444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe custom brokerage market represents a critical component of the continent’s international trade infrastructure, facilitating seamless movement of goods across borders while ensuring regulatory compliance. Custom brokerage services have evolved significantly in recent years, driven by increasing trade volumes, complex regulatory frameworks, and the growing demand for digitalized customs processes. The market encompasses a comprehensive range of services including customs clearance, documentation management, duty calculation, and compliance consulting across all major European Union member states and associated territories.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate of 6.2% over the past five years. This expansion reflects the increasing complexity of international trade regulations, the rise of e-commerce, and the growing need for specialized expertise in navigating customs procedures. Digital transformation has emerged as a key driver, with approximately 78% of custom brokerage firms investing in advanced technology solutions to enhance service delivery and operational efficiency.

Regional variations within Europe showcase distinct market characteristics, with Western European countries maintaining mature markets while Eastern European nations demonstrate accelerated growth rates. The market’s resilience has been particularly evident during recent global disruptions, highlighting the essential nature of custom brokerage services in maintaining supply chain continuity and international trade flows.

The Europe custom brokerage market refers to the comprehensive ecosystem of professional services that facilitate the import and export of goods across European borders by ensuring compliance with customs regulations, tax requirements, and trade policies. Custom brokers serve as licensed intermediaries between importers, exporters, and government customs authorities, providing specialized expertise in navigating complex regulatory frameworks while optimizing trade processes for businesses of all sizes.

Core functions within this market include customs clearance procedures, tariff classification, duty and tax calculation, documentation preparation, and regulatory compliance consulting. These services extend beyond basic administrative tasks to encompass strategic trade consulting, supply chain optimization, and risk management solutions. Modern custom brokerage increasingly incorporates advanced technologies such as artificial intelligence, blockchain, and automated processing systems to enhance accuracy, speed, and transparency in customs operations.

Market participants range from large multinational logistics companies offering integrated custom brokerage services to specialized boutique firms focusing on specific industry sectors or geographic regions. The market also includes technology providers developing innovative solutions for customs automation, compliance management, and trade facilitation across the European economic landscape.

Strategic positioning within the Europe custom brokerage market reveals a sector undergoing significant transformation driven by technological advancement, regulatory evolution, and changing trade patterns. The market demonstrates strong fundamentals with consistent growth trajectories supported by increasing international trade volumes and the growing complexity of customs regulations across European jurisdictions.

Key performance indicators highlight the market’s resilience and adaptability, with digital adoption rates reaching 82% among leading service providers. This technological integration has resulted in improved processing times, enhanced accuracy, and superior customer experience delivery. Service diversification has become a critical success factor, with companies expanding beyond traditional customs clearance to offer comprehensive trade management solutions.

Competitive dynamics showcase a market characterized by both consolidation trends among larger players and the emergence of innovative technology-driven service providers. The sector benefits from strong regulatory support for trade facilitation initiatives and increasing recognition of custom brokerage services as essential components of modern supply chain management. Future growth prospects remain positive, supported by expanding e-commerce activities, evolving trade agreements, and the continuous need for specialized customs expertise in an increasingly complex regulatory environment.

Fundamental market insights reveal several critical trends shaping the Europe custom brokerage landscape:

Market intelligence indicates that successful custom brokerage firms are those that combine deep regulatory expertise with advanced technological capabilities while maintaining strong relationships with customs authorities and trade partners across the European region.

Primary growth drivers propelling the Europe custom brokerage market forward encompass multiple interconnected factors that create sustained demand for specialized customs services. International trade expansion remains the fundamental driver, with European trade volumes continuing to grow despite periodic economic uncertainties and geopolitical challenges.

Regulatory complexity serves as a significant market driver, as businesses increasingly require specialized expertise to navigate evolving customs regulations, trade agreements, and compliance requirements. The implementation of new trade policies, changes in tariff structures, and the ongoing evolution of Brexit-related customs procedures have created substantial demand for professional custom brokerage services. Digital commerce growth has emerged as a particularly strong driver, with cross-border e-commerce transactions requiring specialized handling and expedited customs processing capabilities.

Technology advancement acts as both a driver and enabler, with businesses seeking custom brokerage partners who can provide advanced digital solutions, real-time tracking, and automated processing capabilities. Supply chain optimization initiatives across industries have increased demand for integrated customs services that can seamlessly connect with broader logistics and supply chain management systems. Additionally, risk management requirements have intensified, driving demand for sophisticated compliance monitoring and audit support services that help businesses maintain regulatory adherence while optimizing trade operations.

Significant market restraints present ongoing challenges for the Europe custom brokerage sector, requiring strategic adaptation and innovative solutions from service providers. Regulatory fragmentation across different European jurisdictions creates complexity and operational challenges, particularly for firms operating across multiple countries with varying customs procedures and requirements.

Cost pressures represent a persistent restraint, as businesses continuously seek to optimize their customs-related expenses while maintaining service quality and compliance standards. This pressure is particularly acute for small and medium-sized enterprises that may have limited budgets for specialized customs services. Technology investment requirements pose challenges for smaller custom brokerage firms that must compete with larger organizations having greater resources for digital transformation initiatives.

Talent acquisition and retention difficulties create operational constraints, as the market requires highly specialized professionals with deep knowledge of customs regulations, trade policies, and technological systems. Economic volatility and trade policy uncertainties can impact market stability, affecting both demand patterns and operational planning for custom brokerage firms. Additionally, increasing automation in customs processes, while beneficial for efficiency, may reduce demand for certain traditional custom brokerage services, requiring firms to continuously evolve their service offerings and value propositions.

Substantial market opportunities exist within the Europe custom brokerage sector, driven by evolving trade patterns, technological advancement, and changing business requirements. Digital service expansion presents significant opportunities for firms to develop innovative technology-enabled solutions that provide enhanced value to clients through improved efficiency, transparency, and cost-effectiveness.

E-commerce specialization offers considerable growth potential, as the rapid expansion of cross-border online retail creates demand for specialized customs services tailored to high-volume, low-value shipments requiring expedited processing. Sustainability consulting represents an emerging opportunity, with increasing numbers of businesses seeking guidance on environmentally responsible trade practices and carbon footprint reduction strategies in their customs operations.

Industry vertical specialization provides opportunities for custom brokerage firms to develop deep expertise in specific sectors such as pharmaceuticals, automotive, technology, or agricultural products, commanding premium pricing for specialized knowledge and services. Advisory services expansion beyond traditional customs clearance to include strategic trade consulting, supply chain optimization, and regulatory compliance management offers significant revenue diversification opportunities. Geographic expansion into emerging European markets and the development of comprehensive pan-European service networks present growth opportunities for established custom brokerage providers seeking to expand their market presence and service capabilities.

Complex market dynamics shape the Europe custom brokerage landscape through the interplay of regulatory, technological, and economic factors that influence both demand patterns and service delivery models. Regulatory evolution continues to drive market dynamics, with ongoing changes in trade policies, customs procedures, and compliance requirements creating both challenges and opportunities for service providers.

Competitive intensity has increased significantly, with traditional custom brokerage firms facing competition from integrated logistics providers, technology companies, and specialized digital platforms offering automated customs services. This competition has led to service innovation acceleration, with firms developing comprehensive solutions that combine traditional expertise with advanced technological capabilities. Client expectations have evolved substantially, with businesses demanding greater transparency, faster processing times, and more comprehensive service offerings from their custom brokerage partners.

Technology disruption continues to reshape market dynamics, with artificial intelligence, blockchain, and automation technologies transforming traditional customs processes and creating new service delivery models. Market consolidation trends are evident, with larger firms acquiring specialized providers to expand their capabilities and geographic coverage. According to MarkWide Research analysis, approximately 34% of custom brokerage firms have expanded their service portfolios significantly over the past three years, reflecting the dynamic nature of market requirements and competitive positioning strategies.

Comprehensive research methodology employed for analyzing the Europe custom brokerage market incorporates multiple data collection and analysis techniques to ensure accuracy, reliability, and depth of insights. Primary research components include extensive interviews with industry executives, custom brokerage professionals, regulatory officials, and key stakeholders across major European markets to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses detailed analysis of industry reports, regulatory publications, trade statistics, and academic studies to provide comprehensive market context and historical perspective. Quantitative analysis involves statistical modeling and trend analysis of trade volumes, service pricing, market share data, and performance metrics across different market segments and geographic regions.

Qualitative assessment includes in-depth evaluation of competitive strategies, service innovation trends, regulatory impact analysis, and technology adoption patterns within the custom brokerage sector. Market validation processes involve cross-referencing multiple data sources, expert opinion verification, and scenario analysis to ensure research findings accuracy and reliability. Continuous monitoring of market developments, regulatory changes, and industry announcements provides ongoing validation and updates to research conclusions, ensuring the analysis remains current and relevant for strategic decision-making purposes.

Regional market analysis reveals distinct characteristics and growth patterns across different European geographic segments, with Western Europe maintaining the largest market share at approximately 58% of total market activity. This dominance reflects the region’s mature trade infrastructure, established business relationships, and high-volume international commerce activities centered around major ports and logistics hubs.

Germany leads the regional market with sophisticated custom brokerage services supporting its position as Europe’s largest economy and major trading nation. The country’s custom brokerage sector benefits from advanced technology adoption, comprehensive regulatory expertise, and strong integration with broader logistics networks. United Kingdom represents a unique market dynamic following Brexit, with increased demand for specialized customs services to manage new trade relationships and regulatory requirements.

Eastern Europe demonstrates the highest growth rates, with countries such as Poland, Czech Republic, and Hungary experiencing annual growth rates exceeding 8.5% as their economies integrate more deeply into European and global trade networks. Nordic countries showcase advanced digitalization in customs processes, with high adoption rates of automated systems and technology-enabled service delivery models. Southern Europe markets, including Italy, Spain, and Greece, focus on specialized services for agricultural products, tourism-related trade, and Mediterranean shipping routes, creating distinct service requirements and market opportunities for custom brokerage providers.

Competitive landscape analysis reveals a diverse market structure characterized by multiple player categories ranging from global logistics giants to specialized regional custom brokerage firms. Market leadership is distributed among several key categories of service providers, each offering distinct competitive advantages and market positioning strategies.

Major market participants include:

Competitive differentiation strategies focus on technology innovation, industry specialization, geographic coverage, and service integration capabilities. Market positioning varies significantly, with some firms emphasizing cost leadership while others focus on premium service quality and specialized expertise for complex trade requirements.

Market segmentation analysis reveals multiple classification approaches that provide insights into different market dynamics and growth opportunities within the Europe custom brokerage sector. Service-based segmentation represents the primary classification method, distinguishing between various types of customs-related services and their respective market characteristics.

By Service Type:

By Industry Vertical:

Geographic segmentation reflects distinct regional market characteristics, regulatory environments, and service requirements across different European countries and economic zones.

Detailed category analysis provides comprehensive insights into specific market segments and their unique characteristics, growth patterns, and strategic implications for custom brokerage service providers. Traditional customs clearance services continue to represent the foundation of the market, accounting for approximately 62% of total service revenues, though this segment is experiencing gradual commoditization pressure.

Trade consulting services demonstrate the highest growth potential, with increasing demand for strategic advisory services that help businesses optimize their international trade operations beyond basic customs compliance. This category benefits from the growing complexity of trade regulations and the need for specialized expertise in navigating multi-jurisdictional requirements. Technology-enabled services represent the fastest-growing category, with digital platforms and automated processing solutions gaining significant market traction.

Industry-specific services show strong differentiation potential, with specialized expertise in sectors such as pharmaceuticals, automotive, and technology commanding premium pricing due to complex regulatory requirements and specialized knowledge needs. E-commerce customs services have emerged as a distinct high-growth category, driven by the rapid expansion of cross-border online retail and the need for expedited, cost-effective customs processing solutions. Compliance and risk management services continue to gain importance as businesses face increasing regulatory scrutiny and the need for comprehensive audit support and risk mitigation strategies.

Comprehensive benefits derived from the Europe custom brokerage market extend across multiple stakeholder categories, creating value through improved efficiency, regulatory compliance, and strategic trade optimization. Importers and exporters benefit from reduced administrative burden, faster customs clearance times, and expert guidance in navigating complex regulatory requirements across different European jurisdictions.

Cost optimization represents a significant benefit, with professional custom brokerage services helping businesses minimize duty payments, avoid penalties, and reduce overall trade-related expenses through expert tariff classification and duty management strategies. Risk mitigation benefits include reduced exposure to customs violations, improved regulatory compliance, and proactive identification of potential trade-related risks before they impact business operations.

Operational efficiency gains include streamlined customs processes, reduced documentation errors, and faster shipment processing times that contribute to improved supply chain performance. Technology access through custom brokerage partnerships provides businesses with advanced tracking systems, automated processing capabilities, and real-time visibility into customs status without requiring significant internal technology investments. Regulatory expertise benefits ensure businesses remain compliant with evolving trade regulations while optimizing their international trade strategies for maximum efficiency and cost-effectiveness.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative market trends are reshaping the Europe custom brokerage landscape, with digital transformation leading the evolution toward more efficient, transparent, and automated service delivery models. Artificial intelligence integration has become increasingly prevalent, with approximately 71% of leading firms implementing AI-powered solutions for document processing, risk assessment, and regulatory compliance monitoring.

Sustainability focus represents a growing trend, with custom brokerage firms developing specialized services to help clients reduce their environmental impact through optimized shipping routes, consolidated shipments, and carbon footprint tracking capabilities. Real-time visibility has become a standard expectation, with clients demanding comprehensive tracking and status updates throughout the customs clearance process.

Service integration trends show custom brokerage firms expanding beyond traditional services to offer comprehensive trade management solutions including supply chain consulting, inventory optimization, and strategic trade planning. Blockchain technology adoption is gaining momentum for secure document management and transparent transaction processing. Mobile accessibility has become essential, with service providers developing comprehensive mobile platforms enabling clients to manage customs processes remotely. Predictive analytics utilization for proactive risk management and process optimization represents an emerging trend that is transforming how custom brokerage firms deliver value to their clients.

Significant industry developments continue to shape the Europe custom brokerage market through regulatory changes, technological advancement, and strategic business initiatives. European Union customs modernization initiatives have introduced new digital processing requirements and standardized procedures across member states, creating both opportunities and challenges for service providers.

Brexit implementation has fundamentally altered trade relationships between the UK and EU, creating substantial new demand for specialized customs services and expertise in managing complex new regulatory requirements. Technology partnerships between custom brokerage firms and software providers have accelerated, resulting in more sophisticated platforms offering integrated customs management, compliance monitoring, and trade optimization capabilities.

Merger and acquisition activity has intensified, with larger logistics companies acquiring specialized custom brokerage firms to expand their service capabilities and geographic coverage. Regulatory harmonization efforts across European countries are gradually reducing complexity while creating new opportunities for standardized service delivery models. Sustainability initiatives have gained prominence, with industry associations and regulatory bodies promoting environmentally responsible trade practices and carbon reduction strategies. MarkWide Research data indicates that 43% of custom brokerage firms have made significant strategic investments in technology and service expansion over the past two years, reflecting the dynamic nature of industry development and competitive positioning requirements.

Strategic recommendations for Europe custom brokerage market participants emphasize the critical importance of technology investment, service diversification, and strategic positioning to maintain competitive advantage in an evolving market landscape. Digital transformation acceleration should be prioritized, with firms investing in comprehensive technology platforms that provide automated processing, real-time visibility, and integrated service delivery capabilities.

Service portfolio expansion beyond traditional customs clearance to include strategic consulting, compliance management, and supply chain optimization services will be essential for maintaining relevance and commanding premium pricing. Industry specialization development represents a key opportunity for differentiation, with firms advised to develop deep expertise in specific sectors such as pharmaceuticals, automotive, or e-commerce to create competitive moats and pricing power.

Geographic expansion strategies should focus on emerging European markets and the development of comprehensive pan-European service networks to capture growth opportunities and serve multinational clients effectively. Partnership development with technology providers, logistics companies, and industry associations will be crucial for accessing new capabilities and market opportunities. Talent investment in recruiting and developing professionals with both traditional customs expertise and modern technology skills will be essential for long-term success. Sustainability integration into service offerings will become increasingly important as clients prioritize environmentally responsible trade practices and carbon footprint reduction strategies.

Future market prospects for the Europe custom brokerage sector remain positive, supported by continued growth in international trade, increasing regulatory complexity, and ongoing digital transformation initiatives. Market evolution is expected to accelerate, with traditional service models giving way to more integrated, technology-enabled solutions that provide comprehensive trade management capabilities beyond basic customs clearance.

Growth projections indicate sustained expansion at a compound annual growth rate of 7.1% over the next five years, driven by e-commerce growth, regulatory complexity, and increasing demand for specialized expertise. Technology advancement will continue to reshape service delivery models, with artificial intelligence, blockchain, and automation technologies becoming standard components of competitive custom brokerage offerings.

Market consolidation is expected to continue, with larger firms acquiring specialized providers to expand capabilities and geographic coverage while smaller firms focusing on niche specializations or regional expertise. Regulatory evolution will create both challenges and opportunities, with ongoing harmonization efforts across European countries potentially simplifying some processes while new trade agreements and policy changes create demand for specialized expertise. MWR analysis suggests that firms successfully adapting to these changes through strategic technology investment, service innovation, and market positioning will capture disproportionate growth opportunities in the evolving European custom brokerage landscape.

The Europe custom brokerage market represents a dynamic and essential component of the continent’s international trade infrastructure, characterized by ongoing transformation driven by technological advancement, regulatory evolution, and changing business requirements. Market fundamentals remain strong, supported by consistent growth in international trade volumes, increasing regulatory complexity, and the growing recognition of custom brokerage services as critical enablers of efficient supply chain management.

Strategic positioning for success in this market requires a comprehensive approach combining traditional customs expertise with advanced technology capabilities, service innovation, and strategic market positioning. The sector’s future success will depend on the ability of service providers to adapt to evolving client needs, regulatory changes, and competitive pressures while maintaining the high levels of expertise and service quality that define professional custom brokerage services. Continued investment in technology, talent, and service development will be essential for capturing growth opportunities and maintaining competitive advantage in this evolving and strategically important market sector.

What is Custom Brokerage?

Custom Brokerage involves the services provided by customs brokers to facilitate the import and export of goods across international borders. This includes ensuring compliance with regulations, handling documentation, and managing duties and taxes.

What are the key players in the Europe Custom Brokerage Market?

Key players in the Europe Custom Brokerage Market include DHL, Kuehne + Nagel, DB Schenker, and Expeditors, among others. These companies provide a range of logistics and customs services to streamline cross-border trade.

What are the main drivers of growth in the Europe Custom Brokerage Market?

The growth of the Europe Custom Brokerage Market is driven by increasing international trade, the rise of e-commerce, and the need for efficient supply chain management. Additionally, regulatory changes and trade agreements are influencing market dynamics.

What challenges does the Europe Custom Brokerage Market face?

Challenges in the Europe Custom Brokerage Market include complex regulatory environments, varying customs procedures across countries, and the impact of geopolitical tensions on trade. These factors can complicate logistics and increase operational costs.

What opportunities exist in the Europe Custom Brokerage Market?

Opportunities in the Europe Custom Brokerage Market include the adoption of digital technologies for customs clearance, the growth of specialized brokerage services, and the expansion of trade routes. Companies are increasingly looking for innovative solutions to enhance efficiency.

What trends are shaping the Europe Custom Brokerage Market?

Trends in the Europe Custom Brokerage Market include the integration of automation and artificial intelligence in customs processes, a focus on sustainability in logistics, and the increasing importance of data analytics for compliance and efficiency. These trends are transforming how customs brokerage services are delivered.

Europe Custom Brokerage Market

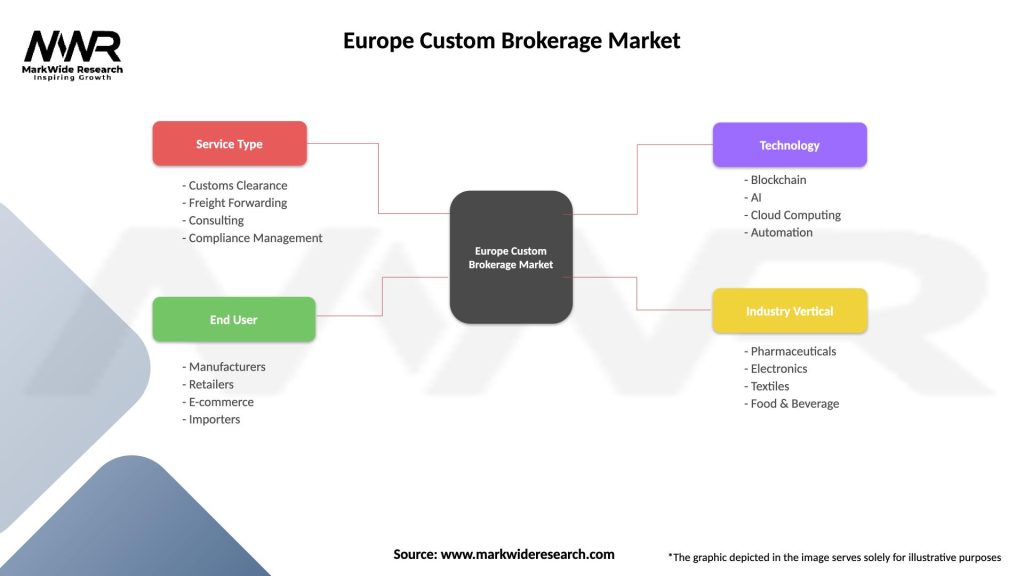

| Segmentation Details | Description |

|---|---|

| Service Type | Customs Clearance, Freight Forwarding, Consulting, Compliance Management |

| End User | Manufacturers, Retailers, E-commerce, Importers |

| Technology | Blockchain, AI, Cloud Computing, Automation |

| Industry Vertical | Pharmaceuticals, Electronics, Textiles, Food & Beverage |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Custom Brokerage Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at