444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe embedded insurance market represents a transformative shift in how insurance products are integrated into customer journeys across various industries. This innovative approach seamlessly incorporates insurance coverage into existing products and services, creating a more intuitive and accessible insurance experience for consumers throughout the European region. The market encompasses diverse sectors including automotive, travel, e-commerce, fintech, and telecommunications, where insurance products are embedded directly into the point-of-sale or service delivery process.

Market dynamics indicate robust growth driven by digital transformation initiatives, changing consumer expectations, and regulatory support for innovative insurance distribution models. The European market benefits from a sophisticated financial services infrastructure, high digital adoption rates, and progressive regulatory frameworks that encourage insurtech innovation. Key markets including Germany, the United Kingdom, France, and the Netherlands are leading the adoption of embedded insurance solutions, with growth rates exceeding 25% annually in several segments.

Technology integration plays a crucial role in market expansion, with artificial intelligence, machine learning, and API-driven platforms enabling seamless insurance embedding across digital ecosystems. The market demonstrates strong momentum in sectors where insurance naturally complements primary products or services, creating value-added propositions that enhance customer satisfaction while generating new revenue streams for businesses.

The Europe embedded insurance market refers to the comprehensive ecosystem of insurance products and services that are seamlessly integrated into non-insurance customer experiences, transactions, and digital platforms across European markets, enabling consumers to access coverage at the point of need without traditional insurance purchasing processes.

Embedded insurance fundamentally transforms the traditional insurance value chain by eliminating friction in the customer journey and making insurance coverage more accessible and contextually relevant. This approach leverages technology partnerships between insurance providers, distributors, and various industry players to create integrated solutions that address specific customer needs at optimal moments in their purchasing or service utilization experience.

The concept encompasses various distribution models including white-label insurance products, API-driven integrations, and co-branded insurance solutions that appear native to the primary service or product offering. This integration creates a more customer-centric approach to insurance distribution while enabling businesses across industries to monetize their customer relationships through relevant insurance offerings.

The European embedded insurance landscape demonstrates exceptional growth potential driven by digital transformation, regulatory innovation, and evolving consumer preferences for seamless, contextual insurance experiences. The market encompasses diverse sectors from automotive and travel to e-commerce and financial services, each presenting unique opportunities for embedded insurance integration.

Key growth drivers include increasing smartphone penetration, API economy expansion, and regulatory frameworks that support innovative insurance distribution models. The market benefits from strong fintech ecosystems, particularly in countries like the UK, Germany, and the Netherlands, where regulatory sandboxes and open banking initiatives create favorable conditions for embedded insurance development.

Market penetration rates vary significantly across sectors, with travel insurance showing adoption rates of approximately 40% in embedded formats, while automotive and e-commerce sectors demonstrate rapid growth trajectories. The competitive landscape includes traditional insurers, insurtech startups, and technology platforms, all competing to capture market share in this evolving distribution channel.

Future prospects indicate continued expansion driven by increasing consumer acceptance, technological advancement, and the growing recognition among businesses that embedded insurance can enhance customer value propositions while generating additional revenue streams.

Strategic market analysis reveals several critical insights that define the European embedded insurance landscape and its growth trajectory:

Digital transformation initiatives across European businesses create fundamental drivers for embedded insurance adoption. Organizations increasingly recognize that integrating insurance into their core customer journeys enhances value propositions while generating additional revenue streams. This digital-first approach aligns with consumer expectations for seamless, integrated experiences that eliminate traditional friction points in insurance purchasing.

Regulatory innovation throughout Europe supports embedded insurance growth through progressive frameworks that encourage insurtech development and alternative distribution models. Open banking regulations, GDPR compliance frameworks, and regulatory sandboxes create favorable conditions for embedded insurance innovation while maintaining consumer protection standards.

Consumer behavior evolution drives market expansion as European consumers increasingly prefer contextual, need-based insurance solutions over traditional annual policies. This shift toward on-demand insurance aligns perfectly with embedded insurance models that provide coverage at the point of need, creating more relevant and accessible insurance experiences.

Technology advancement enables sophisticated embedded insurance implementations through API-driven platforms, artificial intelligence, and real-time data processing capabilities. These technological foundations support seamless integration, personalized pricing, and automated claims processing that enhance the overall customer experience while reducing operational costs.

Regulatory complexity across different European jurisdictions creates challenges for embedded insurance providers seeking to scale across multiple markets. Varying insurance regulations, licensing requirements, and consumer protection standards require significant compliance investments and can slow market entry strategies for innovative embedded insurance solutions.

Technology integration challenges present obstacles for businesses seeking to implement embedded insurance solutions. Legacy systems, data security concerns, and the complexity of integrating insurance APIs into existing platforms can create implementation barriers that delay or complicate embedded insurance deployments.

Consumer trust concerns regarding data privacy and insurance coverage adequacy can limit embedded insurance adoption. Some consumers remain skeptical about insurance products offered through non-traditional channels, particularly regarding claims handling, coverage comprehensiveness, and data protection practices.

Market fragmentation across European countries creates scaling challenges for embedded insurance providers. Different languages, cultural preferences, regulatory requirements, and market maturity levels require localized approaches that increase complexity and resource requirements for market expansion strategies.

Sector expansion opportunities present significant growth potential as embedded insurance extends beyond traditional applications into new industries. Healthcare, real estate, education, and professional services sectors offer untapped opportunities for contextual insurance integration that addresses specific industry needs and customer pain points.

Cross-border harmonization initiatives within the European Union create opportunities for standardized embedded insurance solutions that can scale efficiently across multiple markets. EU digital single market initiatives and regulatory alignment efforts support the development of pan-European embedded insurance platforms.

Partnership ecosystem development offers opportunities for innovative collaboration models between insurers, technology providers, and distribution partners. Strategic alliances can accelerate market penetration while sharing development costs and risks associated with embedded insurance innovation.

Data-driven personalization capabilities enable sophisticated risk assessment and pricing models that create competitive advantages for embedded insurance providers. Real-time data integration and artificial intelligence applications support highly personalized insurance offerings that better match individual customer needs and risk profiles.

Competitive dynamics in the European embedded insurance market reflect a complex ecosystem involving traditional insurers, insurtech startups, technology platforms, and distribution partners. Traditional insurers are adapting their business models to support embedded distribution while maintaining their core underwriting capabilities and regulatory compliance expertise.

Technology evolution drives continuous market transformation through advancing API capabilities, artificial intelligence applications, and cloud-based insurance platforms. These technological improvements enable more sophisticated embedded insurance implementations while reducing integration complexity and operational costs for distribution partners.

Consumer adoption patterns show acceptance rates of approximately 60% for embedded insurance in travel and e-commerce contexts, indicating strong market receptivity when insurance is presented contextually and transparently. This adoption trend supports continued market expansion across additional sectors and use cases.

Regulatory evolution continues to shape market dynamics through progressive frameworks that balance innovation encouragement with consumer protection requirements. Ongoing regulatory developments create both opportunities and challenges for embedded insurance providers seeking to expand their market presence across European jurisdictions.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the European embedded insurance market. Primary research includes extensive interviews with industry executives, technology providers, regulatory officials, and consumer focus groups across key European markets to understand market dynamics and growth drivers.

Secondary research components encompass analysis of regulatory filings, industry reports, technology platform documentation, and financial disclosures from publicly traded companies operating in the embedded insurance space. This approach provides quantitative data to support qualitative insights gathered through primary research activities.

Market sizing methodologies utilize bottom-up and top-down approaches to validate market assessments and growth projections. Bottom-up analysis examines individual sector adoption rates and penetration levels, while top-down analysis considers overall insurance market trends and digital transformation impacts across European markets.

Data validation processes include triangulation of findings across multiple sources, expert review panels, and statistical analysis to ensure research accuracy and reliability. This rigorous approach supports confident market projections and strategic recommendations for industry participants.

Germany represents the largest European embedded insurance market, driven by strong automotive and e-commerce sectors that actively integrate insurance solutions. The German market benefits from sophisticated technology infrastructure, progressive regulatory frameworks, and high consumer acceptance of digital insurance solutions, contributing to market share of approximately 28% of the European embedded insurance landscape.

The United Kingdom demonstrates significant embedded insurance adoption across fintech and travel sectors, supported by regulatory sandboxes and open banking initiatives that encourage innovation. Despite Brexit-related regulatory changes, the UK maintains strong market position through advanced insurtech ecosystems and consumer willingness to adopt new insurance distribution models.

France and the Netherlands show rapid growth in embedded insurance adoption, particularly in mobility and e-commerce applications. These markets benefit from supportive regulatory environments and strong digital adoption rates that facilitate embedded insurance integration across various industry sectors.

Nordic countries including Sweden, Denmark, and Norway demonstrate high embedded insurance penetration rates driven by advanced digital infrastructure and consumer preferences for seamless, technology-enabled services. These markets often serve as testing grounds for innovative embedded insurance solutions before broader European deployment.

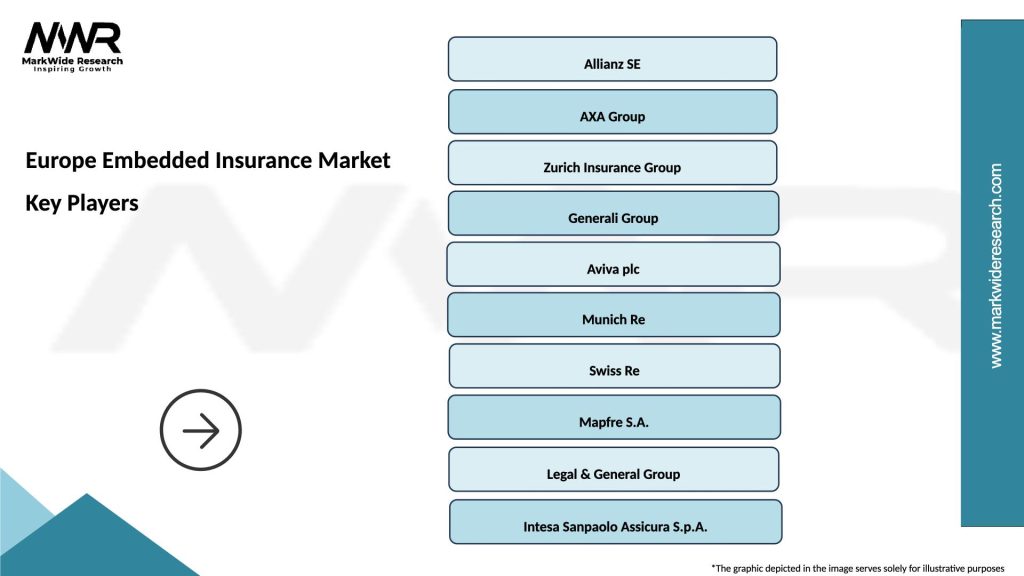

The European embedded insurance competitive landscape encompasses diverse players ranging from traditional insurers to specialized insurtech companies and technology platforms. Key market participants include:

Competitive strategies focus on technology platform development, strategic partnership formation, and sector-specific expertise development to capture market share in this rapidly evolving landscape.

By Distribution Channel:

By Insurance Type:

By Technology Platform:

E-commerce embedded insurance demonstrates the highest growth rates within the European market, driven by increasing online shopping volumes and consumer demand for product protection. This category shows penetration rates of approximately 35% across major e-commerce platforms, with particular strength in electronics, fashion, and home goods sectors.

Automotive embedded insurance represents a mature but evolving category, with traditional auto insurance increasingly supplemented by usage-based and on-demand coverage options. The rise of mobility-as-a-service platforms and electric vehicle adoption creates new opportunities for embedded insurance integration within automotive ecosystems.

Travel embedded insurance shows strong recovery following pandemic-related disruptions, with adoption rates reaching 45% on major booking platforms. This category benefits from natural insurance need alignment with travel purchasing decisions, creating high conversion rates and customer satisfaction levels.

Fintech embedded insurance emerges as a high-growth category, with banking and payment platforms increasingly offering insurance products to enhance customer relationships and generate additional revenue streams. This category demonstrates significant potential for expansion as open banking initiatives mature across European markets.

For Insurance Providers:

For Distribution Partners:

For Consumers:

Strengths:

Weaknesses:

Opportunities:

Threats:

API-First Architecture emerges as a dominant trend, with insurance providers developing comprehensive API platforms that enable seamless integration across diverse distribution channels. This approach supports rapid deployment of embedded insurance solutions while maintaining flexibility for customization and scaling across different market segments and geographic regions.

Artificial Intelligence Integration transforms embedded insurance through automated underwriting, real-time risk assessment, and personalized pricing models. AI applications enable sophisticated customer segmentation and dynamic pricing that enhances profitability while providing more accurate coverage options for consumers.

Micro-Insurance Products gain traction as embedded insurance enables cost-effective distribution of small-value, short-term coverage options. This trend supports insurance accessibility for previously underserved market segments while creating new revenue opportunities for providers and distribution partners.

Real-Time Claims Processing becomes increasingly important as consumers expect immediate resolution of insurance claims through embedded platforms. Automated claims handling and instant settlement capabilities enhance customer satisfaction while reducing operational costs for insurance providers.

Ecosystem Partnerships expand beyond traditional insurance relationships to include technology providers, data analytics companies, and industry-specific platforms. These comprehensive partnerships enable more sophisticated embedded insurance solutions that address complex customer needs across multiple touchpoints.

Regulatory Sandbox Expansions across European markets create favorable conditions for embedded insurance innovation. Countries including the UK, Netherlands, and Germany have expanded their regulatory sandbox programs to specifically accommodate embedded insurance testing and development, accelerating market innovation and adoption.

Major Partnership Announcements demonstrate growing industry confidence in embedded insurance models. Recent collaborations between traditional insurers and technology platforms indicate strategic recognition of embedded insurance as a critical distribution channel for future growth and market expansion.

Technology Platform Launches by established insurance providers signal significant investment in embedded insurance capabilities. These platforms enable rapid deployment of embedded insurance solutions across multiple distribution partners while maintaining regulatory compliance and risk management standards.

Cross-Border Expansion Initiatives reflect growing market maturity and confidence in embedded insurance scalability. Several providers have announced plans for pan-European embedded insurance platforms that leverage regulatory harmonization opportunities within the European Union.

Investment Activity in embedded insurance startups reaches record levels, with funding growth of approximately 150% year-over-year in the European market. This investment surge supports continued innovation and market expansion across diverse industry sectors and geographic regions.

MarkWide Research recommends that insurance providers prioritize API platform development and strategic partnership formation to capture embedded insurance market opportunities. Companies should focus on building flexible, scalable technology infrastructure that supports rapid integration across diverse distribution channels while maintaining regulatory compliance and risk management capabilities.

Distribution partners should evaluate embedded insurance opportunities within their core customer journeys to identify natural integration points that enhance value propositions without creating friction. Successful embedded insurance implementations require careful consideration of customer needs, regulatory requirements, and technology capabilities to ensure positive outcomes for all stakeholders.

Technology providers should develop comprehensive embedded insurance platforms that address the full value chain from product configuration to claims processing. These platforms should prioritize ease of integration, regulatory compliance, and scalability to support rapid market adoption across diverse industry sectors and geographic regions.

Regulatory bodies should continue developing progressive frameworks that balance innovation encouragement with consumer protection requirements. Clear guidelines for embedded insurance operations, data protection, and cross-border activities will support healthy market development while maintaining appropriate oversight and consumer safeguards.

Market expansion prospects indicate continued robust growth driven by increasing digital adoption, regulatory support, and evolving consumer preferences for contextual insurance solutions. MWR projects that embedded insurance will become a mainstream distribution channel across multiple industry sectors, with particularly strong growth expected in healthcare, real estate, and professional services applications.

Technology advancement will enable increasingly sophisticated embedded insurance implementations through artificial intelligence, blockchain applications, and Internet of Things integration. These technological developments will support more personalized, efficient, and transparent embedded insurance experiences that better serve consumer needs while reducing operational costs.

Regulatory harmonization across European markets will facilitate cross-border embedded insurance platform development and scaling. EU digital single market initiatives and regulatory alignment efforts will reduce compliance complexity while supporting innovation and competition in embedded insurance markets.

Consumer adoption rates are expected to reach 70% penetration in key sectors such as travel and e-commerce within the next five years, driven by improved user experiences, transparent pricing, and enhanced coverage options. This adoption growth will support continued market expansion and investment in embedded insurance capabilities across the European region.

The Europe embedded insurance market represents a transformative opportunity that fundamentally reshapes how insurance products are distributed and consumed across diverse industry sectors. The market demonstrates strong growth momentum driven by digital transformation, regulatory innovation, and evolving consumer expectations for seamless, contextual insurance experiences.

Key success factors for market participants include technology platform development, strategic partnership formation, and regulatory compliance capabilities that enable scalable embedded insurance implementations. The market rewards companies that can effectively balance innovation with risk management while delivering superior customer experiences through integrated insurance solutions.

Future market development will be characterized by continued expansion across new industry sectors, technological advancement, and regulatory harmonization that supports cross-border scaling opportunities. The embedded insurance model is positioned to become a dominant distribution channel that enhances customer value propositions while generating new revenue streams for businesses across the European economy.

What is Embedded Insurance?

Embedded Insurance refers to insurance products that are integrated into the purchase of goods or services, providing coverage seamlessly at the point of sale. This model enhances customer experience by simplifying the insurance buying process and is commonly seen in sectors like travel, automotive, and e-commerce.

What are the key players in the Europe Embedded Insurance Market?

Key players in the Europe Embedded Insurance Market include companies like Allianz, AXA, and Zurich Insurance Group, which are actively developing embedded insurance solutions. These companies focus on partnerships with technology firms and service providers to enhance their offerings, among others.

What are the main drivers of growth in the Europe Embedded Insurance Market?

The growth of the Europe Embedded Insurance Market is driven by the increasing demand for convenience among consumers, the rise of digital platforms, and the integration of insurance with various services. Additionally, advancements in technology facilitate the seamless delivery of insurance products.

What challenges does the Europe Embedded Insurance Market face?

The Europe Embedded Insurance Market faces challenges such as regulatory compliance, data privacy concerns, and the need for consumer education. These factors can hinder the adoption of embedded insurance solutions among potential customers.

What opportunities exist in the Europe Embedded Insurance Market?

Opportunities in the Europe Embedded Insurance Market include the potential for innovation in product offerings and the expansion into new sectors such as health and wellness. Additionally, partnerships with fintech companies can enhance distribution channels and customer engagement.

What trends are shaping the Europe Embedded Insurance Market?

Trends shaping the Europe Embedded Insurance Market include the increasing use of artificial intelligence for risk assessment and customer service, as well as the growing popularity of usage-based insurance models. These trends reflect a shift towards more personalized and flexible insurance solutions.

Europe Embedded Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Auto Insurance, Health Insurance, Travel Insurance, Home Insurance |

| End User | Individuals, Small Businesses, Corporates, Startups |

| Distribution Channel | Online Platforms, Insurance Brokers, Direct Sales, Mobile Apps |

| Service Type | Claims Management, Policy Administration, Risk Assessment, Customer Support |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Embedded Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at