities management outsourcing over the past three years, reflecting the sector’s strategic importance in modern business operations.

Technology adoption represents a fundamental market transformation, with smart building solutions, predictive maintenance systems, and integrated facility management platforms becoming standard offerings. The integration of artificial intelligence, machine learning, and IoT technologies has enhanced service delivery capabilities while providing unprecedented visibility into facility performance and optimization opportunities.

Regional variations exist across European markets, with Western European countries demonstrating mature facilities management adoption while Eastern European markets show rapid growth potential. The market benefits from strong regulatory frameworks supporting professional service standards and sustainability requirements that drive demand for specialized facility management expertise.

Strategic positioning within the European facilities management market reveals several critical insights that define current market dynamics and future growth potential:

Primary growth drivers propelling the European facilities management market include fundamental shifts in business operations, technological advancement, and evolving workplace requirements that create sustained demand for professional facility management services.

Outsourcing trends continue to accelerate as organizations focus on core business activities while seeking specialized expertise for facility management operations. This strategic shift enables companies to access advanced capabilities, reduce operational risks, and achieve cost efficiencies that would be difficult to realize through internal facility management approaches.

Technological innovation serves as a powerful market driver, with smart building technologies, IoT sensors, and predictive analytics platforms transforming facility management capabilities. These technologies enable proactive maintenance strategies, optimize energy consumption, and provide real-time visibility into facility performance metrics that support data-driven decision making.

Sustainability requirements drive significant market demand, with European environmental regulations and corporate sustainability commitments creating ongoing need for specialized green building management, energy optimization, and environmental compliance services. Organizations increasingly view facility management as a critical component of their sustainability strategies and carbon reduction initiatives.

Workplace transformation resulting from changing work patterns, employee expectations, and space utilization requirements creates new opportunities for facility management providers. The evolution toward flexible work arrangements and enhanced workplace experiences drives demand for adaptive facility management solutions that support dynamic operational requirements.

Regulatory compliance requirements across health, safety, environmental, and building standards create consistent demand for specialized facility management expertise. The complexity of regulatory frameworks across European markets necessitates professional facility management services that ensure ongoing compliance and risk mitigation.

Economic uncertainties and budget constraints can limit organizational investment in comprehensive facility management services, particularly during periods of economic volatility when companies prioritize cost reduction over service enhancement initiatives.

Skills shortage within the facility management sector presents ongoing challenges, with limited availability of qualified professionals possessing the technical expertise required for modern facility management operations. This constraint can impact service quality and limit market expansion in certain European regions.

Technology integration complexities and implementation costs can create barriers for organizations seeking to adopt advanced facility management solutions. The challenge of integrating new technologies with existing building systems and operational processes may delay adoption and limit market growth potential.

Contractual complexities associated with integrated facility management agreements can create hesitation among potential clients, particularly smaller organizations that may lack the expertise to effectively manage comprehensive service contracts and performance metrics.

Cultural resistance to outsourcing facility management functions may persist in certain European markets where organizations prefer to maintain direct control over facility operations. This resistance can limit market penetration and slow adoption of professional facility management services.

Standardization challenges across diverse European markets, with varying regulations, cultural preferences, and operational requirements, can complicate service delivery for facility management providers operating across multiple countries and create barriers to market expansion.

Digital transformation initiatives present substantial opportunities for facility management providers to develop innovative service offerings that leverage emerging technologies, data analytics, and automation capabilities to deliver enhanced value propositions and competitive differentiation.

Sustainability services represent a rapidly expanding opportunity segment, with increasing demand for specialized environmental management, energy optimization, and green building certification services. Organizations seeking to achieve carbon neutrality and environmental compliance create ongoing opportunities for specialized facility management expertise.

Healthcare facilities management presents significant growth potential, particularly given the expansion of healthcare infrastructure and increasing focus on infection control, specialized cleaning protocols, and regulatory compliance within healthcare environments across European markets.

Smart building integration offers opportunities for facility management providers to develop comprehensive technology-enabled service offerings that combine traditional facility management with advanced building automation, predictive maintenance, and data-driven optimization capabilities.

Small and medium enterprises represent an underserved market segment with substantial growth potential, as these organizations increasingly recognize the benefits of professional facility management while seeking cost-effective service solutions tailored to their specific requirements and budget constraints.

Public sector facility management presents expanding opportunities as government organizations seek to optimize operational efficiency, reduce costs, and improve service delivery through professional facility management partnerships and performance-based service agreements.

Competitive dynamics within the European facilities management market are characterized by ongoing consolidation, strategic partnerships, and service innovation as providers seek to differentiate their offerings and expand market presence across diverse European regions and industry sectors.

Service evolution continues to transform market dynamics, with traditional facility management services expanding to include strategic consulting, workplace analytics, and technology integration services that provide enhanced value propositions and deeper client relationships.

Client expectations have evolved significantly, with organizations demanding measurable outcomes, transparent reporting, and strategic partnership approaches rather than traditional transactional service relationships. This shift drives facility management providers to develop more sophisticated service delivery models and performance measurement capabilities.

Technology disruption creates both opportunities and challenges within the market, as facility management providers must continuously invest in new technologies and capabilities while managing the complexity of integrating advanced solutions with existing operational frameworks and client requirements.

Regulatory evolution across European markets continues to influence market dynamics, with changing environmental standards, health and safety requirements, and building regulations creating ongoing adaptation requirements for facility management providers and their service offerings.

Economic factors including inflation, labor costs, and energy prices impact market dynamics by influencing service pricing, operational efficiency requirements, and client budget allocation decisions that affect demand patterns and service delivery approaches.

Comprehensive analysis of the European facilities management market employs multiple research methodologies to ensure accurate market assessment and reliable insights that support strategic decision making for industry participants and stakeholders.

Primary research activities include extensive interviews with facility management service providers, client organizations, industry associations, and technology vendors across key European markets. These interviews provide firsthand insights into market trends, challenges, opportunities, and competitive dynamics that shape the facilities management sector.

Secondary research encompasses analysis of industry reports, regulatory documents, financial statements, and market publications to establish comprehensive understanding of market structure, competitive landscape, and growth drivers affecting the European facilities management market.

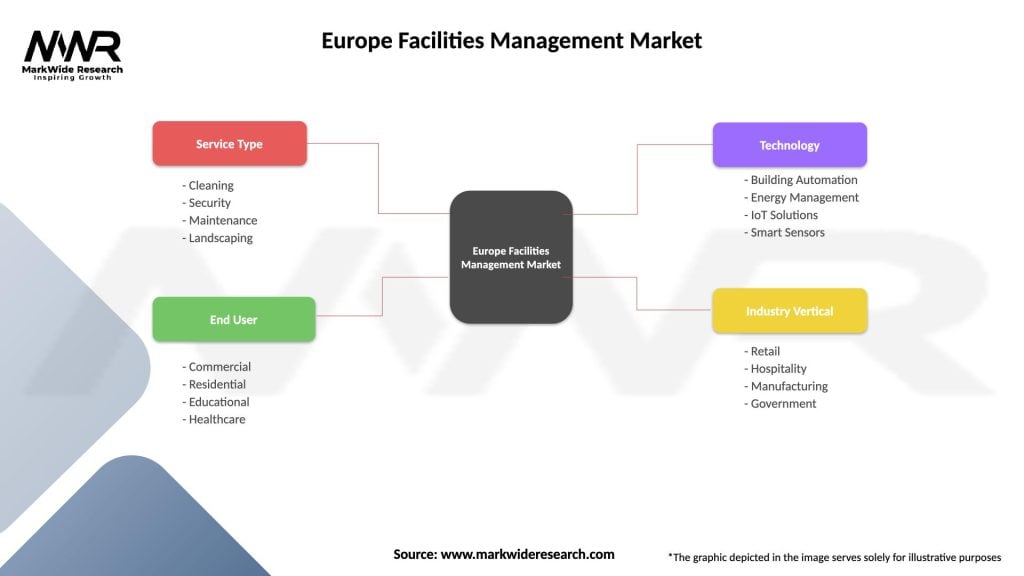

Market segmentation analysis examines service categories, industry verticals, geographic regions, and client organization sizes to identify specific market dynamics and growth opportunities within distinct market segments and regional markets across Europe.

Trend analysis evaluates historical market performance, current market conditions, and emerging trends to develop reliable projections for future market evolution and growth potential within the European facilities management sector.

Validation processes include cross-referencing multiple data sources, expert review, and market participant feedback to ensure accuracy and reliability of research findings and market insights presented in this comprehensive market analysis.

Western Europe dominates the facilities management market, representing approximately 68% of total European market activity, with mature markets in the United Kingdom, Germany, France, and Netherlands demonstrating sophisticated facility management adoption and comprehensive service integration across diverse industry sectors.

United Kingdom maintains market leadership position with well-established facility management practices, strong regulatory frameworks, and extensive outsourcing adoption across both private and public sectors. The UK market demonstrates particular strength in integrated facility management solutions and technology-enabled service delivery approaches.

Germany represents the largest continental European market, characterized by strong industrial facility management demand, emphasis on technical expertise, and growing adoption of sustainable facility management practices. German organizations increasingly seek comprehensive facility management solutions that combine operational efficiency with environmental sustainability.

France demonstrates steady market growth driven by commercial real estate expansion, increasing outsourcing adoption, and growing focus on workplace experience enhancement. The French market shows particular strength in soft services integration and hospitality-focused facility management solutions.

Nordic countries including Sweden, Norway, and Denmark exhibit advanced facility management adoption with strong emphasis on sustainability, technology integration, and innovative service delivery models. These markets demonstrate approximately 15% market share within the European facilities management sector.

Eastern Europe presents the fastest growth potential, with countries including Poland, Czech Republic, and Hungary showing rapid facility management market development driven by economic growth, commercial real estate expansion, and increasing awareness of professional facility management benefits.

Market leadership within the European facilities management sector is characterized by a combination of large multinational service providers, regional specialists, and emerging technology-focused companies that compete across different service categories and market segments.

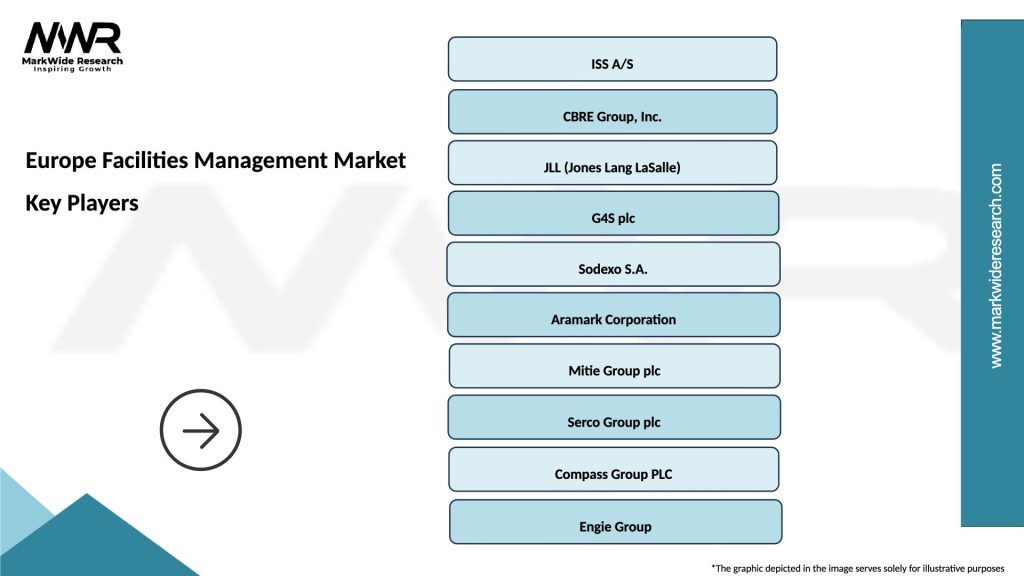

Major market participants include established facility management companies that have developed comprehensive service portfolios and extensive geographic coverage across European markets:

Competitive strategies focus on service innovation, technology integration, geographic expansion, and strategic acquisitions that enable market participants to enhance their service capabilities and expand their market presence across diverse European regions and industry sectors.

Market consolidation continues as larger providers acquire regional specialists and technology companies to enhance their service capabilities, expand geographic coverage, and develop competitive advantages in specific market segments or service categories.

Service-based segmentation divides the European facilities management market into distinct categories that reflect different operational requirements and client preferences:

Hard Services:

Soft Services:

Industry vertical segmentation reflects diverse facility management requirements across different business sectors:

Integrated Facility Management represents the fastest-growing category, with approximately 42% of European organizations preferring comprehensive service solutions that combine multiple facility management disciplines under unified management structures. This approach provides operational efficiency, cost optimization, and simplified vendor management for client organizations.

Technical Services demonstrate strong demand driven by increasing building complexity, regulatory requirements, and the need for specialized expertise in mechanical, electrical, and building automation systems. Organizations increasingly recognize the value of professional technical facility management in maintaining operational reliability and regulatory compliance.

Smart Building Services represent an emerging high-growth category, with technology-enabled facility management solutions gaining traction across European markets. These services combine traditional facility management with IoT integration, data analytics, and predictive maintenance capabilities that optimize building performance and operational efficiency.

Sustainability Services have evolved from optional offerings to essential service components, with environmental management, energy optimization, and green building certification services becoming standard requirements for facility management providers serving environmentally conscious European organizations.

Workplace Services encompass a growing category focused on employee experience, space optimization, and workplace analytics that support modern work patterns and organizational productivity objectives. These services align facility management with strategic business objectives and employee satisfaction initiatives.

Compliance Management services address the complexity of European regulatory requirements across health, safety, environmental, and building standards. This category provides specialized expertise that enables organizations to maintain regulatory compliance while focusing on their core business activities.

Cost optimization represents a primary benefit for organizations engaging professional facility management services, with typical cost reductions of 15-25% achieved through operational efficiency, vendor consolidation, and specialized expertise that eliminates redundancies and optimizes resource utilization.

Operational efficiency improvements enable organizations to focus on core business activities while ensuring optimal facility performance through professional management, preventive maintenance programs, and performance monitoring that maintains facility reliability and functionality.

Risk mitigation benefits include reduced liability exposure, improved regulatory compliance, and enhanced safety management through specialized expertise and professional insurance coverage that protects organizations from facility-related risks and potential liabilities.

Technology access provides organizations with advanced facility management technologies, data analytics platforms, and smart building capabilities that would be cost-prohibitive to develop internally, enabling access to cutting-edge facility management solutions and performance optimization tools.

Scalability advantages allow organizations to adjust facility management services based on changing requirements, business growth, or operational modifications without the complexity and cost of managing internal facility management capabilities and workforce adjustments.

Expertise availability ensures access to specialized facility management knowledge, technical skills, and industry best practices that enhance service quality, operational performance, and strategic facility management decision making across diverse facility types and operational requirements.

Performance transparency through comprehensive reporting, key performance indicators, and data-driven insights enables organizations to monitor facility performance, track cost efficiency, and make informed decisions regarding facility management strategies and service optimization opportunities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart building integration has emerged as a dominant trend, with facility management providers increasingly incorporating IoT sensors, building automation systems, and predictive analytics platforms into their service offerings. This trend enables proactive maintenance, energy optimization, and enhanced operational visibility that delivers measurable value to client organizations.

Sustainability focus continues to intensify across European markets, with approximately 85% of facility management contracts now including specific environmental performance requirements and sustainability targets. This trend drives demand for specialized green building services, energy management expertise, and environmental compliance capabilities.

Workplace transformation resulting from hybrid work models and changing employee expectations is reshaping facility management requirements. Organizations seek adaptive facility management solutions that support flexible space utilization, enhanced workplace experiences, and dynamic operational requirements that align with modern work patterns.

Data-driven decision making has become standard practice, with facility management providers leveraging advanced analytics, performance dashboards, and predictive modeling to optimize service delivery and demonstrate measurable outcomes. This trend enhances transparency and enables continuous improvement in facility management operations.

Service personalization reflects growing client expectations for customized facility management solutions that address specific organizational requirements, industry needs, and operational preferences rather than standardized service packages.

Technology partnerships between facility management providers and technology companies are becoming increasingly common, enabling access to cutting-edge solutions and specialized capabilities that enhance service differentiation and competitive positioning.

Outcome-based contracting is gaining traction as organizations seek facility management agreements that emphasize performance results, sustainability achievements, and strategic business alignment rather than traditional activity-based service delivery models.

Strategic acquisitions continue to reshape the competitive landscape, with major facility management providers acquiring specialized technology companies, regional service providers, and niche expertise to enhance their service capabilities and expand market presence across European regions.

Technology investments by leading facility management companies focus on developing proprietary platforms, mobile applications, and data analytics capabilities that differentiate their service offerings and provide enhanced value propositions to client organizations seeking advanced facility management solutions.

Sustainability certifications and green building expertise have become essential competitive requirements, with facility management providers investing in specialized training, certification programs, and environmental management capabilities to meet growing client sustainability requirements and regulatory compliance needs.

Partnership agreements between facility management providers and technology vendors, equipment manufacturers, and specialized service companies enable comprehensive solution development and enhanced service delivery capabilities that address complex client requirements and market opportunities.

Market expansion initiatives include geographic expansion into emerging European markets, development of new service categories, and targeted industry sector specialization that enables facility management providers to capture growth opportunities and diversify their market presence.

Regulatory compliance investments focus on developing specialized expertise and operational capabilities that address evolving European regulatory requirements across health, safety, environmental, and building standards that impact facility management service delivery.

Technology integration should remain a strategic priority for facility management providers, with continued investment in smart building technologies, data analytics platforms, and mobile applications that enhance service delivery capabilities and provide competitive differentiation in an increasingly technology-driven market environment.

Sustainability expertise development is essential for long-term market success, as environmental requirements continue to intensify across European markets. MarkWide Research analysis indicates that facility management providers with specialized sustainability capabilities achieve higher client retention rates and premium pricing opportunities.

Service innovation focusing on emerging client needs, workplace transformation requirements, and industry-specific solutions will be critical for maintaining competitive positioning and capturing growth opportunities in evolving market segments and geographic regions.

Talent development initiatives should address the ongoing skills shortage through comprehensive training programs, professional certification, and workforce development strategies that ensure availability of qualified facility management professionals with modern technical and analytical capabilities.

Market expansion strategies should prioritize high-growth regions and underserved industry sectors where facility management adoption is accelerating, while maintaining service quality and operational excellence in established markets and client relationships.

Partnership strategies with technology providers, specialized service companies, and industry associations can enhance service capabilities, expand market reach, and provide access to emerging technologies and expertise that support competitive differentiation and market leadership.

Market expansion is projected to continue across European regions, with particularly strong growth anticipated in Eastern European markets where facility management adoption is accelerating and commercial real estate development is driving demand for professional facility management services.

Technology evolution will fundamentally transform facility management service delivery, with artificial intelligence, machine learning, and advanced automation becoming standard components of comprehensive facility management solutions. MarkWide Research projects that technology-enabled services will represent over 60% of facility management contracts by 2028.

Sustainability integration will become increasingly sophisticated, with facility management providers developing comprehensive environmental management capabilities that address carbon neutrality objectives, circular economy principles, and advanced green building requirements across diverse European markets and industry sectors.

Service consolidation trends will continue as organizations seek simplified vendor relationships and integrated service delivery models that combine traditional facility management with strategic consulting, workplace analytics, and technology integration services under unified management structures.

Regulatory evolution across European markets will create ongoing adaptation requirements for facility management providers, with new standards related to health, safety, environmental performance, and building efficiency driving demand for specialized expertise and compliance management capabilities.

Market differentiation will increasingly depend on specialized expertise, technology capabilities, and outcome-based service delivery models that demonstrate measurable value and strategic business alignment rather than traditional cost-focused facility management approaches.

The Europe facilities management market represents a dynamic and rapidly evolving sector characterized by strong growth momentum, technological innovation, and increasing strategic importance within organizational operations. Market expansion is driven by growing outsourcing adoption, sustainability requirements, and the need for specialized expertise in managing complex facility environments across diverse European regions and industry sectors.

Technology integration has emerged as a fundamental market transformation factor, with smart building solutions, data analytics platforms, and predictive maintenance capabilities becoming essential components of modern facility management service offerings. This technological evolution enables enhanced operational efficiency, cost optimization, and strategic value creation that positions facility management as a critical business function rather than a traditional support service.

Sustainability focus continues to intensify across European markets, creating substantial opportunities for facility management providers with specialized environmental expertise and green building capabilities. The alignment of facility management services with organizational sustainability objectives and regulatory compliance requirements ensures continued market demand and growth potential across diverse market segments and geographic regions.

Future market success will depend on facility management providers’ ability to adapt to evolving client requirements, integrate advanced technologies, and develop specialized expertise that addresses complex operational challenges while delivering measurable outcomes and strategic business value. The Europe facilities management market is well-positioned for continued expansion and innovation, supported by strong fundamentals and growing recognition of professional facility management’s strategic importance in modern business operations.

What is Facilities Management?

Facilities Management refers to the integrated approach to maintaining and managing buildings and their services, ensuring functionality, comfort, safety, and efficiency. It encompasses various services such as cleaning, maintenance, security, and space management.

What are the key players in the Europe Facilities Management Market?

Key players in the Europe Facilities Management Market include companies like ISS A/S, Sodexo, CBRE Group, and JLL. These companies provide a range of facilities management services across various sectors, including commercial, healthcare, and education, among others.

What are the main drivers of growth in the Europe Facilities Management Market?

The main drivers of growth in the Europe Facilities Management Market include the increasing demand for outsourcing non-core services, the need for cost efficiency, and the growing focus on sustainability and energy management in facilities.

What challenges does the Europe Facilities Management Market face?

The Europe Facilities Management Market faces challenges such as the need for skilled labor, the complexity of integrating new technologies, and the pressure to meet stringent regulatory requirements related to health and safety.

What opportunities exist in the Europe Facilities Management Market?

Opportunities in the Europe Facilities Management Market include the adoption of smart building technologies, the increasing emphasis on sustainability practices, and the potential for growth in emerging sectors like remote working environments and flexible office spaces.

What trends are shaping the Europe Facilities Management Market?

Trends shaping the Europe Facilities Management Market include the rise of digital transformation, the integration of IoT for enhanced facility monitoring, and a shift towards more sustainable practices in facility operations.

Europe Facilities Management Market

| Segmentation Details | Description |

|---|---|

| Service Type | Cleaning, Security, Maintenance, Landscaping |

| End User | Commercial, Residential, Educational, Healthcare |

| Technology | Building Automation, Energy Management, IoT Solutions, Smart Sensors |

| Industry Vertical | Retail, Hospitality, Manufacturing, Government |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Facilities Management Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at