444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe digital transformation market represents a dynamic and rapidly evolving landscape that encompasses the comprehensive integration of digital technologies across traditional business operations, processes, and customer experiences. European organizations are increasingly embracing digital transformation initiatives to enhance operational efficiency, drive innovation, and maintain competitive advantages in an increasingly connected global economy.

Digital transformation in Europe spans multiple sectors including manufacturing, healthcare, financial services, retail, and public sector organizations. The market is characterized by significant adoption of cloud computing, artificial intelligence, Internet of Things (IoT), blockchain technology, and advanced analytics solutions. European businesses are experiencing substantial growth in digital transformation investments, with adoption rates increasing by 12.5% annually across various industry verticals.

Regional dynamics play a crucial role in shaping the European digital transformation landscape. Countries such as Germany, France, the United Kingdom, and Nordic nations are leading the charge in digital innovation, while emerging markets in Eastern Europe are rapidly catching up. The market demonstrates strong momentum driven by regulatory support, technological infrastructure development, and increasing digital literacy among both businesses and consumers.

Market penetration varies significantly across different European regions, with Western European countries showing 65% higher adoption rates compared to their Eastern European counterparts. However, this gap is narrowing as government initiatives and EU-wide digital strategies promote inclusive digital transformation across all member states.

The Europe digital transformation market refers to the comprehensive ecosystem of technologies, services, and solutions that enable European organizations to fundamentally change their business models, operations, and value propositions through digital technologies. This transformation encompasses the strategic adoption of digital tools to create new revenue streams, improve customer experiences, and optimize operational processes.

Digital transformation in the European context involves the integration of cutting-edge technologies such as artificial intelligence, machine learning, cloud computing, big data analytics, and automation solutions into existing business frameworks. European enterprises leverage these technologies to modernize legacy systems, enhance decision-making capabilities, and create more agile and responsive organizational structures.

The market encompasses various components including digital infrastructure, software solutions, consulting services, system integration, and managed services. European organizations utilize these elements to undergo comprehensive digital modernization that affects every aspect of their operations, from customer-facing applications to backend processes and supply chain management.

The European digital transformation market demonstrates exceptional growth momentum driven by increasing demand for technological modernization across multiple industry sectors. Organizations throughout Europe are prioritizing digital initiatives to enhance competitiveness, improve operational efficiency, and meet evolving customer expectations in an increasingly digital-first economy.

Key market drivers include the accelerated adoption of cloud technologies, growing emphasis on data-driven decision making, and the need for enhanced cybersecurity measures. European businesses are investing heavily in digital transformation initiatives, with 78% of organizations reporting increased technology spending compared to previous years. Cloud adoption represents a particularly significant trend, with European enterprises showing 45% growth in cloud service utilization.

Industry verticals such as manufacturing, healthcare, financial services, and retail are leading digital transformation adoption. Manufacturing companies are implementing Industry 4.0 solutions, while healthcare organizations are leveraging telemedicine and digital health platforms. Financial services continue to drive innovation through fintech solutions and digital banking platforms.

Regional leadership remains concentrated in Western European countries, with Germany, France, and the United Kingdom maintaining strong positions in digital transformation investments. However, Eastern European markets are experiencing rapid growth, supported by EU digital strategy initiatives and increasing foreign investment in technology infrastructure.

European digital transformation initiatives are fundamentally reshaping how organizations operate, compete, and deliver value to customers. The following insights highlight critical aspects of this transformative market:

Several key factors are propelling the growth of the European digital transformation market, creating unprecedented opportunities for technology adoption and business modernization across various industry sectors.

Competitive pressure represents a primary driver as European organizations face increasing competition from digitally native companies and global technology leaders. Traditional businesses are compelled to undergo digital transformation to maintain market relevance and customer loyalty. Customer expectations have evolved significantly, with consumers demanding seamless digital experiences, personalized services, and omnichannel engagement capabilities.

Regulatory support from the European Union plays a crucial role in driving digital transformation adoption. The EU’s Digital Single Market strategy and various national digitalization initiatives provide funding, policy support, and regulatory frameworks that encourage technology adoption. Government incentives and digital transformation grants are particularly influential in accelerating adoption among small and medium enterprises.

Technological advancement and decreasing costs of digital technologies make transformation initiatives more accessible to organizations of all sizes. Cloud computing, artificial intelligence, and automation solutions have become more affordable and easier to implement, reducing barriers to digital adoption. Data proliferation and the need for advanced analytics capabilities drive organizations to invest in digital platforms that can process and analyze large volumes of information.

Operational efficiency requirements motivate European businesses to adopt digital solutions that streamline processes, reduce costs, and improve productivity. Automation technologies enable organizations to optimize resource allocation and eliminate manual, repetitive tasks. Remote work trends accelerated by recent global events have further emphasized the importance of digital infrastructure and collaboration tools.

Despite significant growth potential, the European digital transformation market faces several challenges that may limit adoption rates and implementation success across various organizations and industry sectors.

High implementation costs represent a significant barrier, particularly for small and medium enterprises with limited technology budgets. Digital transformation initiatives often require substantial upfront investments in infrastructure, software licenses, consulting services, and employee training. Return on investment concerns and lengthy payback periods can deter organizations from pursuing comprehensive transformation projects.

Skills shortage poses a critical challenge as European organizations struggle to find qualified professionals with expertise in emerging technologies. The demand for digital transformation specialists, data scientists, cybersecurity experts, and cloud architects significantly exceeds supply. Talent competition among organizations drives up recruitment costs and project timelines.

Legacy system integration complexities create technical challenges for organizations with established IT infrastructure. Many European businesses operate legacy systems that are difficult to integrate with modern digital platforms, requiring extensive customization and potentially disruptive migration processes. Data migration and system compatibility issues can significantly increase project complexity and costs.

Cybersecurity concerns and data privacy regulations create additional complexity for digital transformation initiatives. European organizations must navigate strict GDPR requirements and implement robust security measures to protect digital assets. Compliance costs and the risk of regulatory penalties can slow transformation progress and increase implementation expenses.

Change management challenges within organizations can impede successful digital transformation adoption. Employee resistance to new technologies, cultural barriers, and inadequate change management processes can undermine transformation initiatives. Organizational inertia and risk-averse corporate cultures may limit the scope and pace of digital adoption.

The European digital transformation market presents numerous opportunities for growth, innovation, and value creation across various industry sectors and technology domains.

Emerging technologies such as artificial intelligence, machine learning, and advanced analytics offer significant opportunities for European organizations to gain competitive advantages. AI-powered solutions can enhance decision-making processes, automate complex tasks, and create new business models. Organizations that successfully integrate these technologies can achieve substantial operational improvements and market differentiation.

Industry-specific solutions represent a growing opportunity as technology providers develop specialized digital transformation platforms for healthcare, manufacturing, financial services, and other sectors. Vertical market focus enables more targeted solutions that address specific industry challenges and regulatory requirements, creating opportunities for specialized service providers and technology vendors.

Small and medium enterprise digital transformation represents an underserved market segment with significant growth potential. As digital technologies become more accessible and affordable, SMEs are increasingly adopting transformation initiatives. Cloud-based solutions and software-as-a-service offerings make enterprise-grade technologies available to smaller organizations with limited IT resources.

Sustainability-focused digital transformation initiatives align with European environmental goals and corporate social responsibility objectives. Organizations can leverage digital technologies to reduce energy consumption, optimize resource utilization, and minimize environmental impact. Green technology solutions create opportunities for providers that can demonstrate environmental benefits alongside operational improvements.

Cross-border collaboration and EU-wide digital initiatives create opportunities for technology providers to serve multiple European markets through standardized solutions. Digital Single Market policies facilitate technology adoption across member states, enabling scalable business models and reduced market entry barriers.

The European digital transformation market operates within a complex ecosystem of technological, economic, and regulatory factors that influence adoption patterns, investment decisions, and market growth trajectories.

Technology evolution continues to reshape market dynamics as new innovations emerge and mature technologies become more accessible. The convergence of cloud computing, artificial intelligence, IoT, and blockchain technologies creates synergistic opportunities for comprehensive digital transformation solutions. Integration capabilities between different technology platforms enable more sophisticated and effective transformation initiatives.

Competitive landscape dynamics are intensifying as traditional technology vendors compete with cloud-native providers and specialized digital transformation consultancies. Partnership ecosystems are becoming increasingly important as organizations seek comprehensive solutions that combine multiple technologies and services. Strategic alliances between technology providers, system integrators, and consulting firms create more robust market offerings.

Customer behavior patterns are evolving as European organizations become more sophisticated in their digital transformation approaches. Businesses are moving beyond simple technology adoption to focus on strategic transformation that fundamentally changes business models and value propositions. Outcome-based procurement models are gaining popularity as organizations seek measurable results from their digital investments.

Regulatory environment continues to influence market dynamics through data protection requirements, cybersecurity mandates, and industry-specific compliance standards. GDPR compliance remains a critical consideration for all digital transformation initiatives, while emerging regulations around AI and automated decision-making create new requirements for technology implementations.

Economic factors including inflation, interest rates, and economic uncertainty affect digital transformation investment decisions. However, many European organizations view digital transformation as essential for long-term competitiveness, maintaining investment levels even during economic challenges. Cost optimization through digital transformation often justifies continued investment despite economic pressures.

Comprehensive market research for the European digital transformation market employs multiple methodologies to ensure accurate, reliable, and actionable insights for stakeholders across the technology ecosystem.

Primary research involves extensive interviews with key market participants including technology vendors, system integrators, consulting firms, and end-user organizations across various European countries. Survey methodologies capture quantitative data on adoption rates, investment levels, technology preferences, and implementation challenges from representative samples of European businesses.

Secondary research incorporates analysis of industry reports, government publications, regulatory documents, and academic studies related to digital transformation trends in Europe. Market intelligence gathering includes monitoring of technology vendor announcements, partnership agreements, merger and acquisition activities, and funding rounds within the European digital transformation ecosystem.

Data validation processes ensure research accuracy through triangulation of multiple data sources, expert review panels, and statistical analysis techniques. Quality assurance measures include peer review of research findings, validation of key statistics, and verification of market trends through multiple independent sources.

Geographic coverage encompasses all major European markets including Western Europe, Eastern Europe, and Nordic countries. Sector analysis covers key industry verticals such as manufacturing, healthcare, financial services, retail, telecommunications, and public sector organizations to provide comprehensive market insights.

The European digital transformation market exhibits distinct regional characteristics influenced by economic development levels, regulatory environments, technological infrastructure, and cultural factors across different European countries and regions.

Western Europe maintains market leadership with countries such as Germany, France, and the United Kingdom driving significant digital transformation investments. German manufacturing companies lead Industry 4.0 adoption, while French organizations focus on AI and data analytics implementations. The UK continues to demonstrate strong fintech innovation despite Brexit-related uncertainties. Western European markets account for approximately 60% of total regional digital transformation activity.

Nordic countries including Sweden, Denmark, Norway, and Finland demonstrate exceptional digital maturity and high technology adoption rates. These markets are characterized by strong government support for digitalization, advanced telecommunications infrastructure, and high levels of digital literacy. Nordic organizations show 85% higher cloud adoption rates compared to the European average, driven by progressive regulatory environments and technology-forward business cultures.

Eastern Europe represents the fastest-growing segment of the European digital transformation market, with countries such as Poland, Czech Republic, and Romania experiencing rapid technology adoption. EU funding programs and foreign investment are accelerating digital infrastructure development in these markets. Eastern European organizations are increasingly implementing digital transformation initiatives, with growth rates exceeding 20% annually in several countries.

Southern Europe including Italy, Spain, and Portugal is experiencing steady growth in digital transformation adoption, supported by government digitalization initiatives and EU recovery funds. Italian manufacturing and Spanish telecommunications sectors are leading regional transformation efforts, while Portuguese organizations focus on digital government and smart city initiatives.

The European digital transformation market features a diverse competitive landscape comprising global technology giants, regional specialists, and emerging innovative companies that provide comprehensive transformation solutions and services.

Market competition is intensifying as traditional technology vendors expand their digital transformation portfolios while new entrants introduce innovative solutions. Partnership strategies are becoming increasingly important as companies collaborate to provide comprehensive transformation solutions that address complex customer requirements.

Competitive differentiation focuses on industry expertise, implementation capabilities, and outcome-based service models. Companies that can demonstrate measurable business results and provide end-to-end transformation support maintain competitive advantages in the European market.

The European digital transformation market can be segmented across multiple dimensions to provide detailed insights into specific market segments, customer requirements, and growth opportunities.

By Technology:

By Industry Vertical:

By Organization Size:

Cloud computing represents the largest and fastest-growing category within the European digital transformation market. Organizations are increasingly adopting hybrid and multi-cloud strategies to optimize performance, reduce costs, and maintain flexibility. European businesses show strong preference for hybrid cloud deployments that combine public cloud scalability with private cloud security and control.

Artificial intelligence adoption is accelerating across European organizations, with particular strength in predictive analytics, customer service automation, and process optimization applications. AI implementations are showing measurable business impact, with organizations reporting 25-30% efficiency improvements in automated processes.

Cybersecurity solutions are experiencing robust demand driven by increasing cyber threats and strict European data protection regulations. Organizations are investing in comprehensive security platforms that provide threat detection, incident response, and compliance management capabilities. Security spending represents approximately 15% of total digital transformation budgets across European organizations.

IoT implementations are gaining momentum particularly in manufacturing, healthcare, and smart city applications. European organizations are leveraging IoT technologies to enable predictive maintenance, optimize resource utilization, and improve operational visibility. Industrial IoT adoption is particularly strong in German and Nordic manufacturing companies.

Big data analytics platforms are becoming essential components of digital transformation initiatives as organizations seek to leverage data assets for competitive advantage. Analytics investments focus on real-time processing capabilities, advanced visualization tools, and self-service analytics platforms that enable business users to access insights independently.

Digital transformation initiatives deliver substantial benefits to various stakeholders within the European business ecosystem, creating value through improved efficiency, enhanced customer experiences, and new revenue opportunities.

For Organizations:

For Technology Providers:

For Employees:

Strengths:

Weaknesses:

Opportunities:

Threats:

Several significant trends are shaping the European digital transformation market, influencing technology adoption patterns, investment priorities, and strategic direction across various industry sectors.

Hybrid Work Transformation continues to drive demand for digital collaboration tools, cloud-based applications, and remote work enablement technologies. European organizations are investing in comprehensive digital workplace solutions that support flexible work arrangements while maintaining productivity and security standards. Collaboration platforms and virtual meeting technologies have become essential components of digital transformation strategies.

Sustainability-Driven Digitalization is gaining prominence as European organizations align digital transformation initiatives with environmental goals and corporate social responsibility objectives. Green technology solutions that reduce energy consumption, optimize resource utilization, and minimize environmental impact are increasingly prioritized in transformation planning and investment decisions.

AI-Powered Automation is expanding beyond simple task automation to encompass complex decision-making processes and strategic business functions. European organizations are implementing intelligent automation solutions that combine artificial intelligence, machine learning, and robotic process automation to achieve comprehensive process optimization. Cognitive automation applications are showing significant impact in customer service, financial processing, and supply chain management.

Edge Computing Integration is becoming increasingly important as organizations seek to process data closer to its source for improved performance and reduced latency. Edge technologies enable real-time analytics, enhanced security, and improved user experiences, particularly in IoT and mobile applications.

Low-Code Development platforms are democratizing application development and enabling faster digital solution deployment. European organizations are leveraging low-code tools to accelerate transformation timelines and reduce dependence on specialized development resources. Citizen development initiatives empower business users to create solutions that address specific operational requirements.

Recent industry developments demonstrate the dynamic nature of the European digital transformation market and highlight significant investments, partnerships, and technological advances that are shaping market evolution.

Major cloud providers are expanding their European data center presence to address data sovereignty requirements and improve service performance. Infrastructure investments in edge computing capabilities and 5G network integration are enabling new transformation possibilities for European organizations across various industry sectors.

Strategic partnerships between technology vendors, consulting firms, and system integrators are creating comprehensive digital transformation ecosystems. These alliances combine complementary capabilities to deliver end-to-end solutions that address complex customer requirements and accelerate implementation timelines. Ecosystem collaboration is becoming essential for market success in the competitive European landscape.

Regulatory developments including the EU’s Digital Services Act and AI regulation proposals are influencing digital transformation strategies and technology selection criteria. Organizations are adapting their transformation approaches to ensure compliance with evolving regulatory requirements while maintaining innovation momentum. Compliance-by-design approaches are becoming standard practice in digital transformation planning.

Industry-specific innovations are emerging as technology providers develop specialized solutions for healthcare, manufacturing, financial services, and other vertical markets. Sector-focused platforms address unique regulatory requirements, operational challenges, and business models within specific industries, creating opportunities for targeted transformation solutions.

Acquisition activity continues as established technology companies acquire innovative startups and specialized solution providers to expand their digital transformation capabilities. Market consolidation is creating more comprehensive solution portfolios while maintaining competitive innovation through strategic partnerships and technology integration.

Market analysts recommend several strategic approaches for organizations and technology providers seeking to maximize success in the European digital transformation market. According to MarkWide Research analysis, successful transformation initiatives require comprehensive planning, stakeholder alignment, and phased implementation approaches.

For Organizations: Develop comprehensive digital transformation strategies that align with business objectives and regulatory requirements. Prioritize employee training and change management to ensure successful technology adoption. Start with pilot projects that demonstrate value and build organizational confidence before scaling transformation initiatives across the enterprise.

For Technology Providers: Focus on developing industry-specific solutions that address unique vertical market requirements and regulatory compliance needs. Invest in partnership ecosystems that enable comprehensive solution delivery and customer support. European market success requires understanding of local business cultures, regulatory environments, and customer preferences.

Investment Priorities: Organizations should prioritize cloud infrastructure, cybersecurity, and data analytics capabilities as foundational elements of digital transformation. Security investments are particularly critical given European data protection requirements and increasing cyber threat levels.

Implementation Approach: Adopt agile transformation methodologies that enable iterative improvement and rapid adaptation to changing requirements. Outcome-based metrics should guide transformation initiatives to ensure measurable business value and return on investment.

Risk Management: Develop comprehensive risk management strategies that address cybersecurity, compliance, and operational risks associated with digital transformation. Business continuity planning should account for technology dependencies and potential disruption scenarios.

The European digital transformation market is positioned for continued robust growth driven by technological advancement, regulatory support, and increasing business demand for digital capabilities. Future market development will be characterized by deeper technology integration, expanded automation capabilities, and enhanced focus on sustainable digital solutions.

Technology evolution will continue to create new transformation opportunities as artificial intelligence, quantum computing, and advanced analytics mature. European organizations will increasingly adopt sophisticated digital platforms that combine multiple technologies to deliver comprehensive business solutions. Integration capabilities between different technology domains will become critical success factors for transformation initiatives.

Market growth is expected to accelerate with projected compound annual growth rates of 11-13% across major European markets. Eastern European countries will likely experience the highest growth rates as digital infrastructure development and EU funding programs accelerate transformation adoption. SME market penetration will increase significantly as digital solutions become more accessible and affordable.

Industry transformation will deepen as sector-specific digital solutions mature and demonstrate measurable business impact. Manufacturing, healthcare, and financial services will continue leading transformation investments, while emerging sectors such as agriculture and construction will increase digital adoption. Cross-industry collaboration will create new business models and value creation opportunities.

Regulatory influence will continue shaping market development as European authorities implement new digital policies and standards. Organizations will need to balance innovation objectives with compliance requirements, creating demand for solutions that enable both technological advancement and regulatory adherence. Privacy-preserving technologies and ethical AI solutions will become increasingly important market segments.

Sustainability integration will become a standard requirement for digital transformation initiatives as European organizations pursue environmental goals and regulatory compliance. Green technology solutions that demonstrate both operational and environmental benefits will experience accelerated adoption and investment priority.

The Europe digital transformation market represents a dynamic and rapidly evolving ecosystem that is fundamentally reshaping how organizations operate, compete, and deliver value across multiple industry sectors. With strong regulatory support, advanced technological infrastructure, and increasing business demand for digital capabilities, the European market is positioned for sustained growth and innovation.

Key success factors for market participants include comprehensive strategy development, stakeholder alignment, and phased implementation approaches that balance innovation objectives with regulatory compliance requirements. Organizations that prioritize employee development, cybersecurity, and outcome-based metrics will be best positioned to achieve transformation success and competitive advantage.

Future market development will be characterized by deeper technology integration, expanded automation capabilities, and enhanced focus on sustainable digital solutions. The convergence of artificial intelligence, cloud computing, IoT, and advanced analytics will create new opportunities for comprehensive business transformation that delivers measurable value and competitive differentiation.

Market outlook remains highly positive with continued investment growth, technological advancement, and regulatory support driving adoption across European organizations of all sizes and sectors. The Europe digital transformation market will continue serving as a critical enabler of business modernization, operational efficiency, and innovation-driven growth throughout the region.

What is Digital Transformation?

Digital Transformation refers to the integration of digital technology into all areas of a business, fundamentally changing how it operates and delivers value to customers. It encompasses various aspects such as process automation, data analytics, and customer engagement strategies.

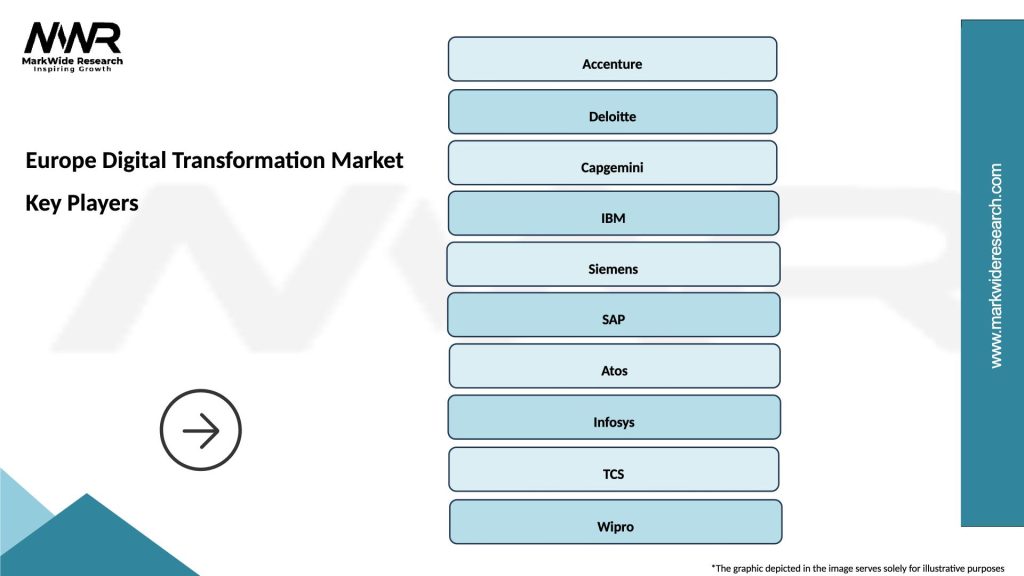

What are the key players in the Europe Digital Transformation Market?

Key players in the Europe Digital Transformation Market include Accenture, IBM, SAP, and Microsoft, among others. These companies provide a range of services and solutions that facilitate digital transformation across various industries.

What are the main drivers of the Europe Digital Transformation Market?

The main drivers of the Europe Digital Transformation Market include the increasing demand for operational efficiency, the need for enhanced customer experiences, and the rapid adoption of cloud technologies. Businesses are also motivated by the potential for data-driven decision-making.

What challenges does the Europe Digital Transformation Market face?

Challenges in the Europe Digital Transformation Market include resistance to change within organizations, data privacy concerns, and the high costs associated with implementing new technologies. Additionally, a lack of skilled workforce can hinder progress.

What opportunities exist in the Europe Digital Transformation Market?

Opportunities in the Europe Digital Transformation Market include the growth of artificial intelligence and machine learning applications, the expansion of Internet of Things (IoT) solutions, and the increasing focus on sustainability through digital initiatives. These trends can lead to innovative business models.

What trends are shaping the Europe Digital Transformation Market?

Trends shaping the Europe Digital Transformation Market include the rise of remote work technologies, the integration of advanced analytics into business processes, and the emphasis on customer-centric digital solutions. Companies are increasingly leveraging digital tools to enhance agility and responsiveness.

Europe Digital Transformation Market

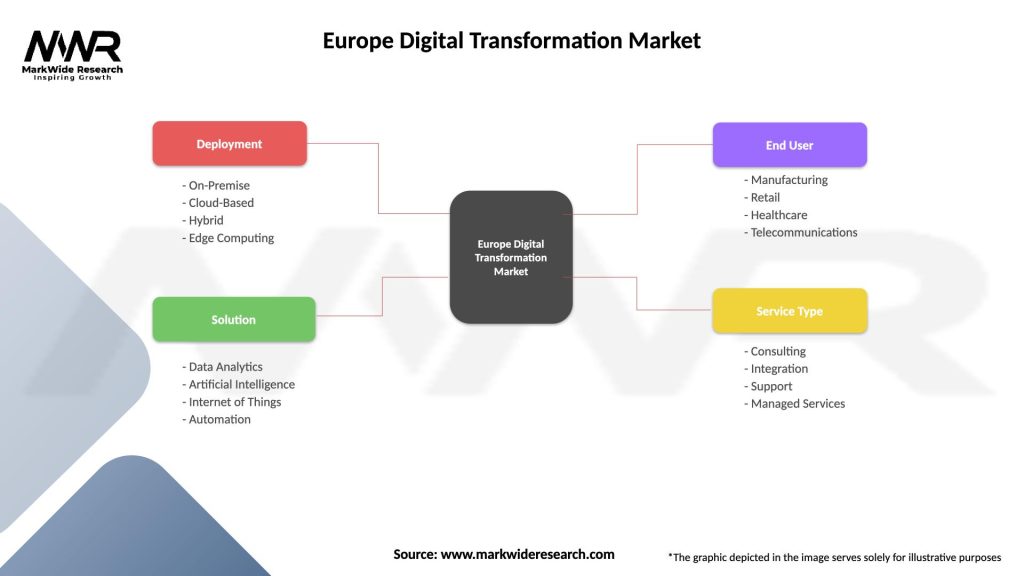

| Segmentation Details | Description |

|---|---|

| Deployment | On-Premise, Cloud-Based, Hybrid, Edge Computing |

| Solution | Data Analytics, Artificial Intelligence, Internet of Things, Automation |

| End User | Manufacturing, Retail, Healthcare, Telecommunications |

| Service Type | Consulting, Integration, Support, Managed Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Digital Transformation Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at