444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe electric bikes cargo market represents a rapidly expanding segment within the broader electric mobility ecosystem, driven by increasing urbanization, environmental consciousness, and the growing demand for sustainable last-mile delivery solutions. Electric cargo bikes have emerged as a transformative solution for urban logistics, offering businesses and individuals an eco-friendly alternative to traditional delivery vehicles while addressing the challenges of congested city centers and stringent emission regulations.

Market dynamics indicate robust growth potential across European nations, with countries like Germany, Netherlands, and France leading adoption rates. The market encompasses various cargo bike configurations, from compact two-wheeled models designed for personal use to heavy-duty three-wheeled variants capable of transporting substantial loads. Growth projections suggest the market is expanding at a compound annual growth rate of 12.8%, reflecting strong consumer acceptance and institutional support.

Urban mobility trends continue to favor sustainable transportation solutions, with electric cargo bikes positioned as a critical component of smart city initiatives. The integration of advanced battery technologies, improved motor efficiency, and enhanced cargo capacity has significantly expanded the practical applications of these vehicles. Commercial adoption has accelerated particularly in e-commerce, food delivery, and postal services, where businesses recognize the operational advantages and cost-effectiveness of electric cargo bikes.

The Europe electric bikes cargo market refers to the commercial ecosystem encompassing the manufacturing, distribution, and utilization of electrically-assisted bicycles specifically designed for transporting goods, packages, and cargo across European territories. These vehicles combine traditional bicycle mechanics with electric propulsion systems and specialized cargo-carrying configurations to provide sustainable urban transportation solutions.

Electric cargo bikes integrate battery-powered motors that assist pedaling, enabling users to transport heavier loads with reduced physical effort while maintaining the environmental benefits of cycling. The market includes various stakeholders, from manufacturers and component suppliers to logistics companies and end-users, all contributing to a comprehensive value chain that supports sustainable urban mobility initiatives.

Market scope encompasses both commercial and personal use applications, ranging from last-mile delivery services and urban logistics to family transportation and recreational activities. The definition extends to include supporting infrastructure, charging solutions, maintenance services, and regulatory frameworks that facilitate the adoption and operation of electric cargo bikes across European markets.

European electric cargo bike adoption has reached unprecedented levels, driven by convergent factors including environmental regulations, urban congestion challenges, and evolving consumer preferences toward sustainable mobility solutions. The market demonstrates strong momentum across multiple segments, with commercial applications leading growth while personal use continues to expand steadily.

Key market drivers include stringent emission standards, government incentives promoting electric mobility, and the increasing cost-effectiveness of electric cargo bikes compared to traditional delivery vehicles. Technology advancement in battery systems has improved range capabilities by 35% over the past three years, while motor efficiency gains have enhanced overall performance and user experience.

Regional variations reflect different adoption patterns, with Northern European countries demonstrating higher penetration rates due to established cycling infrastructure and supportive policy environments. Commercial sector adoption accounts for approximately 68% of market demand, with logistics companies, food delivery services, and e-commerce platforms driving significant volume growth.

Future prospects remain highly favorable, supported by continued urbanization, expanding e-commerce activities, and increasing corporate sustainability commitments. The market is expected to benefit from ongoing infrastructure investments, technological innovations, and evolving consumer behaviors that prioritize environmental responsibility and urban mobility efficiency.

Market intelligence reveals several critical insights shaping the European electric cargo bike landscape:

Environmental regulations serve as primary catalysts for electric cargo bike adoption across European markets. Cities implementing low emission zones and zero-emission delivery requirements are creating compelling incentives for businesses to transition from traditional vehicles to electric cargo bikes. These regulatory frameworks directly impact logistics operations, making electric alternatives increasingly attractive from both compliance and operational perspectives.

Urbanization pressures continue intensifying throughout Europe, with growing populations in city centers creating challenges for traditional delivery methods. Electric cargo bikes offer unique advantages in navigating congested urban environments, accessing pedestrian zones, and providing flexible parking solutions. Traffic congestion costs have increased operational expenses for conventional delivery vehicles, making electric cargo bikes more economically viable.

E-commerce growth has fundamentally transformed urban logistics requirements, with increasing demand for rapid, flexible delivery services. Electric cargo bikes excel in last-mile delivery applications, offering faster delivery times in dense urban areas while reducing operational costs. Consumer expectations for sustainable delivery options are also driving businesses to adopt environmentally responsible transportation solutions.

Government incentives across European nations provide substantial support for electric mobility adoption, including purchase subsidies, tax advantages, and infrastructure investments. These policy measures significantly reduce the total cost of ownership for electric cargo bikes, accelerating market penetration across both commercial and personal use segments.

High initial investment costs represent significant barriers for many potential adopters, particularly small businesses and individual users. While operational costs are generally lower than traditional vehicles, the upfront capital requirements can be substantial, especially for specialized cargo bike configurations with advanced features and higher payload capacities.

Limited range capabilities continue constraining certain applications, despite ongoing battery technology improvements. Extended delivery routes or heavy cargo loads can exceed current battery capacities, requiring careful route planning and potentially limiting operational flexibility. Charging infrastructure availability also varies significantly across European regions, creating operational challenges for commercial users.

Weather dependency affects electric cargo bike utilization, particularly in regions with harsh winter conditions or frequent precipitation. Seasonal variations in usage patterns can impact business operations and return on investment calculations, requiring companies to develop alternative transportation strategies during adverse weather periods.

Regulatory inconsistencies across European markets create complexity for manufacturers and users operating in multiple jurisdictions. Varying technical standards, licensing requirements, and operational restrictions can complicate market entry and expansion strategies, particularly for businesses seeking to scale operations across borders.

Smart city initiatives across Europe present substantial opportunities for electric cargo bike integration into comprehensive urban mobility solutions. Cities investing in connected infrastructure, traffic management systems, and sustainable transportation networks create favorable environments for electric cargo bike adoption and optimization.

Corporate sustainability commitments are driving demand for environmentally responsible logistics solutions, with many companies setting ambitious carbon reduction targets. Electric cargo bikes offer measurable environmental benefits that align with corporate social responsibility objectives while providing operational advantages in urban environments.

Technology convergence opportunities exist in integrating electric cargo bikes with emerging technologies including autonomous systems, IoT connectivity, and advanced logistics software. These integrations can enhance operational efficiency, reduce costs, and create new service models that expand market applications and value propositions.

Market expansion potential remains significant in Eastern European countries where adoption rates are currently lower but economic development and urbanization trends suggest strong future demand. Infrastructure investments in these regions are creating foundations for sustainable transportation solutions, including electric cargo bikes.

Supply chain dynamics in the European electric cargo bike market reflect a complex ecosystem of component manufacturers, assembly operations, and distribution networks. Battery technology represents a critical component, with European manufacturers increasingly developing local supply chains to reduce dependency on Asian suppliers and improve cost competitiveness.

Competitive dynamics are intensifying as traditional bicycle manufacturers expand into electric cargo segments while new entrants focus specifically on cargo applications. This competition is driving innovation in design, functionality, and pricing, ultimately benefiting end users through improved products and more competitive pricing structures.

Demand patterns show seasonal variations with peak activity during warmer months, though commercial applications maintain more consistent year-round utilization. Geographic distribution reveals concentration in major urban centers, with metropolitan areas accounting for approximately 78% of total demand.

Technology evolution continues reshaping market dynamics, with improvements in battery density, motor efficiency, and cargo capacity expanding practical applications. Integration capabilities with digital platforms and fleet management systems are becoming increasingly important for commercial users seeking operational optimization.

Market research approach employed comprehensive primary and secondary research methodologies to ensure accurate and reliable market intelligence. Primary research included extensive interviews with industry stakeholders, including manufacturers, distributors, commercial users, and regulatory authorities across major European markets.

Data collection methods incorporated multiple sources including industry surveys, expert consultations, and field observations to validate market trends and projections. MarkWide Research utilized both quantitative and qualitative research techniques to develop comprehensive market insights and identify emerging opportunities.

Geographic coverage encompassed major European markets including Germany, France, Netherlands, United Kingdom, Italy, Spain, and Nordic countries, with additional analysis of emerging markets in Eastern Europe. Regional variations in adoption patterns, regulatory environments, and market dynamics were carefully documented and analyzed.

Validation processes included cross-referencing multiple data sources, conducting follow-up interviews with key stakeholders, and analyzing historical trends to ensure accuracy and reliability of market projections and insights.

Germany leads the European electric cargo bike market, accounting for approximately 32% of regional demand. The country’s strong manufacturing base, supportive regulatory environment, and established cycling culture create ideal conditions for market growth. German cities have implemented comprehensive cycling infrastructure and cargo bike-friendly policies that facilitate commercial adoption.

Netherlands demonstrates the highest per-capita adoption rates, reflecting the country’s cycling heritage and progressive urban mobility policies. Dutch market characteristics include strong personal use adoption alongside commercial applications, with innovative cargo bike designs originating from local manufacturers gaining international recognition.

France shows rapid growth momentum, particularly in major metropolitan areas where urban logistics challenges drive commercial adoption. French government initiatives supporting electric mobility and sustainable transportation contribute to accelerating market development, with adoption rates increasing by 28% annually.

Nordic countries including Denmark, Sweden, and Norway demonstrate strong market potential despite seasonal usage patterns. These markets benefit from high environmental awareness, supportive government policies, and increasing urban density that favors sustainable transportation solutions.

Eastern European markets represent emerging opportunities with growing urbanization and improving economic conditions. Countries like Poland, Czech Republic, and Hungary show increasing interest in sustainable transportation solutions, though adoption rates remain below Western European levels.

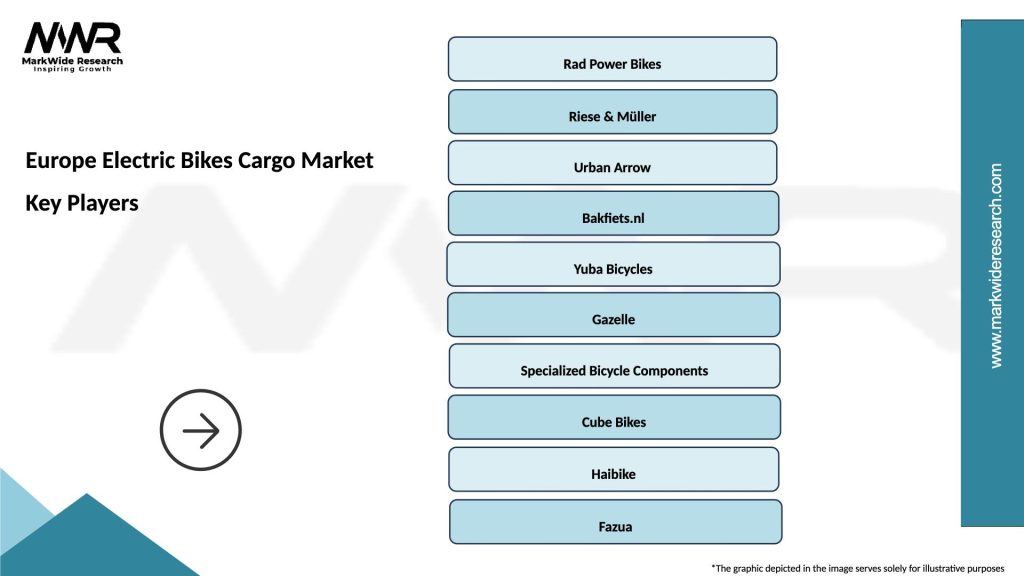

Market leadership is distributed among several key players, each bringing distinct strengths and market positioning strategies:

Competitive strategies vary from premium positioning with advanced features to value-oriented approaches targeting price-sensitive segments. Innovation focus areas include battery technology, cargo capacity optimization, and integration with digital platforms for fleet management applications.

By Product Type:

By Application:

By Battery Type:

By End User:

Commercial delivery segment dominates market demand, driven by e-commerce growth and urban logistics challenges. Professional users prioritize reliability, cargo capacity, and total cost of ownership, leading to preference for robust, feature-rich electric cargo bikes. Fleet applications are expanding rapidly, with logistics companies deploying multiple units and requiring comprehensive service support.

Personal transportation category shows steady growth, particularly in family-oriented applications where electric cargo bikes replace second cars for urban mobility. Consumer preferences emphasize ease of use, safety features, and aesthetic design, with increasing demand for customization options and accessories.

Three-wheeled configurations gain popularity in commercial applications due to enhanced stability and cargo capacity, while two-wheeled variants remain preferred for personal use due to maneuverability and traditional cycling experience. Folding designs address specific urban challenges related to storage and multi-modal transportation needs.

Battery technology preferences vary by application, with commercial users favoring high-capacity systems for extended range and intensive use, while personal users often prioritize lighter weight and lower cost solutions. Charging infrastructure compatibility becomes increasingly important as users seek convenient and flexible charging options.

Manufacturers benefit from expanding market opportunities driven by regulatory support and growing environmental awareness. Product differentiation opportunities exist through technological innovation, specialized applications, and service integration. The market offers potential for premium positioning and sustainable revenue growth through both product sales and aftermarket services.

Commercial users realize significant operational advantages including reduced fuel costs, lower maintenance requirements, and improved urban access capabilities. Total cost of ownership benefits become apparent through reduced operational expenses and potential regulatory compliance advantages. Brand positioning benefits include enhanced corporate sustainability credentials and positive customer perception.

Individual consumers gain access to sustainable transportation solutions that combine environmental benefits with practical functionality. Health benefits from increased physical activity, combined with electric assistance for challenging terrain or heavy loads, create compelling value propositions. Cost savings compared to car ownership for urban transportation needs provide additional economic incentives.

Urban planners and policymakers benefit from reduced traffic congestion, improved air quality, and enhanced urban livability. Infrastructure efficiency gains result from reduced wear on road surfaces and parking requirements. Economic development opportunities emerge through supporting local manufacturing and service industries.

Strengths:

Weaknesses:

Opportunities:

Threats:

Electrification advancement continues driving market evolution, with manufacturers developing more efficient motors, longer-lasting batteries, and intelligent power management systems. Battery technology improvements have increased average range capabilities by 42% over recent years, while reducing charging times and extending battery life cycles.

Smart connectivity integration emerges as a key differentiator, with electric cargo bikes incorporating GPS tracking, fleet management systems, and mobile app connectivity. Digital integration enables optimized route planning, predictive maintenance, and enhanced security features that appeal particularly to commercial users.

Customization and modularity trends reflect diverse user requirements, with manufacturers offering configurable cargo solutions, accessory systems, and application-specific modifications. Modular designs allow users to adapt cargo bikes for different applications and seasonal requirements, enhancing versatility and value proposition.

Service model evolution includes expanding leasing options, comprehensive maintenance packages, and fleet management services. Subscription models and mobility-as-a-service approaches are gaining traction, particularly among commercial users seeking operational flexibility and predictable cost structures.

Sustainability focus extends beyond operational use to include sustainable manufacturing practices, recyclable materials, and circular economy principles. Lifecycle sustainability considerations are becoming increasingly important for environmentally conscious consumers and businesses.

Manufacturing expansion across Europe reflects growing market confidence, with several companies establishing new production facilities and expanding existing operations. Local production strategies aim to reduce supply chain dependencies and improve cost competitiveness while supporting regional economic development.

Technology partnerships between cargo bike manufacturers and technology companies are accelerating innovation in battery systems, smart features, and connectivity solutions. Collaborative development efforts focus on creating integrated solutions that address specific market needs and user requirements.

Infrastructure investments by European cities include dedicated cargo bike lanes, charging stations, and secure parking facilities. Public-private partnerships are facilitating infrastructure development while creating supportive environments for market growth and user adoption.

Regulatory developments include standardization efforts for technical specifications, safety requirements, and operational guidelines. Harmonization initiatives across European markets aim to reduce regulatory complexity and facilitate cross-border operations for manufacturers and users.

Corporate adoption programs by major logistics companies and retailers demonstrate growing commercial acceptance. Pilot programs and fleet deployments provide valuable real-world data and user feedback that inform product development and market strategies.

Market participants should focus on developing comprehensive value propositions that address total cost of ownership rather than just initial purchase price. Service integration opportunities including maintenance, insurance, and fleet management can create competitive advantages and recurring revenue streams.

Technology investment priorities should emphasize battery technology advancement, smart connectivity features, and user experience optimization. MWR analysis suggests that companies investing in proprietary technology development will achieve stronger market positioning and differentiation capabilities.

Geographic expansion strategies should prioritize markets with supportive regulatory environments and established cycling infrastructure. Eastern European markets present significant growth opportunities but require careful market entry strategies and local partnership development.

Partnership development with logistics companies, retailers, and urban mobility service providers can accelerate market penetration and create sustainable competitive advantages. Ecosystem collaboration enables companies to offer comprehensive solutions rather than standalone products.

Sustainability positioning should encompass entire product lifecycles and supply chain operations to meet evolving customer expectations and regulatory requirements. Circular economy principles and environmental certifications can provide important competitive differentiators.

Market trajectory remains strongly positive, supported by continued urbanization, environmental regulations, and technological advancement. Growth projections indicate sustained expansion across all major European markets, with particularly strong momentum in commercial applications and emerging geographic regions.

Technology evolution will continue driving market development, with anticipated improvements in battery energy density, charging speed, and smart features. Autonomous capabilities and advanced connectivity features may emerge as important differentiators in premium market segments over the medium term.

Market maturation is expected to bring increased standardization, improved service networks, and more competitive pricing structures. MarkWide Research projects that market consolidation may occur as successful companies expand through acquisition and strategic partnerships.

Application expansion will likely extend beyond current use cases to include specialized applications in healthcare, municipal services, and emerging mobility concepts. Integration opportunities with smart city initiatives and connected transportation systems will create new value propositions and market segments.

Regulatory evolution is expected to become more supportive and standardized across European markets, facilitating cross-border operations and reducing compliance complexity. Policy support for sustainable transportation will likely continue strengthening, providing stable foundations for long-term market development.

The Europe electric bikes cargo market represents a dynamic and rapidly evolving sector with substantial growth potential driven by converging environmental, economic, and technological factors. Market fundamentals remain strong, supported by regulatory tailwinds, technological advancement, and growing recognition of operational advantages across commercial and personal use applications.

Competitive dynamics continue evolving as established players expand capabilities while new entrants bring innovative approaches and specialized solutions. Success factors increasingly emphasize comprehensive value propositions, service integration, and technological differentiation rather than traditional product-focused strategies.

Future prospects appear highly favorable, with multiple growth drivers supporting sustained market expansion across European regions. Technology advancement, infrastructure development, and evolving user preferences create foundations for continued innovation and market development. The convergence of sustainability imperatives, urban mobility challenges, and technological capabilities positions electric cargo bikes as integral components of future European transportation systems.

What is Electric Bikes Cargo?

Electric Bikes Cargo refers to electric bicycles designed specifically for transporting goods and cargo. These bikes typically feature a larger frame, enhanced storage capacity, and powerful motors to facilitate the movement of heavier loads in urban environments.

What are the key players in the Europe Electric Bikes Cargo Market?

Key players in the Europe Electric Bikes Cargo Market include companies like Rad Power Bikes, Riese & Müller, and Tern Bicycles, which are known for their innovative designs and high-quality electric cargo bikes, among others.

What are the main drivers of growth in the Europe Electric Bikes Cargo Market?

The growth of the Europe Electric Bikes Cargo Market is driven by increasing urbanization, rising environmental concerns, and the demand for sustainable transportation solutions. Additionally, government incentives for electric vehicles are also contributing to market expansion.

What challenges does the Europe Electric Bikes Cargo Market face?

The Europe Electric Bikes Cargo Market faces challenges such as regulatory hurdles, high initial costs, and limited infrastructure for electric bike usage. These factors can hinder widespread adoption and market growth.

What opportunities exist in the Europe Electric Bikes Cargo Market?

Opportunities in the Europe Electric Bikes Cargo Market include the potential for technological advancements in battery life and motor efficiency, as well as the growing trend of e-commerce which increases the demand for efficient delivery solutions.

What trends are shaping the Europe Electric Bikes Cargo Market?

Trends shaping the Europe Electric Bikes Cargo Market include the rise of smart technology integration in electric bikes, increased focus on sustainability, and the growing popularity of bike-sharing programs that incorporate cargo bikes for urban logistics.

Europe Electric Bikes Cargo Market

| Segmentation Details | Description |

|---|---|

| Product Type | Standard Cargo Bikes, Electric Cargo Bikes, Folding Cargo Bikes, Longtail Cargo Bikes |

| End User | Logistics Companies, Delivery Services, Retailers, Urban Commuters |

| Technology | Hub Motor, Mid-Drive Motor, Battery Management System, Regenerative Braking |

| Distribution Channel | Online Retail, Specialty Stores, Direct Sales, Rental Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Electric Bikes Cargo Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at