444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe dog food market represents one of the most dynamic and rapidly evolving segments within the global pet care industry. European consumers are increasingly prioritizing premium nutrition for their canine companions, driving substantial growth across multiple product categories and distribution channels. The market encompasses a diverse range of offerings, from traditional dry kibble to innovative functional foods, organic formulations, and specialized dietary solutions tailored to specific breed requirements and health conditions.

Market dynamics indicate robust expansion driven by humanization trends, where pet owners treat their dogs as family members deserving high-quality nutrition. The region’s mature pet ownership culture, combined with rising disposable incomes and growing awareness of pet health benefits, has created fertile ground for premium and super-premium dog food segments. Growth projections suggest the market will continue expanding at a compound annual growth rate of 6.2% through the forecast period, with particular strength in natural and organic product categories.

Regional variations across European countries reflect diverse consumer preferences, regulatory frameworks, and economic conditions. Western European markets, including Germany, France, and the United Kingdom, demonstrate strong demand for premium products, while Eastern European regions show increasing adoption of commercial dog food as pet ownership rates climb. The market’s evolution reflects broader societal shifts toward pet humanization, sustainability consciousness, and health-focused consumption patterns that are reshaping the entire pet care landscape.

The Europe dog food market refers to the comprehensive ecosystem of manufactured, processed, and packaged nutritional products specifically formulated for canine consumption across European countries. This market encompasses all commercial dog food products, including dry food, wet food, treats, supplements, and specialized dietary formulations distributed through various retail channels including pet specialty stores, supermarkets, online platforms, and veterinary clinics.

Market scope includes both mass-market and premium segments, covering products ranging from basic nutrition maintenance foods to sophisticated functional formulations designed for specific life stages, breed sizes, and health conditions. The definition extends beyond traditional pet food to include emerging categories such as fresh and frozen foods, raw diets, organic formulations, and therapeutic nutrition products that require veterinary prescription or recommendation.

Geographic coverage spans all European Union member countries plus the United Kingdom, Norway, and Switzerland, representing diverse regulatory environments, consumer preferences, and market maturity levels. The market definition incorporates both domestic production and imported products, reflecting the increasingly global nature of pet food manufacturing and distribution networks that serve European consumers.

Market performance across Europe demonstrates exceptional resilience and growth momentum, driven by fundamental shifts in pet ownership attitudes and spending patterns. The dog food sector has emerged as a standout performer within the broader pet care industry, benefiting from premiumization trends that see consumers willing to invest significantly more in high-quality nutrition for their pets. Premium segment growth has outpaced mass-market categories by approximately 8.5% annually, indicating strong consumer migration toward higher-value products.

Key market drivers include the humanization of pets, increasing awareness of nutrition’s role in pet health and longevity, and growing demand for natural and organic ingredients. European consumers are increasingly scrutinizing pet food labels with the same attention they apply to human food products, driving demand for transparency, traceability, and clean ingredient lists. The rise of e-commerce has also transformed distribution patterns, with online sales representing nearly 23% of total market volume.

Competitive dynamics feature a mix of global multinational corporations and regional specialty brands, with increasing market fragmentation as niche players capture specific consumer segments. Innovation focuses on functional ingredients, sustainable packaging, personalized nutrition solutions, and alternative protein sources that align with broader environmental and health consciousness trends shaping European consumer behavior.

Consumer behavior analysis reveals several critical insights shaping market evolution. European dog owners increasingly view pet nutrition as an extension of their own health and wellness priorities, leading to demand for products featuring organic ingredients, functional supplements, and specialized formulations addressing specific health concerns.

Market maturity indicators suggest European consumers have moved beyond basic nutrition requirements toward sophisticated product differentiation based on ingredients, processing methods, and brand values. This evolution creates opportunities for innovative companies while challenging traditional mass-market approaches that rely primarily on price competition.

Humanization trends represent the primary force driving European dog food market expansion. Pet owners increasingly treat their dogs as family members, leading to willingness to invest in premium nutrition products that mirror human food trends. This phenomenon has created demand for organic ingredients, grain-free formulations, and products featuring recognizable, whole-food ingredients that consumers can understand and trust.

Health consciousness among pet owners drives significant market growth as consumers recognize the connection between nutrition and pet longevity, vitality, and disease prevention. Veterinary research highlighting the role of proper nutrition in managing conditions such as obesity, joint health, and digestive issues has educated consumers about the value of investing in high-quality dog food. Preventive health approaches are gaining traction, with owners preferring to invest in superior nutrition rather than face expensive veterinary treatments later.

Demographic shifts across Europe contribute to market expansion, particularly the growing number of millennials and Generation Z consumers who prioritize pet welfare and are willing to spend premium amounts on pet care. These younger demographics often have fewer children and higher disposable incomes, leading to increased per-pet spending. Additionally, aging populations in many European countries are adopting pets for companionship, creating demand for specialized nutrition products for both senior pets and their owners.

Innovation in product development continues driving market growth through introduction of novel ingredients, processing technologies, and packaging solutions. Companies are investing heavily in research and development to create products that address specific health concerns, dietary restrictions, and lifestyle preferences. The emergence of personalized nutrition solutions, subscription services, and direct-to-consumer brands has expanded market reach and consumer engagement opportunities.

Economic sensitivity poses challenges for market growth, particularly during periods of economic uncertainty when consumers may prioritize essential expenses over premium pet products. While the pet food market generally demonstrates resilience during economic downturns, significant economic pressures can lead to trading down from premium to mass-market products, impacting overall market value growth even if volume remains stable.

Regulatory complexity across European markets creates barriers for companies seeking to expand regionally or introduce innovative products. Different countries maintain varying standards for pet food ingredients, labeling requirements, and health claims, necessitating significant investment in regulatory compliance and potentially limiting product standardization across markets. Brexit implications have added additional complexity for companies operating across UK and EU markets.

Supply chain challenges affect market stability, particularly for companies relying on imported ingredients or specialized processing facilities. Raw material price volatility, transportation costs, and availability of high-quality ingredients can impact product pricing and profitability. The COVID-19 pandemic highlighted supply chain vulnerabilities, leading to temporary shortages and increased costs that continue to influence market dynamics.

Market saturation in mature European markets limits growth opportunities for traditional product categories. High pet ownership rates and established feeding patterns in countries like Germany, France, and the UK mean that growth must come primarily from premiumization rather than market expansion. This dynamic intensifies competition and requires companies to invest heavily in differentiation and brand building to maintain market share.

Emerging market penetration presents significant opportunities in Eastern European countries where pet ownership rates and commercial dog food adoption continue growing. Countries such as Poland, Czech Republic, and Romania show strong potential for market expansion as economic development increases disposable incomes and urbanization drives demand for convenient pet care solutions. These markets offer opportunities for both premium and mass-market products as consumer sophistication develops.

Digital transformation creates numerous opportunities for market expansion through e-commerce platforms, subscription services, and direct-to-consumer business models. Online channels enable smaller brands to reach consumers without traditional retail distribution, while established companies can use digital platforms to offer personalized nutrition solutions, educational content, and enhanced customer engagement. Subscription models show particular promise for building customer loyalty and predictable revenue streams.

Functional nutrition development offers substantial growth potential as consumers seek products that address specific health concerns or provide additional benefits beyond basic nutrition. Opportunities exist for products targeting joint health, digestive wellness, cognitive function, and immune system support. The aging pet population creates particular demand for senior-specific formulations that address age-related health challenges.

Sustainability initiatives present opportunities for differentiation and premium positioning as European consumers increasingly prioritize environmental responsibility. Companies can capitalize on demand for sustainable packaging, locally sourced ingredients, alternative protein sources, and carbon-neutral production processes. Circular economy principles applied to pet food manufacturing and packaging can create competitive advantages while addressing consumer values.

Competitive intensity continues escalating across European dog food markets as established multinational corporations face increasing pressure from innovative startups and regional specialty brands. Traditional market leaders must balance maintaining market share in core segments while investing in innovation and premiumization to capture growth opportunities. Market fragmentation increases as niche brands successfully target specific consumer segments with specialized products and direct-to-consumer approaches.

Consumer education plays an increasingly important role in market dynamics as pet owners become more sophisticated about nutrition science and ingredient quality. Companies must invest in educational marketing, transparent communication, and scientific validation of product benefits to build consumer trust and justify premium pricing. Veterinary partnerships become crucial for establishing credibility and accessing professional recommendation channels.

Technology integration transforms market dynamics through applications in product development, manufacturing efficiency, and customer engagement. Artificial intelligence and data analytics enable personalized nutrition recommendations, while advanced processing technologies allow for novel ingredient incorporation and improved product quality. Smart packaging and IoT applications create opportunities for enhanced consumer interaction and brand differentiation.

Regulatory evolution continues shaping market dynamics as European authorities adapt regulations to address emerging ingredients, health claims, and sustainability requirements. Companies must maintain agility to respond to regulatory changes while investing in compliance capabilities that enable market access and competitive positioning. Harmonization efforts across European markets may create opportunities for standardization and efficiency improvements.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into European dog food market dynamics. Primary research includes extensive surveys of pet owners across major European markets, in-depth interviews with industry executives, and focus groups examining consumer preferences and purchasing behaviors. Sample sizes exceed 15,000 respondents across twelve European countries to ensure statistical significance and regional representation.

Secondary research incorporates analysis of industry reports, regulatory filings, company financial statements, and trade association data to validate primary findings and provide comprehensive market context. MarkWide Research analysts utilize proprietary databases and industry connections to access confidential market intelligence and verify data accuracy through multiple sources.

Quantitative analysis employs statistical modeling techniques to project market trends, segment growth rates, and competitive dynamics. Time series analysis of historical data enables identification of cyclical patterns and growth trajectories, while regression analysis examines relationships between market drivers and performance indicators. Forecasting models incorporate economic indicators, demographic trends, and industry-specific factors to project future market evolution.

Qualitative research provides contextual understanding of market dynamics through expert interviews, industry observation, and trend analysis. Ethnographic research methods examine consumer behavior in natural settings, while expert panels provide insights into technological developments, regulatory changes, and competitive strategies. This multi-faceted approach ensures comprehensive understanding of market complexities and emerging opportunities.

Western European markets demonstrate the highest levels of market maturity and per-capita spending on dog food products. Germany leads regional consumption with approximately 28% market share, driven by high pet ownership rates, strong economic conditions, and sophisticated consumer preferences for premium products. German consumers show particular preference for natural and organic formulations, with local brands maintaining strong positions alongside international competitors.

France represents the second-largest European market, characterized by strong demand for gourmet and artisanal dog food products that reflect the country’s culinary culture. French consumers demonstrate willingness to pay premium prices for products featuring high-quality ingredients and sophisticated flavor profiles. The market shows consistent growth of 5.8% annually, with particular strength in wet food and treat categories.

United Kingdom maintains significant market importance despite Brexit-related challenges, with consumers showing strong preference for premium and super-premium products. The UK market demonstrates high adoption of online purchasing channels, with e-commerce representing over 31% of total sales. British consumers prioritize products with clear ingredient labeling and health benefit claims, driving demand for functional nutrition solutions.

Eastern European markets show the strongest growth potential, with countries like Poland, Czech Republic, and Hungary experiencing rapid expansion in commercial dog food adoption. These markets benefit from rising disposable incomes, urbanization trends, and increasing pet ownership rates. Growth rates in Eastern Europe consistently exceed 9% annually, though from smaller baseline values compared to Western European markets.

Nordic countries demonstrate unique market characteristics with strong emphasis on sustainability, local sourcing, and environmental responsibility. Scandinavian consumers show willingness to pay premium prices for products that align with environmental values, creating opportunities for brands emphasizing sustainable practices and ethical sourcing.

Market leadership remains concentrated among several multinational corporations that leverage global scale, extensive distribution networks, and significant marketing investments to maintain dominant positions across European markets. These companies continue investing in innovation, acquisition strategies, and brand portfolio expansion to defend market share while capturing growth opportunities in premium segments.

Emerging competitors include numerous regional and specialty brands that leverage direct-to-consumer models, innovative ingredients, and niche positioning to capture market share from established players. These companies often focus on specific consumer segments, such as organic nutrition, raw feeding, or breed-specific formulations, creating competitive pressure on traditional mass-market approaches.

Product type segmentation reveals distinct growth patterns and consumer preferences across different dog food categories. Dry food maintains the largest market share due to convenience, shelf stability, and cost-effectiveness, while wet food shows strong growth driven by palatability and perceived freshness benefits. Treat categories demonstrate exceptional growth as consumers increasingly use treats for training, bonding, and health supplementation.

By Product Type:

By Life Stage:

By Distribution Channel:

Premium and super-premium segments demonstrate the strongest growth momentum across European markets, driven by consumer willingness to invest in high-quality nutrition for their pets. These categories benefit from superior ingredient quality, advanced nutritional science, and strong brand positioning that justifies premium pricing. Consumer migration from mass-market to premium products continues accelerating, with over 43% of dog owners upgrading their food choices within recent years.

Natural and organic categories show exceptional performance as European consumers increasingly prioritize clean ingredients and sustainable production methods. These segments command significant price premiums while demonstrating strong customer loyalty and repeat purchase rates. Organic certification provides competitive differentiation and appeals to environmentally conscious consumers willing to pay premium prices for products aligning with their values.

Functional nutrition products represent emerging opportunities as consumers seek foods that provide health benefits beyond basic nutrition. Products targeting joint health, digestive wellness, skin and coat condition, and cognitive function show strong growth potential. Scientific validation of health claims becomes increasingly important for consumer acceptance and regulatory compliance in these categories.

Grain-free and limited ingredient diets address growing consumer concerns about food sensitivities and digestive health. While representing smaller market segments, these categories demonstrate strong growth rates and premium pricing opportunities. Veterinary recommendations play crucial roles in driving adoption of specialized dietary formulations for dogs with specific health requirements.

Manufacturers benefit from strong market growth, premiumization trends, and opportunities for innovation-driven differentiation. The European dog food market offers stable demand, growing consumer sophistication, and willingness to pay premium prices for high-quality products. Brand building opportunities exist across multiple segments, from mass-market efficiency to premium positioning and niche specialization.

Retailers gain from high-margin pet food categories that drive customer traffic and loyalty. Pet food represents a destination category that brings consumers to stores regularly, creating opportunities for cross-selling and customer relationship building. E-commerce growth provides additional revenue streams and customer data collection opportunities for retailers investing in digital capabilities.

Ingredient suppliers benefit from growing demand for high-quality, specialized ingredients that command premium pricing. Opportunities exist for suppliers of organic ingredients, functional additives, novel proteins, and sustainable packaging materials. Innovation partnerships with pet food manufacturers create opportunities for ingredient companies to develop proprietary solutions and long-term supply relationships.

Pet owners receive access to increasingly sophisticated nutrition solutions that support their dogs’ health, longevity, and quality of life. Market competition drives continuous improvement in product quality, ingredient transparency, and value proposition. Educational resources from manufacturers and retailers help consumers make informed decisions about their pets’ nutritional needs.

Veterinary professionals gain access to advanced therapeutic nutrition tools that support their treatment protocols and client relationships. The growth of prescription diet segments provides additional revenue opportunities while enhancing patient care capabilities. Professional education programs from manufacturers support veterinary expertise development and client communication.

Strengths:

Weaknesses:

Opportunities:

Threats:

Humanization acceleration continues driving market evolution as European pet owners increasingly treat their dogs as family members deserving high-quality nutrition. This trend manifests in demand for human-grade ingredients, sophisticated flavor profiles, and products that mirror human food trends such as organic, non-GMO, and locally sourced options. Premium positioning becomes essential for brands seeking to capitalize on this fundamental shift in consumer attitudes.

Sustainability consciousness shapes purchasing decisions across European markets as consumers prioritize environmental responsibility in their pet care choices. Brands emphasizing sustainable sourcing, eco-friendly packaging, and carbon-neutral production processes gain competitive advantages. Circular economy principles applied to pet food manufacturing create opportunities for waste reduction and resource efficiency that appeal to environmentally conscious consumers.

Personalization and customization emerge as key differentiators as technology enables tailored nutrition solutions based on individual dog characteristics, health status, and lifestyle factors. Companies leverage data analytics, artificial intelligence, and direct-to-consumer models to offer customized formulations and feeding recommendations. Subscription services provide convenient delivery while building customer relationships and predictable revenue streams.

Functional ingredient integration addresses growing consumer interest in products that provide health benefits beyond basic nutrition. Ingredients such as probiotics, omega fatty acids, glucosamine, and antioxidants become standard features in premium formulations. Scientific validation of health claims becomes increasingly important for consumer acceptance and regulatory compliance.

Alternative protein exploration reflects both sustainability concerns and ingredient innovation as companies investigate novel protein sources including insects, plant-based alternatives, and lab-grown meat. These developments address environmental impact concerns while potentially offering cost advantages and nutritional benefits. Consumer acceptance varies across European markets, creating opportunities for targeted product launches and education campaigns.

Merger and acquisition activity continues reshaping the competitive landscape as established companies seek to expand their portfolios, access new technologies, and enter emerging market segments. Recent transactions focus on acquiring premium brands, direct-to-consumer capabilities, and specialized nutrition expertise. Strategic partnerships between traditional manufacturers and technology companies enable innovation in personalized nutrition and digital customer engagement.

Manufacturing investment in European production facilities reflects companies’ commitment to local sourcing, supply chain resilience, and sustainability goals. New facilities incorporate advanced processing technologies, automation systems, and environmental management systems that improve efficiency while reducing environmental impact. Capacity expansion in Eastern European countries positions companies to serve growing regional demand while optimizing logistics costs.

Regulatory developments across European markets address emerging ingredients, health claims, and sustainability requirements. New regulations governing novel protein sources, functional ingredients, and environmental impact disclosures create both opportunities and challenges for industry participants. Harmonization efforts aim to reduce regulatory fragmentation while maintaining high safety and quality standards.

Technology adoption accelerates across manufacturing, distribution, and customer engagement functions. Companies invest in artificial intelligence for formulation optimization, blockchain for supply chain transparency, and IoT devices for smart packaging applications. Digital transformation enables new business models, enhanced customer experiences, and operational efficiency improvements that provide competitive advantages.

Sustainability initiatives gain prominence as companies respond to consumer demands and regulatory pressures for environmental responsibility. Initiatives include renewable energy adoption, packaging reduction, sustainable sourcing programs, and carbon footprint reduction targets. Circular economy approaches create opportunities for waste reduction and resource efficiency while supporting brand differentiation.

Strategic positioning should focus on premium and super-premium segments where growth rates and profit margins exceed mass-market categories. Companies should invest in brand building, ingredient quality, and scientific validation to justify premium pricing and build consumer loyalty. Portfolio diversification across multiple price points and product categories provides resilience against market fluctuations while capturing different consumer segments.

Innovation investment must prioritize functional nutrition, sustainability, and personalization capabilities that address evolving consumer preferences. Companies should develop proprietary ingredients, processing technologies, and delivery systems that create competitive differentiation. Research partnerships with universities and veterinary institutions can provide scientific credibility and access to emerging technologies.

Digital transformation requires comprehensive strategies encompassing e-commerce capabilities, direct-to-consumer models, and data analytics platforms. Companies should invest in customer relationship management systems, personalization technologies, and digital marketing capabilities that enable direct customer engagement. Omnichannel approaches integrate online and offline touchpoints for seamless customer experiences.

Geographic expansion should prioritize Eastern European markets where growth rates exceed mature Western European countries. Market entry strategies should consider local preferences, regulatory requirements, and distribution partnerships that enable efficient market penetration. Localization efforts in product formulation, marketing messaging, and retail partnerships improve market acceptance and competitive positioning.

Sustainability integration should become central to business strategy rather than peripheral marketing initiatives. Companies should establish measurable environmental goals, implement sustainable sourcing programs, and develop eco-friendly packaging solutions that resonate with European consumers. Transparency initiatives including supply chain traceability and environmental impact reporting build consumer trust and brand credibility.

Market evolution through the forecast period will be characterized by continued premiumization, innovation acceleration, and digital transformation across all market segments. MarkWide Research projects sustained growth momentum with particular strength in functional nutrition, sustainable products, and personalized feeding solutions. The market will likely see increased fragmentation as niche brands capture specific consumer segments while established players defend their positions through innovation and acquisition strategies.

Consumer sophistication will continue increasing as European pet owners become more educated about nutrition science, ingredient quality, and health benefits. This trend will drive demand for transparency, scientific validation, and premium products that deliver measurable health outcomes. Veterinary influence on purchasing decisions will grow as professional recommendations become more important for therapeutic and functional nutrition products.

Technology integration will transform multiple aspects of the industry, from personalized nutrition algorithms to smart packaging applications and supply chain optimization. Companies that successfully leverage artificial intelligence, data analytics, and IoT technologies will gain competitive advantages in product development, customer engagement, and operational efficiency. Direct-to-consumer models will continue expanding, potentially reaching 35% market share by the end of the forecast period.

Sustainability requirements will become increasingly stringent as European regulations address environmental impact and consumer expectations for responsible business practices. Companies must invest in sustainable sourcing, packaging innovation, and carbon footprint reduction to maintain market access and consumer acceptance. Circular economy principles will create new opportunities for waste reduction and resource efficiency while supporting brand differentiation.

Regional dynamics will see continued growth in Eastern European markets as economic development increases pet ownership rates and commercial food adoption. Western European markets will focus on premiumization and innovation-driven growth as volume expansion opportunities become limited. Cross-border harmonization may simplify regulatory compliance while maintaining high safety and quality standards across European markets.

The Europe dog food market represents a dynamic and rapidly evolving industry characterized by strong growth momentum, increasing consumer sophistication, and continuous innovation across multiple product categories. Market fundamentals remain robust, driven by pet humanization trends, premiumization preferences, and growing awareness of nutrition’s role in pet health and longevity. Regional diversity creates opportunities for both established multinational corporations and emerging specialty brands to capture market share through targeted strategies and differentiated positioning.

Future success will depend on companies’ ability to navigate evolving consumer preferences, regulatory requirements, and competitive dynamics while maintaining focus on innovation, sustainability, and customer engagement. The market’s evolution toward premium products, functional nutrition, and personalized solutions creates opportunities for companies that invest in research and development, brand building, and digital transformation capabilities. Strategic positioning in high-growth segments such as natural and organic products, senior nutrition, and e-commerce channels will be crucial for long-term success.

Industry participants must balance growth opportunities with operational challenges including supply chain complexity, regulatory compliance, and intensifying competition. Companies that successfully integrate sustainability initiatives, leverage technology for competitive advantage, and build strong customer relationships will be best positioned to capitalize on the European dog food market’s continued expansion and evolution in the years ahead.

What is Dog Food?

Dog food refers to the commercial food products specifically formulated for the dietary needs of dogs. It includes various types such as dry kibble, wet food, and raw diets, catering to different breeds, sizes, and health requirements.

What are the key companies in the Europe Dog Food Market?

Key companies in the Europe Dog Food Market include Nestlé Purina PetCare, Mars Petcare, and Hill’s Pet Nutrition, among others. These companies dominate the market with a wide range of products tailored to various dog breeds and dietary needs.

What are the growth factors driving the Europe Dog Food Market?

The Europe Dog Food Market is driven by increasing pet ownership, rising awareness of pet nutrition, and a growing trend towards premium and organic dog food products. Additionally, the humanization of pets has led to higher spending on quality pet food.

What challenges does the Europe Dog Food Market face?

The Europe Dog Food Market faces challenges such as stringent regulations on pet food safety and quality, fluctuating raw material prices, and competition from homemade pet food options. These factors can impact production costs and market dynamics.

What opportunities exist in the Europe Dog Food Market?

Opportunities in the Europe Dog Food Market include the growing demand for specialized diets, such as grain-free and hypoallergenic options, and the rise of e-commerce platforms for pet food sales. Innovations in packaging and sustainability practices also present potential growth avenues.

What trends are shaping the Europe Dog Food Market?

Trends in the Europe Dog Food Market include an increasing focus on natural and organic ingredients, the rise of subscription-based pet food services, and the incorporation of functional ingredients that promote health benefits. These trends reflect changing consumer preferences towards healthier pet food options.

Europe Dog Food Market

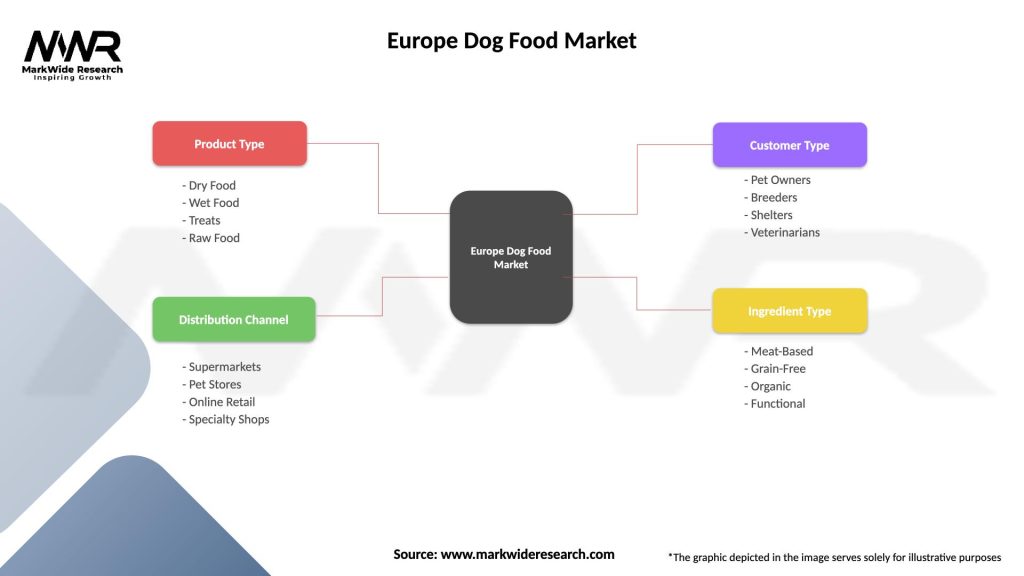

| Segmentation Details | Description |

|---|---|

| Product Type | Dry Food, Wet Food, Treats, Raw Food |

| Distribution Channel | Supermarkets, Pet Stores, Online Retail, Specialty Shops |

| Customer Type | Pet Owners, Breeders, Shelters, Veterinarians |

| Ingredient Type | Meat-Based, Grain-Free, Organic, Functional |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Dog Food Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at