444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The Europe cosmetic implants market encompasses a wide range of surgical and non-surgical procedures aimed at enhancing aesthetic appearance and correcting cosmetic imperfections. Cosmetic implants are used to augment, reshape, or reconstruct various facial and body features, including breasts, buttocks, chin, cheeks, lips, and jawline. With growing social acceptance, changing beauty standards, and advancements in medical technology, the demand for cosmetic implants in Europe has witnessed significant growth in recent years. The market offers a variety of implant options, including silicone implants, saline implants, and autologous fat transfers, catering to the diverse aesthetic preferences and clinical needs of patients across the region.

Meaning

Cosmetic implants refer to medical devices or materials implanted beneath the skin or within body tissues to enhance physical appearance, correct congenital deformities, or restore lost volume. These implants are commonly used in plastic and reconstructive surgery procedures to augment or reconstruct various facial and body features, such as breasts, buttocks, facial contours, and soft tissue defects. Cosmetic implants come in different shapes, sizes, and materials, allowing plastic surgeons to customize treatment plans and achieve desired aesthetic outcomes for patients seeking cosmetic enhancement or reconstruction.

Executive Summary

The Europe cosmetic implants market is driven by various factors, including changing societal attitudes towards cosmetic procedures, increasing awareness and acceptance of aesthetic treatments, rising disposable incomes, and advancements in surgical techniques and implant technologies. While the market offers lucrative opportunities for industry players, it also faces challenges such as regulatory scrutiny, safety concerns, pricing pressures, and competition from non-invasive cosmetic procedures. Understanding the key market dynamics, trends, and drivers is essential for stakeholders to navigate the competitive landscape and capitalize on emerging opportunities in the Europe cosmetic implants market.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Europe cosmetic implants market operates in a dynamic environment shaped by evolving consumer preferences, technological innovations, regulatory changes, and competitive forces. Market dynamics such as demographic trends, economic conditions, social factors, and technological disruptions influence patient demand, healthcare provider practices, and industry strategies in the cosmetic implants sector. Understanding these dynamics is essential for stakeholders to anticipate market trends, mitigate risks, and capitalize on growth opportunities in the Europe cosmetic implants market.

Regional Analysis

The Europe cosmetic implants market exhibits regional variations in terms of market size, growth trends, regulatory frameworks, cultural attitudes towards cosmetic procedures, and healthcare infrastructure. Countries such as Germany, France, Italy, and the United Kingdom are major markets for cosmetic implants in Europe, characterized by advanced healthcare systems, well-established plastic surgery practices, and high patient demand for aesthetic treatments. Eastern European countries, including Poland, Hungary, and Czech Republic, are emerging markets with growing interest in cosmetic procedures and increasing adoption of cosmetic implants.

Competitive Landscape

Leading Companies in Europe Cosmetic Implants Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

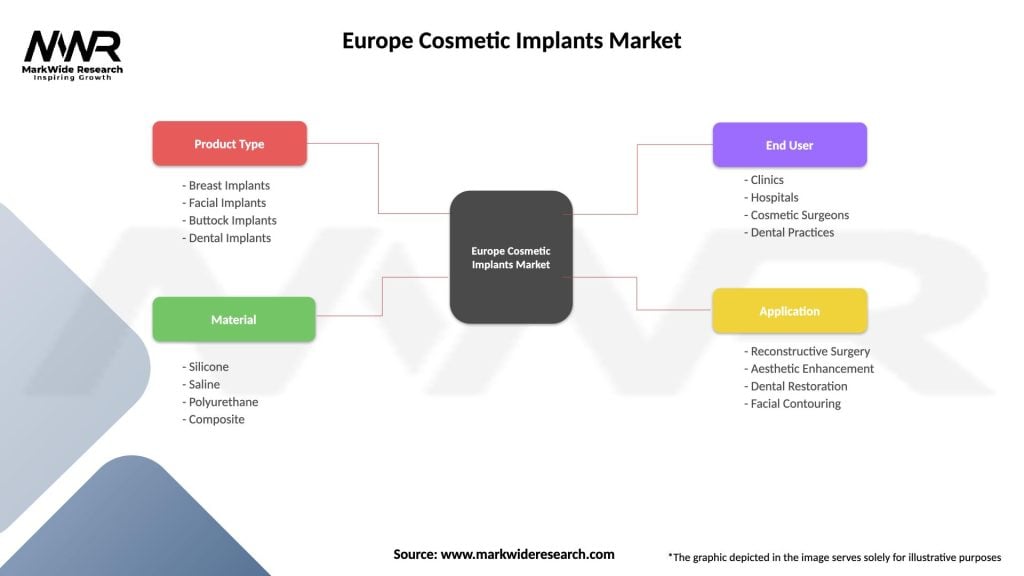

The Europe cosmetic implants market can be segmented based on various factors, including:

Segmentation provides a comprehensive understanding of market dynamics, consumer preferences, and competitive landscape, enabling companies to develop targeted marketing strategies, product innovations, and customer engagement initiatives tailored to specific market segments.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The Europe cosmetic implants market offers several benefits for industry participants and stakeholders:

SWOT Analysis

A SWOT analysis provides insights into the strengths, weaknesses, opportunities, and threats facing the Europe cosmetic implants market:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the Europe cosmetic implants market, disrupting healthcare services, delaying elective surgeries, and affecting patient demand for cosmetic procedures. While the initial phase of the pandemic led to temporary closures of aesthetic clinics and surgical facilities, the market rebounded as restrictions eased, pent-up demand surged, and patients resumed seeking cosmetic treatments. The pandemic accelerated trends such as telemedicine consultations, virtual follow-ups, and digital marketing strategies in the cosmetic industry, driving innovation, efficiency, and patient engagement.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Europe cosmetic implants market is poised for continued growth and innovation, driven by factors such as demographic trends, technological advancements, consumer demand for aesthetic enhancement, and evolving regulatory landscapes. While the Covid-19 pandemic presents short-term challenges and uncertainties, the long-term outlook for the cosmetic implants market remains positive, with opportunities for industry players to capitalize on emerging trends, expand market reach, and contribute to the advancement of aesthetic medicine in Europe.

Conclusion

The Europe cosmetic implants market represents a dynamic and evolving segment of the healthcare industry, offering a wide range of aesthetic solutions for patients seeking cosmetic enhancement or reconstructive procedures. With changing societal attitudes towards beauty, advancements in implant technology, and increasing demand for aesthetic treatments, the market presents lucrative opportunities for manufacturers, healthcare providers, and industry stakeholders. By staying abreast of market trends, adhering to regulatory standards, and prioritizing patient safety and satisfaction, companies can navigate the competitive landscape, drive innovation, and sustain growth in the Europe cosmetic implants market.

What is Cosmetic Implants?

Cosmetic implants are medical devices implanted into the body to enhance or alter physical appearance. They are commonly used in procedures such as breast augmentation, facial reconstruction, and dental applications.

What are the key players in the Europe Cosmetic Implants Market?

Key players in the Europe Cosmetic Implants Market include Allergan, Mentor Worldwide, and Sientra, which are known for their innovative products and extensive market presence, among others.

What are the growth factors driving the Europe Cosmetic Implants Market?

The growth of the Europe Cosmetic Implants Market is driven by increasing consumer awareness about aesthetic procedures, advancements in implant technology, and a rising demand for minimally invasive surgeries.

What challenges does the Europe Cosmetic Implants Market face?

The Europe Cosmetic Implants Market faces challenges such as regulatory hurdles, potential health risks associated with implants, and fluctuating consumer preferences regarding cosmetic procedures.

What opportunities exist in the Europe Cosmetic Implants Market?

Opportunities in the Europe Cosmetic Implants Market include the development of innovative materials, expansion into emerging markets, and increasing acceptance of cosmetic procedures among younger demographics.

What trends are shaping the Europe Cosmetic Implants Market?

Trends in the Europe Cosmetic Implants Market include a growing preference for natural-looking results, the rise of personalized cosmetic solutions, and the integration of advanced technologies such as 3D printing in implant design.

Europe Cosmetic Implants Market

| Segmentation Details | Description |

|---|---|

| Product Type | Breast Implants, Facial Implants, Buttock Implants, Dental Implants |

| Material | Silicone, Saline, Polyurethane, Composite |

| End User | Clinics, Hospitals, Cosmetic Surgeons, Dental Practices |

| Application | Reconstructive Surgery, Aesthetic Enhancement, Dental Restoration, Facial Contouring |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Europe Cosmetic Implants Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at