444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe Engineering Research and Development (ER&D) Services Market represents a dynamic and rapidly evolving sector that encompasses comprehensive engineering solutions, product development services, and technological innovation support across diverse industries. This market has experienced remarkable transformation driven by digital acceleration, Industry 4.0 initiatives, and the increasing complexity of modern engineering challenges. European organizations are increasingly outsourcing their engineering and R&D activities to specialized service providers to enhance innovation capabilities, reduce time-to-market, and optimize operational costs.

Market dynamics indicate substantial growth momentum, with the sector expanding at a robust CAGR of 8.2% during the forecast period. The market encompasses various service categories including product engineering, embedded software development, digital engineering, and advanced analytics solutions. Key industries driving demand include automotive, aerospace, telecommunications, healthcare, and industrial manufacturing, each requiring specialized engineering expertise and cutting-edge technological solutions.

Regional distribution shows Germany, the United Kingdom, and France collectively accounting for approximately 65% of market activity, while emerging markets in Eastern Europe demonstrate accelerating adoption rates. The integration of artificial intelligence, machine learning, and IoT technologies into traditional engineering processes has created new opportunities for service providers and enhanced the value proposition of outsourced ER&D services across the European landscape.

The Europe Engineering Research and Development (ER&D) Services Market refers to the comprehensive ecosystem of specialized service providers offering engineering design, product development, research activities, and technological innovation support to organizations across various industries throughout the European region. This market encompasses both traditional engineering services and next-generation digital engineering solutions that leverage advanced technologies to accelerate innovation and enhance product development capabilities.

ER&D services include a broad spectrum of offerings such as concept design, prototyping, testing and validation, software development, systems integration, and lifecycle management support. These services enable organizations to access specialized expertise, advanced tools, and scalable resources without maintaining extensive in-house engineering teams. Service providers in this market range from large multinational corporations to specialized boutique firms, each offering unique capabilities and industry-specific expertise.

Digital transformation has fundamentally redefined the scope and nature of ER&D services, incorporating cloud-based platforms, collaborative tools, and data-driven methodologies that enhance efficiency and innovation outcomes. The market serves as a critical enabler for European organizations seeking to maintain competitive advantage through accelerated product development, reduced engineering costs, and access to cutting-edge technological capabilities.

Strategic analysis reveals that the Europe Engineering Research and Development Services Market has emerged as a cornerstone of regional innovation infrastructure, supporting diverse industries in their quest for technological advancement and competitive differentiation. The market demonstrates exceptional resilience and growth potential, driven by increasing complexity in product development, regulatory requirements, and the imperative for sustainable engineering solutions.

Key market drivers include the accelerating pace of digital transformation, with 72% of European enterprises prioritizing digital engineering capabilities in their strategic planning. The automotive sector leads demand generation, particularly in electric vehicle development and autonomous driving technologies, while the aerospace industry contributes significantly through next-generation aircraft and space exploration initiatives.

Service evolution has shifted toward integrated solutions that combine traditional engineering expertise with advanced digital capabilities, including simulation and modeling, virtual prototyping, and AI-powered design optimization. This transformation has enabled service providers to deliver enhanced value propositions while addressing the growing complexity of modern engineering challenges across multiple industry verticals.

Competitive landscape features a diverse mix of global technology leaders, specialized engineering consultancies, and emerging digital-native service providers, creating a dynamic ecosystem that fosters innovation and drives continuous improvement in service delivery methodologies and technological capabilities.

Market intelligence reveals several critical insights that define the current state and future trajectory of the Europe ER&D Services Market. The sector demonstrates remarkable adaptability to changing technological landscapes and evolving client requirements, positioning itself as an essential component of European industrial competitiveness.

Primary growth drivers propelling the Europe ER&D Services Market encompass technological advancement, economic factors, and strategic business imperatives that collectively create a favorable environment for market expansion. These drivers reflect fundamental shifts in how European organizations approach innovation and product development.

Digital transformation initiatives represent the most significant driver, with organizations investing heavily in modernizing their engineering capabilities and processes. The integration of Industry 4.0 technologies, including artificial intelligence, machine learning, and advanced analytics, has created unprecedented demand for specialized expertise that many organizations prefer to access through external service providers rather than developing internally.

Cost optimization pressures continue to influence outsourcing decisions, as organizations seek to reduce fixed costs while maintaining access to world-class engineering capabilities. The variable cost structure offered by ER&D service providers enables organizations to scale resources according to project requirements and market conditions, providing greater financial flexibility and risk mitigation.

Talent scarcity in specialized engineering disciplines has become a critical challenge for European organizations, particularly in emerging technology areas such as autonomous systems, renewable energy, and biotechnology. ER&D service providers offer access to global talent pools and specialized expertise that would be difficult or expensive to develop in-house.

Regulatory complexity across various industries has increased the importance of compliance-focused engineering services, with organizations requiring specialized knowledge to navigate evolving regulatory landscapes while maintaining innovation momentum and market competitiveness.

Market constraints affecting the Europe ER&D Services Market include structural challenges, regulatory barriers, and operational limitations that may impact growth potential and service delivery effectiveness. Understanding these restraints is crucial for stakeholders seeking to navigate market complexities successfully.

Intellectual property concerns represent a significant restraint, as organizations remain cautious about sharing sensitive technical information and proprietary knowledge with external service providers. This concern is particularly pronounced in highly competitive industries where technological advantages provide critical market differentiation and competitive positioning.

Quality control challenges can arise when organizations outsource critical engineering functions, particularly when service providers lack deep understanding of specific industry requirements or client organizational culture. Maintaining consistent quality standards across distributed teams and multiple service providers requires sophisticated management approaches and robust governance frameworks.

Communication barriers and cultural differences can impact project effectiveness, especially when service providers operate across multiple geographic locations or time zones. These challenges can lead to misunderstandings, delays, and suboptimal outcomes that may discourage organizations from pursuing outsourcing strategies.

Dependency risks emerge when organizations become overly reliant on external service providers for critical engineering capabilities, potentially limiting internal knowledge development and creating vulnerability to service provider performance issues or market disruptions.

Regulatory compliance complexity varies significantly across European markets, creating challenges for service providers operating in multiple jurisdictions and requiring substantial investment in compliance infrastructure and expertise to serve diverse client requirements effectively.

Emerging opportunities within the Europe ER&D Services Market reflect evolving technological landscapes, changing business models, and new industry requirements that create potential for significant growth and innovation. These opportunities represent areas where forward-thinking service providers can establish competitive advantages and capture market share.

Sustainability engineering presents substantial opportunities as European organizations prioritize environmental responsibility and regulatory compliance. Service providers specializing in green technologies, circular economy principles, and sustainable design methodologies are positioned to capture growing demand from environmentally conscious organizations and regulatory-driven initiatives.

Digital twin technology represents a transformative opportunity, enabling service providers to offer advanced simulation and modeling capabilities that reduce physical prototyping costs and accelerate product development cycles. This technology is particularly valuable in complex industries such as aerospace, automotive, and industrial manufacturing.

Artificial intelligence integration creates opportunities for service providers to enhance their offerings with intelligent automation, predictive analytics, and machine learning capabilities that improve engineering efficiency and innovation outcomes. AI-powered engineering services are experiencing rapid adoption, with implementation rates growing by 38% annually across major European markets.

Cybersecurity engineering has become increasingly important as connected products and IoT devices proliferate across industries. Service providers with specialized cybersecurity expertise can address growing demand for secure-by-design engineering approaches and comprehensive security testing capabilities.

Cross-industry collaboration opportunities enable service providers to leverage expertise across multiple sectors, creating synergies and innovative solutions that benefit from diverse industry perspectives and technological approaches.

Market dynamics within the Europe ER&D Services sector reflect complex interactions between technological evolution, economic conditions, competitive pressures, and regulatory environments that collectively shape market behavior and growth patterns. These dynamics create both challenges and opportunities for market participants.

Technology convergence has fundamentally altered market dynamics, with traditional engineering disciplines increasingly intersecting with software development, data science, and digital technologies. This convergence has created new service categories and business models while requiring service providers to develop multidisciplinary capabilities and expertise.

Client expectations have evolved significantly, with organizations demanding faster delivery, higher quality, and more innovative solutions from their ER&D service providers. This shift has driven service providers to invest in advanced tools, methodologies, and talent development to meet increasingly sophisticated client requirements and maintain competitive positioning.

Competitive intensity has increased as new entrants, including technology startups and digital-native companies, challenge established service providers with innovative approaches and specialized capabilities. This competition has accelerated innovation and improved service quality while creating pricing pressures in certain market segments.

Partnership ecosystems have become increasingly important, with service providers forming strategic alliances and collaborative networks to deliver comprehensive solutions that address complex client requirements. These partnerships enable access to complementary capabilities and expanded market reach while sharing risks and investments.

Regulatory evolution continues to influence market dynamics, with changing compliance requirements creating both challenges and opportunities for service providers. Organizations with strong regulatory expertise and adaptive capabilities are better positioned to navigate these changes and support client compliance objectives.

Comprehensive research methodology employed in analyzing the Europe ER&D Services Market incorporates multiple data sources, analytical frameworks, and validation techniques to ensure accuracy, reliability, and actionable insights for market stakeholders. The methodology combines quantitative and qualitative research approaches to provide holistic market understanding.

Primary research activities include extensive interviews with industry executives, service providers, and client organizations across major European markets. These interviews provide firsthand insights into market trends, challenges, opportunities, and strategic priorities that shape market development and competitive dynamics.

Secondary research encompasses analysis of industry reports, company financial statements, regulatory filings, and academic publications to establish market context and validate primary research findings. This approach ensures comprehensive coverage of market factors and trends that influence sector development.

Data triangulation techniques are employed to cross-validate findings from multiple sources and ensure research accuracy. This process involves comparing and contrasting information from different sources to identify consistencies and resolve discrepancies in market data and analysis.

Market modeling utilizes advanced analytical techniques to project market trends, growth patterns, and competitive dynamics based on historical data and identified market drivers. These models incorporate various scenarios to provide robust forecasting and strategic planning insights.

Expert validation involves review and feedback from industry experts and thought leaders to ensure research findings accurately reflect market realities and provide valuable insights for strategic decision-making and investment planning.

Regional market analysis reveals significant variations in ER&D services adoption, growth patterns, and competitive dynamics across European markets, reflecting differences in industrial base, technological infrastructure, and regulatory environments that influence market development and opportunity distribution.

Germany maintains its position as the largest European market for ER&D services, accounting for approximately 28% of regional market activity. The country’s strong automotive and industrial manufacturing sectors drive substantial demand for engineering services, particularly in electric vehicle development, automation technologies, and Industry 4.0 initiatives. German organizations demonstrate high adoption rates for advanced engineering services and digital transformation solutions.

United Kingdom represents the second-largest market, with 22% market share, driven by strong aerospace, financial services, and telecommunications sectors. Despite Brexit-related uncertainties, the UK market continues to attract significant investment in ER&D services, particularly in fintech, aerospace innovation, and renewable energy technologies.

France accounts for 15% of market activity, with particular strength in aerospace, automotive, and luxury goods industries. French organizations increasingly prioritize sustainability-focused engineering services and digital transformation initiatives that support competitive positioning in global markets.

Nordic countries collectively represent a high-growth market segment, with adoption rates increasing by 35% annually. These markets demonstrate strong demand for clean technology engineering, digital health solutions, and sustainable manufacturing processes that align with regional environmental priorities.

Eastern European markets show the highest growth potential, with emerging economies investing heavily in industrial modernization and technology adoption that creates opportunities for ER&D service providers seeking to establish regional presence and capture growing demand.

Competitive landscape analysis reveals a diverse and dynamic market structure featuring global technology leaders, specialized engineering consultancies, and emerging digital-native service providers that compete across various service categories and industry verticals. This competitive environment fosters innovation and drives continuous improvement in service delivery capabilities.

Market positioning strategies vary significantly among competitors, with some focusing on comprehensive service portfolios while others specialize in specific industries or technology domains. This diversity creates a competitive environment that benefits clients through varied service options and competitive pricing structures.

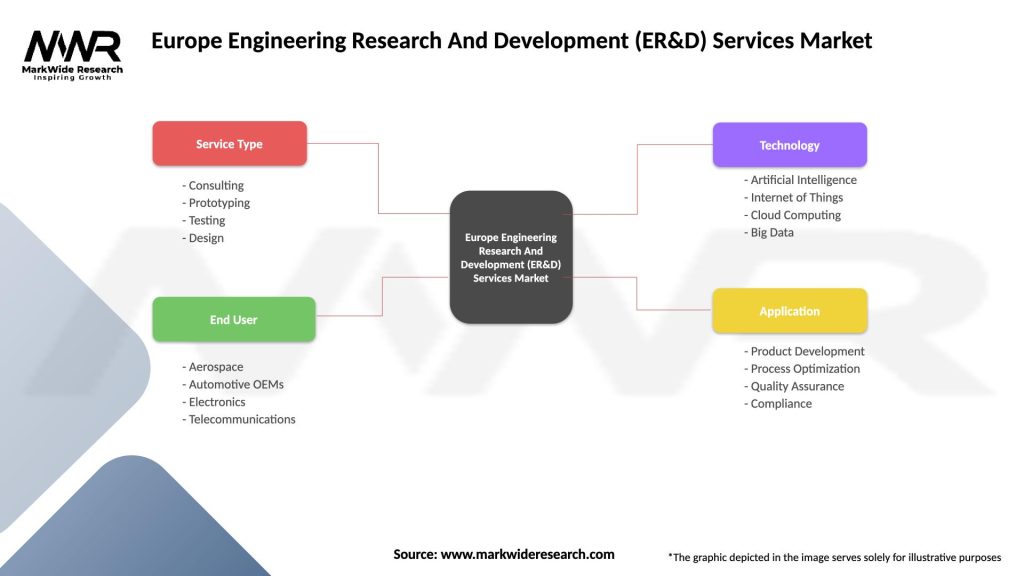

Market segmentation analysis provides detailed insights into various service categories, industry applications, and technology domains that comprise the Europe ER&D Services Market. This segmentation enables stakeholders to understand market structure, identify growth opportunities, and develop targeted strategies for specific market segments.

By Service Type:

By Industry Vertical:

By Technology Domain:

Category analysis reveals distinct characteristics, growth patterns, and competitive dynamics within major service segments of the Europe ER&D Services Market. These insights enable stakeholders to understand segment-specific opportunities and challenges that influence strategic planning and investment decisions.

Product Engineering Services represent the largest market category, driven by increasing product complexity and shortened development cycles across industries. This segment benefits from growing demand for innovative products, regulatory compliance requirements, and the need for specialized expertise in emerging technology domains. Service providers in this category focus on end-to-end product development capabilities and industry-specific expertise.

Digital Engineering Services demonstrate the highest growth rates, with expansion accelerating by 42% annually as organizations embrace digital transformation initiatives. This category encompasses virtual prototyping, digital twin technology, and AI-powered design optimization that enable faster, more cost-effective product development processes.

Software Engineering Services continue to evolve rapidly, driven by increasing software content in traditional hardware products and growing demand for embedded systems. This category benefits from automotive electrification, IoT proliferation, and digital transformation across industries that require sophisticated software development capabilities.

Testing and Validation Services maintain steady growth driven by increasing regulatory requirements, quality standards, and the complexity of modern products. This category is particularly important in safety-critical industries such as automotive, aerospace, and healthcare where comprehensive testing is essential for market approval and customer acceptance.

Emerging service categories including sustainability engineering, cybersecurity services, and AI-powered solutions represent high-growth opportunities that reflect evolving market requirements and technological advancement in the European ER&D services landscape.

Strategic benefits derived from participation in the Europe ER&D Services Market extend across multiple stakeholder categories, creating value for service providers, client organizations, and the broader European innovation ecosystem. These benefits reflect the transformative impact of specialized engineering services on business performance and competitive positioning.

For Client Organizations:

For Service Providers:

For the European Innovation Ecosystem:

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends shaping the Europe ER&D Services Market reflect broader technological evolution, changing business models, and evolving client expectations that collectively redefine service delivery approaches and competitive dynamics within the sector.

Digital Engineering Transformation represents the most significant trend, with organizations increasingly adopting cloud-based platforms, collaborative tools, and data-driven methodologies that enhance engineering efficiency and innovation outcomes. This transformation enables real-time collaboration, advanced simulation capabilities, and integrated development environments that accelerate product development cycles.

AI-Powered Engineering has emerged as a game-changing trend, with artificial intelligence and machine learning technologies being integrated into design processes, testing procedures, and optimization algorithms. MarkWide Research analysis indicates that AI-enabled engineering services are experiencing adoption rates of 55% annually across major European markets.

Sustainability-Focused Engineering has become increasingly important as organizations prioritize environmental responsibility and regulatory compliance. This trend drives demand for circular economy design principles, renewable energy solutions, and environmentally conscious engineering practices that minimize environmental impact throughout product lifecycles.

Agile Development Methodologies are being widely adopted in engineering services, enabling faster iteration cycles, improved client collaboration, and enhanced responsiveness to changing requirements. These methodologies support continuous improvement and adaptive project management approaches that better align with dynamic market conditions.

Industry 4.0 Integration continues to influence service delivery models, with IoT, robotics, and automation technologies being incorporated into engineering processes to enhance efficiency, quality, and innovation capabilities across various industry applications.

Recent industry developments highlight the dynamic nature of the Europe ER&D Services Market and demonstrate how leading organizations are adapting to changing market conditions, technological advancement, and evolving client requirements through strategic initiatives and innovative approaches.

Strategic Acquisitions have accelerated as major service providers seek to expand capabilities, enter new markets, and acquire specialized expertise in emerging technology domains. These acquisitions enable rapid capability development and market positioning in high-growth segments such as AI, cybersecurity, and sustainability engineering.

Partnership Ecosystems are being established to deliver comprehensive solutions that address complex client requirements. Leading service providers are forming strategic alliances with technology vendors, academic institutions, and specialized consultancies to create integrated service offerings and enhanced value propositions.

Digital Platform Investments represent significant industry development, with service providers investing heavily in cloud-based platforms, collaborative tools, and advanced analytics capabilities that enable more efficient service delivery and enhanced client experiences. These platforms support remote collaboration, real-time project monitoring, and integrated development environments.

Talent Development Initiatives have become critical as organizations address skills shortages in emerging technology areas. Leading service providers are investing in comprehensive training programs, university partnerships, and certification initiatives to develop specialized expertise and maintain competitive advantages.

Sustainability Commitments are being integrated into service offerings as organizations respond to client demands for environmentally responsible engineering solutions. These commitments include carbon-neutral operations, sustainable design practices, and green technology development capabilities.

Strategic recommendations for stakeholders in the Europe ER&D Services Market emphasize the importance of adaptation, innovation, and strategic positioning to capitalize on emerging opportunities while addressing market challenges and competitive pressures effectively.

For Service Providers: Focus on developing specialized capabilities in high-growth technology domains such as artificial intelligence, cybersecurity, and sustainability engineering. Invest in digital platforms and collaborative tools that enhance service delivery efficiency and client experience. Establish strategic partnerships to expand service portfolios and market reach while maintaining focus on quality and innovation.

For Client Organizations: Develop comprehensive outsourcing strategies that balance cost optimization with quality requirements and intellectual property protection. Establish clear governance frameworks for managing external service providers and ensure alignment with organizational objectives and cultural values. Consider long-term partnership approaches that foster collaboration and shared value creation.

For Investors: Prioritize service providers with strong digital capabilities, specialized expertise, and proven track records in high-growth industry segments. Evaluate companies based on their ability to adapt to technological change, maintain client relationships, and demonstrate sustainable competitive advantages in evolving market conditions.

Market Entry Strategies: New entrants should focus on specialized niches or emerging technology domains where established competitors may have limited presence. Develop unique value propositions based on innovative service delivery models, advanced technologies, or industry-specific expertise that differentiate from existing market participants.

Technology Investment: Continuous investment in emerging technologies and digital capabilities is essential for maintaining competitiveness and meeting evolving client requirements. Prioritize technologies that enhance service delivery efficiency, improve innovation outcomes, and create sustainable competitive advantages.

Future market prospects for the Europe ER&D Services Market indicate continued strong growth driven by technological advancement, increasing engineering complexity, and evolving business models that favor specialized service providers over in-house capabilities. The market is positioned for sustained expansion across multiple dimensions.

Technology Evolution will continue to reshape service offerings, with artificial intelligence, quantum computing, and advanced materials creating new opportunities for specialized service providers. MWR projections indicate that next-generation technology services will account for 40% of market growth over the next five years, reflecting the transformative impact of emerging technologies on engineering practices.

Industry Transformation across automotive, aerospace, and healthcare sectors will drive sustained demand for specialized engineering services. The transition to electric vehicles, development of autonomous systems, and advancement of personalized medicine create substantial opportunities for service providers with relevant expertise and capabilities.

Sustainability Integration will become increasingly important as regulatory requirements and market pressures drive demand for environmentally responsible engineering solutions. Service providers with strong sustainability capabilities and green technology expertise are positioned to capture growing market share in this expanding segment.

Digital Platform Evolution will enable new service delivery models that enhance efficiency, collaboration, and innovation outcomes. Cloud-based platforms, AI-powered tools, and integrated development environments will become standard components of service offerings, creating competitive advantages for early adopters.

Market Expansion into emerging European markets and new industry sectors will provide additional growth opportunities for established service providers seeking to diversify revenue streams and expand geographic presence. These markets demonstrate strong growth potential and increasing adoption of ER&D outsourcing strategies.

The Europe Engineering Research and Development Services Market represents a dynamic and rapidly evolving sector that plays a crucial role in supporting regional innovation and industrial competitiveness. The market demonstrates exceptional growth potential driven by digital transformation, technological advancement, and increasing complexity of modern engineering challenges across diverse industry sectors.

Key success factors for market participants include developing specialized capabilities in emerging technology domains, investing in digital platforms and collaborative tools, and establishing strategic partnerships that enhance service portfolios and market reach. The integration of artificial intelligence, sustainability principles, and advanced digital technologies will continue to reshape service offerings and competitive dynamics.

Strategic positioning requires careful consideration of market trends, client requirements, and competitive pressures while maintaining focus on quality, innovation, and value creation. Organizations that successfully adapt to changing market conditions and invest in future-ready capabilities will be best positioned to capitalize on emerging opportunities and achieve sustainable growth in this expanding market.

Future outlook remains highly positive, with continued market expansion expected across multiple dimensions including technology domains, industry applications, and geographic markets. The Europe ER&D Services Market will continue to serve as a critical enabler of innovation and competitive advantage for European organizations seeking to maintain leadership in an increasingly complex and technology-driven global economy.

What is Engineering Research And Development (ER&D) Services?

Engineering Research And Development (ER&D) Services encompass a range of activities aimed at developing new products and technologies, improving existing ones, and providing engineering solutions across various industries. These services are crucial for innovation and competitiveness in sectors such as automotive, aerospace, and electronics.

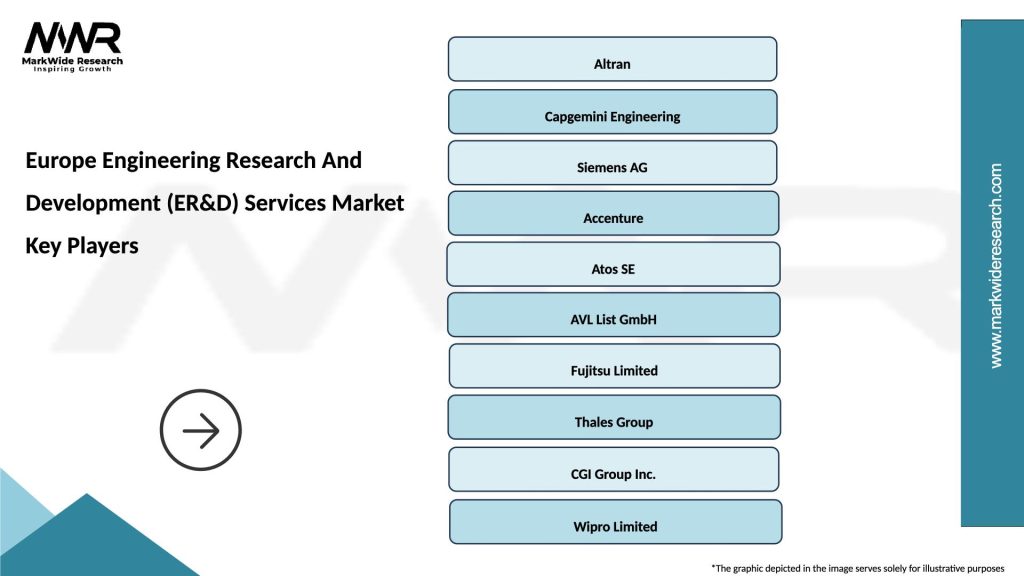

What are the key players in the Europe Engineering Research And Development (ER&D) Services Market?

Key players in the Europe Engineering Research And Development (ER&D) Services Market include companies like Siemens, Altran, and Capgemini, which provide comprehensive engineering solutions and consulting services. These companies are known for their expertise in various sectors, including automotive, telecommunications, and manufacturing, among others.

What are the growth factors driving the Europe Engineering Research And Development (ER&D) Services Market?

The Europe Engineering Research And Development (ER&D) Services Market is driven by factors such as the increasing demand for innovative products, advancements in technology, and the need for cost-effective solutions. Additionally, the growing focus on sustainability and digital transformation in industries is further propelling market growth.

What challenges does the Europe Engineering Research And Development (ER&D) Services Market face?

The Europe Engineering Research And Development (ER&D) Services Market faces challenges such as the high costs associated with R&D activities and the rapid pace of technological change. Additionally, regulatory compliance and the need for skilled labor can hinder the growth of ER&D services in the region.

What opportunities exist in the Europe Engineering Research And Development (ER&D) Services Market?

Opportunities in the Europe Engineering Research And Development (ER&D) Services Market include the rise of smart technologies, such as IoT and AI, which require advanced engineering solutions. Furthermore, the increasing collaboration between industries and research institutions presents avenues for innovation and development.

What trends are shaping the Europe Engineering Research And Development (ER&D) Services Market?

Trends shaping the Europe Engineering Research And Development (ER&D) Services Market include the growing emphasis on digital engineering, the integration of AI and machine learning in design processes, and the shift towards sustainable engineering practices. These trends are influencing how companies approach product development and innovation.

Europe Engineering Research And Development (ER&D) Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Consulting, Prototyping, Testing, Design |

| End User | Aerospace, Automotive OEMs, Electronics, Telecommunications |

| Technology | Artificial Intelligence, Internet of Things, Cloud Computing, Big Data |

| Application | Product Development, Process Optimization, Quality Assurance, Compliance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Engineering Research And Development (ER&D) Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at