444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The Europe Crowd Lending and Crowd Investing Market has witnessed significant growth in recent years. It has emerged as a popular alternative investment platform, allowing individuals and businesses to raise funds from a large number of people through online platforms. This market provides an opportunity for investors to diversify their portfolios and for borrowers to access much-needed capital outside of traditional banking channels. This article explores the various aspects of the Europe Crowd Lending and Crowd Investing Market, including its meaning, key market insights, drivers, restraints, opportunities, regional analysis, competitive landscape, segmentation, and more.

Meaning

Crowd lending and crowd investing refer to the practice of raising funds from a group of individuals, often through online platforms, for various purposes such as business expansion, real estate projects, personal loans, and startup funding. Unlike traditional banking systems, crowd lending and crowd investing platforms enable borrowers to directly connect with potential lenders or investors. These platforms provide a transparent and efficient way for borrowers to secure funding and for investors to earn attractive returns on their investments.

Executive Summary

The Europe Crowd Lending and Crowd Investing Market has experienced significant growth in recent years, driven by factors such as increasing investor demand for alternative investment options, advancements in financial technology (fintech), and the need for access to capital for small and medium-sized enterprises (SMEs). This market offers a wide range of opportunities for both borrowers and investors, leading to the emergence of numerous crowd lending and crowd investing platforms throughout Europe. However, there are also challenges and regulatory considerations that need to be addressed to ensure the long-term sustainability and stability of the market.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

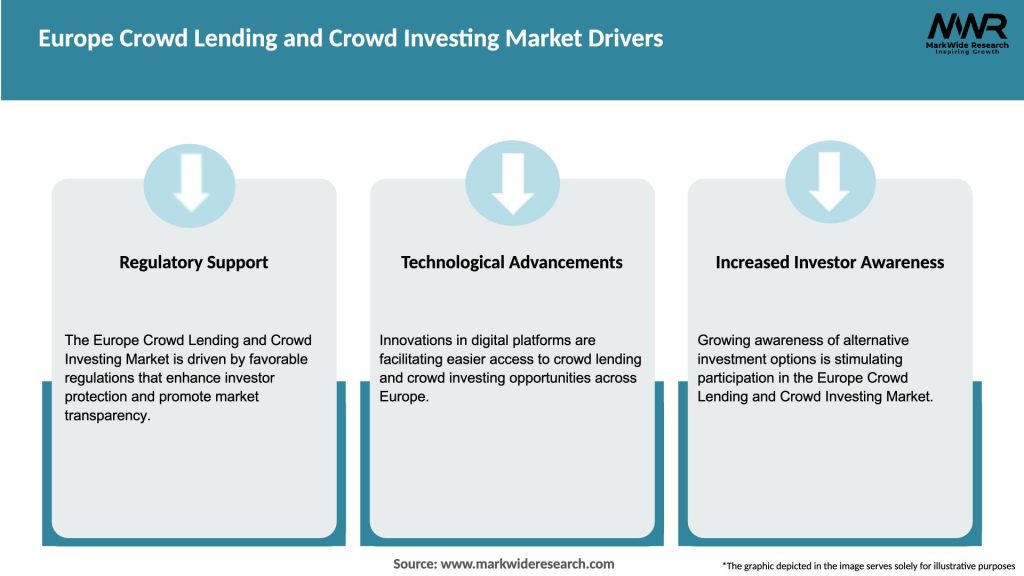

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Europe Crowd Lending and Crowd Investing Market is characterized by its dynamic nature, driven by changing investor preferences, technological advancements, and regulatory developments. The market is highly competitive, with various platforms vying for investor attention and borrower demand. Continuous innovation and adaptation to market trends are crucial for the sustained growthof crowd lending and crowd investing platforms.

Regional Analysis

The Europe Crowd Lending and Crowd Investing Market can be segmented into various regions, including Western Europe, Eastern Europe, Northern Europe, Southern Europe, and Central Europe. Each region has its own unique market dynamics and regulatory frameworks. Western Europe, including countries like the United Kingdom, Germany, and France, has been at the forefront of the crowd lending and crowd investing market, experiencing substantial growth in recent years. However, Eastern European countries are also emerging as promising markets, driven by increasing investor interest and favorable regulatory reforms.

Competitive Landscape

Leading Companies in the Europe Crowd Lending and Crowd Investing Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Europe Crowd Lending and Crowd Investing Market can be segmented based on the type of investment opportunities offered, including business loans, consumer loans, real estate projects, peer-to-peer lending, equity crowdfunding, and reward-based crowdfunding. Each segment has its own unique characteristics and attracts different types of investors and borrowers. The diversification of investment options contributes to the overall growth and stability of the market.

Category-wise Insights

Within the Europe Crowd Lending and Crowd Investing Market, there are various categories that cater to specific investment preferences and risk profiles. These categories include:

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the Europe Crowd Lending and Crowd Investing Market. Initially, the market experienced a slowdown due to economic uncertainties and investor caution. However, as the pandemic unfolded, crowd lending and crowd investing platforms played a crucial role in supporting small businesses and individuals affected by the crisis. The market demonstrated its resilience by adapting to the new normal, implementing risk management measures, and providing much-needed funding for recovery and growth.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Europe Crowd Lending and Crowd Investing Market is poised for continued growth in the coming years. The market will benefit from increasing investor demand for alternative investment options, advancements in financial technology, and the need for capital among small businesses and startups. Regulatory reforms and collaborations between traditional financial institutions and platforms will further boost market development and expansion. However, challenges such as regulatory uncertainties, investor education, and economic uncertainties need to be addressed to ensure the long-term sustainability and stability of the market.

Conclusion

The Europe Crowd Lending and Crowd Investing Market presents significant opportunities for investors, borrowers, and platform operators. It offers a flexible and efficient way to raise funds and diversify investment portfolios. While the market is still evolving and faces certain challenges, the overall outlook is positive. With the right regulatory framework, investor education, and technological advancements, the crowd lending and crowd investing market will continue to play a vital role in the European financial landscape, fostering economic growth and innovation.

What is Crowd Lending and Crowd Investing?

Crowd Lending and Crowd Investing refer to alternative financing methods where individuals or businesses raise funds from a large number of people, typically via online platforms. These methods allow for direct investment in projects or loans, bypassing traditional financial institutions.

What are the key players in the Europe Crowd Lending and Crowd Investing Market?

Key players in the Europe Crowd Lending and Crowd Investing Market include platforms like Funding Circle, Seedrs, and Crowdcube, which facilitate peer-to-peer lending and equity crowdfunding. These companies are known for connecting investors with startups and small businesses, among others.

What are the growth factors driving the Europe Crowd Lending and Crowd Investing Market?

The growth of the Europe Crowd Lending and Crowd Investing Market is driven by increasing demand for alternative financing solutions, the rise of digital platforms, and a growing number of startups seeking funding. Additionally, investor interest in diversifying portfolios contributes to market expansion.

What challenges does the Europe Crowd Lending and Crowd Investing Market face?

The Europe Crowd Lending and Crowd Investing Market faces challenges such as regulatory uncertainties, competition from traditional financial institutions, and concerns over the creditworthiness of borrowers. These factors can impact investor confidence and market stability.

What opportunities exist in the Europe Crowd Lending and Crowd Investing Market?

Opportunities in the Europe Crowd Lending and Crowd Investing Market include the potential for innovative financial products, increased collaboration with fintech companies, and the expansion of investment options for retail investors. The growing interest in sustainable and impact investing also presents new avenues for growth.

What trends are shaping the Europe Crowd Lending and Crowd Investing Market?

Trends shaping the Europe Crowd Lending and Crowd Investing Market include the rise of blockchain technology for secure transactions, the increasing popularity of real estate crowdfunding, and a shift towards more regulated environments. These trends are influencing how investors and borrowers interact in the market.

Europe Crowd Lending and Crowd Investing Market

| Segmentation Details | Description |

|---|---|

| Investment Strategy | Equity Crowdfunding, Debt Crowdfunding, Hybrid Models, Real Estate Crowdfunding |

| Investor Type | Retail Investors, Institutional Investors, Accredited Investors, Crowdfunding Platforms |

| Transaction Size | Small Scale, Medium Scale, Large Scale, Micro Investments |

| Fund Structure | Closed-End Funds, Open-End Funds, Interval Funds, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Europe Crowd Lending and Crowd Investing Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at