444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe data center physical security market represents a critical segment of the broader cybersecurity and infrastructure protection landscape across European nations. Physical security measures in data centers encompass comprehensive protection systems designed to safeguard critical IT infrastructure, servers, and sensitive data from unauthorized access, environmental threats, and potential security breaches. The market has experienced substantial growth driven by increasing digitalization, cloud adoption, and stringent regulatory requirements across European Union member states.

Market dynamics indicate robust expansion with the sector demonstrating a compound annual growth rate (CAGR) of 8.2% over recent years. This growth trajectory reflects the escalating importance of data protection and the proliferation of hyperscale data centers across major European markets including Germany, United Kingdom, France, and the Netherlands. Enterprise adoption of advanced physical security solutions has accelerated significantly, with 72% of organizations prioritizing enhanced security infrastructure investments.

Regional distribution shows concentrated market activity in key technology hubs, with Western Europe accounting for 68% of market share while Eastern European markets demonstrate the highest growth potential. The integration of artificial intelligence, biometric authentication, and smart surveillance technologies has transformed traditional security approaches, creating new opportunities for innovative solution providers.

The Europe data center physical security market refers to the comprehensive ecosystem of hardware, software, and service solutions designed to protect data center facilities from physical threats, unauthorized access, and environmental hazards across European territories. This market encompasses access control systems, surveillance technologies, perimeter security, fire suppression systems, environmental monitoring, and integrated security management platforms specifically tailored for data center environments.

Physical security in data centers extends beyond traditional security measures to include sophisticated biometric authentication, multi-factor access controls, thermal imaging, and intelligent threat detection systems. The market addresses critical requirements for compliance adherence with European data protection regulations, including GDPR, while ensuring operational continuity and asset protection for mission-critical infrastructure.

Modern implementations integrate advanced technologies such as artificial intelligence-powered analytics, cloud-based security management, and IoT-enabled monitoring systems that provide real-time threat assessment and automated response capabilities throughout European data center facilities.

Market expansion in the Europe data center physical security sector reflects the convergence of digital transformation initiatives, regulatory compliance requirements, and evolving threat landscapes across European markets. The sector demonstrates strong momentum with increasing investments in next-generation security technologies and comprehensive protection frameworks.

Key growth drivers include the proliferation of edge computing infrastructure, rising cybersecurity concerns, and mandatory compliance with European data protection standards. Organizations are prioritizing integrated security solutions that combine physical and logical security measures, creating demand for sophisticated platforms that offer centralized management and real-time monitoring capabilities.

Technology advancement has enabled the development of intelligent security ecosystems that leverage machine learning algorithms for predictive threat analysis and automated incident response. The market benefits from substantial investment in research and development, with 45% of security vendors focusing on AI-enhanced solutions for European data center applications.

Competitive dynamics feature established security technology providers alongside emerging specialists offering innovative solutions for specific market segments. The landscape continues evolving with strategic partnerships, technology integrations, and expansion of service capabilities to address diverse customer requirements across European regions.

Strategic insights reveal several critical factors shaping the Europe data center physical security market landscape:

Market maturation demonstrates increasing sophistication in security solution deployment, with organizations implementing multi-layered protection strategies that address diverse threat vectors and operational requirements across European data center facilities.

Primary growth drivers propelling the Europe data center physical security market include escalating digitalization across European economies and the corresponding need for robust infrastructure protection. Digital transformation initiatives have accelerated data center construction and expansion, creating substantial demand for comprehensive security solutions that protect critical IT assets and ensure operational continuity.

Regulatory compliance requirements serve as a fundamental market driver, with European data protection regulations mandating stringent security measures for organizations handling personal and sensitive data. The General Data Protection Regulation (GDPR) specifically requires appropriate technical and organizational measures to ensure data security, driving investments in advanced physical security infrastructure.

Cybersecurity threat evolution continues driving market growth as organizations recognize the interconnected nature of physical and digital security risks. Sophisticated attack vectors targeting data center infrastructure necessitate comprehensive protection strategies that combine traditional physical security with intelligent monitoring and response capabilities.

Cloud computing adoption across European enterprises creates additional security requirements as organizations migrate critical workloads to cloud infrastructure. Hyperscale data centers supporting major cloud service providers require enterprise-grade security solutions capable of protecting vast server farms and network infrastructure from physical threats and unauthorized access attempts.

Implementation costs represent a significant market restraint, particularly for smaller data center operators and organizations with limited security budgets. Advanced security technologies require substantial capital investments for hardware, software, and professional services, creating barriers to adoption for cost-sensitive market segments.

Technical complexity associated with modern security systems poses challenges for organizations lacking specialized expertise in security technology deployment and management. Integration requirements with existing infrastructure and legacy systems can create implementation difficulties and extended deployment timelines.

Skills shortage in cybersecurity and physical security domains limits market growth potential as organizations struggle to find qualified personnel capable of managing sophisticated security infrastructure. The talent gap particularly affects smaller European markets where specialized security expertise may be limited.

Regulatory variations across European Union member states create compliance complexities for multinational organizations operating data centers in multiple jurisdictions. Differing requirements for security standards and data protection measures can complicate solution standardization and increase operational overhead for cross-border data center operators.

Emerging opportunities in the Europe data center physical security market stem from technological advancement and evolving customer requirements across European regions. Artificial intelligence integration presents significant growth potential as organizations seek intelligent security solutions capable of predictive threat analysis and automated incident response.

Edge computing expansion creates substantial opportunities for security solution providers as the proliferation of distributed data centers requires scalable protection frameworks. 5G network deployment across Europe necessitates enhanced security measures for edge infrastructure supporting next-generation telecommunications services.

Sustainability initiatives drive demand for energy-efficient security solutions that align with European environmental regulations and corporate sustainability goals. Green data center development creates opportunities for eco-friendly security technologies that minimize environmental impact while maintaining comprehensive protection capabilities.

Managed security services represent a growing opportunity as organizations seek to outsource security operations to specialized providers. Security-as-a-Service models enable cost-effective access to enterprise-grade protection for smaller data center operators while providing scalable solutions for larger enterprises.

Market dynamics in the Europe data center physical security sector reflect the complex interplay between technological innovation, regulatory requirements, and evolving threat landscapes. Competitive pressures drive continuous innovation as security vendors develop advanced solutions to differentiate their offerings and capture market share.

Customer expectations continue evolving toward integrated security platforms that provide comprehensive visibility and control across data center environments. Operational efficiency requirements drive demand for automated security systems that reduce manual intervention while maintaining high levels of protection and compliance adherence.

Technology convergence between physical security and IT infrastructure creates new market dynamics as traditional boundaries between security domains become increasingly blurred. Software-defined security approaches enable flexible deployment models and centralized management capabilities that appeal to modern data center operators.

Partnership ecosystems play crucial roles in market development as security vendors collaborate with technology integrators, data center operators, and cloud service providers to deliver comprehensive solutions. These strategic alliances enable market expansion and accelerate solution adoption across diverse customer segments.

Comprehensive research methodology employed for analyzing the Europe data center physical security market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability of market insights. Primary research activities include structured interviews with industry executives, technology vendors, data center operators, and end-user organizations across major European markets.

Secondary research encompasses analysis of industry reports, regulatory documents, company financial statements, and technology specifications from leading security solution providers. Market sizing methodologies utilize bottom-up and top-down approaches to validate market estimates and growth projections.

Data validation processes involve cross-referencing information from multiple sources and conducting expert interviews to verify market trends and competitive dynamics. Quantitative analysis techniques include statistical modeling and trend analysis to identify growth patterns and market opportunities.

Regional analysis methodology incorporates country-specific research to understand local market conditions, regulatory requirements, and competitive landscapes across European Union member states and associated territories.

Western Europe dominates the regional market landscape, accounting for the largest share of data center physical security investments across the continent. Germany leads regional adoption with extensive data center infrastructure supporting major European enterprises and cloud service providers. The country’s robust manufacturing sector and stringent data protection requirements drive substantial security technology investments.

United Kingdom maintains significant market presence despite Brexit-related uncertainties, with London serving as a major data center hub for financial services and technology companies. Regulatory alignment with European standards continues supporting market growth and cross-border data center operations.

France demonstrates strong growth potential driven by government digitalization initiatives and increasing cloud adoption across enterprise sectors. Paris emerges as a key data center location with growing demand for advanced security solutions supporting critical infrastructure protection.

Netherlands benefits from strategic geographic positioning and excellent connectivity infrastructure, making Amsterdam a preferred location for hyperscale data centers serving European markets. The region shows 35% growth in security solution deployments over recent periods.

Eastern Europe presents emerging opportunities with countries like Poland and Czech Republic experiencing rapid data center development and corresponding security infrastructure investments.

Competitive dynamics in the Europe data center physical security market feature established multinational corporations alongside specialized regional providers offering innovative solutions for diverse customer requirements. Market leadership positions are determined by technology innovation, geographic coverage, and comprehensive solution portfolios.

Leading market participants include:

Competitive strategies focus on technology differentiation, strategic partnerships, and geographic expansion to capture growing market opportunities across European regions.

Market segmentation analysis reveals diverse categories based on solution types, deployment models, and end-user applications across the Europe data center physical security market.

By Solution Type:

By Deployment Model:

By Data Center Type:

Access control systems represent the largest market category, driven by increasing adoption of biometric authentication technologies and multi-factor access management solutions. Advanced biometrics including facial recognition and iris scanning demonstrate 28% adoption growth across European data centers as organizations enhance security protocols.

Video surveillance solutions experience significant growth with intelligent analytics capabilities enabling proactive threat detection and automated incident response. AI-powered analytics transform traditional surveillance approaches by providing real-time behavioral analysis and anomaly detection capabilities.

Environmental monitoring systems gain importance as data centers implement comprehensive climate control and disaster prevention measures. Integrated monitoring platforms provide real-time visibility into temperature, humidity, and air quality conditions while enabling automated response to environmental threats.

Fire detection and suppression technologies evolve toward advanced systems specifically designed for data center environments, incorporating clean agent suppression systems and intelligent detection algorithms that minimize false alarms while ensuring rapid response to actual fire threats.

Perimeter security solutions integrate advanced detection technologies with intelligent analytics to provide comprehensive protection against unauthorized access attempts and potential security breaches at data center facility boundaries.

Data center operators benefit from comprehensive physical security solutions that ensure regulatory compliance, protect critical assets, and maintain operational continuity. Enhanced security measures reduce insurance costs, minimize downtime risks, and support customer confidence in data protection capabilities.

Enterprise customers gain assurance that their critical data and applications are protected by advanced security infrastructure meeting European regulatory requirements. Compliance adherence simplifies audit processes and reduces regulatory risks associated with data protection violations.

Security solution providers access growing market opportunities driven by increasing digitalization and regulatory compliance requirements across European markets. Technology innovation enables differentiation and competitive advantage in expanding market segments.

System integrators benefit from increasing demand for comprehensive security implementations that combine multiple technologies into unified platforms. Professional services opportunities include design, installation, and ongoing management of sophisticated security infrastructure.

Regulatory bodies achieve improved compliance outcomes as organizations implement robust security measures that align with data protection requirements and critical infrastructure protection standards across European jurisdictions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration emerges as a dominant trend transforming data center physical security across European markets. Machine learning algorithms enable predictive threat analysis, automated incident response, and intelligent behavioral analytics that enhance traditional security approaches.

Biometric authentication adoption accelerates as organizations implement advanced access control systems utilizing facial recognition, fingerprint scanning, and iris detection technologies. Multi-modal biometrics combining multiple authentication factors provide enhanced security while improving user experience.

Cloud-based security management gains traction as organizations seek centralized platforms for managing distributed data center security infrastructure. Software-as-a-Service models enable cost-effective access to enterprise-grade security capabilities while providing scalability and flexibility.

Environmental sustainability influences security solution selection as European organizations prioritize energy-efficient technologies that align with corporate sustainability goals and regulatory requirements. Green security systems minimize environmental impact while maintaining comprehensive protection capabilities.

Integration convergence between physical security and IT infrastructure creates unified platforms that provide comprehensive visibility and control across data center environments. Converged solutions simplify management while reducing operational complexity and costs.

Recent industry developments demonstrate accelerating innovation and market expansion across the Europe data center physical security sector. Technology partnerships between security vendors and data center operators drive solution development tailored for specific European market requirements.

Regulatory updates including enhanced cybersecurity directives and critical infrastructure protection requirements influence security solution specifications and deployment strategies across European data centers. Compliance frameworks continue evolving to address emerging threats and technological capabilities.

Acquisition activities reshape competitive dynamics as established security companies acquire specialized technology providers to expand solution portfolios and geographic coverage. Strategic consolidation enables comprehensive solution offerings while accelerating market penetration.

Investment increases in research and development drive advancement of next-generation security technologies including quantum-resistant encryption, advanced biometrics, and AI-powered threat detection systems specifically designed for data center applications.

MarkWide Research analysis indicates that standardization initiatives across European markets promote interoperability and reduce deployment complexity for multinational data center operators implementing comprehensive security infrastructure.

Strategic recommendations for market participants include prioritizing technology innovation and developing comprehensive solution portfolios that address diverse customer requirements across European data center markets. Investment focus should emphasize artificial intelligence integration and advanced analytics capabilities that provide competitive differentiation.

Partnership development with system integrators, data center operators, and cloud service providers enables market expansion and accelerates solution adoption across target customer segments. Channel strategies should leverage local expertise and established relationships in key European markets.

Compliance expertise becomes increasingly important as organizations navigate complex regulatory requirements across European jurisdictions. Solution providers should develop specialized knowledge of local regulations and industry standards to support customer compliance objectives.

Service capabilities including managed security services and ongoing support become critical differentiators in competitive markets. Comprehensive offerings that combine technology solutions with professional services provide enhanced customer value and recurring revenue opportunities.

Geographic expansion into emerging Eastern European markets presents growth opportunities as these regions experience rapid data center development and increasing security infrastructure investments.

Future market prospects for the Europe data center physical security sector remain highly positive, driven by continued digitalization, regulatory compliance requirements, and technological advancement across European markets. Growth projections indicate sustained expansion with the market expected to maintain robust CAGR of 8.5% over the forecast period.

Technology evolution will continue transforming security capabilities with artificial intelligence, machine learning, and advanced analytics becoming standard features in next-generation security platforms. Quantum computing developments may influence future security architectures and encryption requirements for data center protection.

Edge computing proliferation creates substantial growth opportunities as distributed data center infrastructure requires scalable security solutions capable of protecting diverse deployment environments. 5G network expansion across Europe will drive additional security requirements for edge data centers supporting telecommunications infrastructure.

Sustainability initiatives will increasingly influence solution selection as European organizations prioritize environmentally responsible technologies that align with carbon reduction goals and regulatory requirements. Energy-efficient security systems become competitive advantages in environmentally conscious markets.

MWR projections suggest that managed security services will experience the highest growth rates as organizations seek to outsource security operations while maintaining comprehensive protection capabilities across their data center infrastructure.

The Europe data center physical security market represents a dynamic and rapidly expanding sector driven by digital transformation, regulatory compliance requirements, and evolving threat landscapes across European territories. Market fundamentals remain strong with sustained growth expected as organizations continue investing in comprehensive security infrastructure to protect critical data center assets and ensure operational continuity.

Technology innovation continues reshaping market dynamics with artificial intelligence, advanced biometrics, and integrated security platforms providing enhanced protection capabilities while simplifying management and reducing operational complexity. Competitive differentiation increasingly depends on solution sophistication, service capabilities, and ability to address diverse customer requirements across European markets.

Strategic opportunities abound for market participants willing to invest in technology development, geographic expansion, and comprehensive service offerings that address the evolving needs of European data center operators. Future success will depend on adaptability to changing market conditions, regulatory requirements, and technological advancement while maintaining focus on customer value creation and operational excellence throughout the dynamic Europe data center physical security market landscape.

What is Data Center Physical Security?

Data Center Physical Security refers to the measures and protocols implemented to protect data centers from physical threats such as unauthorized access, natural disasters, and vandalism. This includes surveillance systems, access controls, and environmental monitoring.

What are the key players in the Europe Data Center Physical Security Market?

Key players in the Europe Data Center Physical Security Market include companies like Schneider Electric, IBM, and Cisco Systems, which provide various security solutions and technologies for data centers, among others.

What are the main drivers of the Europe Data Center Physical Security Market?

The main drivers of the Europe Data Center Physical Security Market include the increasing frequency of cyber threats, the growing need for data protection regulations, and the expansion of cloud computing services that require robust physical security measures.

What challenges does the Europe Data Center Physical Security Market face?

Challenges in the Europe Data Center Physical Security Market include the high costs associated with implementing advanced security technologies, the complexity of integrating various security systems, and the evolving nature of security threats that require constant updates and adaptations.

What opportunities exist in the Europe Data Center Physical Security Market?

Opportunities in the Europe Data Center Physical Security Market include the rising demand for smart security solutions, advancements in AI and machine learning for threat detection, and the increasing focus on sustainability in security practices.

What trends are shaping the Europe Data Center Physical Security Market?

Trends shaping the Europe Data Center Physical Security Market include the adoption of biometric access controls, the integration of IoT devices for real-time monitoring, and the shift towards cloud-based security management systems.

Europe Data Center Physical Security Market

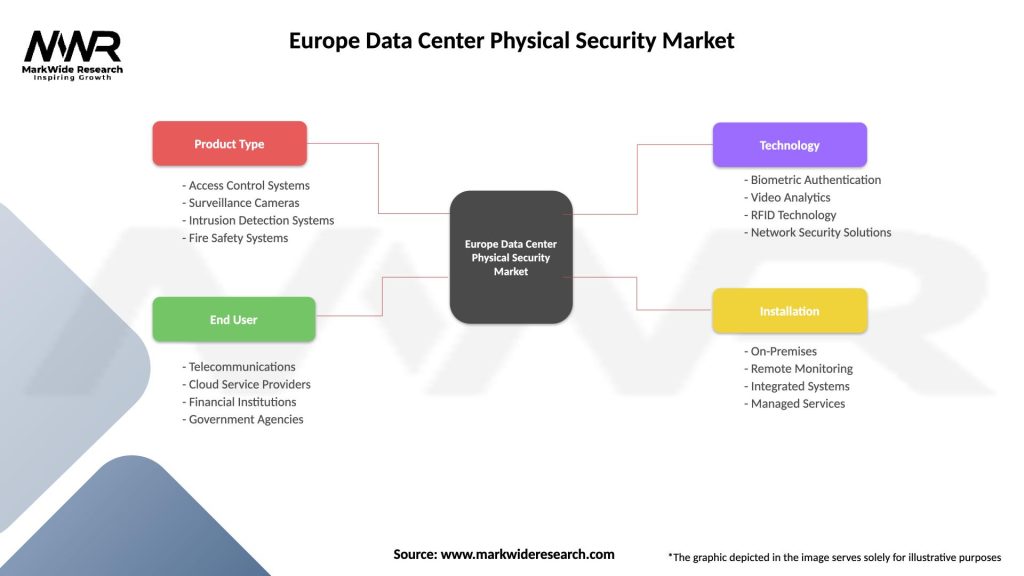

| Segmentation Details | Description |

|---|---|

| Product Type | Access Control Systems, Surveillance Cameras, Intrusion Detection Systems, Fire Safety Systems |

| End User | Telecommunications, Cloud Service Providers, Financial Institutions, Government Agencies |

| Technology | Biometric Authentication, Video Analytics, RFID Technology, Network Security Solutions |

| Installation | On-Premises, Remote Monitoring, Integrated Systems, Managed Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Data Center Physical Security Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at