444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe craft spirit market represents a dynamic and rapidly evolving segment of the alcoholic beverage industry, characterized by artisanal production methods, premium quality offerings, and innovative flavor profiles. This market encompasses a diverse range of spirits including craft whiskey, gin, vodka, rum, and specialty liqueurs produced by small-scale distilleries across European nations. Market dynamics indicate robust growth driven by changing consumer preferences toward premium, locally-sourced alcoholic beverages with unique characteristics and authentic production stories.

Regional distribution shows significant concentration in countries with established distilling traditions such as Scotland, Ireland, Germany, and France, while emerging markets in Eastern Europe demonstrate increasing craft spirit adoption rates. The market benefits from growing consumer sophistication and willingness to pay premium prices for artisanal products that offer distinctive taste experiences and cultural authenticity.

Industry transformation reflects broader trends toward premiumization, with craft spirits experiencing growth rates of approximately 12-15% annually across key European markets. This expansion is supported by favorable regulatory environments, increasing tourism interest in distillery experiences, and rising demand for locally-produced alcoholic beverages that reflect regional terroir and craftsmanship traditions.

The Europe craft spirit market refers to the commercial ecosystem encompassing small-batch, artisanal alcoholic beverage production across European territories, characterized by traditional distillation methods, premium ingredients, and limited production volumes that emphasize quality over quantity.

Craft spirits distinguish themselves from mass-produced alternatives through several key characteristics including small-scale production facilities, hands-on distillation processes, locally-sourced ingredients, and innovative flavor development approaches. These products typically command premium pricing due to their artisanal nature, unique taste profiles, and the storytelling elements associated with their production heritage.

Market definition encompasses various spirit categories including single malt whiskeys, small-batch gins, artisanal vodkas, craft rums, and specialty liqueurs produced by independent distilleries with annual production volumes typically below established thresholds that define craft production standards. The segment emphasizes authenticity, craftsmanship, and regional identity as core value propositions.

Market performance demonstrates exceptional momentum across European craft spirit segments, with premium gin categories leading growth trends followed by artisanal whiskey and innovative vodka offerings. Consumer preferences increasingly favor authentic, locally-produced spirits that offer unique taste experiences and compelling brand narratives rooted in traditional craftsmanship and regional heritage.

Key growth drivers include rising disposable incomes, increasing consumer sophistication regarding spirit quality and production methods, growing interest in experiential consumption, and expanding distribution channels including specialized retail outlets, premium bars, and direct-to-consumer sales platforms. Tourism growth contributes significantly through distillery visits and tasting experiences that drive brand awareness and consumer loyalty.

Competitive landscape features hundreds of small-scale distilleries across European markets, with concentration varying significantly by country and spirit category. Market leaders typically combine traditional production methods with innovative marketing approaches, leveraging digital platforms and experiential marketing to build brand recognition and consumer engagement in increasingly crowded market segments.

Future projections indicate continued expansion driven by demographic trends favoring premium consumption, regulatory support for small-scale producers, and growing export opportunities as European craft spirits gain international recognition for quality and authenticity.

Consumer behavior analysis reveals significant shifts toward premium spirit consumption, with craft offerings capturing increasing market share from traditional mass-market brands. Key insights demonstrate the importance of authenticity, local sourcing, and artisanal production methods in driving purchase decisions among target demographics.

Consumer sophistication represents the primary driver of European craft spirit market expansion, as increasingly knowledgeable consumers seek authentic, high-quality alcoholic beverages that offer unique taste experiences and compelling production stories. This trend reflects broader premiumization movements across consumer goods categories, with spirits benefiting from growing appreciation for artisanal craftsmanship and traditional production methods.

Economic prosperity in key European markets supports premium consumption patterns, enabling consumers to allocate higher spending toward quality alcoholic beverages. Rising disposable incomes, particularly among urban professionals and affluent demographics, create favorable conditions for craft spirit adoption and brand loyalty development.

Cultural authenticity drives demand for locally-produced spirits that reflect regional heritage and traditional distillation practices. Consumers increasingly value products with authentic origin stories, local ingredient sourcing, and connections to cultural traditions, creating opportunities for craft distilleries to differentiate through heritage marketing and terroir emphasis.

Tourism growth contributes significantly through distillery experiences, tasting tours, and cultural tourism initiatives that introduce consumers to craft spirits while building brand awareness and emotional connections. The experiential aspect of craft spirit consumption aligns with broader tourism trends favoring authentic, immersive cultural experiences.

Regulatory support from European governments recognizes the economic and cultural value of craft distilleries, with policies supporting small-scale producers through favorable taxation, simplified licensing procedures, and promotional initiatives that enhance market access and competitiveness.

High production costs present significant challenges for craft distilleries, as small-scale operations cannot achieve the economies of scale available to large commercial producers. Premium ingredient sourcing, traditional production methods, and limited production volumes result in higher per-unit costs that must be passed to consumers through premium pricing strategies.

Regulatory complexity across European markets creates barriers for small-scale producers seeking to expand distribution or export products. Varying national regulations, licensing requirements, and taxation structures complicate market entry and expansion strategies, particularly for smaller distilleries with limited regulatory expertise and compliance resources.

Distribution challenges limit market access for many craft spirit producers, as traditional distribution channels favor established brands with proven sales volumes and marketing support. Limited shelf space in retail outlets and competition for premium positioning create barriers for new entrants and smaller producers seeking market visibility.

Capital intensity requirements for distillery establishment and expansion constrain market entry and growth opportunities. Equipment costs, facility requirements, aging processes for certain spirits, and working capital needs create significant financial barriers for potential market participants, limiting competitive dynamics and innovation potential.

Consumer education needs represent ongoing challenges, as craft spirit appreciation requires knowledge development regarding production methods, quality indicators, and taste differentiation. Limited consumer awareness of craft alternatives and established brand loyalties create marketing challenges for emerging producers seeking market share growth.

Export expansion presents substantial growth opportunities as European craft spirits gain international recognition for quality and authenticity. Growing global appreciation for premium alcoholic beverages creates market opportunities in North America, Asia-Pacific, and other regions where European craft spirits can command premium positioning and pricing.

Digital marketing platforms enable craft distilleries to build direct relationships with consumers, bypassing traditional distribution limitations while creating authentic brand narratives that resonate with target demographics. Social media marketing, e-commerce platforms, and digital storytelling provide cost-effective market access and brand building opportunities.

Experiential tourism integration offers revenue diversification through distillery tours, tasting experiences, educational programs, and cultural events that enhance brand visibility while generating direct sales and building consumer loyalty. This approach leverages growing interest in authentic travel experiences and cultural immersion.

Innovation opportunities exist in flavor development, sustainable production methods, packaging design, and product positioning that differentiate craft offerings from mass-market alternatives. Limited edition releases, seasonal offerings, and collaborative products create excitement and exclusivity that drive consumer interest and premium pricing.

Partnership development with restaurants, bars, hotels, and specialty retailers creates distribution opportunities while building brand credibility through association with quality-focused establishments. Strategic partnerships enable market access while providing authentic consumption contexts that enhance brand positioning.

Supply chain evolution reflects increasing sophistication in craft spirit production, with distilleries developing direct relationships with ingredient suppliers, investing in quality control systems, and implementing sustainable production practices that enhance product differentiation and brand positioning. These developments support premium pricing while building consumer trust and loyalty.

Competitive intensity continues increasing as market success attracts new entrants and existing producers expand product portfolios. This dynamic drives innovation, quality improvements, and marketing sophistication while potentially pressuring profit margins and market share distribution among participants.

Technology integration enhances production efficiency, quality consistency, and consumer engagement through advanced distillation equipment, quality monitoring systems, and digital marketing platforms. According to MarkWide Research analysis, technology adoption enables craft distilleries to maintain artisanal character while improving operational efficiency and market competitiveness.

Consumer engagement strategies increasingly emphasize authenticity, transparency, and educational content that builds appreciation for craft spirit production methods and quality characteristics. Successful brands combine traditional craftsmanship with modern marketing approaches that create emotional connections and brand loyalty among target consumers.

Market consolidation trends show larger beverage companies acquiring successful craft distilleries to access premium market segments while maintaining authentic brand positioning. This dynamic provides exit opportunities for craft producers while potentially changing competitive dynamics and market structure.

Primary research methodology encompasses comprehensive interviews with craft distillery owners, industry experts, distributors, and retail partners across major European markets. This approach provides direct insights into market dynamics, competitive challenges, consumer preferences, and growth opportunities from industry participants with firsthand market experience.

Secondary research analysis incorporates industry publications, trade association reports, regulatory filings, and market intelligence from established sources to validate primary findings and provide comprehensive market context. This methodology ensures research accuracy while identifying trends and patterns that may not be apparent through primary research alone.

Consumer surveys conducted across key demographic segments provide insights into purchasing behavior, brand preferences, consumption patterns, and factors influencing craft spirit selection. Survey methodology includes both quantitative preference measurements and qualitative feedback regarding product attributes and brand perceptions.

Market observation techniques include retail channel analysis, pricing studies, promotional activity monitoring, and competitive product assessment to understand market positioning strategies and consumer response patterns. This approach provides real-world validation of reported market trends and consumer preferences.

Data validation processes ensure research accuracy through cross-referencing multiple sources, statistical analysis of survey responses, and expert review of findings and conclusions. Quality control measures maintain research integrity while providing confidence in market projections and strategic recommendations.

United Kingdom leads European craft spirit production and consumption, with Scotland’s whisky heritage providing foundation for craft distillery expansion while England experiences rapid growth in craft gin production. The market benefits from strong consumer acceptance of premium spirits, established distribution networks, and favorable regulatory environments supporting small-scale producers.

Germany demonstrates significant craft spirit market development, particularly in traditional categories like schnapps and innovative gin offerings. Regional preferences for locally-produced alcoholic beverages support craft distillery growth, while strong economic conditions enable premium consumption patterns that benefit artisanal producers.

France maintains strong positions in craft brandy and liqueur segments while experiencing growth in artisanal gin and whiskey production. The market leverages established wine and spirits expertise, premium brand positioning capabilities, and sophisticated consumer appreciation for quality alcoholic beverages.

Ireland benefits from whiskey heritage while expanding into other craft spirit categories, with tourism integration providing significant market support through distillery experiences and cultural marketing. Strong export potential enhances growth opportunities beyond domestic market limitations.

Nordic countries including Sweden, Norway, and Denmark show increasing craft spirit adoption, with aquavit traditions providing foundation for innovation while gin and whiskey categories gain consumer acceptance. High disposable incomes support premium consumption patterns despite regulatory challenges in some markets.

Eastern Europe represents emerging opportunities with countries like Poland, Czech Republic, and Hungary developing craft spirit markets based on traditional production heritage combined with modern consumer preferences for premium, authentic alcoholic beverages.

Market structure features hundreds of craft distilleries across European markets, ranging from established producers with regional recognition to emerging startups focusing on innovation and niche positioning. Competition emphasizes quality, authenticity, and unique brand narratives rather than price competition typical in mass-market segments.

Competitive strategies focus on differentiation through production methods, ingredient sourcing, brand storytelling, and consumer engagement rather than price competition. Successful companies combine authentic craftsmanship with sophisticated marketing approaches that build brand recognition and consumer loyalty in premium market segments.

By Product Type:

By Distribution Channel:

By Price Range:

Craft Gin Segment demonstrates exceptional growth across European markets, driven by consumer interest in botanical complexity, innovative flavor profiles, and premium positioning. This category benefits from relatively lower production barriers compared to aged spirits, enabling rapid market entry and product innovation. Market share continues expanding as gin consumption grows among younger demographics seeking premium cocktail experiences.

Craft Whiskey Category leverages established consumer appreciation for whiskey quality while offering unique regional characteristics and innovative production methods. Despite longer production cycles requiring aging, this segment commands premium pricing and strong consumer loyalty. Scottish and Irish producers maintain market leadership while emerging markets develop distinctive regional identities.

Craft Vodka Segment focuses on ingredient quality, distillation purity, and authentic production methods to differentiate from mass-market alternatives. Success requires clear positioning strategies that communicate quality advantages and unique characteristics to consumers accustomed to established vodka brands.

Specialty Liqueur Category offers opportunities for innovation and regional authenticity, with traditional European liqueur styles providing foundation for craft interpretation and modern market positioning. This segment benefits from cultural heritage while adapting to contemporary consumer preferences for premium, authentic products.

Craft Rum Segment remains relatively small in European markets but demonstrates growth potential as consumer interest in premium rum increases. Producers focus on traditional production methods, unique aging processes, and authentic Caribbean or regional connections to build market positioning.

Craft Distilleries benefit from premium pricing opportunities, direct consumer relationships, brand differentiation possibilities, and growing market demand for authentic, high-quality spirits. The segment enables small-scale producers to compete effectively against large corporations through quality focus and authentic positioning rather than price competition.

Distributors and Retailers gain access to high-margin products with strong consumer interest and growing demand. Craft spirits provide differentiation opportunities in competitive retail environments while attracting affluent consumers seeking premium products and unique shopping experiences.

Hospitality Industry benefits from craft spirits’ ability to enhance beverage programs, create unique cocktail offerings, and attract consumers seeking premium dining and drinking experiences. These products support higher beverage margins while differentiating establishments in competitive hospitality markets.

Tourism Operators leverage craft distilleries as authentic cultural attractions that provide immersive experiences for visitors seeking authentic local culture and traditional craftsmanship. Distillery tourism creates economic opportunities while promoting regional identity and cultural heritage.

Investors and Financial Institutions find opportunities in a growing market segment with premium positioning, strong consumer demand, and potential for consolidation and expansion. The craft spirits market offers investment opportunities across production, distribution, and retail segments.

Consumers benefit from increased product choice, higher quality offerings, authentic production methods, and unique taste experiences that reflect regional heritage and artisanal craftsmanship. The market provides access to premium products with compelling stories and authentic cultural connections.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Focus increasingly influences consumer purchasing decisions and production methods, with craft distilleries implementing organic ingredients, renewable energy, sustainable packaging, and environmental responsibility initiatives. This trend aligns with broader consumer consciousness regarding environmental impact and corporate responsibility.

Experiential Marketing emphasizes distillery tours, tasting experiences, educational programs, and cultural events that create emotional connections between consumers and brands. MWR data indicates that experiential marketing significantly enhances brand loyalty and consumer willingness to pay premium prices for craft spirits.

Local Sourcing trends emphasize regional ingredients, traditional methods, and authentic connections to local culture and heritage. Consumers increasingly value products that reflect terroir and regional identity, creating opportunities for craft distilleries to differentiate through local authenticity and cultural storytelling.

Innovation in Aging includes alternative aging methods, unique barrel selections, finishing techniques, and experimental approaches that create distinctive flavor profiles while potentially reducing traditional aging time requirements. These innovations enable product differentiation and premium positioning.

Digital Direct Sales platforms enable craft distilleries to build direct relationships with consumers, bypassing traditional distribution limitations while maintaining higher margins and better customer data access. Online sales growth accelerated significantly during recent years and continues expanding.

Collaborative Products between distilleries, with other craft producers, or with local businesses create unique offerings that generate consumer interest while sharing marketing costs and expanding market reach through cross-promotion opportunities.

Regulatory Evolution across European markets shows increasing support for craft distilleries through simplified licensing procedures, favorable taxation policies, and promotional initiatives that recognize the economic and cultural value of small-scale spirits production. These developments reduce barriers to entry and expansion while supporting market growth.

Technology Integration enhances production efficiency and quality consistency through advanced distillation equipment, automated monitoring systems, and quality control technologies that maintain artisanal character while improving operational effectiveness and product consistency.

Distribution Innovation includes specialized craft spirits distributors, online platforms, subscription services, and direct-to-consumer shipping options that expand market access for small-scale producers while providing consumers with greater product access and convenience.

Investment Activity shows increasing interest from private equity, venture capital, and strategic investors recognizing growth potential in craft spirits markets. Investment provides capital for expansion, equipment upgrades, and marketing initiatives while potentially accelerating market development.

International Recognition of European craft spirits through awards, media coverage, and export success enhances market credibility while creating opportunities for premium positioning and international expansion. Recognition validates quality standards and production methods.

Educational Initiatives including spirits education programs, certification courses, and consumer education efforts build market appreciation for craft spirits while developing knowledgeable consumers who can appreciate quality differences and production methods.

Market Entry Strategy should emphasize authentic positioning, quality focus, and unique value propositions that differentiate new entrants from existing competitors. Successful market entry requires clear brand identity, compelling production story, and targeted marketing approaches that resonate with premium consumers seeking authentic experiences.

Distribution Development recommendations include building relationships with specialty retailers, premium hospitality establishments, and direct-to-consumer channels before attempting broader market distribution. Focused distribution strategies enable better brand control and margin preservation while building market presence.

Innovation Focus should balance traditional production methods with modern consumer preferences, emphasizing unique flavor profiles, sustainable practices, and authentic regional characteristics. Innovation opportunities exist in ingredients, production techniques, packaging, and consumer engagement approaches.

Partnership Opportunities with tourism operators, hospitality establishments, specialty retailers, and complementary craft producers can expand market reach while sharing marketing costs and building brand credibility through association with quality-focused partners.

Investment Priorities should emphasize production quality, brand building, and distribution development rather than rapid expansion that may compromise quality or brand positioning. Sustainable growth strategies maintain premium positioning while building long-term market presence.

Export Considerations include regulatory compliance, distribution partnerships, and marketing adaptation for international markets where European craft spirits can command premium positioning based on heritage and quality reputation.

Market expansion projections indicate continued growth driven by consumer premiumization trends, increasing appreciation for authentic products, and expanding distribution opportunities. The European craft spirits market is expected to maintain strong growth momentum with annual expansion rates of 10-12% across key segments and geographic markets.

Technology integration will enhance production efficiency while maintaining artisanal character, enabling craft distilleries to improve quality consistency and operational effectiveness. Advanced monitoring systems, automated processes, and digital marketing platforms will support growth while preserving authentic production methods and brand positioning.

International expansion opportunities will continue developing as European craft spirits gain global recognition for quality and authenticity. Export growth potential remains substantial, with international markets offering premium positioning opportunities and revenue diversification for established European producers.

Consolidation trends may accelerate as successful craft distilleries attract acquisition interest from larger beverage companies seeking premium market access. According to MarkWide Research projections, strategic acquisitions will provide growth capital while potentially changing competitive dynamics and market structure.

Innovation acceleration will drive product development in flavors, production methods, packaging, and consumer engagement approaches. Sustainability initiatives, experiential marketing, and digital platforms will become increasingly important for competitive differentiation and consumer attraction.

Regulatory support is expected to continue as European governments recognize the economic and cultural value of craft distilleries. Policy developments supporting small-scale producers through taxation, licensing, and promotional initiatives will enhance market growth conditions and competitive positioning.

The Europe craft spirit market represents a dynamic and rapidly expanding segment characterized by premium positioning, authentic production methods, and strong consumer demand for quality and authenticity. Market growth is driven by changing consumer preferences toward premium products, increasing appreciation for artisanal craftsmanship, and expanding distribution opportunities that enable small-scale producers to reach target consumers effectively.

Key success factors include authentic brand positioning, quality focus, innovative marketing approaches, and strategic distribution development that maintains premium positioning while expanding market reach. The market rewards producers who combine traditional craftsmanship with modern business practices and consumer engagement strategies.

Future prospects remain highly positive, with continued growth expected across product categories and geographic markets. The combination of favorable consumer trends, regulatory support, and expanding international opportunities creates a supportive environment for existing producers and new market entrants who can effectively differentiate their offerings and build authentic brand connections with premium consumers seeking quality and authenticity in their spirits consumption.

What is Craft Spirit?

Craft Spirit refers to distilled alcoholic beverages produced in small batches, often emphasizing traditional methods and unique flavors. This category includes artisanal gin, whiskey, rum, and other spirits that prioritize quality and craftsmanship over mass production.

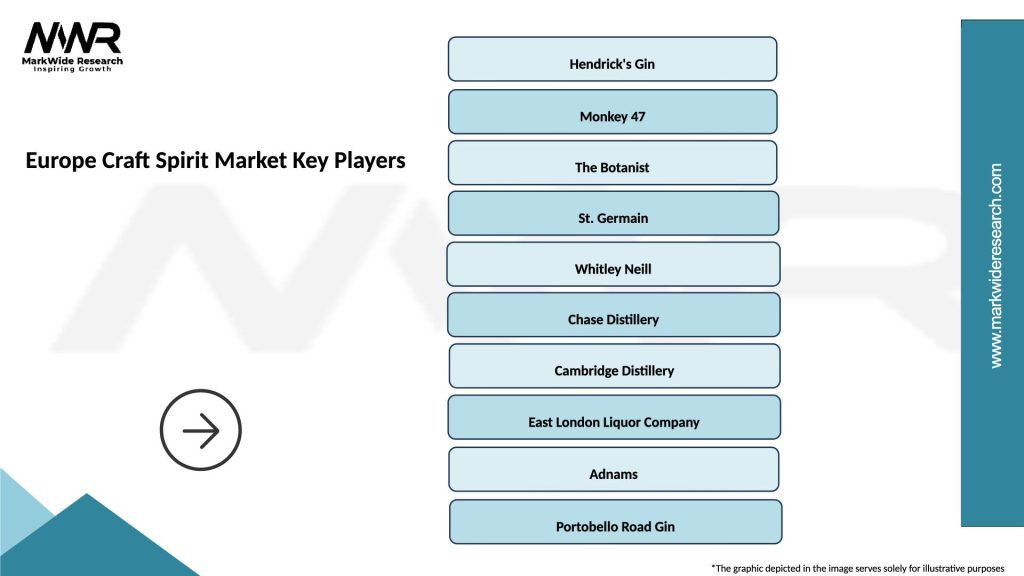

What are the key players in the Europe Craft Spirit Market?

Key players in the Europe Craft Spirit Market include companies like Sipsmith, Hendrick’s Gin, and The Macallan, which are known for their innovative products and strong brand presence. These companies focus on quality ingredients and unique production techniques, appealing to a growing consumer base interested in premium spirits, among others.

What are the growth factors driving the Europe Craft Spirit Market?

The Europe Craft Spirit Market is driven by increasing consumer demand for premium and artisanal products, a growing interest in mixology, and the rise of craft cocktail culture. Additionally, the trend towards local sourcing and sustainability in production methods is contributing to market growth.

What challenges does the Europe Craft Spirit Market face?

The Europe Craft Spirit Market faces challenges such as regulatory hurdles, competition from established brands, and the need for consistent quality in small-batch production. Additionally, fluctuating raw material costs can impact profitability for craft distillers.

What opportunities exist in the Europe Craft Spirit Market?

Opportunities in the Europe Craft Spirit Market include expanding into emerging markets, developing new flavor profiles, and leveraging e-commerce for direct-to-consumer sales. The increasing popularity of craft spirits among younger consumers also presents a significant growth avenue.

What trends are shaping the Europe Craft Spirit Market?

Trends shaping the Europe Craft Spirit Market include the rise of flavored spirits, the use of local and organic ingredients, and the growing popularity of ready-to-drink cocktails. Additionally, sustainability practices in production and packaging are becoming increasingly important to consumers.

Europe Craft Spirit Market

| Segmentation Details | Description |

|---|---|

| Product Type | Gin, Vodka, Rum, Whiskey |

| End User | Bars, Restaurants, Retailers, Online Stores |

| Packaging Type | Glass Bottles, Cans, Tetra Packs, Kegs |

| Distribution Channel | Direct Sales, Wholesalers, E-commerce, Distributors |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Craft Spirit Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at