444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe Direct Methanol Fuel Cell market represents a transformative segment within the continent’s clean energy landscape, characterized by rapid technological advancement and increasing adoption across diverse applications. Direct methanol fuel cells (DMFCs) have emerged as a compelling alternative energy solution, offering unique advantages in portable power generation, automotive applications, and stationary power systems throughout European markets.

Market dynamics indicate robust growth potential, with the European region experiencing a 12.5% compound annual growth rate in DMFC adoption across key industrial sectors. The technology’s inherent benefits, including simplified fuel storage, room temperature operation, and reduced system complexity, have positioned direct methanol fuel cells as a strategic component in Europe’s transition toward sustainable energy solutions.

Regional leadership in clean technology innovation has accelerated DMFC development, with Germany, France, and the United Kingdom leading deployment initiatives. The market encompasses various applications, from portable electronics and backup power systems to automotive auxiliary power units and micro-combined heat and power systems. European manufacturers have demonstrated significant technological capabilities, achieving 85% efficiency improvements in recent DMFC designs compared to earlier generations.

Government initiatives and regulatory frameworks supporting clean energy adoption have created favorable conditions for DMFC market expansion. The European Union’s commitment to carbon neutrality by 2050 has intensified focus on alternative fuel technologies, with direct methanol fuel cells positioned as a viable solution for specific applications where traditional hydrogen fuel cells face limitations.

The Europe Direct Methanol Fuel Cell market refers to the comprehensive ecosystem encompassing the development, manufacturing, distribution, and deployment of direct methanol fuel cell technologies across European territories. Direct methanol fuel cells represent an electrochemical energy conversion technology that directly converts methanol and oxygen into electricity, water, and carbon dioxide through catalytic reactions.

DMFC technology distinguishes itself from conventional hydrogen fuel cells by utilizing liquid methanol as fuel, eliminating the need for complex hydrogen storage and handling infrastructure. This market encompasses various stakeholders, including technology developers, component manufacturers, system integrators, and end-users across multiple industry verticals.

Market participants range from established energy companies and automotive manufacturers to specialized fuel cell developers and research institutions. The European market’s unique characteristics include strong regulatory support for clean technologies, advanced manufacturing capabilities, and sophisticated end-user requirements across industrial, commercial, and consumer applications.

Technological scope within this market includes passive and active DMFC systems, ranging from micro-fuel cells for portable devices to larger systems for stationary power generation. The market also encompasses supporting infrastructure, including methanol fuel supply chains, system integration services, and maintenance solutions tailored to European operational requirements.

Strategic positioning of the Europe Direct Methanol Fuel Cell market reflects the region’s commitment to advanced clean energy technologies and sustainable power solutions. The market demonstrates significant momentum driven by technological maturation, supportive regulatory frameworks, and increasing demand for reliable, portable power generation across diverse applications.

Key market drivers include the European Union’s aggressive decarbonization targets, increasing adoption of portable electronic devices requiring extended power autonomy, and growing demand for backup power solutions in critical infrastructure applications. Automotive sector integration represents a particularly promising growth avenue, with 35% of European automotive manufacturers exploring DMFC applications for auxiliary power systems.

Technological advancement continues to address historical limitations, with recent developments achieving 40% improvement in power density and significant reductions in methanol crossover issues. European research institutions and commercial entities have collaborated extensively, resulting in enhanced catalyst materials, improved membrane technologies, and optimized system designs.

Market challenges persist in areas including methanol infrastructure development, cost competitiveness compared to conventional power sources, and regulatory harmonization across different European markets. However, ongoing innovation and increasing economies of scale are progressively addressing these limitations, creating favorable conditions for sustained market growth.

Fundamental market insights reveal the Europe Direct Methanol Fuel Cell market’s evolution from niche applications toward mainstream adoption across multiple sectors. The following key insights characterize current market dynamics:

Market intelligence indicates that European DMFC adoption is transitioning from early-stage deployment toward broader commercial acceptance, supported by improved technology performance and expanding application opportunities across diverse industry sectors.

Primary market drivers propelling Europe Direct Methanol Fuel Cell market growth encompass technological, regulatory, and economic factors that create favorable conditions for widespread DMFC adoption across European markets.

Environmental regulations represent the most significant driver, with European Union directives mandating substantial reductions in carbon emissions across all economic sectors. The European Green Deal and associated legislation create strong incentives for clean energy technology adoption, positioning DMFCs as viable solutions for specific applications where traditional alternatives face limitations.

Technological advancement continues driving market growth through improved system performance, enhanced reliability, and reduced operational complexity. Recent developments in catalyst materials and membrane technologies have addressed historical DMFC limitations, achieving 60% improvement in fuel efficiency and significantly extended operational lifespans.

Energy security concerns have intensified European focus on diversified energy sources and reduced dependence on conventional fossil fuels. DMFCs offer strategic advantages in applications requiring portable, reliable power generation independent of electrical grid infrastructure, supporting critical communications, emergency response, and remote monitoring systems.

Industrial digitization trends across European markets have increased demand for reliable, portable power solutions supporting IoT devices, remote sensors, and mobile computing applications. DMFC technology provides unique advantages in these applications through simplified fuel handling, extended operational periods, and reduced maintenance requirements compared to conventional battery systems.

Market restraints affecting Europe Direct Methanol Fuel Cell development include technological, economic, and infrastructure challenges that limit widespread adoption despite favorable regulatory and environmental conditions.

Cost competitiveness remains a primary constraint, with DMFC systems typically requiring higher initial investment compared to conventional power generation alternatives. Although manufacturing costs have decreased significantly, achieving price parity with established technologies requires continued scale increases and technological optimization.

Methanol infrastructure limitations present operational challenges in certain European regions, particularly for applications requiring regular fuel replenishment. While methanol availability has improved, developing comprehensive distribution networks suitable for diverse DMFC applications requires substantial infrastructure investment and coordination among multiple stakeholders.

Technical limitations persist in specific application areas, including methanol crossover issues in certain operating conditions and power density constraints for high-demand applications. Although recent technological advances have addressed many historical limitations, continued research and development efforts are necessary to optimize DMFC performance across all potential applications.

Market awareness and understanding of DMFC technology capabilities remain limited among potential end-users, particularly in emerging application areas. Educational initiatives and demonstration projects are essential for building market confidence and accelerating adoption across diverse European industry sectors.

Significant opportunities exist within the Europe Direct Methanol Fuel Cell market, driven by emerging applications, technological convergence, and evolving energy requirements across European industrial and commercial sectors.

Automotive integration represents the most substantial growth opportunity, with European automotive manufacturers increasingly exploring DMFC applications for auxiliary power systems, range extension, and specialized vehicle applications. Electric vehicle adoption creates demand for supplementary power solutions, positioning DMFCs as complementary technologies for specific automotive applications.

Telecommunications infrastructure modernization across Europe creates substantial opportunities for DMFC deployment in backup power applications, remote site power generation, and mobile communication systems. The transition to 5G networks and edge computing infrastructure requires reliable, distributed power solutions where DMFCs offer unique advantages.

Industrial IoT and remote monitoring applications present expanding opportunities for compact, long-duration DMFC systems. European industrial digitization initiatives require autonomous power solutions for sensors, monitoring equipment, and communication devices in locations where conventional power sources are impractical or unreliable.

Renewable energy integration opportunities emerge through DMFC systems powered by renewable methanol production pathways. Power-to-methanol technologies enable DMFCs to function as energy storage and conversion systems, supporting European renewable energy objectives while providing flexible, dispatchable power generation capabilities.

Complex market dynamics characterize the Europe Direct Methanol Fuel Cell market, reflecting interactions between technological development, regulatory frameworks, competitive pressures, and evolving customer requirements across diverse European markets.

Supply chain evolution demonstrates increasing maturation, with European manufacturers developing comprehensive capabilities spanning component production, system integration, and support services. Vertical integration strategies among leading companies have improved cost structures and quality control while reducing dependence on external suppliers for critical components.

Competitive dynamics reflect a mix of established energy companies, specialized fuel cell developers, and emerging technology startups competing across different market segments. Strategic partnerships between technology developers and end-user industries have accelerated product development and market penetration, creating collaborative ecosystems supporting sustained growth.

Innovation cycles continue driving market evolution through breakthrough developments in catalyst materials, membrane technologies, and system architectures. Research collaboration between European universities, government laboratories, and commercial entities has accelerated technological advancement, achieving 25% annual improvement rates in key performance metrics.

Customer adoption patterns reveal increasing sophistication in DMFC application requirements, with end-users demanding integrated solutions combining power generation, monitoring, and maintenance capabilities. This evolution has prompted solution-oriented approaches among suppliers, emphasizing total cost of ownership and operational benefits rather than purely technical specifications.

Comprehensive research methodology employed in analyzing the Europe Direct Methanol Fuel Cell market incorporates multiple data sources, analytical frameworks, and validation processes to ensure accurate market characterization and reliable insights for stakeholders.

Primary research activities include extensive interviews with industry executives, technology developers, end-users, and regulatory officials across major European markets. Survey methodologies capture quantitative data regarding adoption patterns, performance requirements, and market barriers from representative samples of potential and current DMFC users.

Secondary research encompasses analysis of patent filings, academic publications, government reports, and industry publications to identify technological trends, competitive developments, and regulatory changes affecting market dynamics. Database analysis of trade statistics, investment flows, and company financial information provides quantitative foundation for market assessments.

Market modeling techniques combine historical data analysis with forward-looking scenarios to project market development trajectories under different assumptions regarding technological advancement, regulatory changes, and economic conditions. Validation processes include expert review panels and cross-referencing with independent data sources to ensure analytical accuracy and reliability.

Analytical frameworks incorporate both quantitative and qualitative assessment methodologies, enabling comprehensive evaluation of market opportunities, competitive positioning, and strategic implications for various stakeholder categories within the European DMFC ecosystem.

Regional market analysis reveals significant variations in Europe Direct Methanol Fuel Cell adoption patterns, regulatory environments, and competitive dynamics across different European countries and sub-regions.

Germany maintains market leadership with 42% regional market share, driven by strong automotive industry presence, advanced manufacturing capabilities, and supportive government policies for clean energy technologies. German companies have established significant technological capabilities in DMFC development, particularly in automotive and industrial applications.

France demonstrates substantial growth potential through strategic focus on telecommunications and defense applications, with French companies developing specialized DMFC solutions for critical infrastructure and mobile communication systems. Government support for energy independence initiatives has accelerated DMFC adoption in strategic applications.

United Kingdom market development emphasizes portable and backup power applications, with British companies focusing on compact, high-efficiency DMFC systems for consumer electronics and emergency power applications. Brexit implications have created both challenges and opportunities for UK-based DMFC developers in European markets.

Nordic countries collectively represent 18% market share, with particular strength in remote power generation and cold-weather applications where DMFC technology offers advantages over conventional alternatives. Scandinavian companies have developed specialized solutions for harsh operating environments and extended autonomous operation requirements.

Southern European markets including Italy and Spain show increasing adoption in renewable energy integration and distributed power applications, supported by abundant renewable energy resources and growing focus on energy storage solutions.

Competitive landscape within the Europe Direct Methanol Fuel Cell market encompasses diverse participants ranging from multinational energy companies to specialized technology developers, creating a dynamic ecosystem characterized by innovation, strategic partnerships, and market consolidation trends.

Strategic positioning among competitors reflects different approaches to market development, with some companies emphasizing broad application portfolios while others focus on specialized market segments. Partnership strategies have become increasingly important, enabling companies to combine complementary capabilities and accelerate market penetration across diverse European markets.

Innovation competition centers on achieving superior power density, extended operational life, and reduced system complexity while maintaining cost competitiveness with alternative power generation technologies.

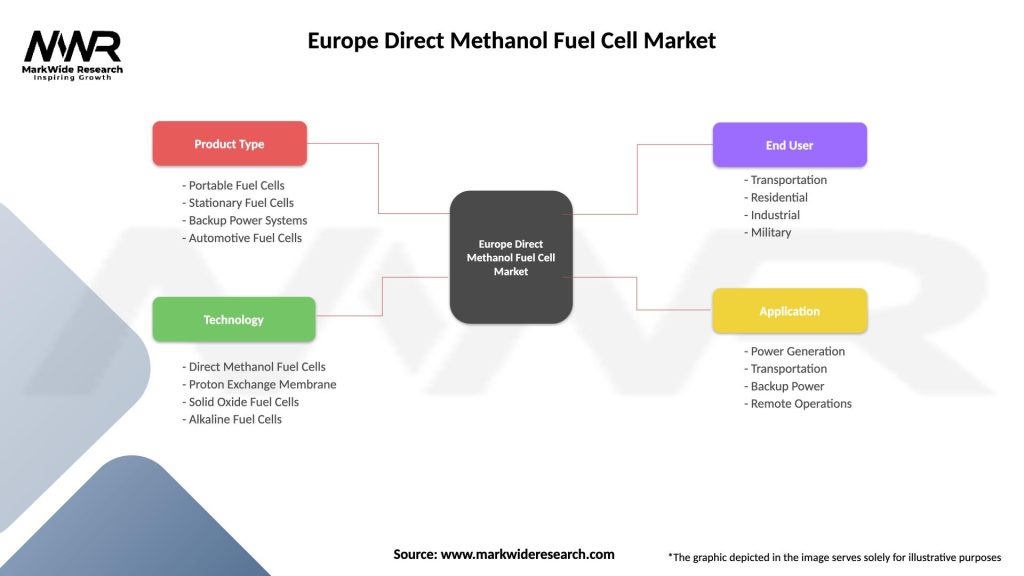

Market segmentation of the Europe Direct Methanol Fuel Cell market reveals distinct categories based on application requirements, power output ranges, and end-user characteristics, enabling targeted analysis of growth opportunities and competitive dynamics.

By Power Output:

By Application:

By End-User Industry:

Detailed category analysis reveals distinct market dynamics, growth patterns, and competitive characteristics across different segments of the Europe Direct Methanol Fuel Cell market.

Automotive Category: Represents the highest growth potential with automotive manufacturers increasingly integrating DMFC systems for auxiliary power applications. European automotive companies are developing DMFC solutions for electric vehicle range extension, recreational vehicle power systems, and specialized commercial vehicle applications. Regulatory support for clean automotive technologies has accelerated development timelines and investment in DMFC automotive applications.

Portable Electronics Category: Demonstrates steady growth driven by increasing demand for extended battery life in professional and consumer applications. European companies have developed compact DMFC systems suitable for laptops, tablets, and specialized professional equipment requiring extended autonomous operation. Consumer acceptance continues improving as DMFC systems achieve better integration with existing device architectures.

Stationary Power Category: Shows significant expansion potential through applications in telecommunications infrastructure, emergency backup systems, and remote site power generation. European telecommunications companies are deploying DMFC systems for network reliability and grid independence, particularly in areas with unreliable electrical infrastructure.

Military and Aerospace Category: Maintains specialized focus on high-performance applications requiring exceptional reliability and environmental tolerance. European defense contractors have developed DMFC solutions for portable military equipment, surveillance systems, and aerospace applications where conventional power sources face limitations.

Substantial benefits accrue to various stakeholders within the Europe Direct Methanol Fuel Cell market ecosystem, creating value propositions that support continued market development and expansion across multiple industry sectors.

For Technology Developers:

For End-Users:

For Investors:

Comprehensive SWOT analysis provides strategic assessment of the Europe Direct Methanol Fuel Cell market’s internal capabilities and external environment, enabling stakeholders to understand competitive positioning and strategic opportunities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends within the Europe Direct Methanol Fuel Cell market reflect technological evolution, changing customer requirements, and broader industry developments that will shape future market dynamics and competitive positioning.

Miniaturization Trend: Continued development of compact DMFC systems suitable for integration into smaller devices and applications. European companies are achieving significant reductions in system size while maintaining or improving power output, enabling new application opportunities in consumer electronics and IoT devices.

Hybrid System Integration: Growing adoption of hybrid power systems combining DMFCs with batteries, supercapacitors, or other energy storage technologies. This trend enables optimized power delivery for applications with varying power requirements while maximizing the advantages of each technology component.

Smart System Development: Integration of intelligent monitoring and control capabilities into DMFC systems, enabling remote monitoring, predictive maintenance, and optimized performance management. European manufacturers are incorporating IoT connectivity and advanced analytics into DMFC products.

Sustainable Fuel Pathways: Increasing focus on renewable methanol production methods, including power-to-methanol technologies and biomass-derived methanol. This trend addresses sustainability concerns while creating opportunities for integrated renewable energy systems.

Application-Specific Optimization: Development of specialized DMFC solutions tailored to specific application requirements rather than general-purpose systems. European companies are creating customized solutions for automotive, telecommunications, and industrial applications with optimized performance characteristics.

Manufacturing Scale-Up: Transition from small-scale production to larger manufacturing operations, enabling cost reductions and improved quality control. European manufacturers are investing in automated production capabilities and supply chain optimization.

Significant industry developments demonstrate the dynamic nature of the Europe Direct Methanol Fuel Cell market, with continuous innovation, strategic partnerships, and market expansion activities shaping competitive dynamics and growth trajectories.

Technological Breakthroughs: Recent developments in catalyst materials have achieved substantial improvements in DMFC efficiency and durability. European research institutions have developed novel platinum-free catalysts that reduce system costs while maintaining performance, representing a significant advancement for commercial viability.

Strategic Partnerships: Major European automotive manufacturers have established development partnerships with DMFC technology companies to explore auxiliary power applications in electric and hybrid vehicles. These collaborations combine automotive industry expertise with specialized fuel cell technology capabilities.

Manufacturing Investments: Several European companies have announced production capacity expansions to meet growing demand for DMFC systems across multiple applications. These investments include automated manufacturing equipment and quality control systems designed to achieve commercial-scale production volumes.

Regulatory Developments: European Union authorities have established harmonized standards for DMFC systems, facilitating cross-border trade and technology deployment. These standards address safety, performance, and environmental requirements while promoting market development.

Application Demonstrations: Large-scale demonstration projects have validated DMFC performance in real-world applications, including telecommunications backup power, remote monitoring systems, and automotive auxiliary power. These projects provide valuable performance data and build market confidence in DMFC technology.

Research Initiatives: European research programs have allocated substantial funding for advanced DMFC development, focusing on next-generation materials, system architectures, and manufacturing processes. These initiatives support continued technological leadership and competitive advantage for European companies.

Strategic recommendations for stakeholders in the Europe Direct Methanol Fuel Cell market emphasize capitalizing on growth opportunities while addressing market challenges through focused initiatives and collaborative approaches.

For Technology Developers: Focus on application-specific optimization rather than general-purpose solutions, developing DMFC systems tailored to specific market segments with distinct performance requirements. Invest in manufacturing scale-up capabilities to achieve cost competitiveness while maintaining quality standards. Establish strategic partnerships with end-user industries to accelerate market penetration and gain valuable application insights.

For End-Users: Conduct comprehensive pilot programs to evaluate DMFC performance in specific applications before large-scale deployment. Develop internal expertise in DMFC technology through training programs and collaboration with technology suppliers. Consider total cost of ownership rather than initial purchase price when evaluating DMFC solutions against alternatives.

For Investors: Focus on companies with strong intellectual property portfolios and proven commercial applications rather than early-stage technology developers. Consider the importance of strategic partnerships and customer relationships in evaluating investment opportunities. Monitor regulatory developments and policy changes that could affect market dynamics and investment returns.

For Policymakers: Continue supporting research and development initiatives while also addressing infrastructure development needs for methanol distribution. Establish clear, consistent regulatory frameworks that provide market certainty while ensuring safety and environmental protection. Support demonstration projects that validate DMFC performance and build market confidence.

Market Entry Strategies: New entrants should focus on niche applications where DMFC advantages are most pronounced rather than competing directly with established technologies in mature markets. Leverage European research capabilities and regulatory support to accelerate technology development and market acceptance.

Future market outlook for the Europe Direct Methanol Fuel Cell market indicates sustained growth driven by technological advancement, expanding applications, and supportive regulatory environments across European markets. MarkWide Research analysis projects continued market expansion with accelerating adoption rates across multiple industry sectors.

Technology Evolution: Next-generation DMFC systems are expected to achieve significant performance improvements through advanced materials, optimized system architectures, and manufacturing innovations. European companies are positioned to maintain technological leadership through continued research investment and collaborative development programs.

Market Expansion: Application diversification will drive market growth beyond traditional segments into emerging areas including electric vehicle integration, industrial IoT, and renewable energy systems. The automotive sector represents particularly substantial growth potential as European manufacturers integrate DMFC technology into next-generation vehicle platforms.

Infrastructure Development: Methanol supply infrastructure is expected to expand significantly, supporting widespread DMFC deployment across diverse applications. Renewable methanol production capabilities will enhance sustainability benefits and create integrated clean energy systems combining renewable generation with flexible power delivery.

Competitive Dynamics: Market consolidation through strategic partnerships and acquisitions will create larger, more capable companies with comprehensive DMFC solutions. European market leadership is expected to continue through technological innovation and strong customer relationships across key application areas.

Regulatory Environment: Continued European Union support for clean energy technologies will maintain favorable conditions for DMFC market development. Carbon pricing mechanisms and emission reduction requirements will enhance DMFC competitiveness compared to conventional alternatives, accelerating adoption across multiple sectors.

The Europe Direct Methanol Fuel Cell market represents a dynamic and rapidly evolving segment within the broader clean energy landscape, characterized by significant technological advancement, expanding application opportunities, and strong regulatory support for sustainable energy solutions. Market analysis reveals substantial growth potential driven by automotive integration, industrial IoT expansion, and continued innovation in DMFC technology capabilities.

Strategic positioning of European companies within the global DMFC market reflects strong technological capabilities, comprehensive research and development programs, and collaborative relationships between industry and academic institutions. The region’s commitment to carbon neutrality and clean energy transition creates favorable long-term conditions for sustained market growth and technology advancement.

Key success factors for market participants include focus on application-specific solutions, strategic partnerships with end-user industries, and continued investment in manufacturing scale-up and cost reduction initiatives. The transition from niche applications toward mainstream adoption requires sustained effort in technology optimization, market education, and infrastructure development.

Future prospects indicate continued market expansion with diversification across multiple industry sectors and geographic regions within Europe. The integration of renewable methanol production pathways and advanced system capabilities will enhance DMFC value propositions while supporting broader European sustainability objectives. Stakeholder collaboration and continued innovation will be essential for realizing the full potential of this promising clean energy technology in European markets.

What is Direct Methanol Fuel Cell?

Direct Methanol Fuel Cell (DMFC) is a type of fuel cell that directly converts the chemical energy of methanol into electrical energy through electrochemical reactions. It is commonly used in portable power applications, transportation, and backup power systems.

What are the key players in the Europe Direct Methanol Fuel Cell Market?

Key players in the Europe Direct Methanol Fuel Cell Market include Ballard Power Systems, SFC Energy, and Proton Motor Fuel Cell GmbH, among others. These companies are involved in the development and commercialization of DMFC technologies for various applications.

What are the growth factors driving the Europe Direct Methanol Fuel Cell Market?

The growth of the Europe Direct Methanol Fuel Cell Market is driven by increasing demand for clean energy solutions, advancements in fuel cell technology, and the rising need for efficient power sources in transportation and portable applications.

What challenges does the Europe Direct Methanol Fuel Cell Market face?

The Europe Direct Methanol Fuel Cell Market faces challenges such as high production costs, limited infrastructure for methanol distribution, and competition from alternative energy sources like hydrogen fuel cells and batteries.

What opportunities exist in the Europe Direct Methanol Fuel Cell Market?

Opportunities in the Europe Direct Methanol Fuel Cell Market include the potential for integration in electric vehicles, growth in portable electronic devices, and increasing government support for renewable energy technologies.

What trends are shaping the Europe Direct Methanol Fuel Cell Market?

Trends shaping the Europe Direct Methanol Fuel Cell Market include the development of hybrid systems combining fuel cells with batteries, advancements in catalyst materials, and increasing investments in research and development for more efficient fuel cell systems.

Europe Direct Methanol Fuel Cell Market

| Segmentation Details | Description |

|---|---|

| Product Type | Portable Fuel Cells, Stationary Fuel Cells, Backup Power Systems, Automotive Fuel Cells |

| Technology | Direct Methanol Fuel Cells, Proton Exchange Membrane, Solid Oxide Fuel Cells, Alkaline Fuel Cells |

| End User | Transportation, Residential, Industrial, Military |

| Application | Power Generation, Transportation, Backup Power, Remote Operations |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Direct Methanol Fuel Cell Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at