444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe deodorant market represents one of the most mature and sophisticated personal care segments globally, characterized by high consumer awareness, premium product positioning, and innovative formulations. European consumers demonstrate strong preferences for natural ingredients, sustainable packaging, and long-lasting protection, driving manufacturers to continuously innovate their product offerings. The market encompasses various product categories including antiperspirants, natural deodorants, roll-ons, sprays, and stick formulations.

Market dynamics in Europe are significantly influenced by stringent regulatory frameworks, environmental consciousness, and evolving consumer preferences toward aluminum-free formulations. The region’s diverse cultural landscape creates distinct market segments, with Northern European countries favoring clinical-strength products while Mediterranean regions show preference for fragrance-forward options. Growth rates across the region indicate a steady expansion of 8.2% CAGR in the premium segment, driven by increasing disposable income and health-conscious consumer behavior.

Innovation trends continue to shape market development, with manufacturers investing heavily in sustainable packaging solutions, probiotic formulations, and gender-neutral products. The European market demonstrates particular strength in the natural and organic segment, which accounts for approximately 32% market penetration across major European countries, significantly higher than global averages.

The Europe deodorant market refers to the comprehensive ecosystem of personal care products designed to prevent or mask body odor through various mechanisms including antimicrobial action, fragrance masking, and perspiration control across European Union countries, the United Kingdom, and associated territories. This market encompasses traditional antiperspirants containing aluminum salts, natural deodorants utilizing plant-based ingredients, and hybrid formulations combining multiple odor-control technologies.

Product categories within this market include spray deodorants, roll-on applications, stick formulations, cream-based products, and emerging formats such as solid bars and refillable systems. The market serves diverse consumer segments ranging from budget-conscious buyers seeking basic protection to premium customers demanding luxury formulations with advanced skin care benefits and sophisticated fragrance profiles.

Distribution channels span traditional retail outlets, specialty beauty stores, online platforms, and direct-to-consumer brands, creating a complex marketplace where established multinational corporations compete alongside innovative indie brands and sustainable startups. The European regulatory environment significantly influences product development, with strict guidelines governing ingredient safety, environmental impact, and consumer protection standards.

Market leadership in the Europe deodorant sector is characterized by intense competition between established multinational brands and emerging natural product manufacturers. The market demonstrates robust growth patterns driven by premiumization trends, with consumers increasingly willing to invest in higher-priced products offering superior performance, skin benefits, and environmental sustainability. Innovation acceleration has become a critical success factor, with companies launching new products at unprecedented rates to capture evolving consumer preferences.

Consumer behavior analysis reveals significant shifts toward aluminum-free alternatives, with adoption rates reaching 45% penetration among millennials and Gen Z demographics. This trend has prompted traditional manufacturers to expand their natural product lines while maintaining their conventional offerings for consumers preferring clinical-strength protection. Sustainability concerns drive approximately 67% of purchasing decisions among European consumers, influencing packaging design, ingredient sourcing, and manufacturing processes.

Regional variations create distinct market opportunities, with Scandinavian countries leading in eco-friendly product adoption, while Southern European markets maintain strong preferences for fragrance-intensive formulations. The market’s resilience during economic uncertainties demonstrates the essential nature of deodorant products, with consumers showing willingness to maintain spending on personal care despite broader economic pressures.

Consumer preference evolution represents the most significant market transformation, with European buyers increasingly prioritizing ingredient transparency, ethical sourcing, and environmental responsibility over traditional performance metrics alone. This shift has created opportunities for brands that effectively communicate their sustainability credentials while delivering effective odor protection.

Market segmentation reveals distinct consumer clusters with varying priorities, from performance-focused athletes requiring maximum protection to environmentally conscious consumers prioritizing sustainable ingredients and packaging. Understanding these segments enables targeted product development and marketing strategies that resonate with specific consumer groups.

Health consciousness serves as a primary market driver, with European consumers increasingly scrutinizing personal care product ingredients and seeking alternatives to traditional aluminum-based antiperspirants. This trend has accelerated following various health studies and media coverage regarding potential links between aluminum exposure and health concerns, creating substantial demand for aluminum-free alternatives.

Environmental sustainability concerns drive significant market transformation, with consumers actively seeking products featuring recyclable packaging, biodegradable formulations, and ethical ingredient sourcing. European regulatory initiatives supporting circular economy principles further amplify this trend, encouraging manufacturers to adopt sustainable practices throughout their supply chains.

Lifestyle changes including increased fitness participation, longer working hours, and social media influence create demand for high-performance products capable of providing extended protection under various conditions. The rise of athleisure culture particularly influences product development, with consumers seeking deodorants that complement active lifestyles while maintaining professional presentation standards.

Technological advancement in formulation science enables development of more effective natural ingredients, improved delivery systems, and enhanced user experiences. Microencapsulation technology, probiotic integration, and time-release mechanisms represent key innovations driving consumer interest and market growth. These technological improvements help bridge the performance gap between traditional and natural formulations.

Regulatory complexity across European markets creates significant challenges for manufacturers, with varying requirements for ingredient approval, labeling standards, and environmental compliance across different countries. These regulatory differences increase development costs and time-to-market for new products, particularly affecting smaller companies with limited regulatory expertise and resources.

Raw material volatility impacts manufacturing costs and product pricing, with natural ingredients often subject to supply chain disruptions, seasonal availability, and price fluctuations. The transition toward sustainable sourcing further complicates procurement processes, as manufacturers must balance cost considerations with environmental and ethical requirements.

Consumer skepticism regarding natural product efficacy remains a significant barrier, with many consumers questioning whether aluminum-free formulations can provide adequate protection compared to traditional antiperspirants. This perception challenge requires substantial investment in consumer education and clinical validation to overcome established preferences and usage patterns.

Market saturation in mature European markets limits growth opportunities for established brands, forcing companies to compete primarily through market share capture rather than category expansion. This competitive intensity pressures profit margins and requires continuous innovation investment to maintain market position and consumer relevance.

Natural product expansion presents substantial growth opportunities as consumer acceptance of aluminum-free formulations continues increasing. Manufacturers investing in advanced natural technologies and effective marketing strategies can capture significant market share from traditional products, particularly among younger demographics prioritizing health and environmental considerations.

Personalization trends create opportunities for customized deodorant solutions based on individual skin chemistry, lifestyle factors, and personal preferences. Direct-to-consumer models enable companies to offer personalized products while building stronger customer relationships and gathering valuable consumer data for product development.

Emerging markets within Eastern Europe offer growth potential as economic development increases disposable income and consumer awareness of personal care products. These markets present opportunities for both premium and value-oriented products, depending on local economic conditions and consumer preferences.

Technology integration opportunities include smart packaging, IoT connectivity, and digital health monitoring capabilities that appeal to tech-savvy consumers. These innovations can differentiate products in competitive markets while providing valuable consumer insights for future product development and marketing strategies.

Competitive intensity continues escalating as traditional multinational corporations face challenges from innovative startup brands offering disruptive formulations and sustainable business models. This competition drives rapid innovation cycles, with companies launching new products more frequently to maintain market relevance and consumer interest.

Supply chain evolution toward more sustainable and transparent practices influences market dynamics, with companies investing in vertical integration, ethical sourcing partnerships, and local production capabilities. These changes affect cost structures, product positioning, and competitive advantages across different market segments.

Consumer education plays an increasingly important role in market dynamics, with companies investing heavily in ingredient transparency, clinical validation, and sustainability communication. Brands successfully educating consumers about their product benefits and values gain competitive advantages in crowded marketplaces.

Digital transformation impacts market dynamics through e-commerce growth, social media marketing, and direct-to-consumer sales channels. These digital channels enable smaller brands to compete effectively with established companies while providing consumers with greater product access and information.

Primary research methodologies employed in analyzing the Europe deodorant market include comprehensive consumer surveys, in-depth interviews with industry stakeholders, and focus groups across major European markets. These primary sources provide insights into consumer preferences, purchasing behavior, and emerging trends that quantitative data alone cannot capture.

Secondary research incorporates analysis of industry reports, regulatory filings, patent databases, and academic studies related to personal care product development and consumer behavior. This research foundation ensures comprehensive market understanding and validates primary research findings through multiple data sources.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to project future market developments and identify potential growth opportunities. These models incorporate various factors including demographic changes, economic conditions, and regulatory developments that influence market dynamics.

Competitive analysis examines product portfolios, pricing strategies, marketing approaches, and financial performance of key market participants. This analysis provides insights into competitive positioning, market share dynamics, and strategic opportunities for market participants.

Western European markets demonstrate mature characteristics with high penetration rates and sophisticated consumer preferences. Countries including Germany, France, and the United Kingdom lead in premium product adoption, with approximately 58% market share concentrated in higher-priced segments. These markets show particular strength in natural and organic products, driven by strong environmental consciousness and regulatory support for sustainable practices.

Nordic countries represent the most advanced markets for sustainable deodorant products, with Sweden, Norway, and Denmark achieving 72% penetration rates for aluminum-free formulations. These markets serve as testing grounds for innovative products and sustainable packaging solutions, often influencing trends across broader European markets.

Southern European markets including Italy, Spain, and Greece maintain distinct preferences for fragrance-forward products and traditional formulations. However, these markets show increasing adoption of natural alternatives, particularly among urban consumers and younger demographics. Market growth rates in these regions average 6.4% annually for natural product categories.

Eastern European markets present significant growth opportunities as economic development increases consumer spending on personal care products. Countries including Poland, Czech Republic, and Hungary demonstrate rapid market expansion, with premium segment growth reaching 12.8% annually as consumers upgrade from basic to advanced formulations.

Market leadership remains concentrated among several multinational corporations that have successfully adapted their product portfolios to address evolving consumer preferences while maintaining strong distribution networks and marketing capabilities. These companies leverage their research and development resources to innovate across both traditional and natural product categories.

Emerging competitors include numerous startup brands focusing on sustainable formulations, innovative packaging, and direct-to-consumer business models. These companies often target specific consumer segments with specialized products, creating niche market opportunities and driving innovation across the broader market.

Product type segmentation reveals distinct market categories with varying growth trajectories and consumer preferences. Traditional antiperspirants maintain significant market presence despite declining growth rates, while natural deodorants experience rapid expansion driven by health and environmental concerns.

By Product Type:

By Application Format:

By Distribution Channel:

Natural deodorant category demonstrates the strongest growth momentum, driven by increasing consumer awareness of ingredient safety and environmental impact. This segment benefits from premium pricing strategies and strong brand loyalty, with consumers willing to pay higher prices for products aligning with their values and health priorities.

Performance characteristics vary significantly across product categories, with traditional antiperspirants offering superior sweat protection while natural alternatives focus on odor neutralization and skin health benefits. Consumer education plays a crucial role in managing expectations and building satisfaction across different product categories.

Innovation focus differs by category, with traditional products emphasizing extended protection duration and skin comfort, while natural products prioritize ingredient transparency, sustainable packaging, and additional skin care benefits. These different innovation paths create distinct competitive landscapes within the broader market.

Price positioning reflects category characteristics, with natural and premium products commanding higher prices while mass market traditional products compete primarily on value and accessibility. This pricing structure creates opportunities for brands to position products across multiple price points and consumer segments.

Manufacturers benefit from growing market demand, particularly in premium and natural product segments that offer higher profit margins and stronger brand differentiation opportunities. The trend toward sustainable products enables companies to build stronger consumer relationships while contributing to environmental protection goals.

Retailers gain from increased consumer spending on personal care products and the opportunity to offer diverse product ranges appealing to different consumer segments. The growth of premium categories particularly benefits retailers through improved margins and customer satisfaction.

Consumers benefit from expanded product choices, improved formulations, and greater transparency regarding ingredient safety and environmental impact. The market’s evolution toward natural alternatives provides options for health-conscious consumers while maintaining effective odor protection.

Suppliers of natural ingredients and sustainable packaging materials experience increased demand and opportunities for innovation partnerships with deodorant manufacturers. This trend creates new business opportunities and supports the development of more sustainable supply chains.

Research institutions benefit from increased industry investment in formulation science, sustainability research, and consumer behavior studies. These partnerships advance scientific understanding while supporting practical product development applications.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration represents the most significant trend shaping the European deodorant market, with companies investing heavily in eco-friendly packaging, renewable ingredients, and carbon-neutral manufacturing processes. This trend extends beyond product formulation to encompass entire business operations and supply chain management.

Personalization advancement drives development of customized deodorant solutions based on individual skin chemistry, lifestyle factors, and personal preferences. Direct-to-consumer brands lead this trend by offering personalized consultations and tailored product recommendations that enhance customer satisfaction and loyalty.

Gender-neutral positioning gains momentum as brands recognize changing consumer attitudes toward gendered personal care products. This trend creates opportunities for unisex formulations and marketing approaches that appeal to broader consumer segments while simplifying product portfolios.

Probiotic integration emerges as a key innovation trend, with manufacturers incorporating beneficial bacteria into formulations to support skin health and natural odor control mechanisms. This scientific approach appeals to health-conscious consumers seeking products that work with their body’s natural processes.

Digital engagement transforms how brands connect with consumers, utilizing social media, influencer partnerships, and educational content to build awareness and trust. These digital strategies particularly benefit natural and emerging brands competing against established market leaders.

Product launches accelerate across the European market as companies respond to evolving consumer preferences and competitive pressures. Recent developments include refillable deodorant systems, probiotic formulations, and hybrid products combining natural ingredients with enhanced performance characteristics.

Acquisition activity increases as large corporations seek to expand their natural product portfolios through strategic purchases of innovative smaller brands. These acquisitions provide established companies with natural product expertise while offering startup brands access to broader distribution networks and marketing resources.

Regulatory developments continue shaping market dynamics, with European authorities implementing stricter requirements for ingredient safety testing, environmental impact assessment, and consumer protection standards. These regulations drive innovation while ensuring product safety and environmental responsibility.

Sustainability initiatives expand beyond individual companies to encompass industry-wide efforts toward circular economy principles, renewable energy adoption, and waste reduction. These collaborative efforts demonstrate the industry’s commitment to environmental stewardship while addressing consumer concerns.

Technology partnerships emerge between deodorant manufacturers and technology companies to develop smart packaging solutions, IoT-enabled products, and digital health monitoring capabilities. These partnerships represent the industry’s evolution toward more connected and intelligent personal care solutions.

Investment priorities should focus on natural product development, sustainable packaging innovation, and digital marketing capabilities to capture growing market segments and build competitive advantages. Companies investing in these areas position themselves for long-term success in evolving market conditions.

Market entry strategies for new participants should emphasize differentiated positioning, direct-to-consumer channels, and targeted consumer segments rather than attempting to compete directly with established brands across broad market categories. MarkWide Research analysis indicates that successful new entrants typically focus on specific consumer needs or underserved market segments.

Innovation focus should prioritize formulation improvements that address consumer concerns about natural product efficacy while maintaining safety and environmental benefits. Companies successfully bridging the performance gap between traditional and natural products will capture significant market opportunities.

Partnership opportunities exist across the value chain, from ingredient suppliers and packaging manufacturers to retail partners and technology companies. Strategic partnerships can accelerate innovation, reduce development costs, and provide access to new market segments and distribution channels.

Consumer education investments will become increasingly important as the market evolves toward more sophisticated products and ingredients. Companies that effectively communicate their product benefits, safety profiles, and environmental impact will build stronger consumer relationships and brand loyalty.

Market evolution will continue favoring natural and sustainable products, with traditional antiperspirants maintaining presence primarily among consumers prioritizing maximum protection over ingredient concerns. The market will likely bifurcate into distinct segments serving different consumer priorities and preferences.

Innovation acceleration will drive development of more effective natural ingredients, advanced delivery systems, and integrated skin care benefits. MWR projections indicate that successful products will combine multiple benefits including odor protection, skin health, and environmental sustainability.

Digital transformation will reshape how consumers discover, purchase, and interact with deodorant brands. E-commerce growth is expected to reach 38% market share within the next five years, driven by subscription services, personalized recommendations, and direct-to-consumer brands.

Regulatory evolution will likely introduce stricter requirements for ingredient transparency, environmental impact disclosure, and sustainability claims verification. Companies preparing for these changes will gain competitive advantages while those failing to adapt may face market access challenges.

Consumer sophistication will continue increasing, with buyers demanding more information about product ingredients, manufacturing processes, and environmental impact. This trend will reward companies investing in transparency, education, and authentic sustainability practices while challenging those relying primarily on traditional marketing approaches.

The Europe deodorant market stands at a transformative juncture, characterized by evolving consumer preferences, technological innovation, and increasing environmental consciousness. Market dynamics favor companies that successfully balance traditional performance expectations with modern demands for natural ingredients, sustainable practices, and transparent communication.

Growth opportunities remain substantial, particularly in natural product segments, personalized solutions, and emerging Eastern European markets. However, success requires strategic investment in innovation, sustainability, and consumer education to navigate competitive pressures and regulatory requirements effectively.

Future market leaders will likely be those companies that embrace change while maintaining product efficacy, invest in sustainable practices throughout their operations, and build authentic connections with increasingly sophisticated consumers. The market’s evolution toward more natural, personalized, and environmentally responsible products represents both challenge and opportunity for industry participants willing to adapt and innovate.

What is Deodorant?

Deodorant refers to a substance applied to the body to mask or eliminate body odor caused by bacterial growth. It is commonly used in personal care routines and comes in various forms such as sprays, sticks, and gels.

What are the key players in the Europe Deodorant Market?

Key players in the Europe Deodorant Market include Unilever, Procter & Gamble, Beiersdorf, and Colgate-Palmolive, among others. These companies offer a wide range of deodorant products catering to different consumer preferences and needs.

What are the growth factors driving the Europe Deodorant Market?

The growth of the Europe Deodorant Market is driven by increasing consumer awareness of personal hygiene, the rising demand for natural and organic products, and the expansion of retail channels. Additionally, innovative product formulations and marketing strategies contribute to market growth.

What challenges does the Europe Deodorant Market face?

The Europe Deodorant Market faces challenges such as intense competition among brands, regulatory compliance regarding ingredient safety, and changing consumer preferences towards sustainable products. These factors can impact market dynamics and brand loyalty.

What opportunities exist in the Europe Deodorant Market?

Opportunities in the Europe Deodorant Market include the growing trend of eco-friendly packaging, the introduction of gender-neutral products, and the increasing popularity of personalized deodorant solutions. These trends can help brands capture new consumer segments.

What trends are shaping the Europe Deodorant Market?

Trends shaping the Europe Deodorant Market include the rise of natural and organic deodorants, the use of innovative fragrances, and the incorporation of skincare benefits in deodorant products. These trends reflect changing consumer preferences towards health and wellness.

Europe Deodorant Market

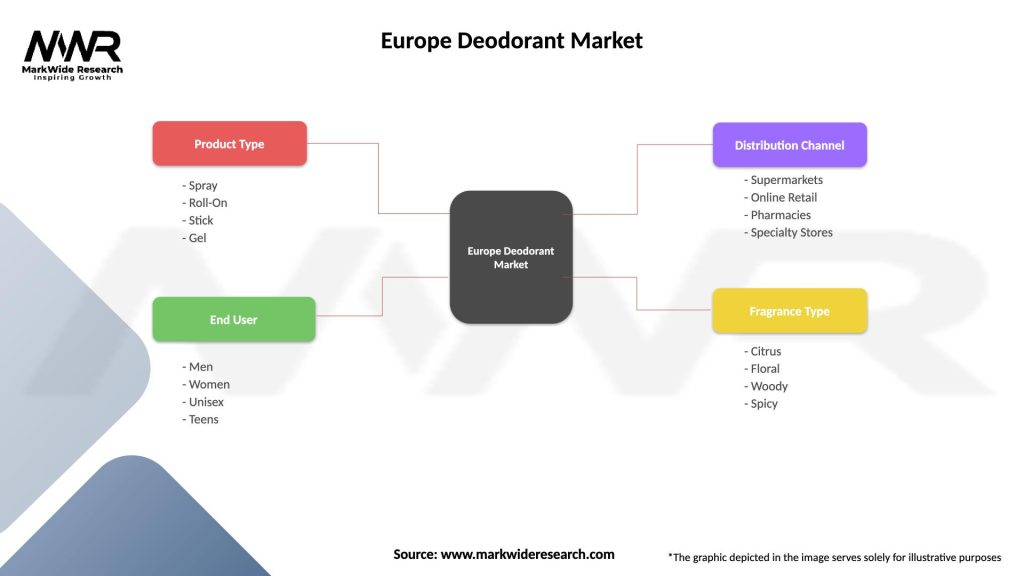

| Segmentation Details | Description |

|---|---|

| Product Type | Spray, Roll-On, Stick, Gel |

| End User | Men, Women, Unisex, Teens |

| Distribution Channel | Supermarkets, Online Retail, Pharmacies, Specialty Stores |

| Fragrance Type | Citrus, Floral, Woody, Spicy |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Deodorant Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at