444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe defense logistics market represents a critical component of the continent’s military infrastructure, encompassing comprehensive supply chain management, equipment maintenance, and strategic resource allocation across multiple defense sectors. European nations are increasingly investing in advanced logistics capabilities to enhance operational readiness and maintain strategic autonomy in an evolving geopolitical landscape.

Defense logistics operations across Europe have experienced significant transformation, driven by modernization initiatives and the need for enhanced interoperability among NATO allies. The market encompasses various segments including transportation services, warehousing solutions, maintenance and repair operations, and integrated supply chain management systems. Growth rates in the sector indicate robust expansion, with the market experiencing approximately 6.2% CAGR over recent years.

Regional dynamics play a crucial role in shaping market development, with major European powers including Germany, France, the United Kingdom, and Italy leading investment in defense logistics infrastructure. The increasing focus on digital transformation and automation technologies has revolutionized traditional logistics approaches, enabling more efficient resource management and improved operational effectiveness.

Market participants range from established defense contractors to specialized logistics service providers, creating a competitive landscape that drives innovation and service quality improvements. The integration of artificial intelligence and predictive analytics has become increasingly important for optimizing supply chain operations and reducing operational costs.

The Europe defense logistics market refers to the comprehensive ecosystem of services, technologies, and infrastructure supporting military supply chain operations across European nations. This market encompasses the planning, implementation, and control of efficient movement and storage of military equipment, supplies, personnel, and information from point of origin to point of consumption.

Defense logistics involves multiple interconnected components including procurement management, inventory control, transportation coordination, maintenance services, and distribution networks. The market serves various stakeholders including national defense ministries, military branches, defense contractors, and allied international organizations operating within the European theater.

Strategic importance of defense logistics extends beyond traditional supply chain management to include critical capabilities such as rapid deployment support, crisis response coordination, and peacekeeping mission logistics. Modern defense logistics operations integrate advanced technologies including blockchain systems, IoT sensors, and automated inventory management platforms to enhance operational efficiency and transparency.

European defense logistics has emerged as a strategic priority for nations seeking to enhance military readiness and operational capabilities in response to evolving security challenges. The market demonstrates strong growth momentum driven by increased defense spending, modernization programs, and the need for enhanced logistics interoperability among European allies.

Key market drivers include rising geopolitical tensions, NATO commitment requirements, and the push for strategic autonomy in defense capabilities. European nations are investing heavily in logistics infrastructure modernization, with approximately 23% of defense budgets allocated to logistics and support functions across major European military powers.

Technology integration represents a fundamental shift in defense logistics operations, with artificial intelligence, machine learning, and predictive analytics becoming essential components of modern supply chain management. The adoption of digital logistics platforms has improved efficiency metrics by approximately 35% in participating European defense organizations.

Market consolidation trends indicate increasing collaboration between traditional defense contractors and specialized logistics service providers, creating integrated solutions that address complex operational requirements. The focus on sustainability initiatives and green logistics practices is becoming increasingly important for European defense organizations committed to environmental responsibility.

Strategic positioning within the European defense logistics landscape requires understanding of multiple interconnected factors that influence market dynamics and growth opportunities:

Geopolitical tensions across Europe have intensified focus on defense preparedness and logistics capabilities, driving substantial investments in supply chain infrastructure and operational readiness. The ongoing security challenges in Eastern Europe have highlighted the critical importance of robust logistics networks capable of supporting rapid military deployment and sustained operations.

NATO commitment requirements mandate specific logistics capabilities and interoperability standards among member nations, creating consistent demand for advanced logistics solutions and infrastructure development. European nations are required to maintain logistics readiness levels that support both national defense objectives and alliance obligations.

Modernization initiatives across European defense forces emphasize the replacement of legacy logistics systems with advanced digital platforms and automated solutions. The integration of Industry 4.0 technologies including IoT sensors, blockchain systems, and artificial intelligence has become essential for maintaining competitive logistics capabilities.

Strategic autonomy objectives drive European nations to develop independent logistics capabilities and reduce reliance on external suppliers for critical defense materials. This trend has accelerated investment in domestic logistics infrastructure and European-based supply chain networks.

Operational efficiency demands require defense organizations to optimize logistics costs while maintaining high service levels and operational readiness. The implementation of lean logistics principles and advanced analytics has enabled significant improvements in resource utilization and cost management.

Budget constraints represent a significant challenge for European defense organizations seeking to modernize logistics capabilities while managing overall defense spending limitations. Many nations face pressure to balance logistics investments with other critical defense priorities including equipment procurement and personnel costs.

Regulatory complexity across different European jurisdictions creates challenges for implementing standardized logistics solutions and achieving seamless interoperability among allied nations. Varying procurement regulations and compliance requirements can slow the adoption of innovative logistics technologies and services.

Legacy system integration poses technical and financial challenges as defense organizations work to modernize logistics infrastructure while maintaining compatibility with existing equipment and processes. The cost of system migration and staff retraining can be substantial barriers to technology adoption.

Cybersecurity concerns related to digital logistics platforms and connected supply chain systems create additional complexity and cost requirements for defense organizations. The need for robust security measures can slow implementation timelines and increase overall project costs.

Skills shortage in specialized logistics and technology areas limits the ability of defense organizations to fully leverage advanced logistics capabilities. The competition for qualified personnel with both military logistics experience and modern technology skills creates recruitment and retention challenges.

Artificial intelligence integration presents significant opportunities for enhancing logistics efficiency through predictive analytics, automated decision-making, and optimized resource allocation. European defense organizations are increasingly interested in AI-powered logistics solutions that can improve operational effectiveness while reducing costs.

Public-private partnerships offer opportunities for commercial logistics providers to leverage their expertise and infrastructure in support of defense logistics requirements. These collaborations can provide cost-effective solutions while allowing defense organizations to focus on core military capabilities.

Sustainability initiatives create opportunities for developing environmentally responsible logistics solutions that align with European environmental policies and corporate responsibility objectives. The demand for green logistics technologies is expected to grow significantly as defense organizations prioritize environmental stewardship.

Regional integration efforts within the European Union provide opportunities for standardizing logistics processes and achieving economies of scale through coordinated procurement and shared infrastructure development. EU defense cooperation initiatives are creating new markets for integrated logistics solutions.

Emerging technologies including blockchain, autonomous vehicles, and advanced robotics offer opportunities for revolutionizing defense logistics operations. Early adoption of these innovative technologies can provide competitive advantages and improved operational capabilities.

Supply and demand dynamics in the European defense logistics market are influenced by multiple factors including defense spending levels, operational tempo, and modernization priorities. The market experiences cyclical patterns related to defense budget cycles and major procurement programs that drive logistics infrastructure investments.

Technology evolution continues to reshape market dynamics as new solutions emerge and mature technologies become more accessible and cost-effective. The rapid pace of digital transformation creates both opportunities and challenges for market participants seeking to maintain competitive positions.

Competitive pressures drive continuous innovation and service improvement among logistics providers serving European defense markets. The need to demonstrate value proposition and operational excellence has intensified as defense organizations become more sophisticated in their procurement approaches.

Regulatory changes and policy developments at both national and European Union levels influence market dynamics and create new requirements for logistics service providers. Compliance requirements continue to evolve, particularly in areas related to cybersecurity and data protection.

International cooperation trends affect market dynamics as European nations increase participation in multinational defense initiatives and peacekeeping operations. These activities create demand for expeditionary logistics capabilities and specialized support services.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into European defense logistics market dynamics. The research approach combines quantitative data analysis with qualitative insights from industry experts and stakeholders across the defense logistics ecosystem.

Primary research activities include structured interviews with defense logistics professionals, procurement officials, and technology providers serving European markets. These discussions provide valuable insights into market trends, challenges, and emerging opportunities that may not be apparent through secondary research alone.

Secondary research encompasses analysis of government defense budgets, procurement announcements, industry reports, and academic studies related to defense logistics operations. This information provides quantitative foundation for market size estimates and growth projections.

Data validation processes ensure accuracy and reliability of research findings through cross-referencing multiple sources and expert review of key conclusions. The methodology includes triangulation techniques to verify important market insights and projections.

Market modeling approaches utilize statistical analysis and forecasting techniques to project future market developments based on historical trends and identified growth drivers. According to MarkWide Research analysis, the methodology incorporates scenario planning to account for various potential market developments.

Western Europe dominates the defense logistics market with major contributions from Germany, France, and the United Kingdom, collectively representing approximately 58% of regional market activity. These nations maintain sophisticated logistics infrastructure and continue investing in modernization programs that drive market growth.

Germany leads European defense logistics investment with comprehensive programs focused on digitalization and interoperability enhancement. German defense logistics operations emphasize efficiency optimization and integration with NATO alliance requirements, creating substantial market opportunities for technology providers.

France maintains strong defense logistics capabilities with particular emphasis on expeditionary operations and international mission support. French logistics modernization programs focus on autonomous systems and artificial intelligence integration to improve operational effectiveness.

United Kingdom continues significant defense logistics investment despite Brexit-related changes, with focus on maintaining global deployment capabilities and supporting international partnerships. UK logistics programs emphasize innovation and public-private collaboration.

Eastern Europe represents the fastest-growing regional segment with approximately 12% annual growth in defense logistics investment. Nations including Poland, Czech Republic, and the Baltic states are rapidly modernizing logistics capabilities in response to regional security concerns.

Nordic countries demonstrate strong coordination in defense logistics development with emphasis on regional cooperation and shared infrastructure utilization. These nations focus on cold-weather logistics capabilities and Arctic operations support.

Market leadership in European defense logistics is distributed among several categories of providers including traditional defense contractors, specialized logistics companies, and technology solution providers. The competitive environment encourages innovation and service excellence across all market segments.

Strategic partnerships and joint ventures are increasingly common as companies seek to combine complementary capabilities and expand market reach. These collaborations often focus on technology integration and comprehensive service delivery models.

By Service Type:

By End User:

By Technology:

Transportation services represent the largest segment of European defense logistics, driven by the need for rapid deployment capabilities and international mission support. This category has experienced approximately 8% annual growth as European nations enhance their expeditionary capabilities and NATO contribution requirements.

Maintenance and repair operations constitute a critical market segment with emphasis on predictive maintenance technologies and condition-based servicing approaches. The adoption of advanced diagnostics and AI-powered maintenance scheduling has improved equipment availability rates by approximately 28% across participating European defense organizations.

Digital logistics platforms represent the fastest-growing category as defense organizations prioritize technology modernization and operational efficiency improvements. The integration of artificial intelligence and machine learning capabilities has enabled significant improvements in supply chain visibility and decision-making processes.

Warehousing and storage solutions are evolving toward automated systems and smart inventory management capabilities. European defense organizations are investing in robotic systems and IoT-enabled storage facilities to improve efficiency and reduce operational costs.

Supply chain management services focus on strategic sourcing and supplier relationship management to ensure reliable access to critical defense materials. The emphasis on supply chain resilience has driven investment in alternative sourcing strategies and strategic stockpiling programs.

Defense organizations benefit from improved operational readiness and reduced logistics costs through the adoption of advanced logistics solutions and services. Modern logistics capabilities enable faster deployment and more effective mission support while optimizing resource utilization.

Technology providers gain access to stable, long-term contracts and opportunities for innovation development through partnerships with European defense organizations. The defense logistics market provides predictable revenue streams and opportunities for technology advancement and market expansion.

Commercial logistics companies can leverage their expertise and infrastructure to serve defense markets while diversifying revenue sources and developing specialized capabilities. Defense logistics contracts often provide premium pricing and long-term relationship opportunities.

Government stakeholders achieve improved defense capabilities and cost efficiency through modernized logistics operations and strategic partnerships with private sector providers. Enhanced logistics capabilities support national security objectives while optimizing taxpayer investment in defense infrastructure.

Allied nations benefit from improved interoperability and coordinated logistics capabilities that enhance collective defense effectiveness and mission success rates. Standardized logistics approaches facilitate multinational operations and resource sharing among European allies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence adoption is transforming European defense logistics through predictive analytics, automated decision-making, and optimized resource allocation. Defense organizations are implementing AI-powered systems that can analyze vast amounts of logistics data to improve efficiency and reduce costs.

Sustainability initiatives are becoming increasingly important as European defense organizations commit to environmental responsibility and carbon footprint reduction. The development of green logistics practices includes electric vehicle adoption, renewable energy utilization, and sustainable packaging solutions.

Blockchain technology is gaining traction for supply chain transparency and security, enabling secure tracking of sensitive defense materials and equipment throughout the logistics network. This technology provides immutable records and enhanced visibility for critical supply chain operations.

Autonomous systems including unmanned vehicles and robotic warehouse operations are being integrated into defense logistics operations to improve efficiency and reduce human resource requirements. These systems enable 24/7 operations and improved safety in hazardous environments.

Predictive maintenance approaches are replacing traditional scheduled maintenance programs, utilizing sensor data and analytics to optimize equipment servicing and reduce downtime. This trend has improved equipment availability by approximately 32% in participating European defense organizations.

Digital platform integration has accelerated across European defense organizations with major investments in comprehensive logistics management systems. These platforms integrate multiple logistics functions including inventory management, transportation coordination, and maintenance scheduling into unified operational environments.

Strategic partnerships between defense contractors and commercial logistics providers have expanded significantly, creating integrated service offerings that combine military expertise with commercial efficiency. These collaborations leverage best practices from both sectors to deliver enhanced logistics capabilities.

Cybersecurity enhancements have become critical priorities as defense logistics operations become increasingly digitized and connected. European defense organizations are implementing robust security protocols and investing in cybersecurity technologies to protect sensitive logistics information.

International cooperation initiatives have expanded beyond NATO requirements to include broader European defense collaboration programs. These efforts focus on standardization and interoperability improvements that facilitate coordinated logistics operations among allied nations.

Sustainability programs have gained momentum with European defense organizations implementing comprehensive environmental management approaches for logistics operations. According to MWR analysis, these initiatives include carbon footprint reduction targets and sustainable procurement practices.

Investment prioritization should focus on digital transformation initiatives that provide measurable improvements in operational efficiency and cost reduction. Defense organizations should evaluate technology solutions based on their ability to integrate with existing systems and deliver quantifiable benefits.

Partnership strategies should emphasize collaboration with commercial logistics providers that possess complementary capabilities and proven track records in complex supply chain management. These partnerships can provide access to innovation and specialized expertise while reducing internal resource requirements.

Cybersecurity planning must be integrated into all logistics modernization initiatives to ensure protection of sensitive information and operational continuity. Defense organizations should implement comprehensive security frameworks that address both technical and procedural aspects of cybersecurity.

Skills development programs should address the growing need for personnel with both military logistics experience and modern technology expertise. Investment in training and education will be critical for successful implementation of advanced logistics capabilities.

Sustainability integration should be considered in all logistics planning and procurement decisions to align with European environmental policies and corporate responsibility objectives. Organizations should develop comprehensive sustainability strategies that address environmental impact while maintaining operational effectiveness.

Market growth prospects remain strong for European defense logistics with continued investment in modernization programs and capability enhancement initiatives. The market is expected to maintain robust growth rates of approximately 7.1% CAGR over the next five years, driven by ongoing geopolitical tensions and NATO commitment requirements.

Technology evolution will continue to reshape defense logistics operations with increasing adoption of artificial intelligence, autonomous systems, and advanced analytics. These technologies will enable unprecedented efficiency improvements and operational capabilities that transform traditional logistics approaches.

Regional integration efforts within the European Union will create new opportunities for standardization and coordinated logistics development. These initiatives will facilitate economies of scale and improved interoperability among European defense organizations.

Sustainability requirements will become increasingly important factors in logistics planning and procurement decisions. European defense organizations will need to balance operational effectiveness with environmental responsibility and carbon footprint reduction objectives.

Public-private collaboration will expand as defense organizations seek to leverage commercial expertise and innovation while maintaining security and operational requirements. These partnerships will drive continuous improvement and cost optimization across European defense logistics operations.

European defense logistics market represents a dynamic and evolving sector that plays a critical role in maintaining military readiness and operational effectiveness across the continent. The market demonstrates strong growth potential driven by geopolitical tensions, modernization requirements, and the ongoing digital transformation of defense operations.

Technology integration continues to reshape market dynamics with artificial intelligence, automation, and advanced analytics becoming essential components of modern defense logistics operations. These innovations enable significant improvements in efficiency, cost-effectiveness, and operational capabilities while supporting the complex requirements of contemporary military operations.

Strategic partnerships between defense organizations and commercial logistics providers are creating new opportunities for innovation and service excellence. These collaborations leverage the strengths of both sectors to deliver comprehensive solutions that address evolving defense logistics requirements while optimizing resource utilization and operational effectiveness.

Future success in the European defense logistics market will depend on organizations’ ability to adapt to changing requirements, embrace technological innovation, and maintain focus on operational excellence while addressing sustainability and cybersecurity challenges. The market outlook remains positive with continued investment and development expected across all major European defense markets.

What is Defense Logistics?

Defense logistics refers to the planning and execution of the movement and support of forces in military operations. It encompasses various activities including supply chain management, transportation, and maintenance of equipment and personnel.

What are the key players in the Europe Defense Logistics Market?

Key players in the Europe Defense Logistics Market include companies such as BAE Systems, Thales Group, and Rheinmetall AG, which provide a range of logistics and support services for defense operations, among others.

What are the main drivers of growth in the Europe Defense Logistics Market?

The main drivers of growth in the Europe Defense Logistics Market include increasing defense budgets, the need for modernization of military capabilities, and the rising complexity of global security threats. These factors are pushing nations to enhance their logistics capabilities.

What challenges does the Europe Defense Logistics Market face?

Challenges in the Europe Defense Logistics Market include budget constraints, the need for interoperability among different military systems, and the complexities of managing supply chains in conflict zones. These issues can hinder effective logistics operations.

What opportunities exist in the Europe Defense Logistics Market?

Opportunities in the Europe Defense Logistics Market include advancements in technology such as automation and AI, which can improve efficiency and reduce costs. Additionally, increasing collaboration among European nations for joint defense initiatives presents further growth potential.

What trends are shaping the Europe Defense Logistics Market?

Trends shaping the Europe Defense Logistics Market include the integration of digital technologies for better data management, a focus on sustainability in logistics operations, and the shift towards more agile supply chain models to respond to rapid changes in military needs.

Europe Defense Logistics Market

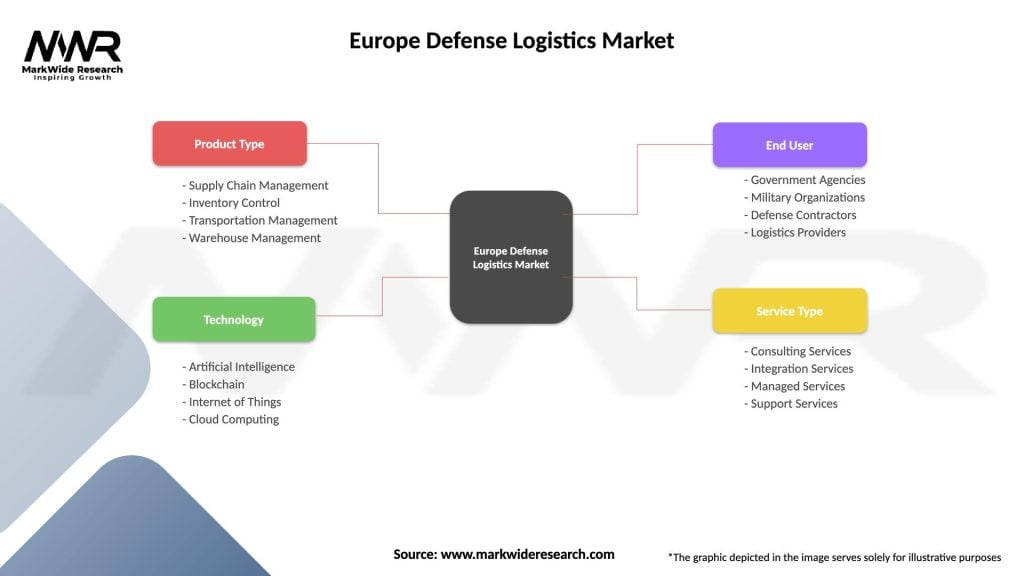

| Segmentation Details | Description |

|---|---|

| Product Type | Supply Chain Management, Inventory Control, Transportation Management, Warehouse Management |

| Technology | Artificial Intelligence, Blockchain, Internet of Things, Cloud Computing |

| End User | Government Agencies, Military Organizations, Defense Contractors, Logistics Providers |

| Service Type | Consulting Services, Integration Services, Managed Services, Support Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Defense Logistics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at