444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe electronic test and measurement market represents a dynamic and rapidly evolving sector that encompasses sophisticated instruments, systems, and software solutions designed to validate, characterize, and optimize electronic devices and systems. This comprehensive market spans across multiple industries including telecommunications, automotive, aerospace, defense, healthcare, and consumer electronics, driving innovation and ensuring quality standards across the European continent.

Market dynamics indicate robust growth potential, with the sector experiencing a 6.8% CAGR driven by increasing complexity in electronic systems, stringent regulatory requirements, and the proliferation of emerging technologies such as 5G, Internet of Things (IoT), and artificial intelligence. The European market demonstrates particular strength in precision instrumentation, automated test equipment, and specialized measurement solutions that cater to the region’s advanced manufacturing capabilities.

Regional distribution shows Germany, France, and the United Kingdom leading market adoption with approximately 65% combined market share, while Nordic countries and Eastern European nations are experiencing accelerated growth in electronic test and measurement adoption. The market encompasses diverse product categories including oscilloscopes, spectrum analyzers, signal generators, network analyzers, and multimeters, each serving specific testing and measurement requirements across various applications.

The Europe electronic test and measurement market refers to the comprehensive ecosystem of instruments, equipment, software, and services used to evaluate, validate, and optimize the performance of electronic components, circuits, and systems across various industries throughout European countries. This market encompasses both traditional benchtop instruments and advanced automated test systems that ensure product quality, compliance, and reliability.

Electronic test and measurement solutions serve critical functions in product development, manufacturing quality control, field service, and research applications. These sophisticated tools enable engineers and technicians to measure electrical parameters, analyze signal integrity, verify performance specifications, and troubleshoot complex electronic systems with precision and accuracy.

The market includes various categories of instruments such as general-purpose test equipment for basic measurements, specialized analyzers for specific applications, and automated test systems for high-volume production environments. Additionally, the scope extends to calibration services, software solutions, and integrated measurement platforms that provide comprehensive testing capabilities for modern electronic devices and systems.

Market leadership in the Europe electronic test and measurement sector is characterized by strong technological innovation, diverse application requirements, and increasing demand for precision measurement solutions. The market demonstrates resilience and growth potential driven by digital transformation initiatives, automotive electrification trends, and expanding telecommunications infrastructure development across European nations.

Key growth drivers include the rapid adoption of 5G technology, which accounts for approximately 28% of new investment in test equipment, increasing complexity in automotive electronics, and stringent quality standards in aerospace and defense applications. The market benefits from Europe’s strong manufacturing base, advanced research institutions, and supportive regulatory environment that promotes innovation and quality excellence.

Competitive dynamics reveal a market structure dominated by established global players alongside specialized European manufacturers who focus on niche applications and customized solutions. The integration of artificial intelligence, machine learning, and cloud-based analytics is transforming traditional test and measurement approaches, creating new opportunities for market expansion and service differentiation.

Future prospects indicate sustained growth momentum supported by emerging technologies, increasing automation requirements, and expanding applications in renewable energy, electric vehicles, and smart manufacturing systems. The market is positioned to benefit from Europe’s commitment to technological sovereignty and sustainable development initiatives.

Strategic insights reveal several critical factors shaping the Europe electronic test and measurement market landscape:

Technological advancement serves as the primary catalyst for market growth, with increasing complexity in electronic systems requiring sophisticated test and measurement solutions. The proliferation of 5G networks, IoT devices, and autonomous systems creates demand for advanced measurement capabilities that can handle higher frequencies, greater signal complexity, and multi-domain analysis requirements.

Automotive industry transformation significantly impacts market dynamics, as the shift toward electric vehicles and autonomous driving systems necessitates specialized test equipment for battery management systems, power electronics, and sensor validation. The automotive sector’s adoption of advanced driver assistance systems (ADAS) and vehicle-to-everything (V2X) communication technologies drives demand for RF and microwave test solutions.

Regulatory compliance requirements across European markets mandate rigorous testing and validation procedures, particularly in telecommunications, medical devices, and aerospace applications. Stringent electromagnetic compatibility (EMC) standards and safety regulations require comprehensive measurement capabilities to ensure product compliance and market access.

Manufacturing quality initiatives emphasize zero-defect production and continuous improvement processes, driving adoption of automated test systems and statistical process control solutions. The integration of test and measurement systems with manufacturing execution systems enables real-time quality monitoring and rapid response to production variations.

High capital investment requirements present significant barriers for small and medium-sized enterprises seeking to implement advanced test and measurement solutions. The cost of sophisticated instruments, particularly those designed for emerging technologies like millimeter-wave applications and high-speed digital systems, can limit market accessibility for budget-conscious organizations.

Technical complexity associated with modern test and measurement systems requires specialized expertise and extensive training, creating challenges for organizations with limited technical resources. The rapid pace of technological change necessitates continuous skill development and equipment updates, adding to operational complexity and costs.

Market fragmentation across different European countries creates challenges related to varying standards, regulations, and customer preferences. The need to support multiple languages, compliance requirements, and local service networks can increase operational complexity for market participants.

Economic uncertainties and geopolitical factors may impact investment decisions and procurement cycles, particularly for large-scale test system implementations. Currency fluctuations and trade considerations can affect pricing strategies and market competitiveness for international suppliers.

Emerging technology adoption creates substantial opportunities for innovative test and measurement solutions, particularly in areas such as quantum computing, advanced materials characterization, and next-generation wireless technologies. The development of 6G research initiatives and terahertz applications opens new market segments for specialized measurement equipment.

Digital transformation initiatives across European industries drive demand for connected test instruments, cloud-based analytics platforms, and remote monitoring capabilities. The integration of artificial intelligence and machine learning algorithms into measurement systems enables predictive maintenance, automated fault diagnosis, and enhanced measurement accuracy.

Sustainability focus presents opportunities for energy-efficient test equipment, renewable energy system validation tools, and environmental monitoring solutions. The European Green Deal and carbon neutrality commitments create demand for specialized measurement capabilities in clean energy technologies and environmental compliance applications.

Service expansion opportunities include calibration services, equipment rental programs, and comprehensive maintenance contracts that provide predictable revenue streams and strengthen customer relationships. The development of specialized training programs and certification services addresses the growing need for skilled technicians and engineers.

Competitive intensity in the Europe electronic test and measurement market reflects a balance between established global manufacturers and specialized regional players. Market leaders leverage economies of scale, extensive R&D capabilities, and comprehensive product portfolios to maintain competitive advantages, while niche players focus on specialized applications and customized solutions.

Innovation cycles are accelerating due to rapid technological advancement and changing customer requirements. The integration of software-defined instrumentation, modular architectures, and cloud-based analytics is transforming traditional hardware-centric approaches to measurement solutions. Companies investing in next-generation platforms demonstrate 15-20% higher growth rates compared to those relying on legacy technologies.

Customer relationships are evolving from transactional equipment sales to strategic partnerships that encompass comprehensive solutions, ongoing support, and collaborative development programs. Long-term service agreements and outcome-based pricing models are becoming increasingly important for market differentiation and customer retention.

Supply chain considerations have gained prominence following recent global disruptions, with companies focusing on supply chain resilience, component availability, and local sourcing strategies. The emphasis on European technological sovereignty is influencing procurement decisions and partnership strategies across the market.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Europe electronic test and measurement market. Primary research activities include structured interviews with industry executives, technical specialists, and end-users across various sectors to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research encompasses extensive analysis of industry publications, company reports, patent filings, and regulatory documents to understand technological developments, competitive positioning, and market dynamics. Trade association data, government statistics, and academic research contribute to the comprehensive understanding of market fundamentals and growth drivers.

Quantitative analysis utilizes statistical modeling techniques to project market trends, segment performance, and regional variations. Data validation processes ensure consistency and accuracy across multiple sources, while sensitivity analysis examines the impact of various scenarios on market projections and strategic recommendations.

Expert validation involves consultation with industry thought leaders, technology specialists, and market analysts to verify findings and refine insights. This collaborative approach ensures that research conclusions reflect real-world market conditions and provide actionable intelligence for stakeholders.

Germany dominates the European electronic test and measurement market with approximately 32% market share, driven by its strong automotive industry, advanced manufacturing capabilities, and significant investment in Industry 4.0 initiatives. The country’s focus on precision engineering and quality standards creates substantial demand for sophisticated measurement solutions across multiple sectors.

France represents the second-largest market with 18% market share, supported by its aerospace and defense industries, telecommunications infrastructure development, and growing renewable energy sector. French companies demonstrate particular strength in specialized measurement applications and custom instrumentation solutions.

United Kingdom maintains significant market presence with 15% market share, despite Brexit-related uncertainties. The country’s strengths in financial services technology, telecommunications, and research institutions continue to drive demand for advanced test and measurement capabilities.

Nordic countries collectively represent a rapidly growing segment with 12% market share, led by strong adoption of 5G technology, renewable energy systems, and smart city initiatives. Sweden, Denmark, and Norway demonstrate particular strength in telecommunications test equipment and environmental monitoring solutions.

Eastern European markets show accelerating growth with 8% combined market share, driven by manufacturing expansion, automotive industry development, and increasing foreign investment in technology sectors. Poland, Czech Republic, and Hungary lead regional adoption of automated test systems and quality control solutions.

Market leadership is characterized by a diverse ecosystem of global technology companies, specialized instrument manufacturers, and regional solution providers. The competitive landscape reflects varying strengths in different product categories and application segments:

Competitive strategies focus on technological innovation, strategic partnerships, and comprehensive service offerings that address evolving customer requirements and emerging market opportunities.

By Product Type:

By Application:

By End-User:

RF and Microwave Segment demonstrates the highest growth potential with 22% market share, driven by 5G network deployment, satellite communications expansion, and automotive radar applications. Advanced capabilities in millimeter-wave testing and beamforming validation create significant opportunities for specialized equipment manufacturers.

Semiconductor Test Equipment maintains strong performance with 28% market share, supported by European semiconductor manufacturing initiatives and increasing complexity in chip design and validation. The segment benefits from growing demand for automotive semiconductors and IoT device testing capabilities.

General Purpose Instruments represent the largest segment with 35% market share, encompassing oscilloscopes, multimeters, and basic measurement tools used across multiple industries. Digital transformation and Industry 4.0 initiatives drive demand for connected instruments with advanced analytics capabilities.

Environmental Test Equipment shows steady growth with 15% market share, driven by stringent quality standards, regulatory compliance requirements, and increasing focus on product reliability. Climate testing, EMC validation, and mechanical stress testing remain critical for product certification and market access.

According to MarkWide Research analysis, the integration of artificial intelligence and machine learning capabilities across all product categories is creating new value propositions and competitive differentiation opportunities for market participants.

Manufacturers benefit from improved product quality, reduced time-to-market, and enhanced compliance with regulatory requirements through advanced test and measurement solutions. Automated test systems enable higher throughput, consistent results, and reduced labor costs in production environments.

Research institutions gain access to cutting-edge measurement capabilities that enable breakthrough discoveries, accurate characterization of new materials and devices, and validation of innovative technologies. Collaborative partnerships with instrument manufacturers provide early access to emerging measurement techniques.

Service providers can offer comprehensive calibration, maintenance, and consulting services that generate recurring revenue streams and strengthen customer relationships. Specialized expertise in emerging technologies creates opportunities for premium service offerings and market differentiation.

End-users across industries benefit from improved product reliability, reduced warranty costs, and enhanced customer satisfaction through rigorous testing and validation processes. Investment in advanced test equipment demonstrates commitment to quality and supports brand reputation in competitive markets.

Technology ecosystem participants including software developers, system integrators, and component suppliers benefit from expanding market opportunities and collaborative development programs that accelerate innovation and market adoption.

Strengths:

Weaknesses:

Opportunities:

Threats:

Software-Defined Instrumentation represents a transformative trend that enables flexible, upgradeable measurement platforms with reduced hardware dependency. This approach allows users to adapt instrument functionality through software updates and custom applications, extending equipment life and reducing total cost of ownership.

Cloud-Based Analytics integration enables remote monitoring, predictive maintenance, and collaborative analysis capabilities that enhance measurement productivity and enable new service models. The trend toward connected instruments supports real-time data sharing and centralized measurement management across distributed operations.

Artificial Intelligence Integration is revolutionizing measurement automation, fault diagnosis, and data interpretation. AI-powered instruments can automatically optimize measurement parameters, identify anomalies, and provide intelligent recommendations for troubleshooting and process improvement.

Modular Architecture adoption allows users to configure customized measurement systems that meet specific application requirements while providing scalability and future upgrade paths. This trend supports cost-effective solutions and reduces inventory complexity for system integrators.

Sustainability Initiatives drive demand for energy-efficient instruments, recyclable materials, and extended product lifecycles. Environmental considerations are becoming increasingly important in procurement decisions and product development strategies.

5G Technology Deployment has accelerated demand for advanced RF and microwave test equipment capable of handling millimeter-wave frequencies, massive MIMO systems, and beamforming validation. European telecommunications operators are investing heavily in network infrastructure that requires sophisticated measurement capabilities.

Automotive Electrification trends drive development of specialized test equipment for electric vehicle components, battery management systems, and charging infrastructure. The transition to autonomous driving systems creates additional requirements for sensor validation and communication system testing.

Semiconductor Manufacturing expansion in Europe, supported by government initiatives and private investment, increases demand for advanced wafer testing, parametric analysis, and yield optimization solutions. The focus on technological sovereignty drives local manufacturing capabilities and associated test equipment requirements.

Industry 4.0 Implementation across European manufacturing sectors emphasizes connected production systems, real-time quality monitoring, and predictive maintenance capabilities. This transformation requires integration of test and measurement systems with manufacturing execution platforms and enterprise resource planning systems.

Regulatory Evolution in areas such as electromagnetic compatibility, cybersecurity, and environmental compliance creates new testing requirements and market opportunities for specialized measurement solutions.

Investment priorities should focus on emerging technology capabilities, particularly in 5G and beyond wireless technologies, automotive electronics, and sustainable energy systems. Companies that develop early expertise in these areas will be well-positioned to capture market opportunities as these sectors mature.

Service expansion represents a critical growth strategy, with opportunities in calibration services, remote monitoring, predictive maintenance, and comprehensive support programs. MWR analysis indicates that service-oriented business models demonstrate higher customer retention rates and more predictable revenue streams.

Partnership strategies should emphasize collaboration with technology leaders, research institutions, and system integrators to accelerate innovation and market access. Strategic alliances can provide complementary capabilities and reduce time-to-market for new solutions.

Digital transformation initiatives should prioritize connected instruments, cloud-based analytics, and artificial intelligence integration to meet evolving customer expectations and competitive requirements. Investment in software capabilities and data analytics expertise will be essential for future success.

Geographic expansion opportunities exist in Eastern European markets and emerging application sectors where local presence and specialized expertise can provide competitive advantages. Understanding regional requirements and building local partnerships will be critical for success.

Market evolution toward intelligent, connected measurement systems will continue to drive innovation and create new value propositions for customers across various industries. The integration of artificial intelligence, machine learning, and cloud-based analytics will enable predictive capabilities and autonomous measurement operations that enhance productivity and reduce operational costs.

Technology convergence between traditional test equipment and software-defined platforms will accelerate, enabling more flexible, upgradeable solutions that adapt to changing requirements. This trend supports longer equipment lifecycles and reduced total cost of ownership for end-users while creating opportunities for recurring software revenue streams.

Application expansion into emerging sectors such as quantum computing, advanced materials, and next-generation energy systems will create new market segments and measurement challenges. Companies that invest in research and development for these emerging applications will be positioned to capture first-mover advantages.

Sustainability focus will become increasingly important, with customers prioritizing energy-efficient instruments, sustainable manufacturing practices, and circular economy principles. Environmental considerations will influence product design, procurement decisions, and competitive positioning across the market.

Growth projections indicate sustained market expansion with 7.2% CAGR expected over the next five years, driven by technological advancement, regulatory requirements, and expanding application areas. The market will benefit from Europe’s commitment to technological leadership and sustainable development initiatives.

The Europe electronic test and measurement market represents a dynamic and essential sector that enables innovation, quality assurance, and technological advancement across multiple industries. The market demonstrates strong growth potential driven by emerging technologies, regulatory requirements, and the ongoing digital transformation of European industries.

Key success factors for market participants include technological innovation, comprehensive service offerings, strategic partnerships, and adaptability to evolving customer requirements. The integration of artificial intelligence, cloud-based analytics, and software-defined instrumentation will be critical for maintaining competitive advantages and meeting future market demands.

Strategic opportunities exist in emerging application areas such as 5G technology, automotive electrification, renewable energy systems, and advanced manufacturing processes. Companies that invest in these growth sectors while maintaining excellence in traditional measurement applications will be well-positioned for long-term success.

Market outlook remains positive, with sustained growth expected across all major segments and regions. The emphasis on quality, compliance, and innovation in European markets creates a favorable environment for advanced test and measurement solutions that enable technological progress and competitive excellence.

What is Electronic Test And Measurement?

Electronic Test And Measurement refers to the processes and tools used to measure electrical and electronic parameters such as voltage, current, resistance, and frequency. These measurements are crucial for ensuring the performance and reliability of electronic devices and systems.

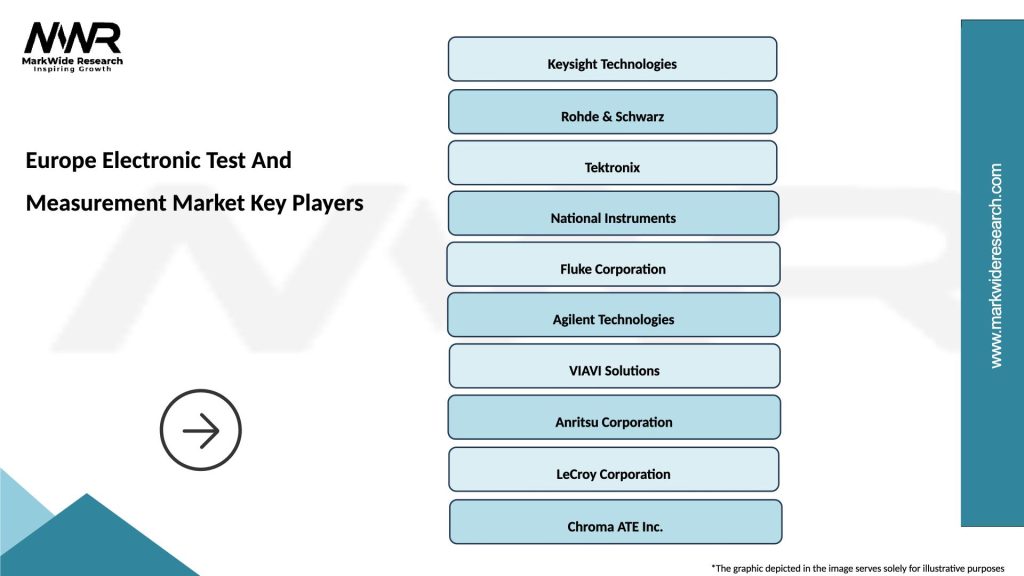

What are the key players in the Europe Electronic Test And Measurement Market?

Key players in the Europe Electronic Test And Measurement Market include companies like Keysight Technologies, Tektronix, and Rohde & Schwarz. These companies are known for their innovative testing solutions and equipment used across various industries, among others.

What are the growth factors driving the Europe Electronic Test And Measurement Market?

The growth of the Europe Electronic Test And Measurement Market is driven by the increasing demand for advanced electronic devices, the rise of the Internet of Things (IoT), and the need for stringent quality control in manufacturing processes. Additionally, the expansion of the telecommunications sector contributes significantly to market growth.

What challenges does the Europe Electronic Test And Measurement Market face?

The Europe Electronic Test And Measurement Market faces challenges such as the rapid pace of technological advancements, which can lead to obsolescence of existing equipment. Additionally, the high cost of advanced testing equipment can be a barrier for smaller companies looking to invest in new technologies.

What opportunities exist in the Europe Electronic Test And Measurement Market?

Opportunities in the Europe Electronic Test And Measurement Market include the growing demand for automation in testing processes and the increasing focus on renewable energy technologies. Furthermore, advancements in wireless communication technologies present new avenues for growth.

What trends are shaping the Europe Electronic Test And Measurement Market?

Trends shaping the Europe Electronic Test And Measurement Market include the integration of artificial intelligence in testing processes, the shift towards portable and compact testing devices, and the increasing use of cloud-based solutions for data analysis and storage. These trends are enhancing efficiency and accuracy in testing applications.

Europe Electronic Test And Measurement Market

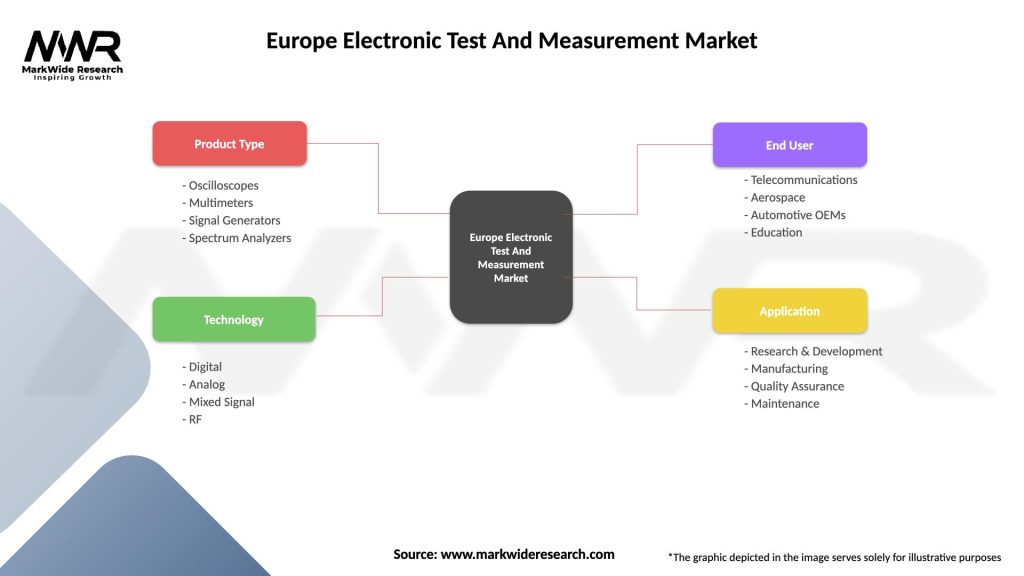

| Segmentation Details | Description |

|---|---|

| Product Type | Oscilloscopes, Multimeters, Signal Generators, Spectrum Analyzers |

| Technology | Digital, Analog, Mixed Signal, RF |

| End User | Telecommunications, Aerospace, Automotive OEMs, Education |

| Application | Research & Development, Manufacturing, Quality Assurance, Maintenance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Electronic Test And Measurement Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at